Embed presentation

Download to read offline

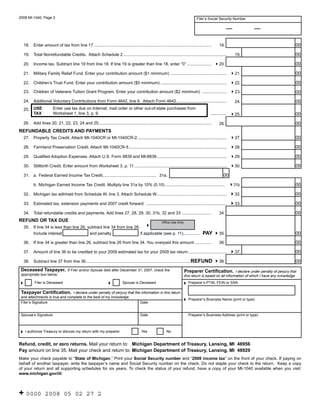

This document is a Michigan individual income tax return form for 2008. It contains instructions for filing a state income tax return and calculating taxes owed or refund due. The form requests personal information, filing status, income sources, exemptions, tax payments and credits to determine tax liability. It provides options to contribute to military relief and children's funds or receive a refund.