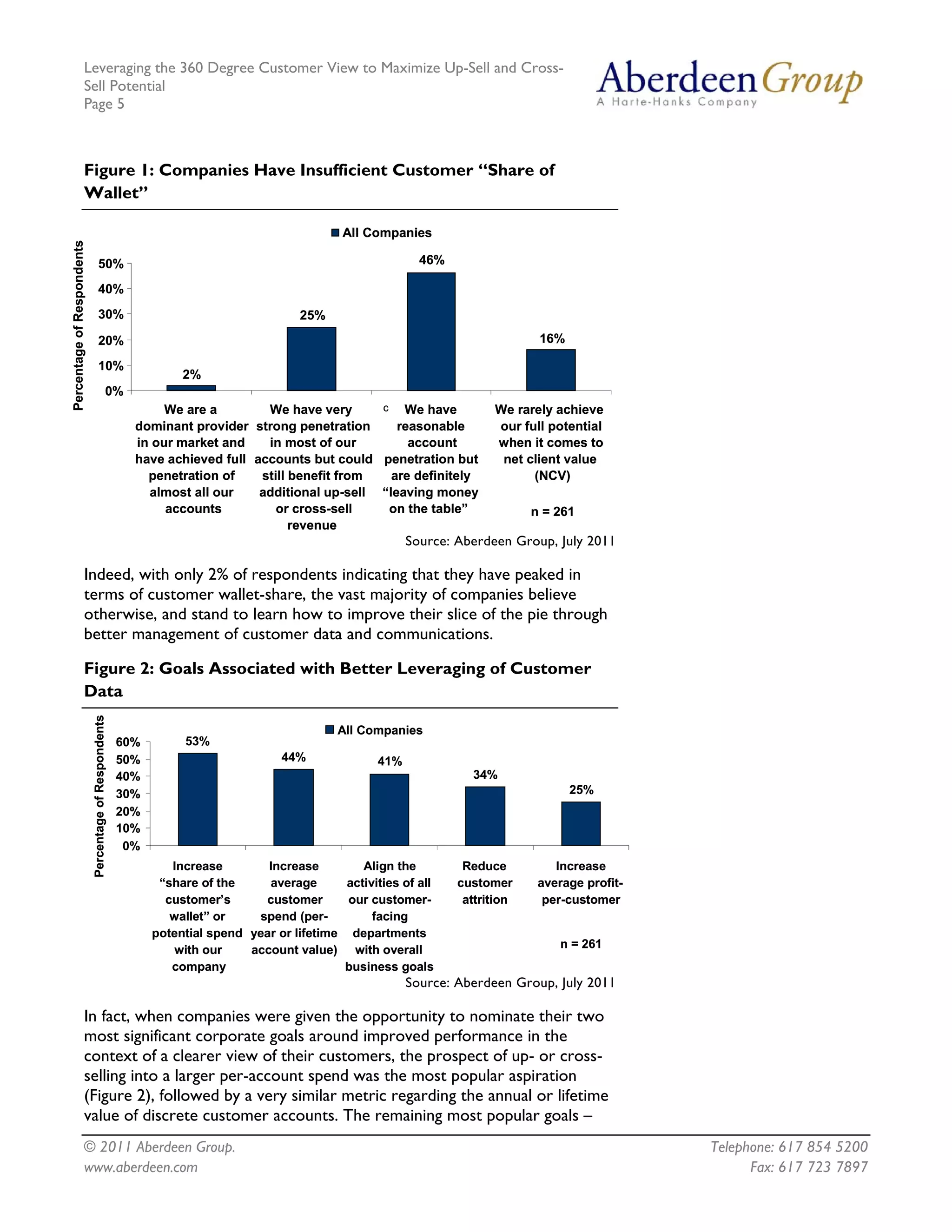

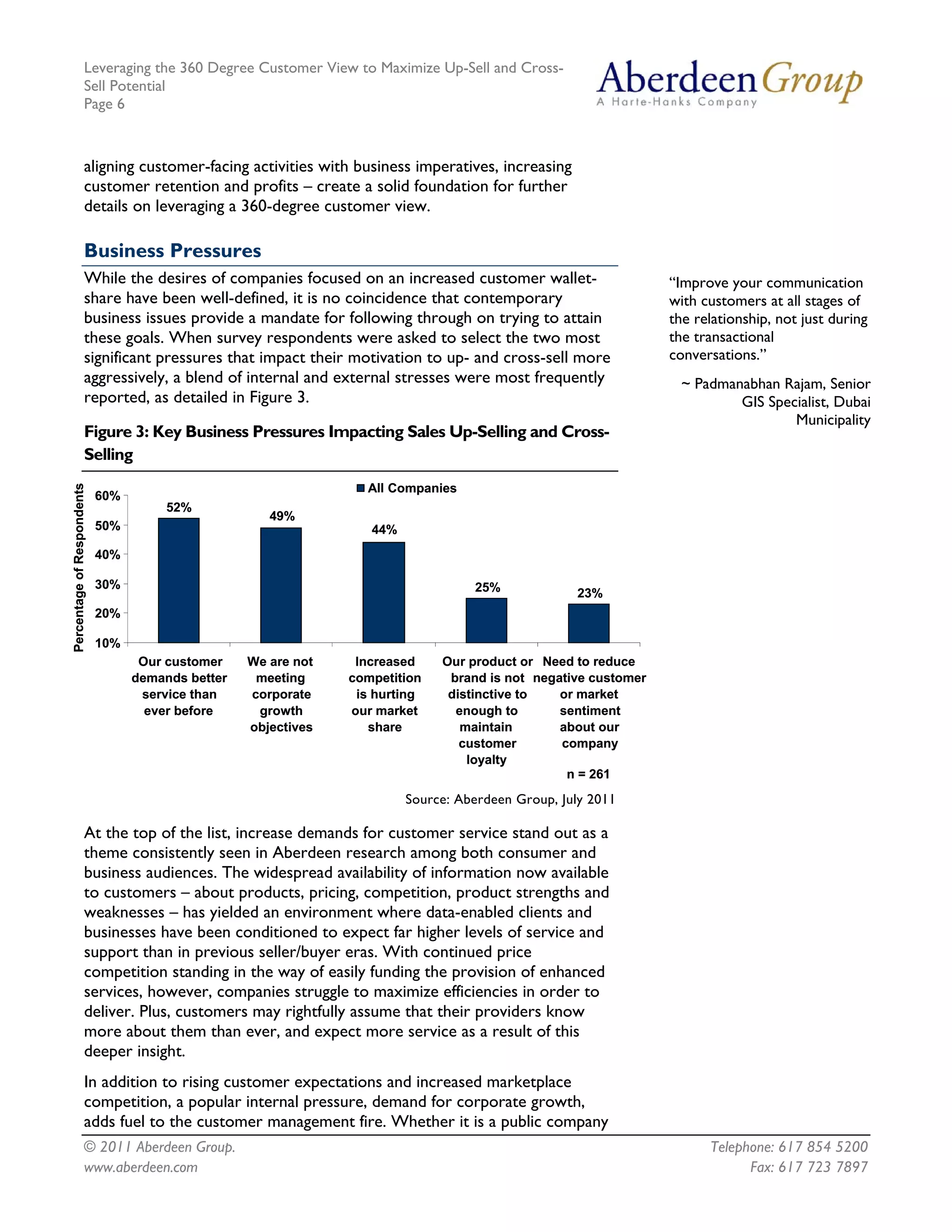

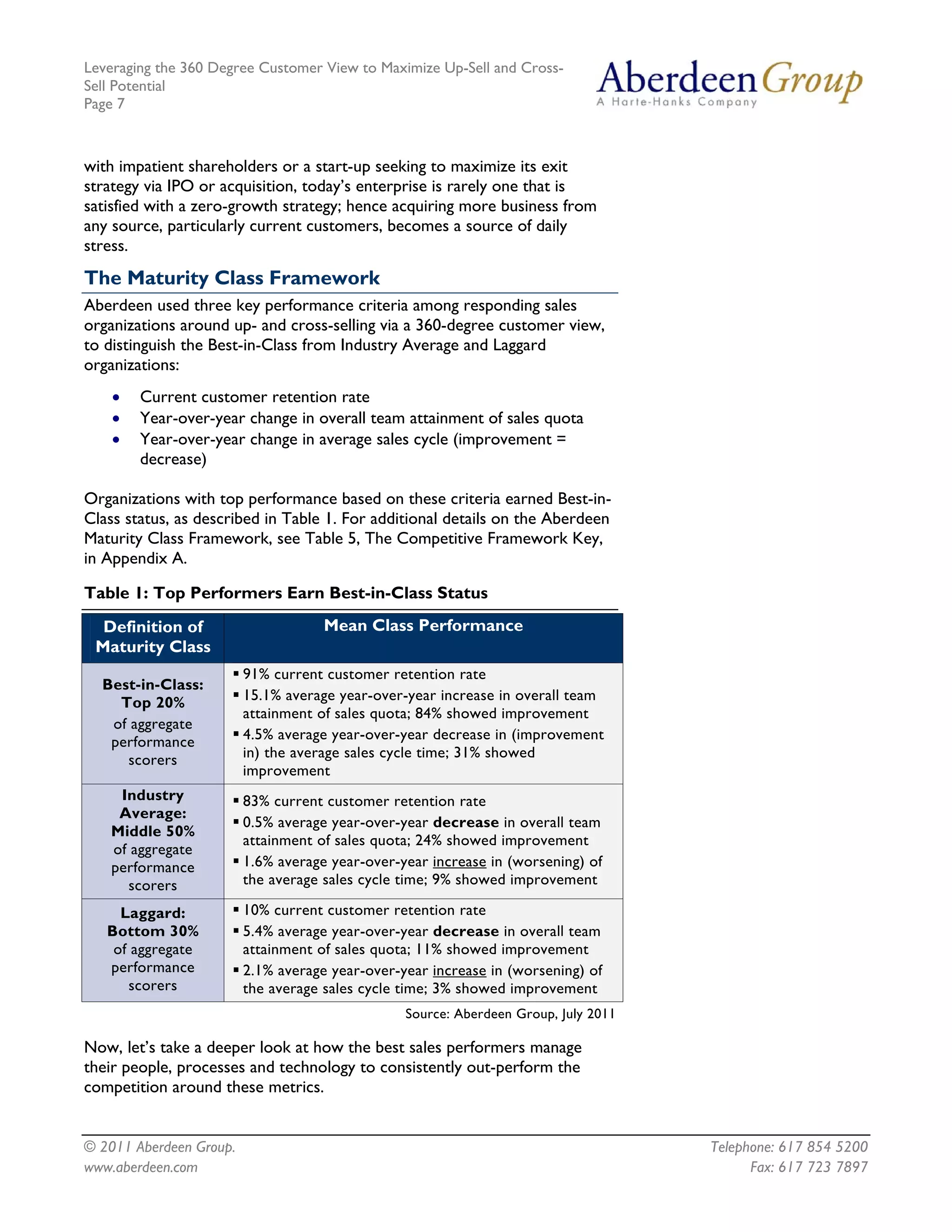

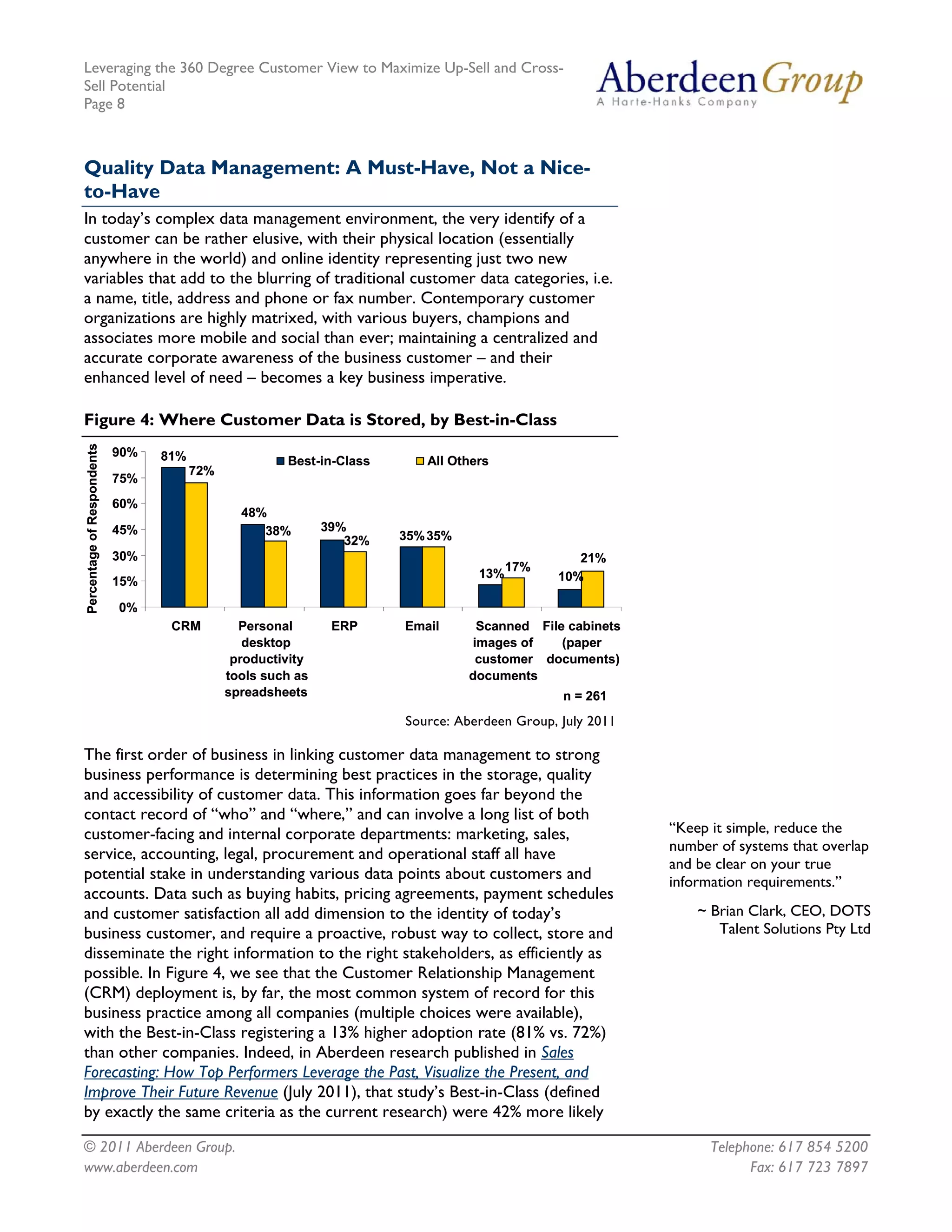

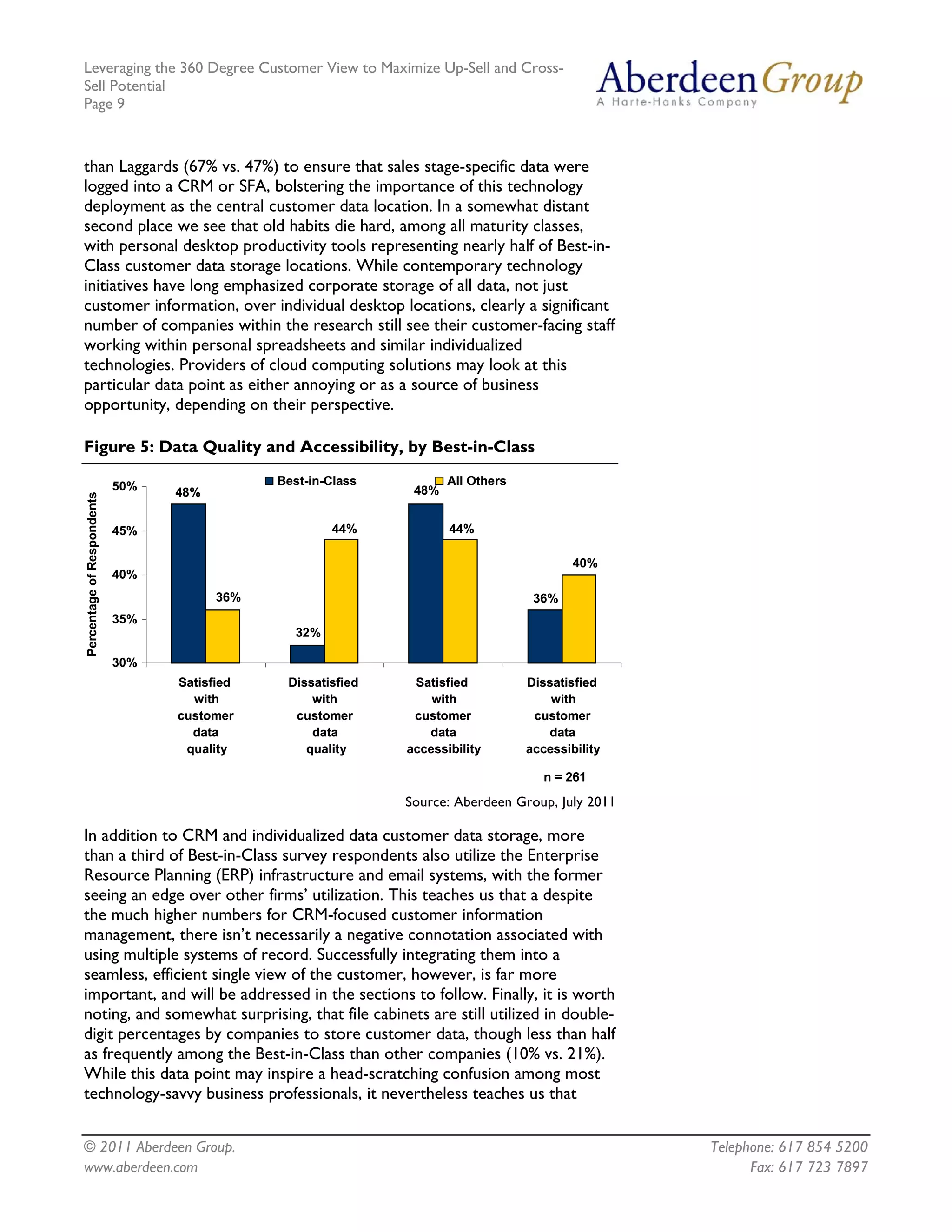

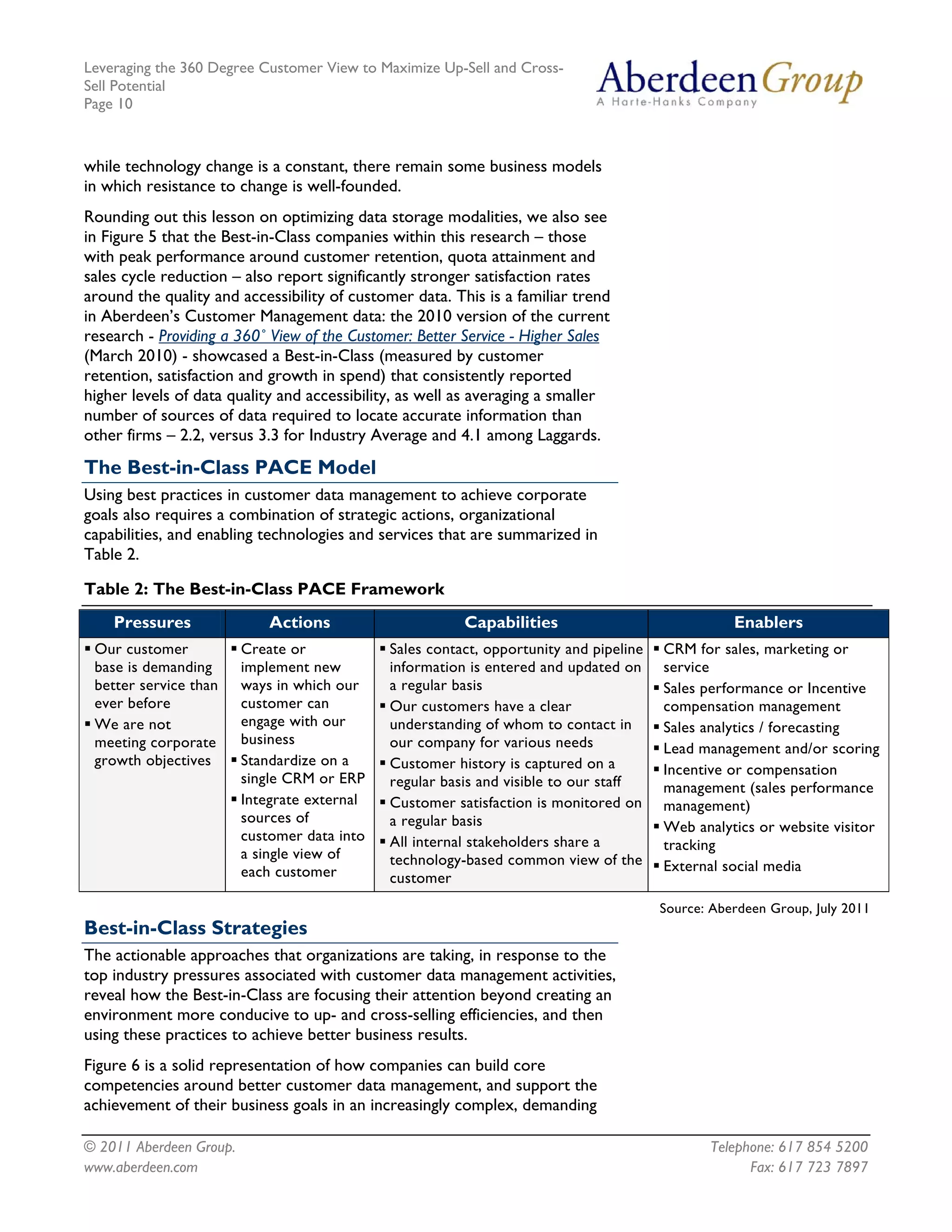

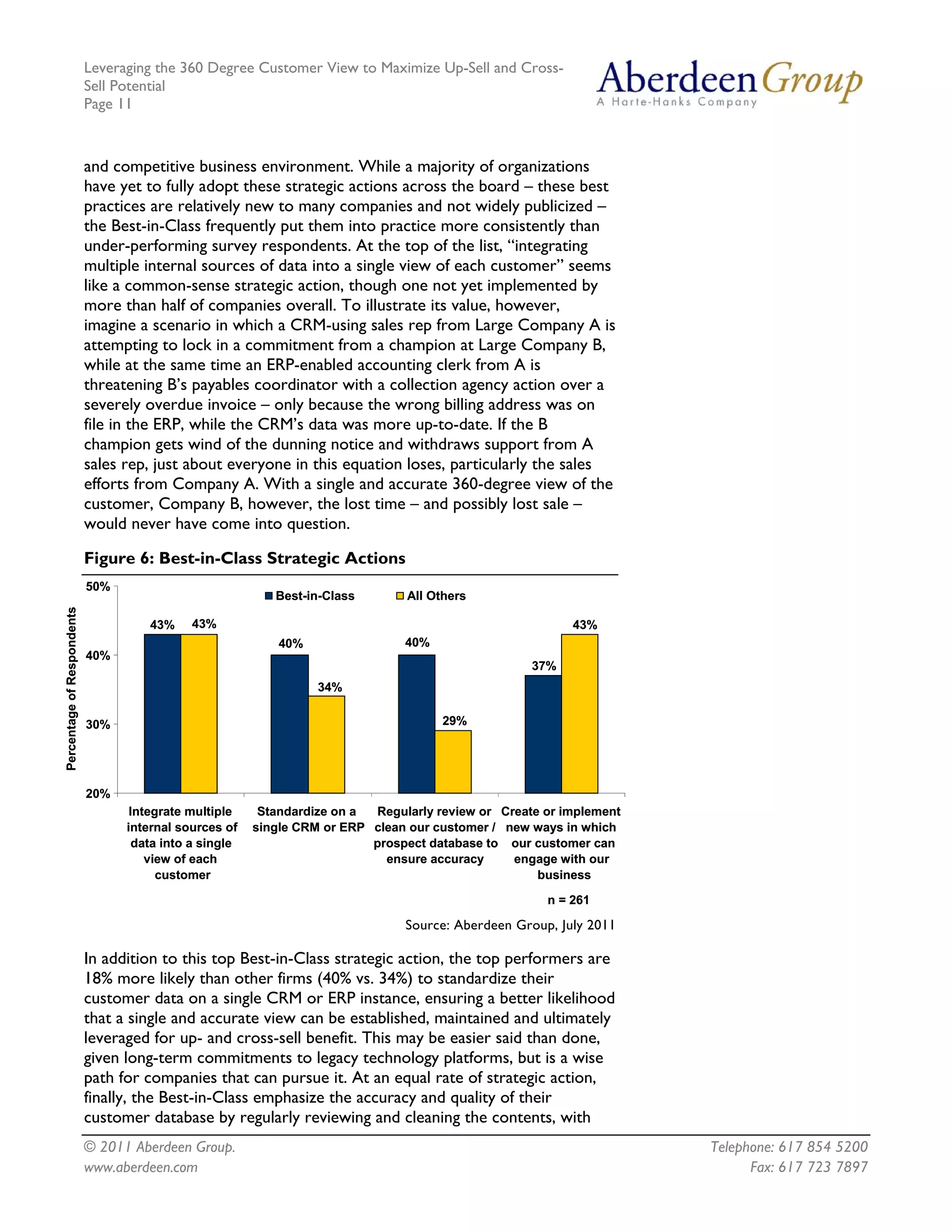

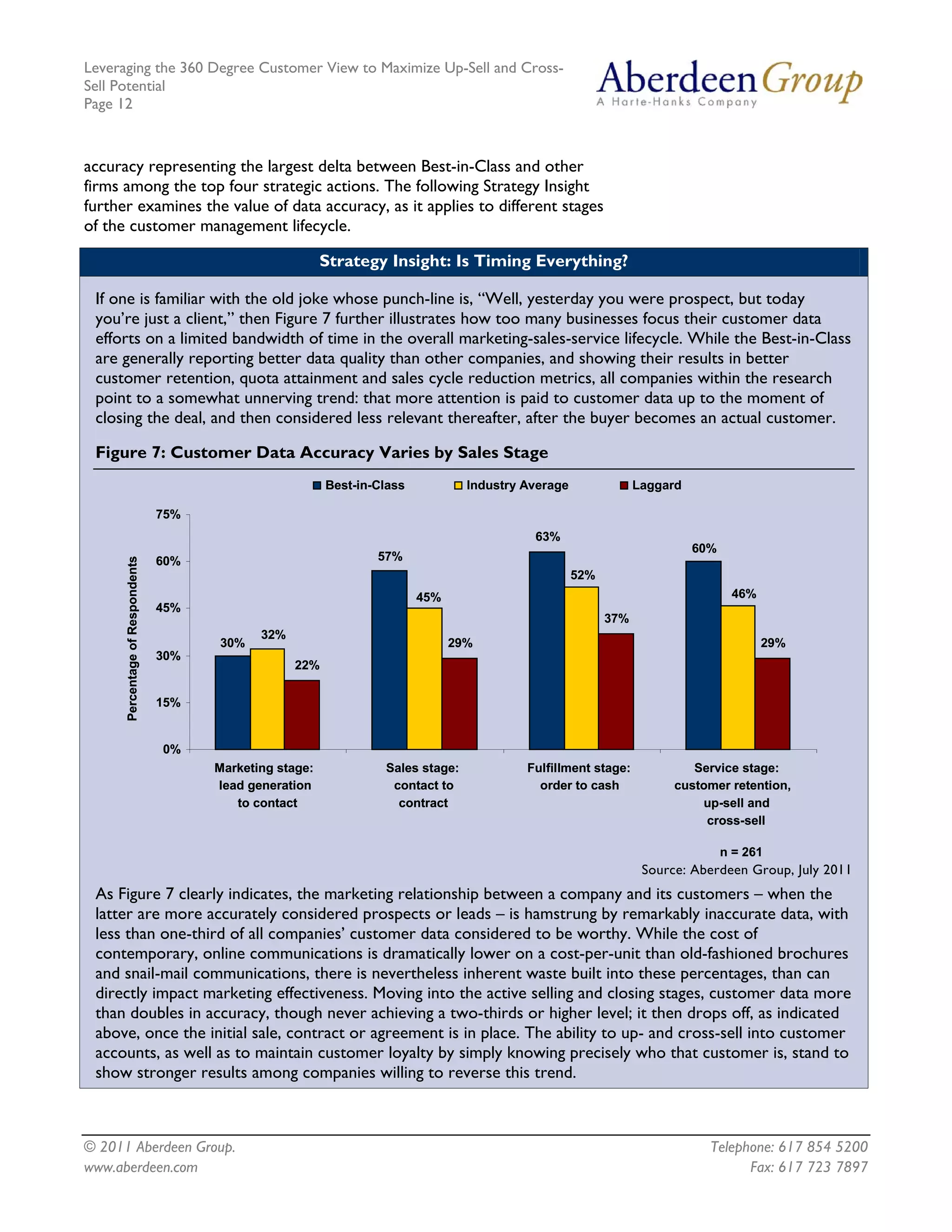

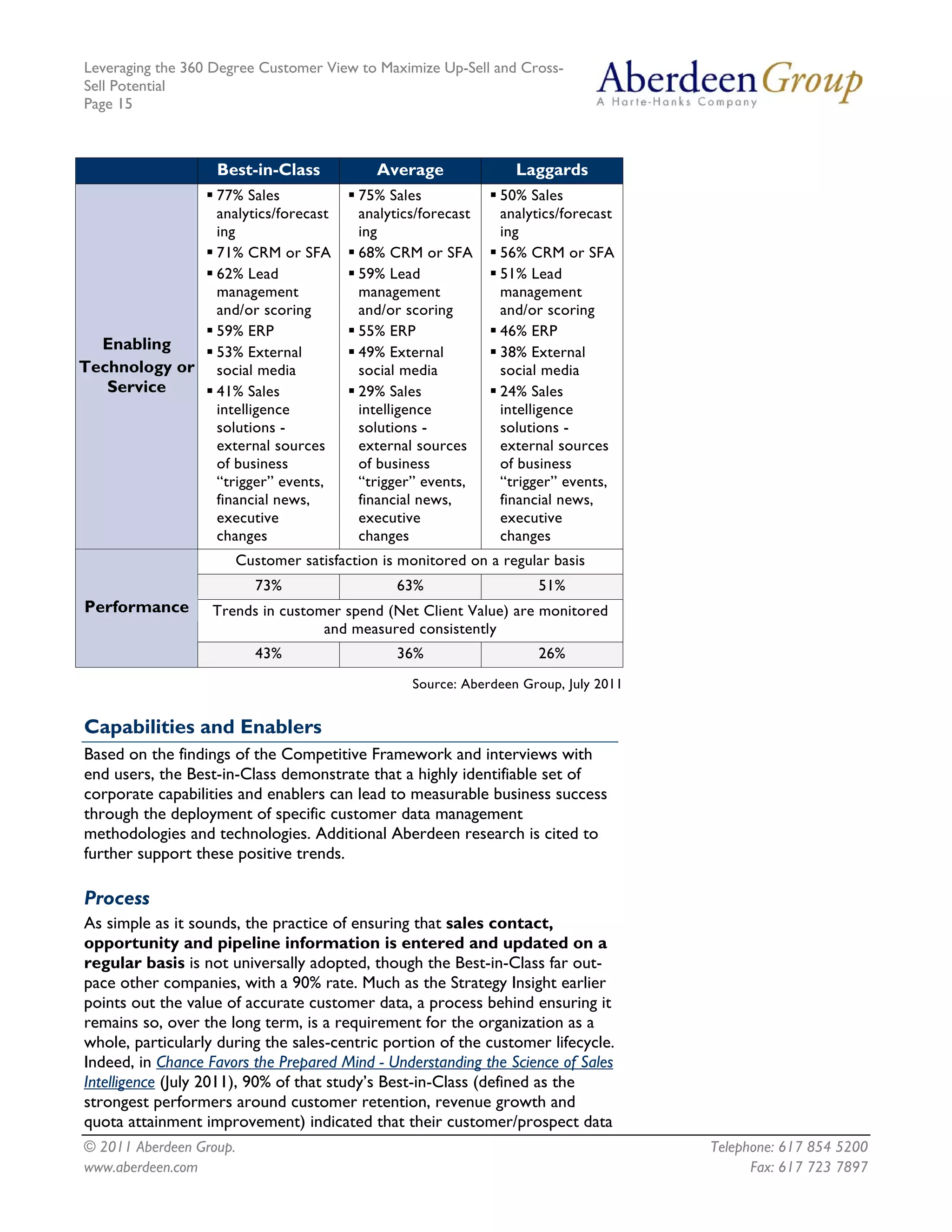

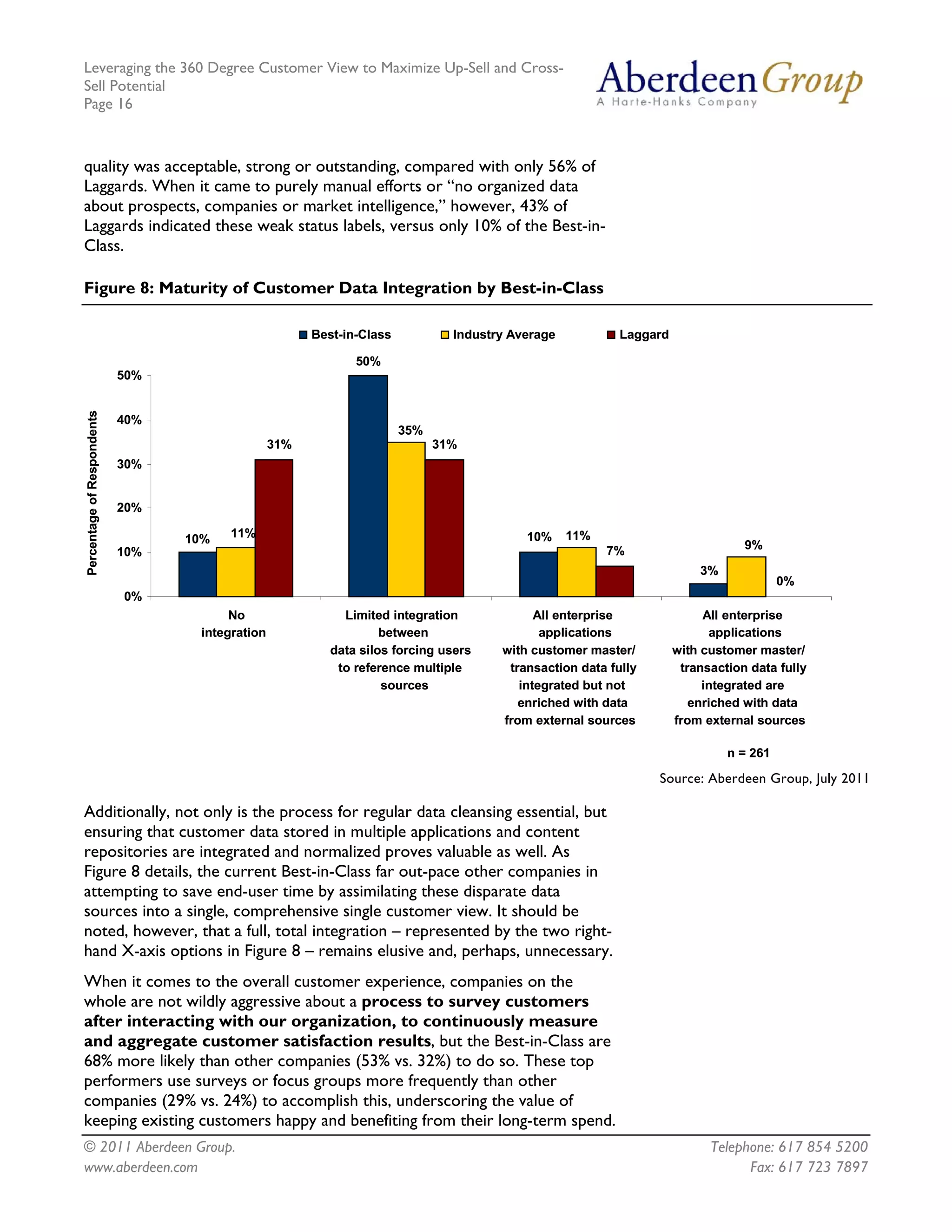

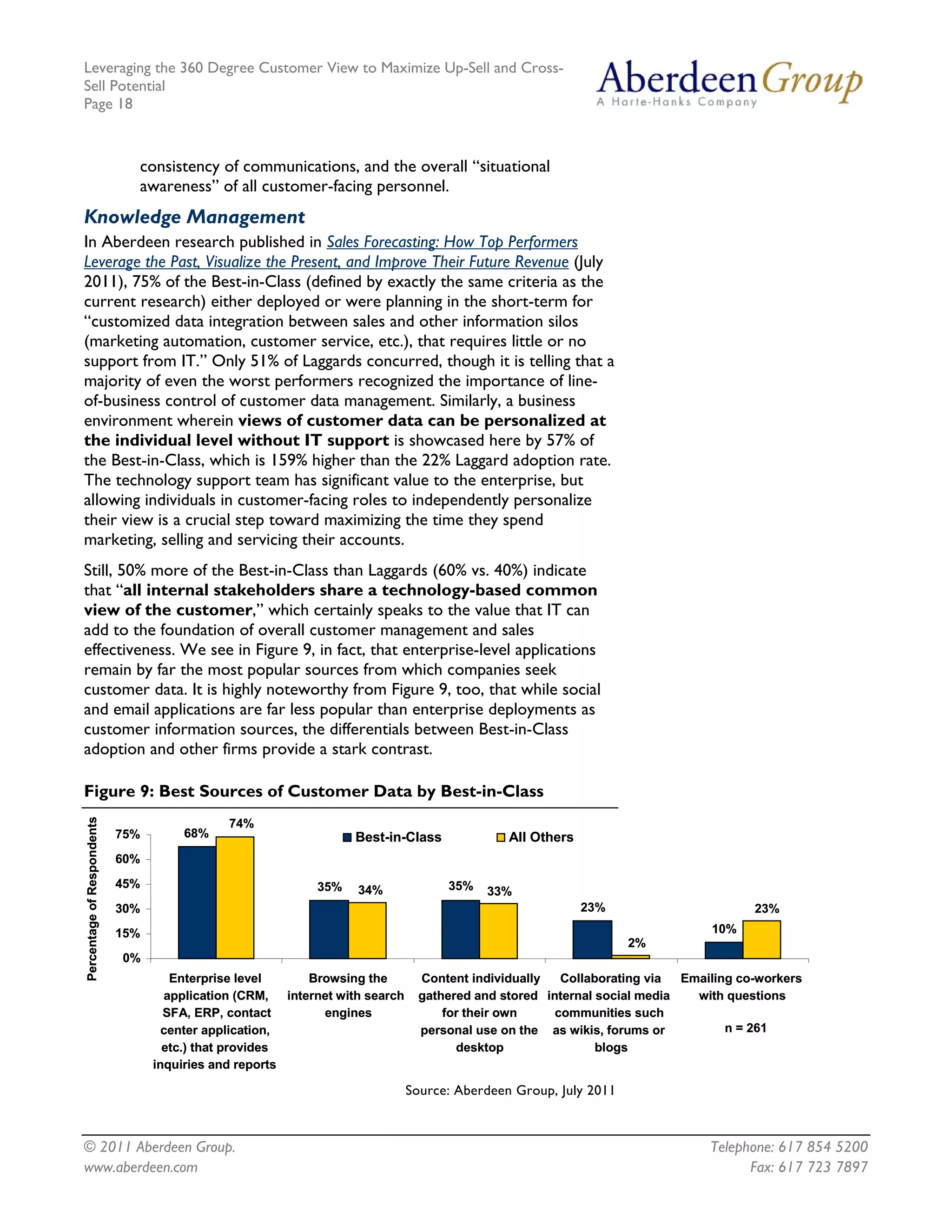

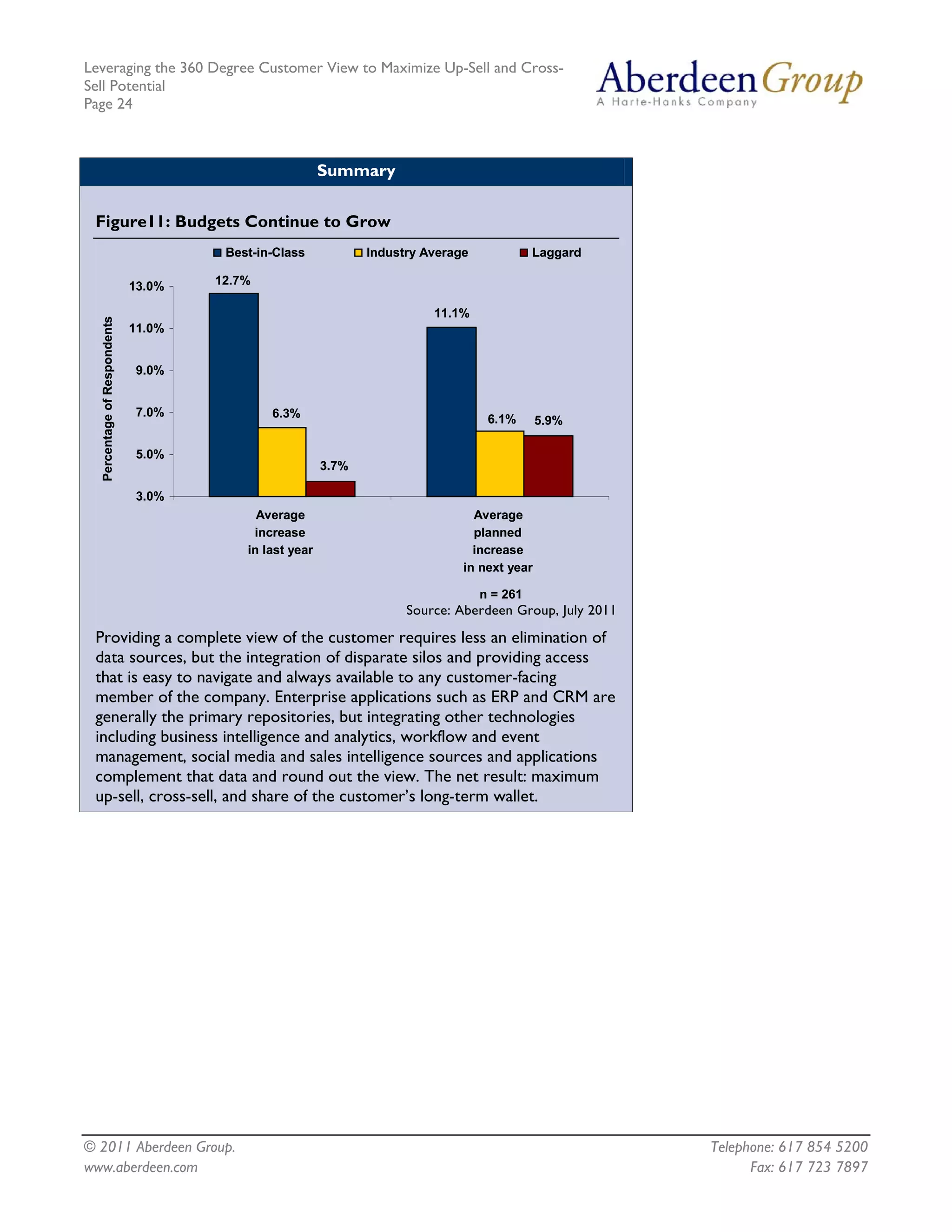

The document discusses leveraging a 360-degree customer view to enhance up-sell and cross-sell opportunities, emphasizing the benefits of improved customer insights for sales effectiveness. It highlights that best-in-class companies achieve higher customer retention rates, better sales performance, and shorter sales cycles through regular updates of customer data and effective communication strategies. An analysis of performance metrics indicates significant advantages for organizations that implement comprehensive data management and customer engagement practices.