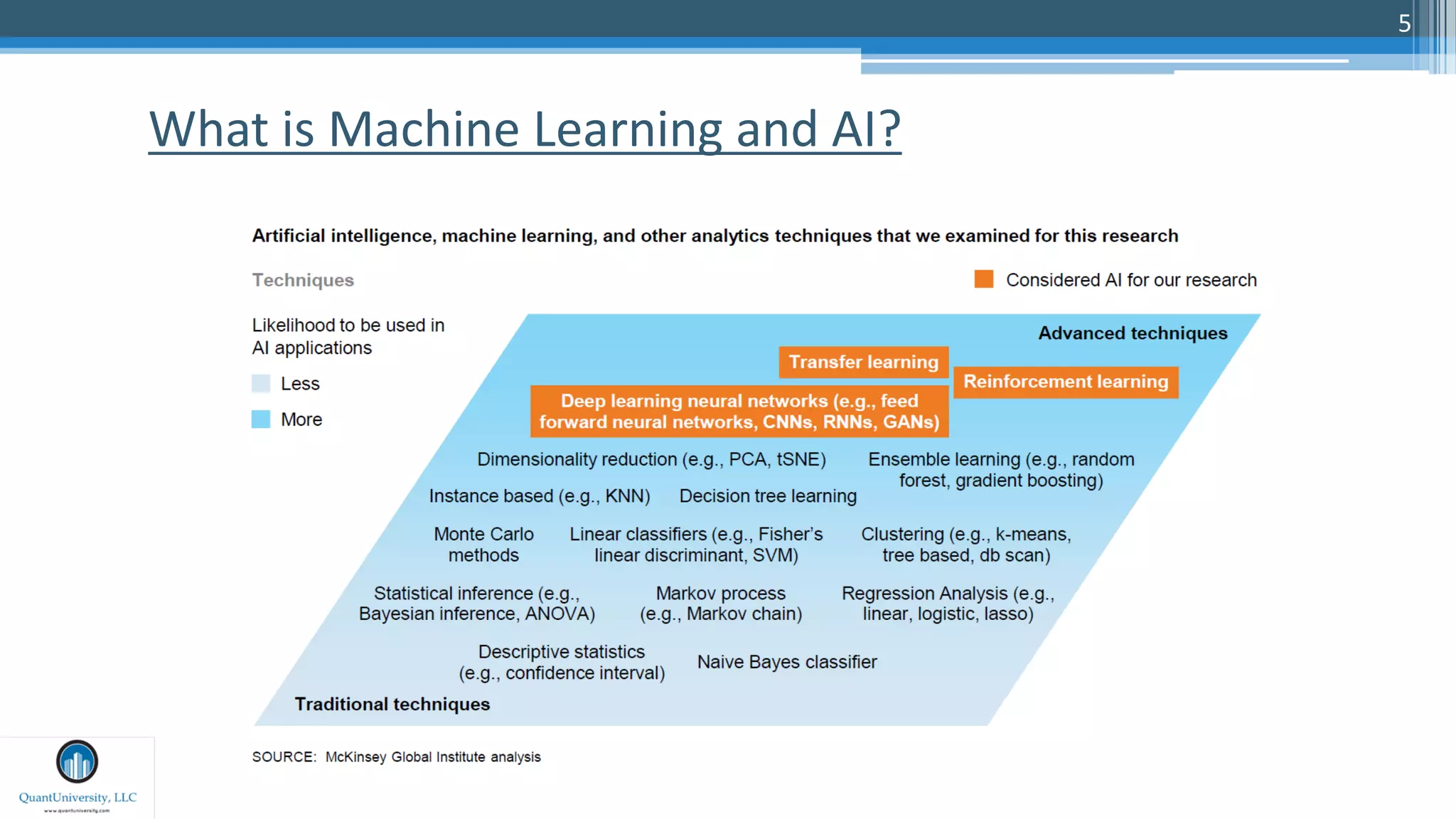

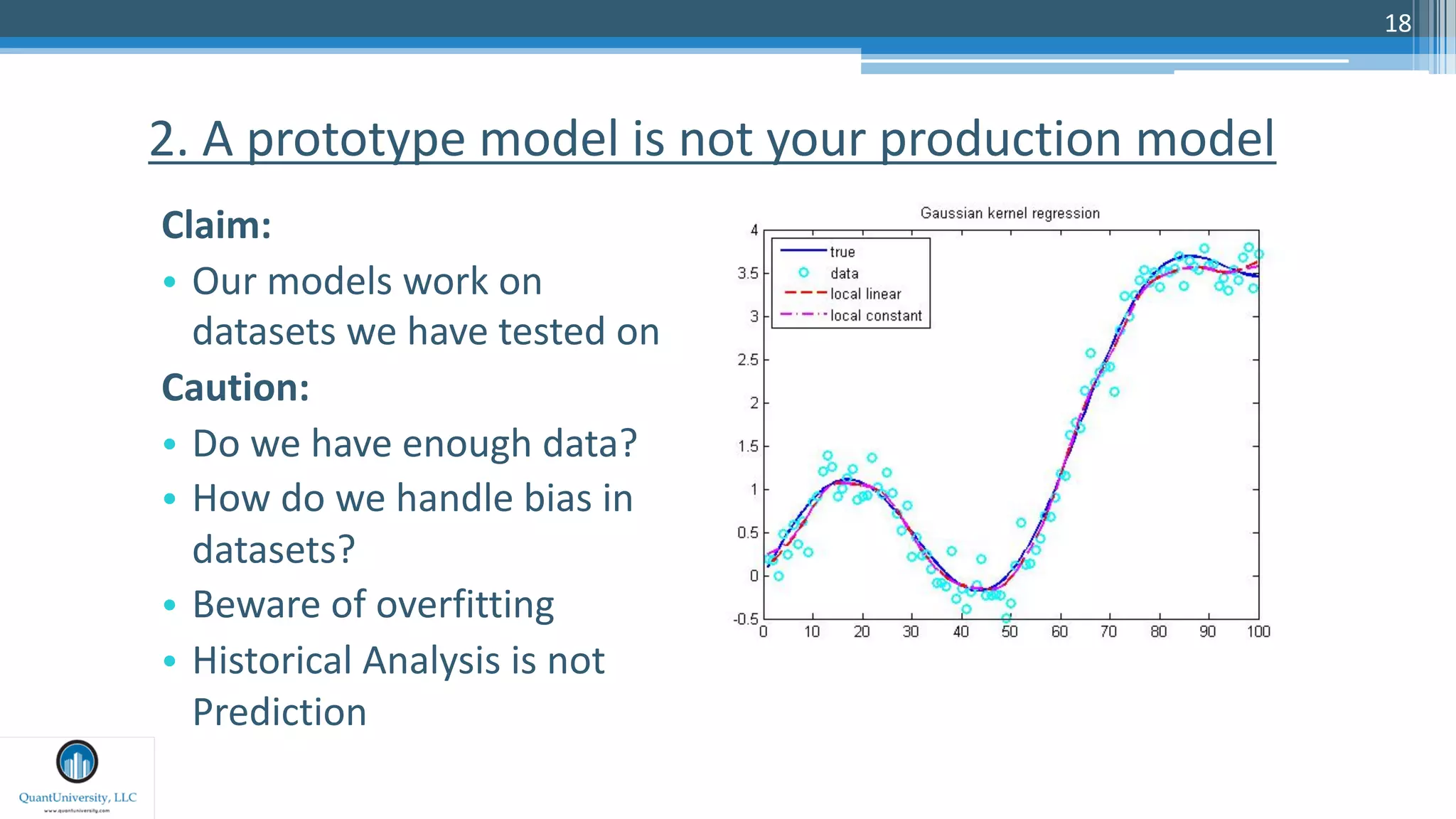

The document discusses the impact and applications of AI and machine learning in finance, highlighting their potential benefits and challenges. Key claims include enhanced accuracy over traditional models for tasks like fraud detection, but it cautions against the pitfalls of interpretation, bias, and overfitting. It emphasizes that while AI and machine learning pave the way for innovation, careful evaluation and management are critical for successful implementation.

![19

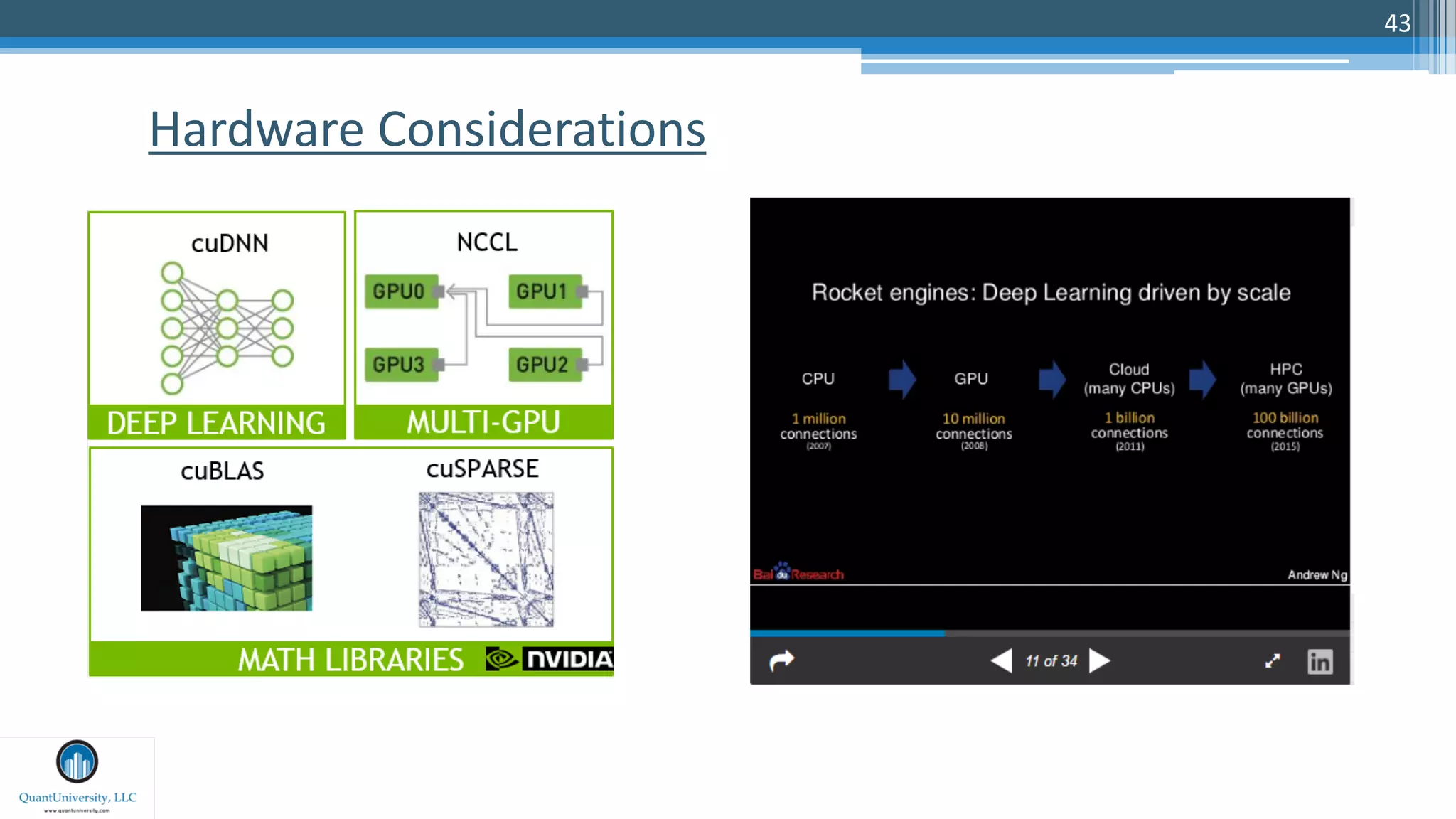

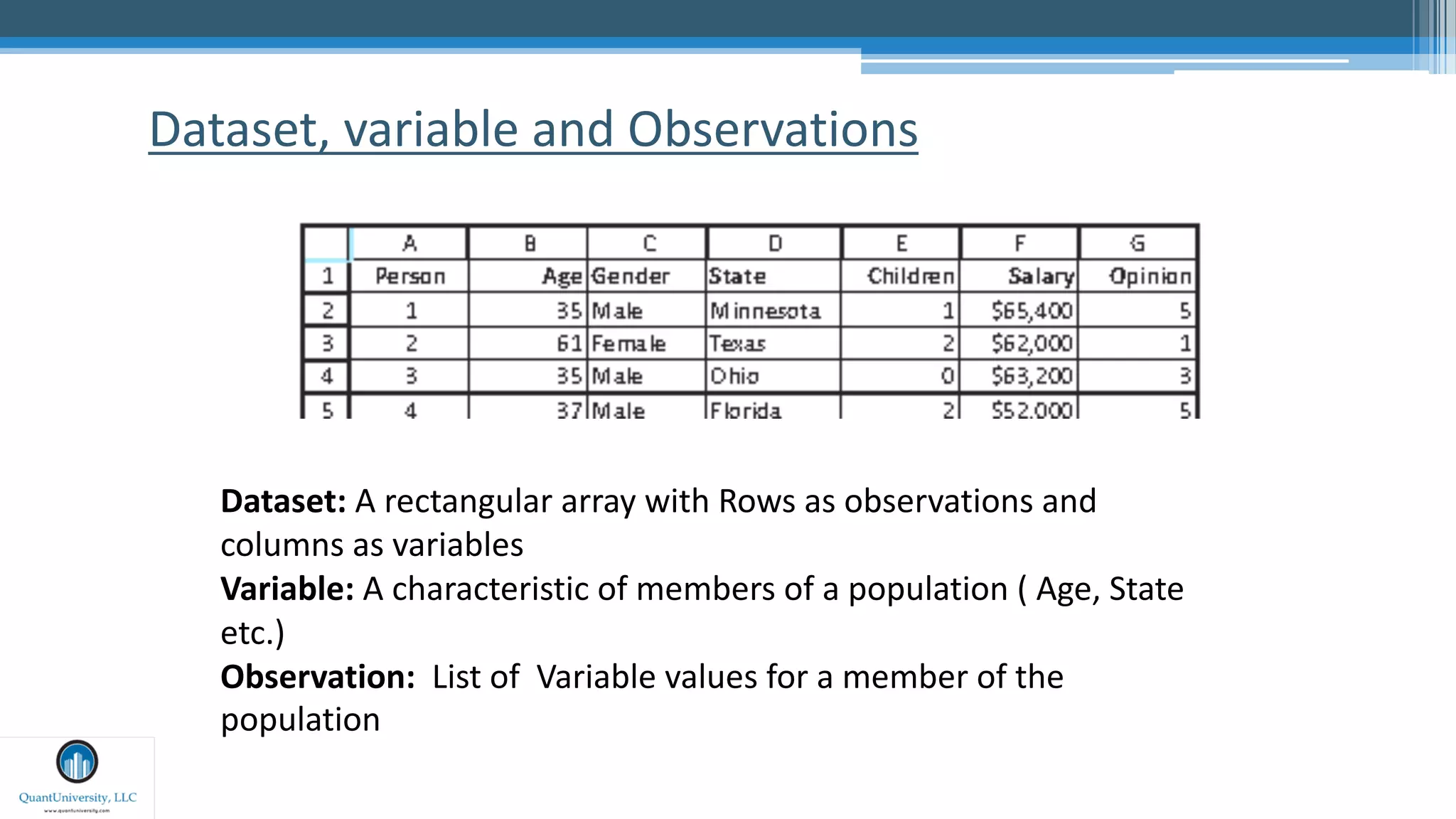

AI and Machine Learning in Production

https://www.itnews.com.au/news/hsbc-societe-generale-run-

into-ais-production-problems-477966

Kristy Roth from HSBC:

“It’s been somewhat easy - in a funny way - to

get going using sample data, [but] then you hit

the real problems,” Roth said.

“I think our early track record on PoCs or pilots

hides a little bit the underlying issues.

Matt Davey from Societe Generale:

“We’ve done quite a bit of work with RPA

recently and I have to say we’ve been a bit

disillusioned with that experience,”

“the PoC is the easy bit: it’s how you get that

into production and shift the balance”](https://image.slidesharecdn.com/aiinfinance-190206170721/75/Ai-in-finance-19-2048.jpg)

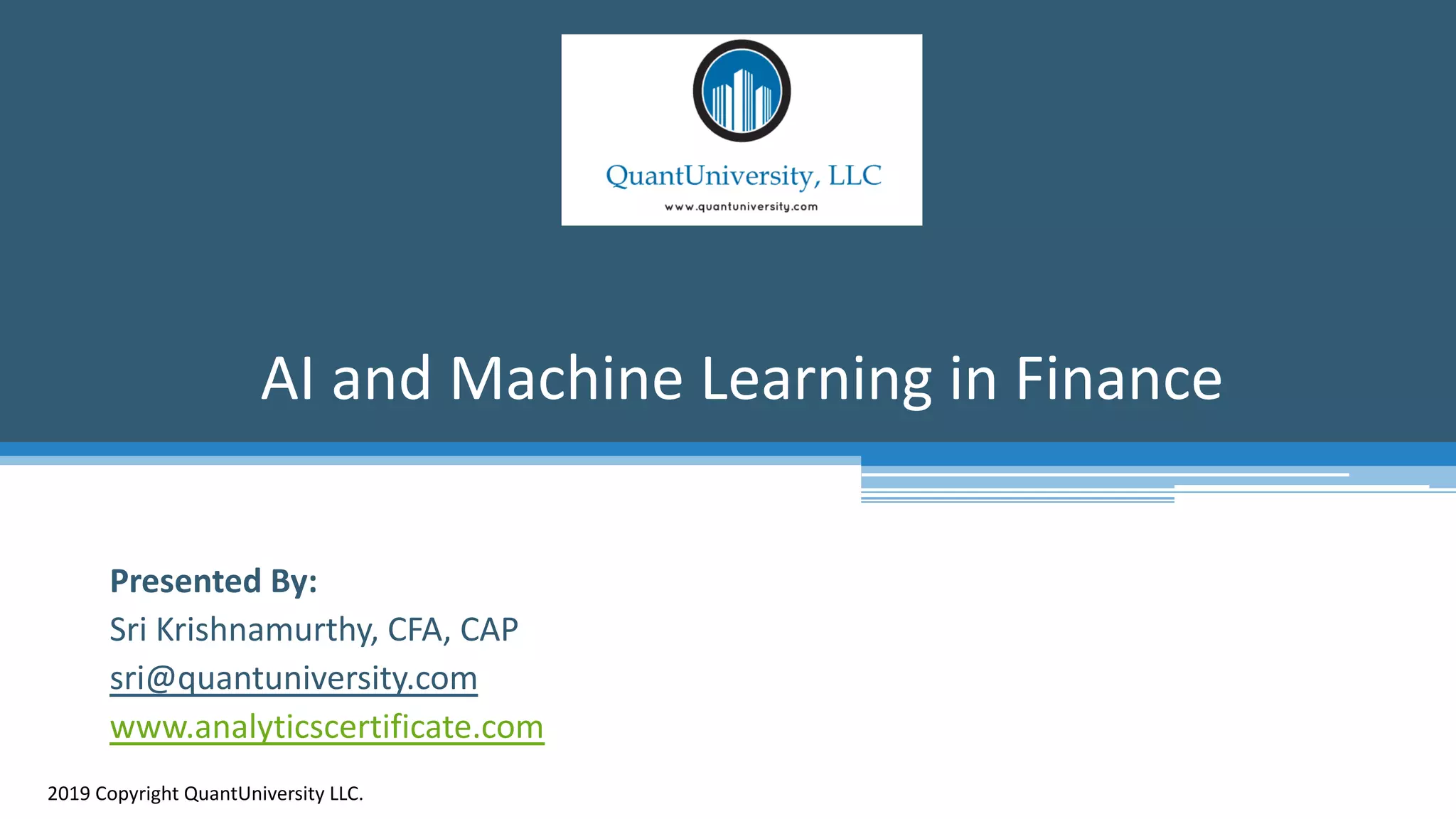

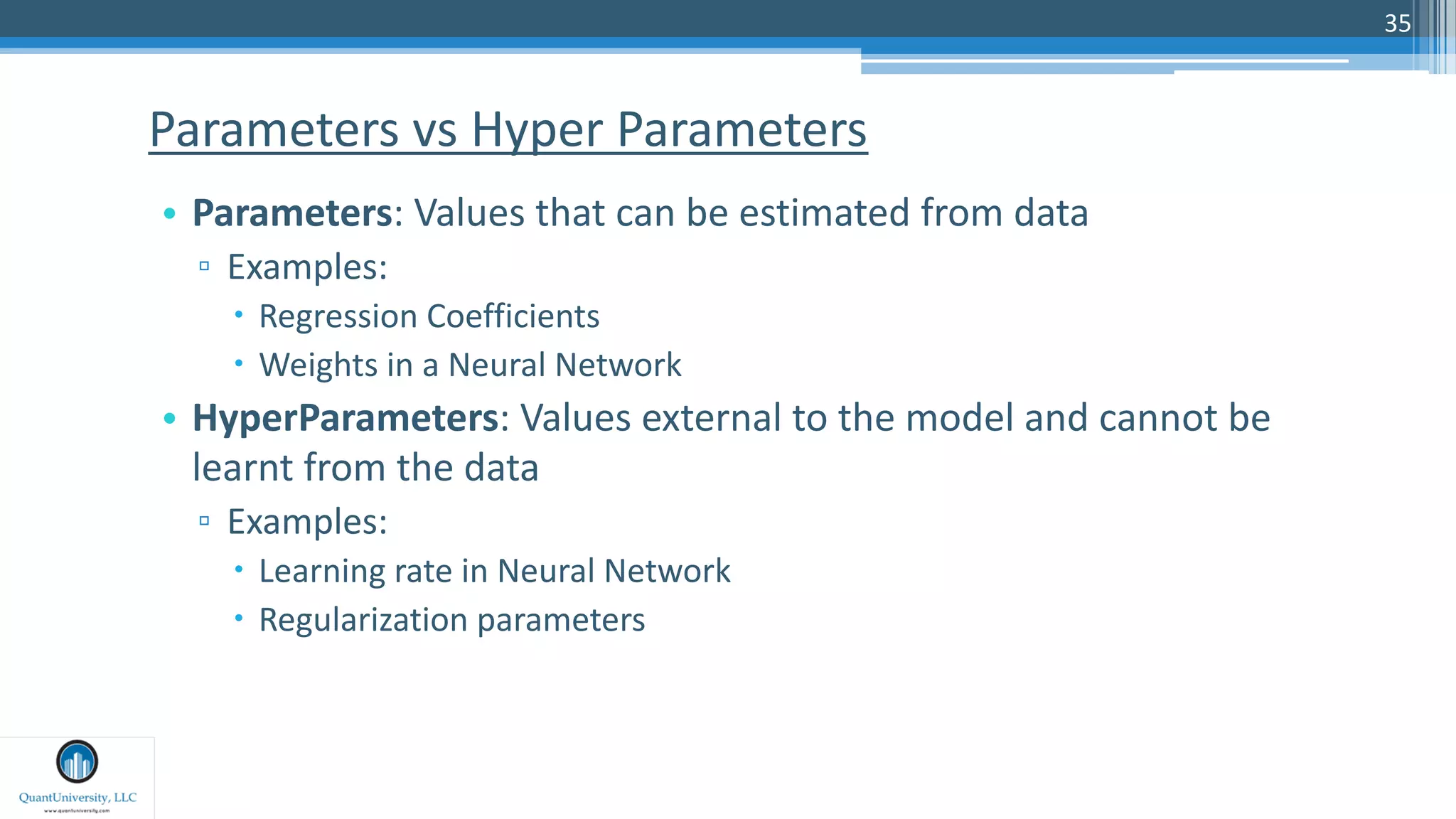

![36

• Hyperparameter optimization finds a tuple of hyperparameters that yields an

optimal model which minimizes a predefined loss function on given

independent data.[1]

• [1] Claesen, Marc; Bart De Moor (2015). "Hyperparameter Search in Machine

Learning".

• Image from:

https://support.sas.com/resources/papers/proceedings17/SAS0514-2017.pdf

Hyperparameter optimization](https://image.slidesharecdn.com/aiinfinance-190206170721/75/Ai-in-finance-36-2048.jpg)