Embed presentation

Download to read offline

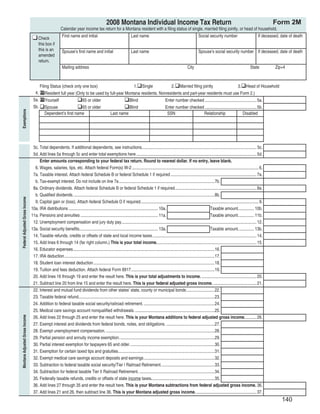

This document is a Montana individual income tax return form for 2008. It includes sections to report income, deductions, exemptions, tax, payments and amounts owed or refunded. The form is for residents filing as single, married filing jointly, or head of household. It provides line items to report wages, interest, dividends, capital gains, retirement income and other income. It allows standard or itemized deductions and exemptions. It calculates tax, nonrefundable credits, payments and any amounts due or to be refunded.