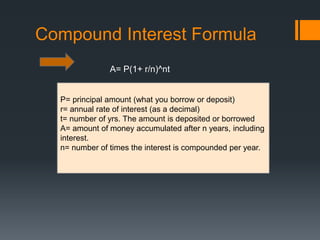

The document covers essential financial concepts including financial markets, institutions, and intermediaries, as well as stocks and bonds, explaining their pros and cons. It discusses the federal government's budget deficit, the value of money, and various strategies for dealing with financial risks. Additionally, it includes information on topics such as present and future value, compound interest, and the implications of currency depreciation.

![References

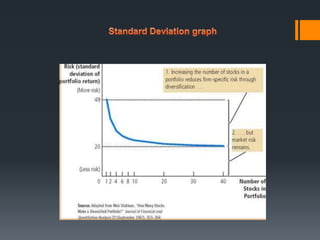

Mankiw, N. (Producer). (2014). FIGURE 2 Diversification Reduces

Risk [Print Graphic]. Retrieved from

http://digitalbookshelf.southuniversity.edu/

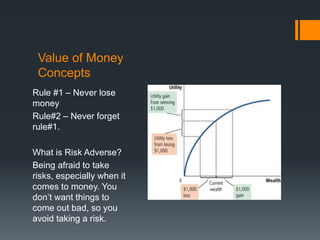

Mankiw,N. (Producer). (2014). Figure 1- The Utility Function [Web

Graphic]. Retrieved from http://digitalbookshelf.southuniversity.edu/

Norstad, J. (1999). An introduction to utility theory., Retrieved from:

http://www.norstad.org/finance/util.pdf

The Huffington Post. (Producer). (2013, October 14). Confused

About The Deficit? This 2-Minute Video Can Help [Web Video].

Retrieved from Confused About The Deficit? This 2-Minute Video

Can Help

Valderramo, D. (2004, August 13). Does a fall in the dollar mean

higher u.s. consumer prices? Retrieved from

http://www.frbsf.org/economic-research/publications/economic-

letter/2004/august/does-a-fall-in-the-dollar-mean-higher-us-

consumer-prices/](https://image.slidesharecdn.com/financialconcepts-140824155007-phpapp01/85/Financial-concepts-15-320.jpg)