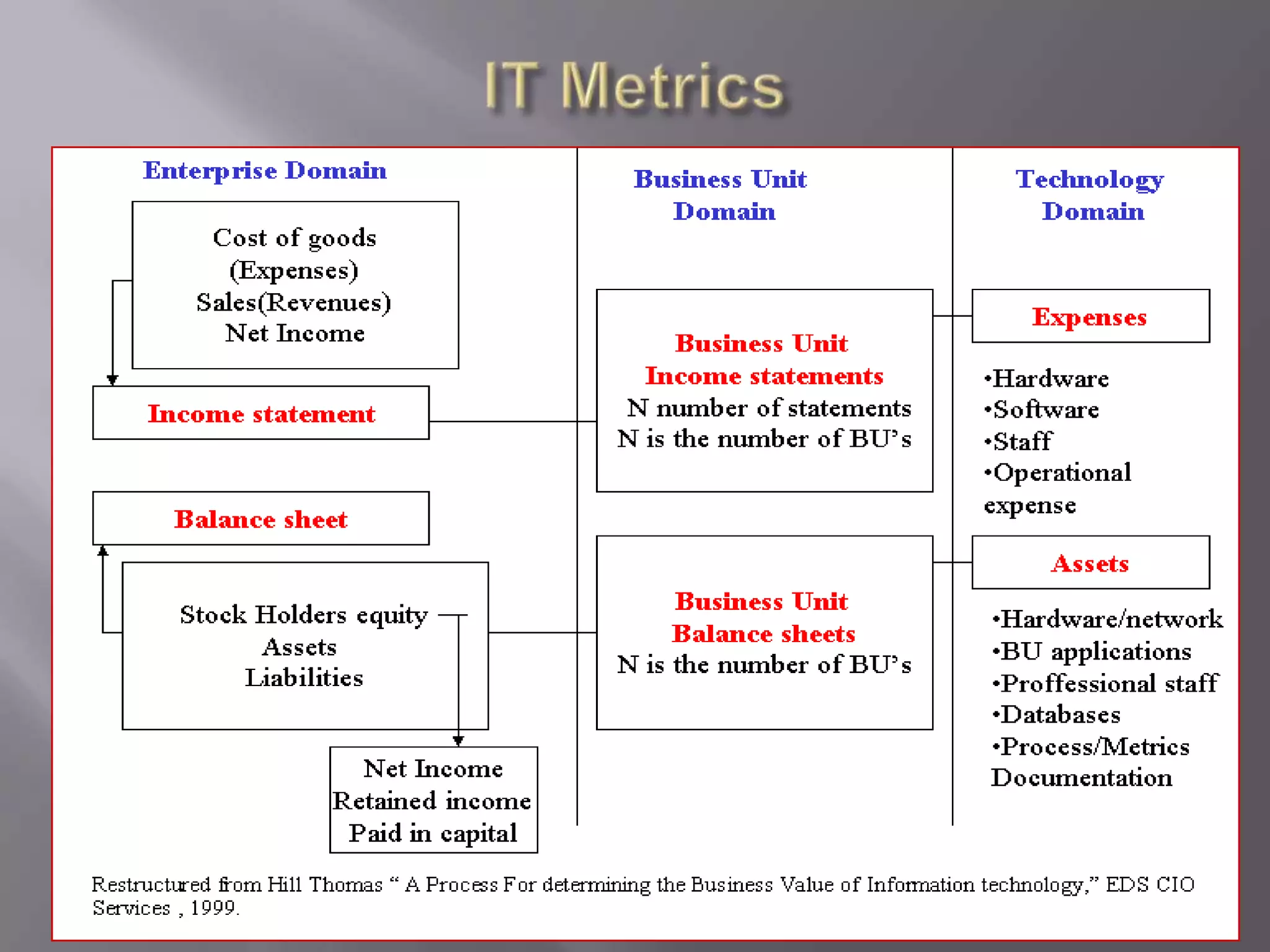

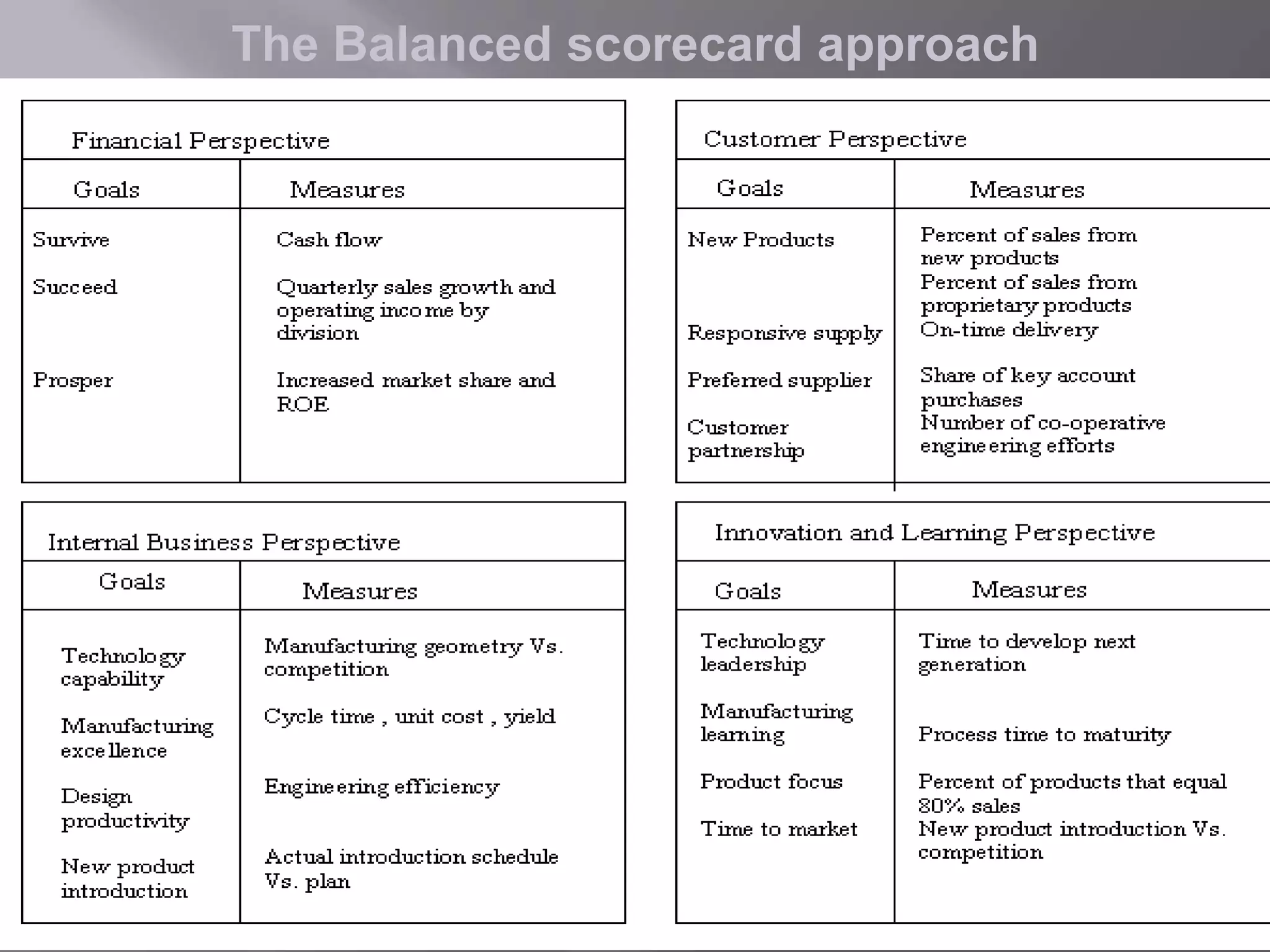

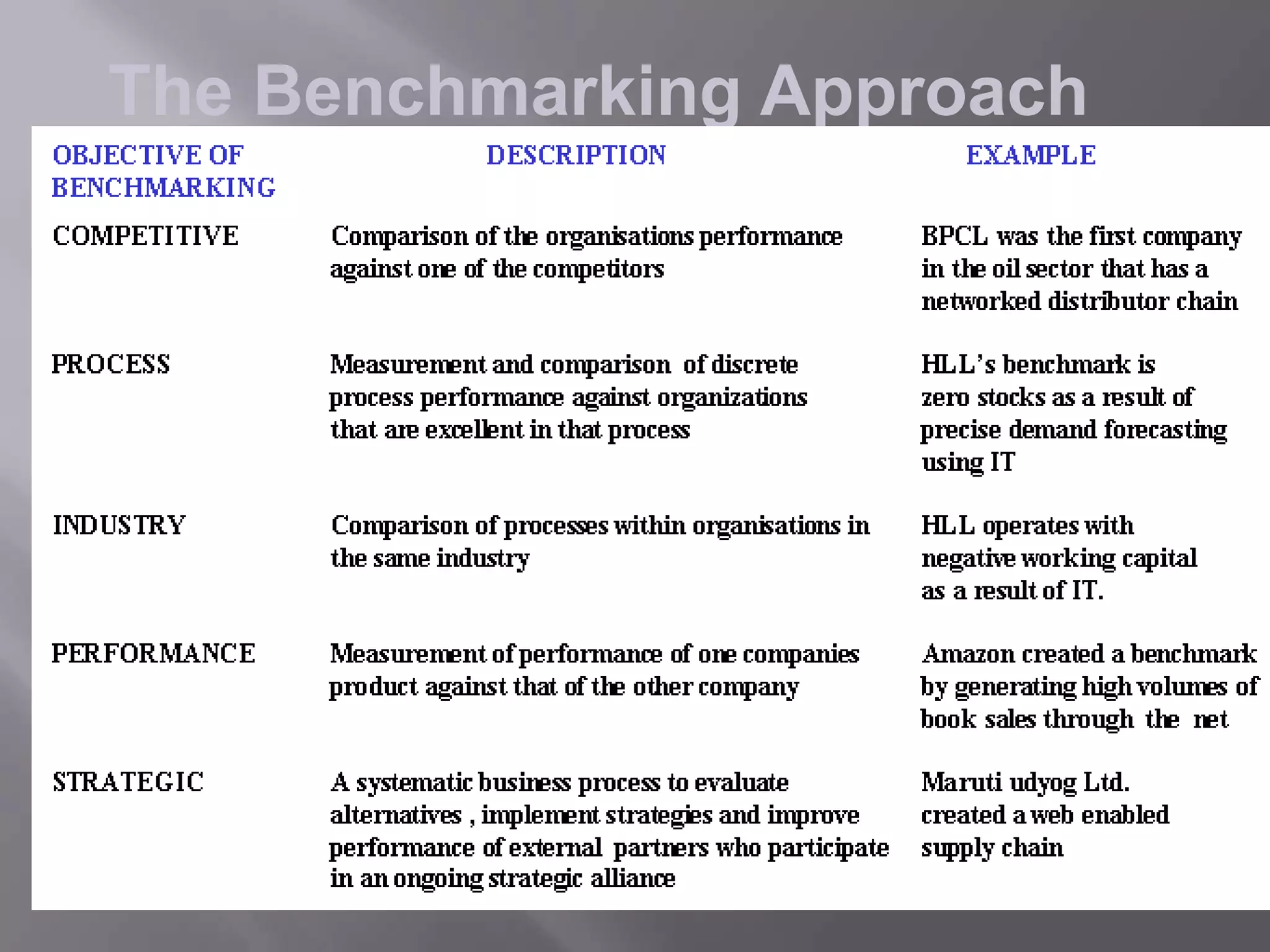

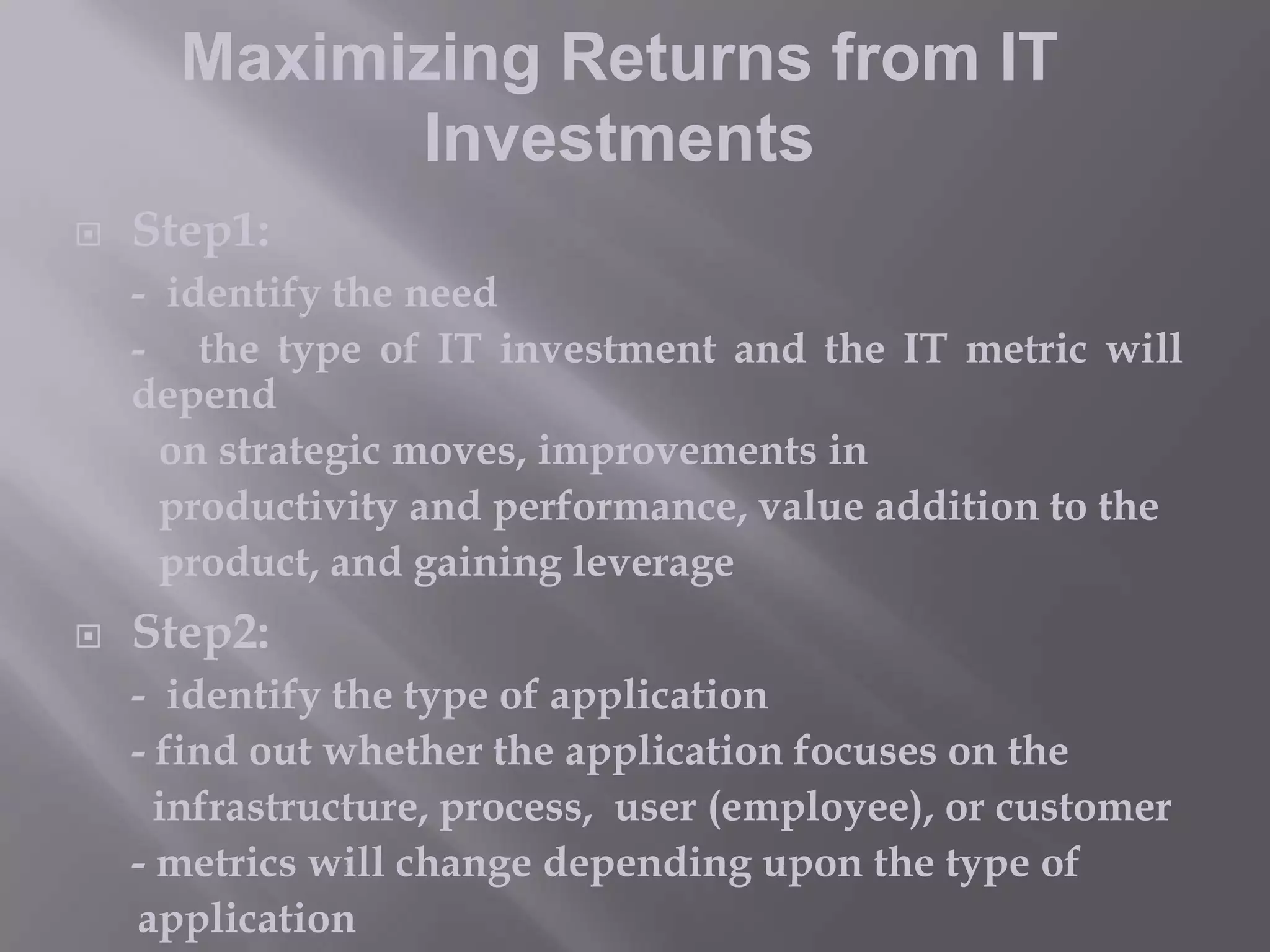

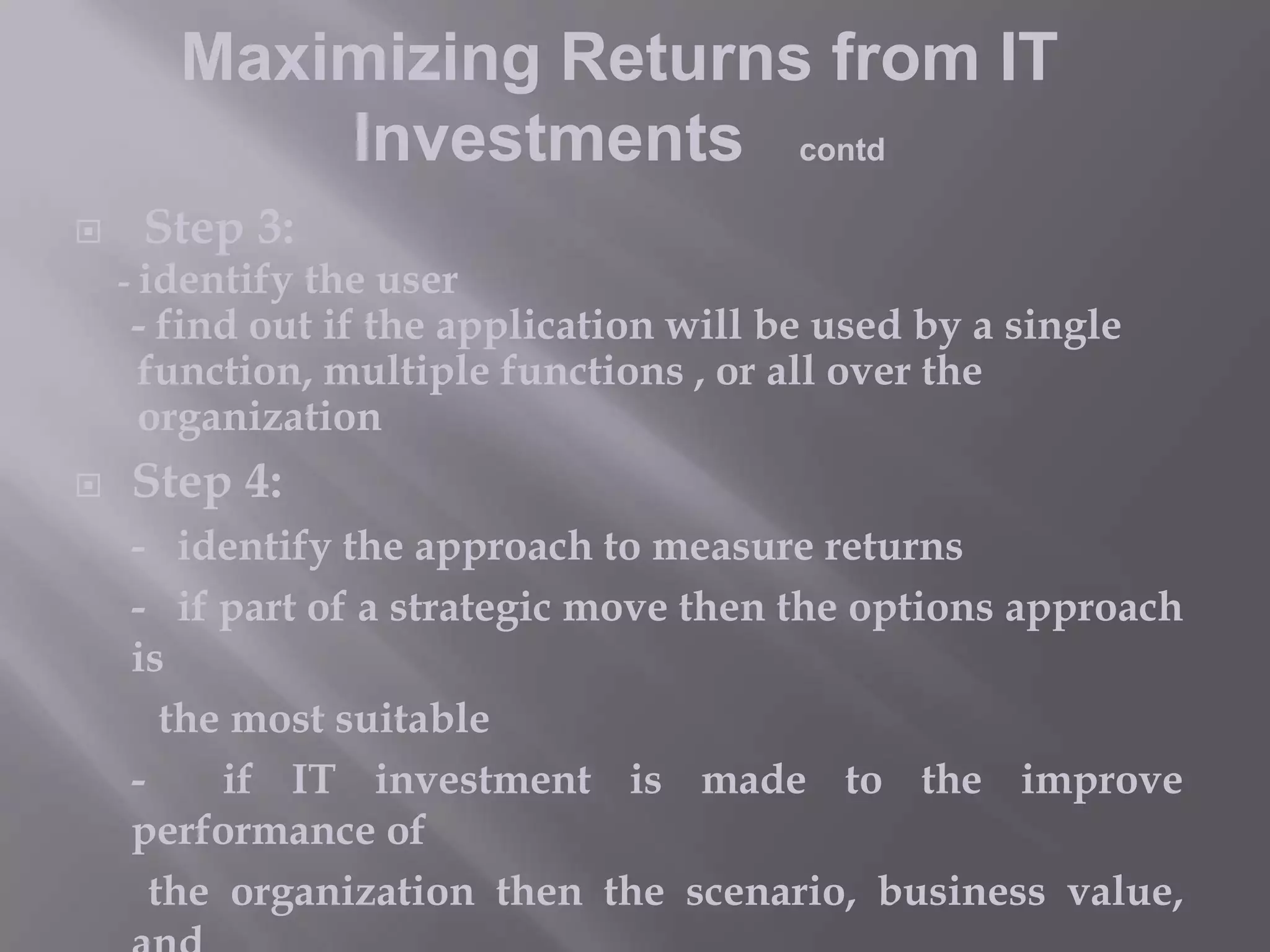

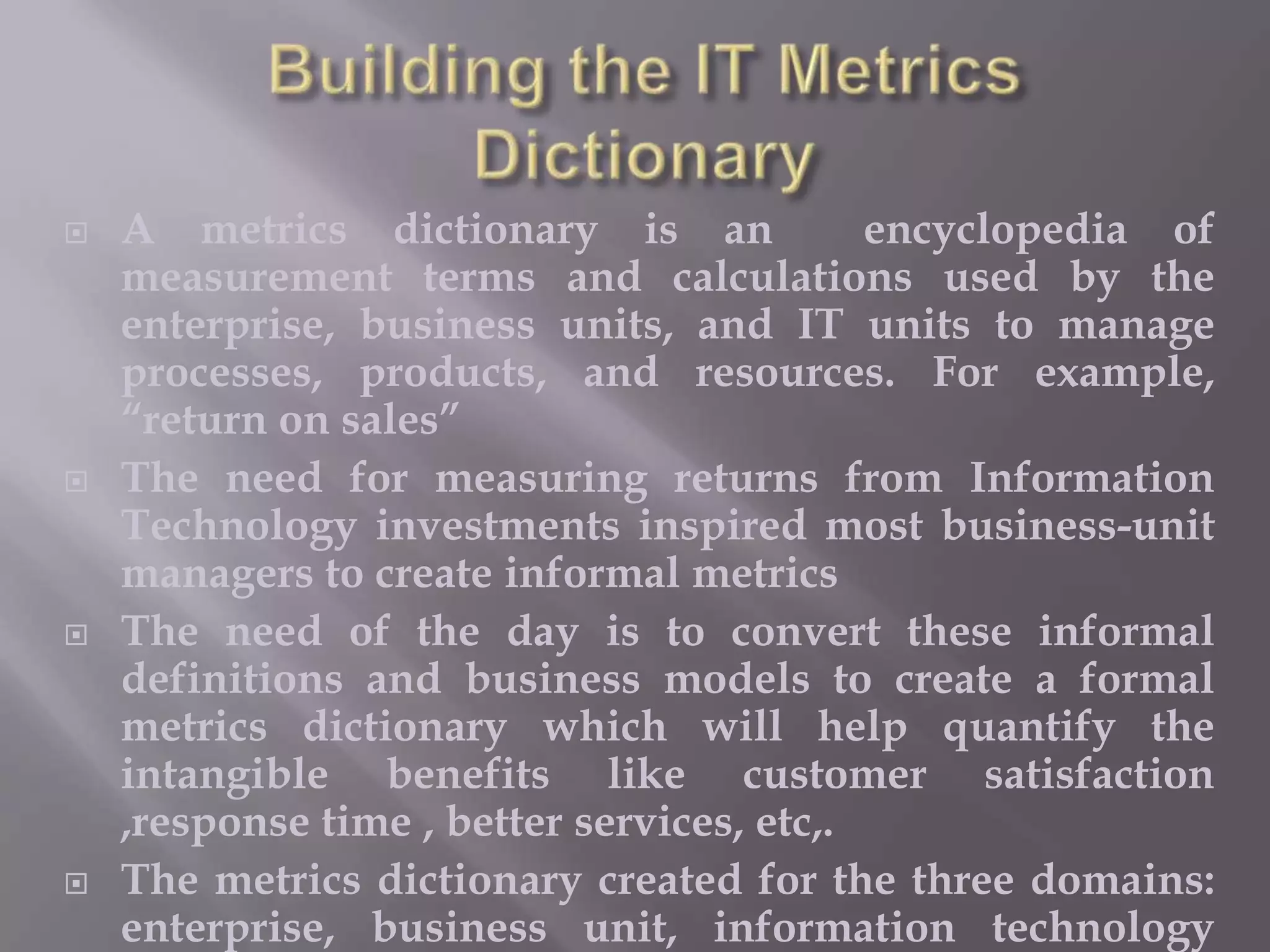

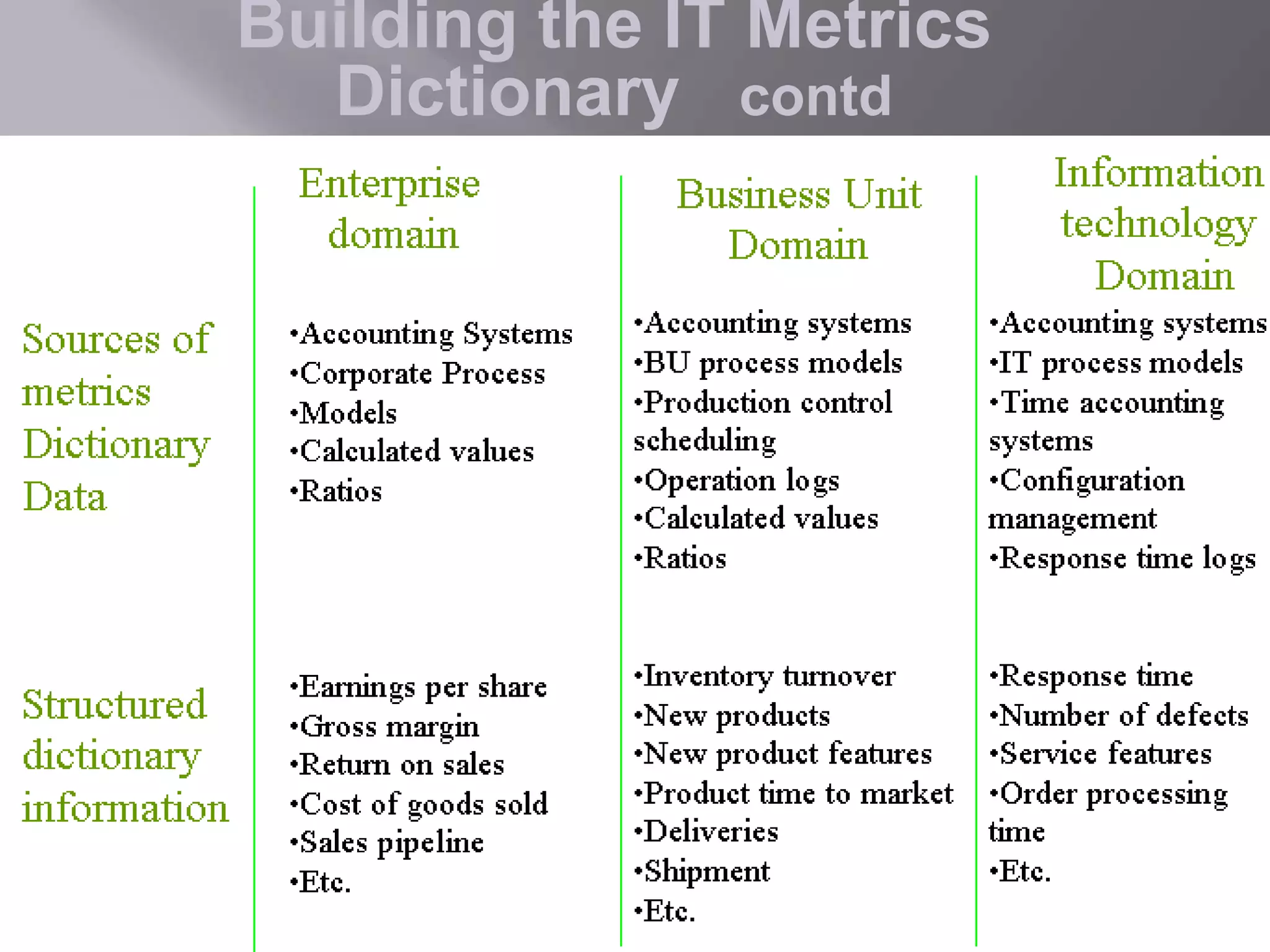

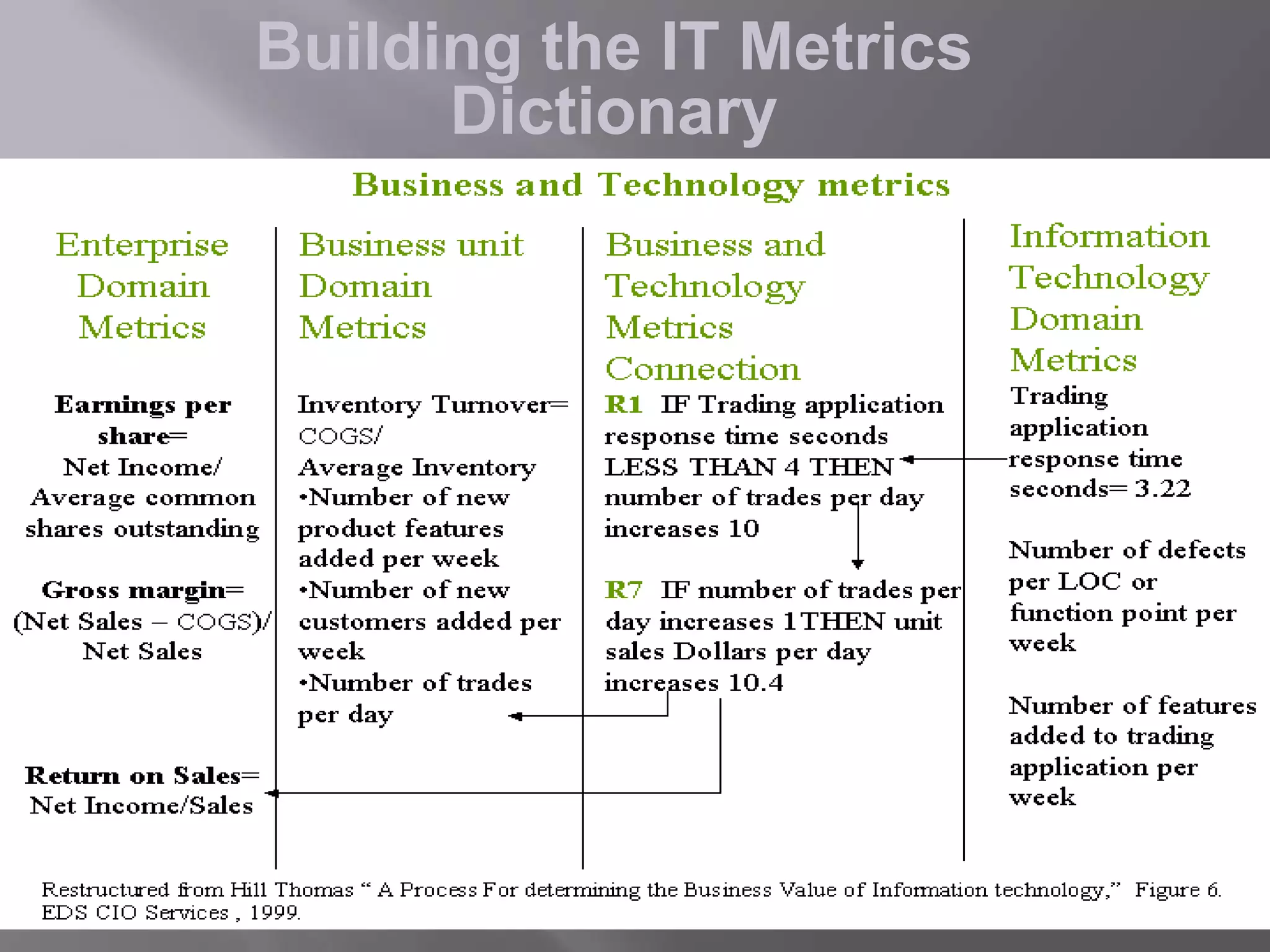

This document discusses several approaches for justifying investments in information technology (IT) and maximizing returns from IT investments, as IT has become a key lever for competitive advantage but also represents high costs. It describes approaches such as net present value, cost effectiveness, business value, chargeback, balanced scorecard, options, benchmarking, and identifying metrics based on the type of investment, user, and strategic goals. The goal is to formalize metrics for quantifying both tangible and intangible returns from IT expenditures.