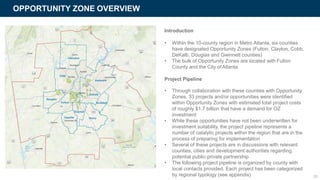

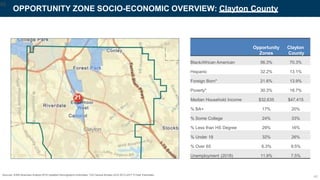

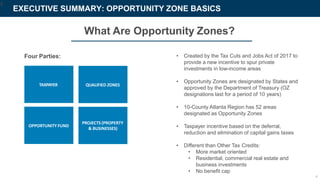

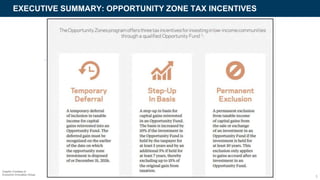

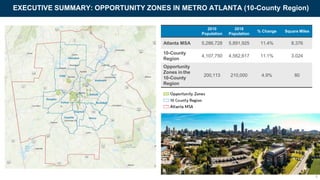

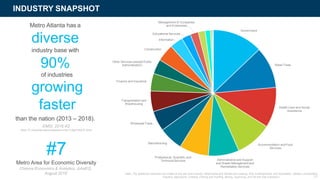

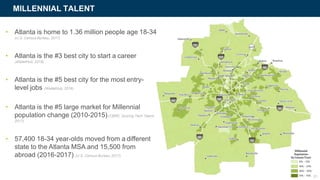

The Metro Atlanta Opportunity Zone Prospectus outlines investment opportunities in a rapidly growing region projected to expand its population from 6 million to 8 million by 2040. It highlights Atlanta's diverse economy, efficient transportation infrastructure, and robust labor pool, making it an attractive location for businesses and investments. The document serves as a resource for understanding opportunity zones and outlines various projects and incentives designed to stimulate private investments in designated low-income areas.

![ATLANTA BELTLINE

$4.1BPrivate development along

corridor

7Parks

22Planned miles of pedestrian-

friendly rail transit

12Miles of

multi-use trails completed

11,000Permanent jobs

2,500Number of affordable

housing units within walking

distance

“Until the BeltLine, there wasn’t a true dense urban core in

Atlanta that had the energy of other big cities. I was

deliberately trying to create a place where young people like

myself would enjoy hanging out—a place that incorporated

the walkability, accessibility, and just the feeling of

community the BeltLine provided.”

Michael Lennox, Ladybird Grove & Mess Hall, Founder & Owner

“Strategic sites in key urban markets across the

country—such as Atlanta—openup possibilities,

helps us attract exciting new talent and resources,

and affords us opportunities to host more

prospects andclients.”

Todd Haedrich, athenahealth, Vice President & General

Manager of Small Groups

athenahealth recently announced plans to expand its footprint at Ponce City Market,which is

located along the BeltLine and isalso home to other tech companieslike MailChimp and Twitter.

“It’s [The BeltLine] the best thing ever to happen to Atlanta. It’s changing how I think of Atlanta.”

Mildred Spalding, Atlanta Resident

Source: Atlanta BeltLine Partnership 2017 Annual Report 23](https://image.slidesharecdn.com/10metroatlantaozprospectus-190529182131/85/Metro-Atlanta-Opprtunity-Zone-Prospectus-23-320.jpg)