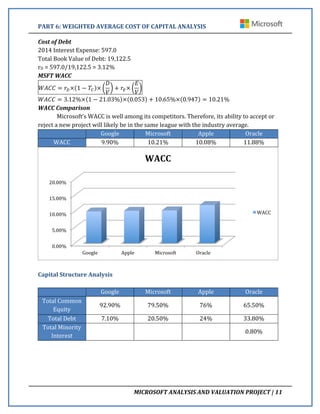

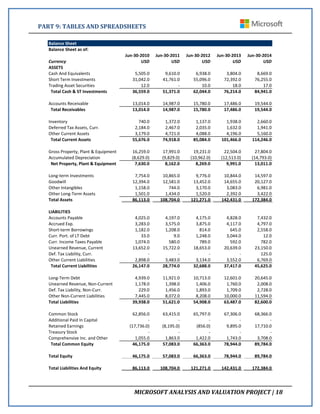

The document provides an analysis and valuation of Microsoft Corporation. It includes 10 parts covering: company description and background; business model including SWOT analysis and revenue/expense drivers; recent and peer financial performance analysis; future performance projections; weighted average cost of capital calculation; common share valuation; and conclusion/recommendation. Tables and spreadsheets with historical and forecasted financial statements are also included.