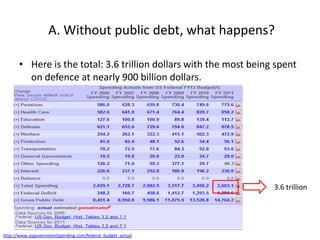

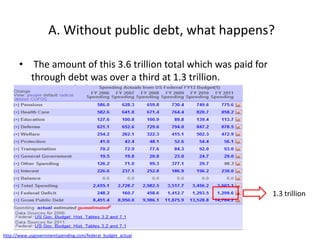

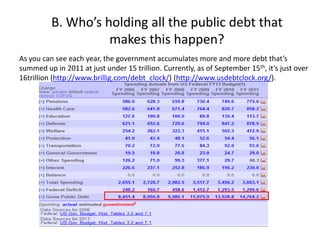

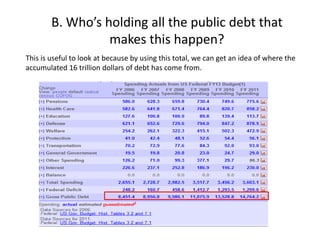

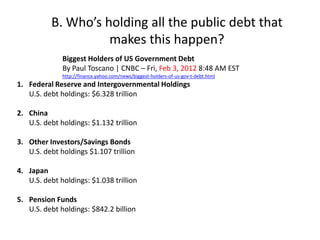

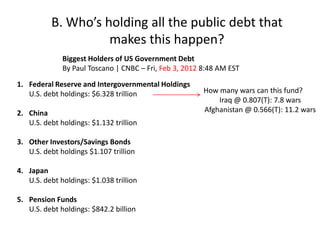

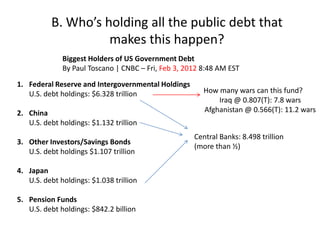

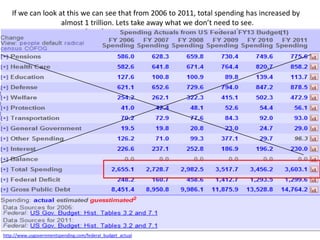

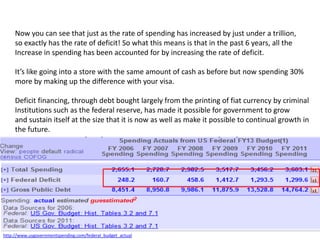

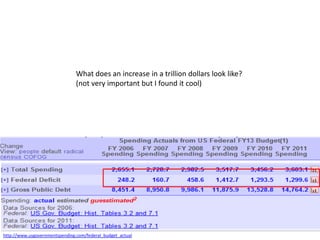

This document provides an overview of a presentation arguing that most of what governments do that is immoral would be impossible without fiat currency and public debt. It outlines the main thesis and sub-thesis, and then explores three parts of the argument: 1) What would happen without public debt, concluding government aspects would need to shrink by 1/3 on average; 2) Who holds the public debt, with over half held by central banks; and 3) Why sustained government growth would be much more difficult without taking on debt, as people would riot if taxes increased substantially to cover additional spending.