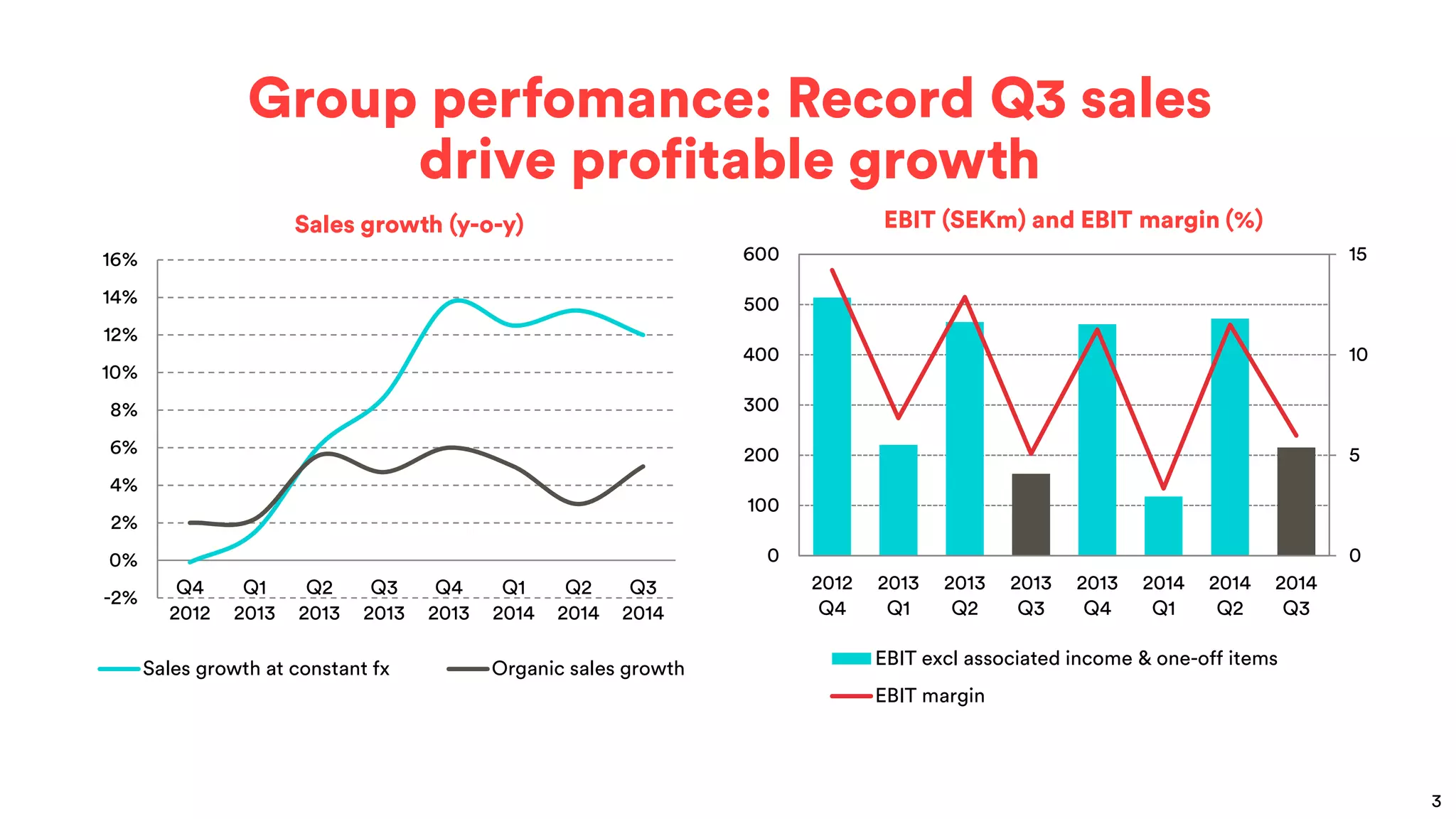

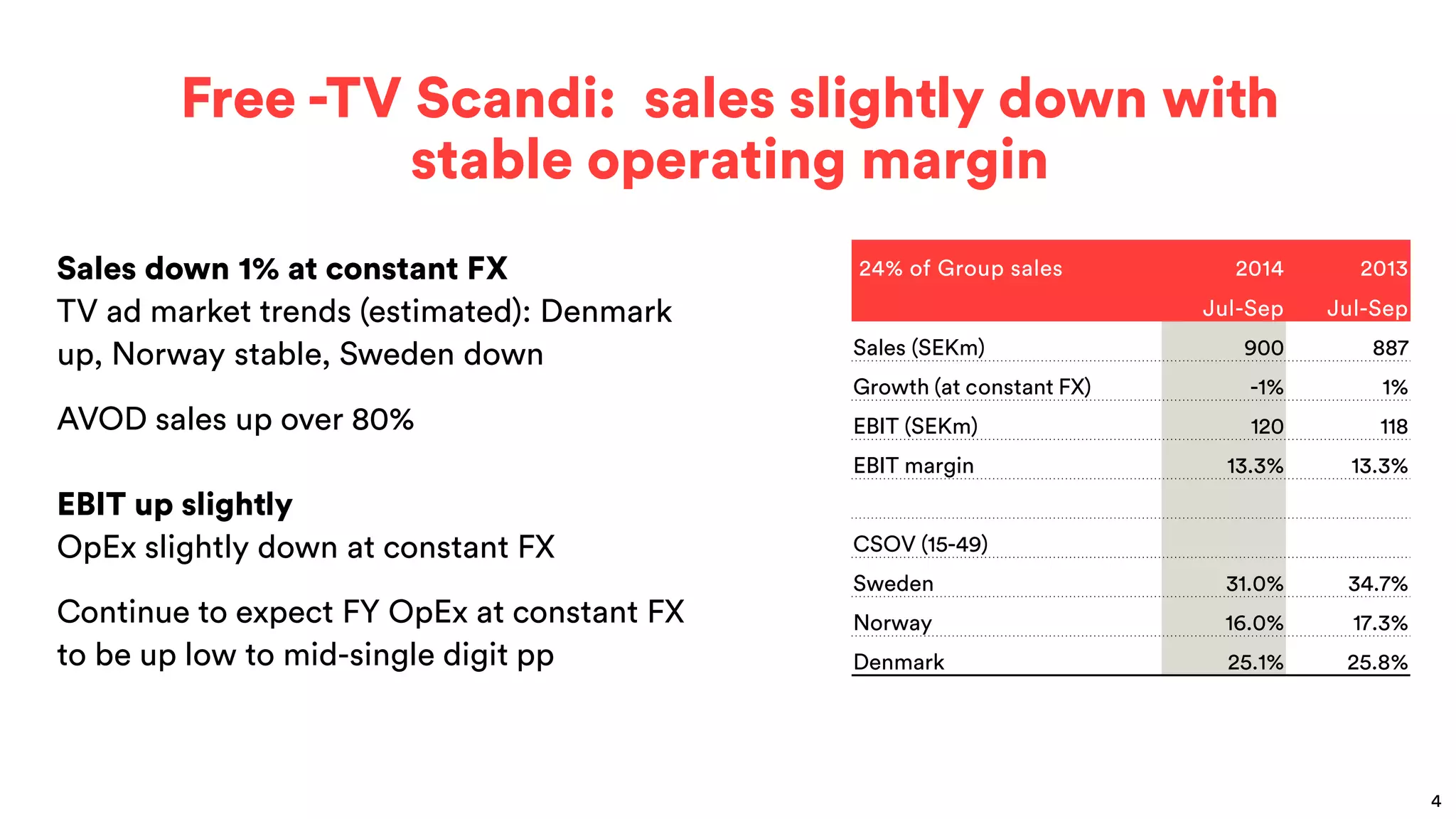

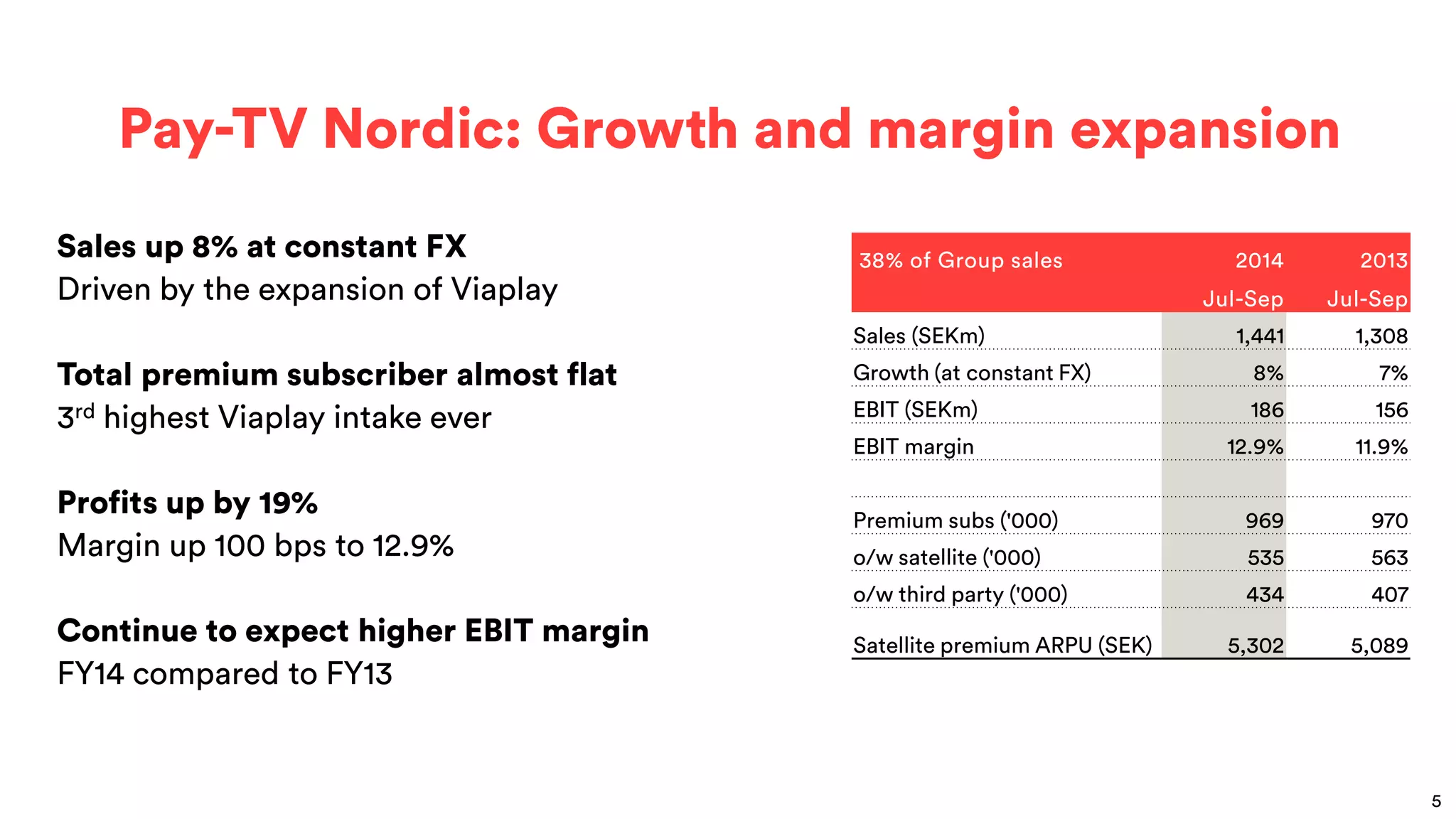

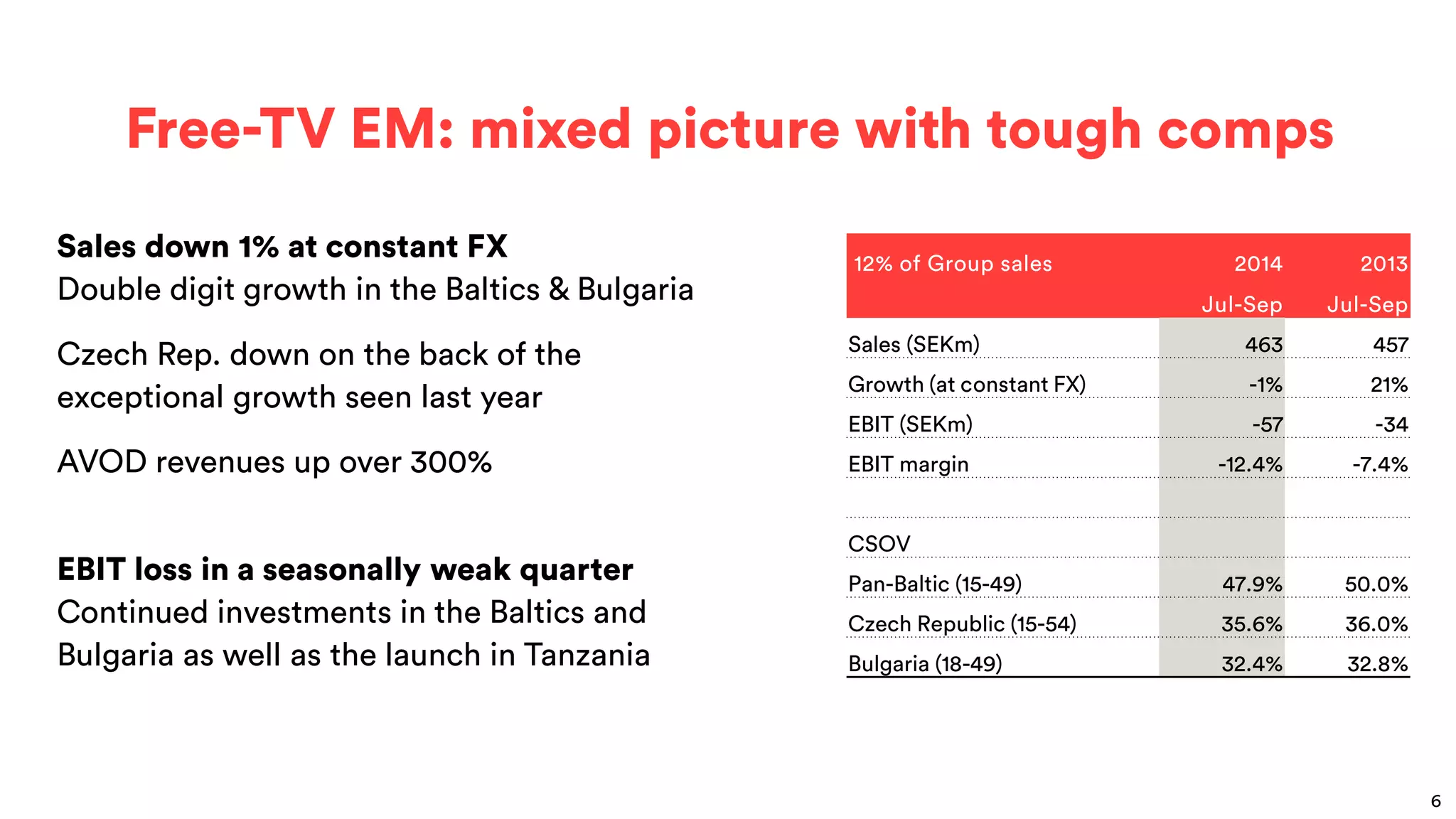

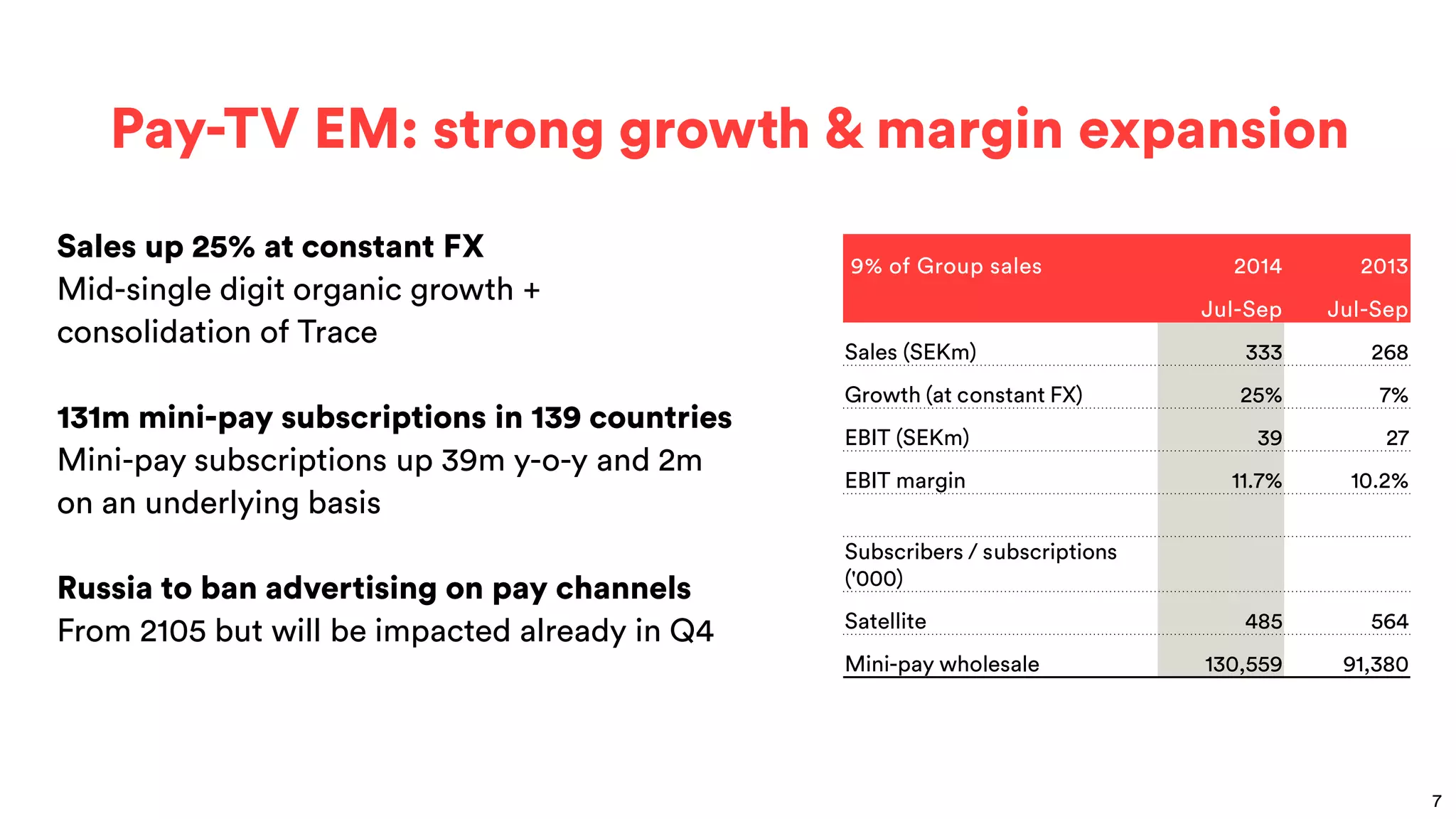

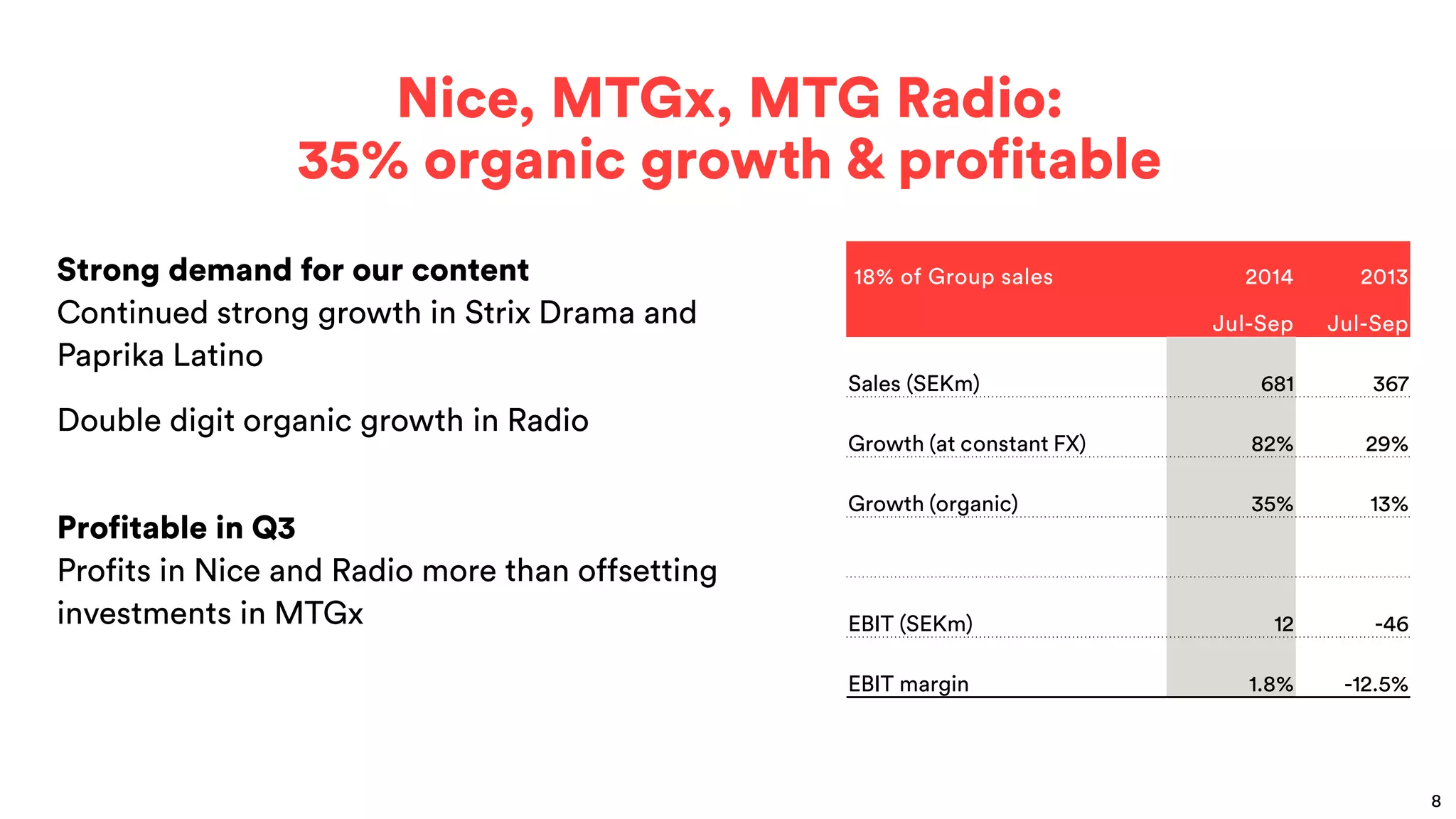

In Q3 2014, MTG reported record sales growth of 12% at constant FX and 5% organic growth. EBIT excluding associates was up 32% to SEK 215m. The Nordic free and pay-TV operations grew sales and profits by 7% and 11% respectively. Nice, MTGx, and MTG Radio reported strong organic sales growth of 35% and were profitable. Pay-TV in emerging markets grew sales 25% at constant FX, with mid-single digit organic growth.