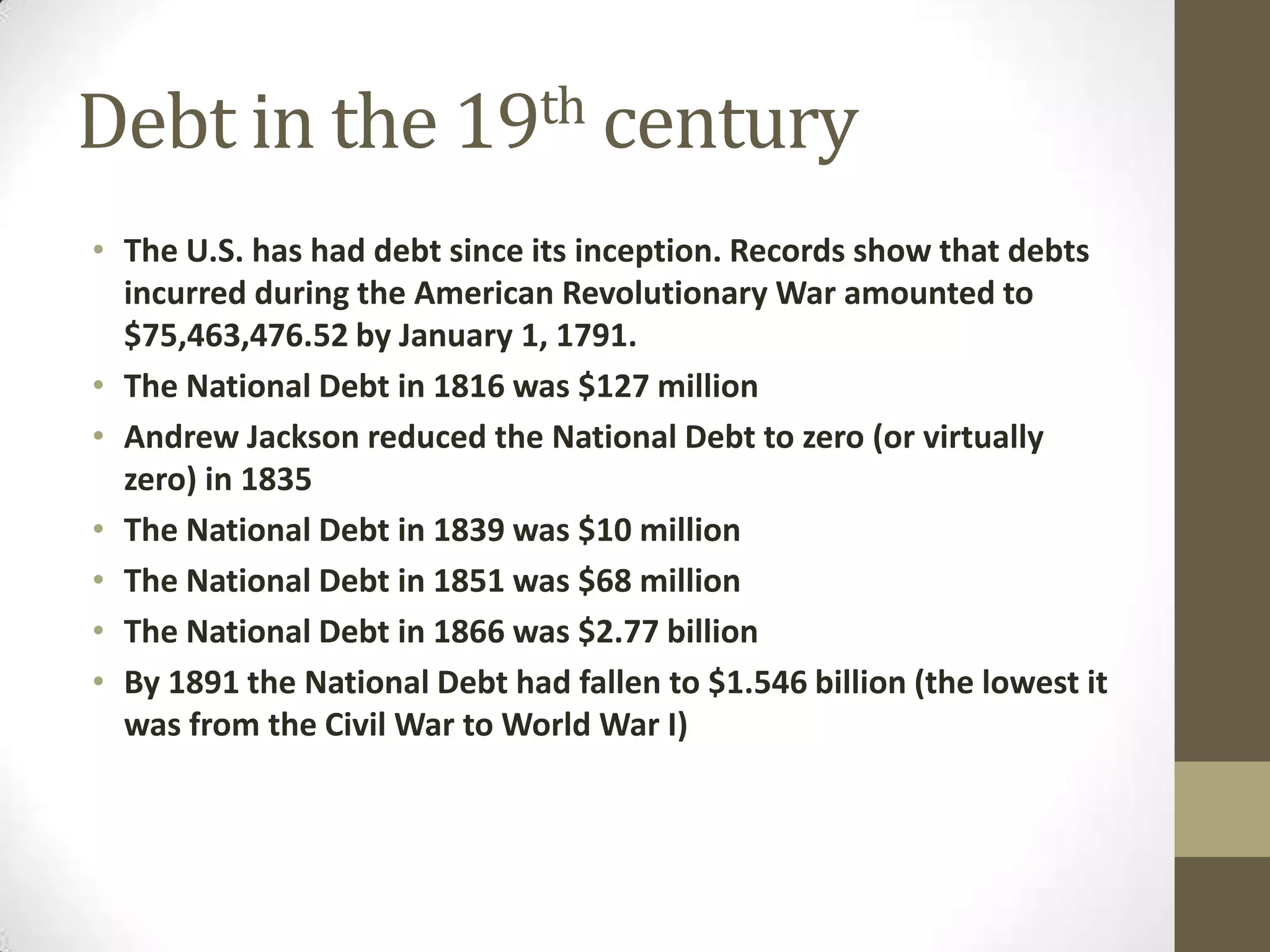

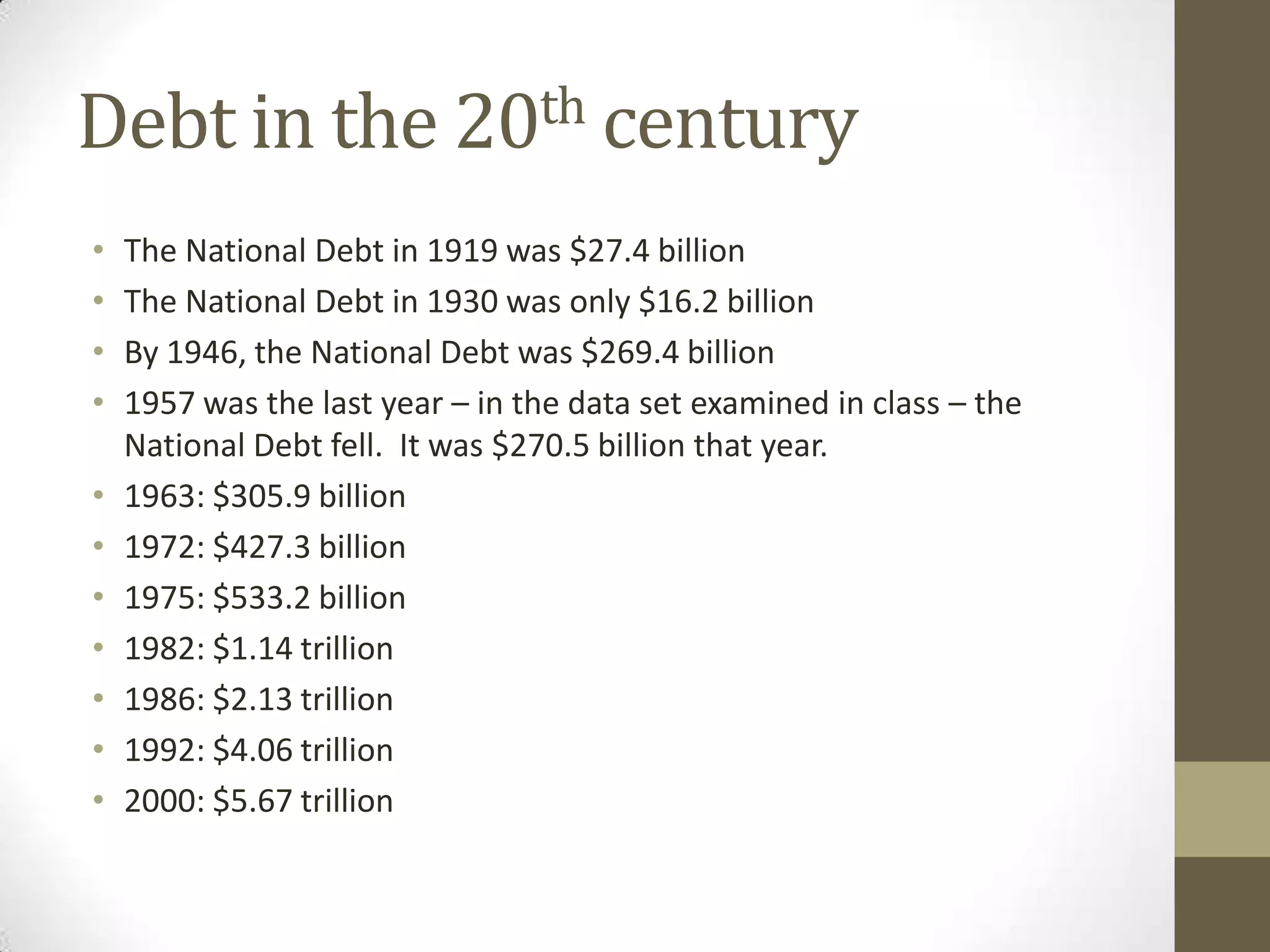

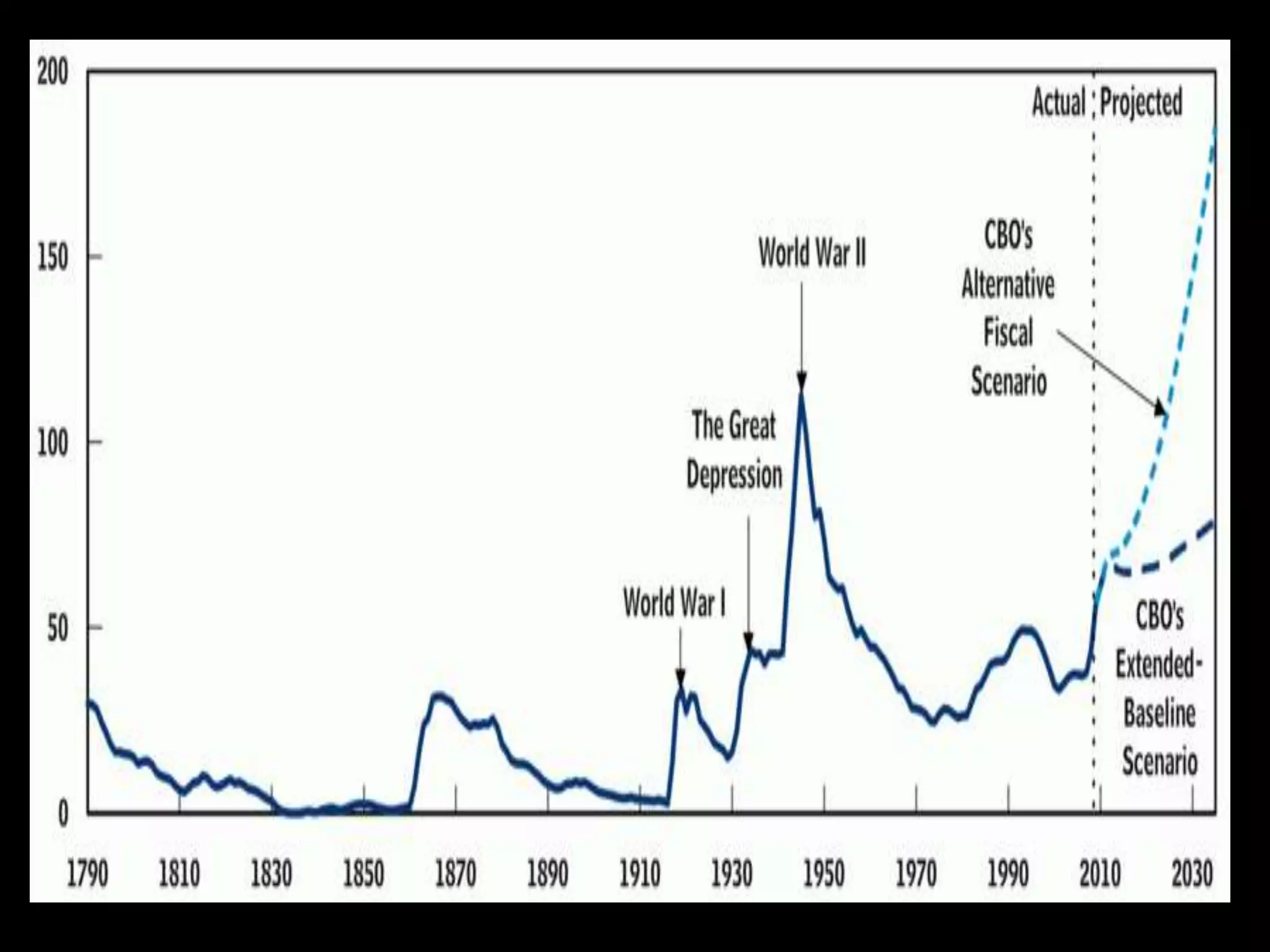

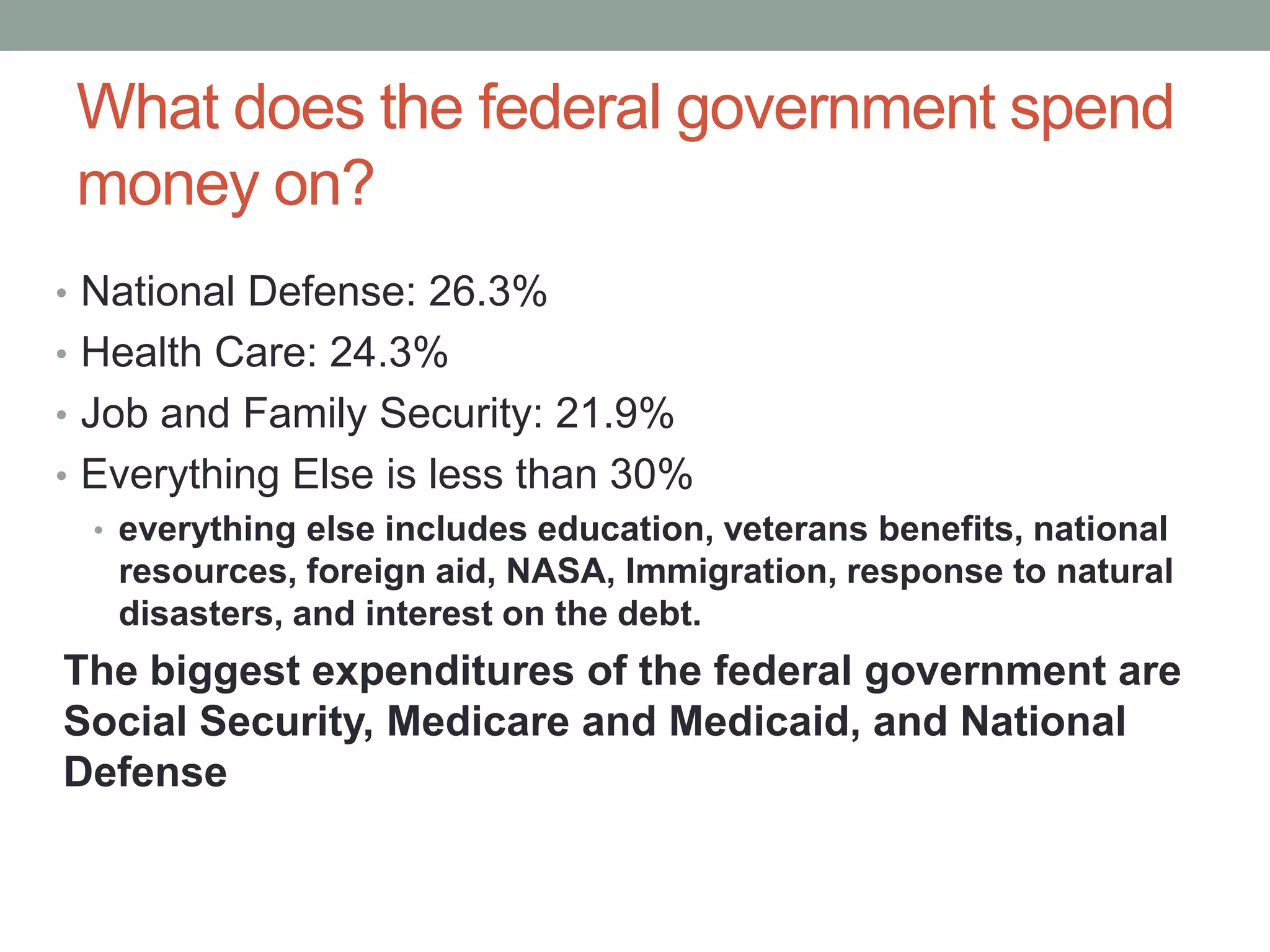

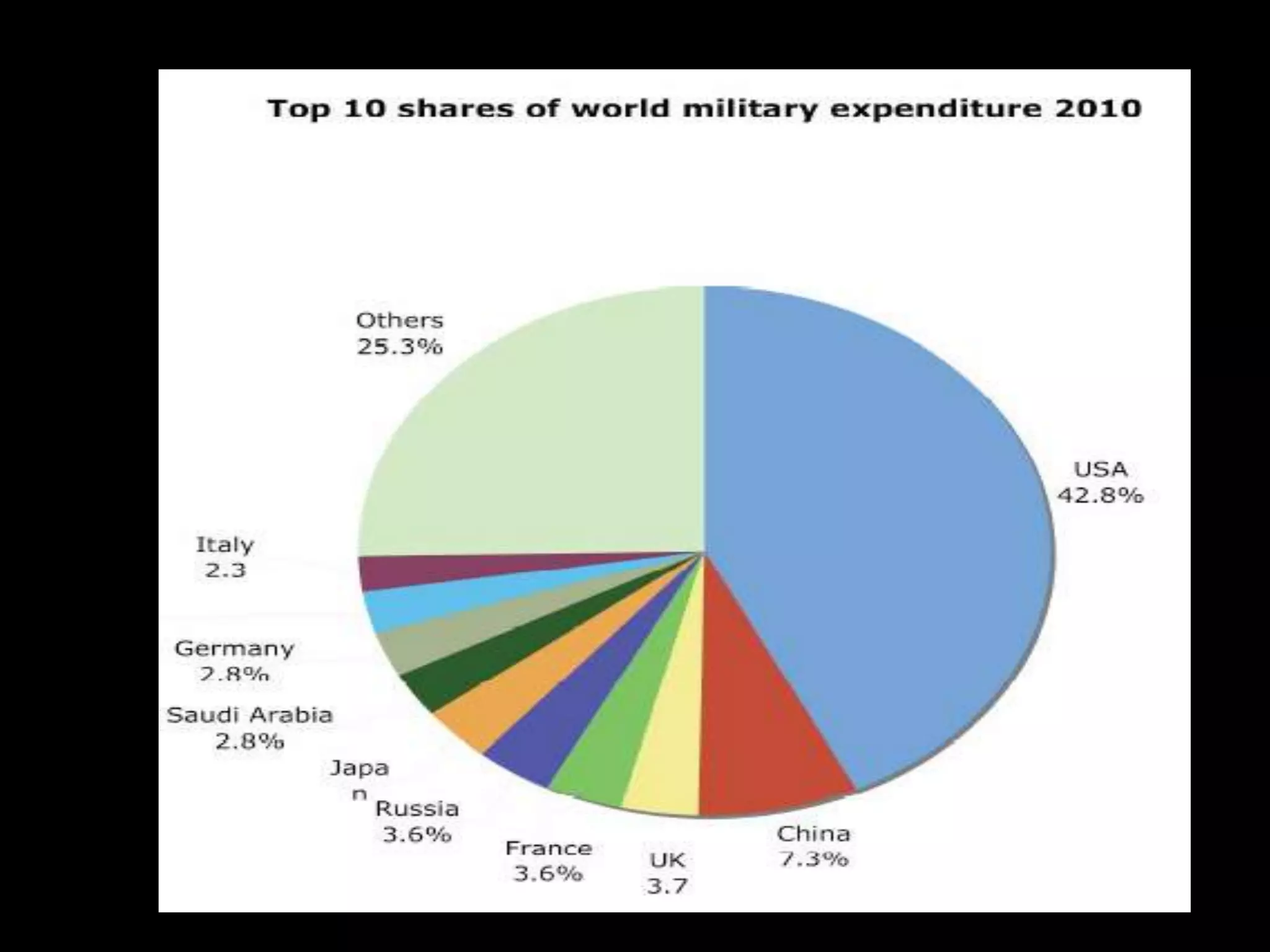

The US has carried debt since the Revolutionary War, with amounts fluctuating over time based on wars and economic conditions. Debt increased dramatically due to the Civil War and World Wars, reaching $1 trillion in 1982 and surpassing $5 trillion in 2000. The national debt has risen due to factors like military spending, recessions reducing tax revenue, and social programs increasing spending. A high debt level relative to GDP can increase interest rates, taxes, and fiscal deficits while slowing economic growth. Suggestions to recover include making American companies more competitive, restricting strategic asset sales to foreigners, and revising trade policies to better serve US interests.