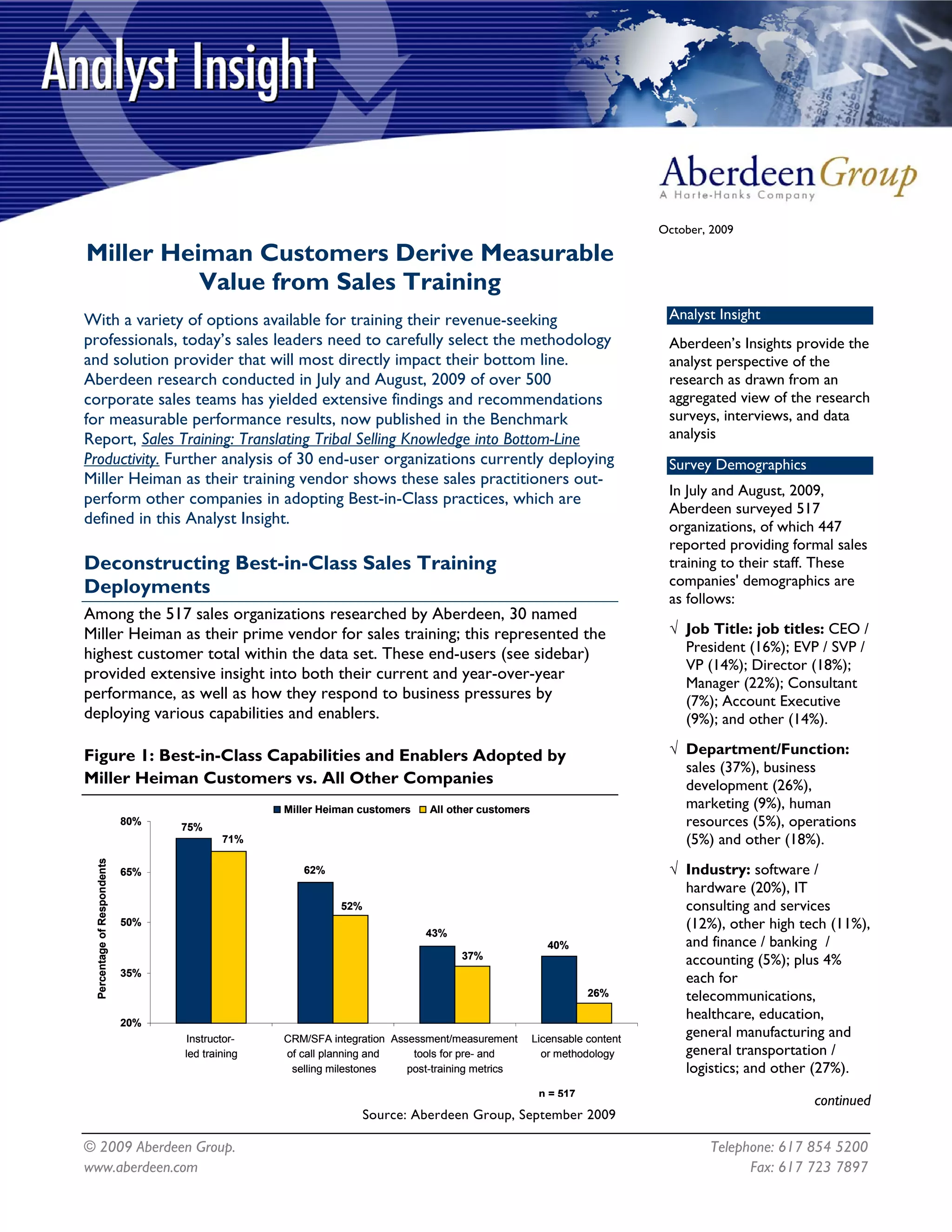

Miller Heiman customers who use their sales training services achieve better performance outcomes than other companies. An analysis of 30 companies that use Miller Heiman found they outperform peers in adopting best practices like instructor-led training, integrating CRM with call planning, and using assessment tools before and after training. One customer, Mercer, saw a measurable ROI after implementing Miller Heiman's training across their global sales force.