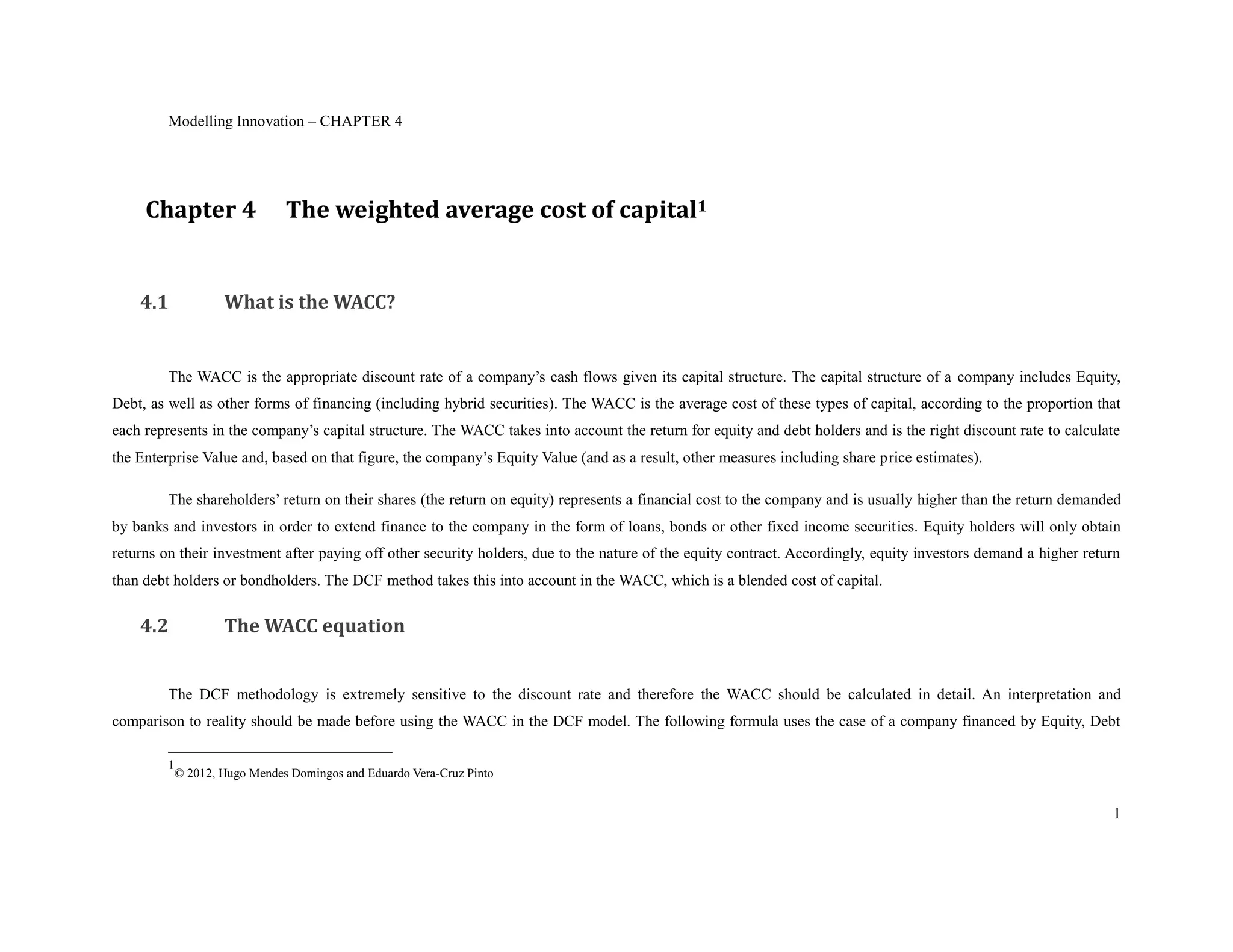

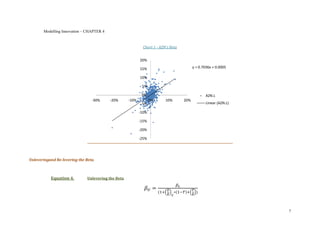

Chapter 4 discusses the Weighted Average Cost of Capital (WACC), which serves as the discount rate reflecting a company's capital structure, including equity and debt. The chapter details the formulas for calculating WACC, cost of debt, and cost of equity, emphasizing the sensitivity of valuation models to these rates. It also explains the significance of the company's beta and country risk premium in determining the overall cost of capital.