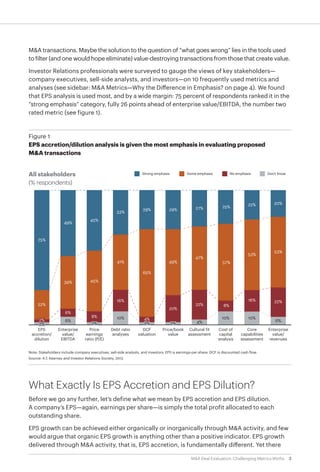

- EPS accretion/dilution is the most emphasized metric used to evaluate M&A deals between public companies according to a survey. However, EPS accretion does not necessarily create value and EPS dilution does not necessarily destroy value.

- While an EPS accretive deal increases reported EPS, it often comes with a lower growth rate for earnings. This reduced growth is not factored into the valuation, counterbalancing the higher EPS. No real value is created.

- Synergies from a deal are what can potentially create value, not whether the deal is EPS accretive or dilutive. Some highly dilutive deals may offer the greatest opportunities for synergies. Emphasizing EPS over fundamentals can lead companies to pursue