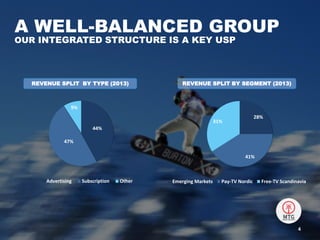

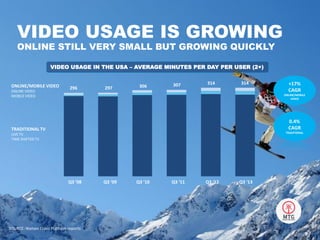

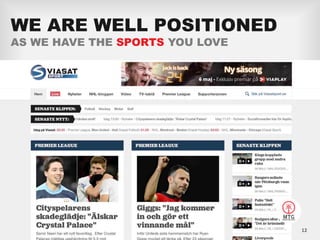

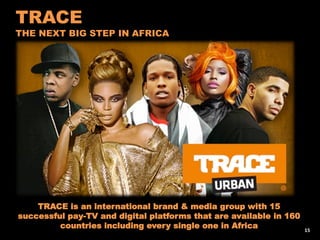

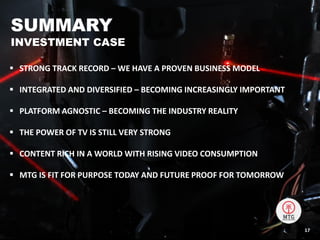

This document discusses MTG's position as a leading entertainment company. It highlights MTG's successful track record of growth over 10 years, with 11% sales CAGR and 15% EBIT CAGR. MTG has a unique and integrated business model across TV, digital, and different regions. It is focusing on content, digital delivery, and geographic expansion to continue driving long-term value creation. MTG is well-positioned for the future as online and mobile video consumption grows due to its large content library and platform-agnostic strategy.