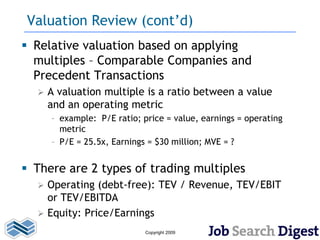

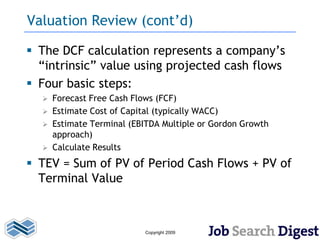

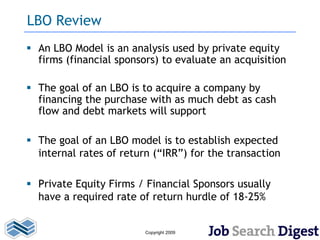

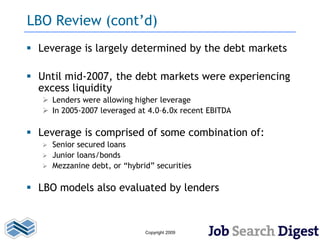

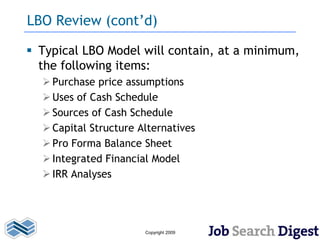

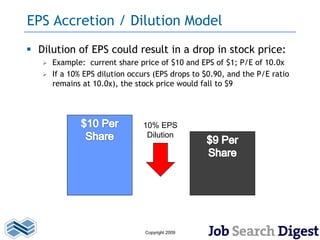

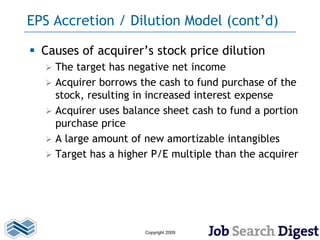

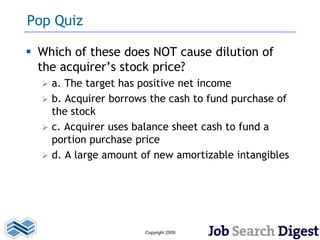

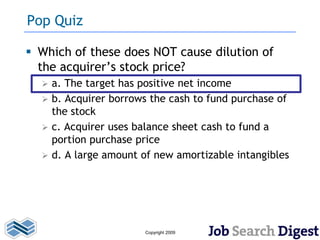

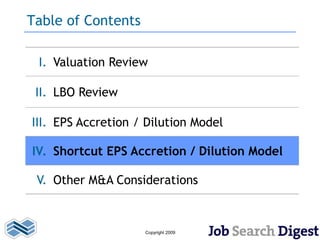

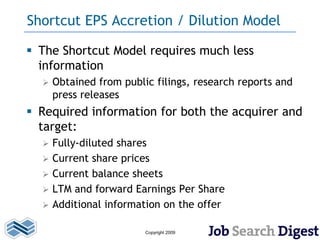

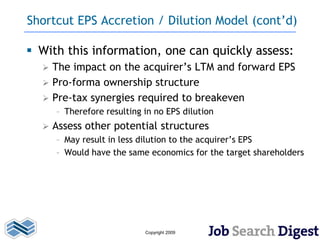

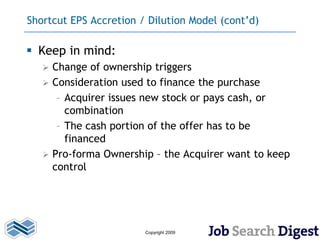

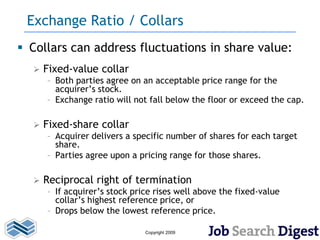

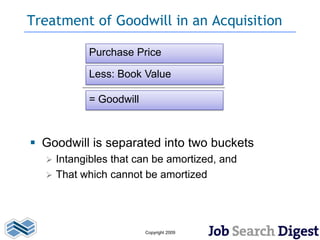

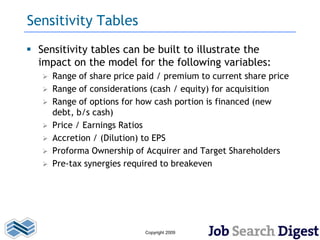

This document provides a summary of key considerations for mergers and acquisitions. It discusses valuation methodologies like comparable company analysis, precedent transactions analysis, and discounted cash flow analysis. It also reviews leveraged buyout models, earnings per share accretion/dilution models, and other factors like pre-tax synergies required and exchange ratio collars.