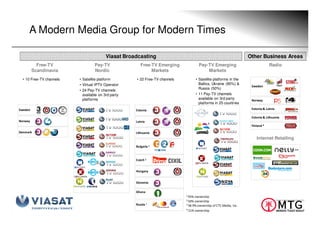

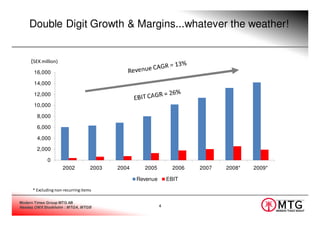

MTG is an international entertainment broadcasting group with a large broadcast footprint in Europe. It has 60 Viasat channels watched by 125 million people in 31 countries. MTG is the largest free-TV and pay-TV operator in Scandinavia and the Baltics, and the second largest free-TV operator in the Czech Republic and Bulgaria. MTG also has emerging market satellite pay-TV platforms in Russia and Ukraine and pay-TV channels available in 25 countries. MTG has sustained double digit revenue growth and margins despite economic downturns.