Embed presentation

Download to read offline

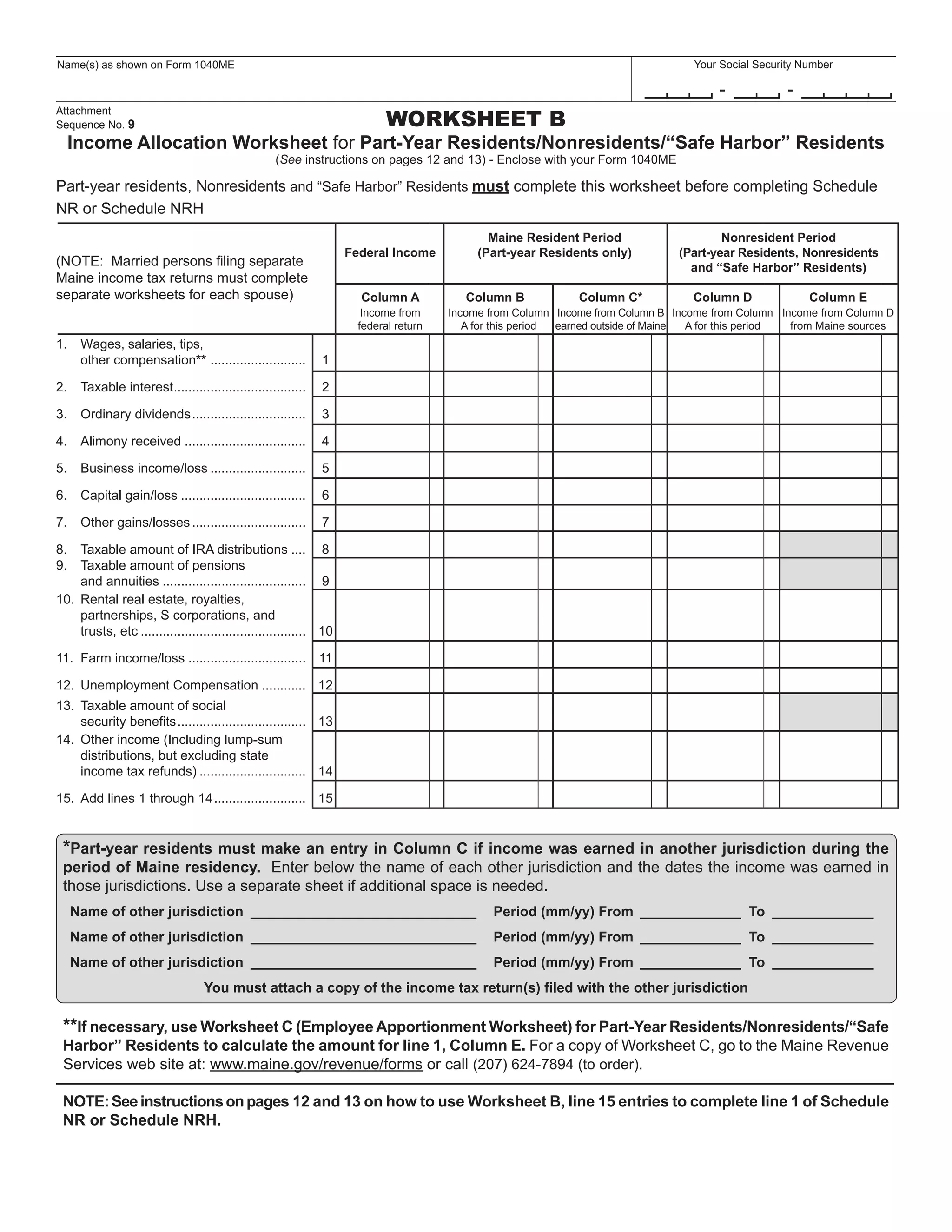

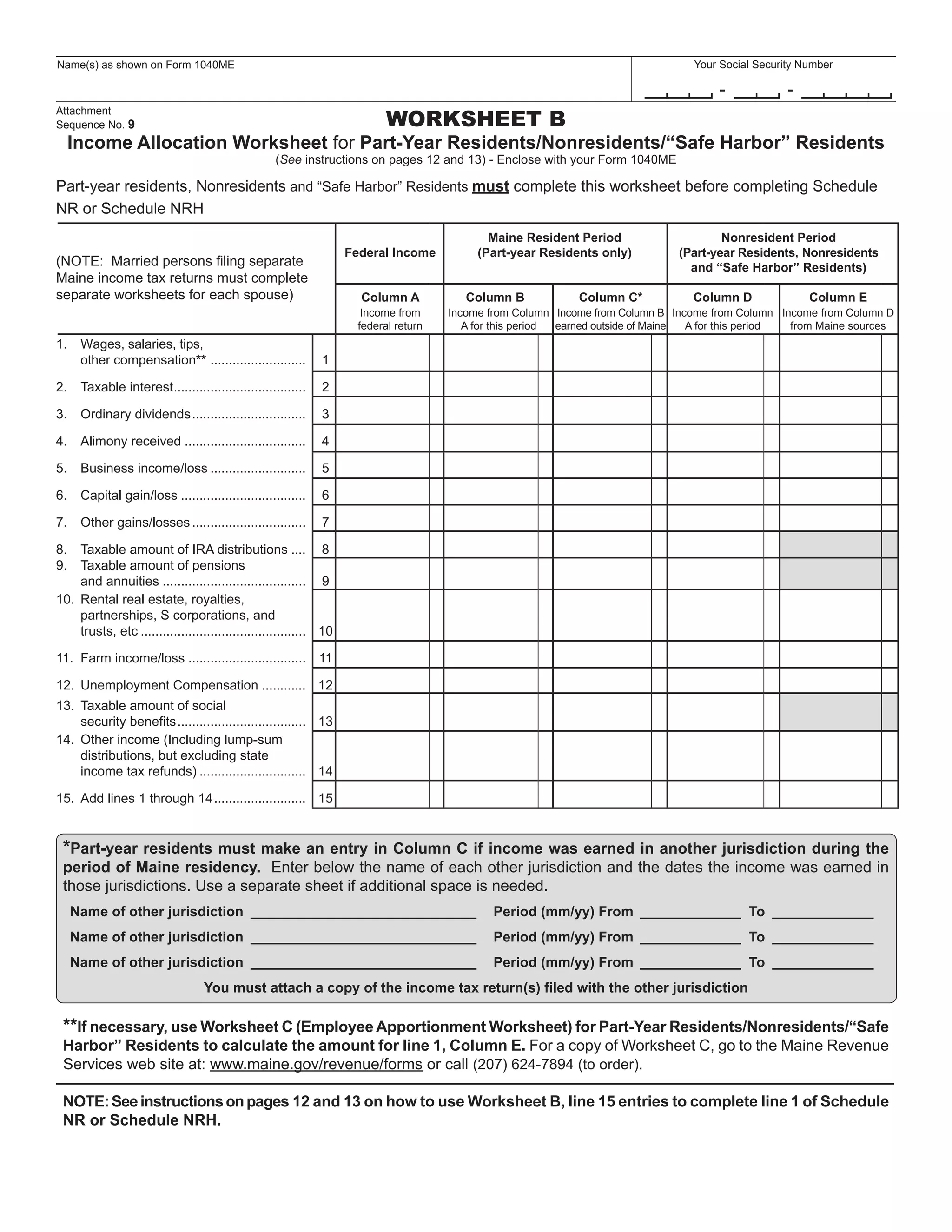

This document contains two worksheets for part-year residents, nonresidents, and "safe harbor" residents of Maine to complete before filing their Maine income tax return. Worksheet A collects information about the taxpayer's residency status and presence in Maine. Worksheet B allocates different types of income to the periods when the taxpayer was a Maine resident or a nonresident, to determine what income is taxable by Maine.