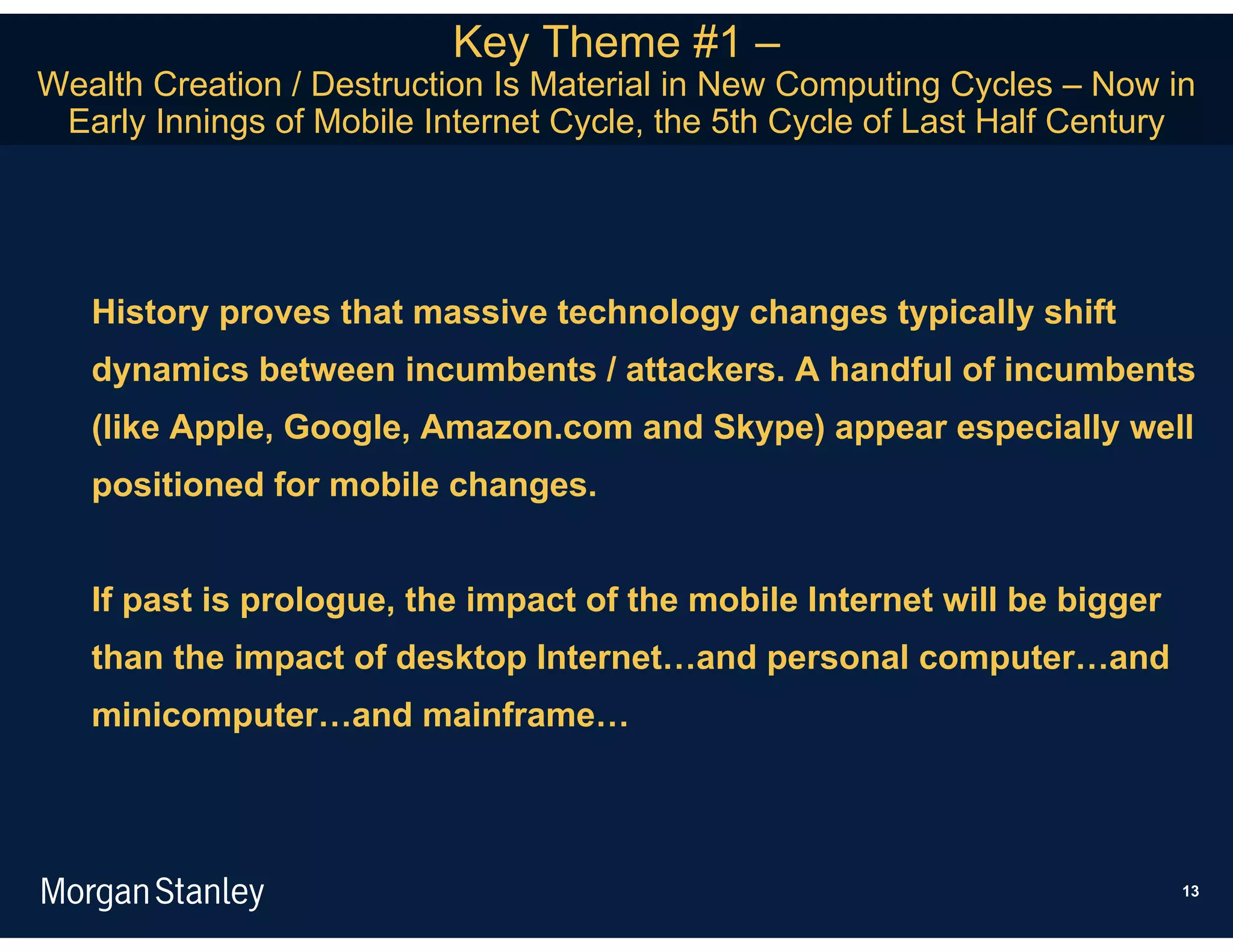

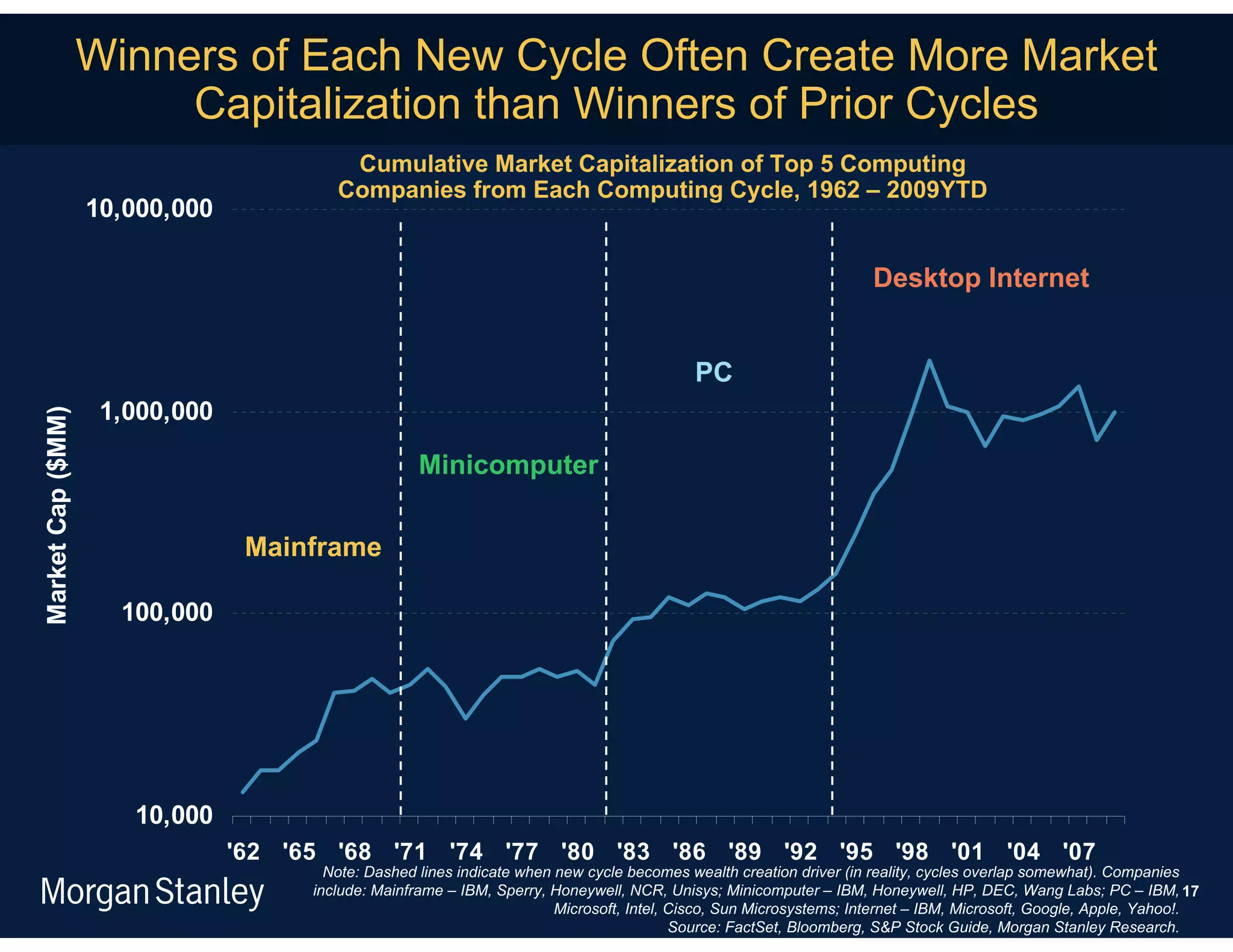

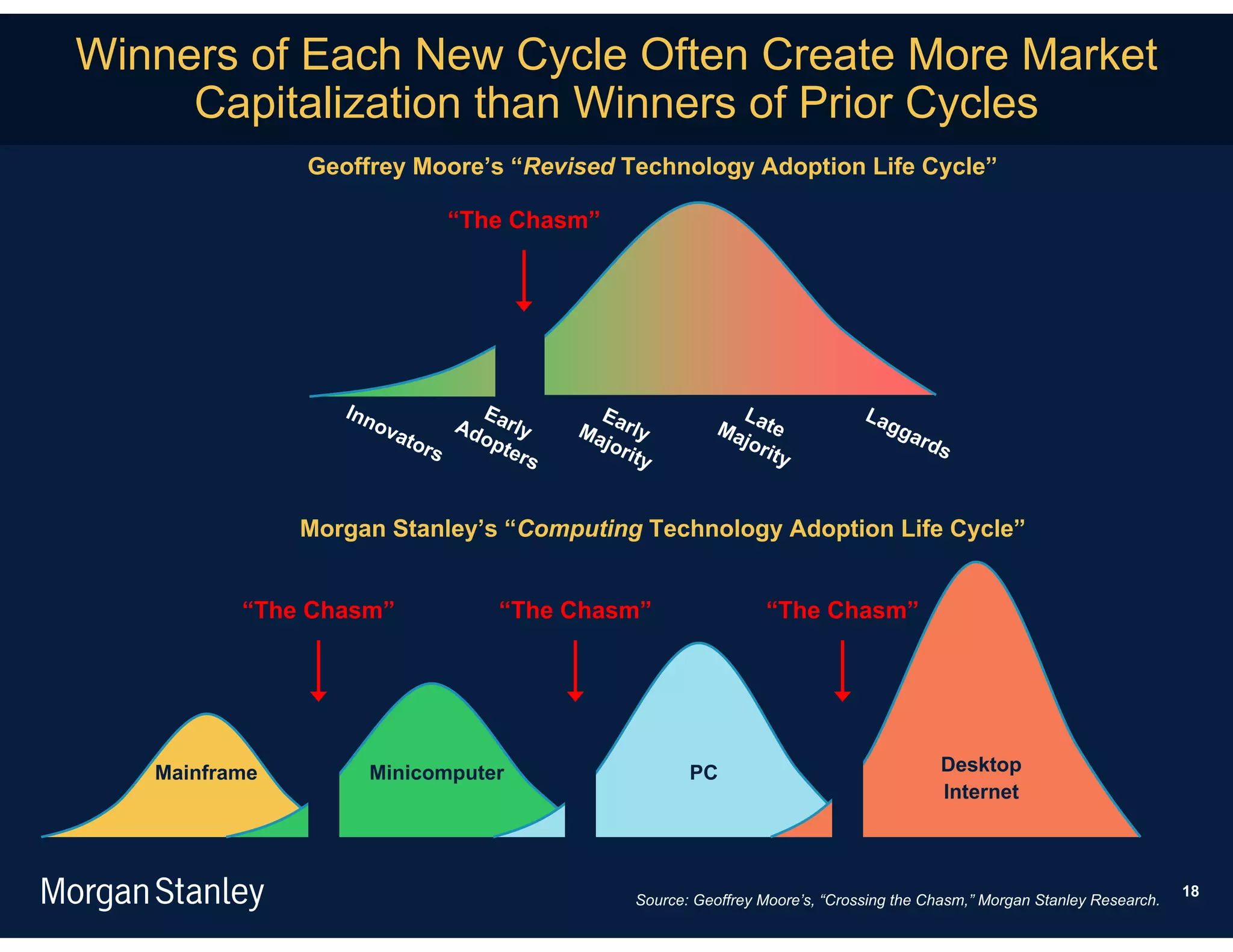

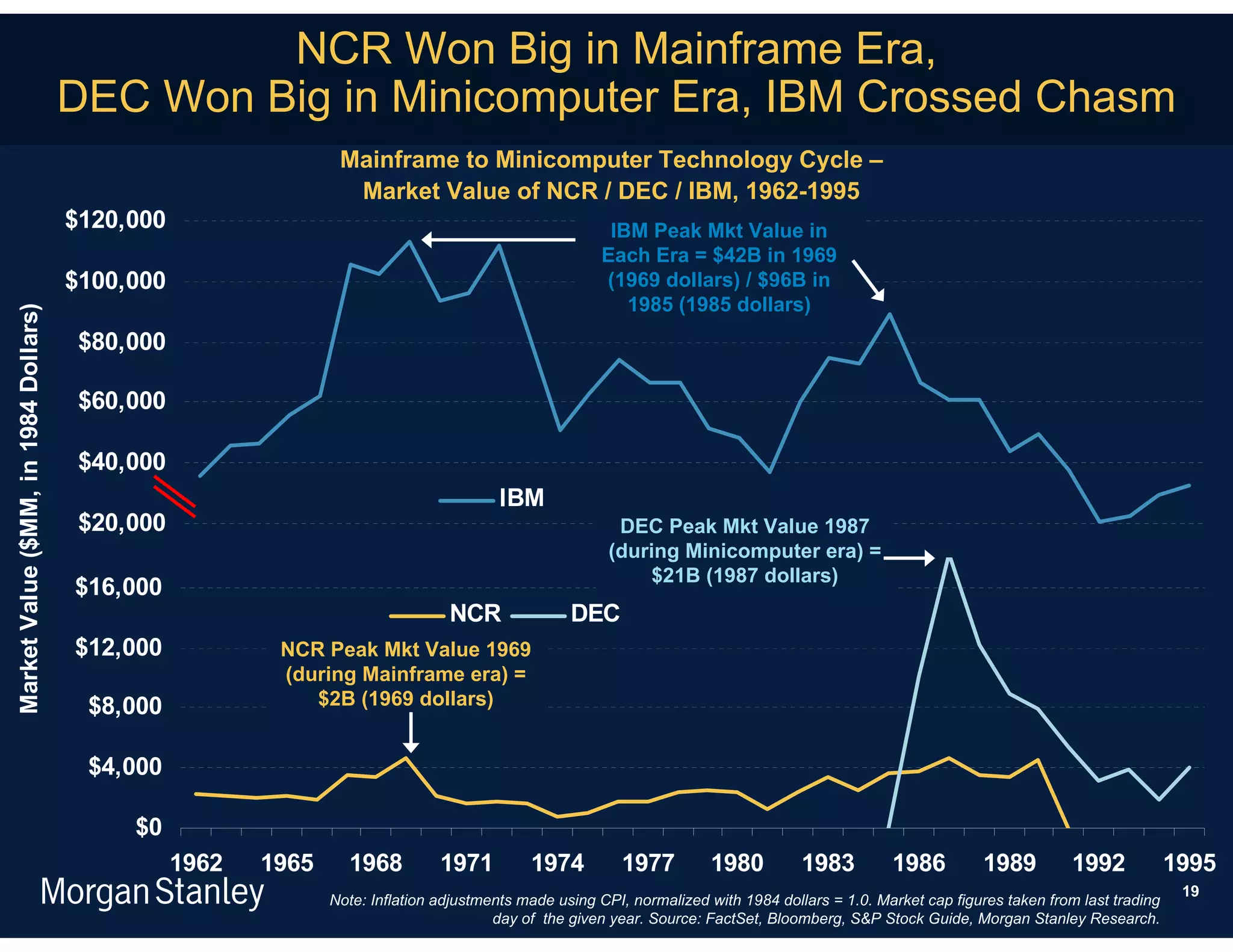

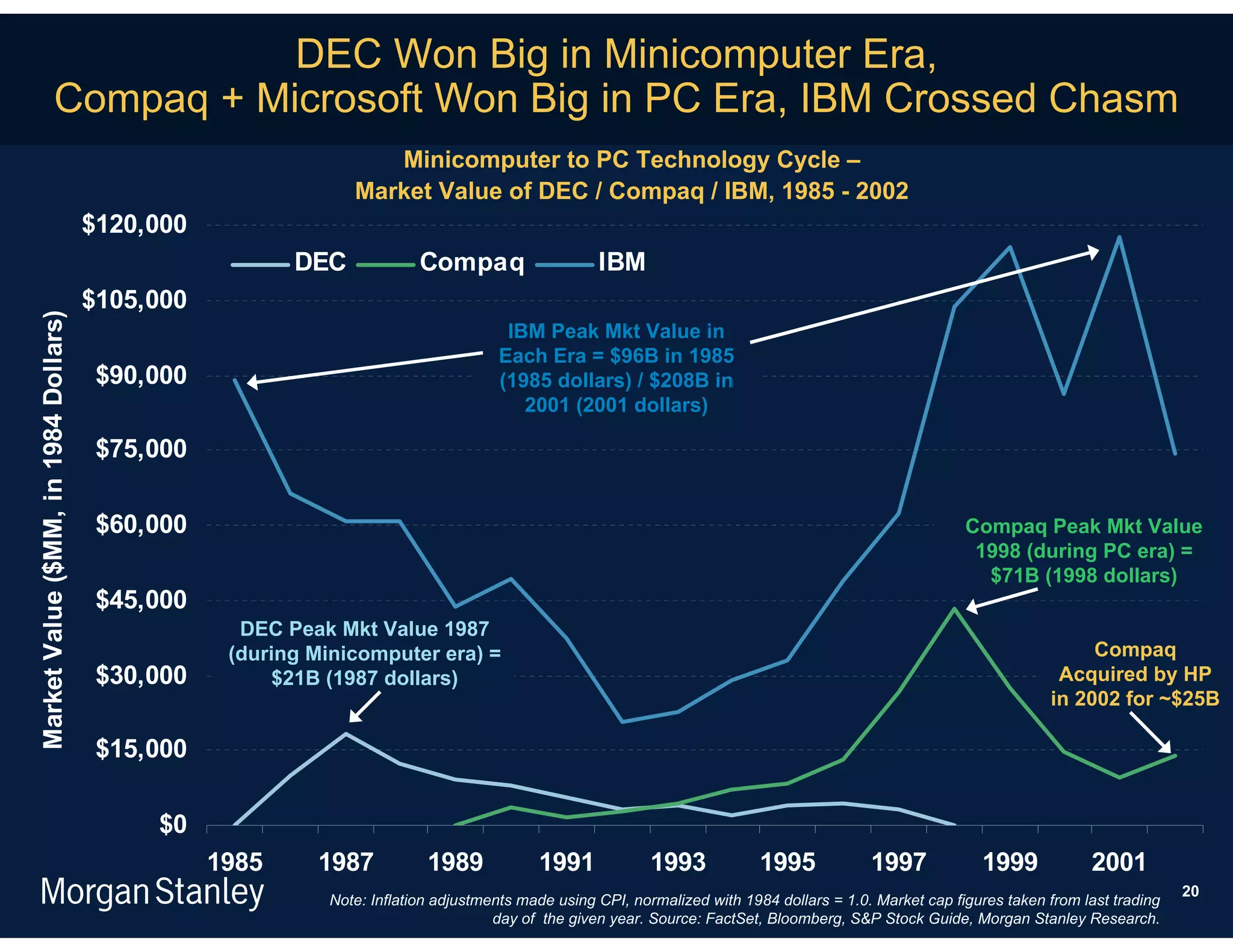

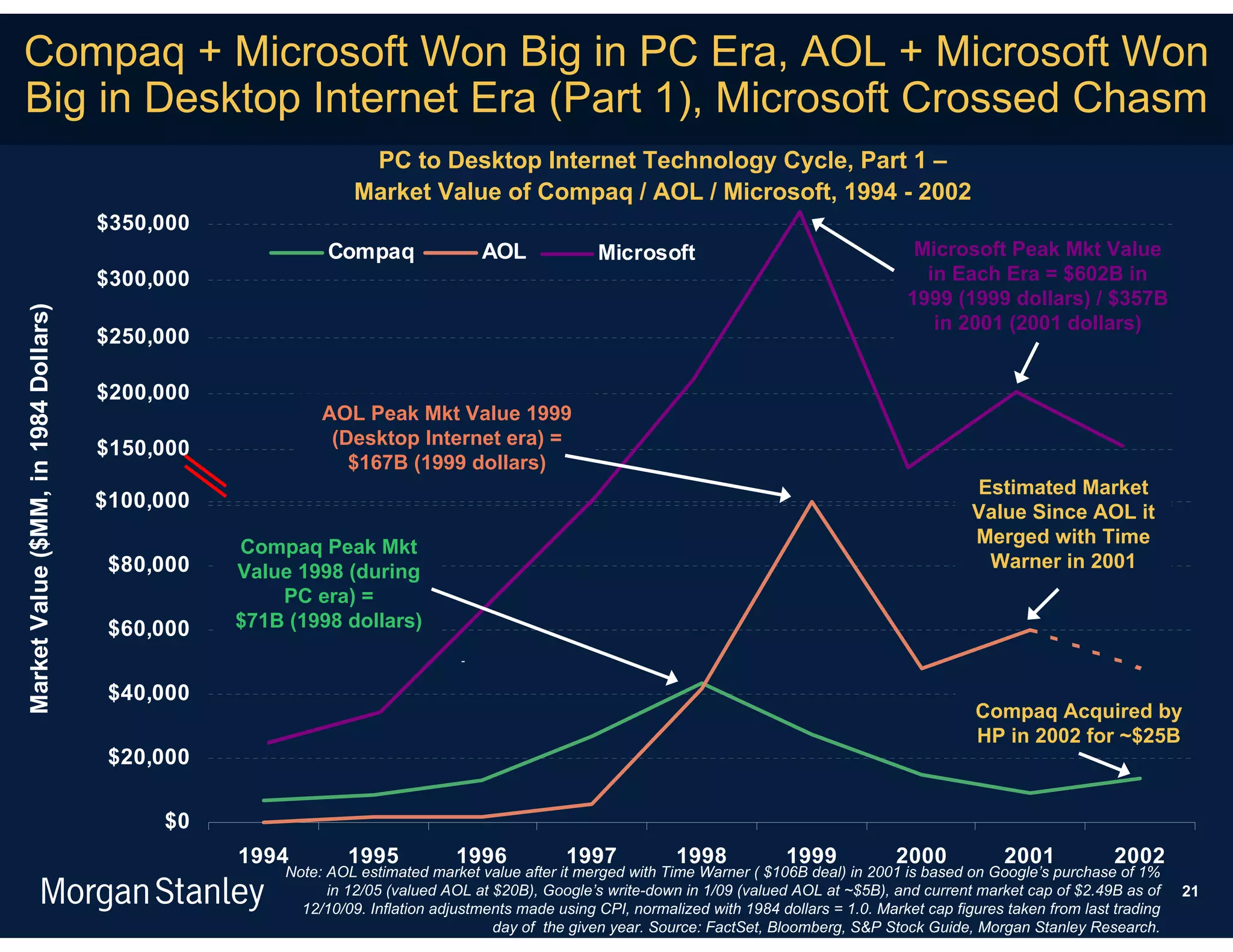

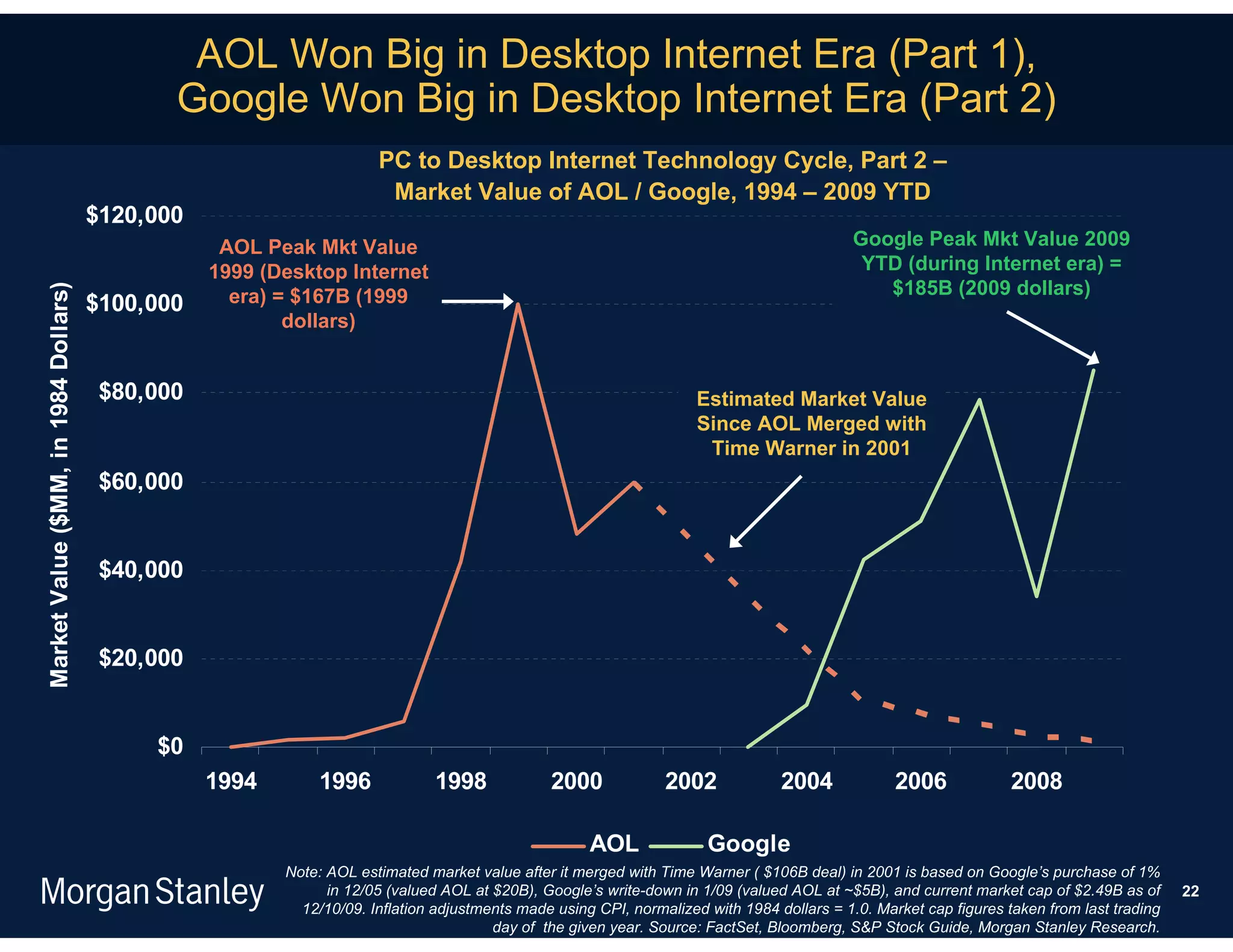

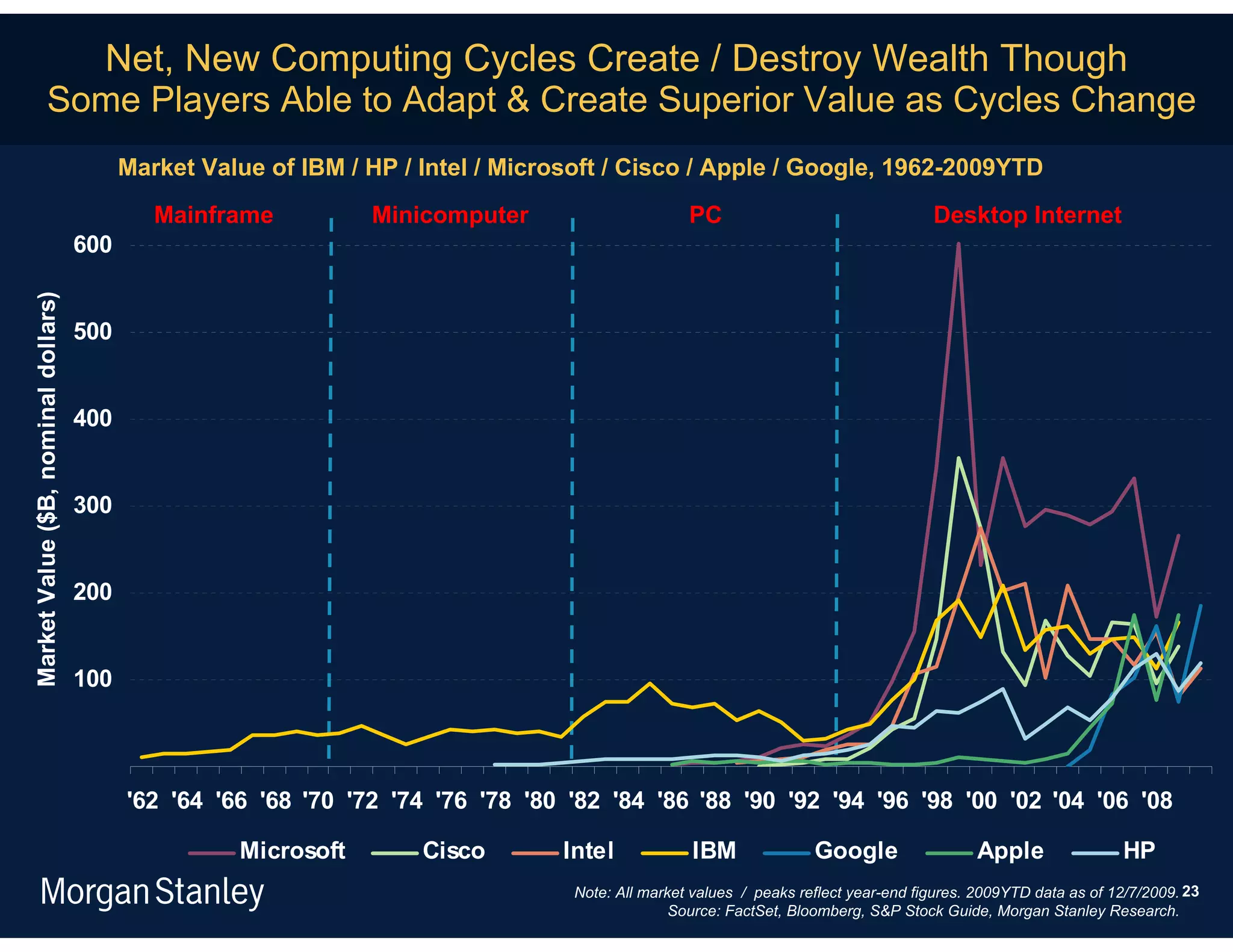

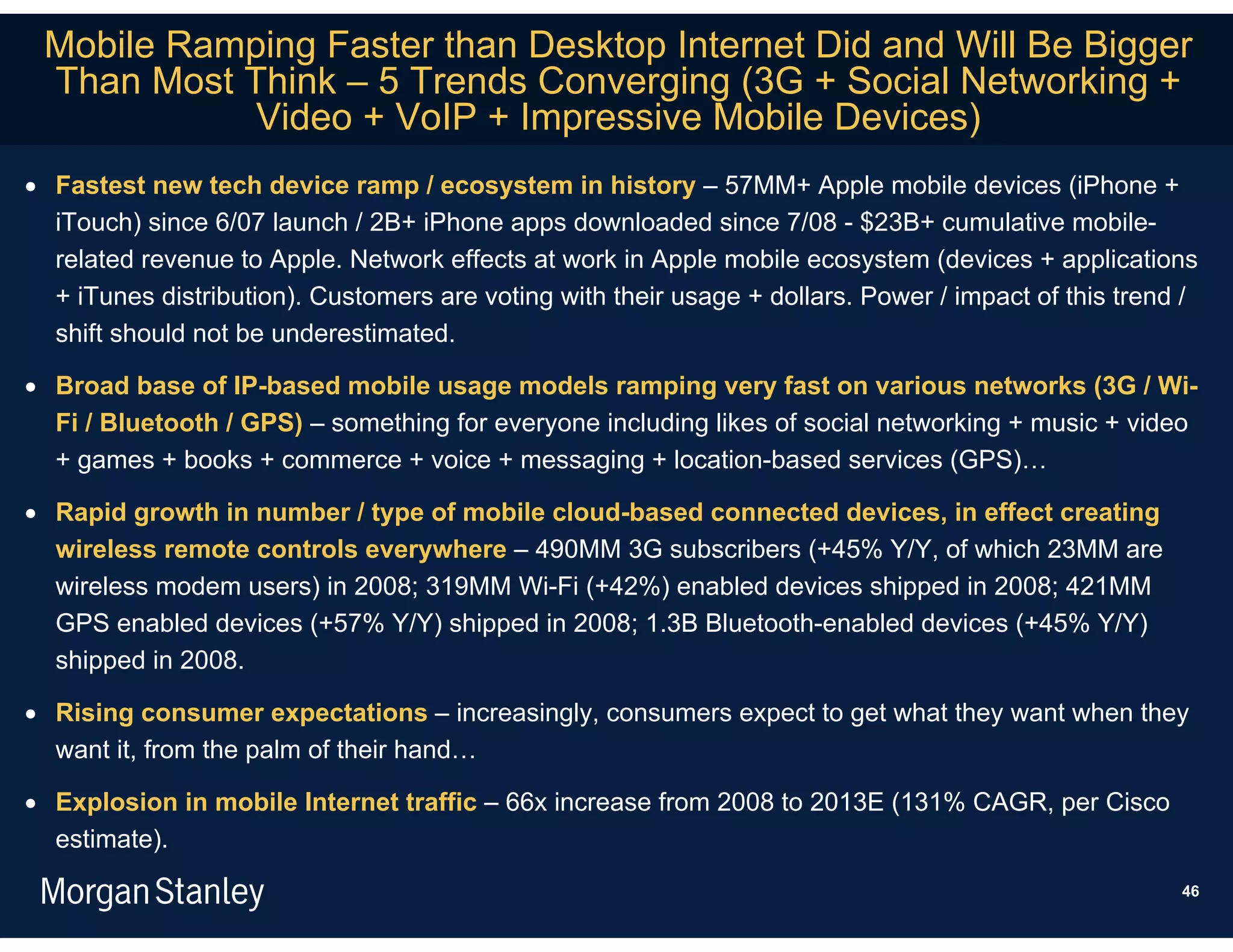

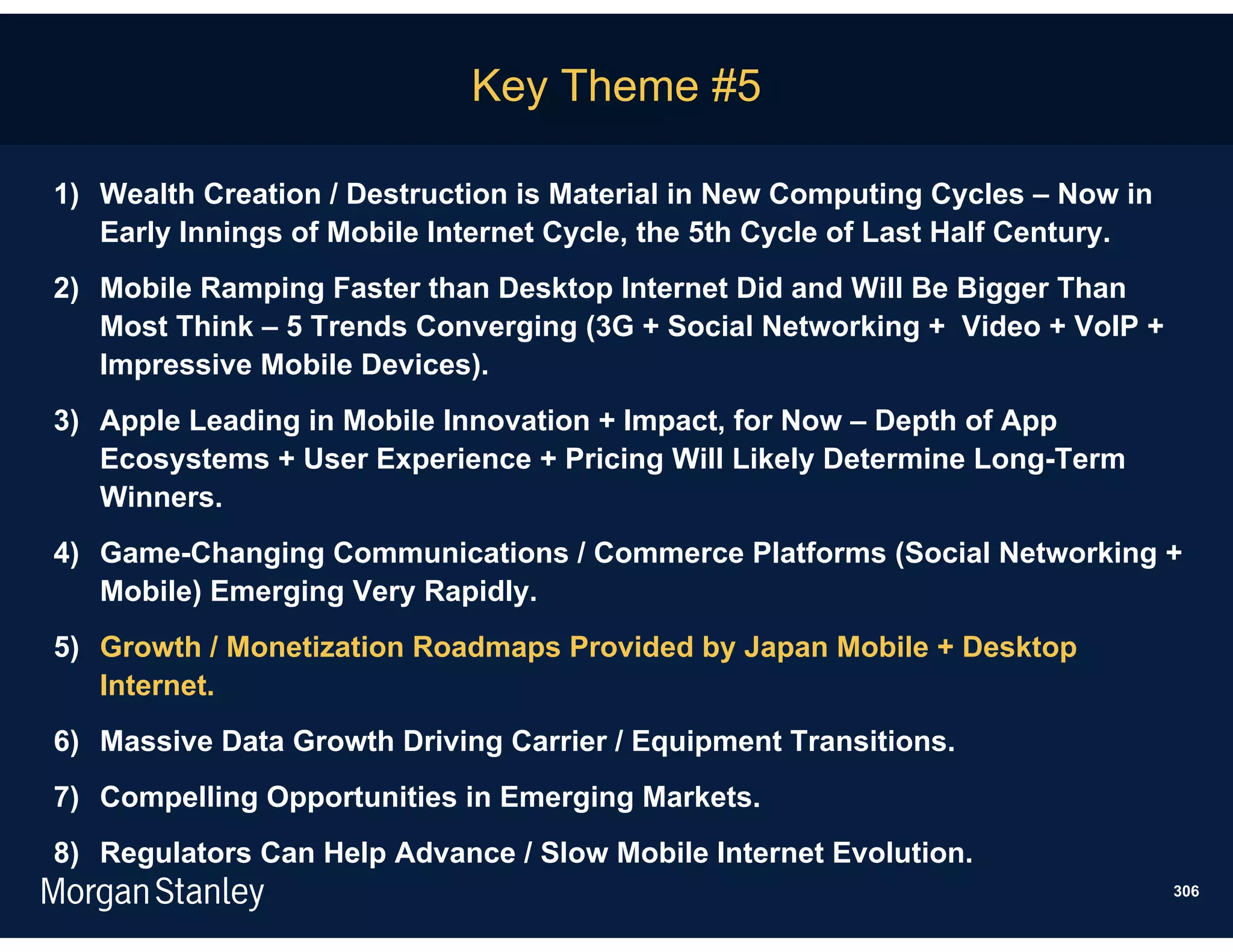

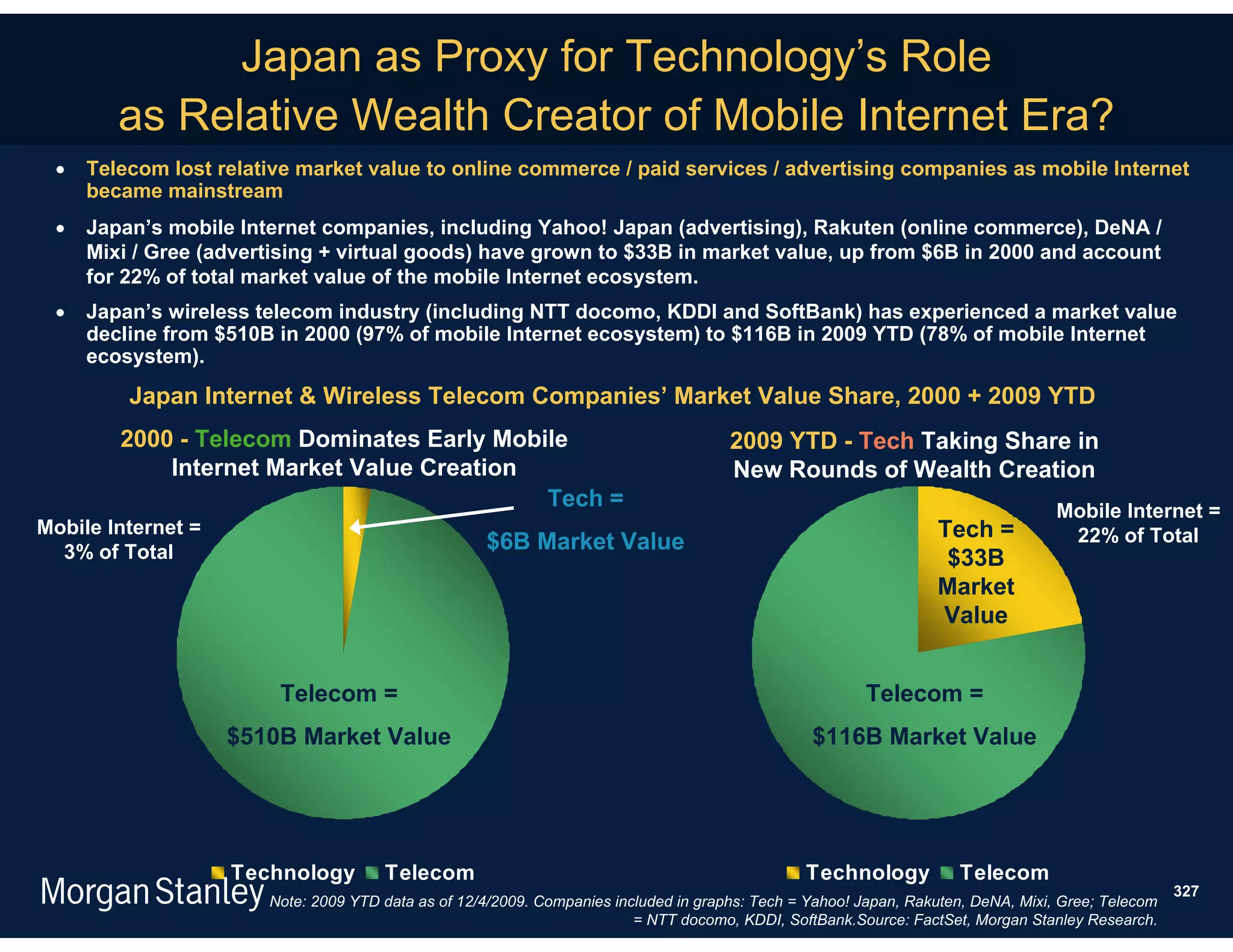

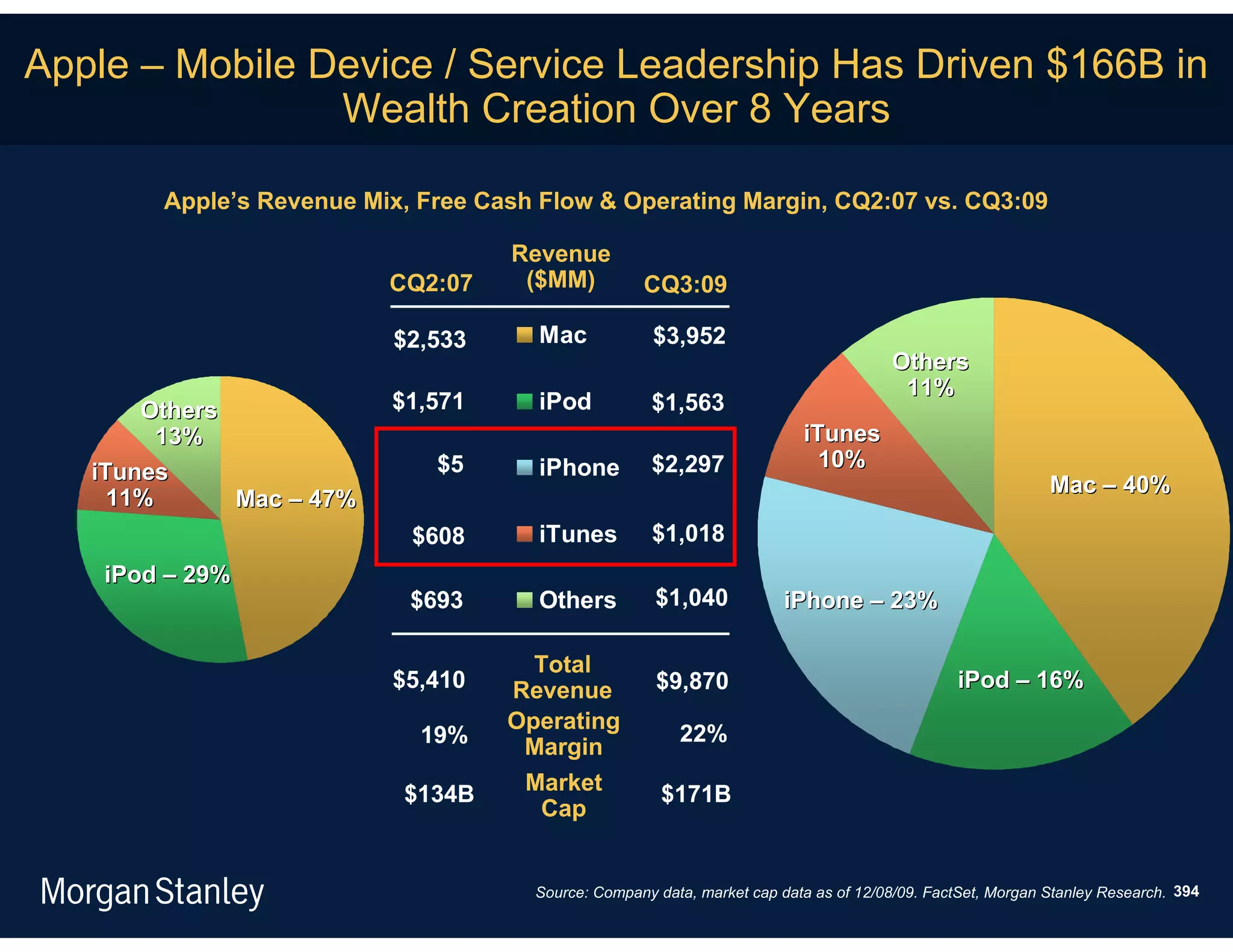

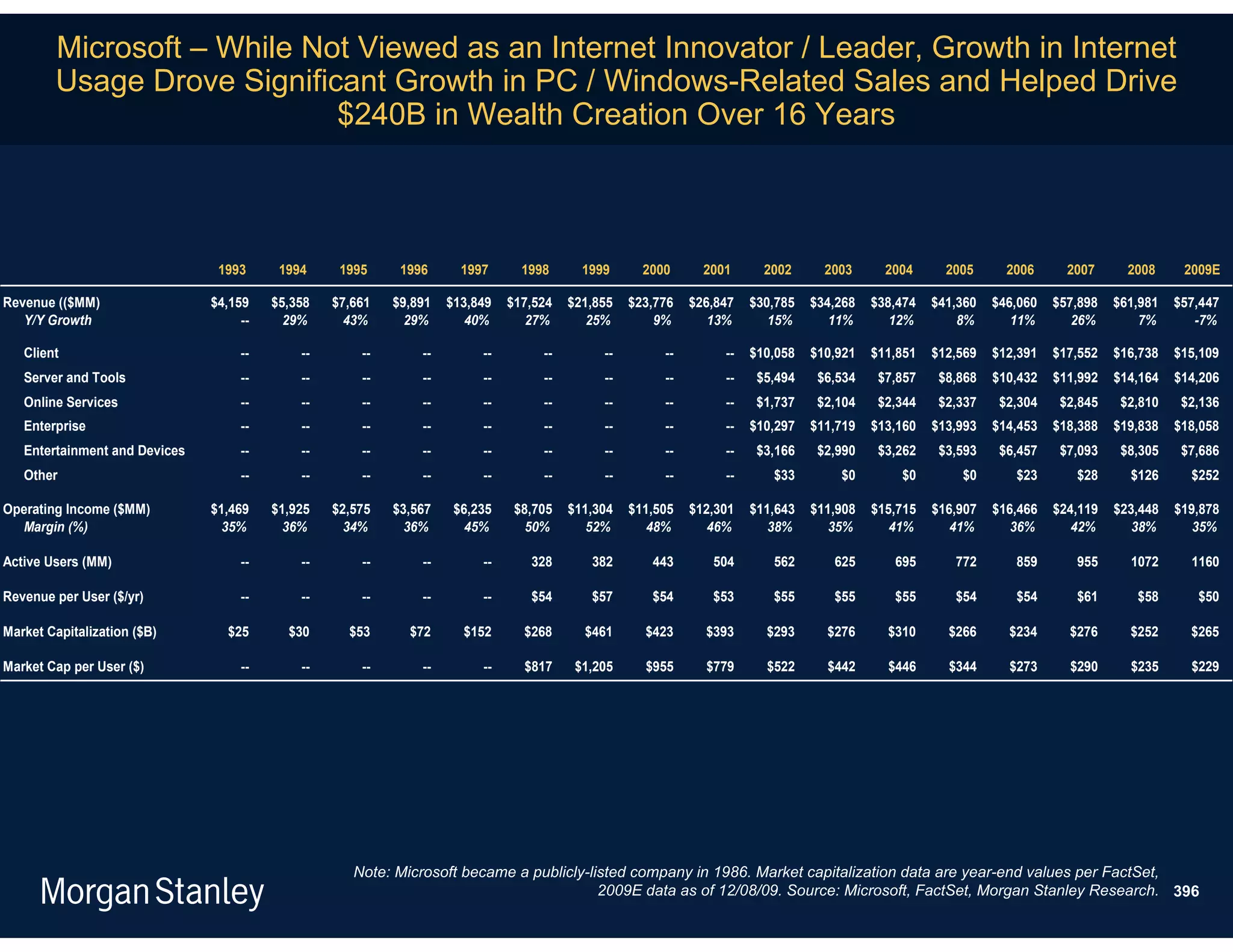

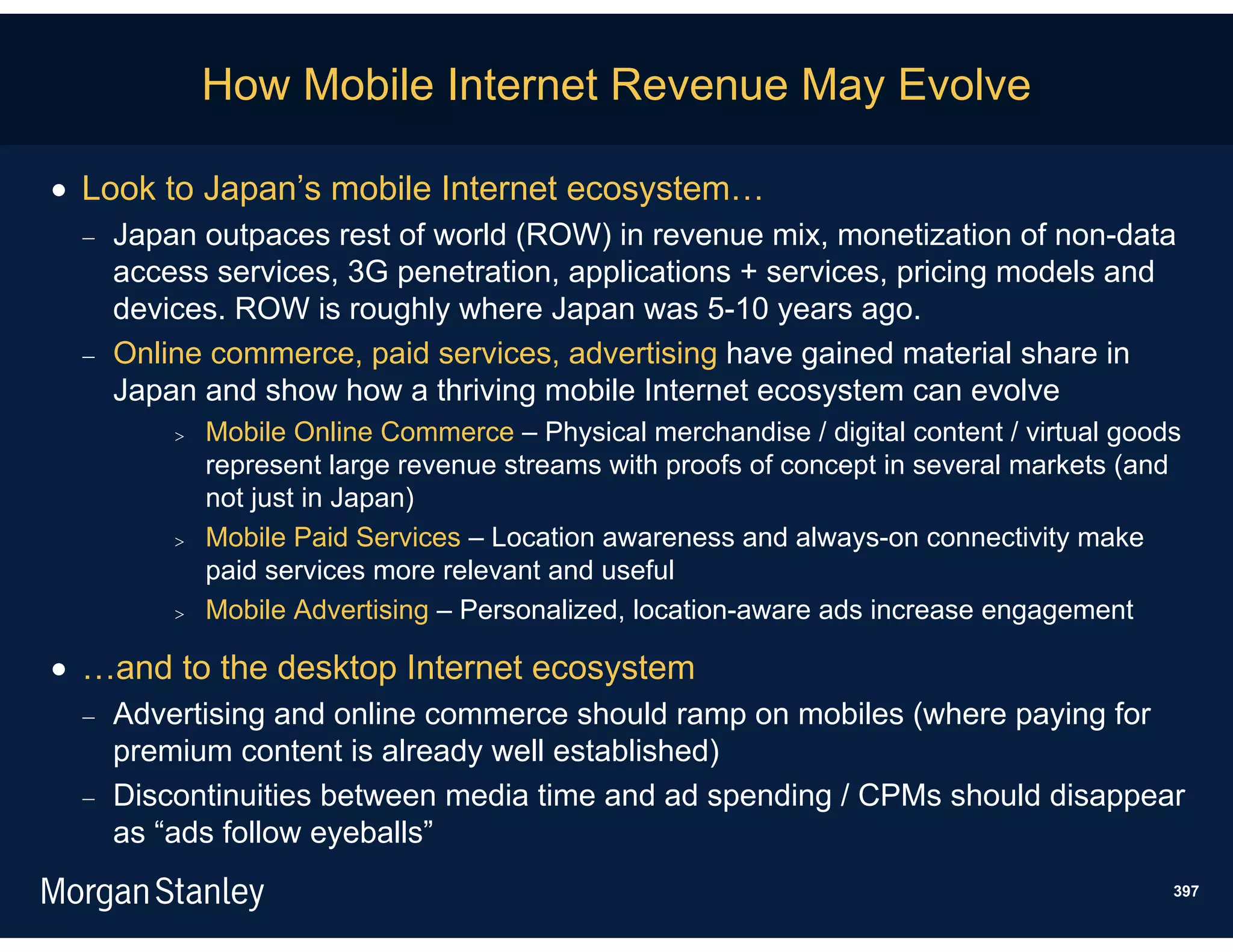

The document summarizes key themes from Morgan Stanley's Mobile Internet Report. The first theme is that wealth creation and destruction is material during new computing cycles, and we are currently in the early innings of the mobile internet cycle. History shows that massive technology changes typically shift dynamics between incumbents and attackers, creating winners and losers. A handful of current incumbents like Apple, Google, Amazon and Skype appear well positioned for the mobile changes.

![Paul Saffo Opined About the Internet in 1995 -

Here We Are 14 Years Later

It's a very consistent pattern in this business that collectively as

a society and as individuals we all suffer from what I call macro-

myopia. A pattern where our hopes and our expectations or our

fears about the threatened impact of some new technology

causes us to overestimate its short-term impacts and reality

always fails to meet those inflated expectations. And as a result

our disappointment then leads us to turn around and

underestimate the long-term implications and I can guarantee

you this time will be no different. The short-term impact of this

stuff [the Internet] will be less than the hype would suggest but

the long-term implications will be vastly larger than we can

possibly imagine today.

- Paul Saffo, 6/12/1995

Note: Paul Saffo was a director of the Institute for the Future, a consulting group that studies technology and future trends. 14

Source: Interview with PBS in Palo Alto, CA. 6/12/1995.](https://image.slidesharecdn.com/mobileinternetreportkeythemesfinal-100425034727-phpapp02/75/Mobile-internet-report_key_themes_final-14-2048.jpg)

![Mobile Internet Likely to Follow Timing & Development

Patterns of Desktop Internet Market

Timing & Development of Internet Market Segment – From Our 1996 Internet Retailing Report

nt]

s / C ns /

onte

s]

io

tform

Ser pplicat

[Pla

vice

[A

Mobile Internet

2005 … … … 2011E Timeline (ex. Japan)

39

Note: Original chart (black text) from Morgan Stanley’s Internet Retailing Report, published in 1996. Red text augmented in 11/09.

Source: Morgan Stanley Research.](https://image.slidesharecdn.com/mobileinternetreportkeythemesfinal-100425034727-phpapp02/75/Mobile-internet-report_key_themes_final-39-2048.jpg)

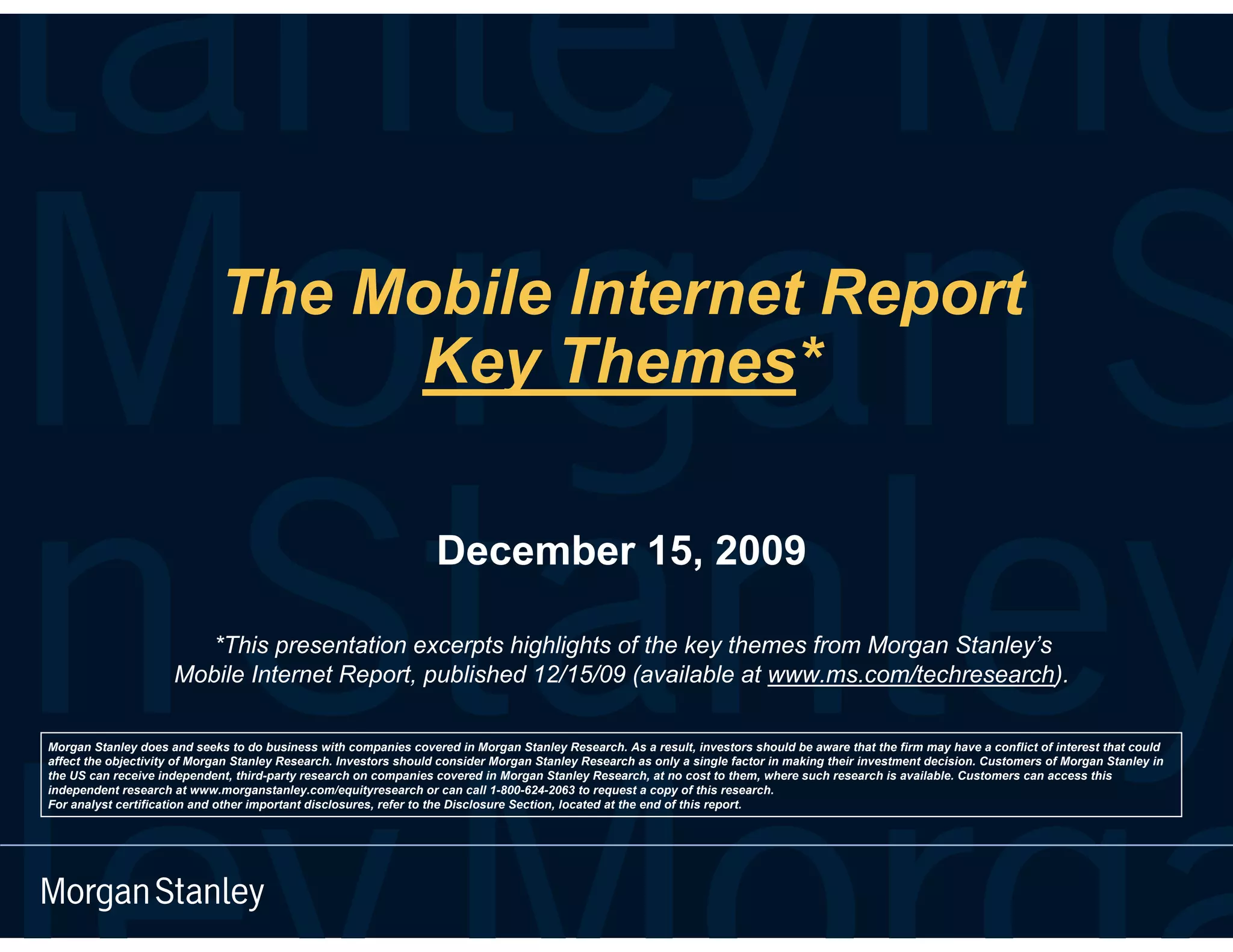

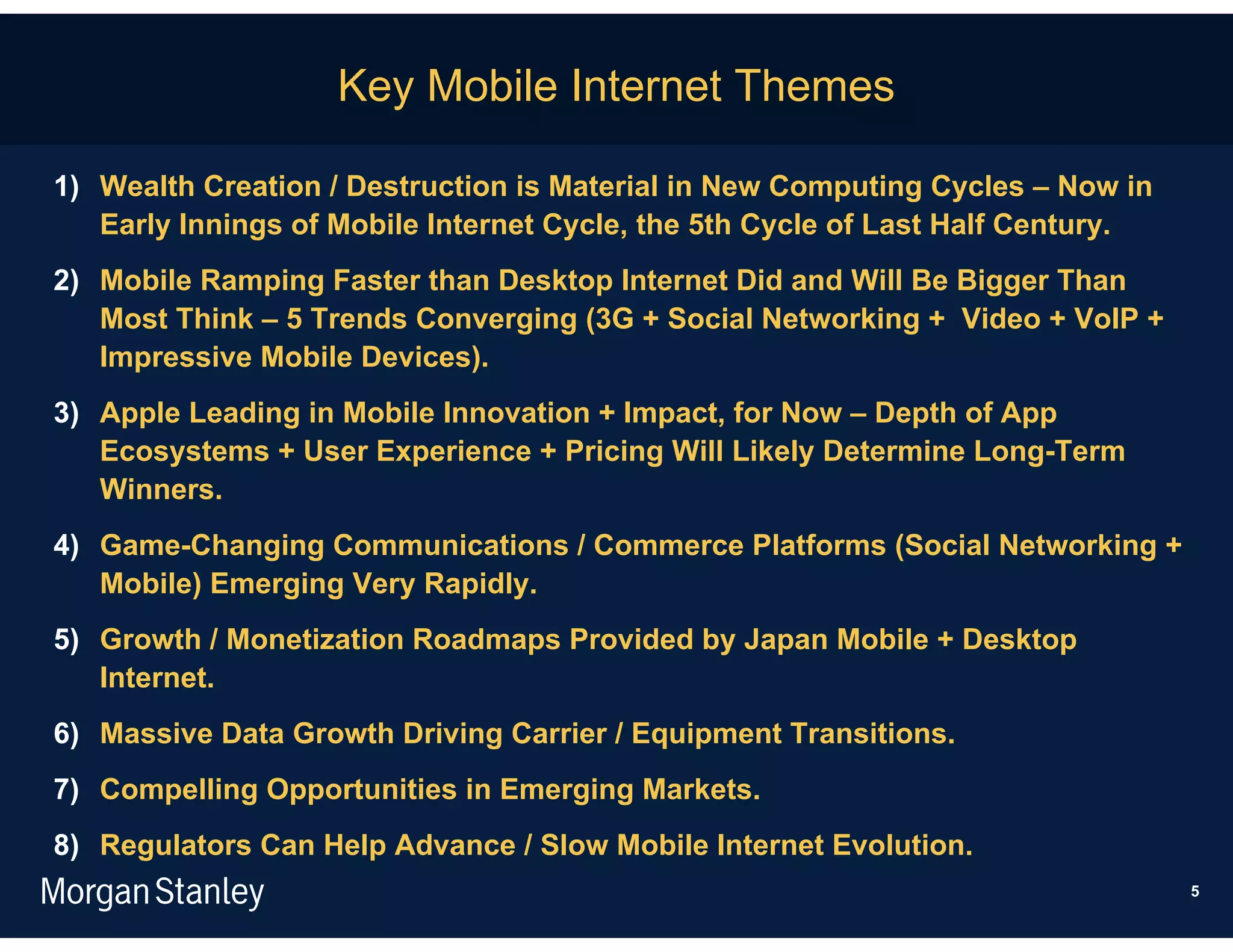

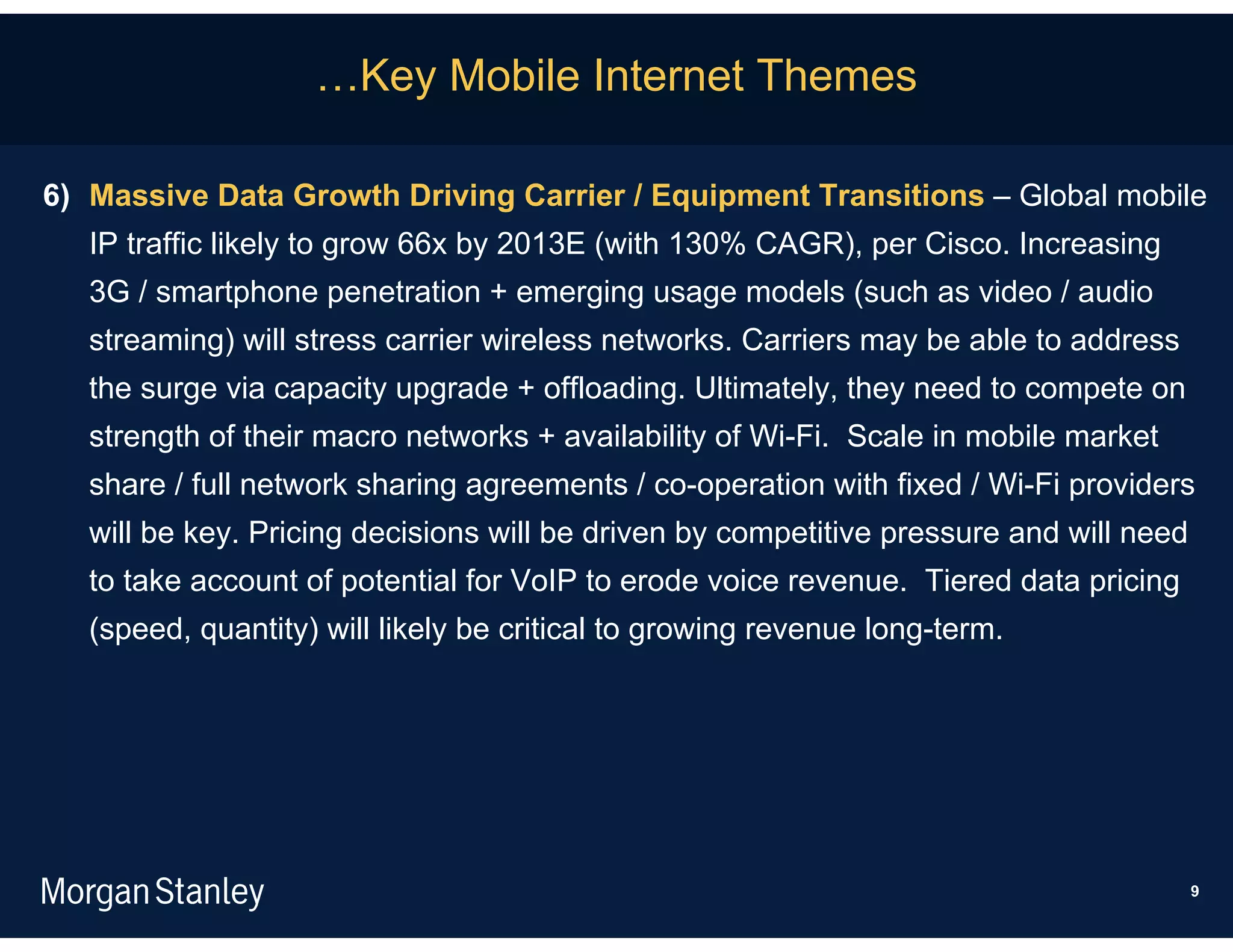

![iPhone Apps for Nearly Everyone –

Lots of Disintermediation Already…More to Come

Existing Potentially Displaced by… …iPhone Solutions Existing Product

Products Shipments / Users

Wi-Fi enabled VoIP Apps (Skype / Free calling + online status + IM / SMS 1B

Landline Phone Fring / Truphone…) integration 2008 global phone lines

Pandora / Spotify / iMeem / Last.fm / Personalized radio station based on genre 233MM*

Standalone Radio Public Radio (app)… / artist 2008E USA listeners

Portable DVD / Integrated iPod Function / YouTube / Better UI / local storage not a limit (for 130MM

Multimedia Players tv.com / [Hulu] / [Netflix] streaming apps) 2009E global shipments

Low-end Digital Built-in Camera / Nationwide 3.0 Megapixels / tap to select focus / anti- 103MM

Camera Insurance app… shake shutter / OTA sharing on Facebook

/ Flickr / email / Nationwide Insurance app 2009E global shipments

Better UI / local storage not a limit (for 62MM

MP3 Players Integrated iPod Function / Spotify streaming apps) 2009E global shipments

Built-in Google Maps / App Store Same basic function + always-on Internet 48MM

GPS Devices (ATT Navigator…) connection 2009E global shipments

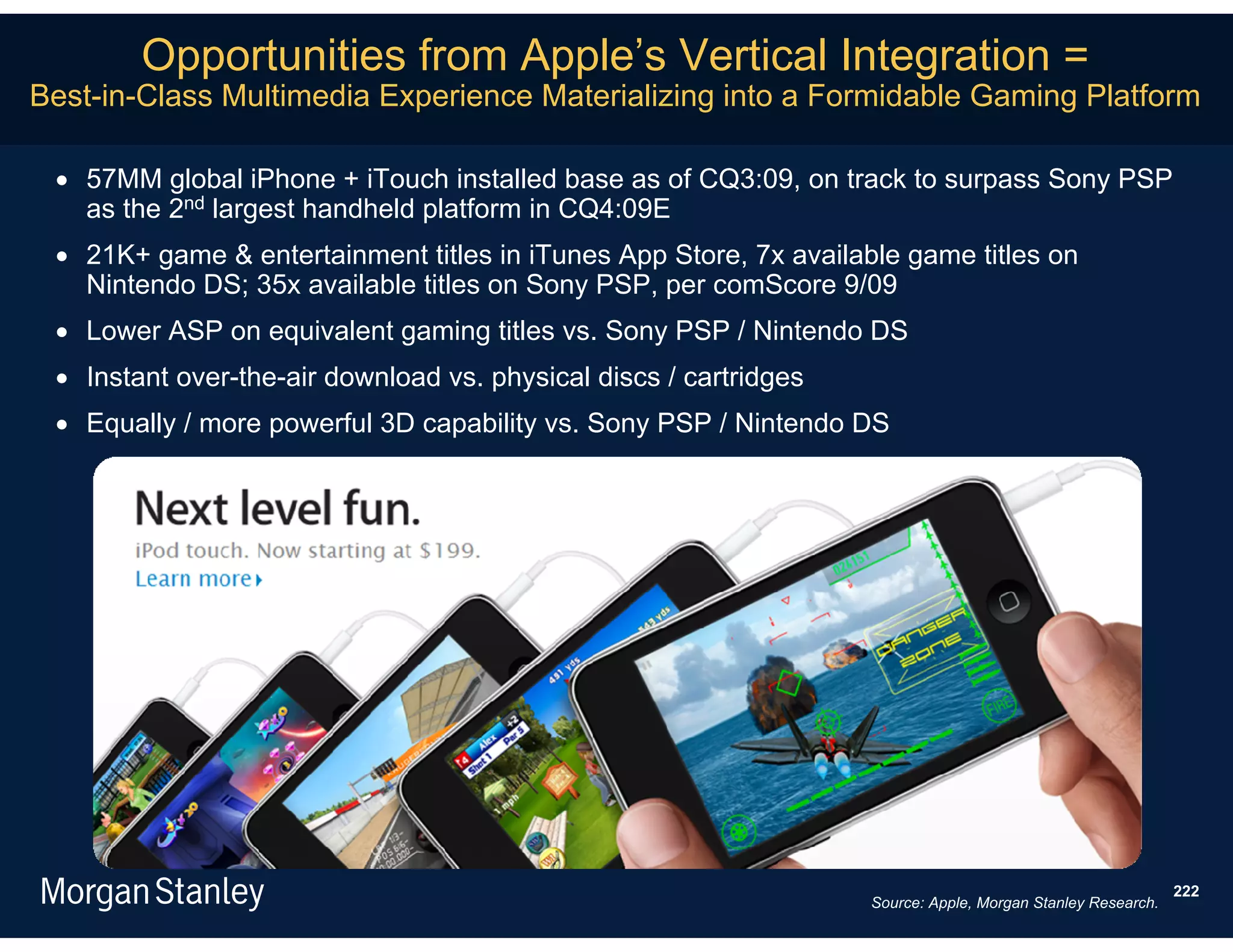

Portable Gaming Tap Tap Revenge / Bejeweled / Flight Lower ASP / instant OTA download / multi- 48MM

Devices Control… touch control 2009E global shipments

Low-end Built-in Video Capture Function / Built-in video editing / OTA upload to 14MM

Camcorders FOX News UReport… YouTube / OTA upload to FOX News 2009E global shipments

Standalone Voice Built-in Voice Recorder Digitized / easy to manage / sync with PC --

Recorder

Compass Built-in Electronic Compass Synergy with built-in maps feature --

Audible Dictionary Lonely Planet Mobile Phrasebook Available in 10 languages, 600+ spoken --

phrases in each language

Note: *OTA = Over the Air; 233MM radio listeners in USA, per SNL Kagan / Arbitron. Source: Future Horizons, iSuppli, IDC, 145

Morgan Stanley Research.](https://image.slidesharecdn.com/mobileinternetreportkeythemesfinal-100425034727-phpapp02/75/Mobile-internet-report_key_themes_final-145-2048.jpg)

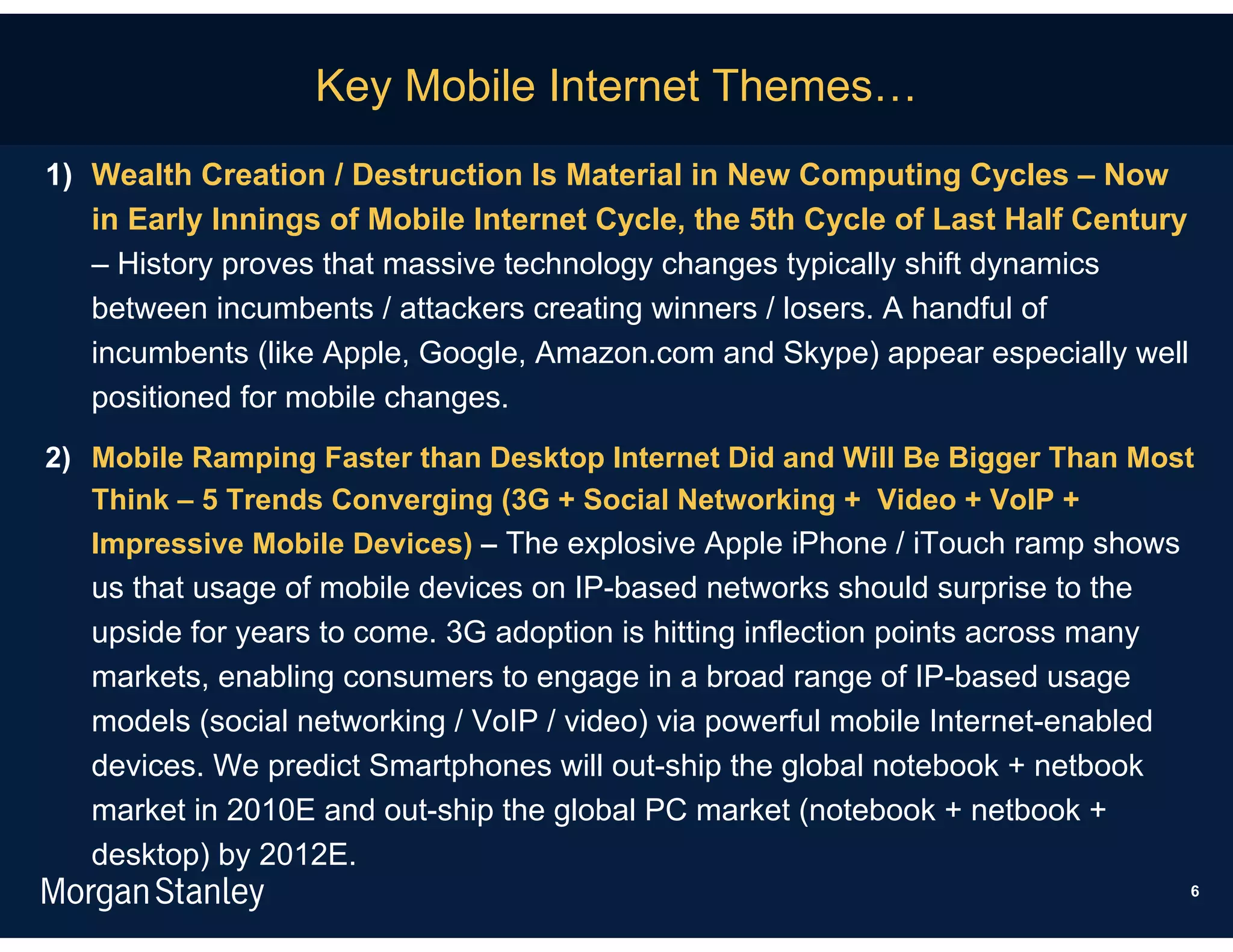

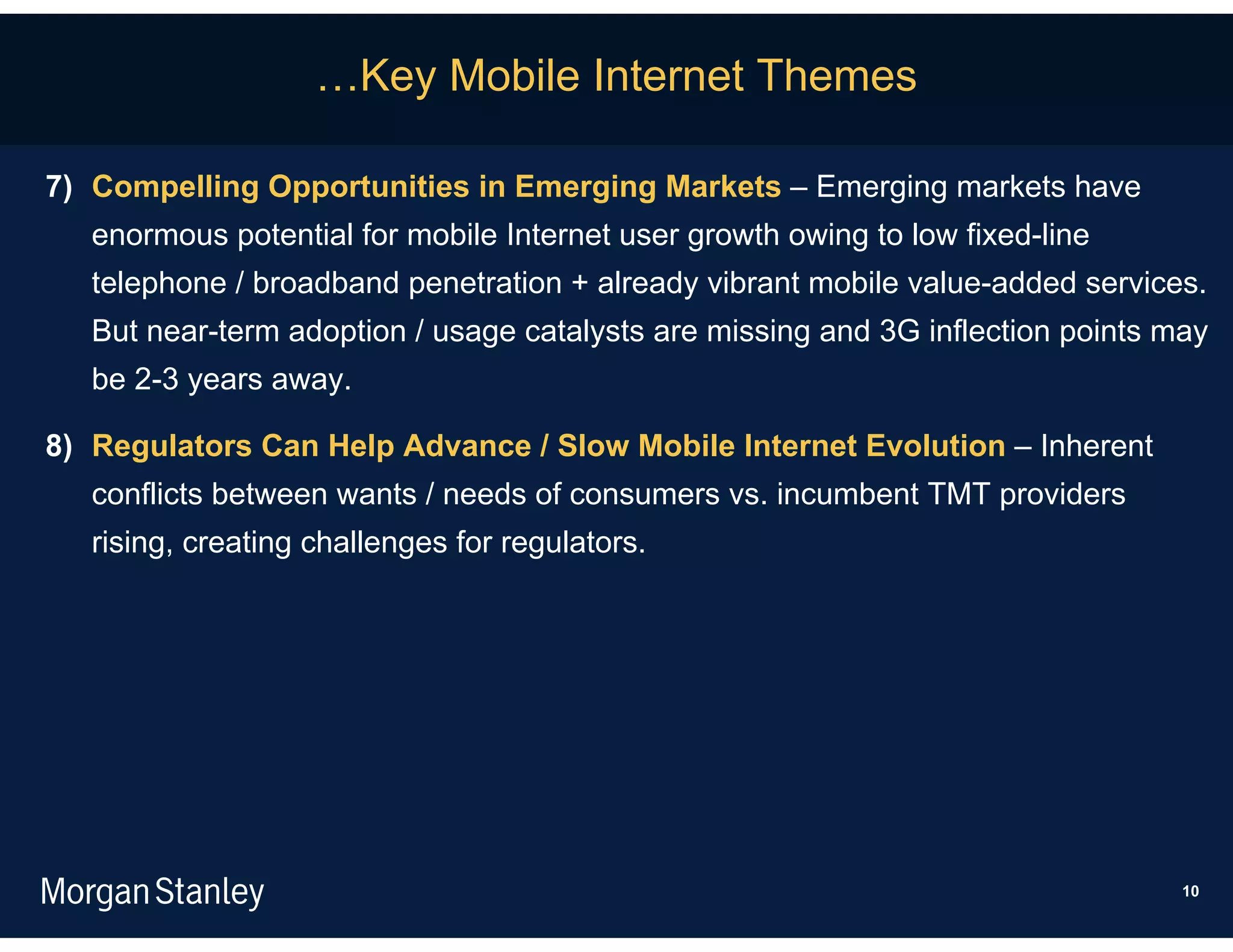

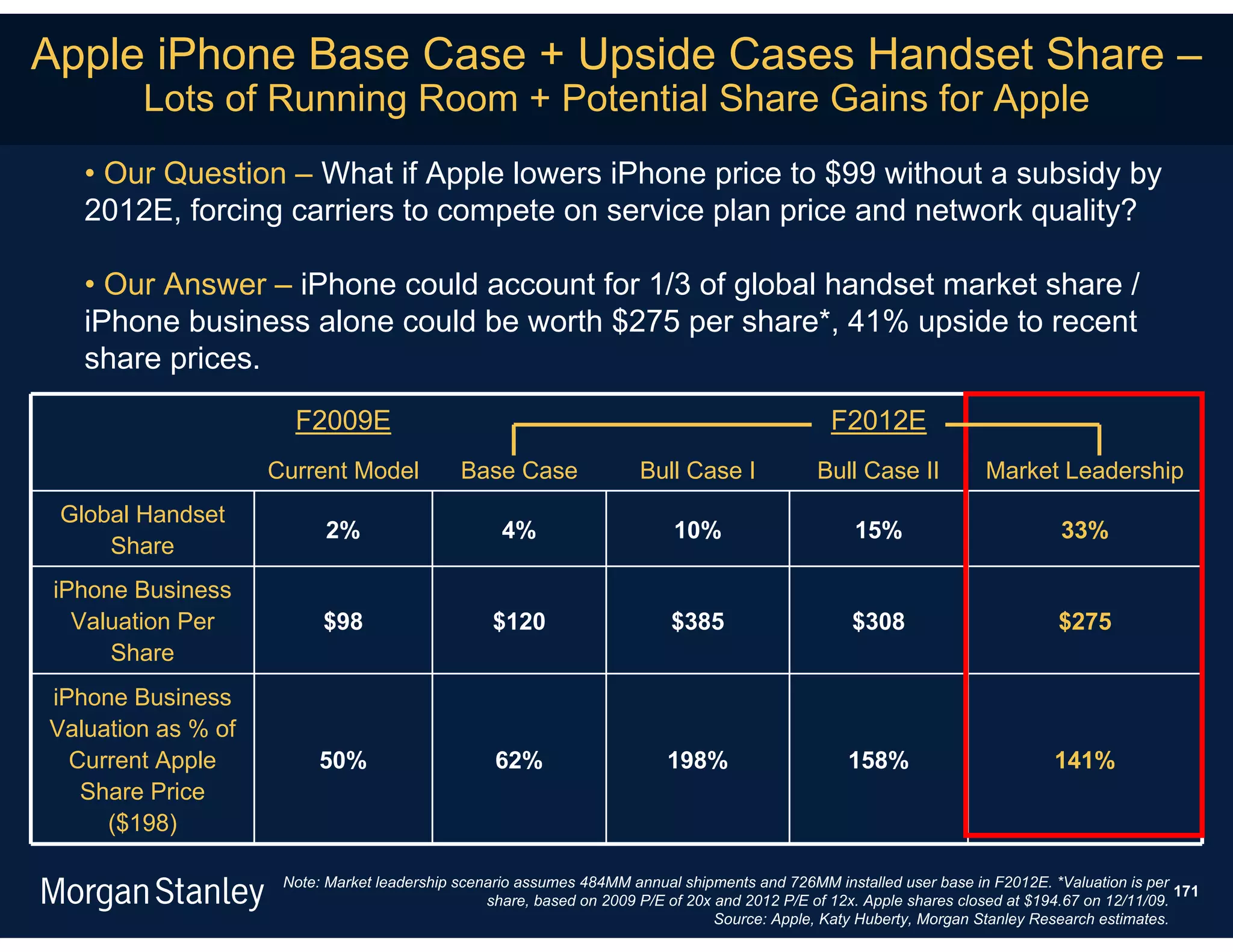

F2009 F2012

Bull Case - Broaden Bull Case - Broaden Bull Case - Market

distribution: Stable to low-end: Half Leadership: No

Subsidy / Modest BOM Subsidy / Average Subsidy / Aggressive

Current Model Base Case Decline BOM Decline BOM Decline

iPhone price to consumer $200 $99 $99 $99 $99

Average subsidy 400 387 400 200 -

Assumed annual BOM decrease 1% -10% -15% -33%

iPhone costs 240 248 206 152 75

iPhone gross Margin 60% 49% 59% 49% 24%

iPhone gross Profit 7,463 14,885 43,985 33,026 11,524

iPhone device revenue $12,439 $30,664 $74,850 $67,275 $47,916

iPhone shipments 21 63 150 225 484

iPhone installed base 32 116 255 360 726

Global handset share 2% 4% 10% 15% 33%

Other iPhone revenue $976 $3,570 $7,457 $9,892 $38,265

Other revenue per iPhone $30 $31 $29 $27 $53

Total iPhone revenue $13,415 $34,234 $82,307 $77,167 $86,181

Gross profit margin 61% 51% 60% 53% 44%

Operating margin 46% 39% 52% 45% 36%

Total iPhone EPS $4.90 $10.04 $32.04 $25.63 $22.90

iPhone business valuation (12x F2012 EPS) $98 $120 $385 $308 $275

iPhone revenue % of total apple 31% 45% 67% 65% 68%

iPhone business valuation as % of

current Apple share price ($195) 50% 62% 198% 158% 141%

Note: (1) based on valuation of $120-385 per share and 899.8 shares. Valuation is per share, based on 2009 P/E of 20x

173

and 2012 P/E of 12x. Apple shares closed at $194.67 on 12/11/09. Source: Apple, Katy Huberty, Morgan Stanley Research.](https://image.slidesharecdn.com/mobileinternetreportkeythemesfinal-100425034727-phpapp02/75/Mobile-internet-report_key_themes_final-173-2048.jpg)

![Mobile Internet Likely to Follow Timing & Development

Patterns of Desktop Internet Market

Timing & Development of Internet Market Segment – From Our 1996 Internet Retailing Report

nt]

s / C ns /

onte

s]

io

tform

Ser pplicat

[Pla

vice

[A

Mobile Internet

2005 … … … 2011E Timeline (ex. Japan)

328

Note: Original chart (black text) from Morgan Stanley’s Internet Retailing Report, published in 1996. Red text augmented in 11/09.

Source: Morgan Stanley Research.](https://image.slidesharecdn.com/mobileinternetreportkeythemesfinal-100425034727-phpapp02/75/Mobile-internet-report_key_themes_final-328-2048.jpg)

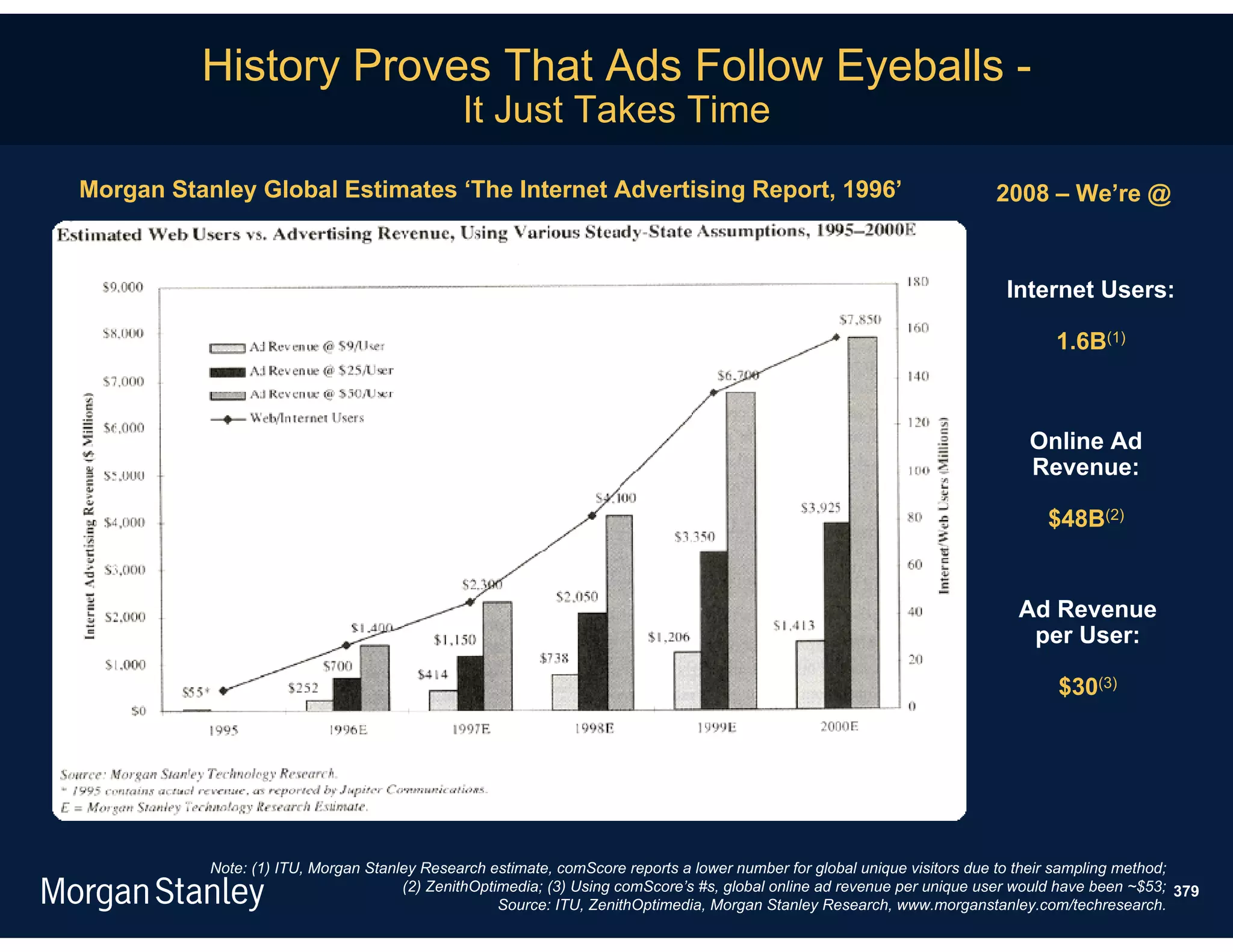

![Media Time Spent vs. Ad Spend Out of Whack

Companies are spending up to 12% to 13% on digital

[advertising]. We know we spend up to 20% of our time

online, so in theory spending should be up at 20%. It's just

natural conservatism, resistance to change and inability to

adapt to change. I believe when digital budgets get to 20%,

which will be in four or five years, we will be spending 30%

of our time online.

- Sir Martin Sorrell, CEO of WPP Group

Source: WSJ.com Interview with Sir Martin Sorrell, 9/22/09. 377](https://image.slidesharecdn.com/mobileinternetreportkeythemesfinal-100425034727-phpapp02/75/Mobile-internet-report_key_themes_final-377-2048.jpg)

![Competitive Share Gain Opportunities Keep Carriers in

Search of Next Hot Handset and Afraid of Network Outages

Global wireless carriers continue to compete to offer iPhone as they see it as a

way to gain share of high-value customers / reduce churn.

Apple is broadening its distribution to multiple carriers in the same country (UK /

Canada…).

In markets that will become competitive as multiple carriers offer iPhones,

carriers that have paying customers who hate their service will find that their

customers simply go to another vendor.

Competition to offer the best 3G+ services will intensify…

Getting iPhone was top of my to-do list.

-- Tom Alexander, CEO of Orange, 10/07

It’s clear that the iPhone has worked pretty well in the UK market and not

having it has penalized us [losing 159K customers].

-- Vittorio Colao, CEO of Vodafone, CQ1:09 Earnings Call

547

Source: The Telegraph, 10/02/09. Vodafone CQ1:09 Earnings Call.](https://image.slidesharecdn.com/mobileinternetreportkeythemesfinal-100425034727-phpapp02/75/Mobile-internet-report_key_themes_final-547-2048.jpg)