1. The document provides an agenda for a presentation on machine learning and AI in finance. The presentation will cover key trends in AI, an introduction to machine learning concepts, and two case studies on interest rate prediction and synthetic data generation.

2. The speaker is introduced as an advisory consultant with experience in financial analytics and teaching AI/ML topics. He is the founder and CEO of QuantUniversity, a training platform for quantitative methods.

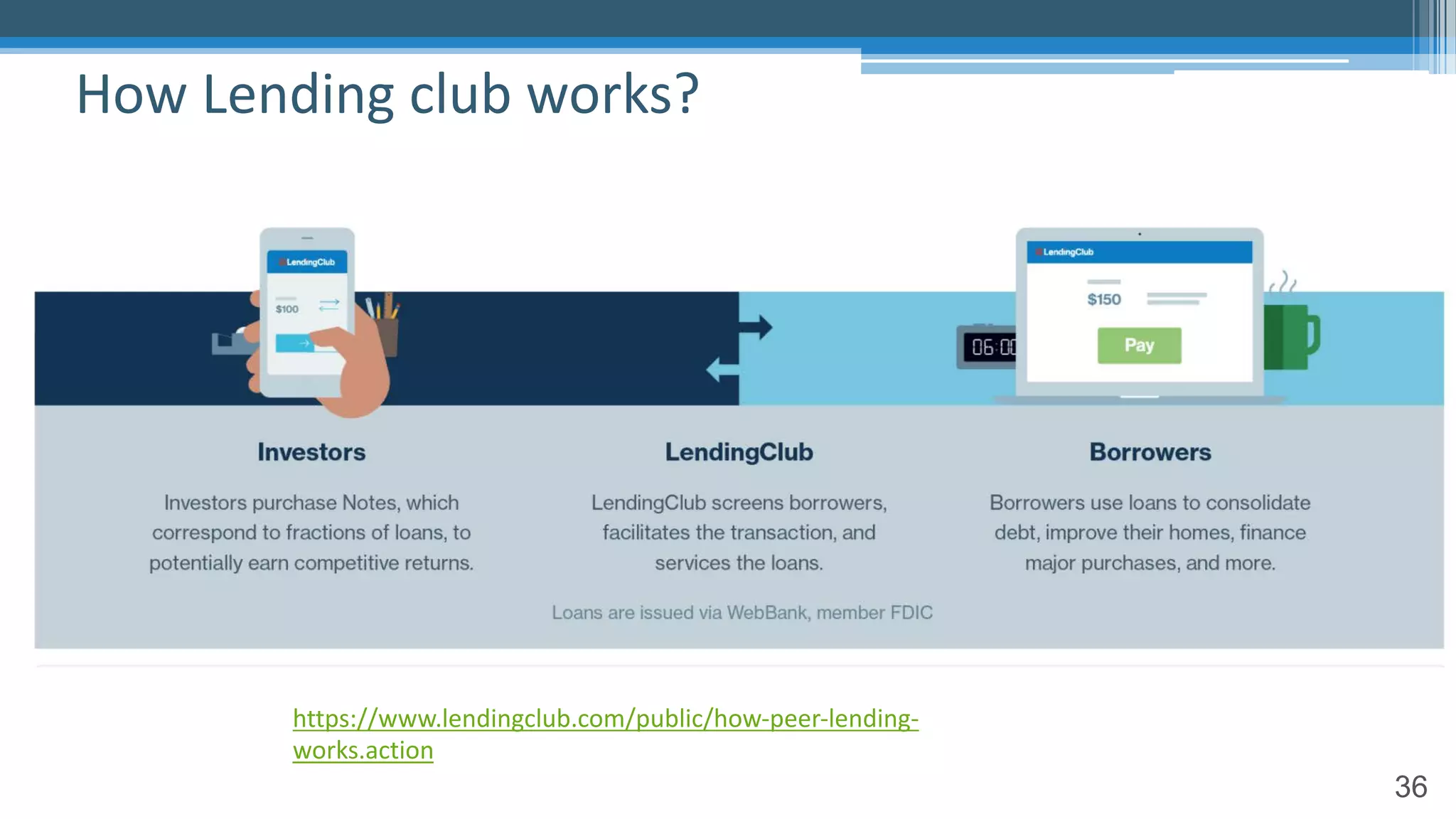

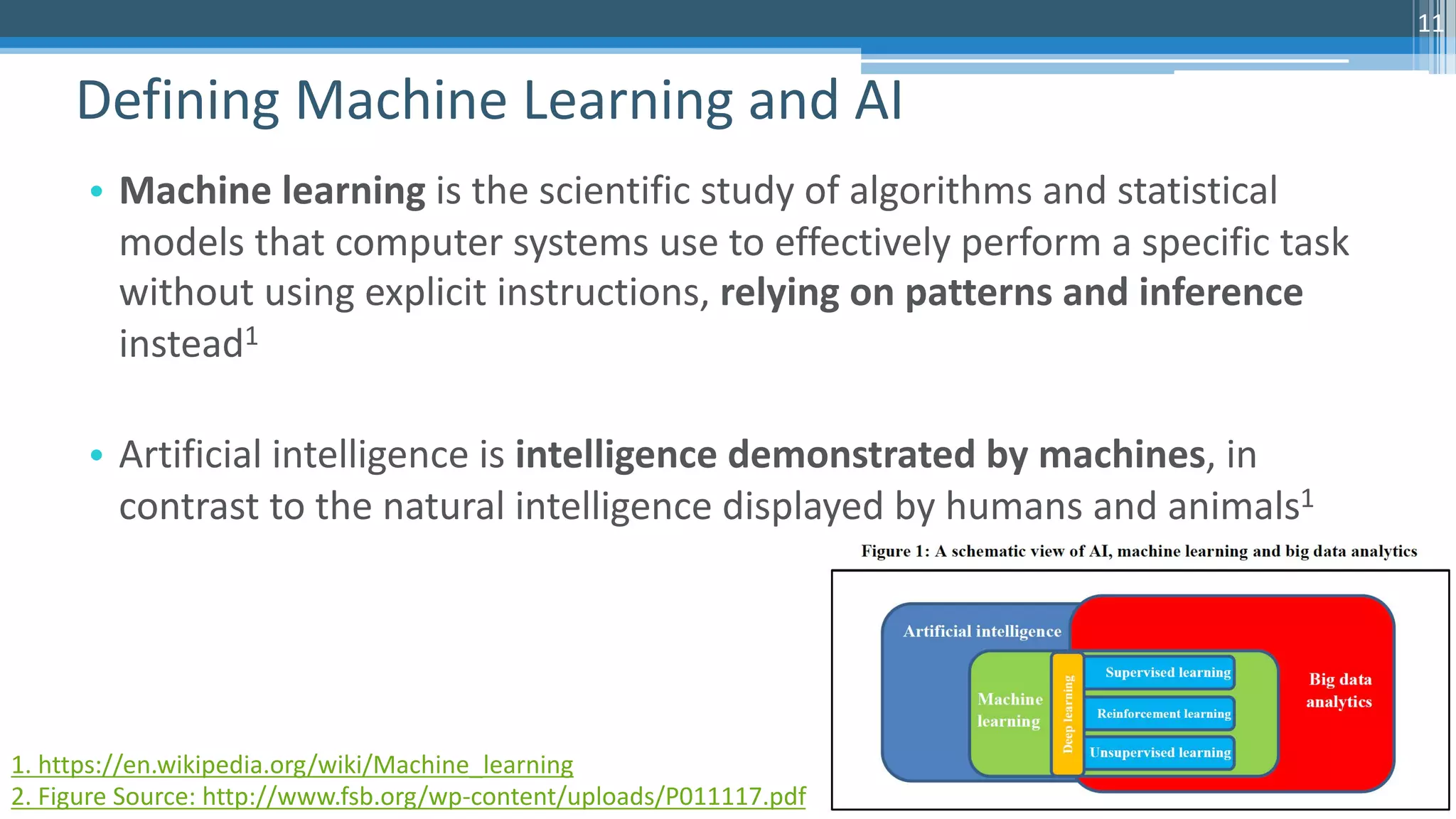

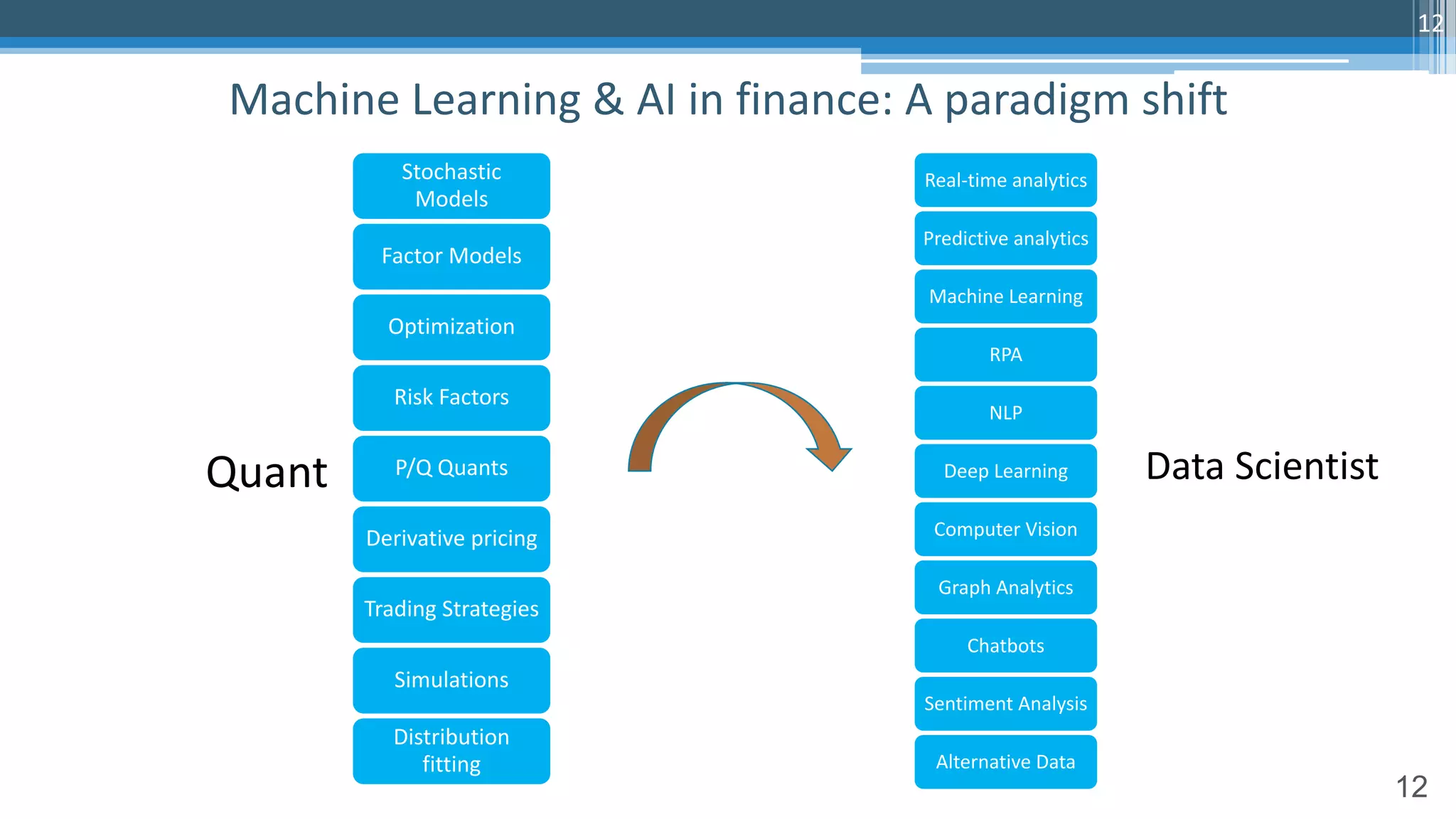

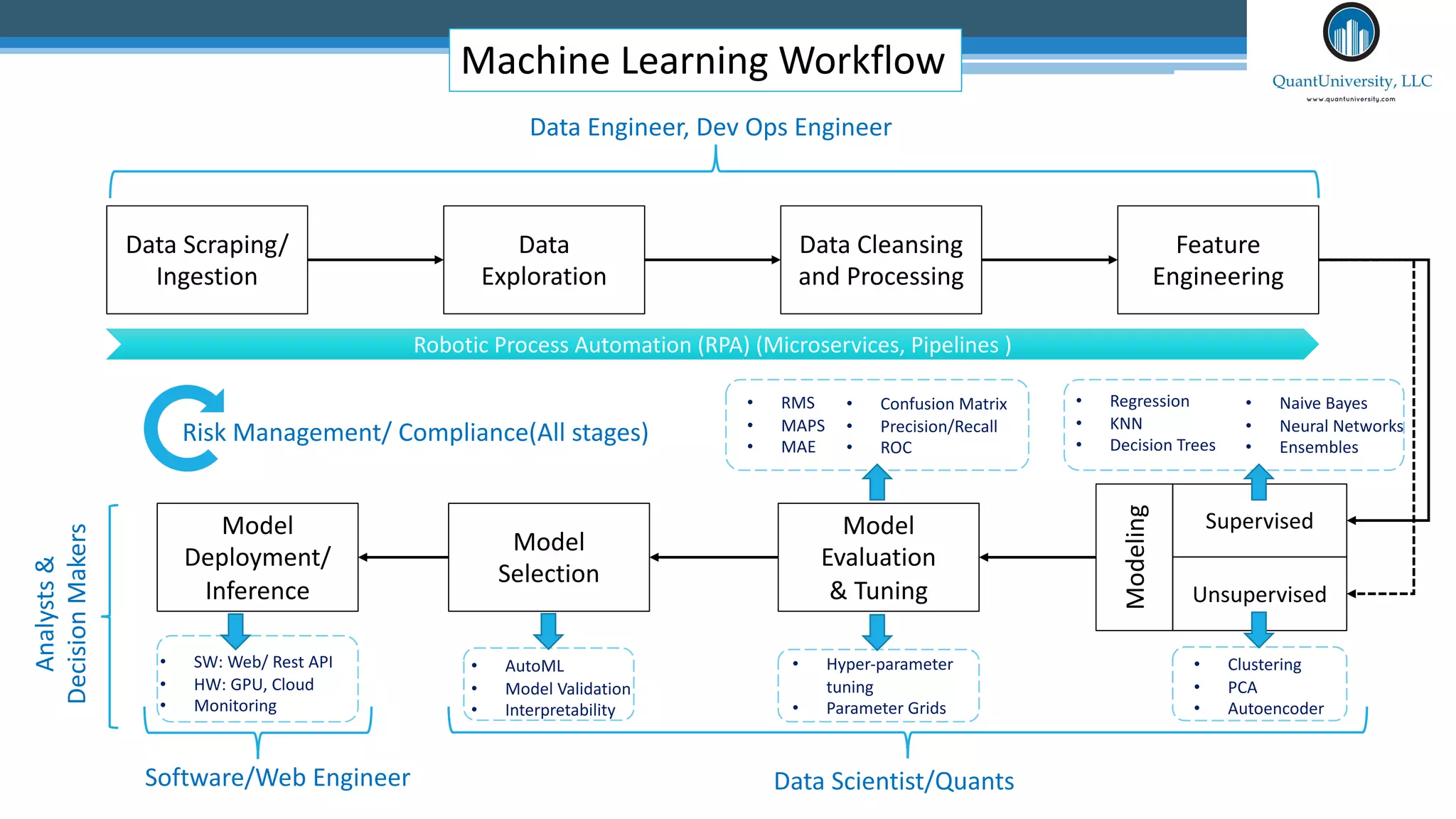

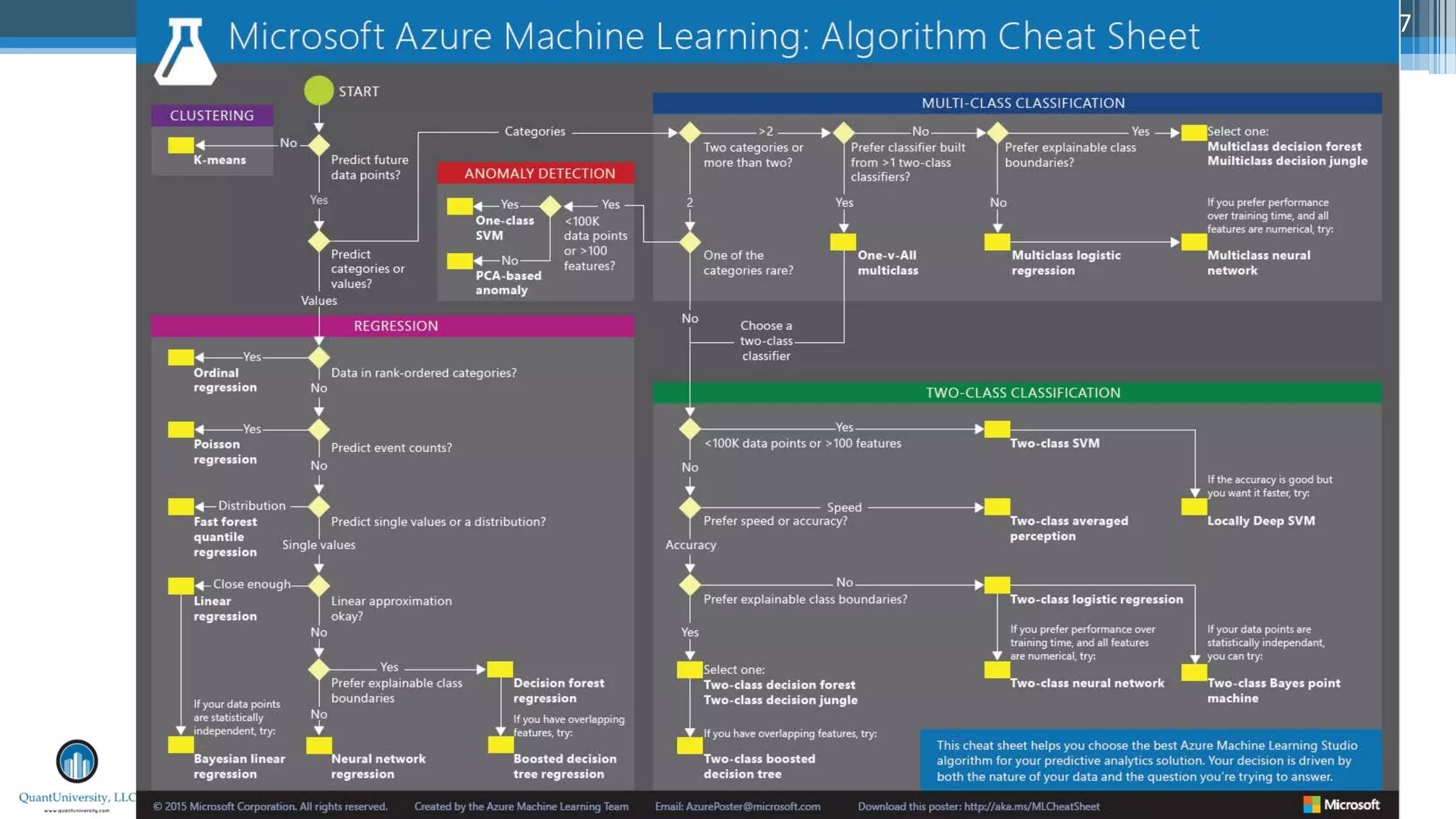

3. The presentation will provide an intuitive introduction to machine learning and AI concepts and discuss their growing impact and applications in finance industry such as fraud detection and arbitrage opportunities.

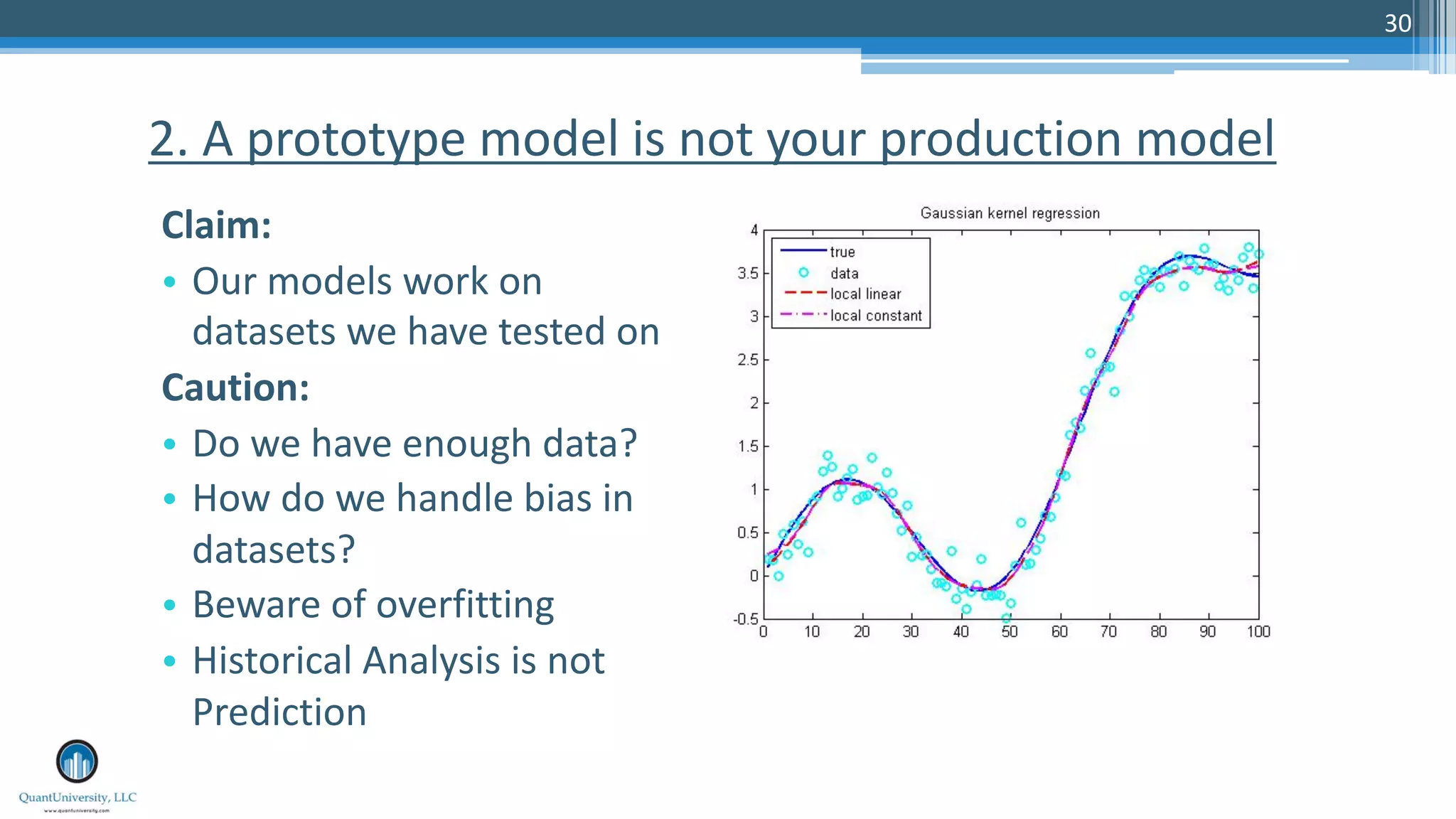

![31

AI and Machine Learning in Production

https://www.itnews.com.au/news/hsbc-societe-generale-run-

into-ais-production-problems-477966

Kristy Roth from HSBC:

“It’s been somewhat easy - in a funny way - to

get going using sample data, [but] then you hit

the real problems,” Roth said.

“I think our early track record on PoCs or pilots

hides a little bit the underlying issues.

Matt Davey from Societe Generale:

“We’ve done quite a bit of work with RPA

recently and I have to say we’ve been a bit

disillusioned with that experience,”

“the PoC is the easy bit: it’s how you get that

into production and shift the balance”](https://image.slidesharecdn.com/mlmasterclass-northeasternuniversity-201027215813/75/Ml-master-class-northeastern-university-31-2048.jpg)