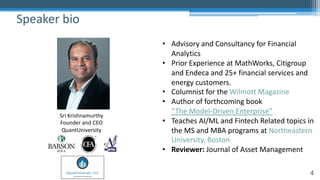

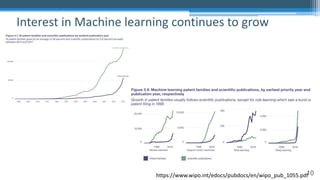

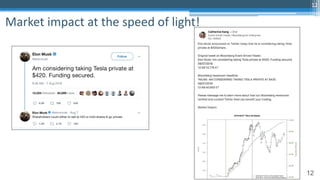

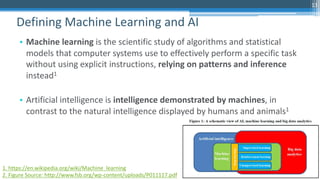

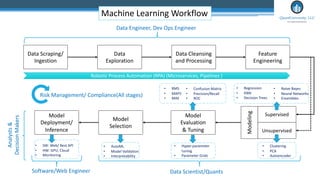

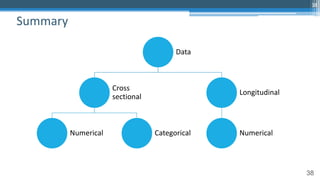

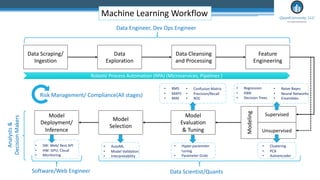

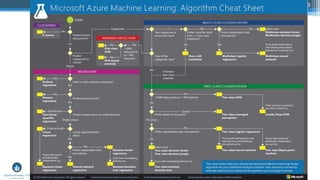

The document provides an overview of a presentation on machine learning and artificial intelligence, particularly in the finance sector, delivered by Sri Krishnamurthy and moderated by Richard Fernand. It highlights key trends, definitions, use cases, and the transformative impact of AI and ML in financial services, emphasizing the increasing automation and the imperative for organizations to adopt these technologies. Additionally, it covers the workflow involved in machine learning, including data processing, model evaluation, and the importance of interpretability and transparency in AI applications.

![67

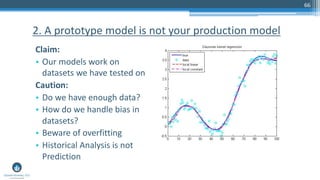

AI and Machine Learning in Production

https://www.itnews.com.au/news/hsbc-societe-generale-run-

into-ais-production-problems-477966

Kristy Roth from HSBC:

“It’s been somewhat easy - in a funny way - to

get going using sample data, [but] then you hit

the real problems,” Roth said.

“I think our early track record on PoCs or pilots

hides a little bit the underlying issues.

Matt Davey from Societe Generale:

“We’ve done quite a bit of work with RPA

recently and I have to say we’ve been a bit

disillusioned with that experience,”

“the PoC is the easy bit: it’s how you get that

into production and shift the balance”](https://image.slidesharecdn.com/mlmasterclassfinal-part1-cfainstitute2020-200429025544/85/Machine-Learning-and-AI-An-Intuitive-Introduction-CFA-Institute-Masterclass-67-320.jpg)