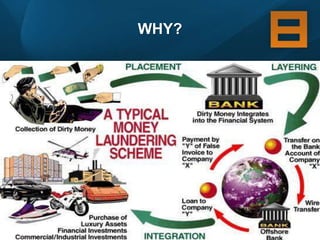

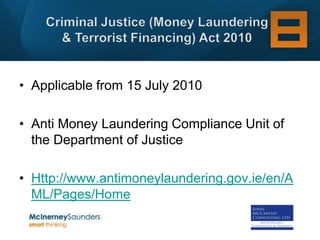

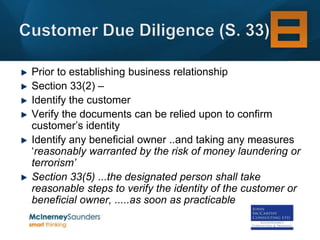

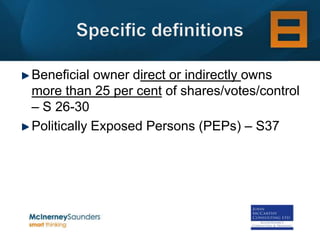

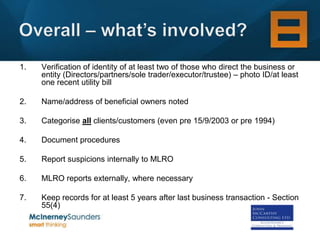

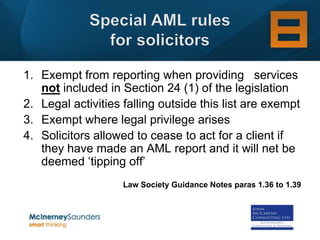

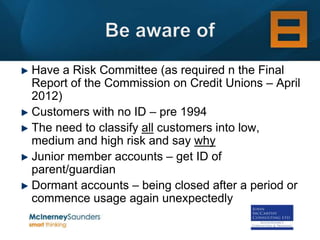

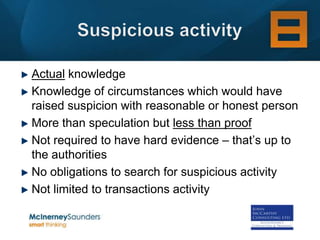

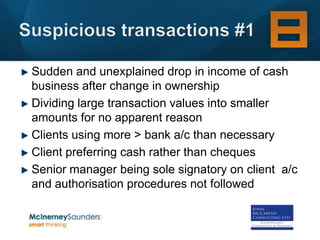

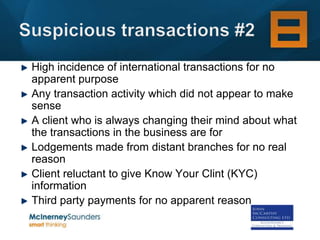

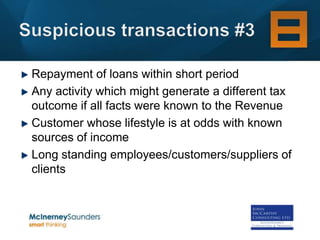

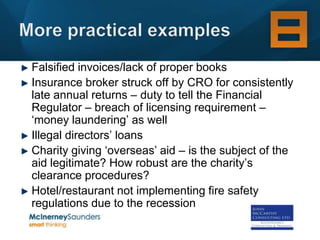

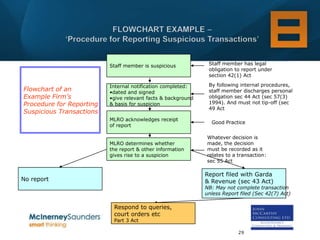

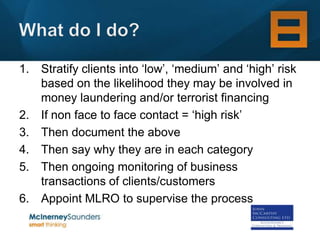

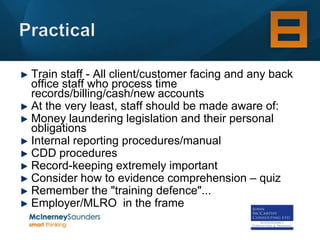

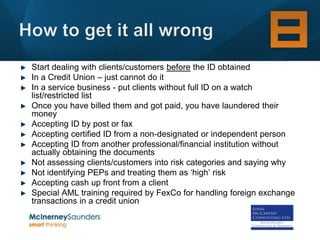

This document discusses anti-money laundering regulations and obligations for solicitors and credit unions. It provides an overview of key legislation, requirements for customer due diligence, identifying beneficial owners, reporting suspicious transactions, record keeping, and training staff. It notes the penalties for non-compliance and examples of suspicious activities and red flags that could trigger reporting obligations.