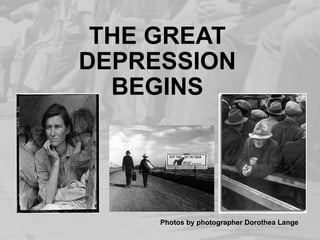

The document summarizes the key events leading up to and during the Great Depression in the United States. Major industries like agriculture, manufacturing, and housing struggled in the late 1920s. Consumer spending declined as incomes stagnated. The stock market crash of 1929 signaled the beginning of the Great Depression, exacerbating economic problems. Unemployment skyrocketed to 25% by 1933 as GDP declined nearly 50% and thousands of businesses and banks failed.