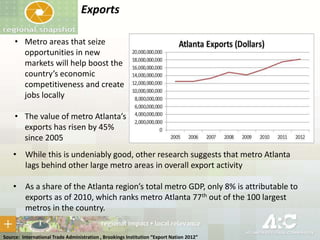

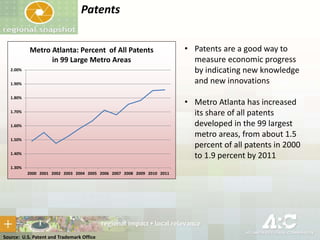

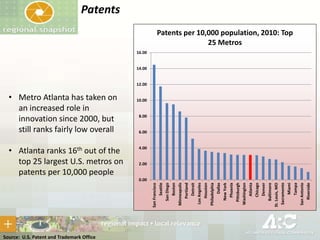

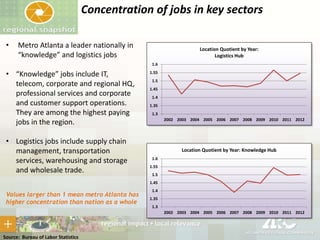

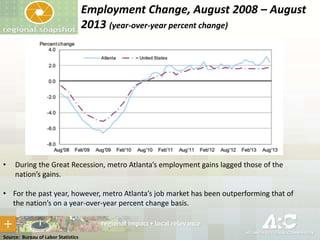

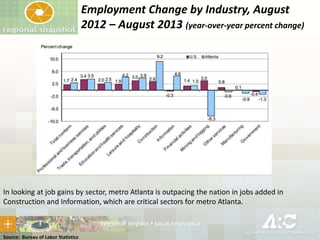

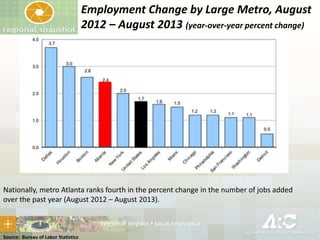

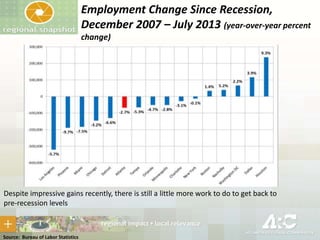

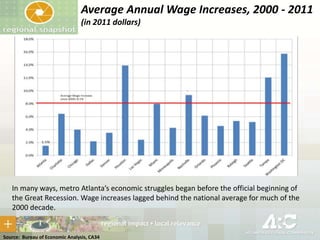

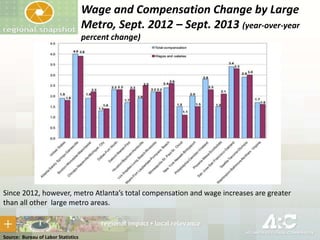

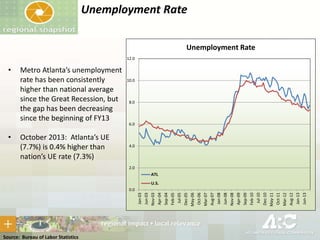

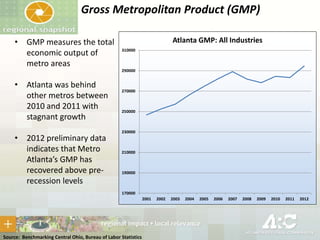

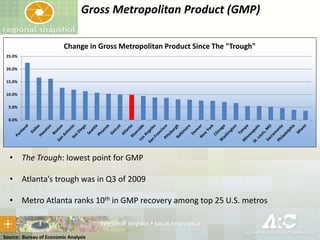

The document discusses the economic recovery goals for Metro Atlanta under Plan 2040, highlighting its competitiveness, growth in exports, and increasing innovation as measured by patents. While the employment rate is improving, it still lags behind national averages, and the area ranks 10th in the recovery of gross metropolitan product since the recession. Additionally, Metro Atlanta has notable gains in home prices but continues to face challenges with unemployment rates above the national average.