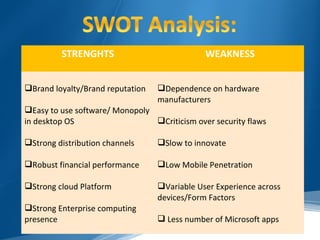

This document contains information about Group 7 which includes 6 members - Jyoti, Simila, Sonal, Thomas, Sreeparna and Sumit. It also includes the vision and mission statements of Microsoft. There are details provided about the IT industry trends, Microsoft's products and services, its financial performance for fiscal years 2013 and 2012. SWOT analysis and PESTLE analysis for the IT industry are also presented.