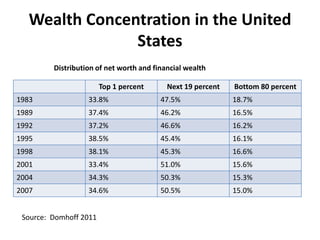

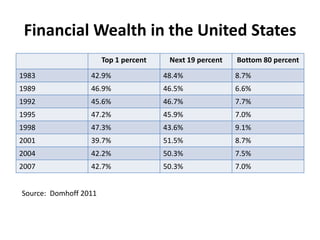

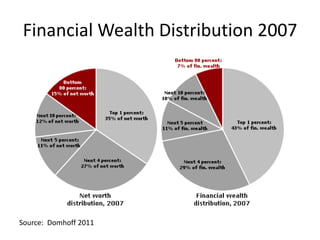

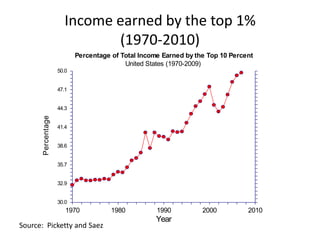

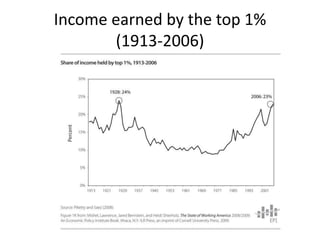

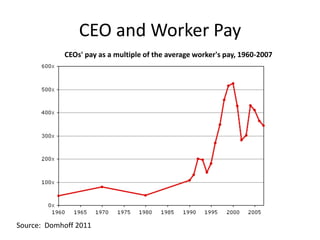

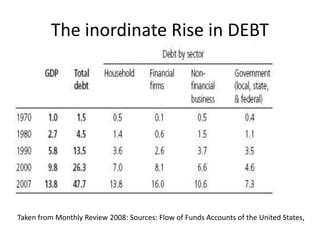

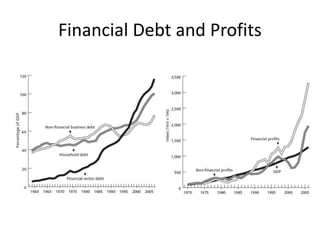

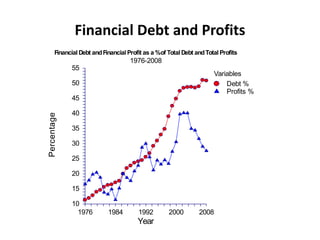

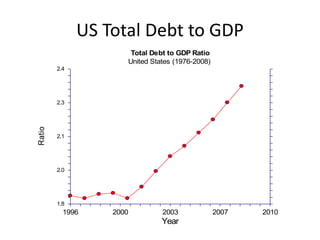

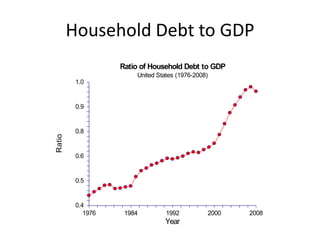

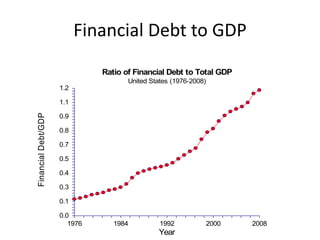

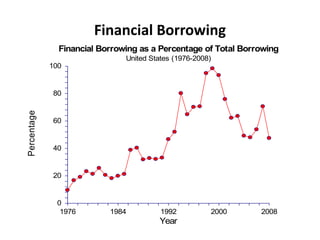

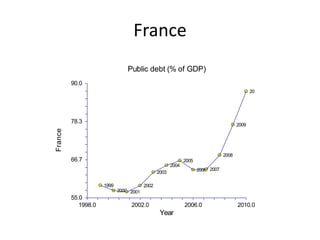

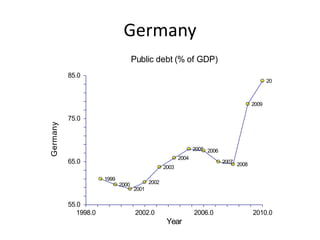

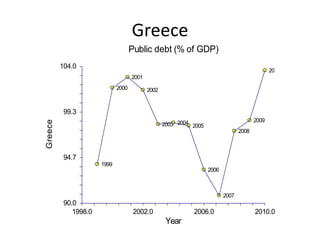

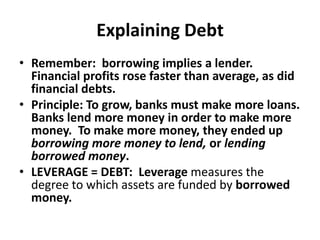

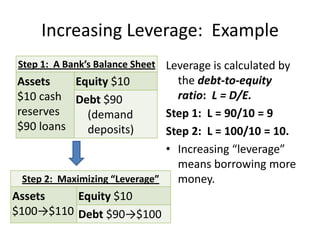

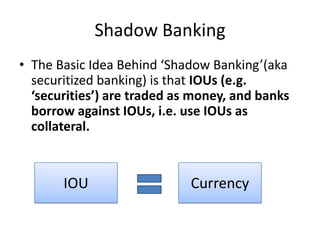

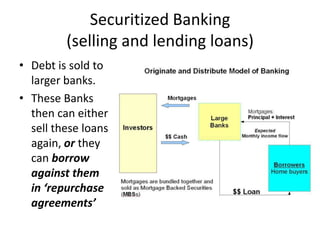

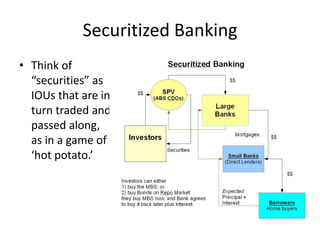

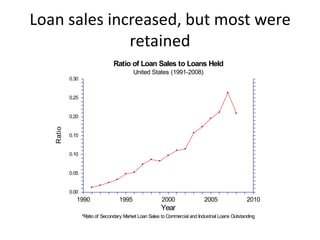

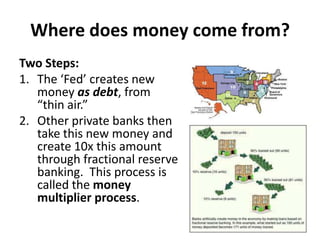

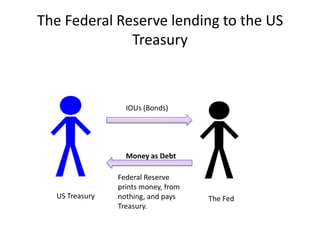

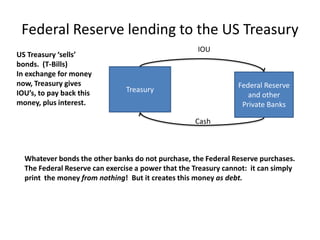

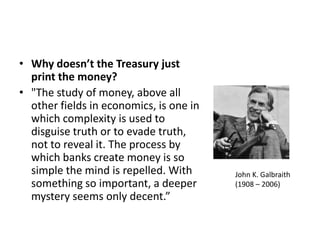

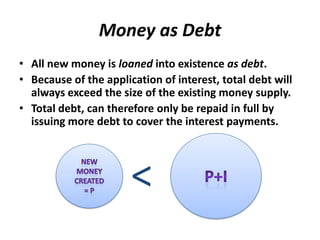

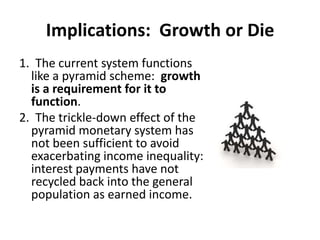

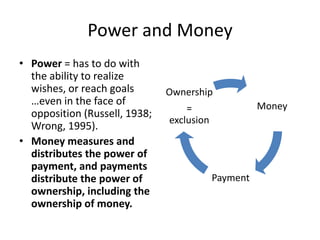

The document discusses rising inequality, debt, and monetary power in the United States. It argues that the current monetary system requires perpetual growth because all new money is created as debt by private banks. This exacerbates inequality as interest payments do not fully circulate back to workers. The document proposes alternatives like "narrow banking" where money creation is delegated solely to the government instead of private banks. This could support programs like a basic income independent of private debt.