Embed presentation

Download to read offline

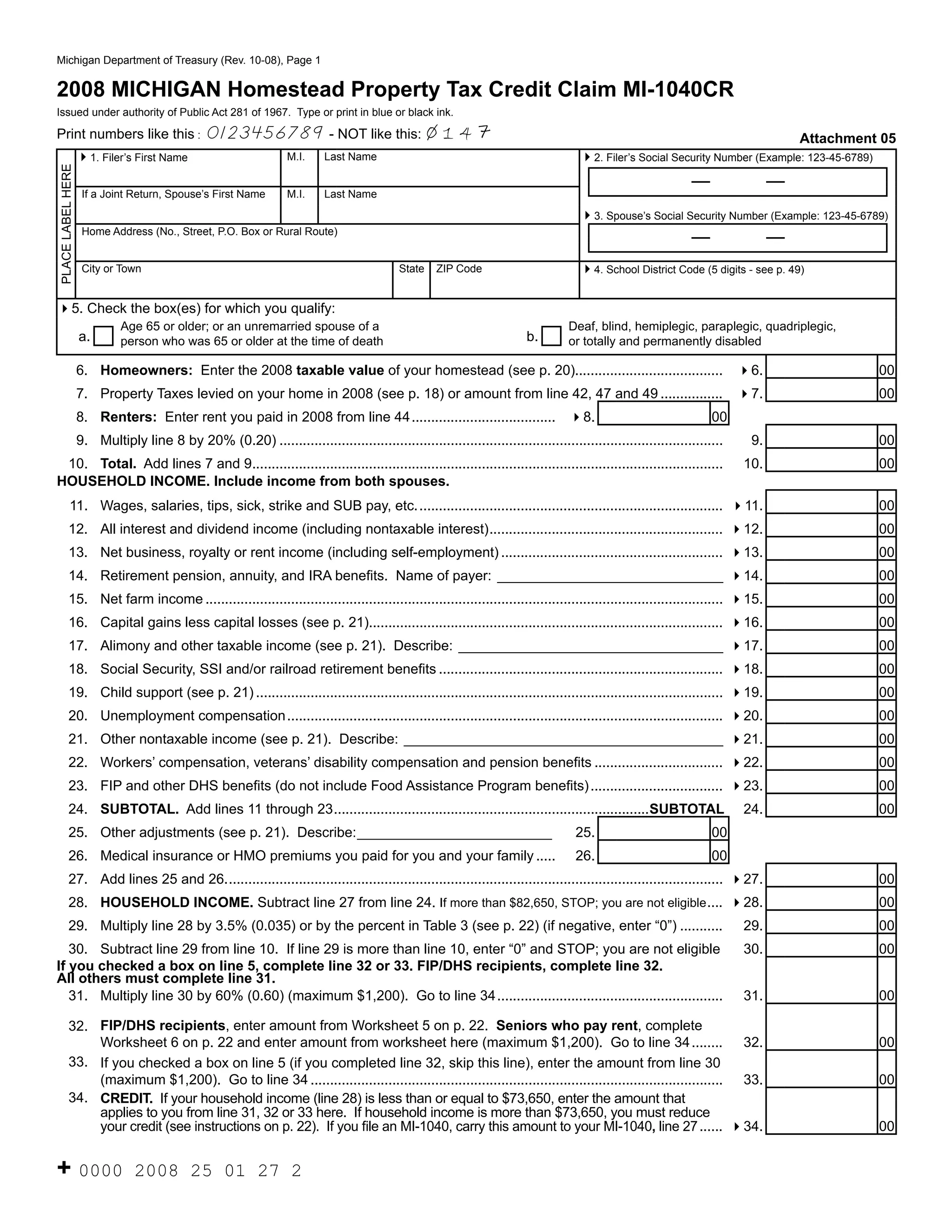

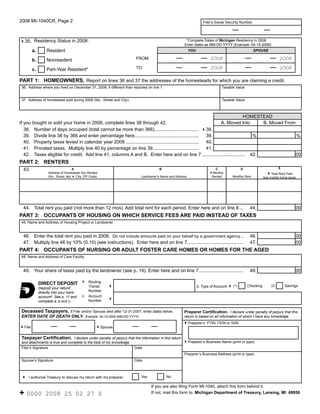

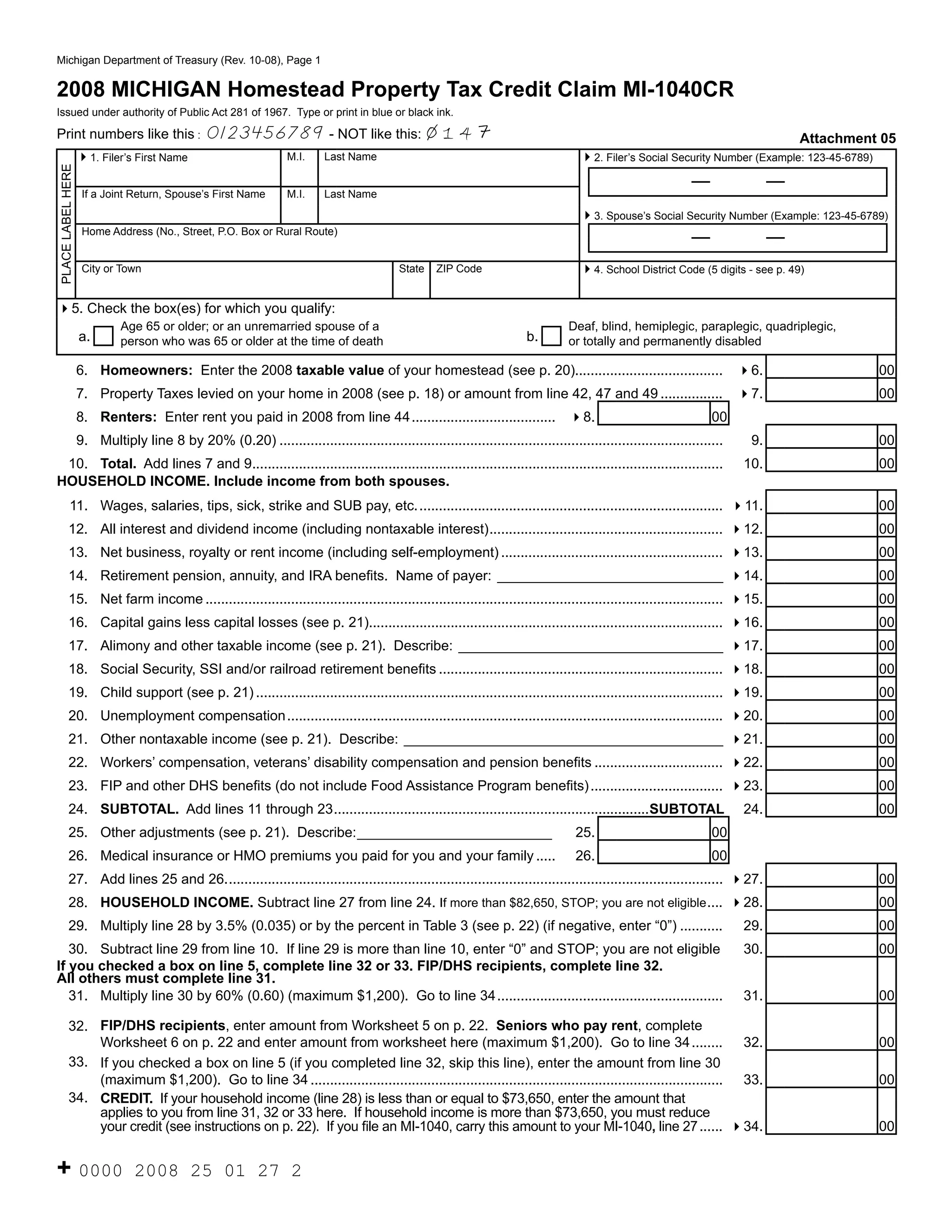

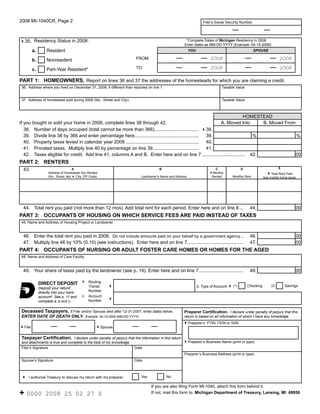

This document is a Michigan Homestead Property Tax Credit Claim form for 2008. It requests information to determine eligibility for a tax credit, including the filer's home address, age, disability status, household income, property taxes paid, rent paid, and other financial information. The form provides instructions on how to calculate the potential tax credit amount and includes sections for homeowners, renters, occupants of housing where service fees are paid, and occupants of nursing homes.