This document provides a summary of Medicare claims processing procedures for inpatient hospital billing. It outlines the table of contents which includes sections on general inpatient requirements, payment under the prospective payment system (PPS) diagnosis-related groups (DRGs), additional payment amounts for disproportionate share hospitals, rural hospital flexibility programs, billing coverage and utilization rules, adjustment bills, swing-bed services, and billing instructions for specific situations such as transplants and foreign hospital services. It provides procedural guidance to Medicare contractors for processing inpatient hospital claims.

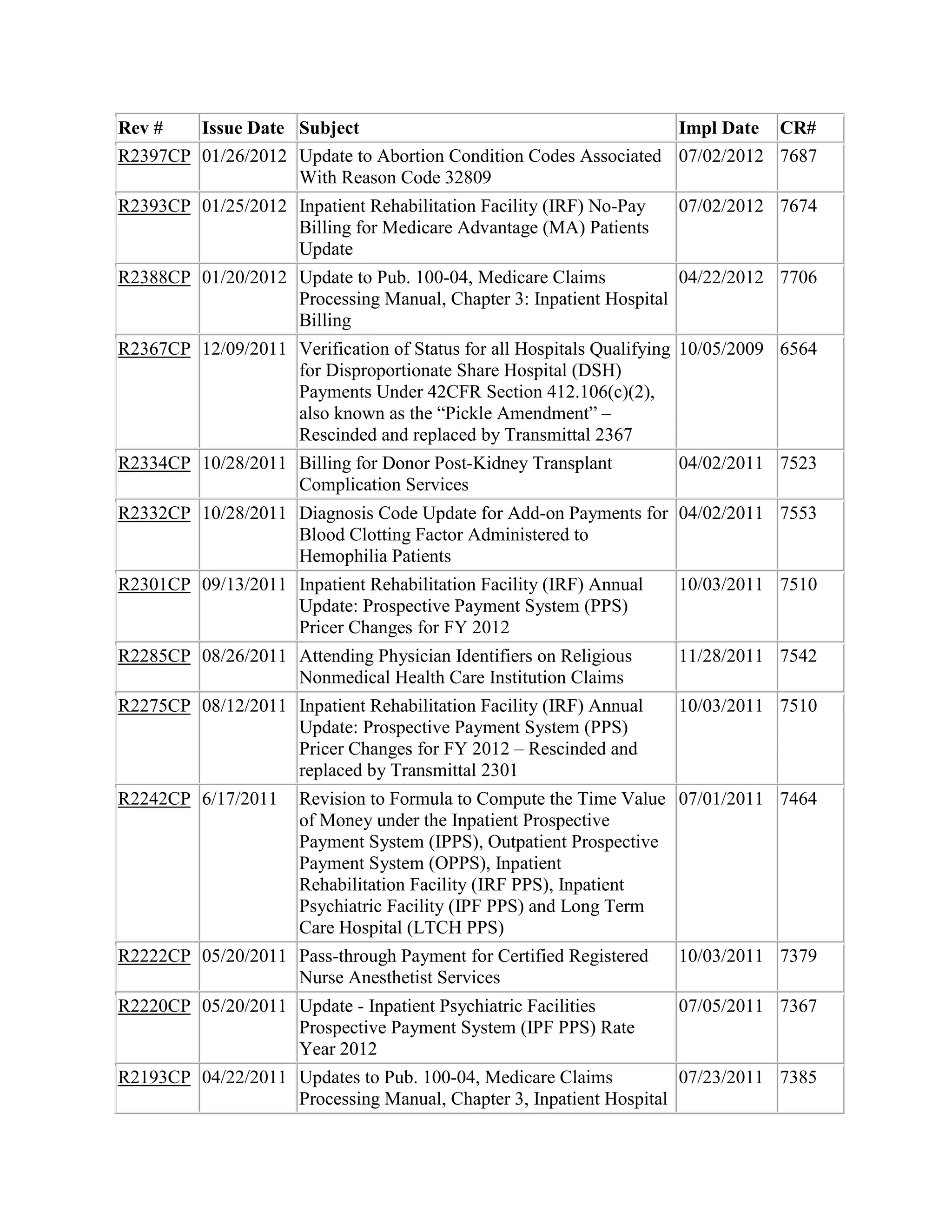

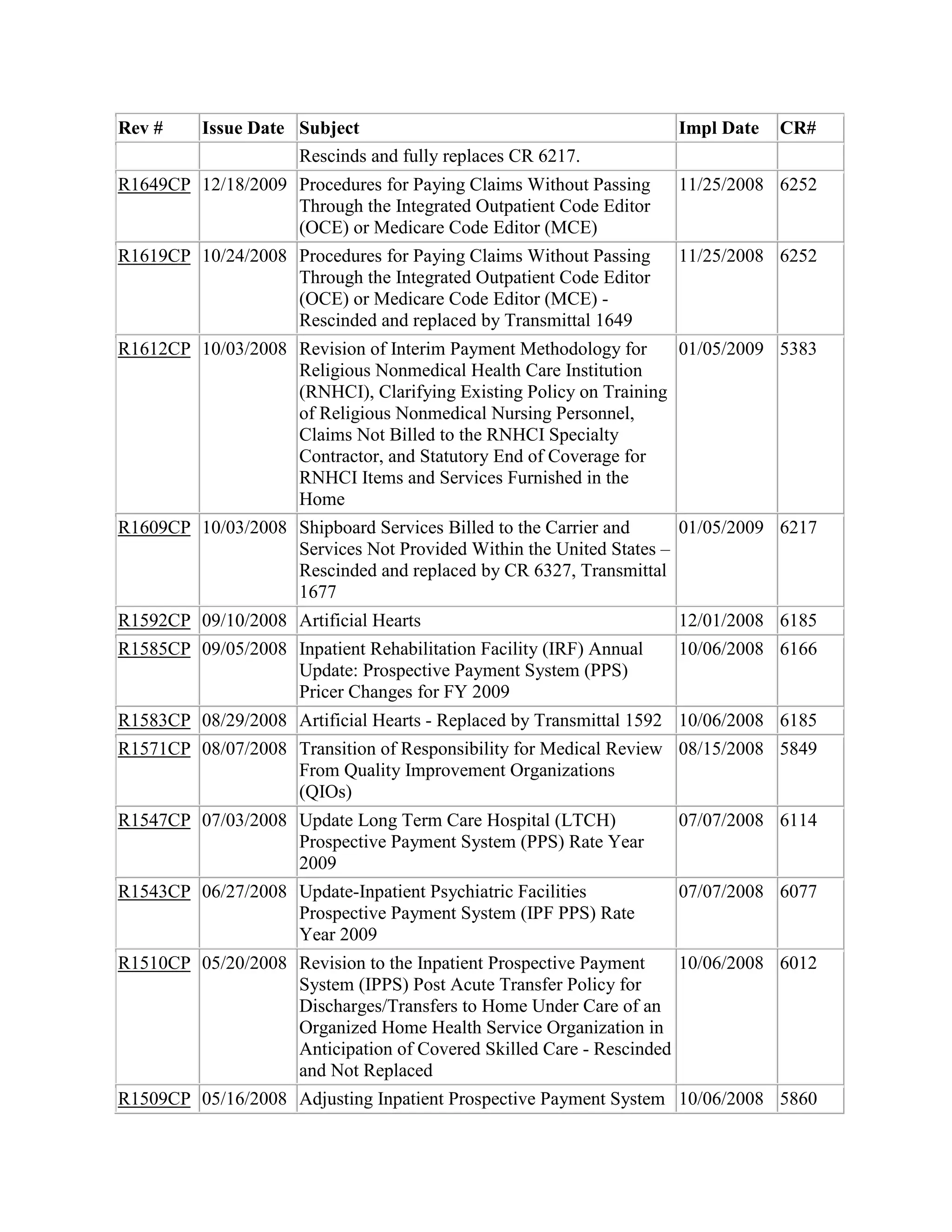

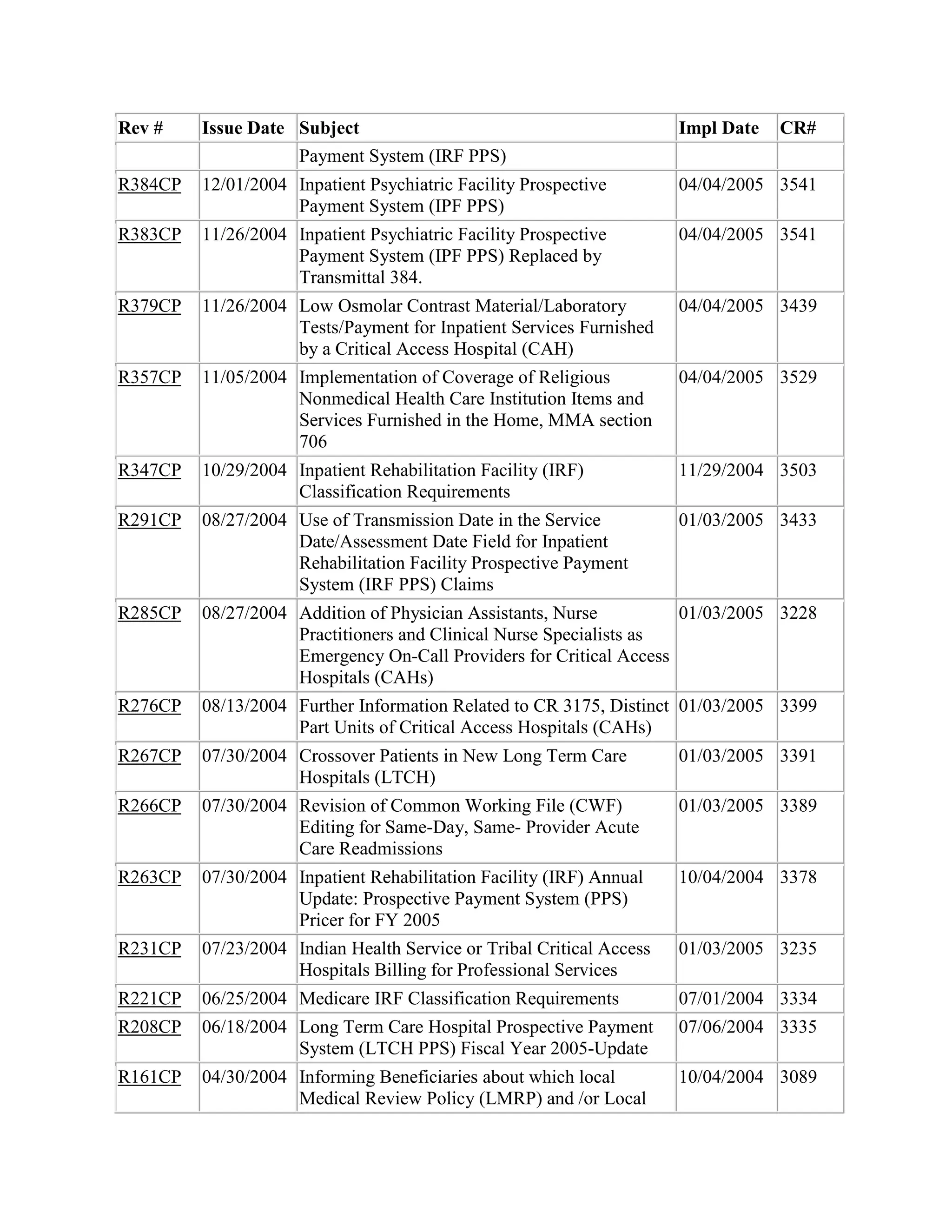

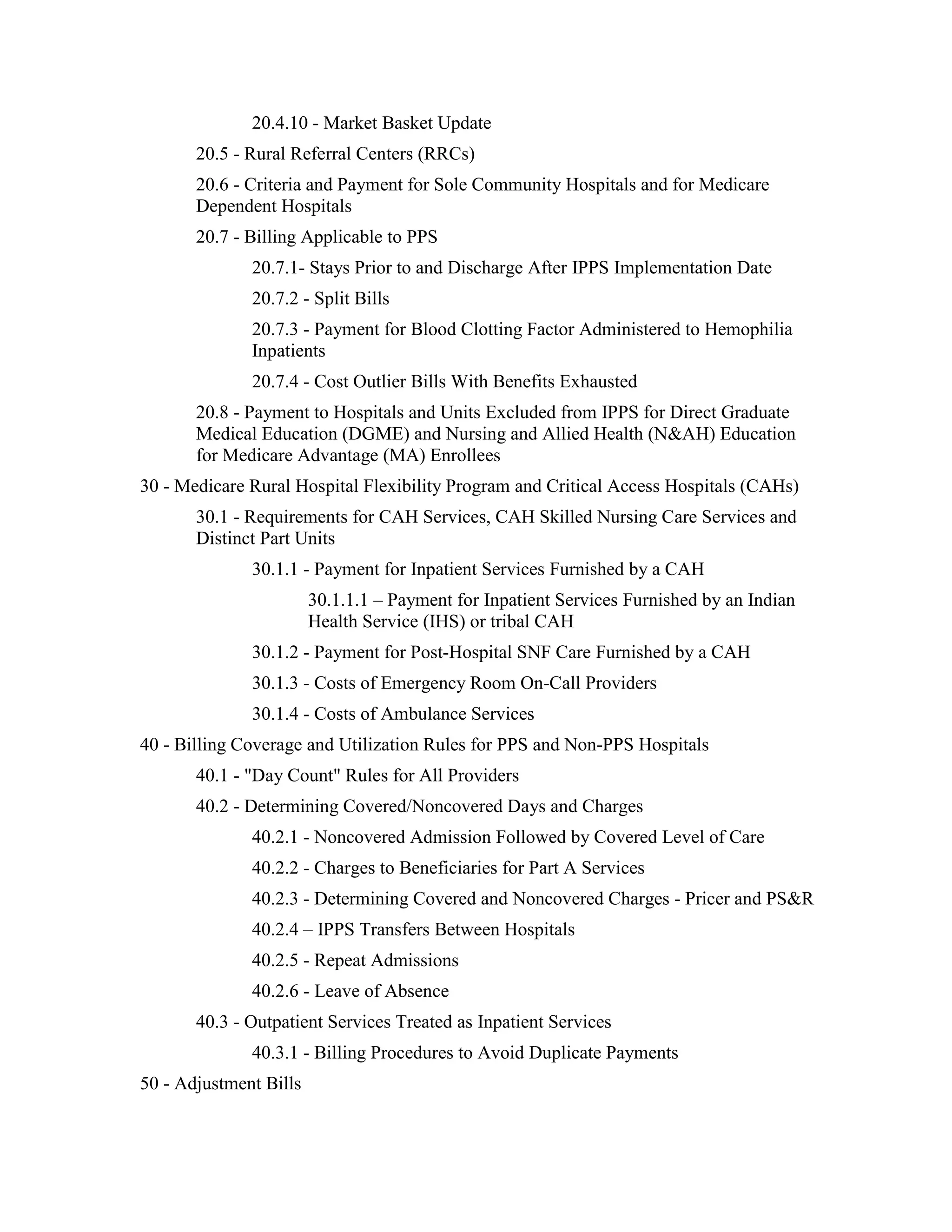

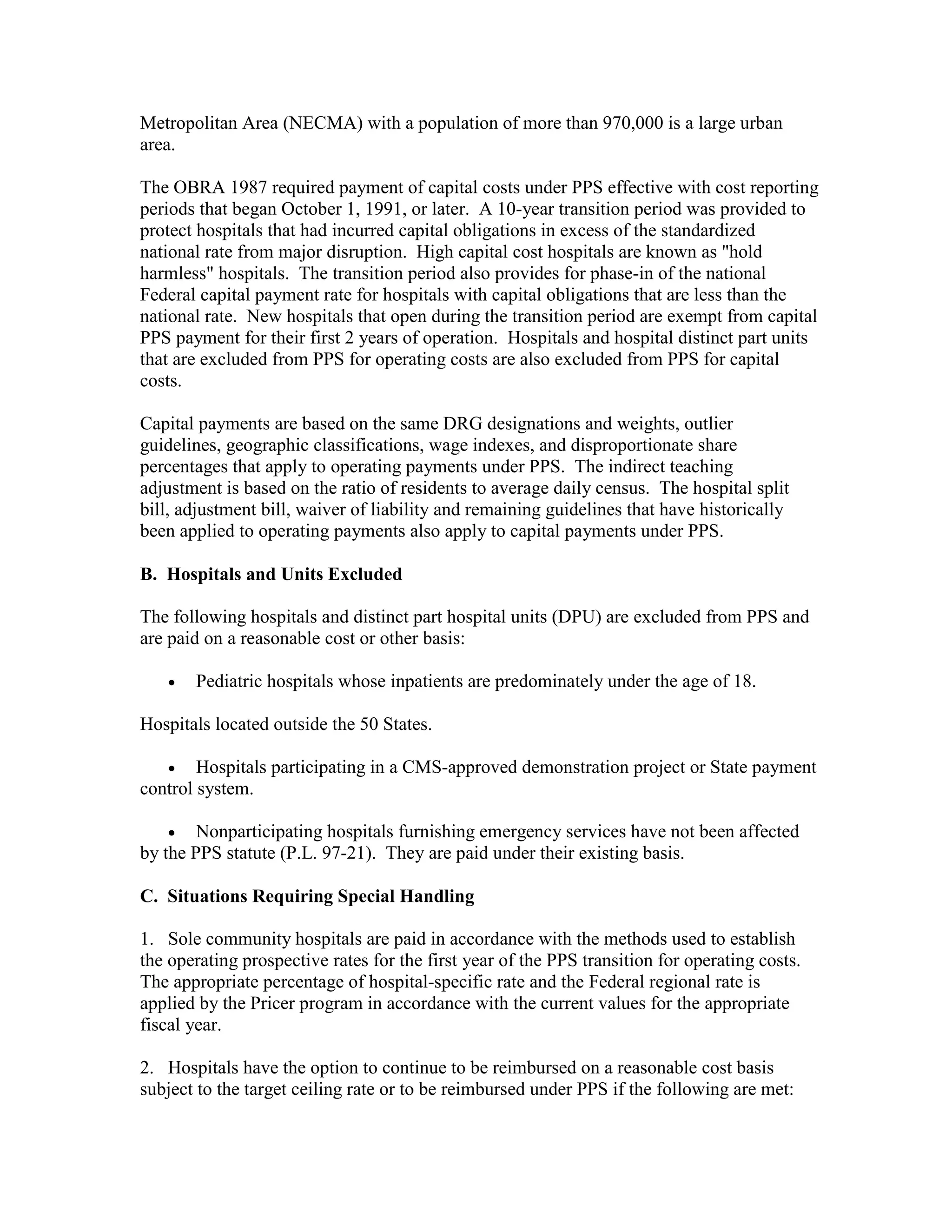

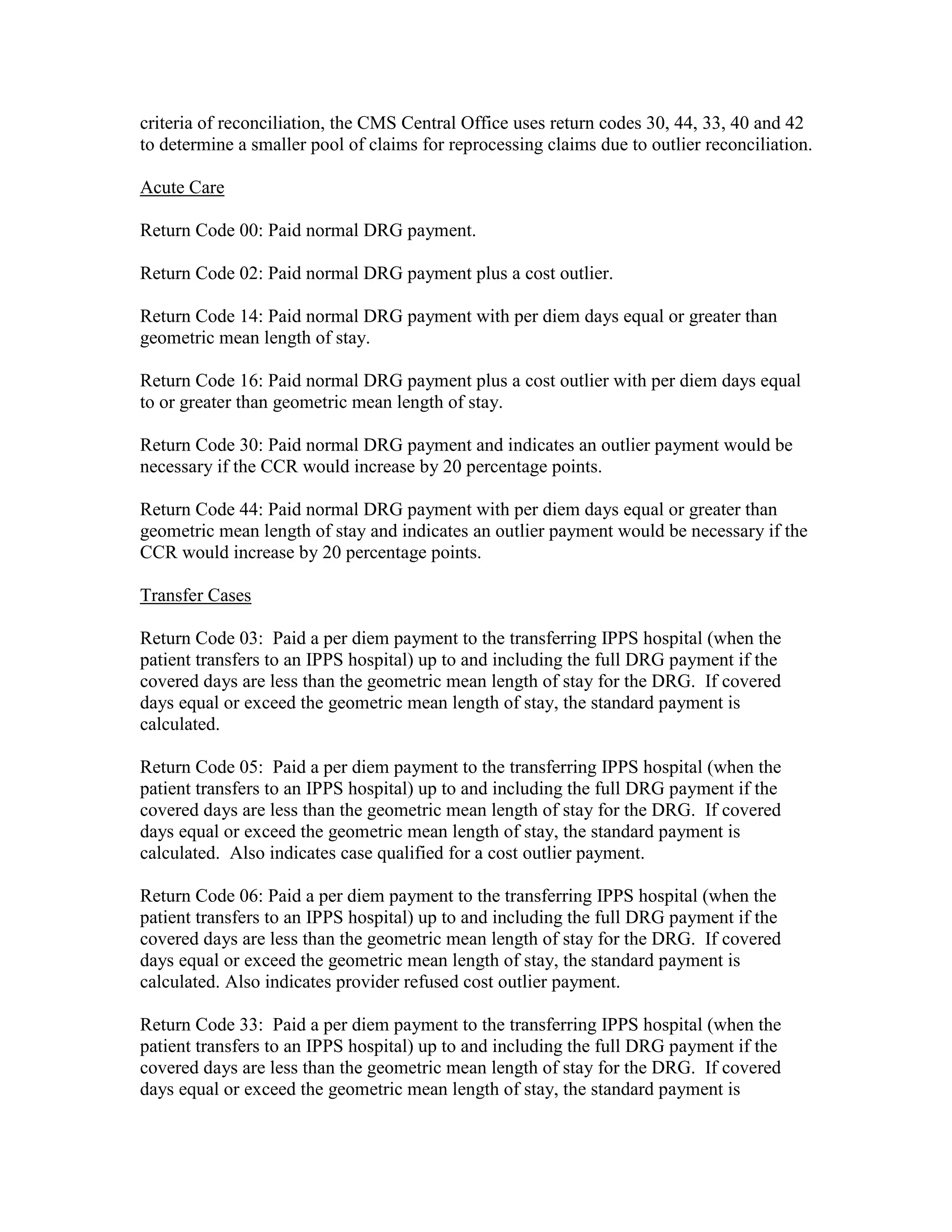

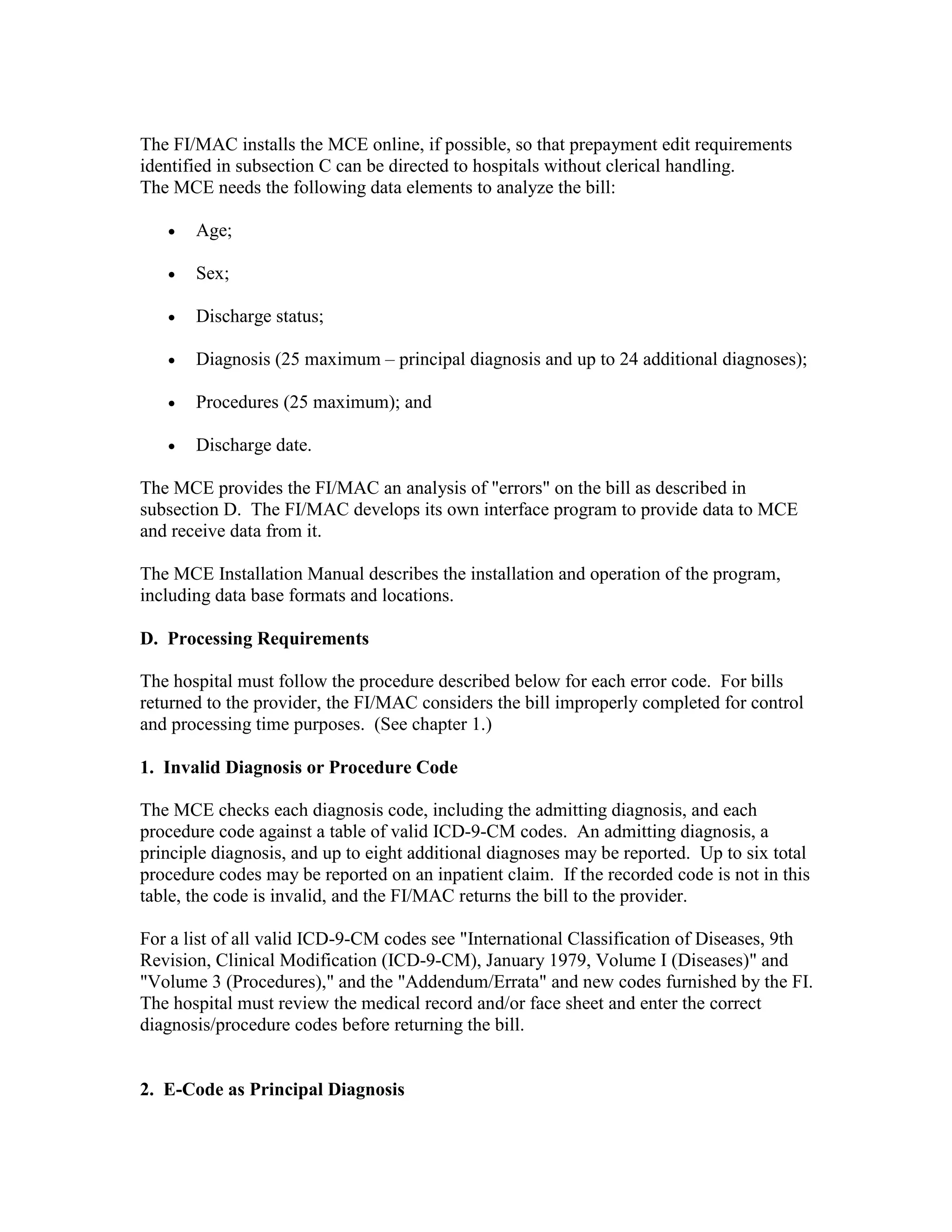

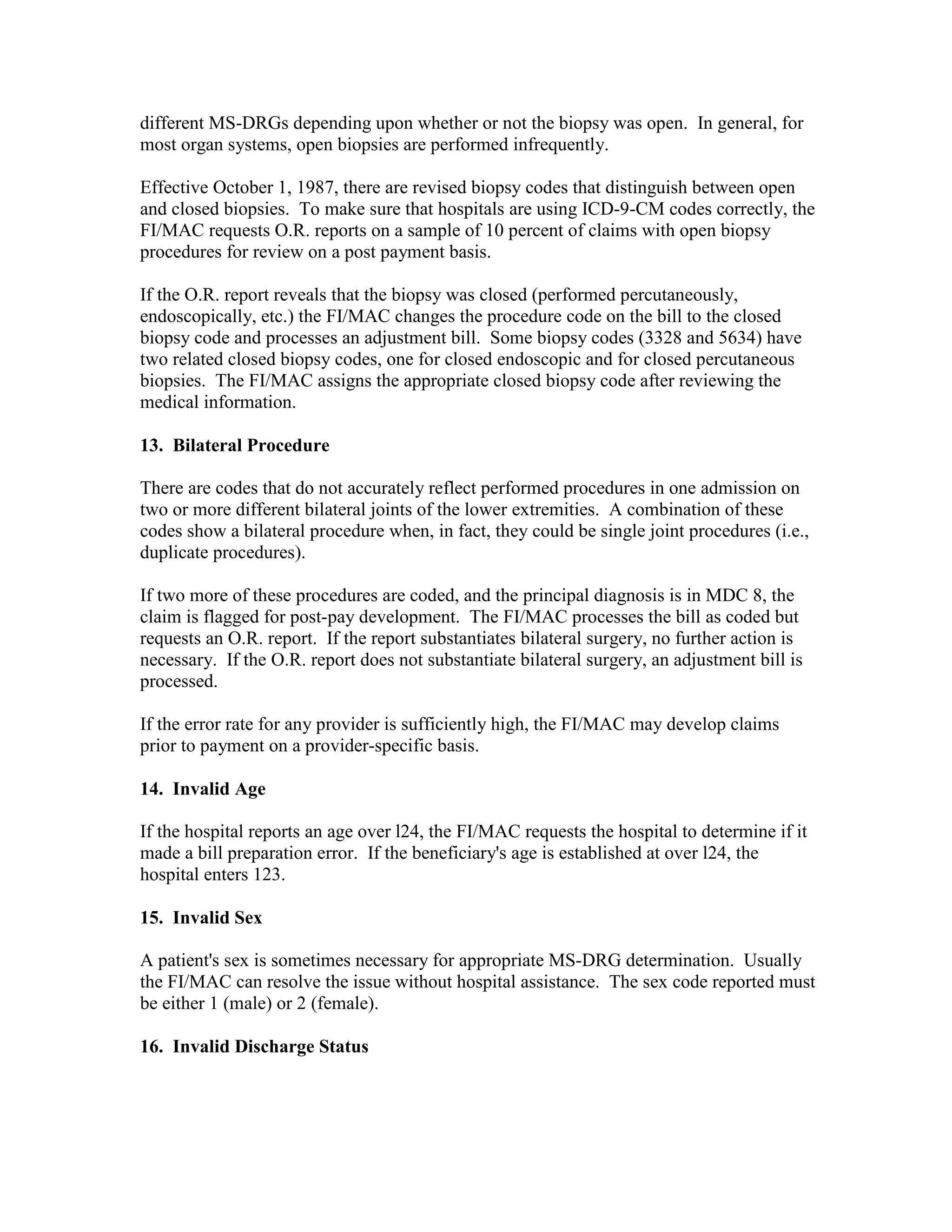

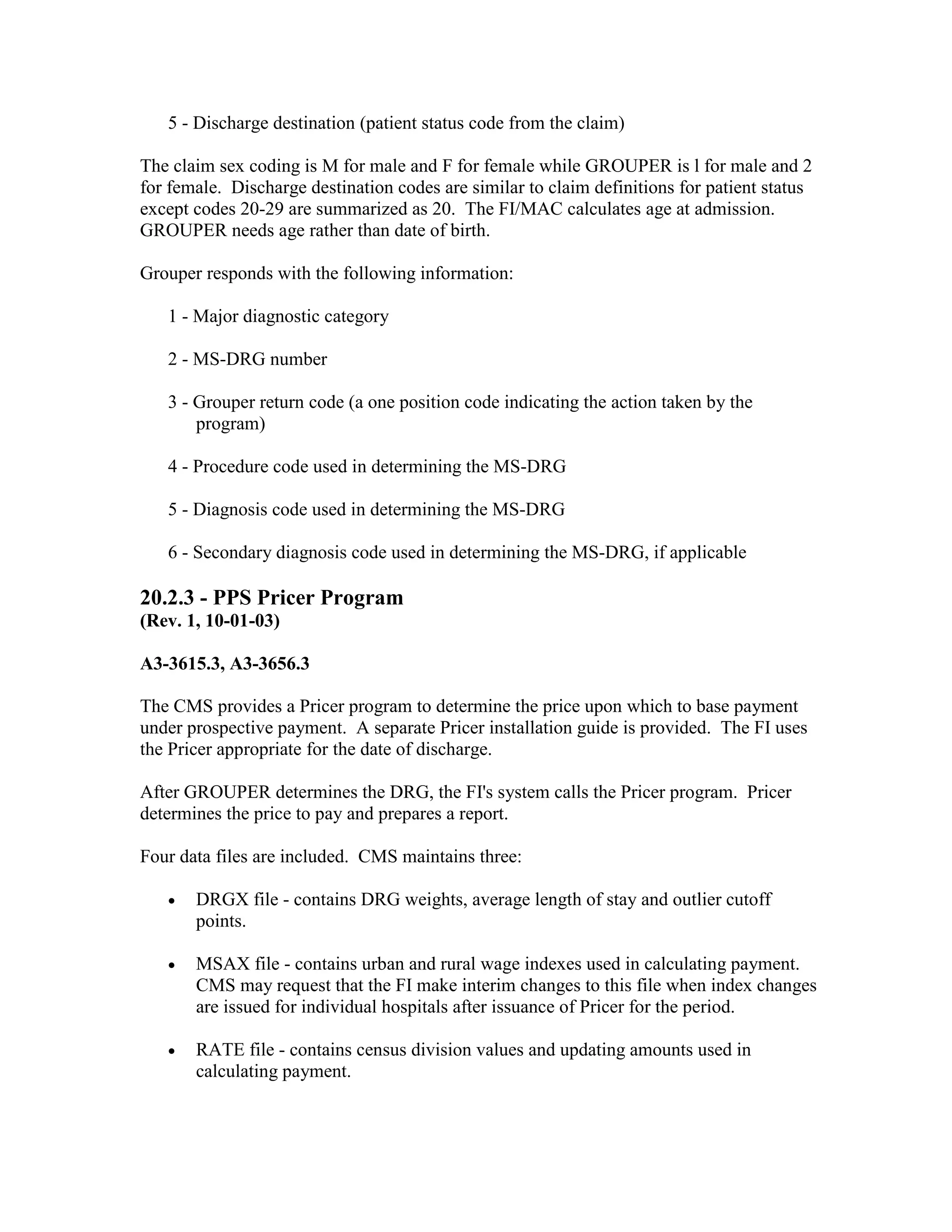

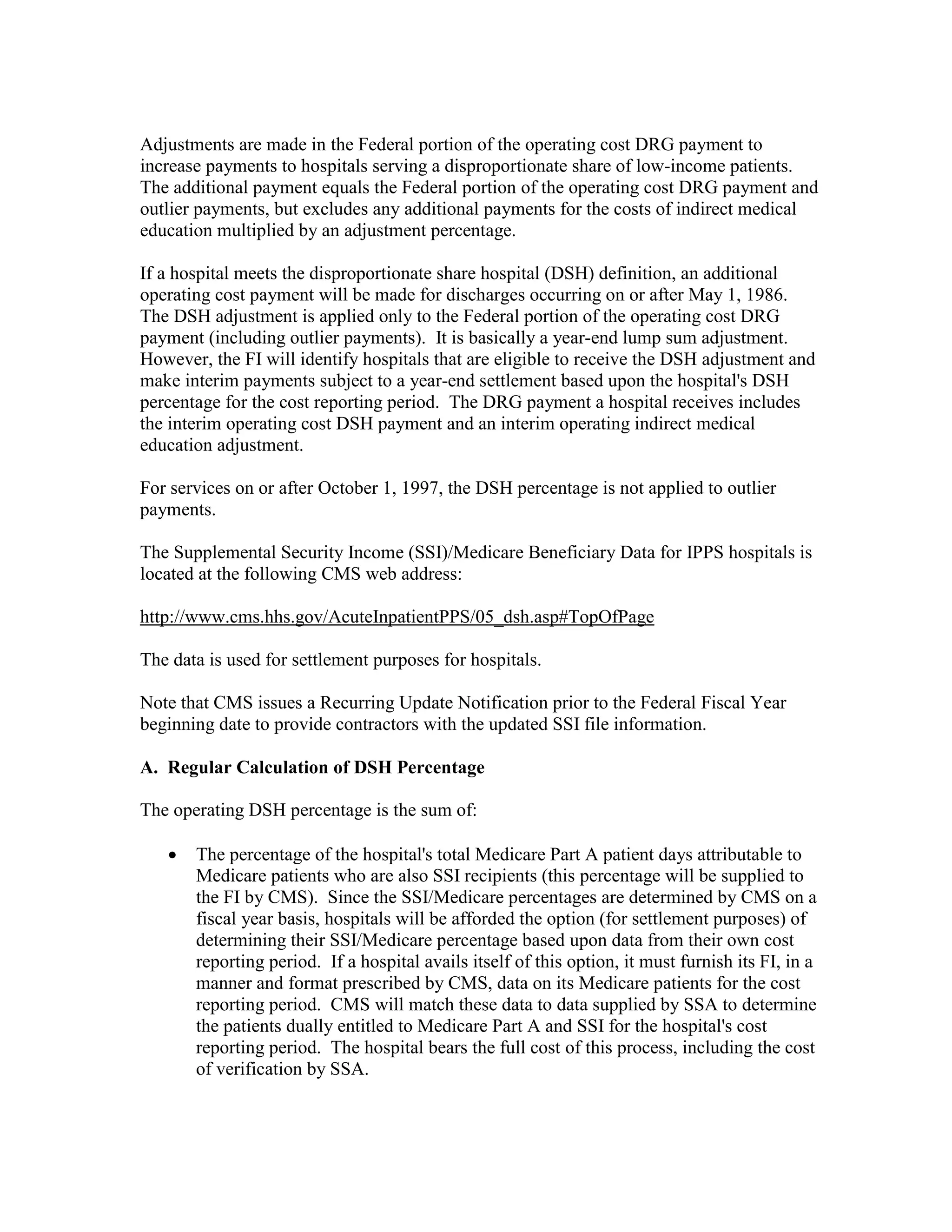

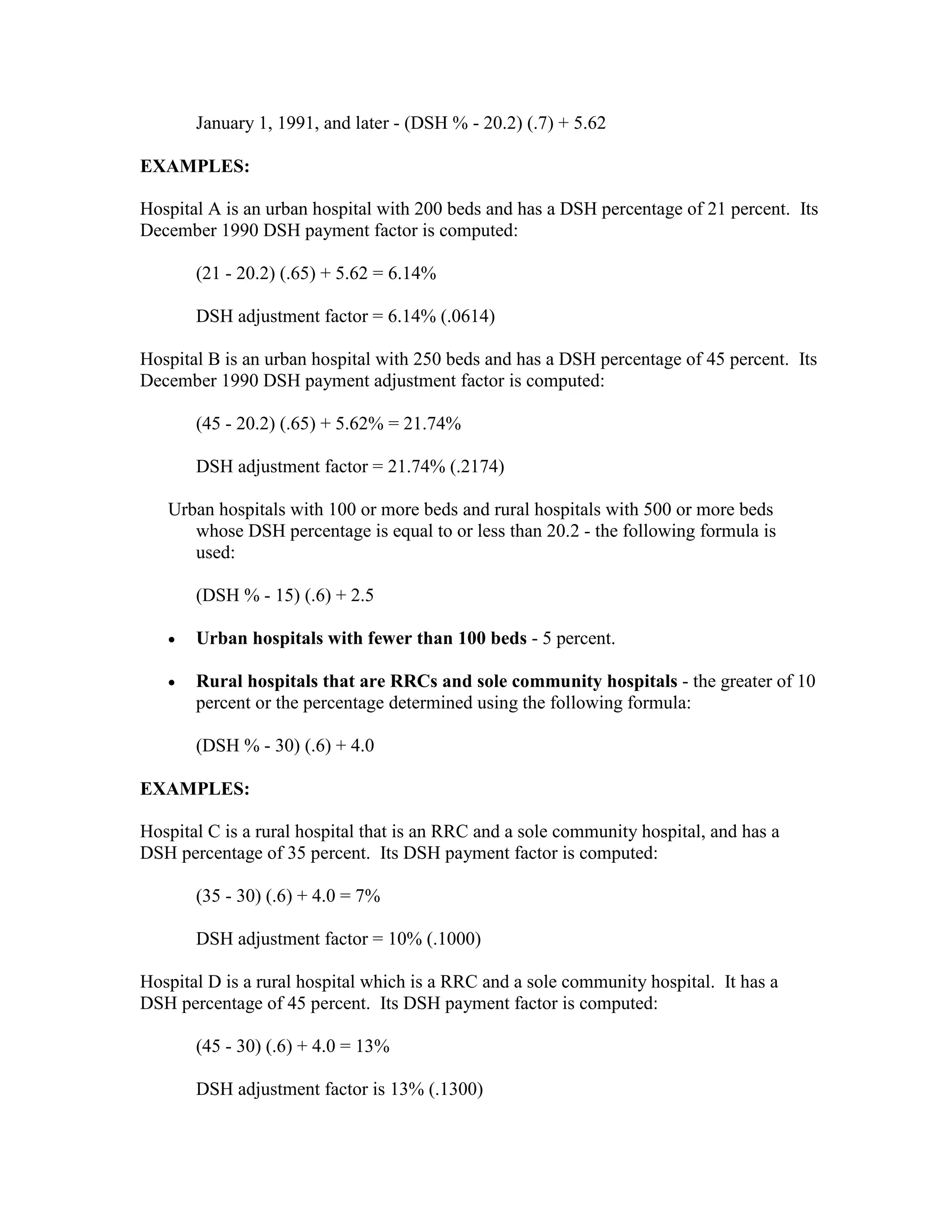

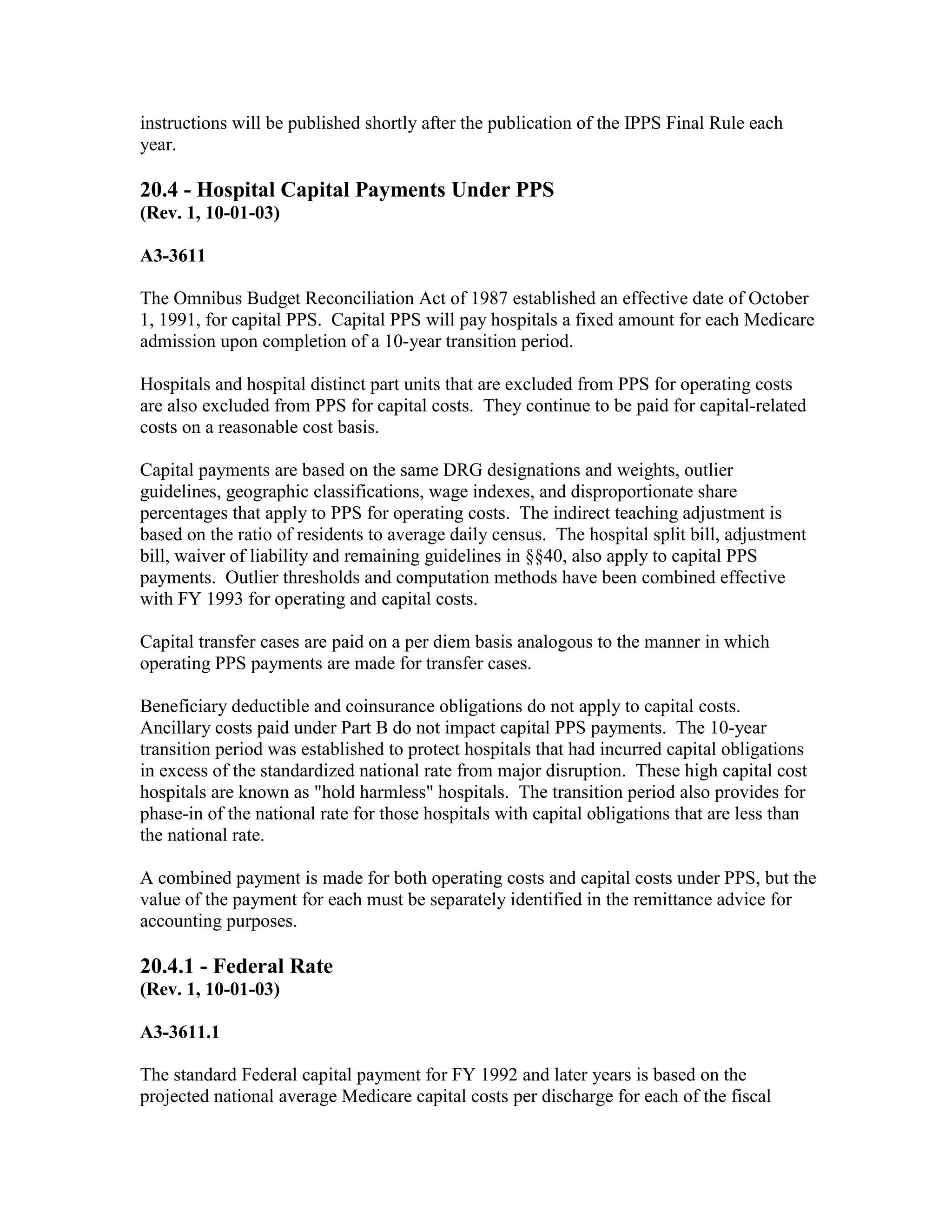

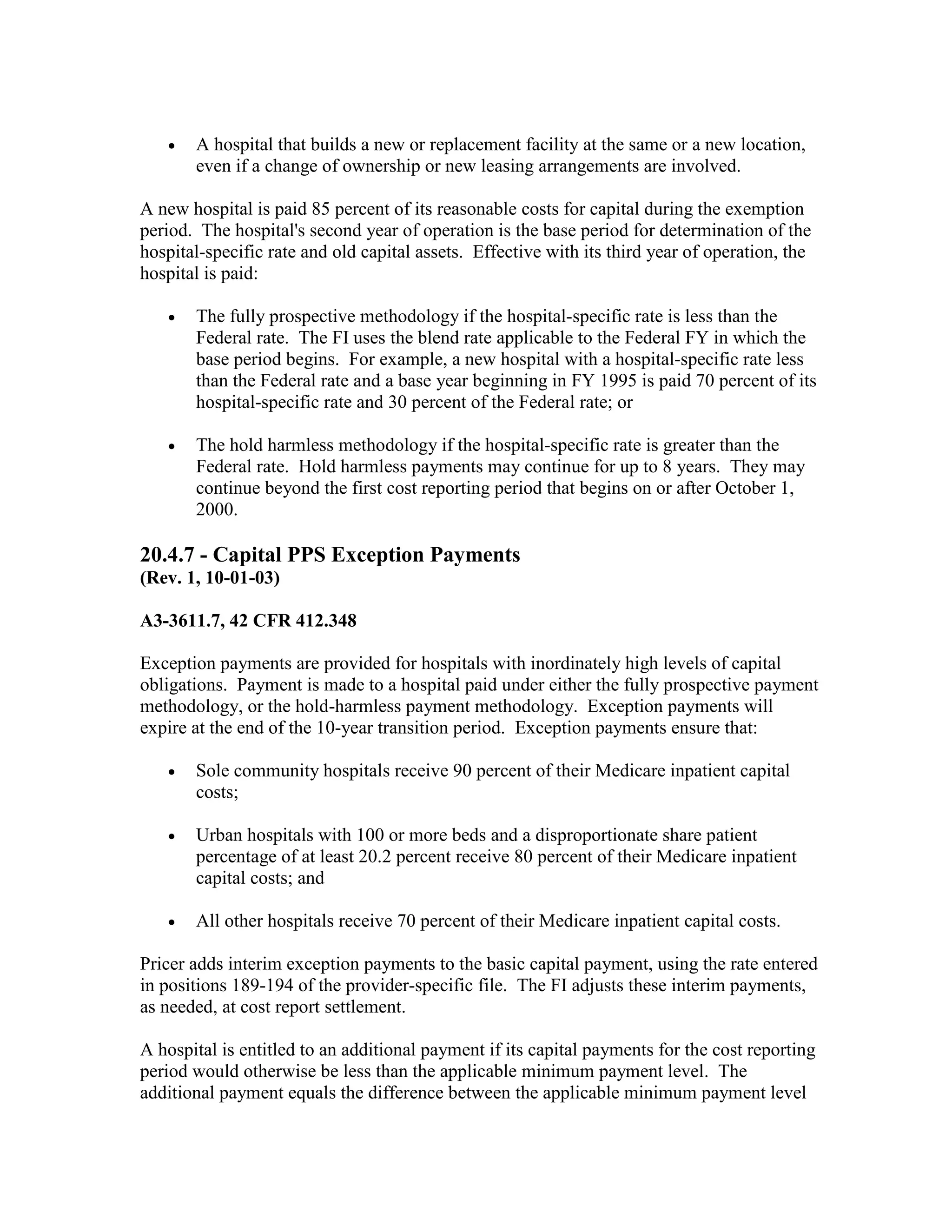

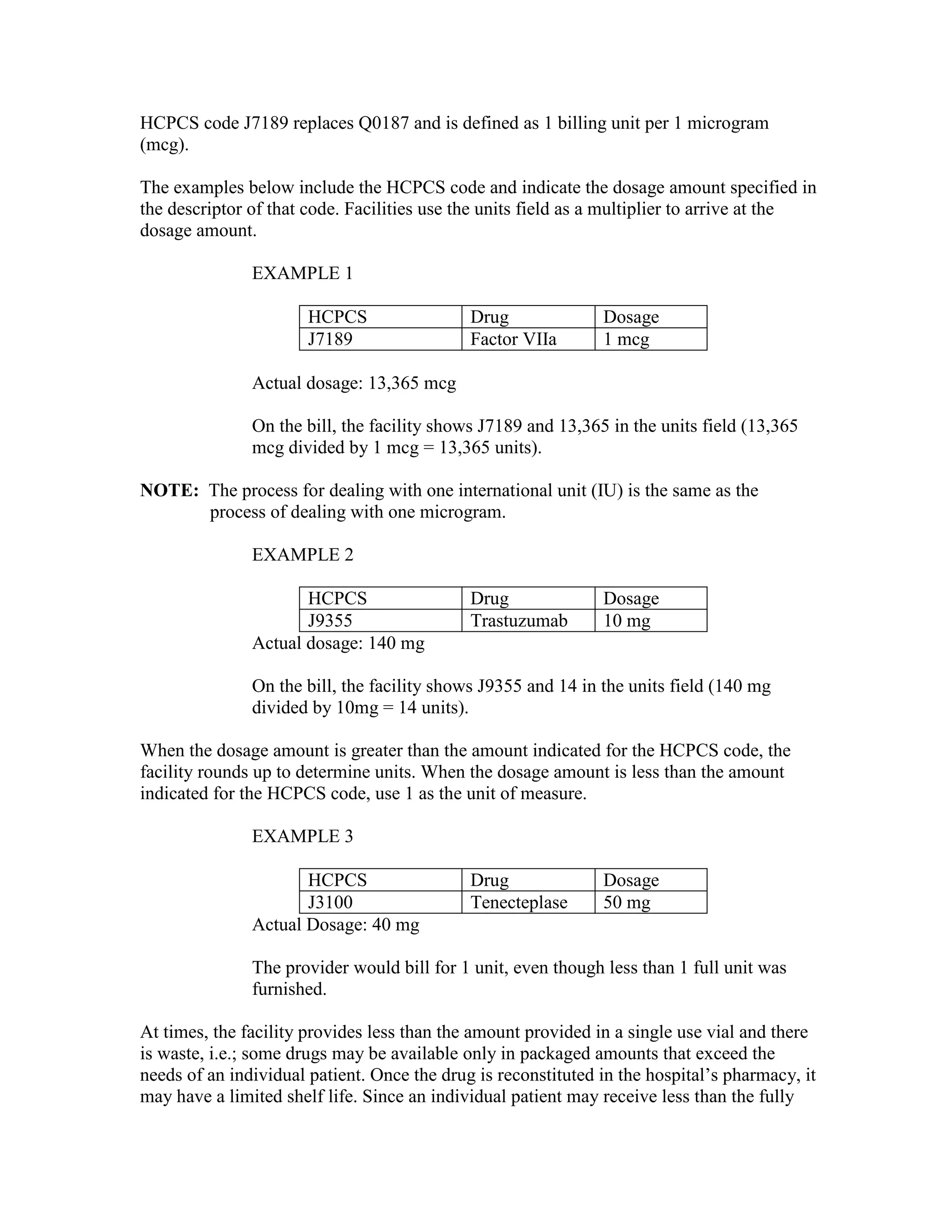

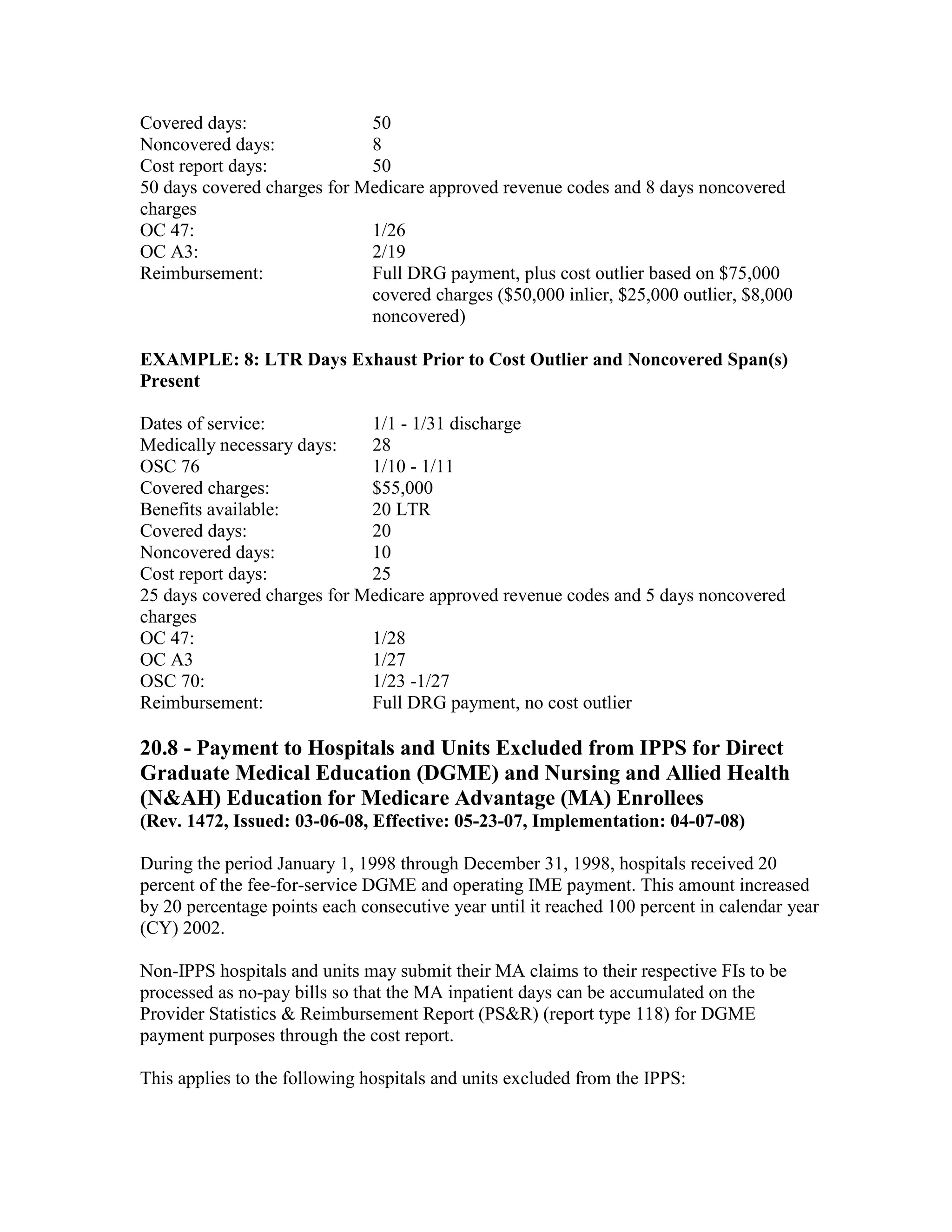

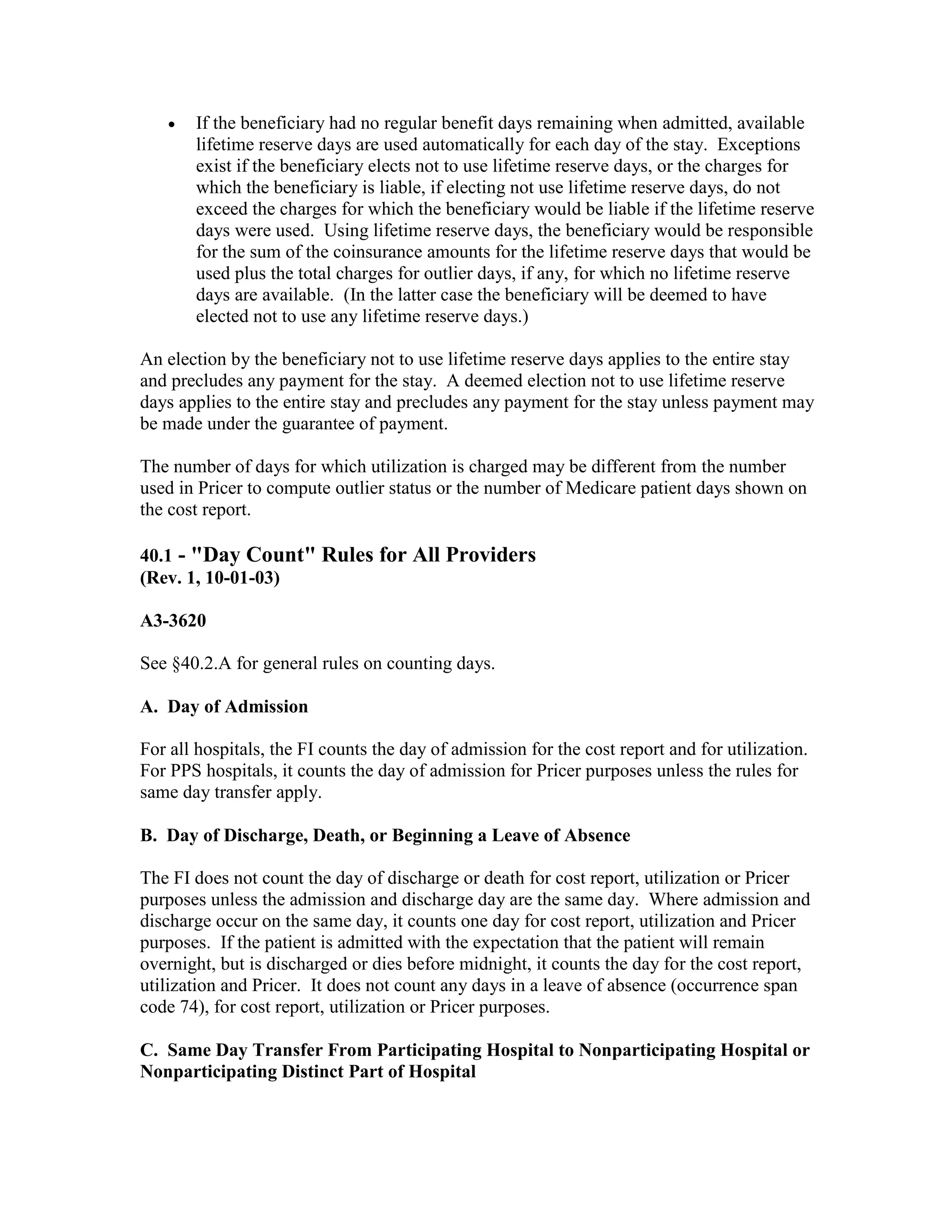

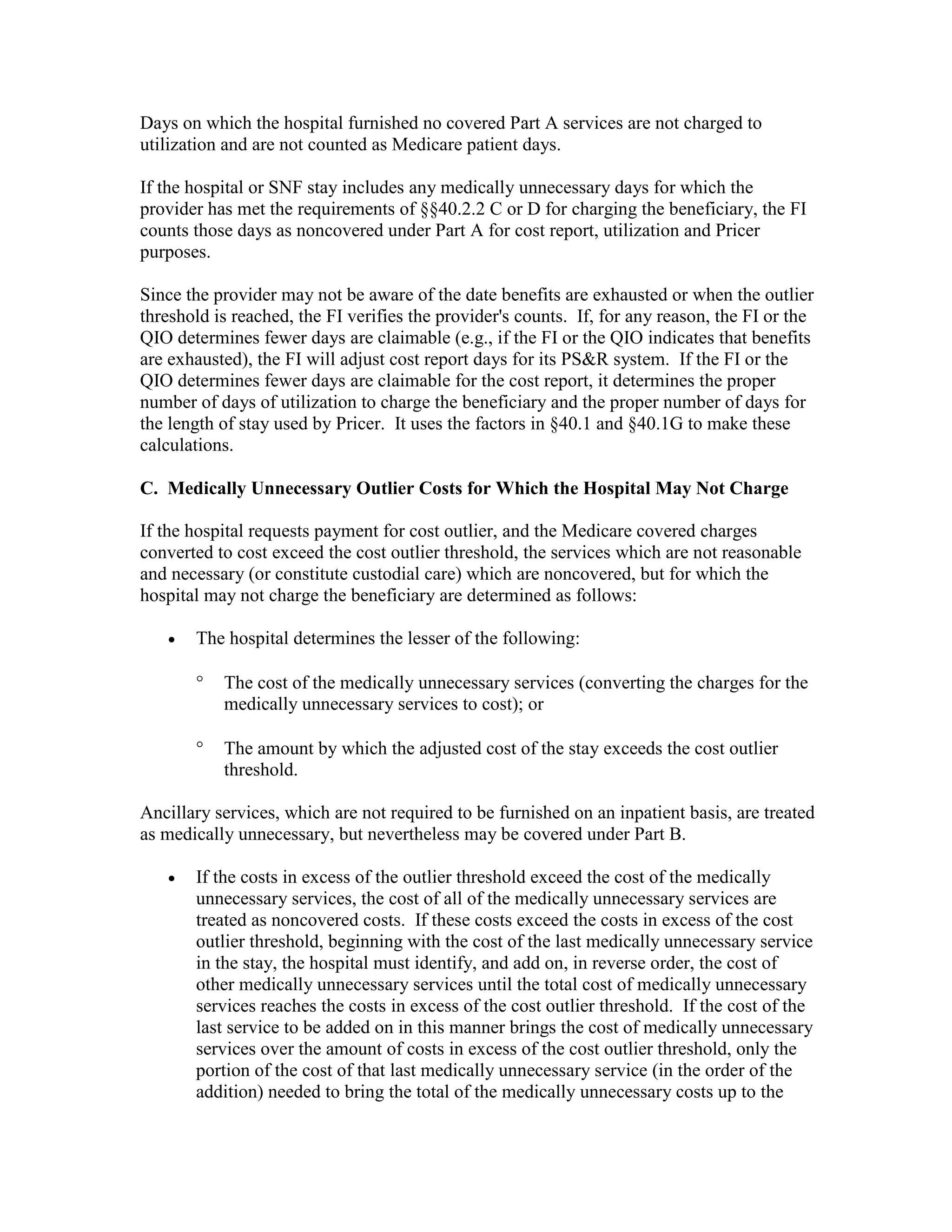

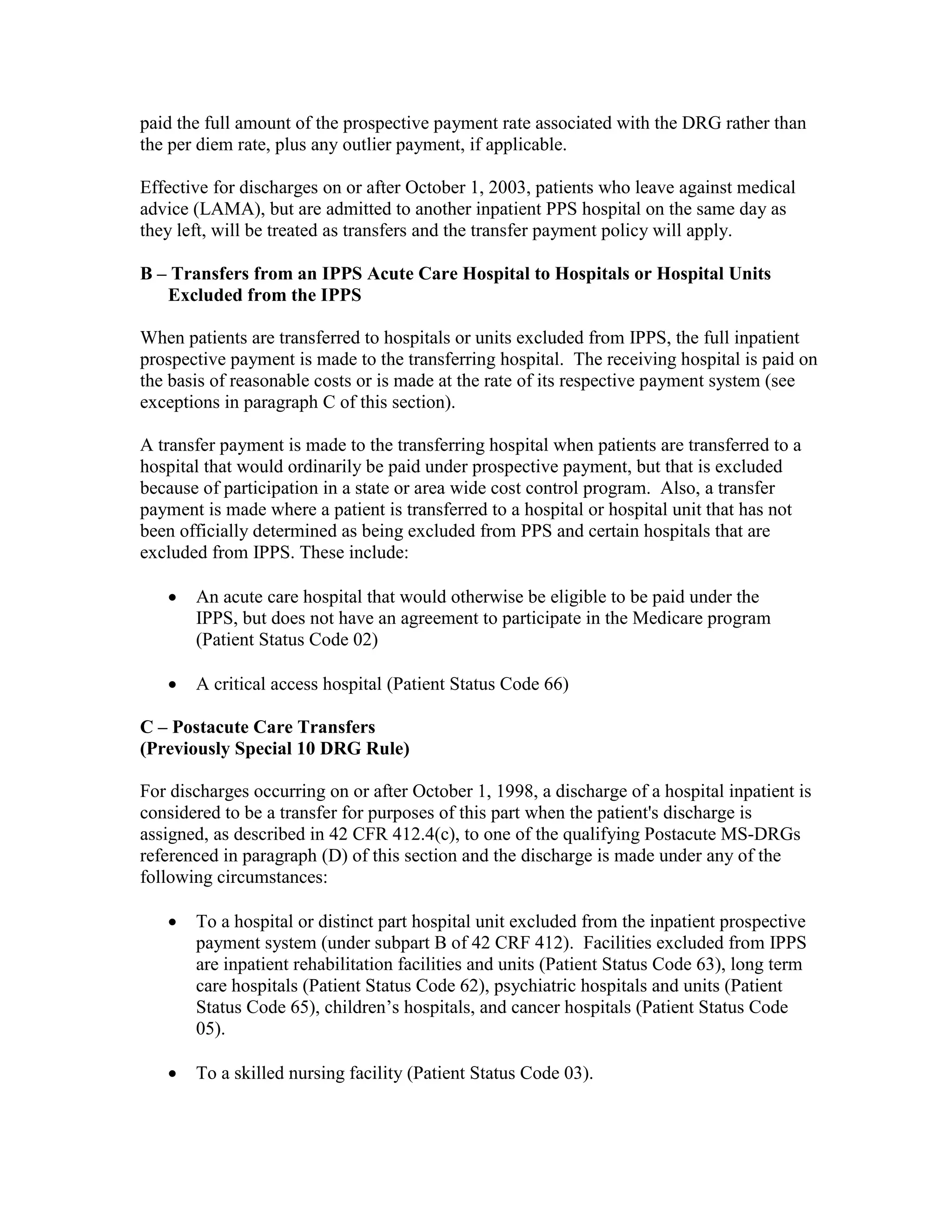

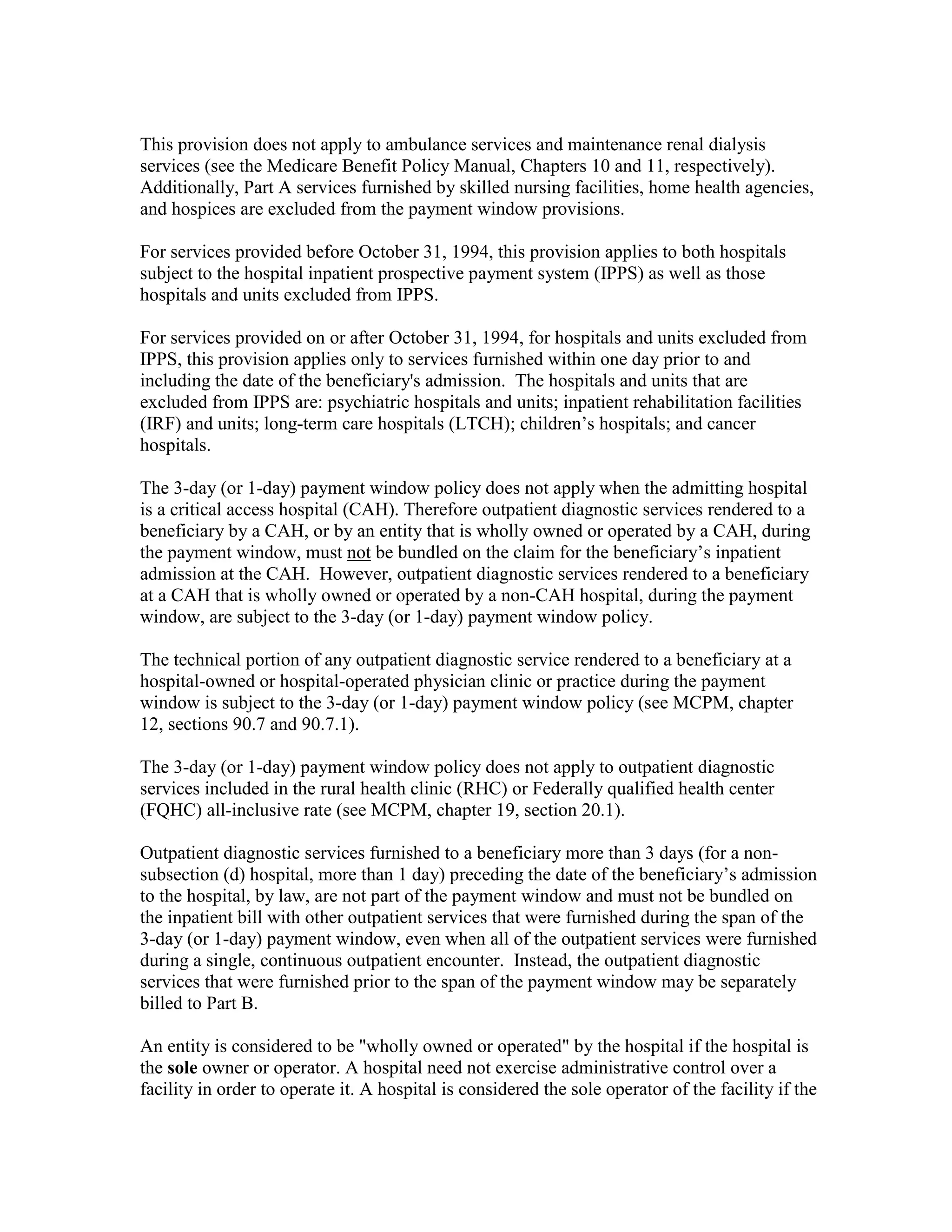

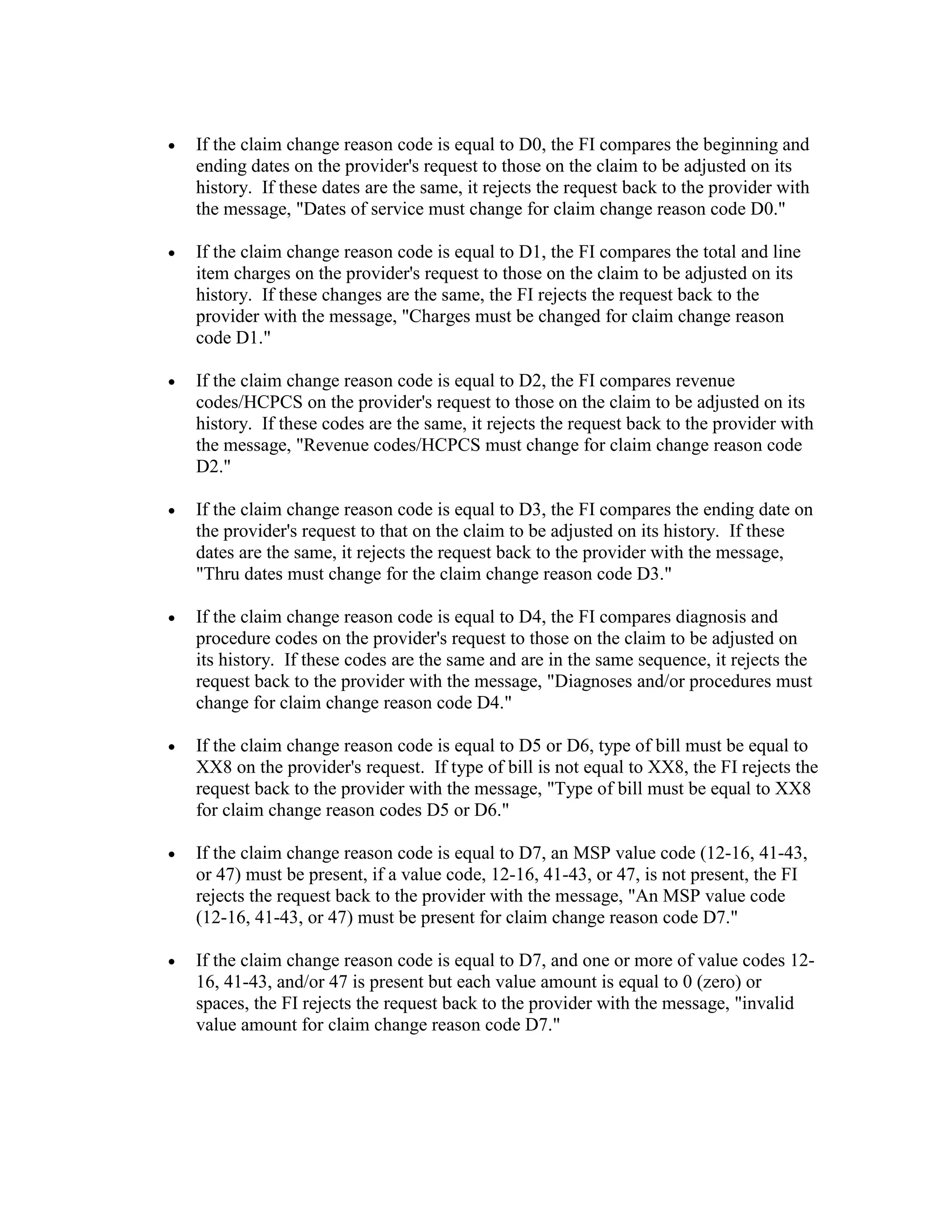

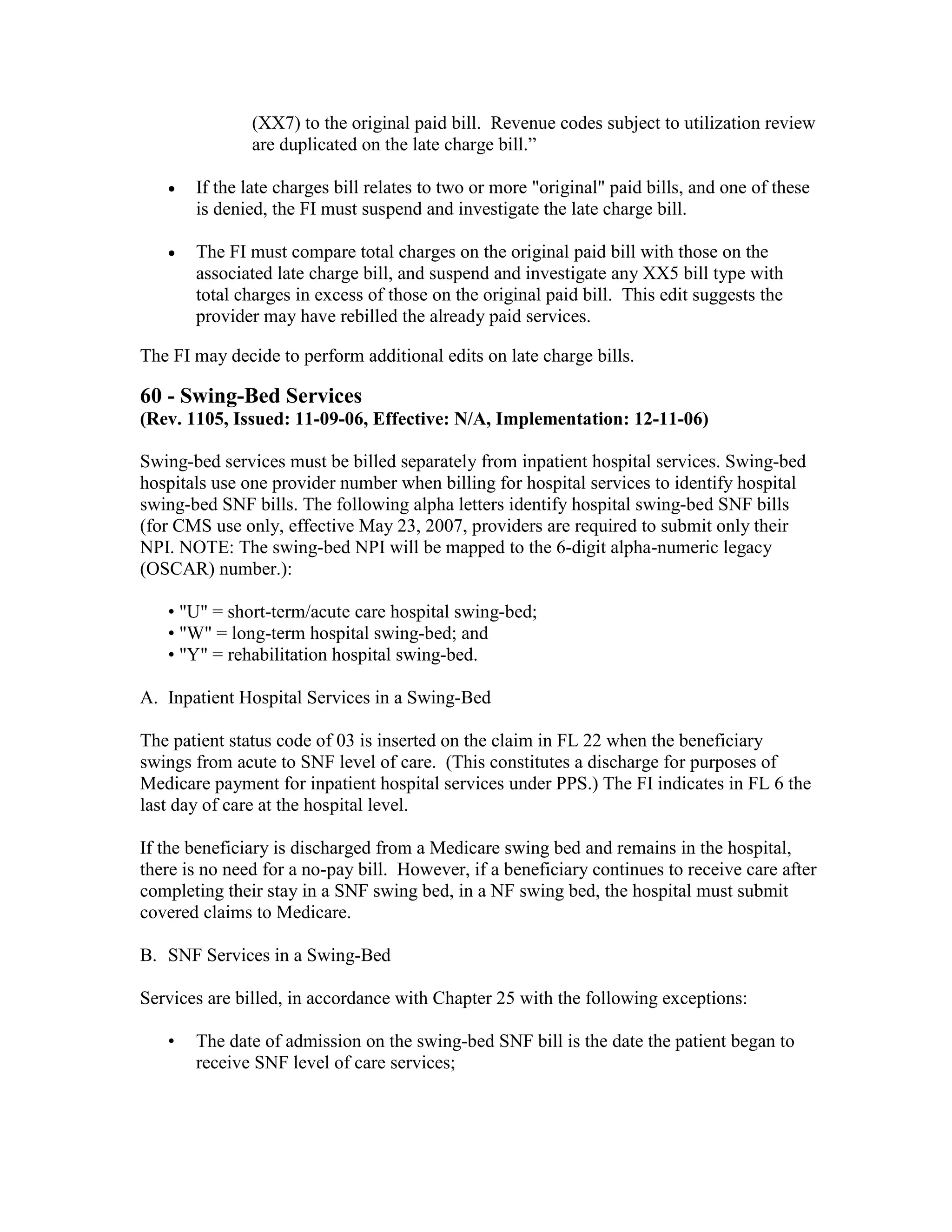

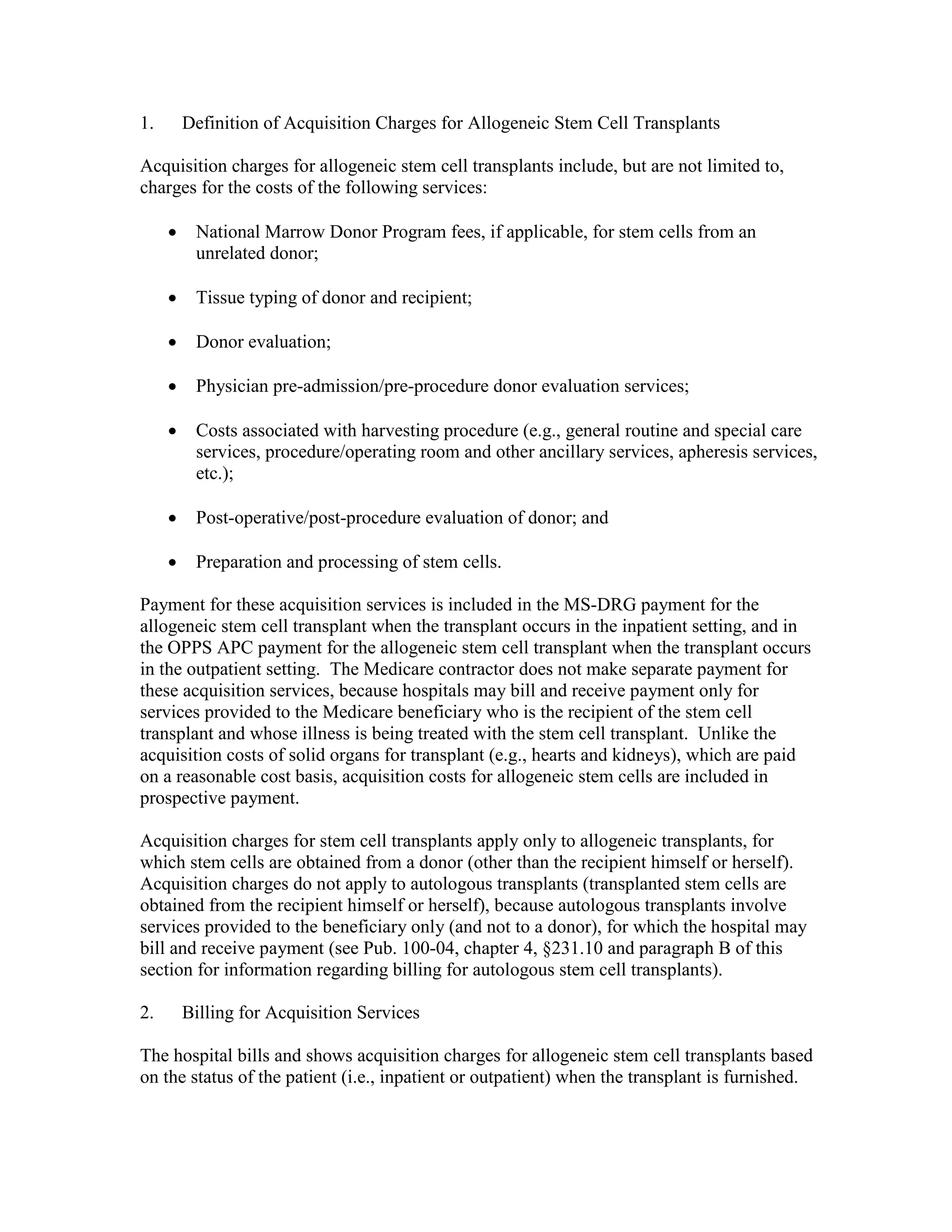

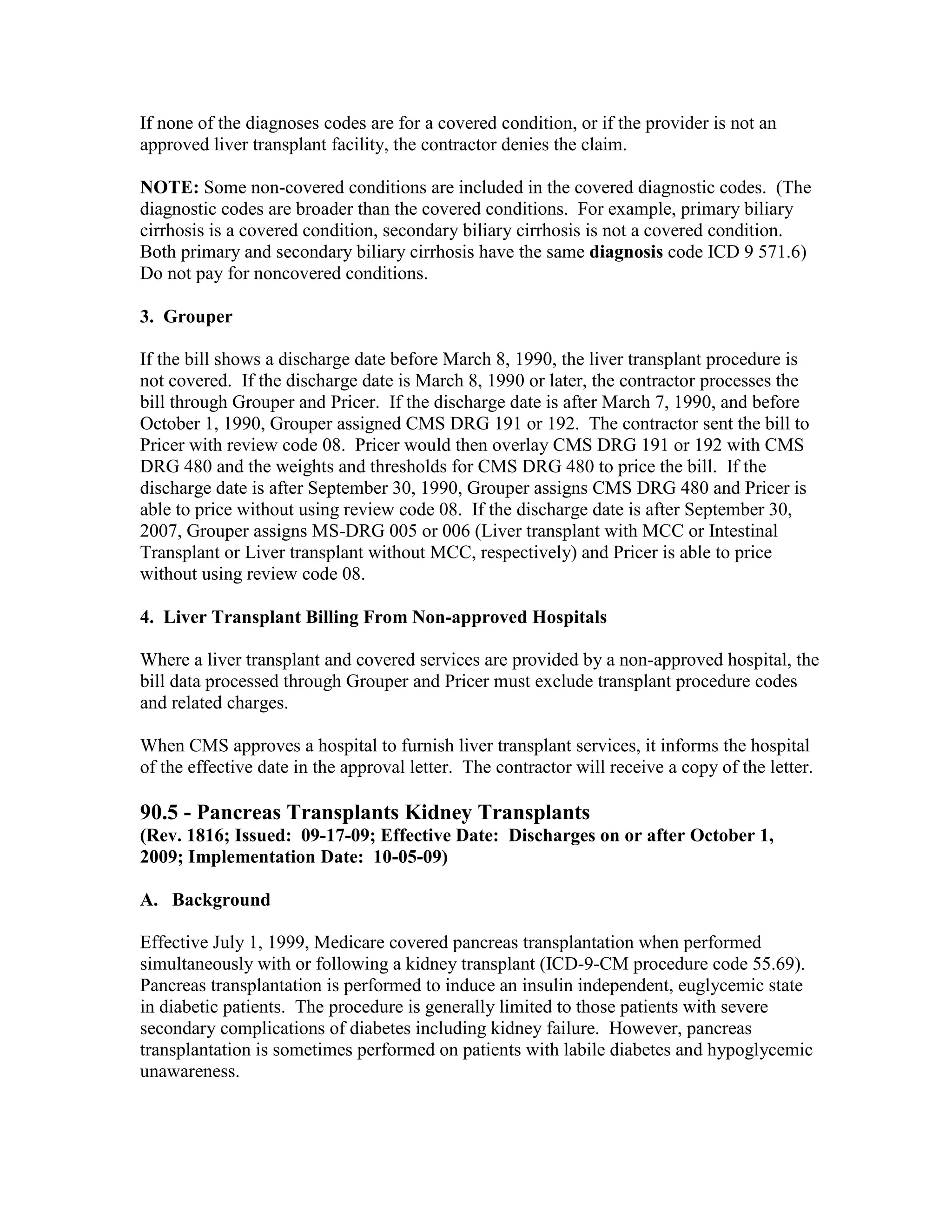

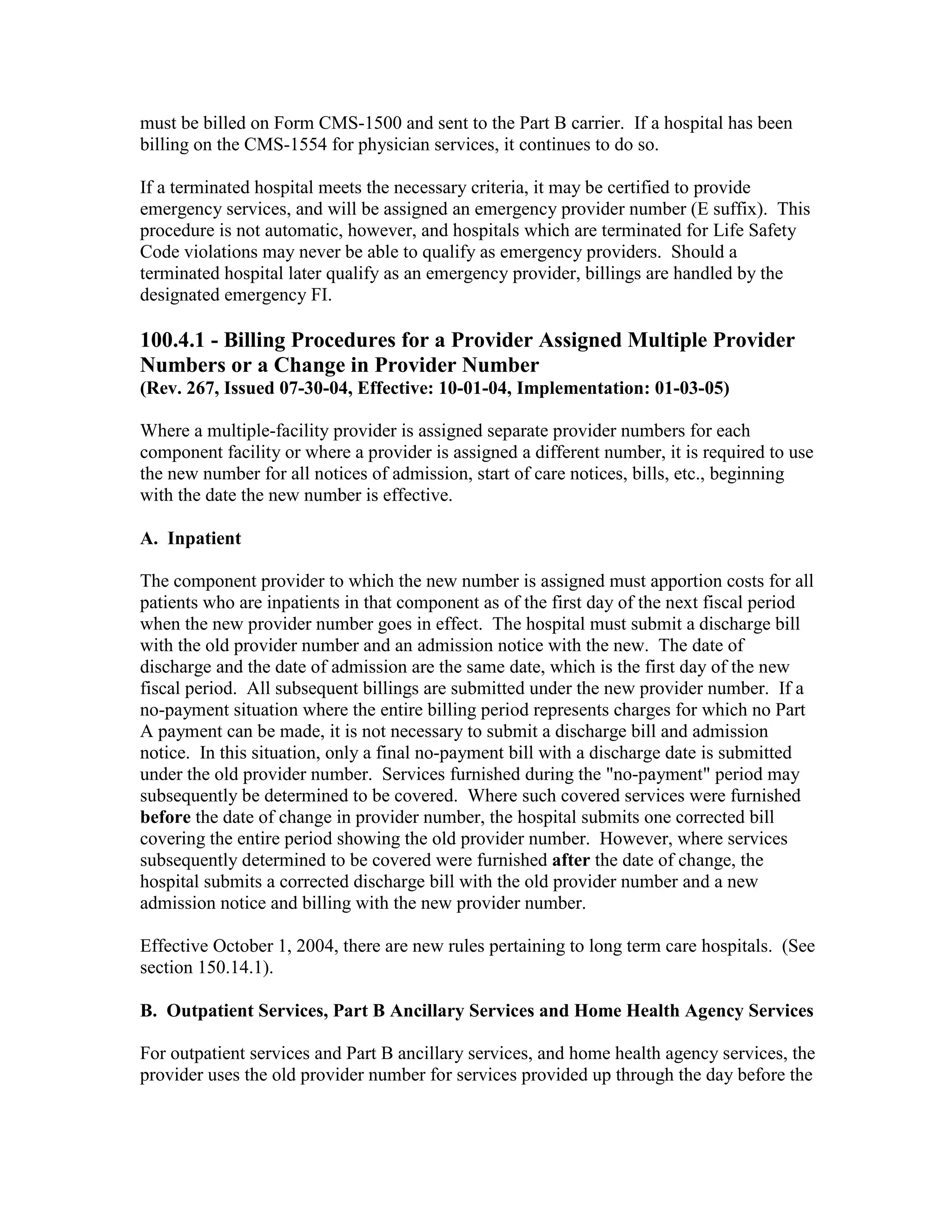

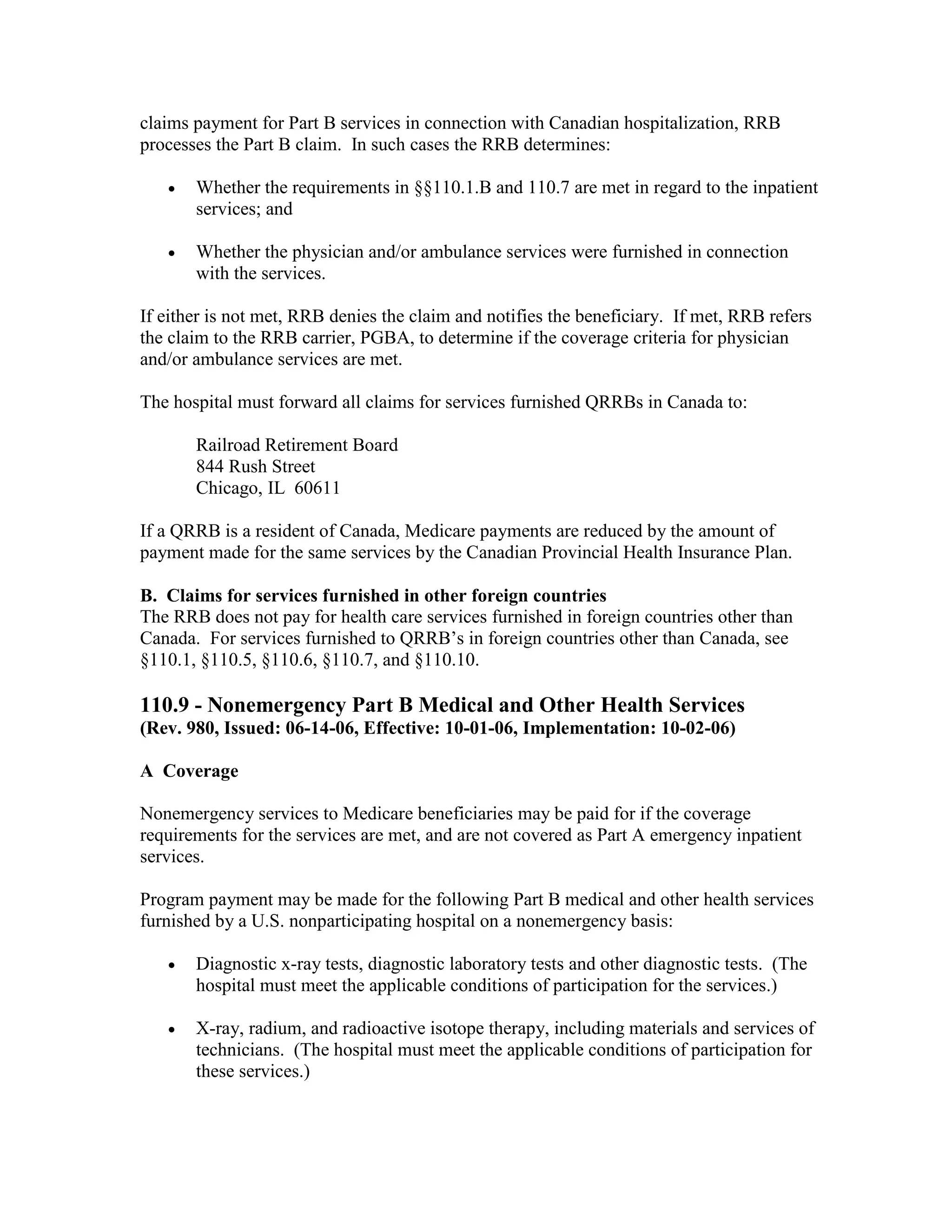

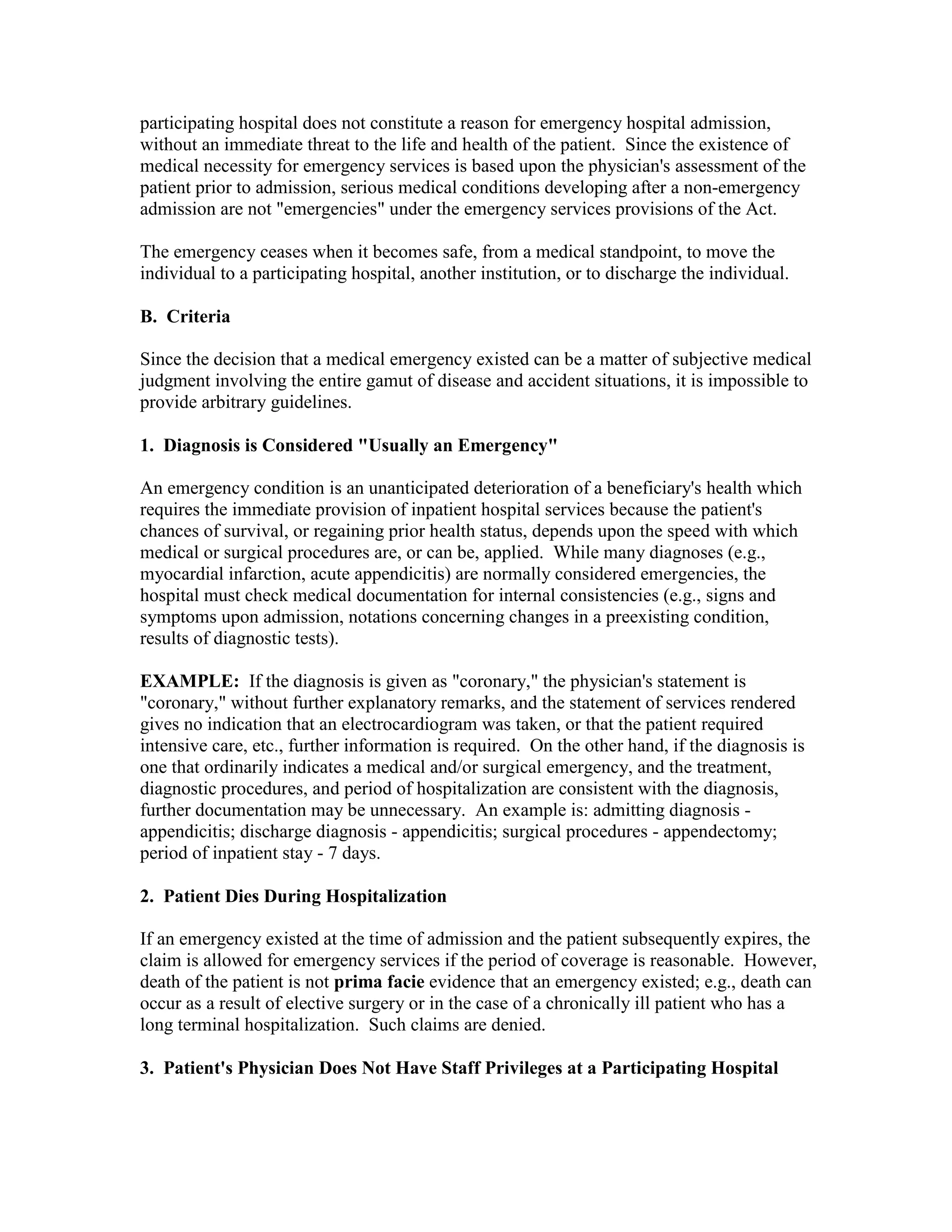

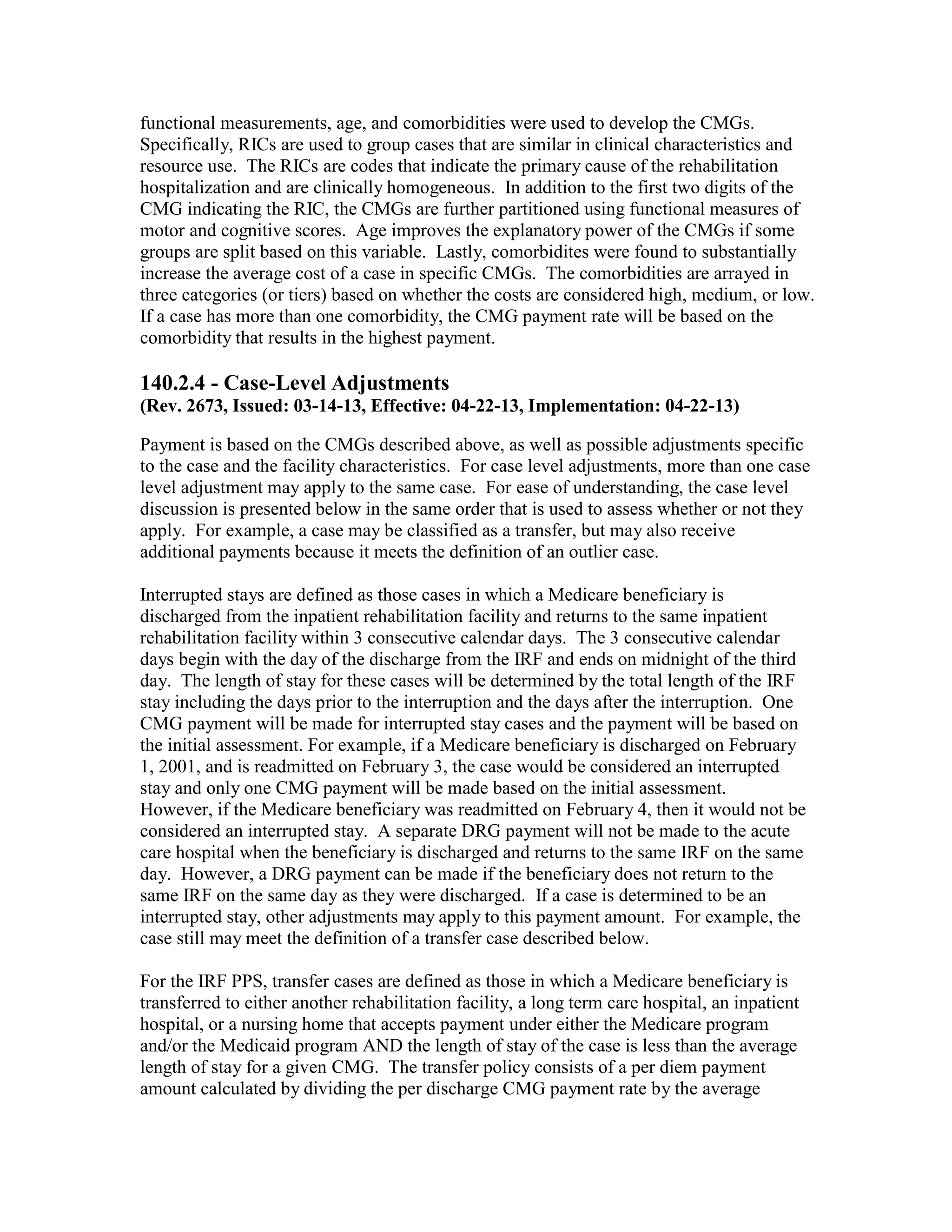

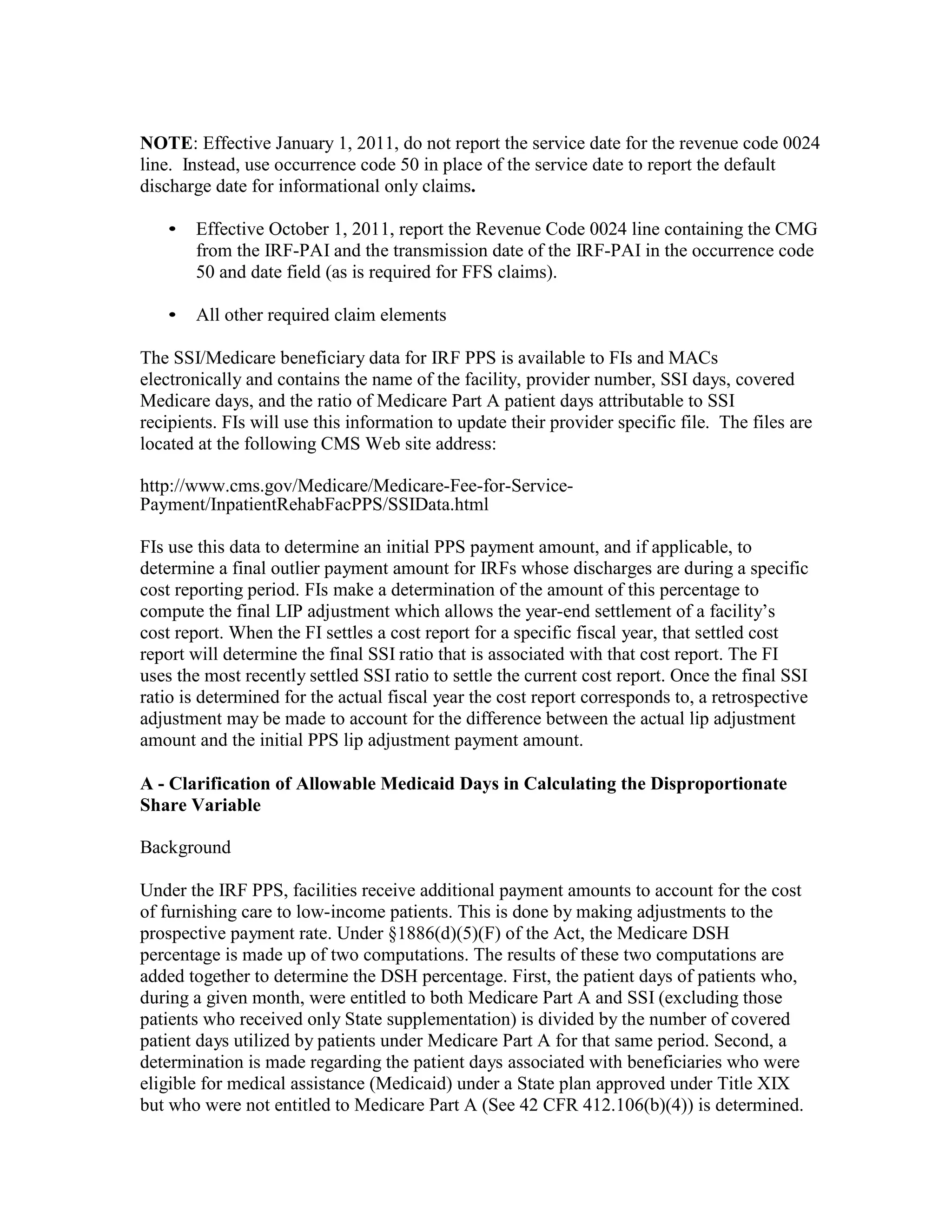

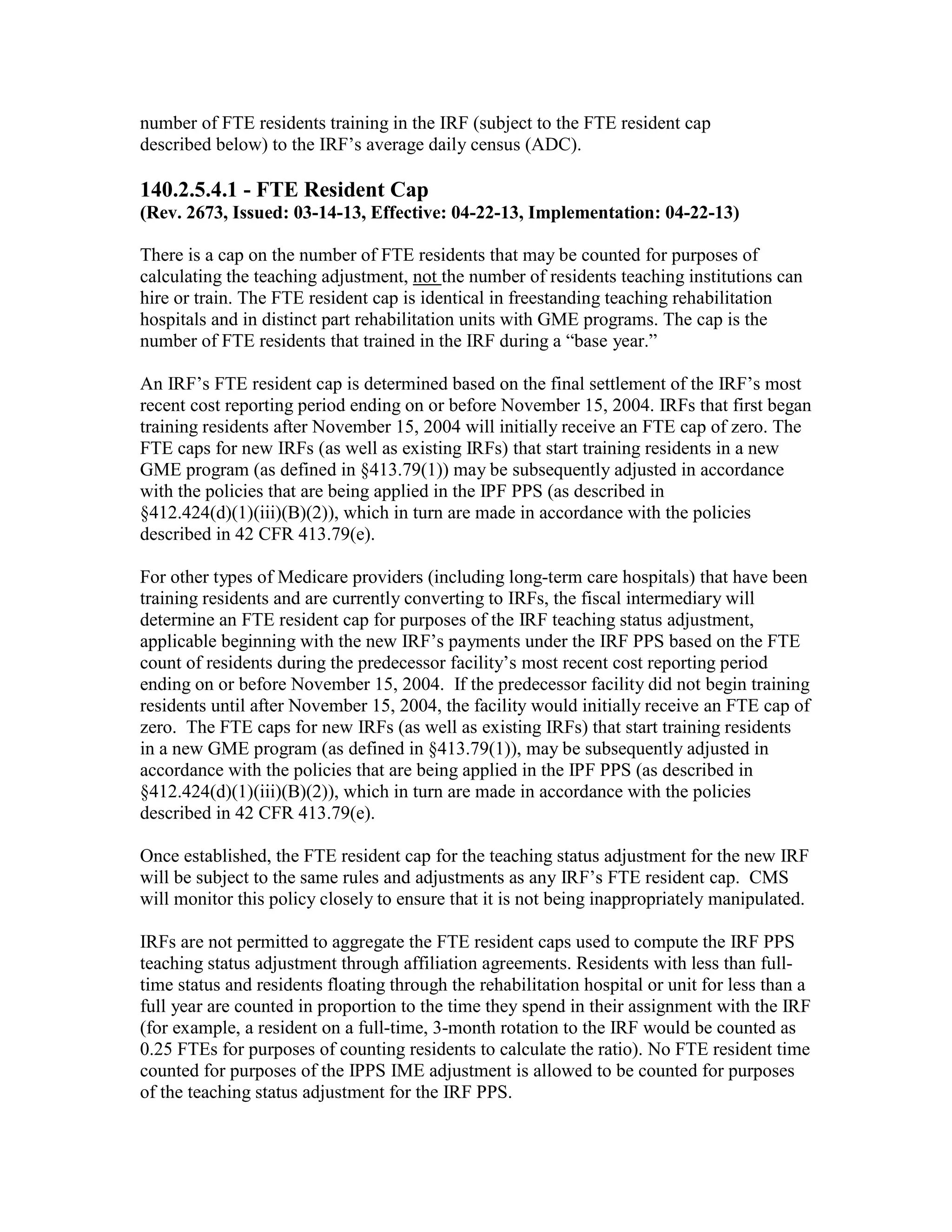

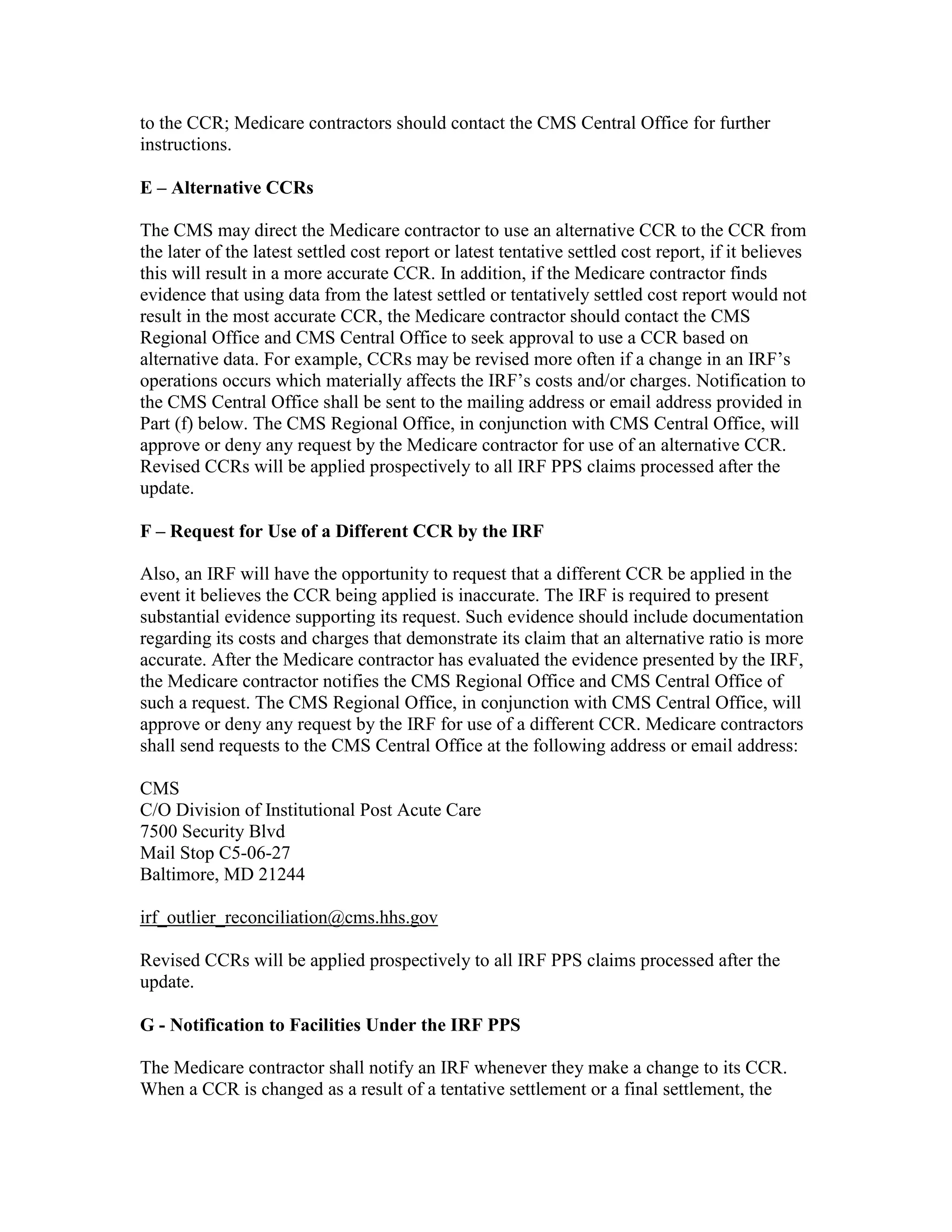

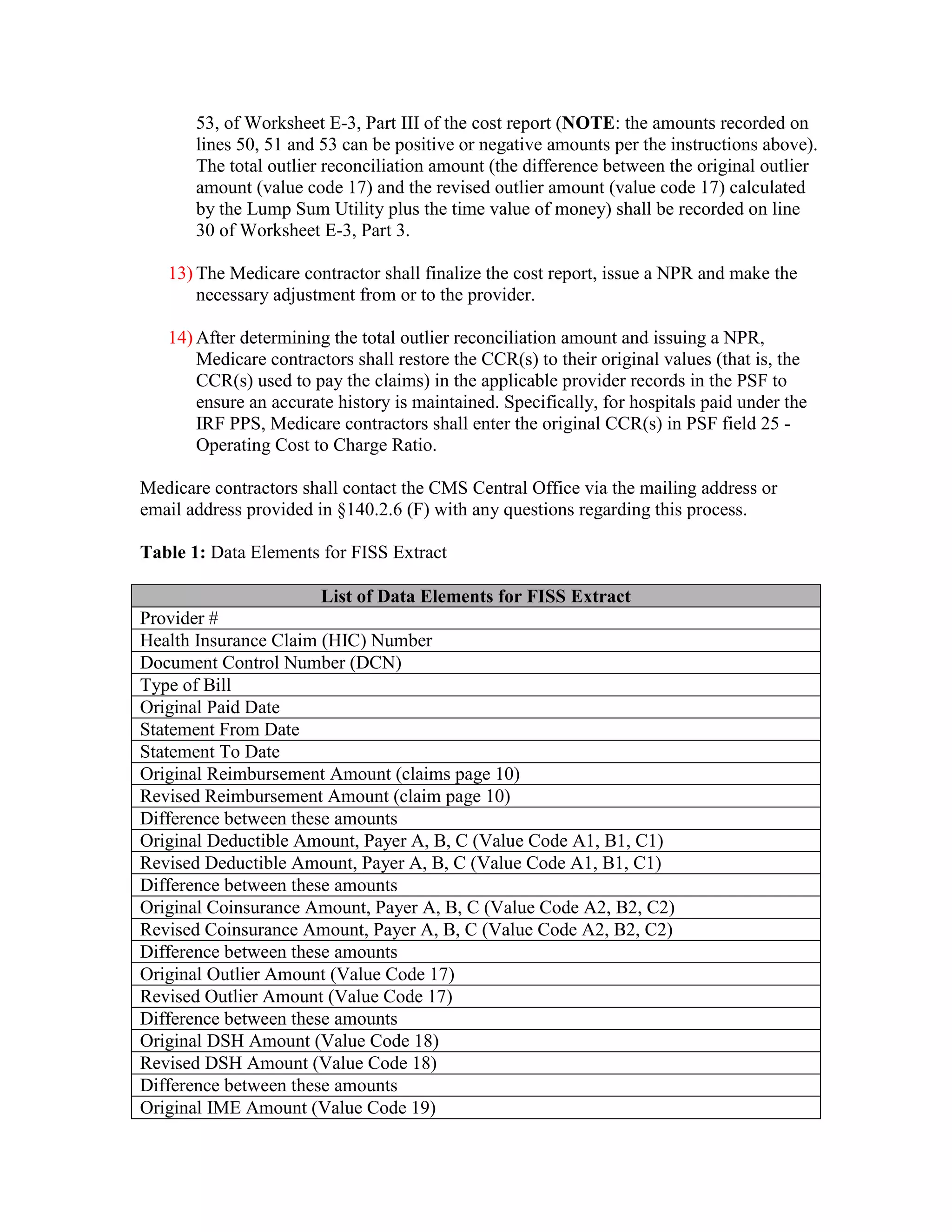

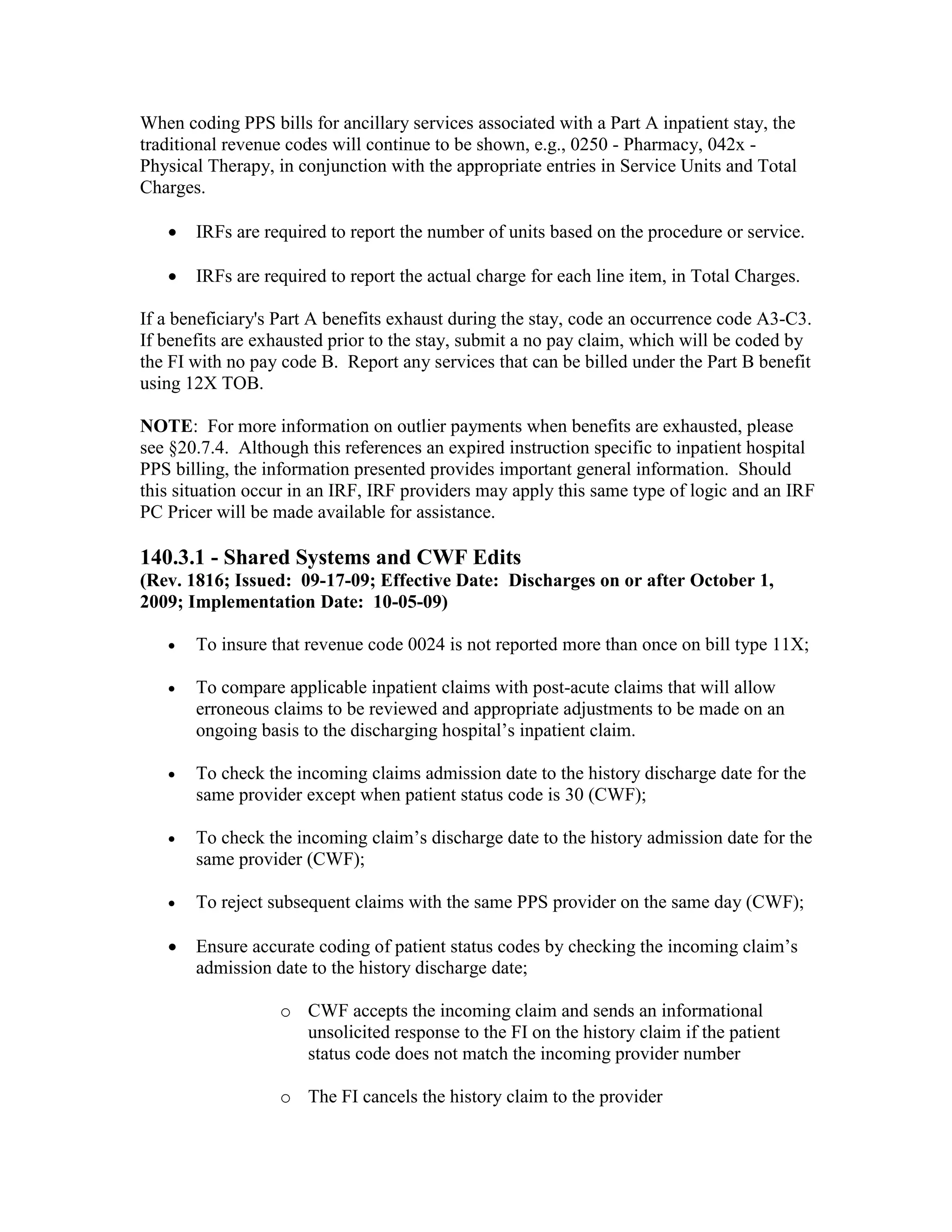

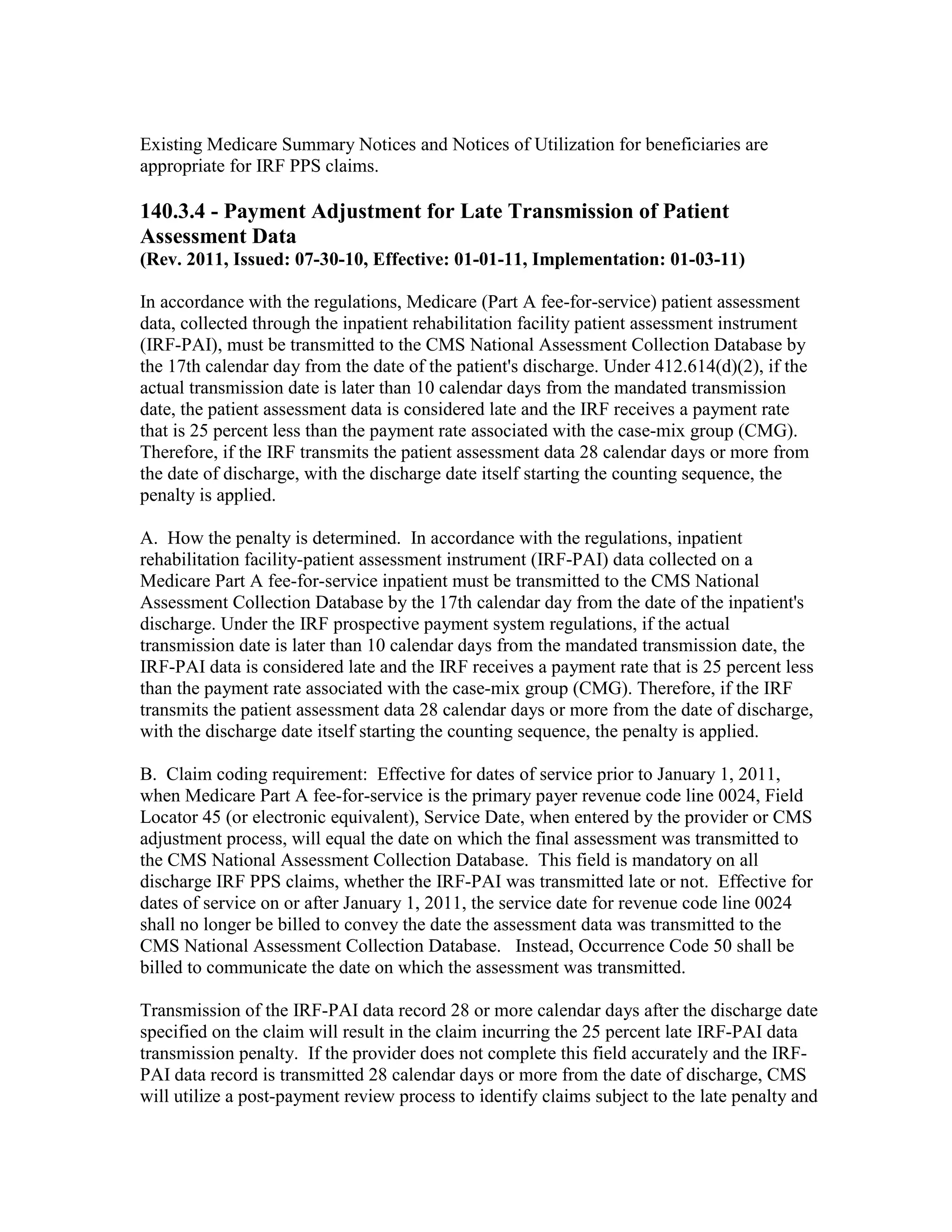

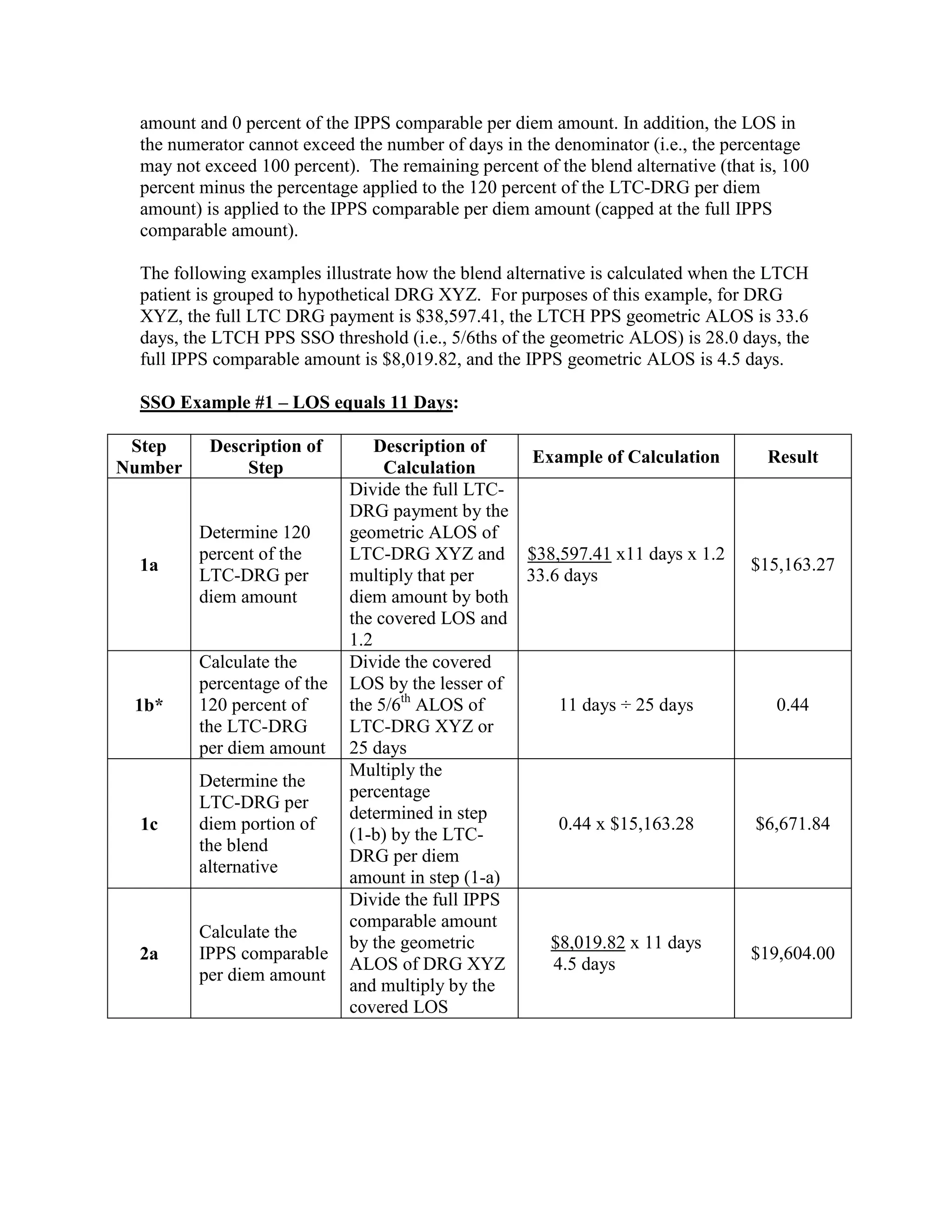

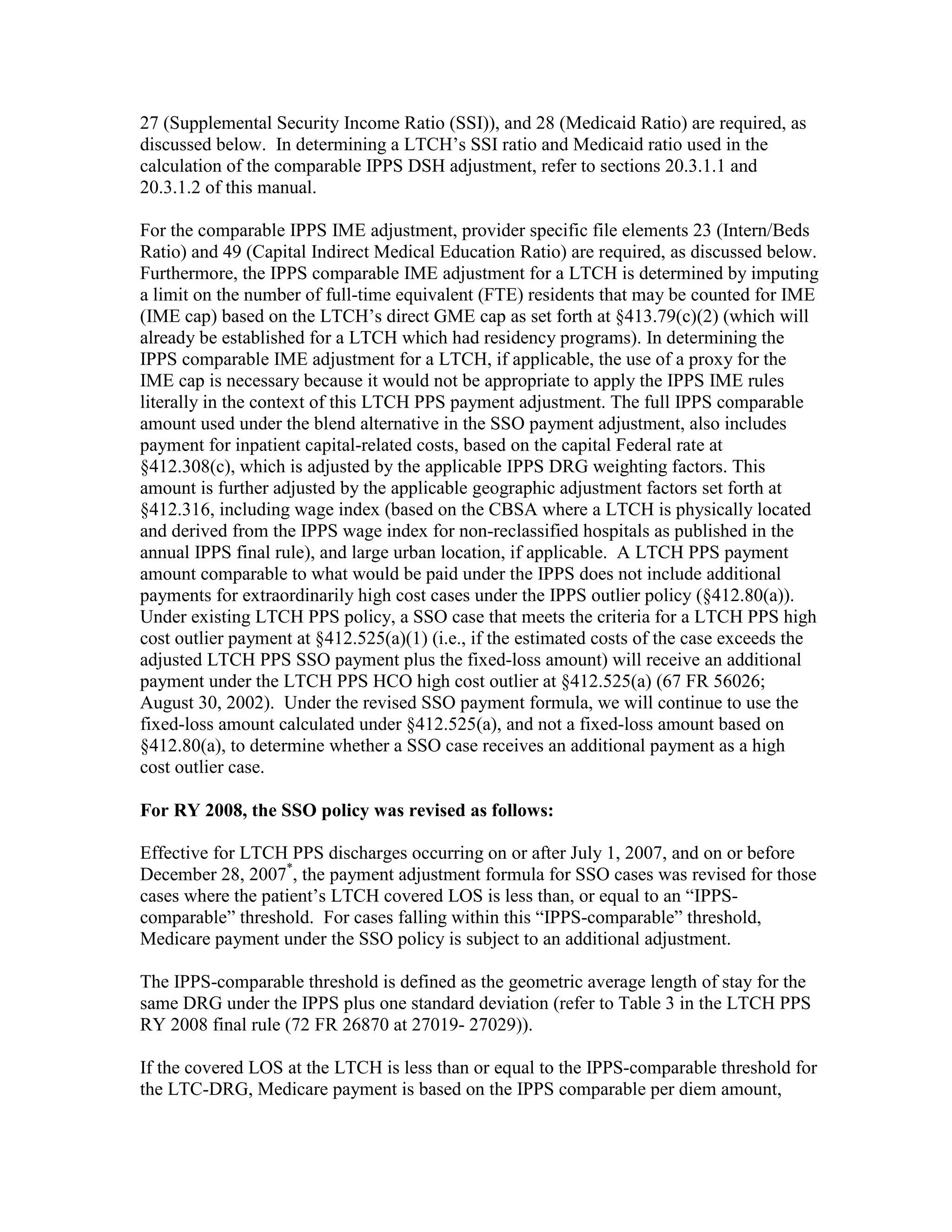

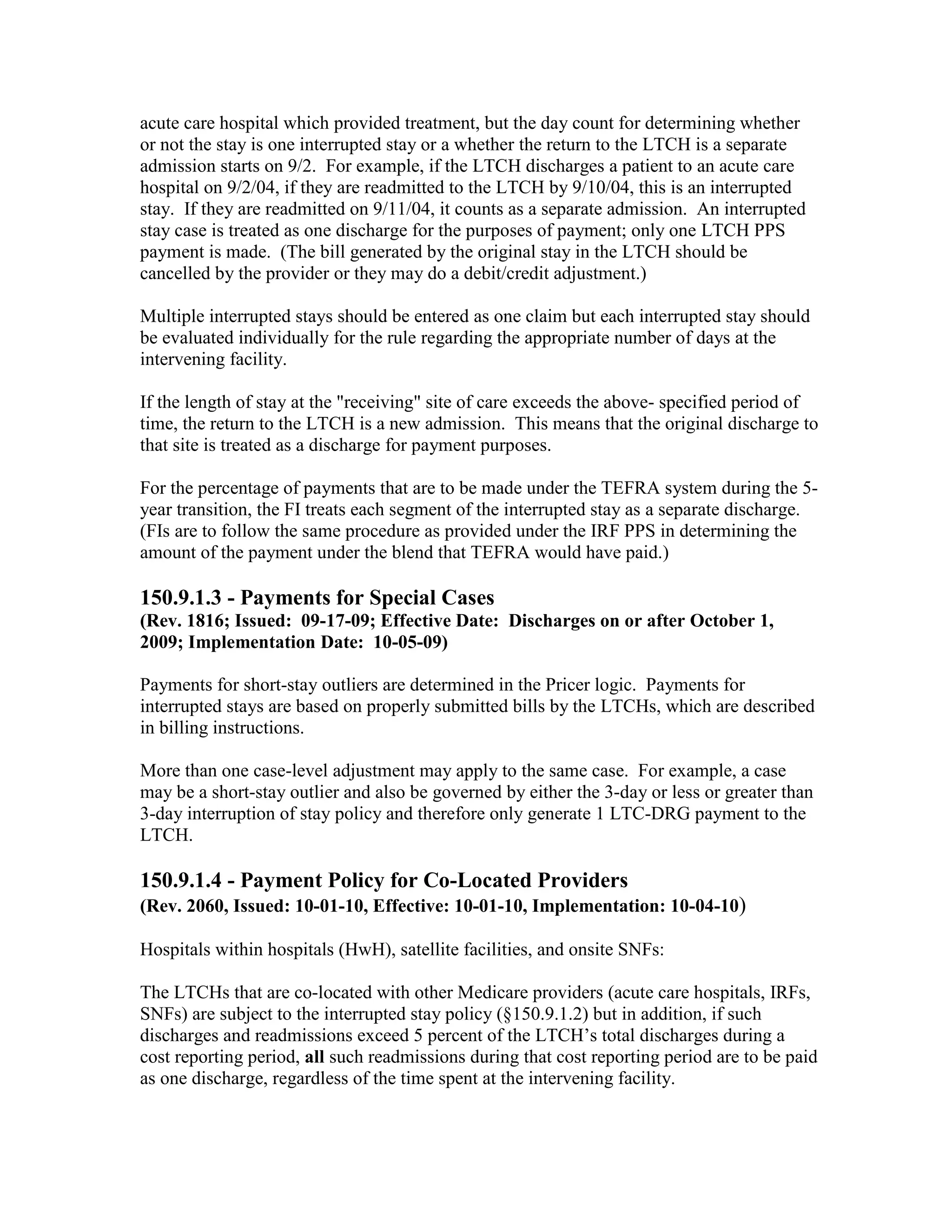

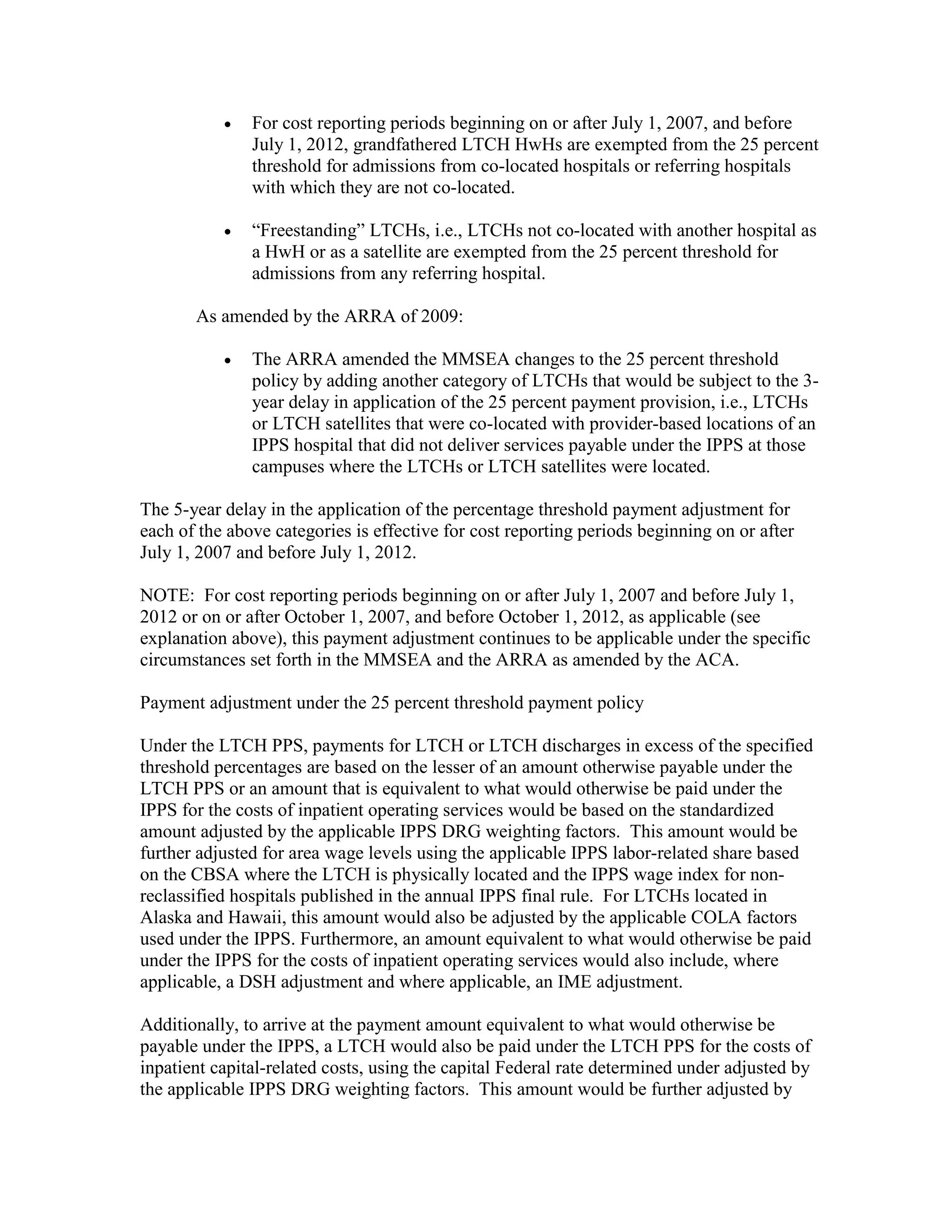

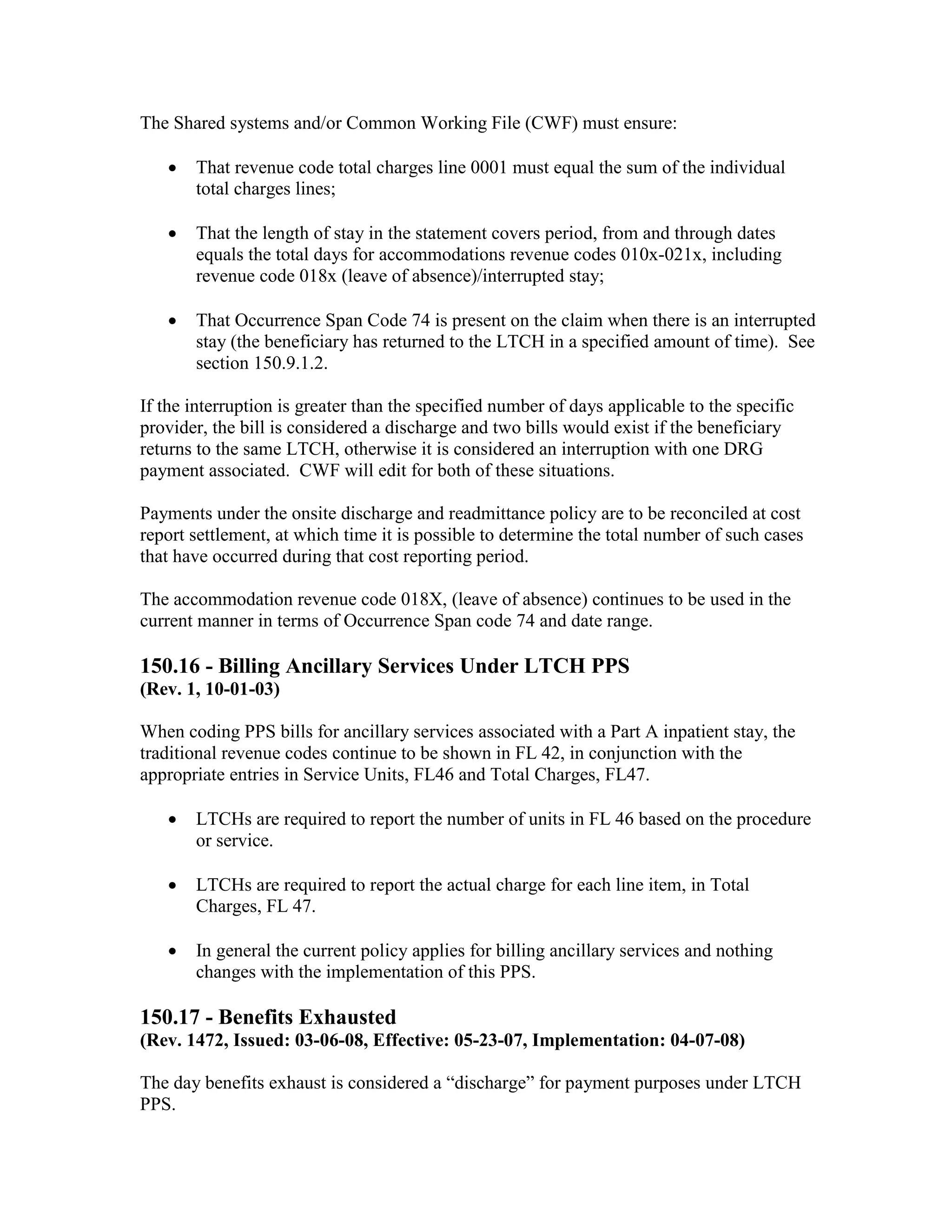

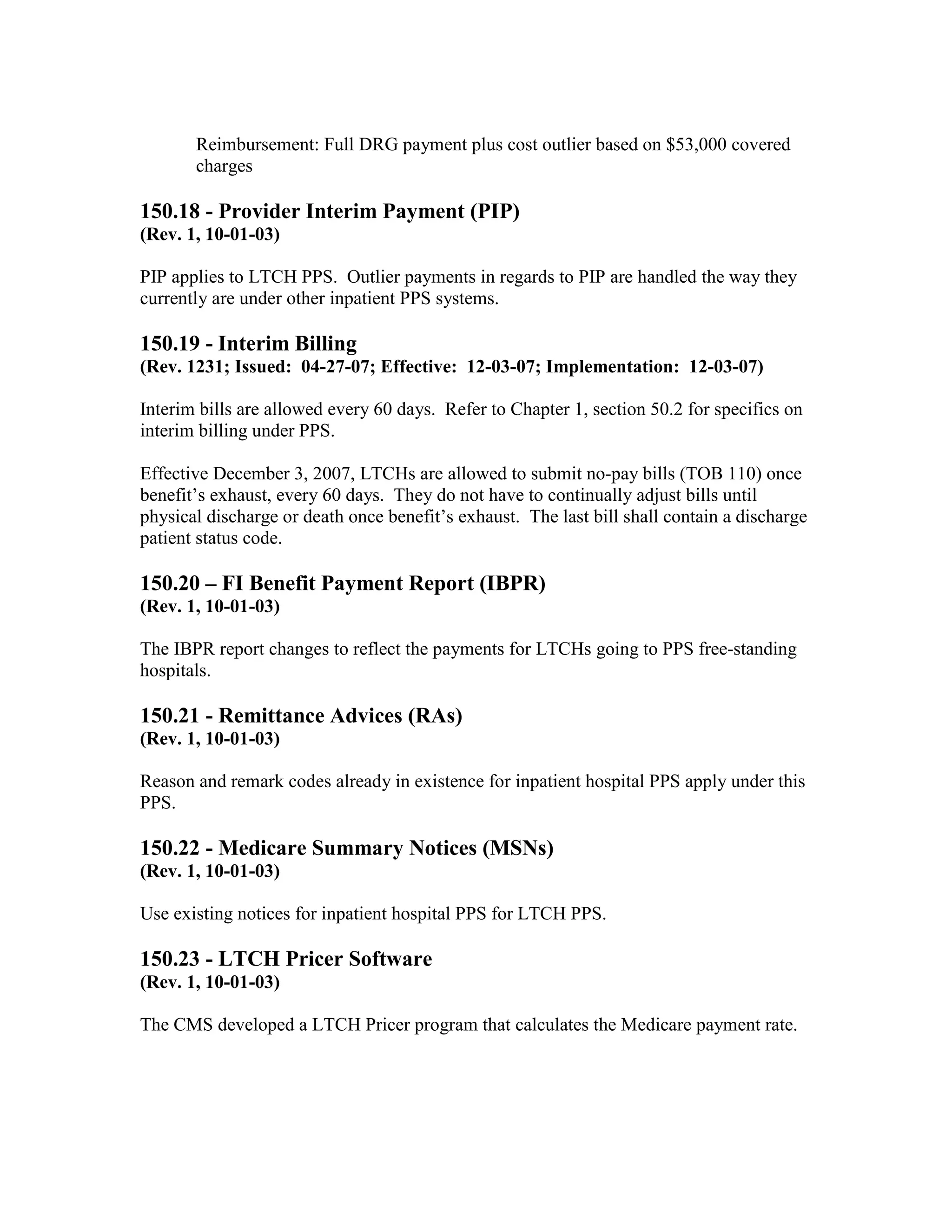

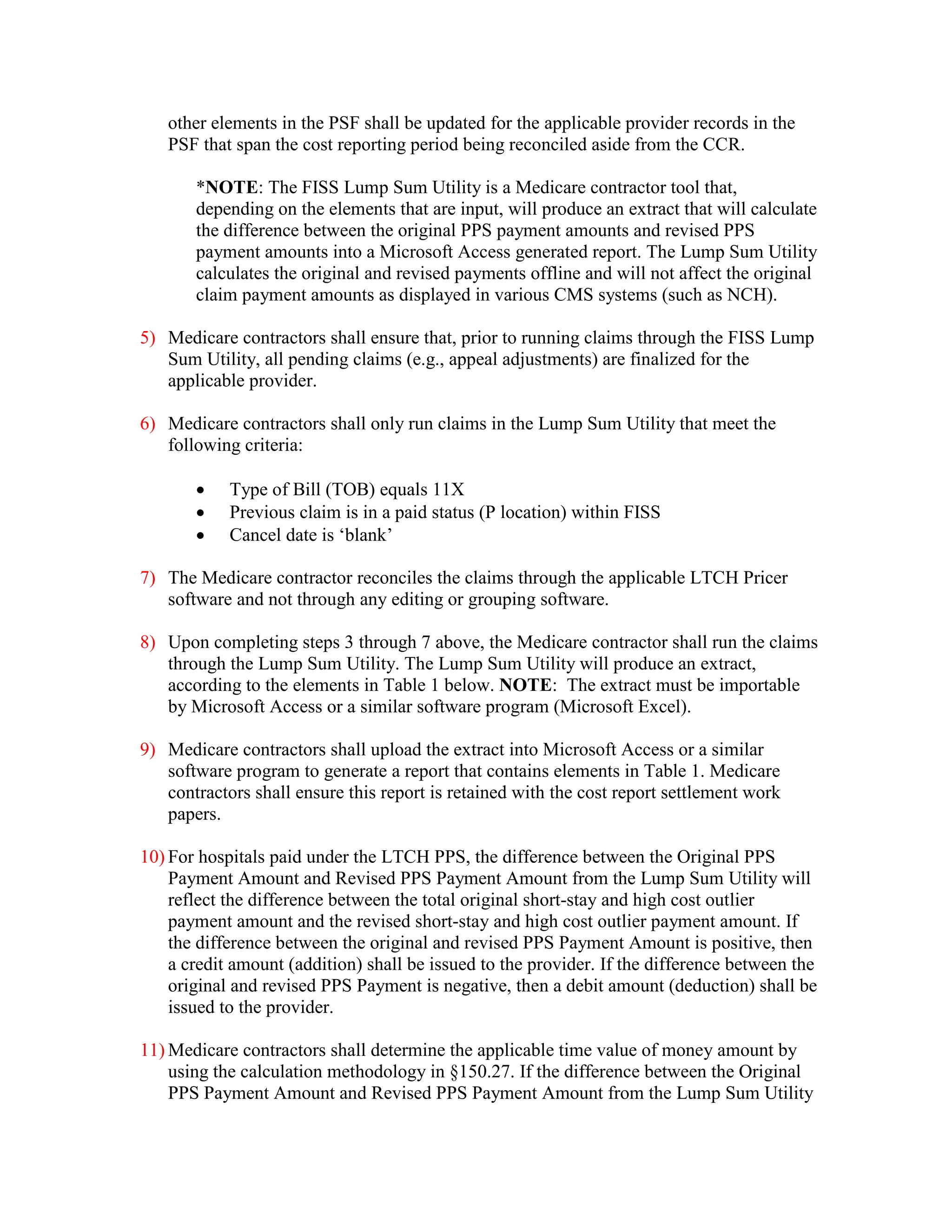

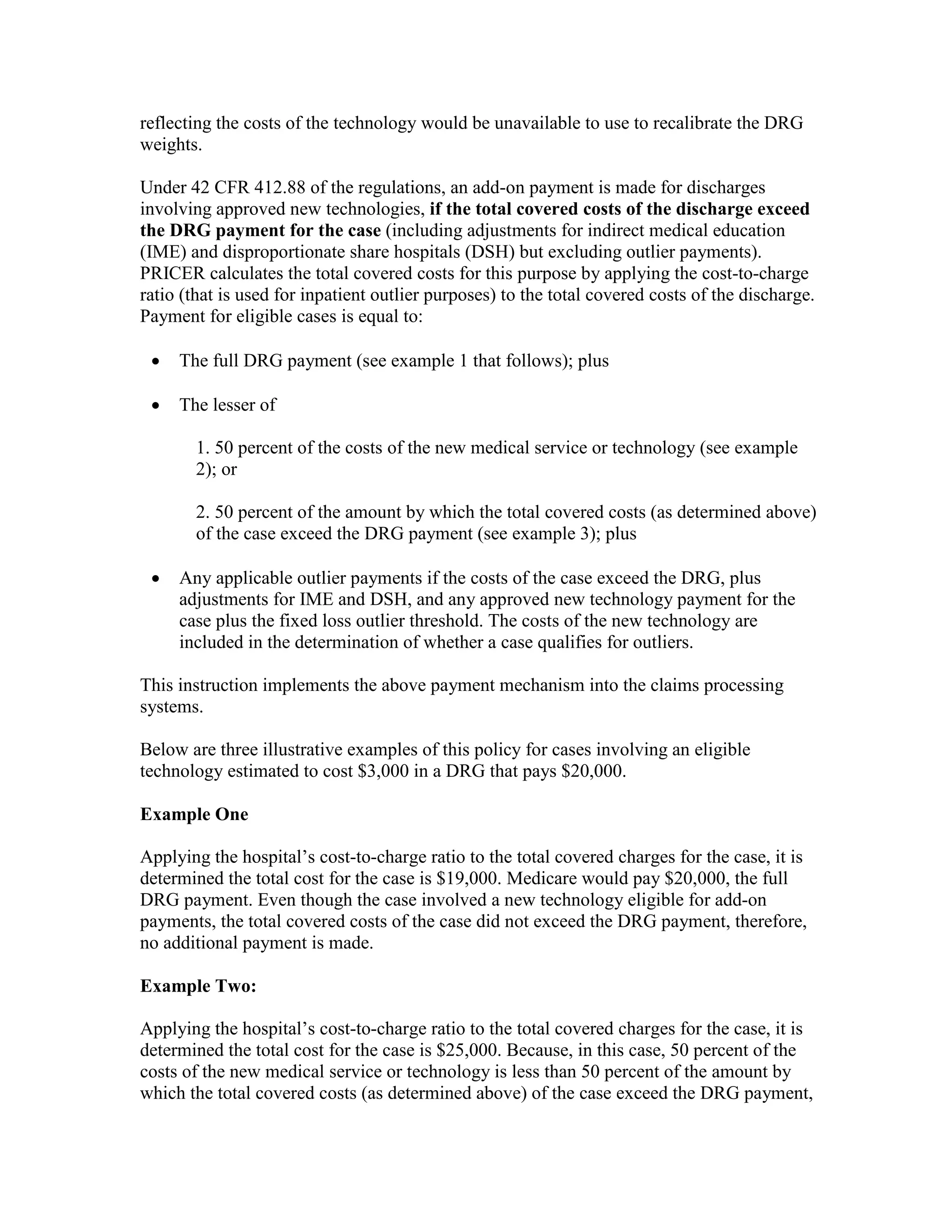

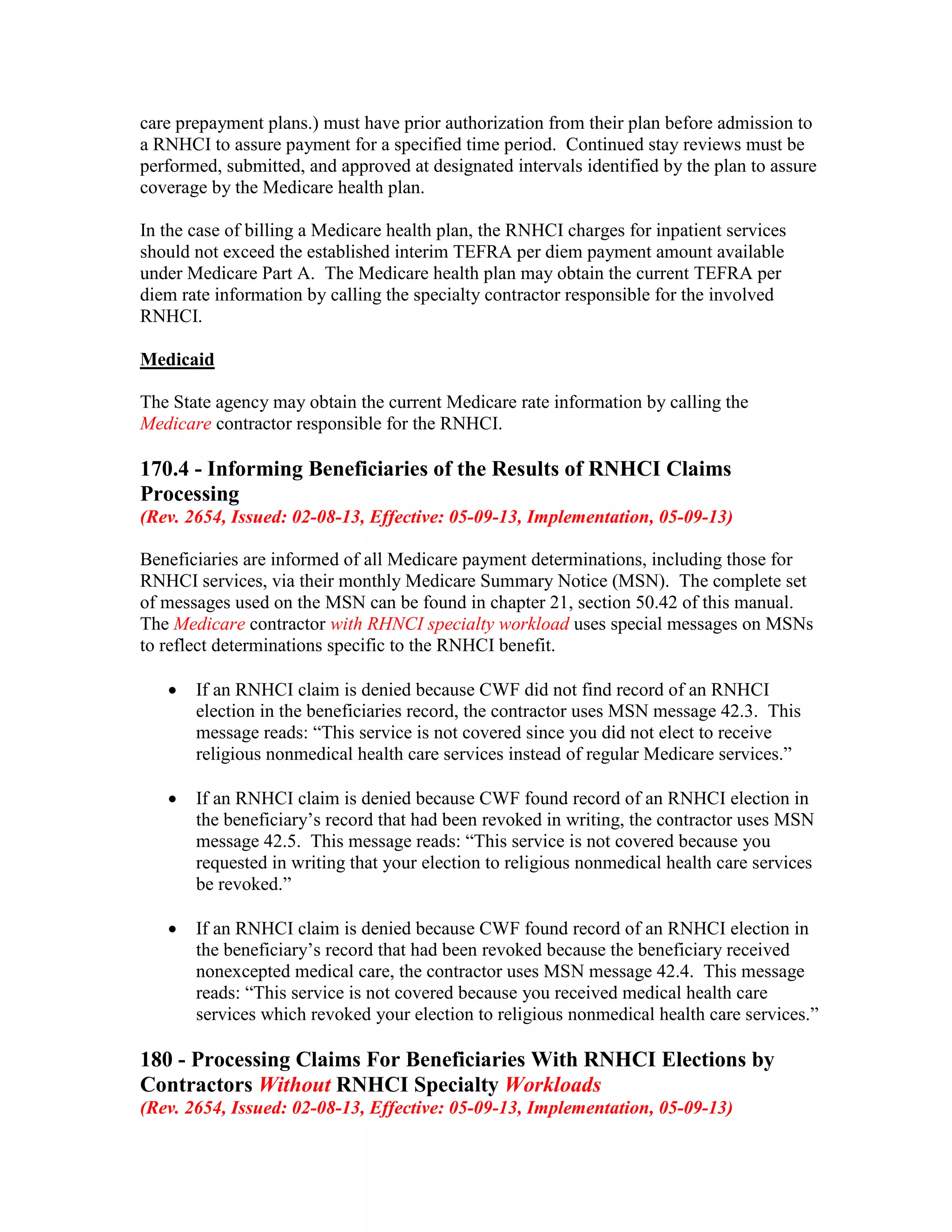

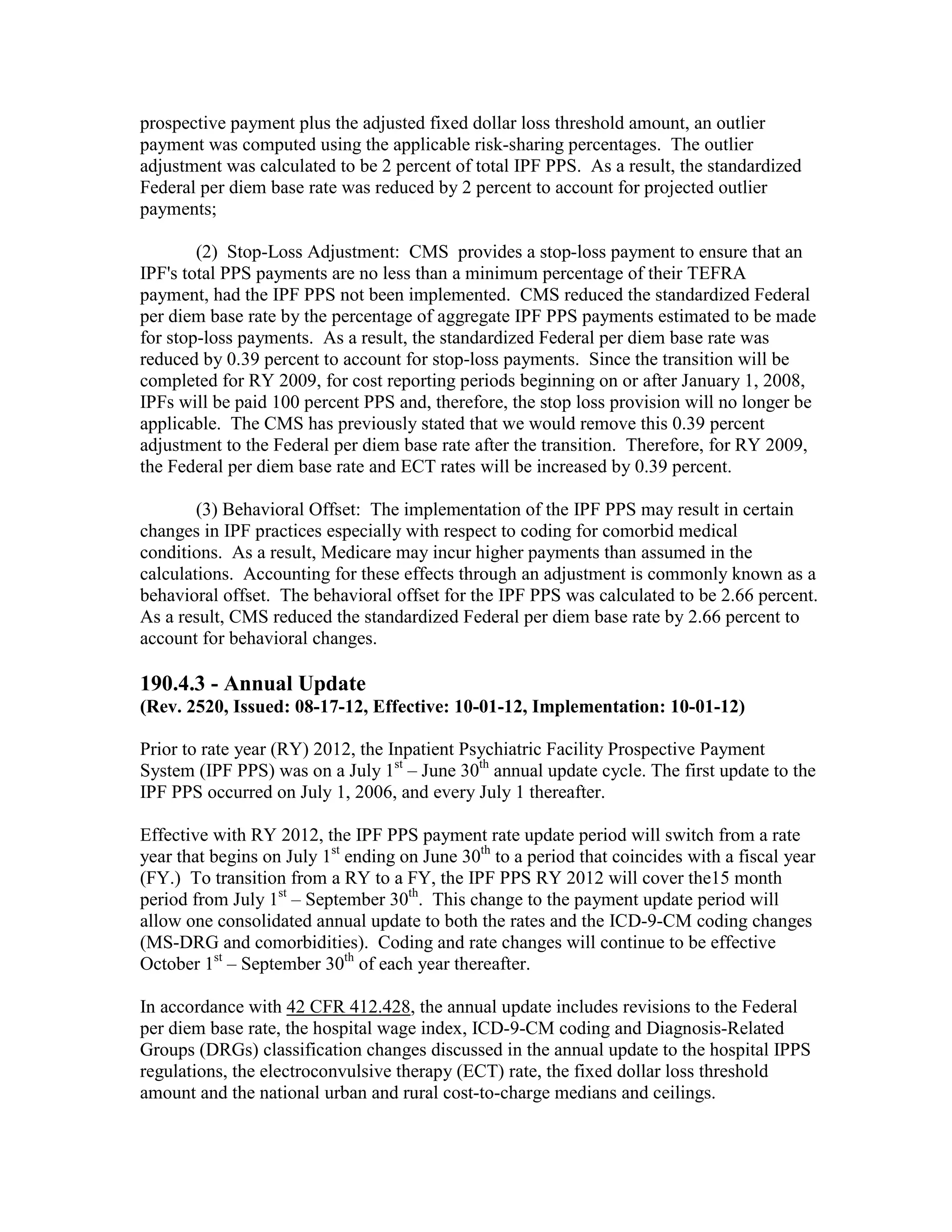

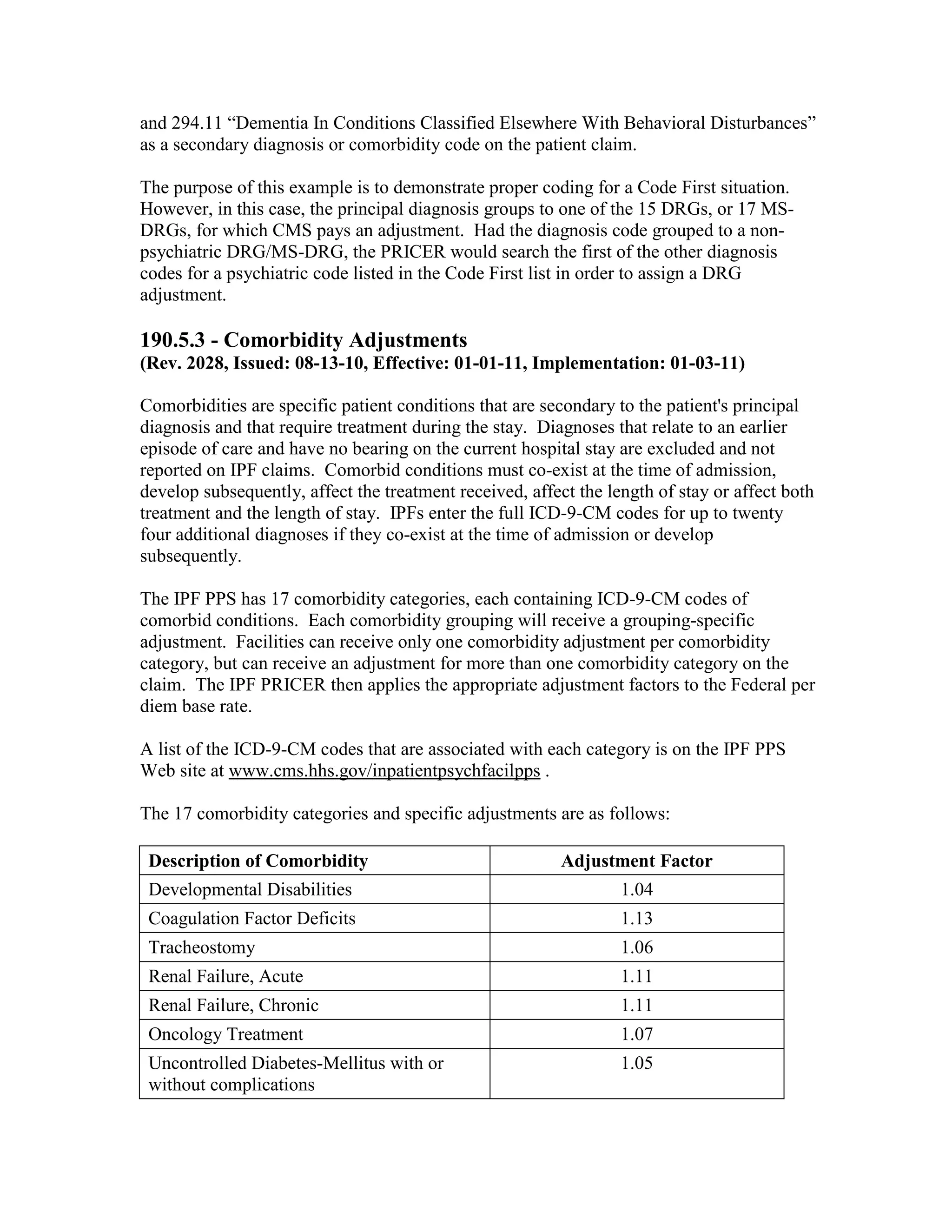

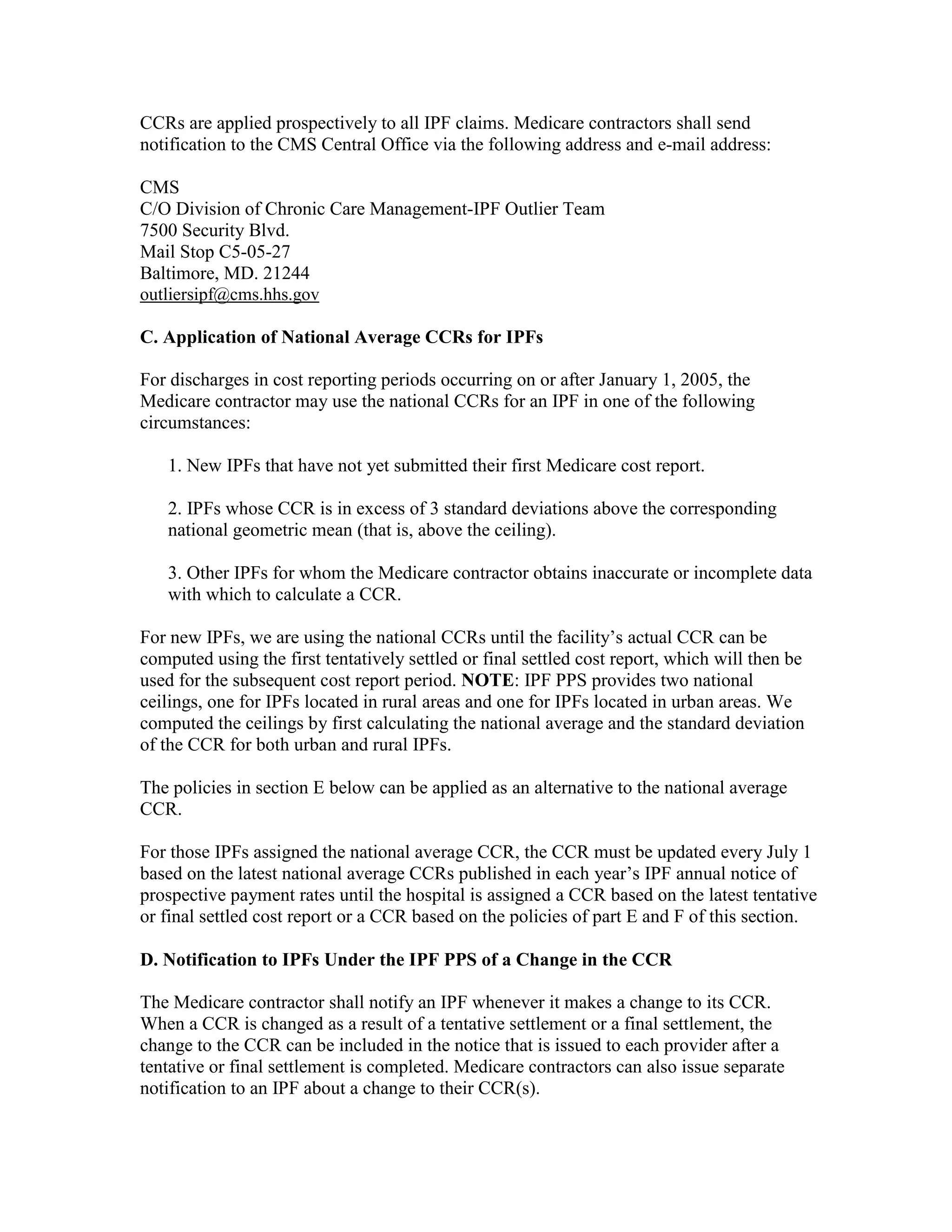

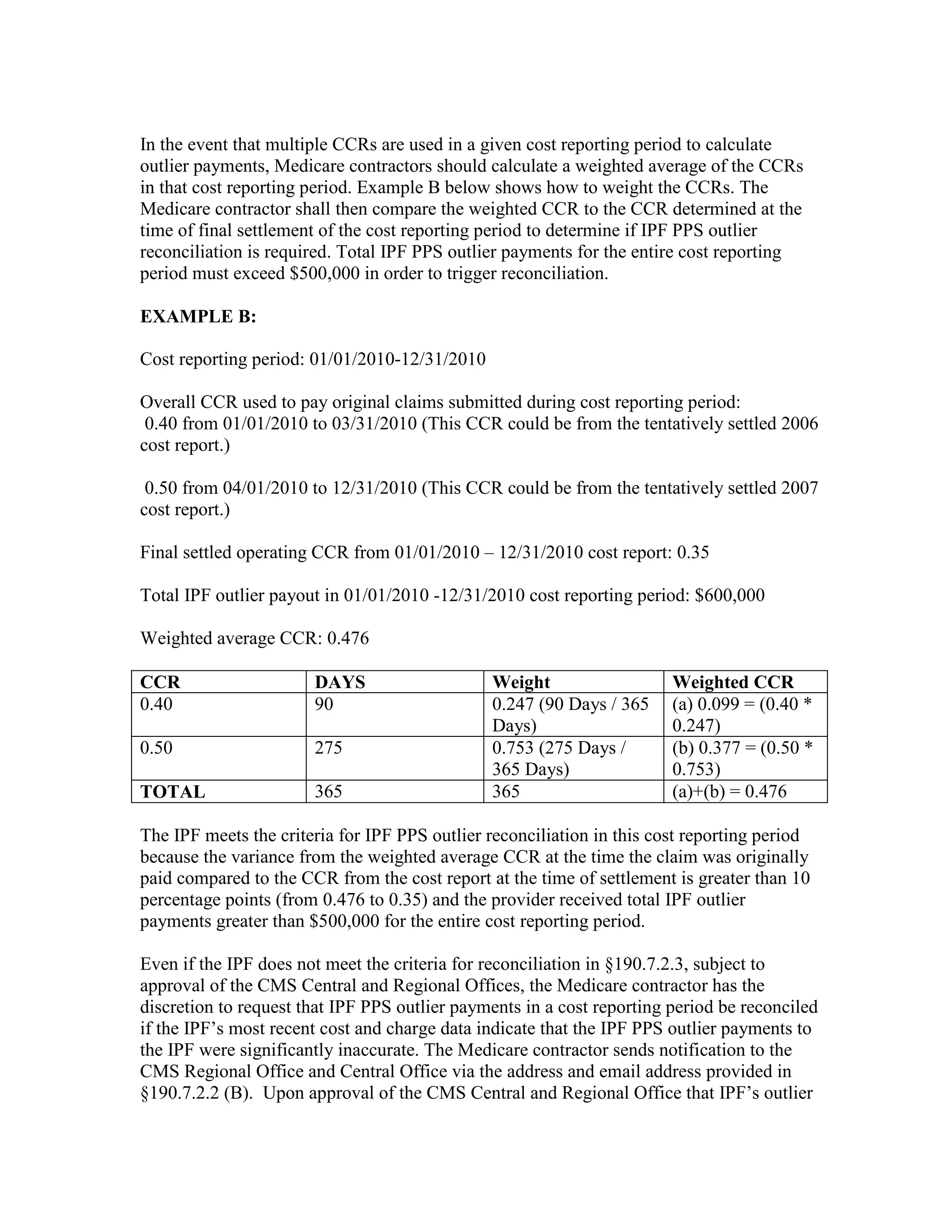

![The specific changes are identified below.

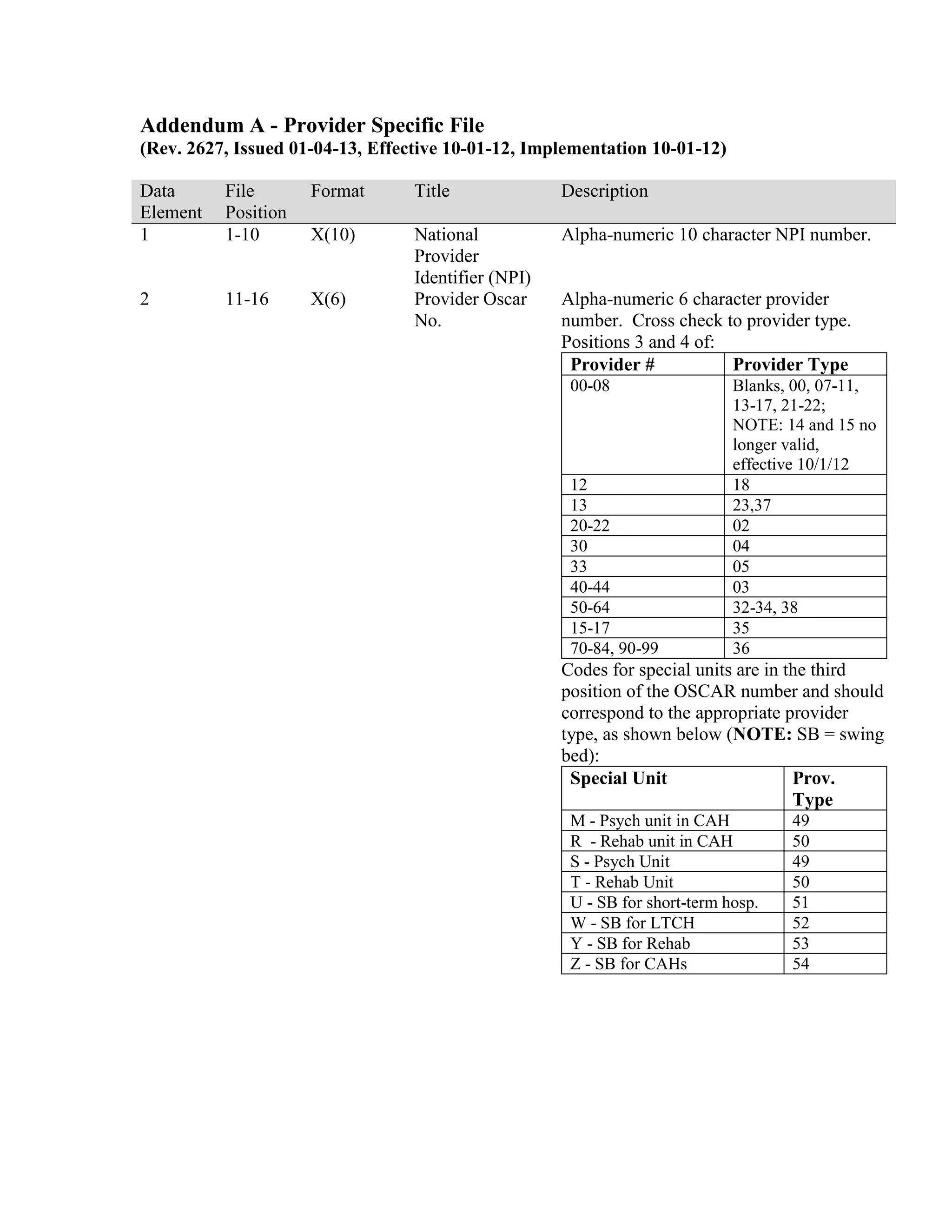

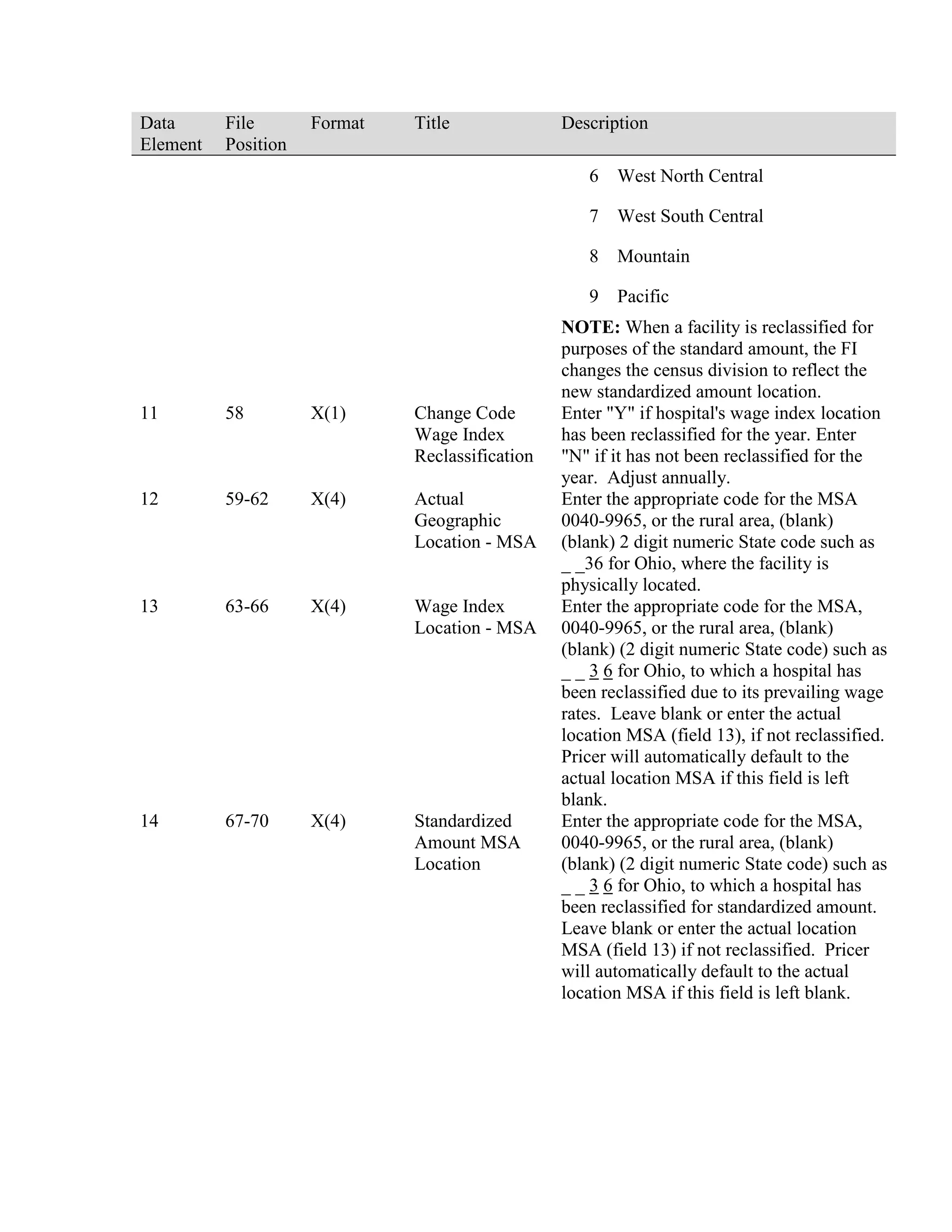

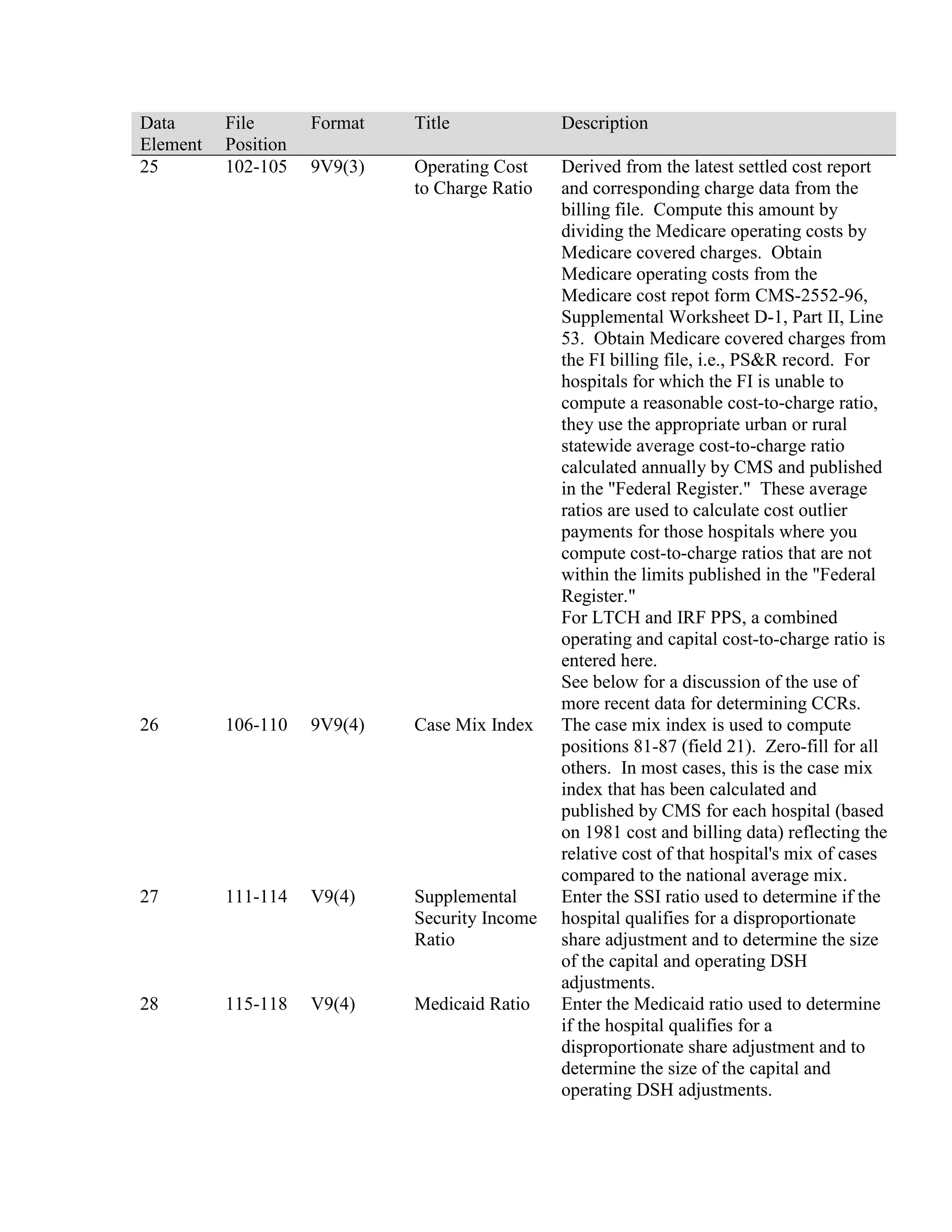

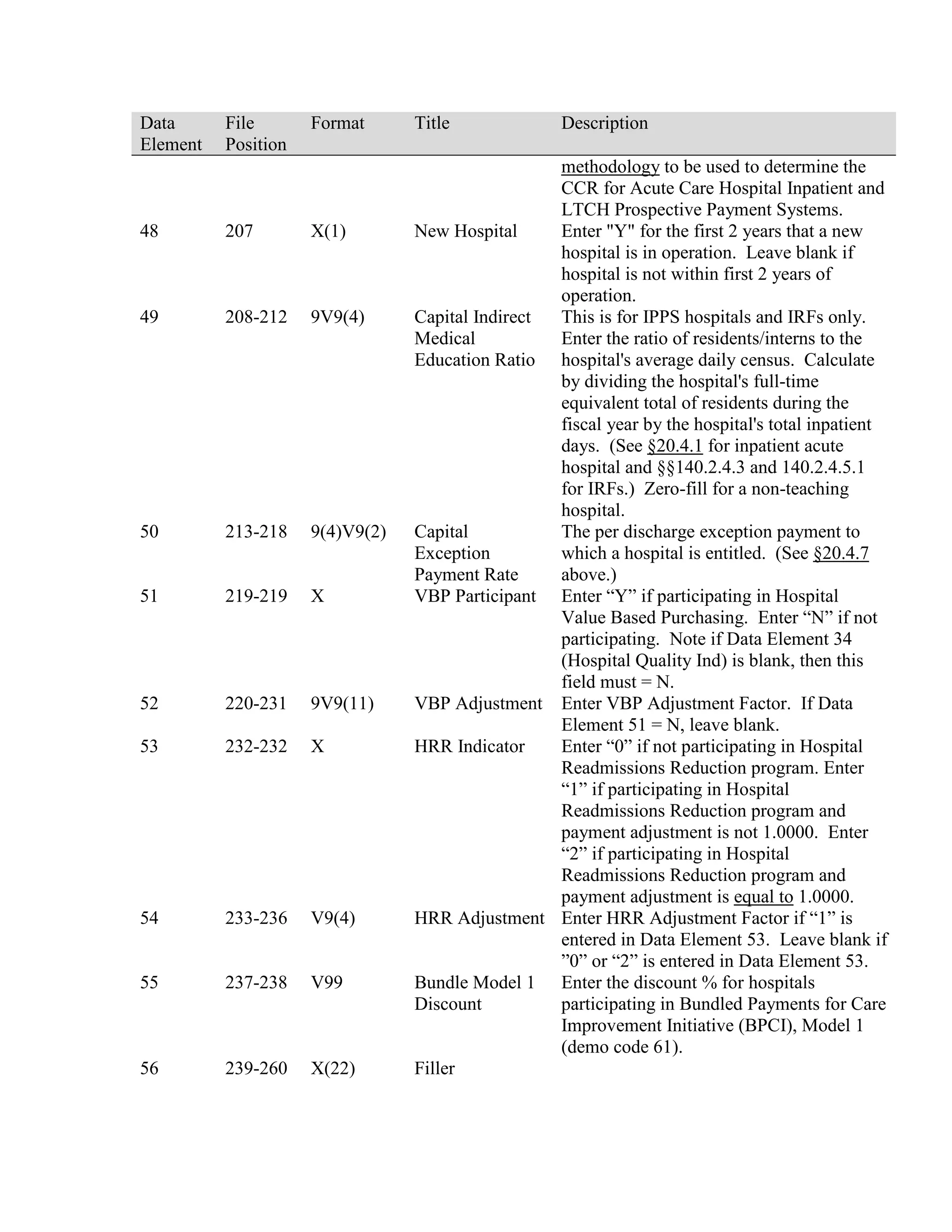

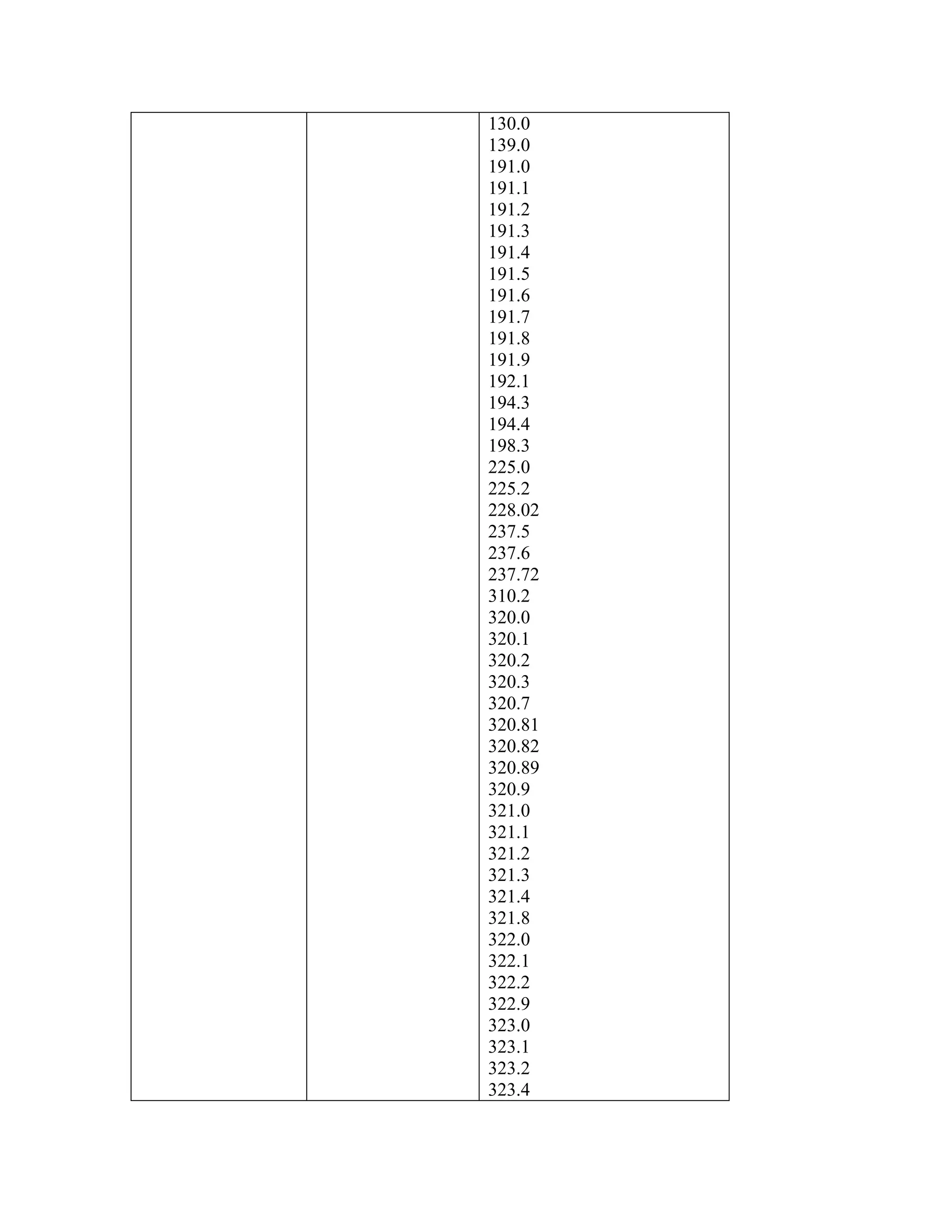

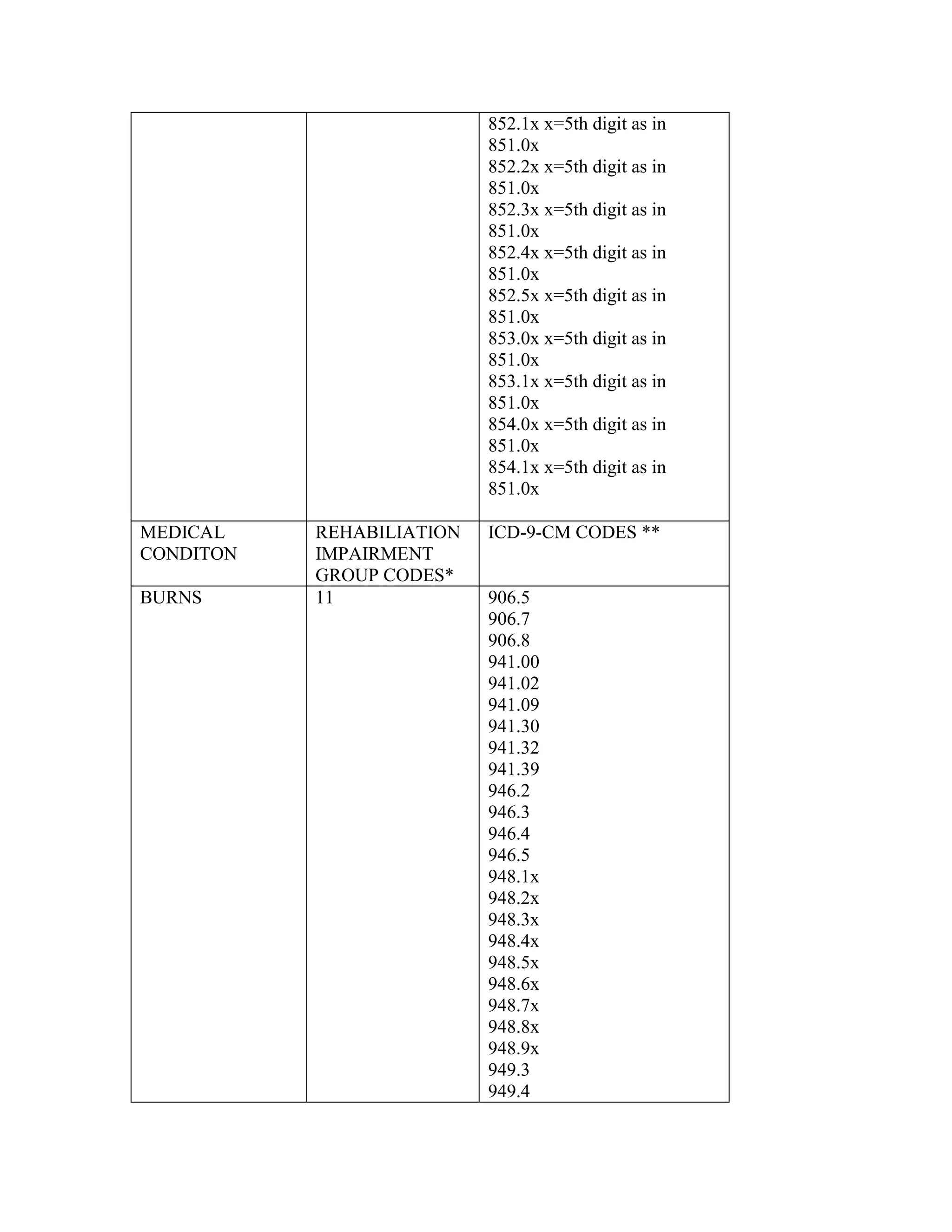

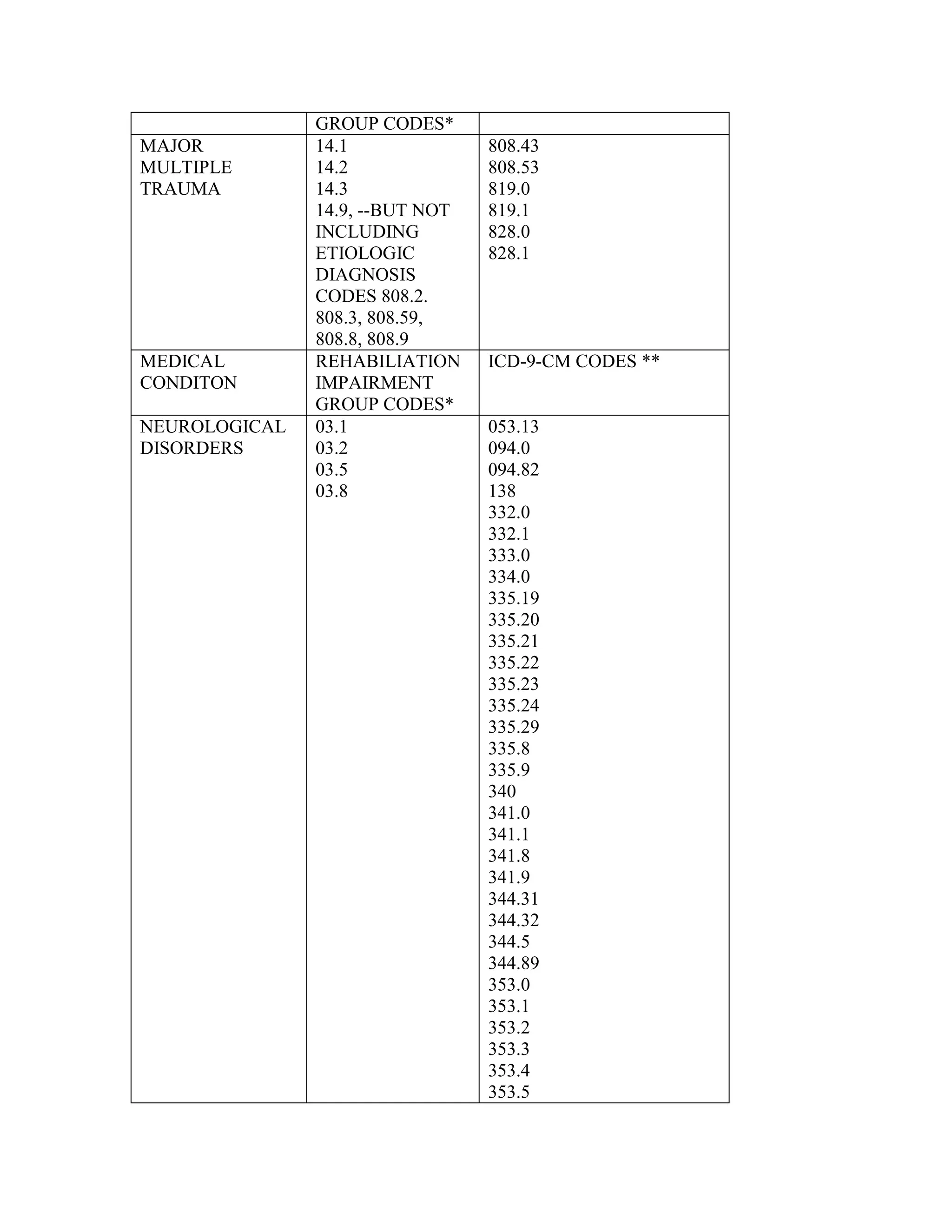

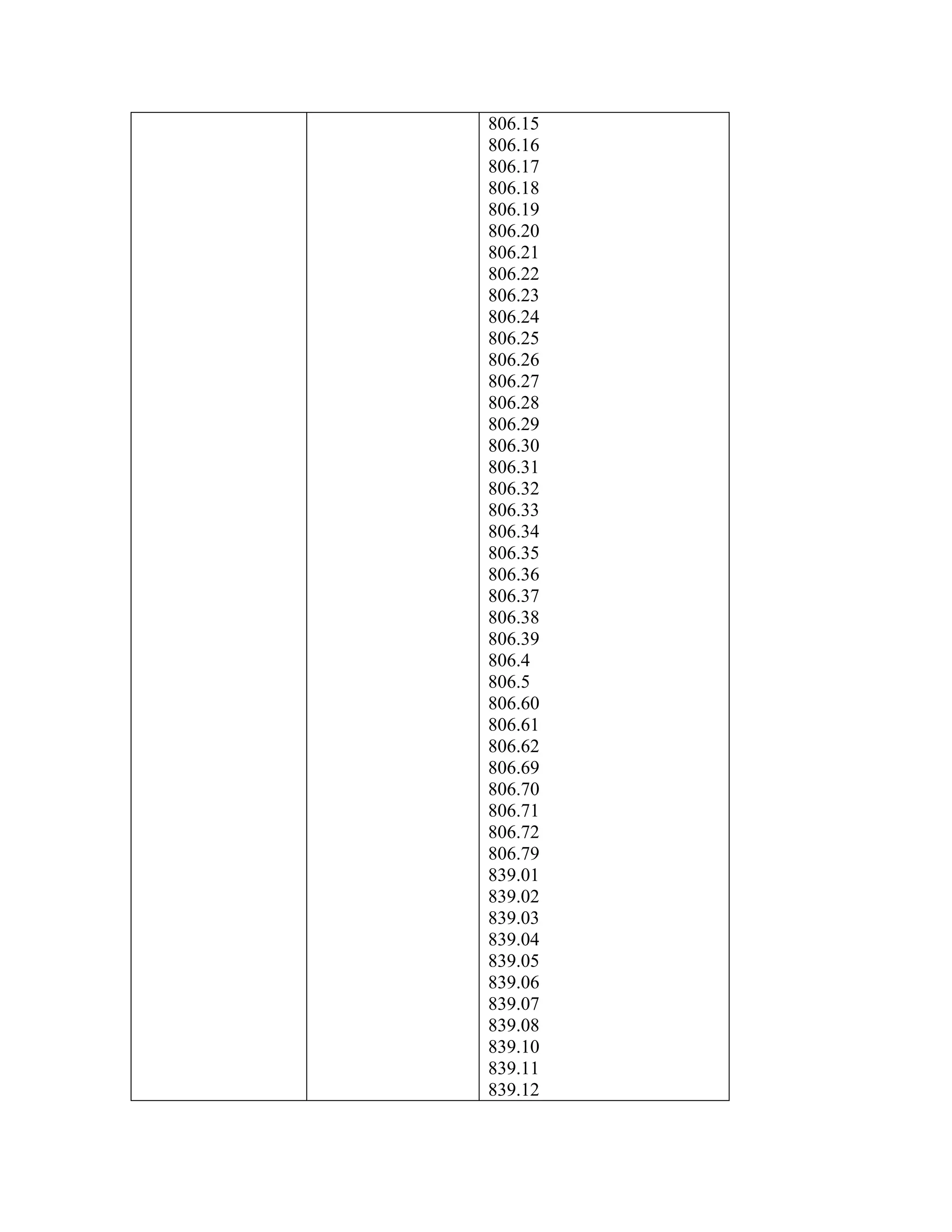

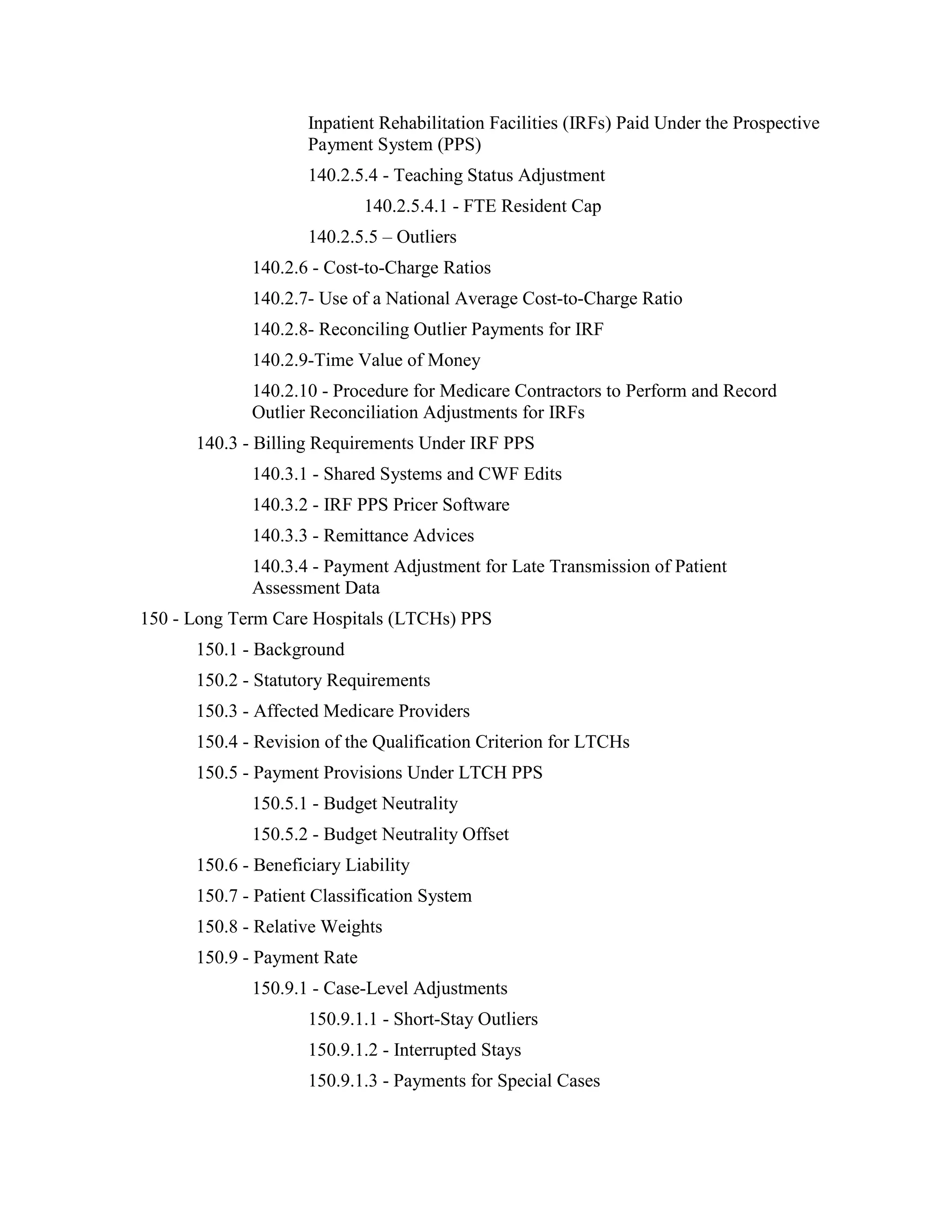

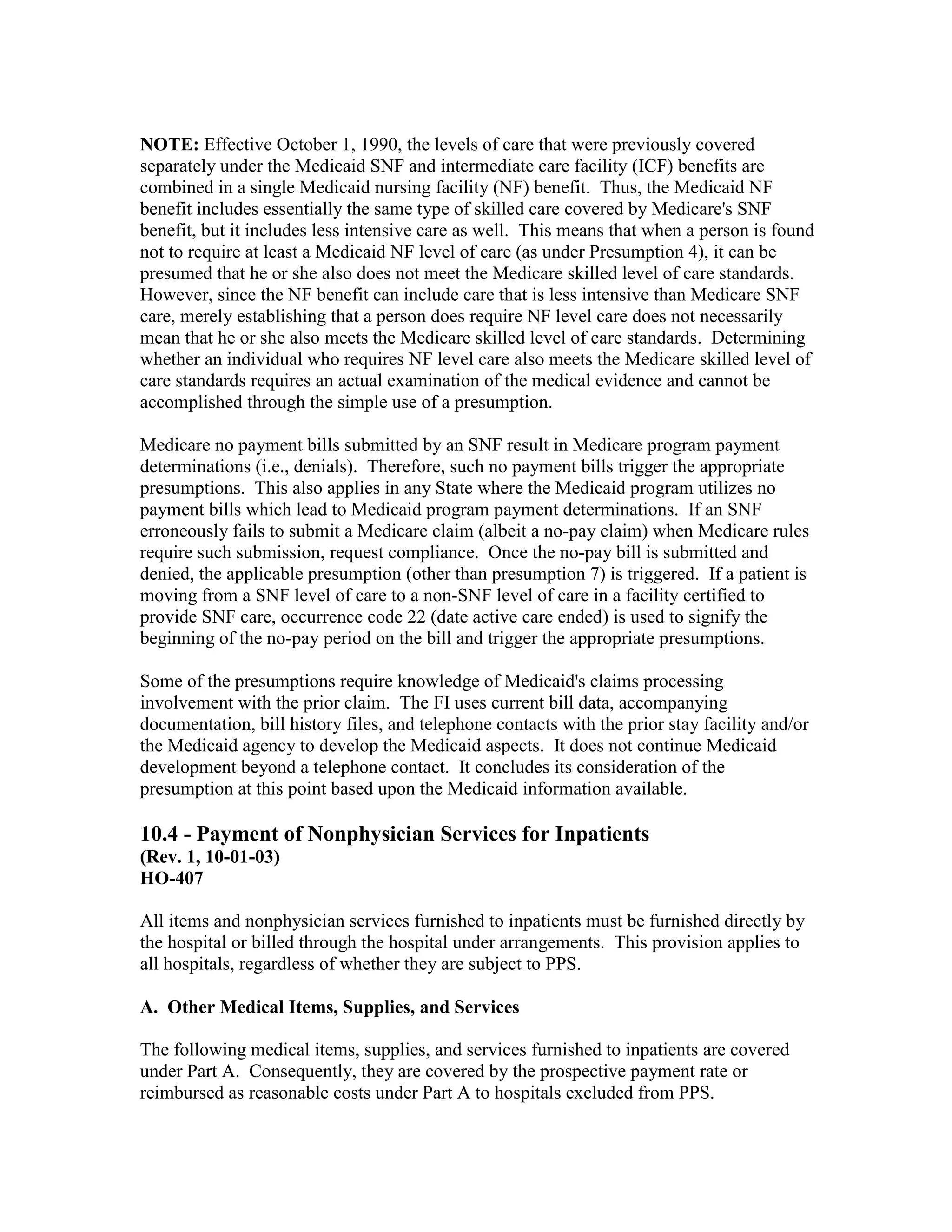

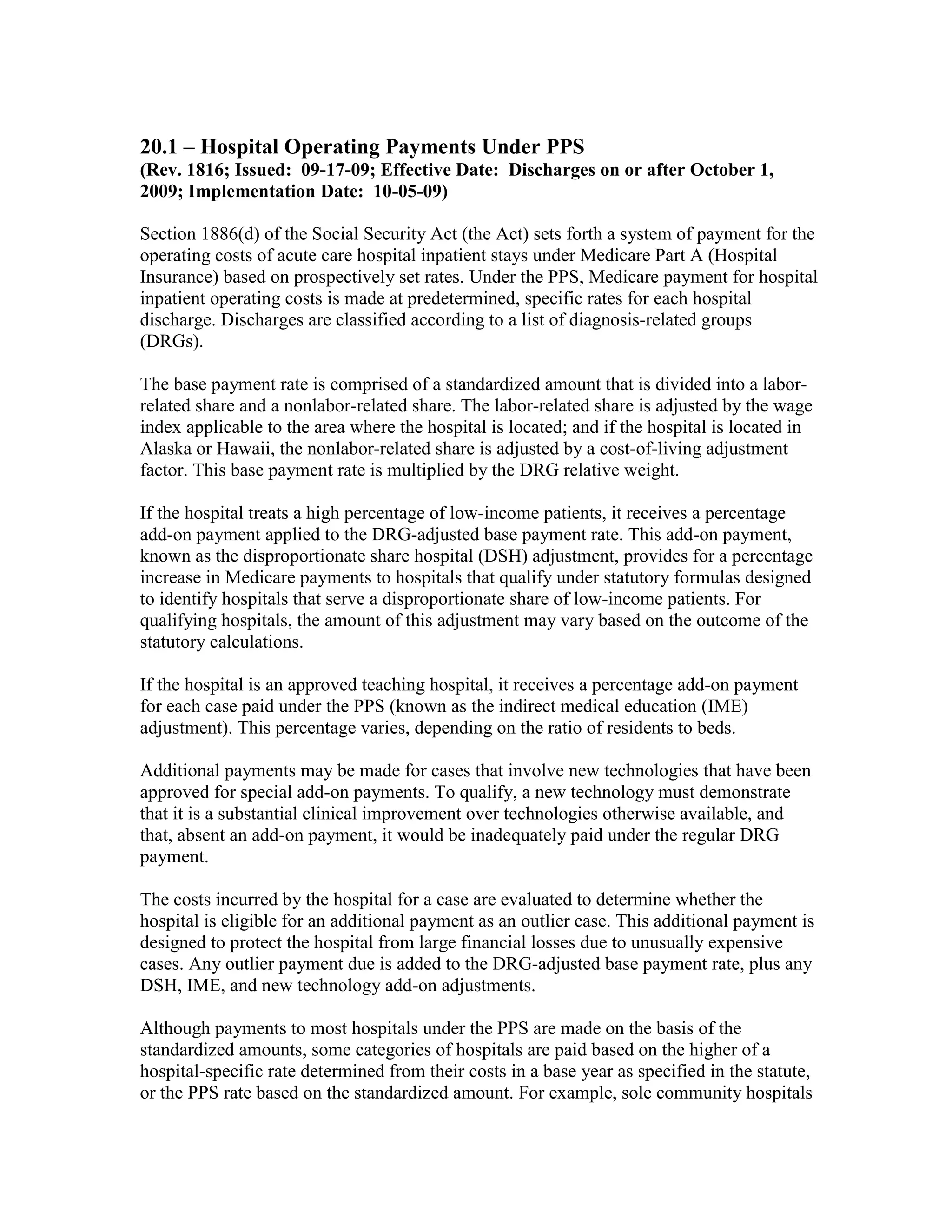

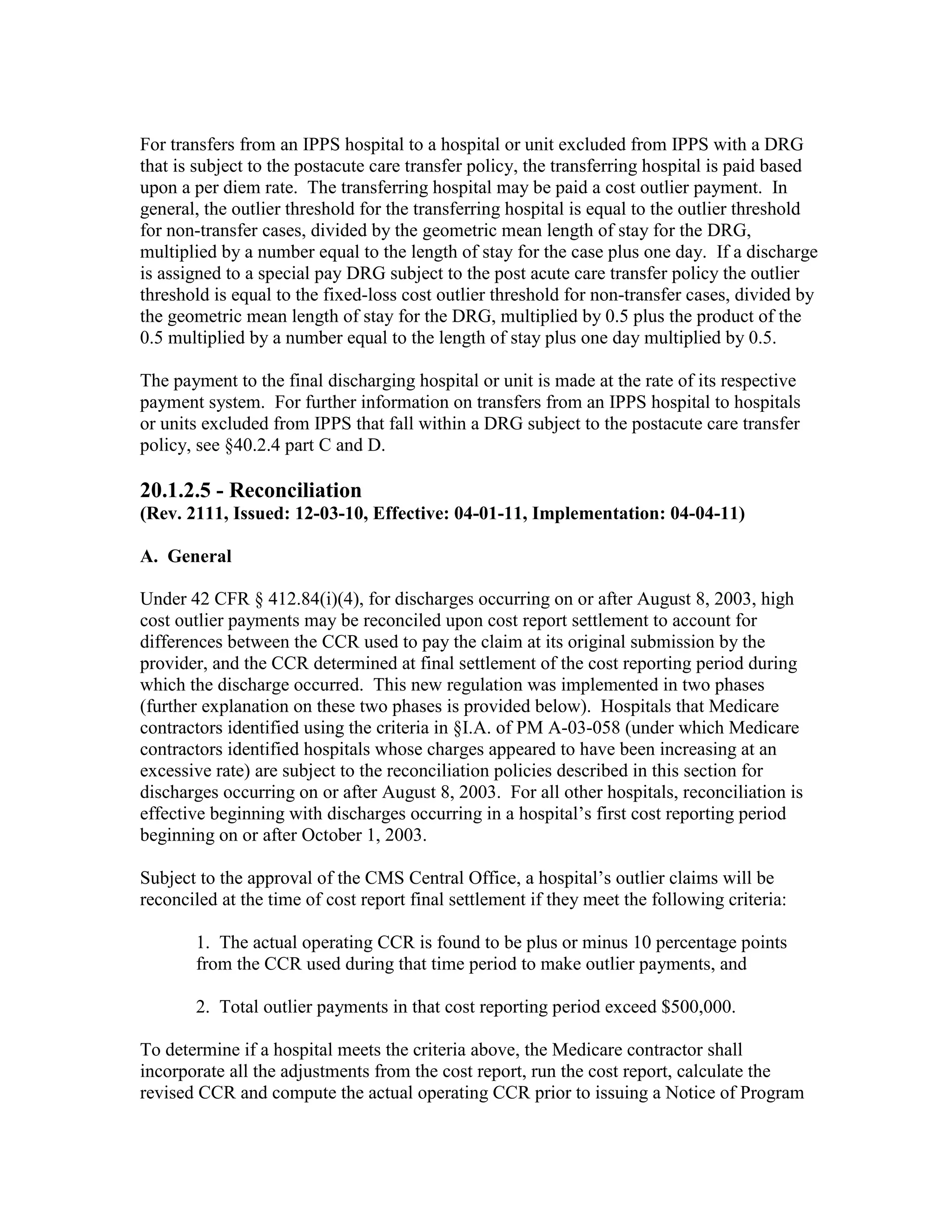

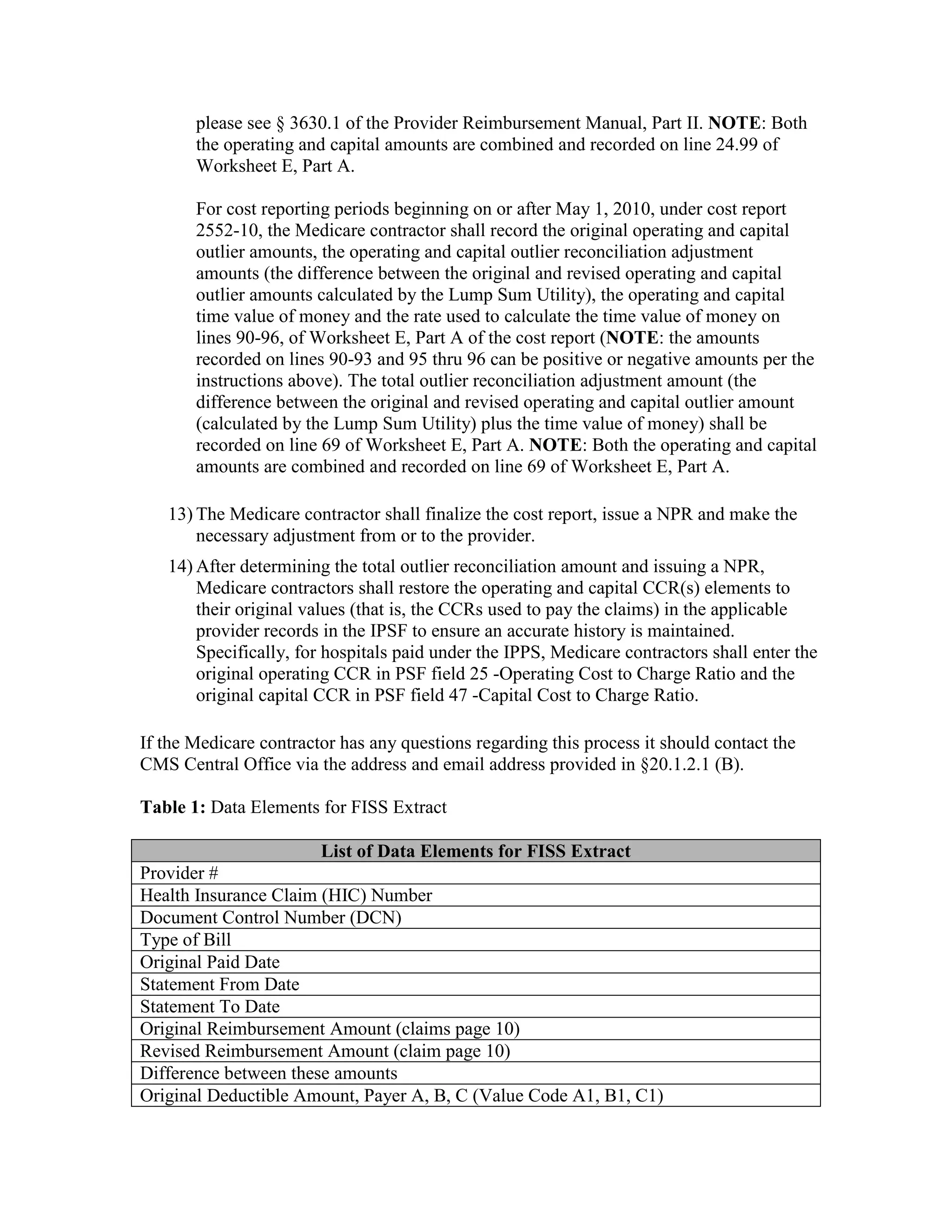

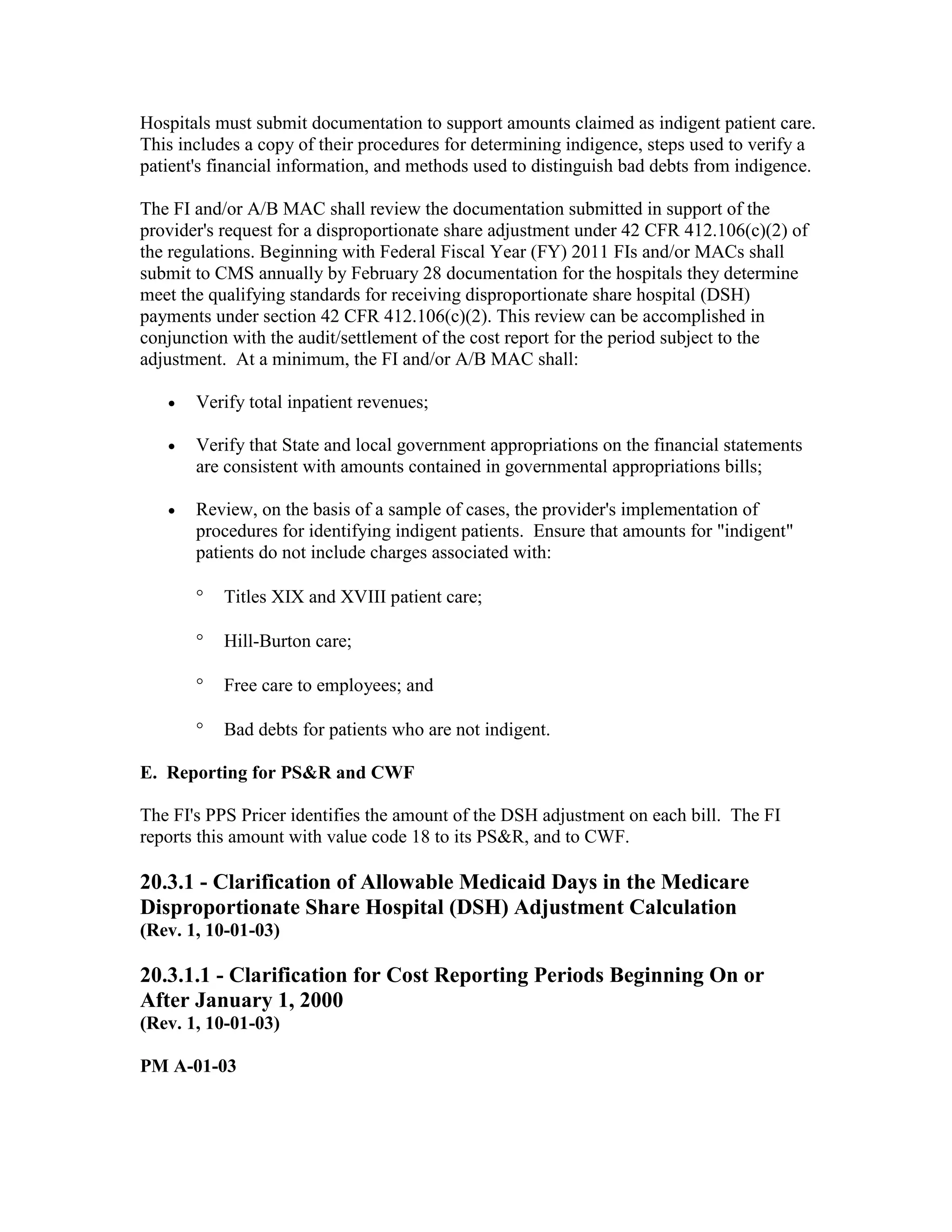

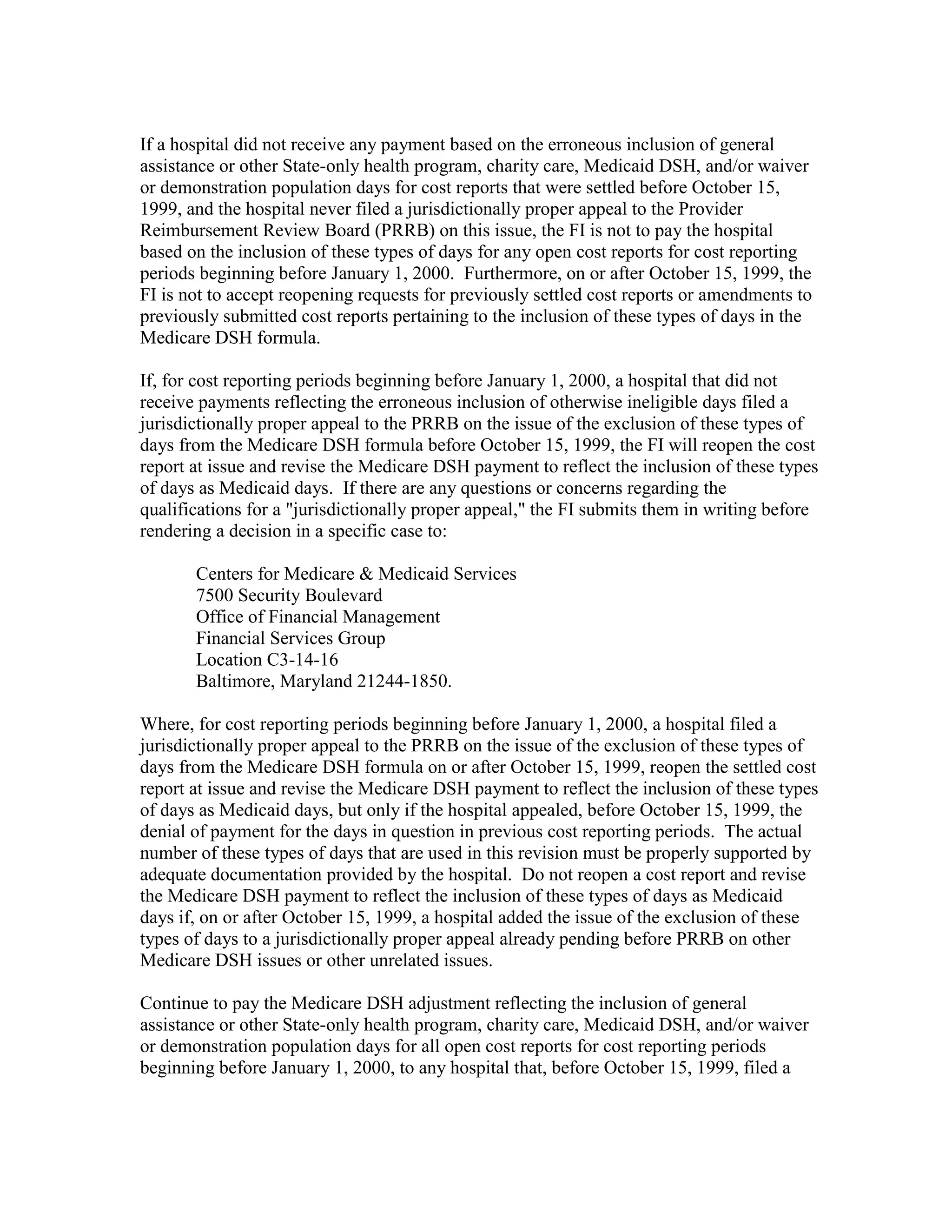

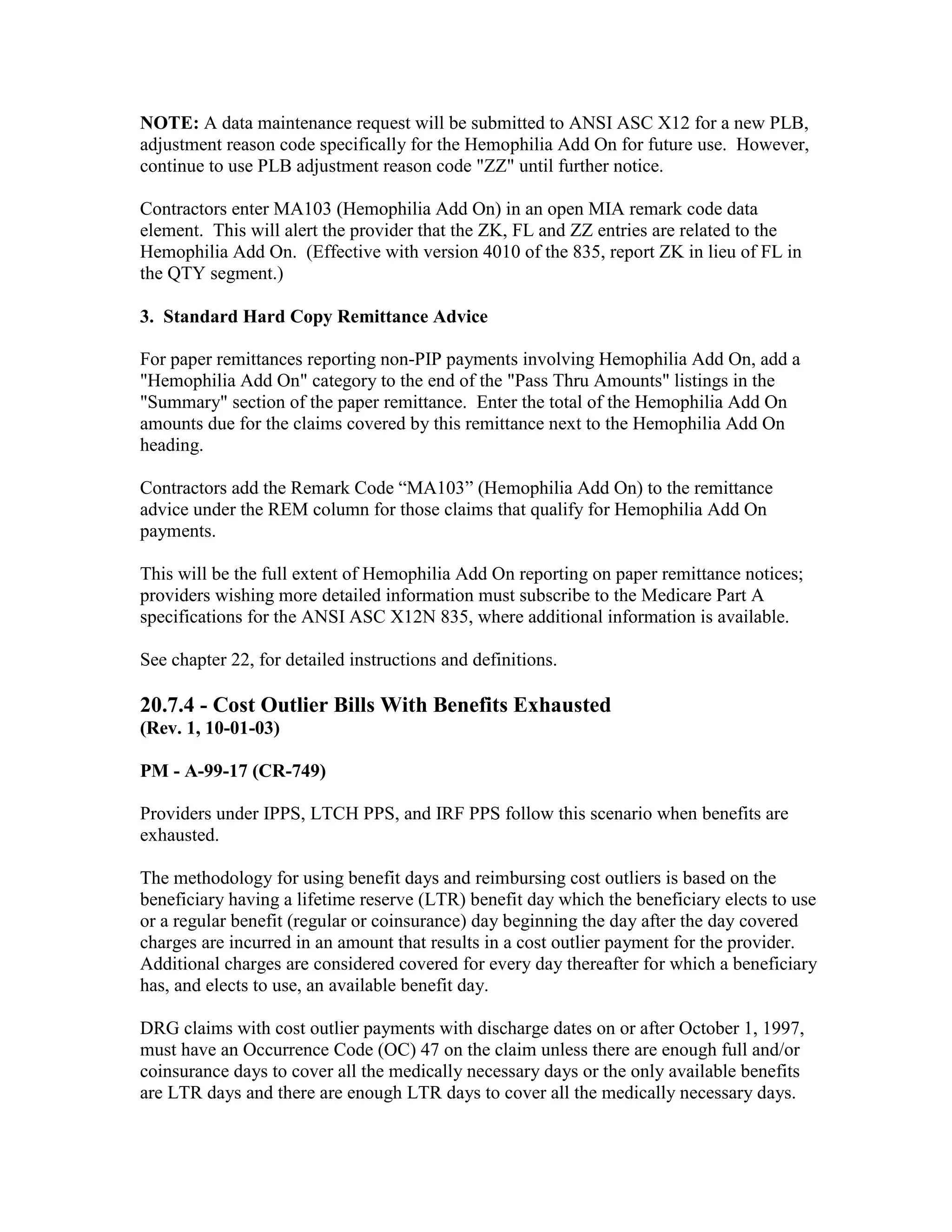

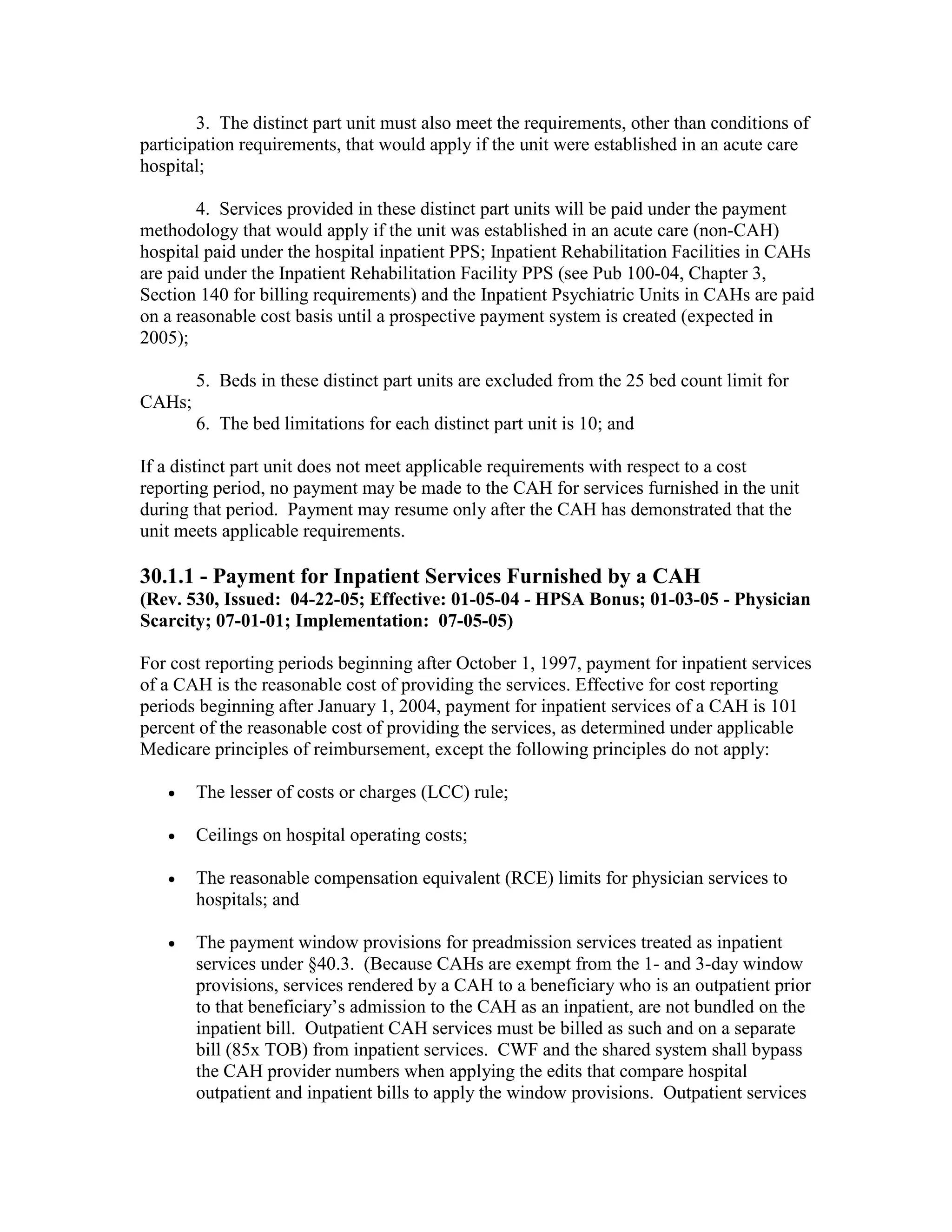

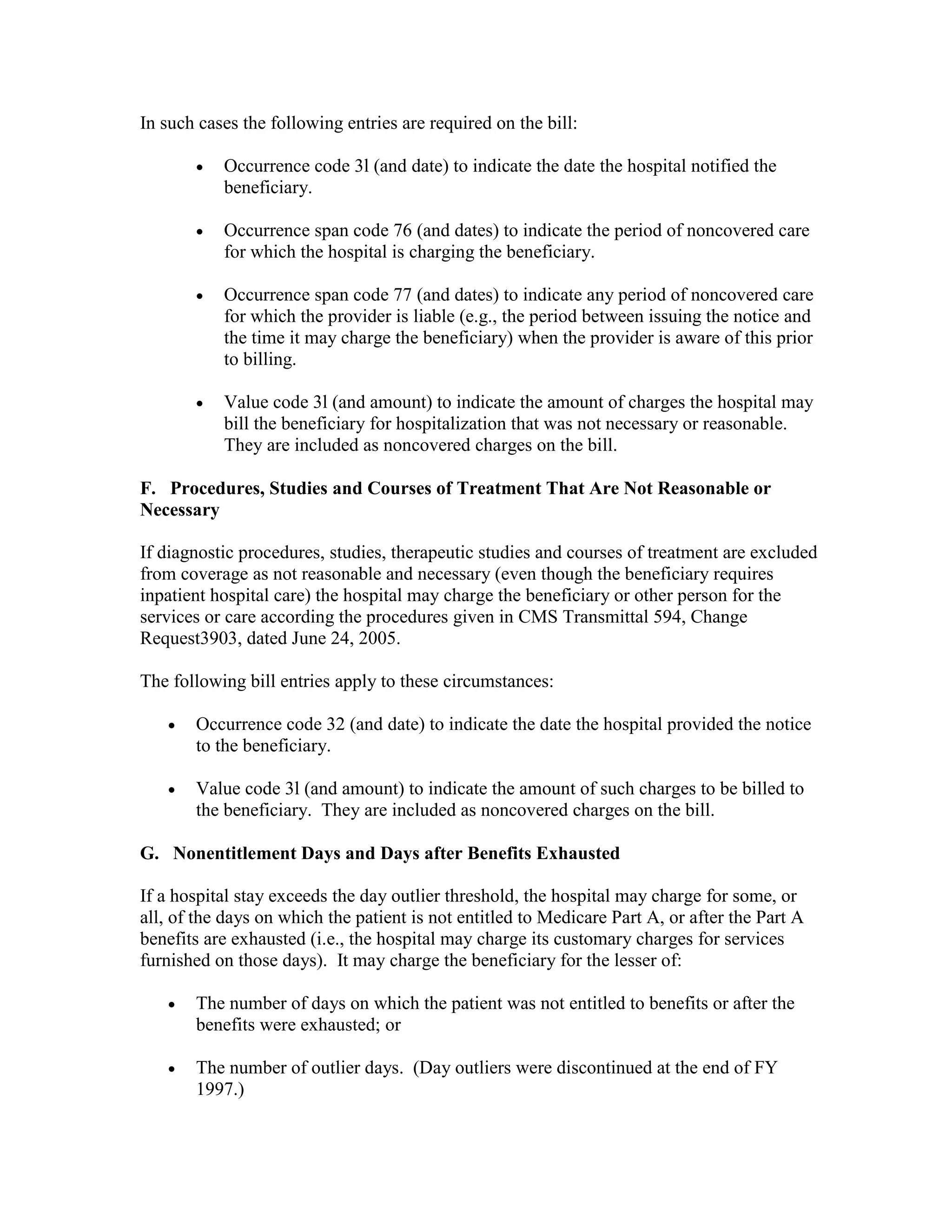

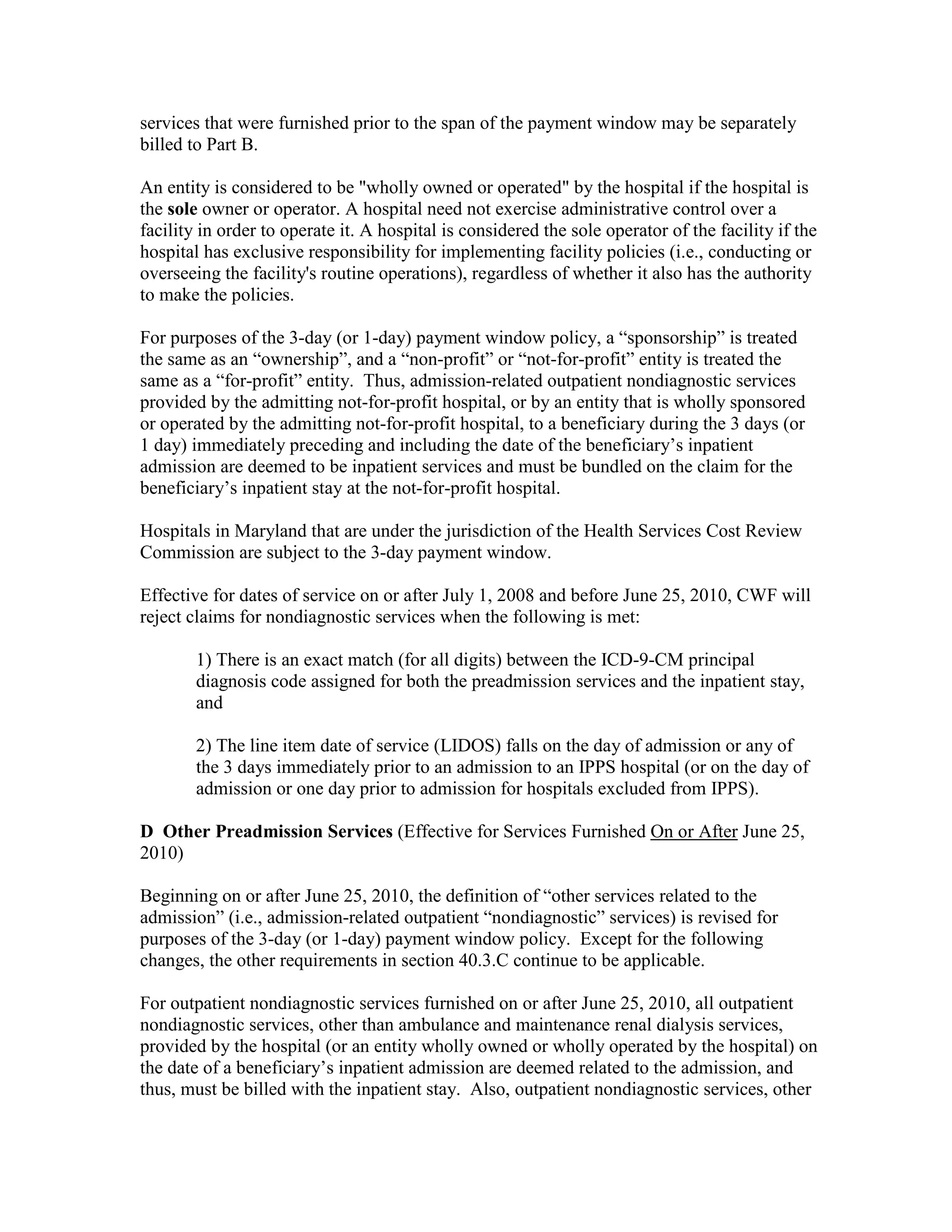

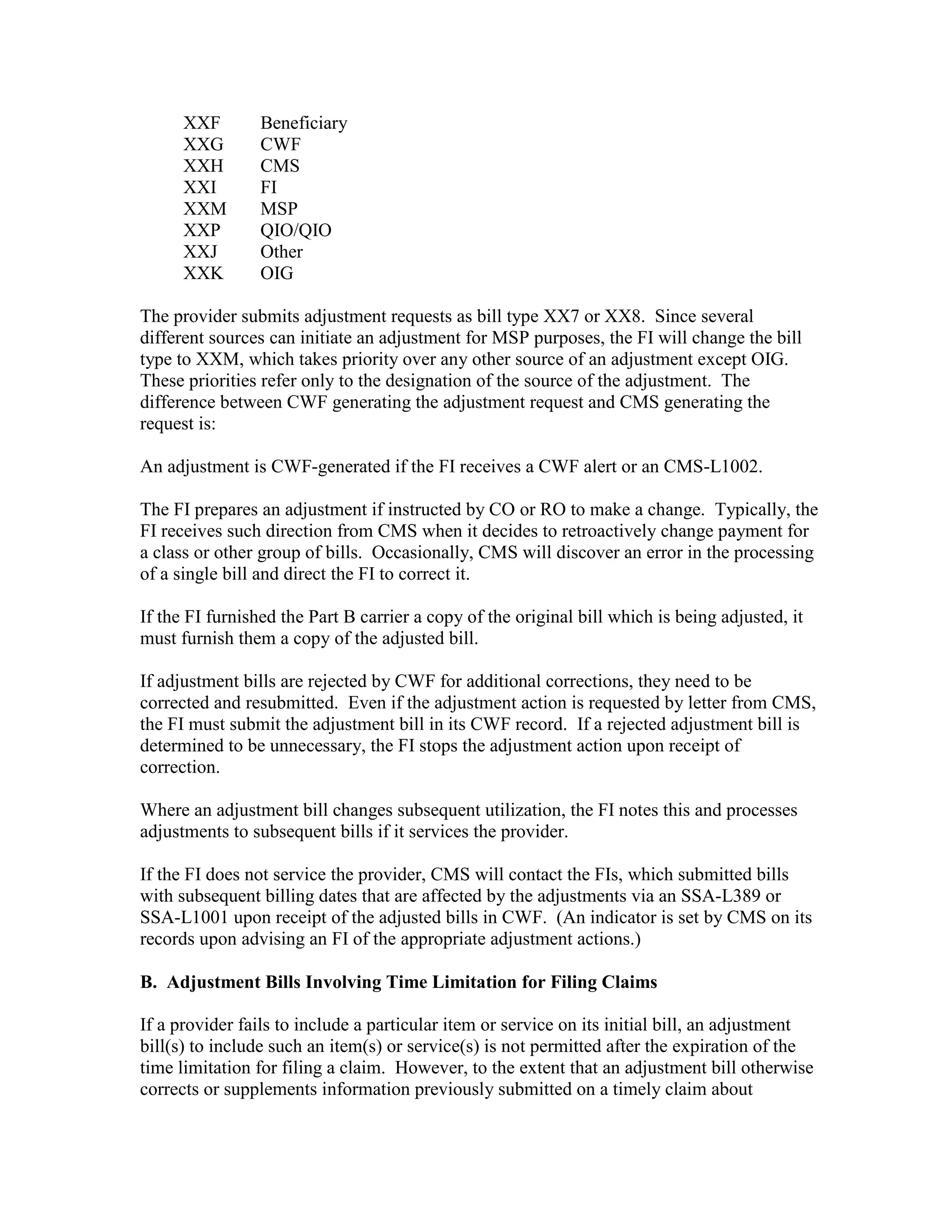

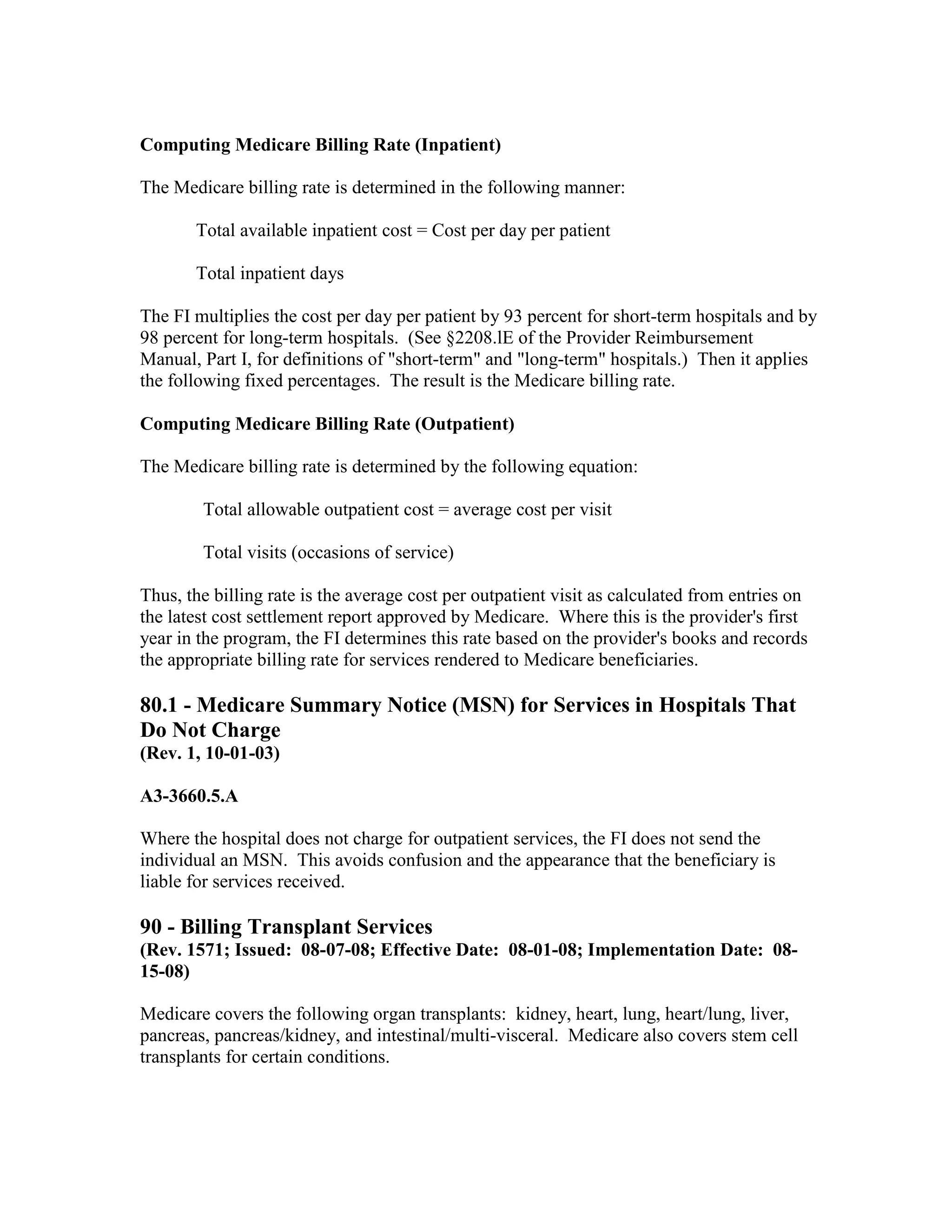

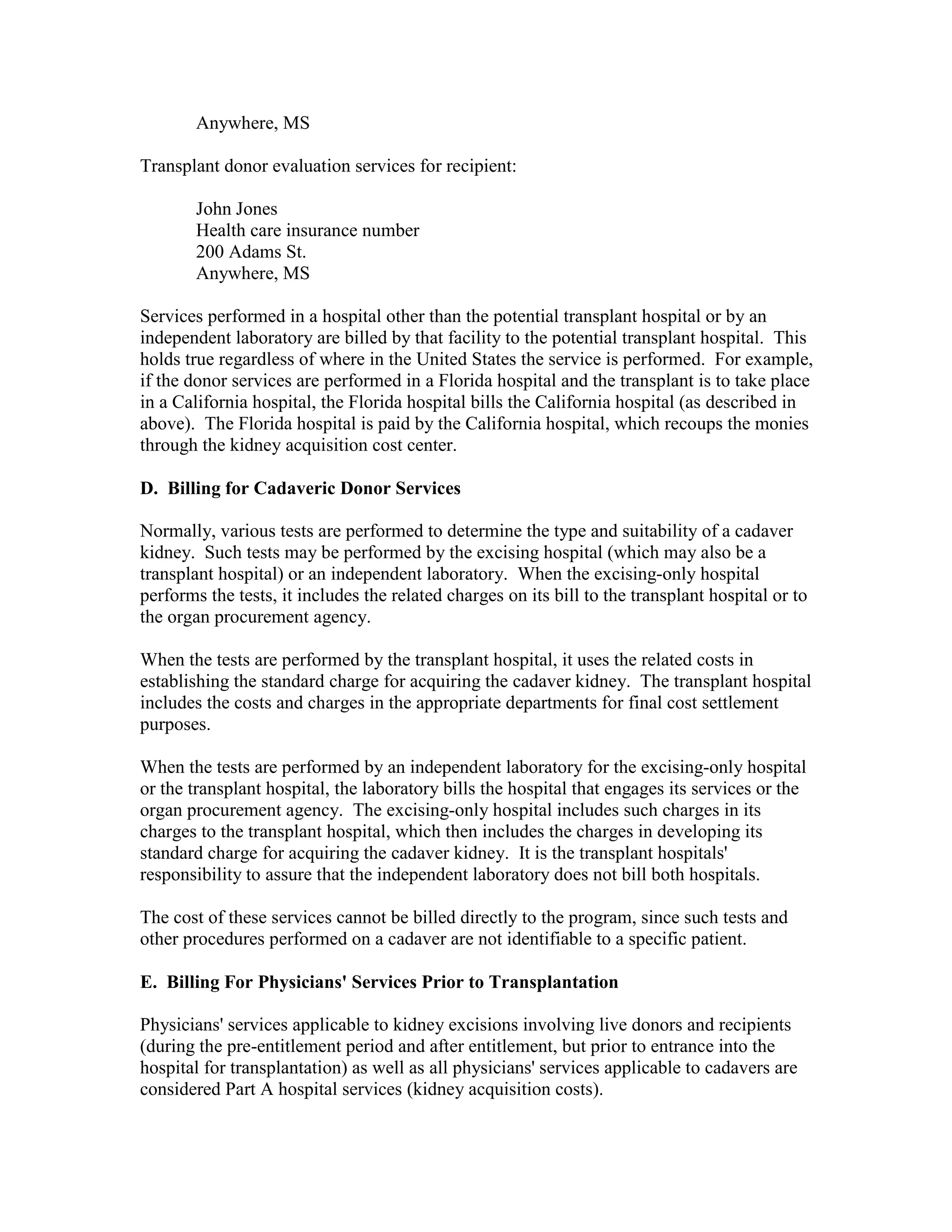

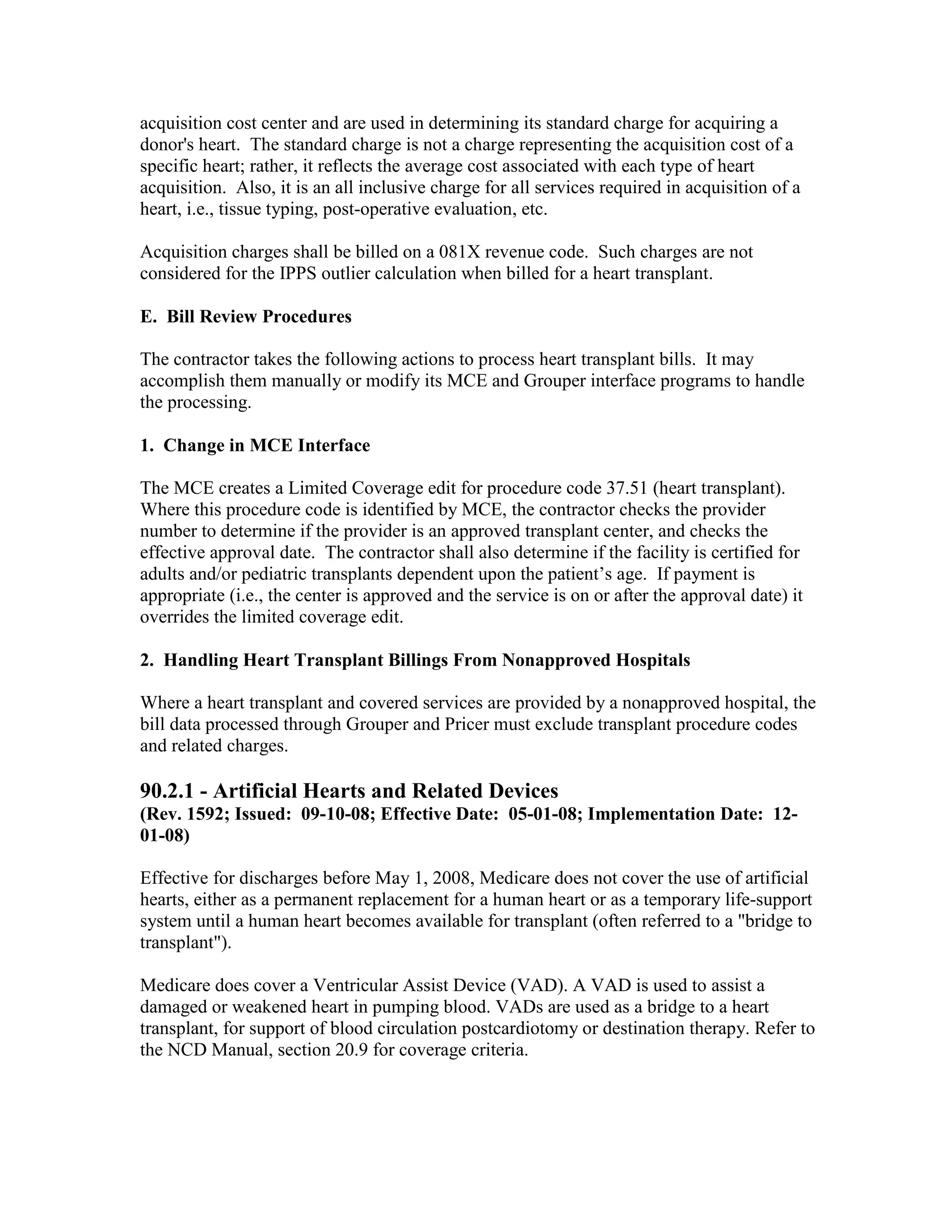

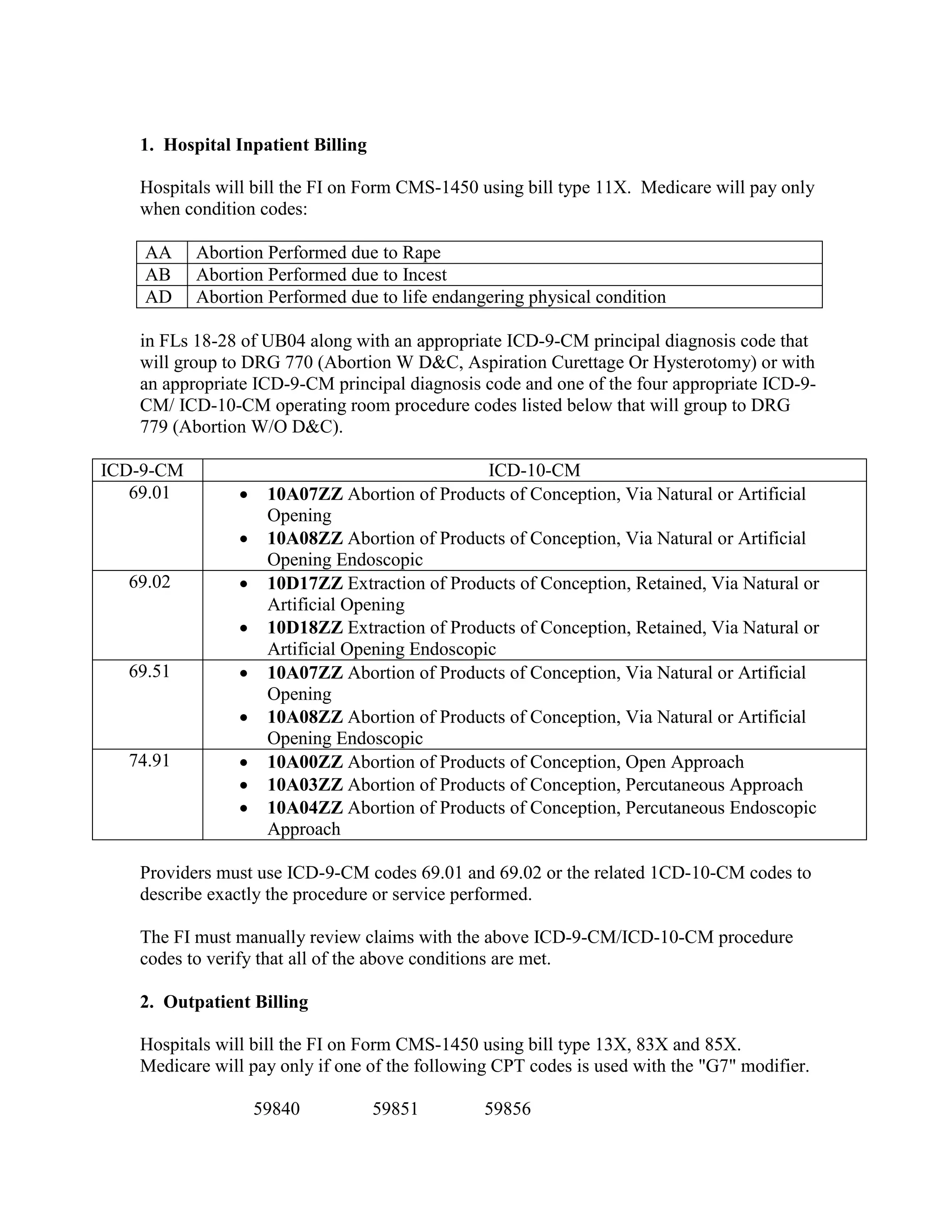

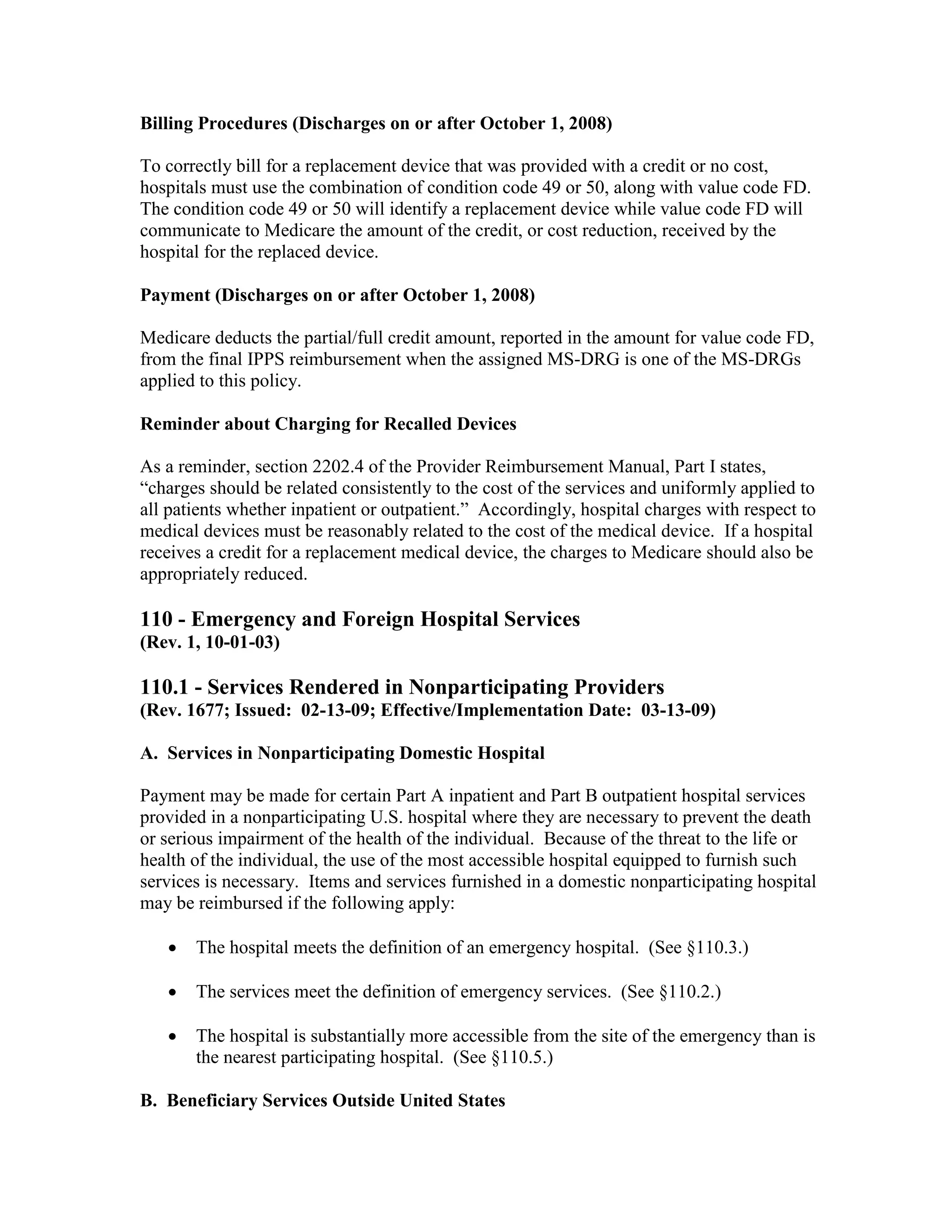

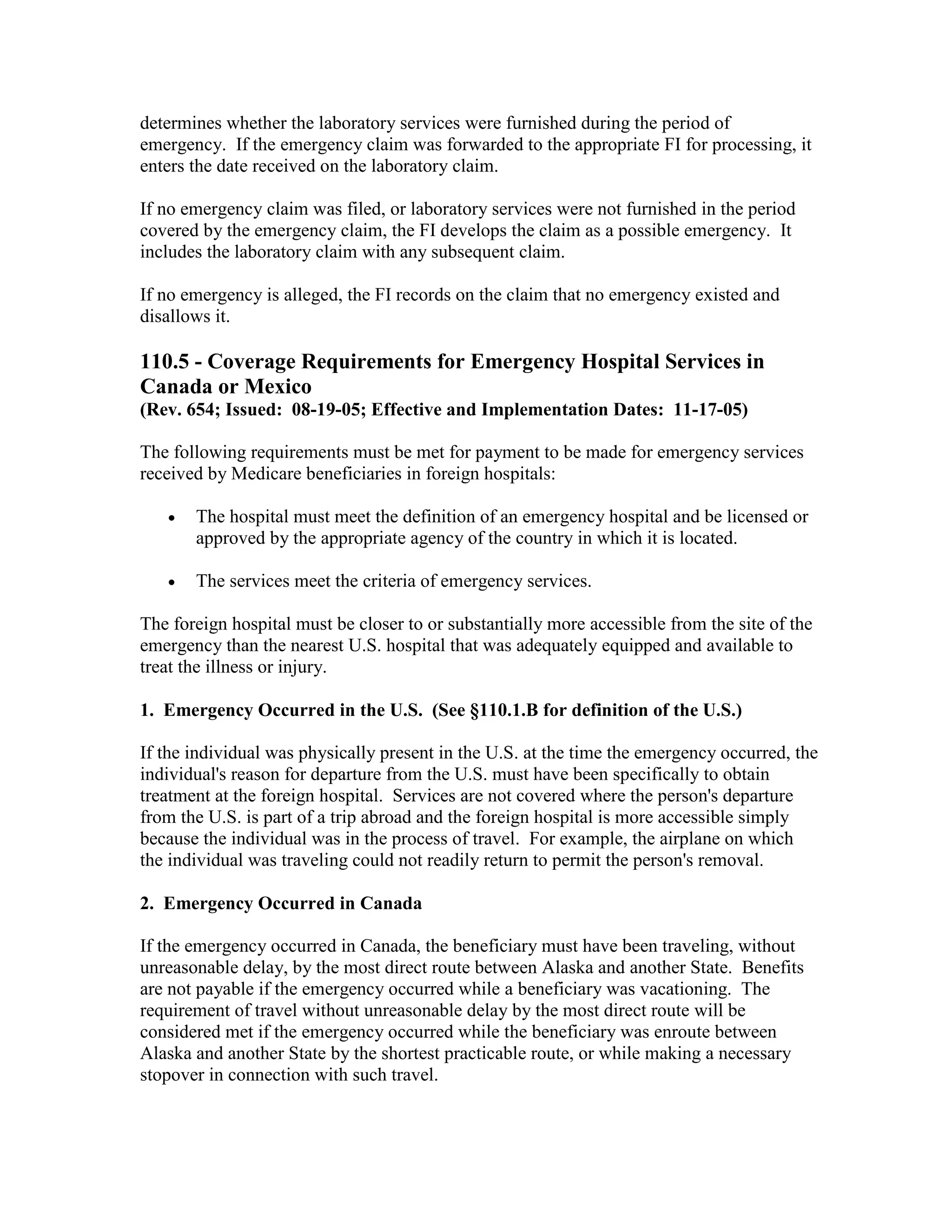

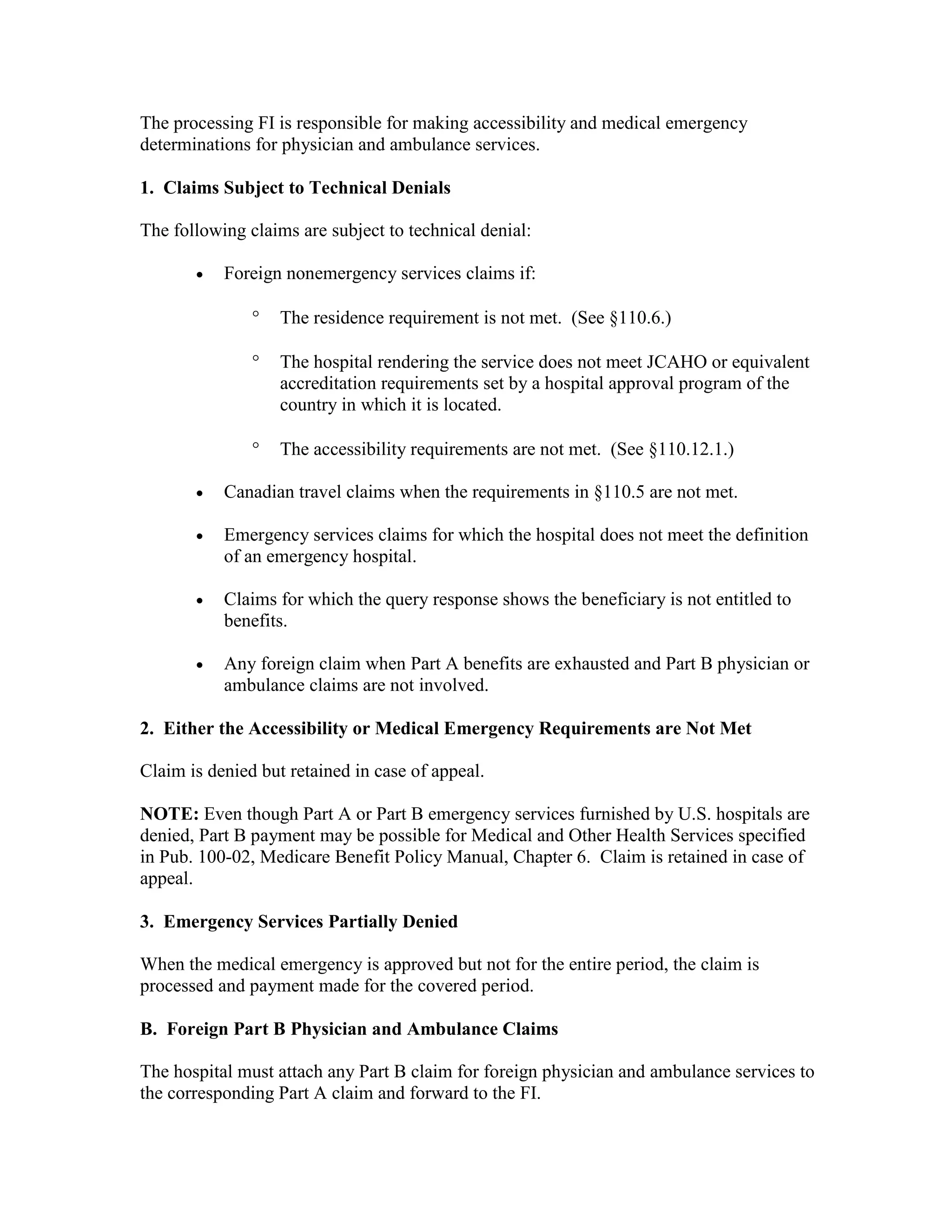

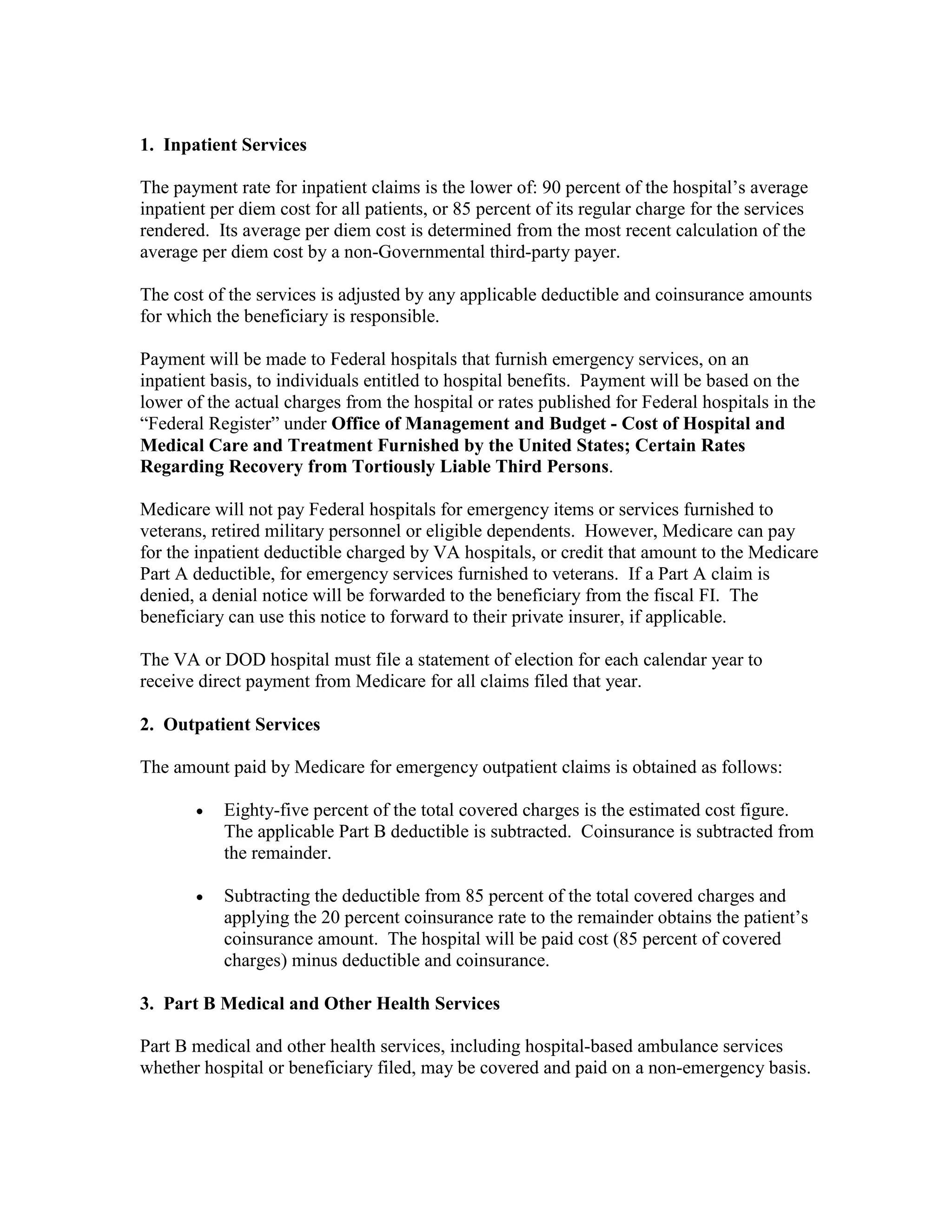

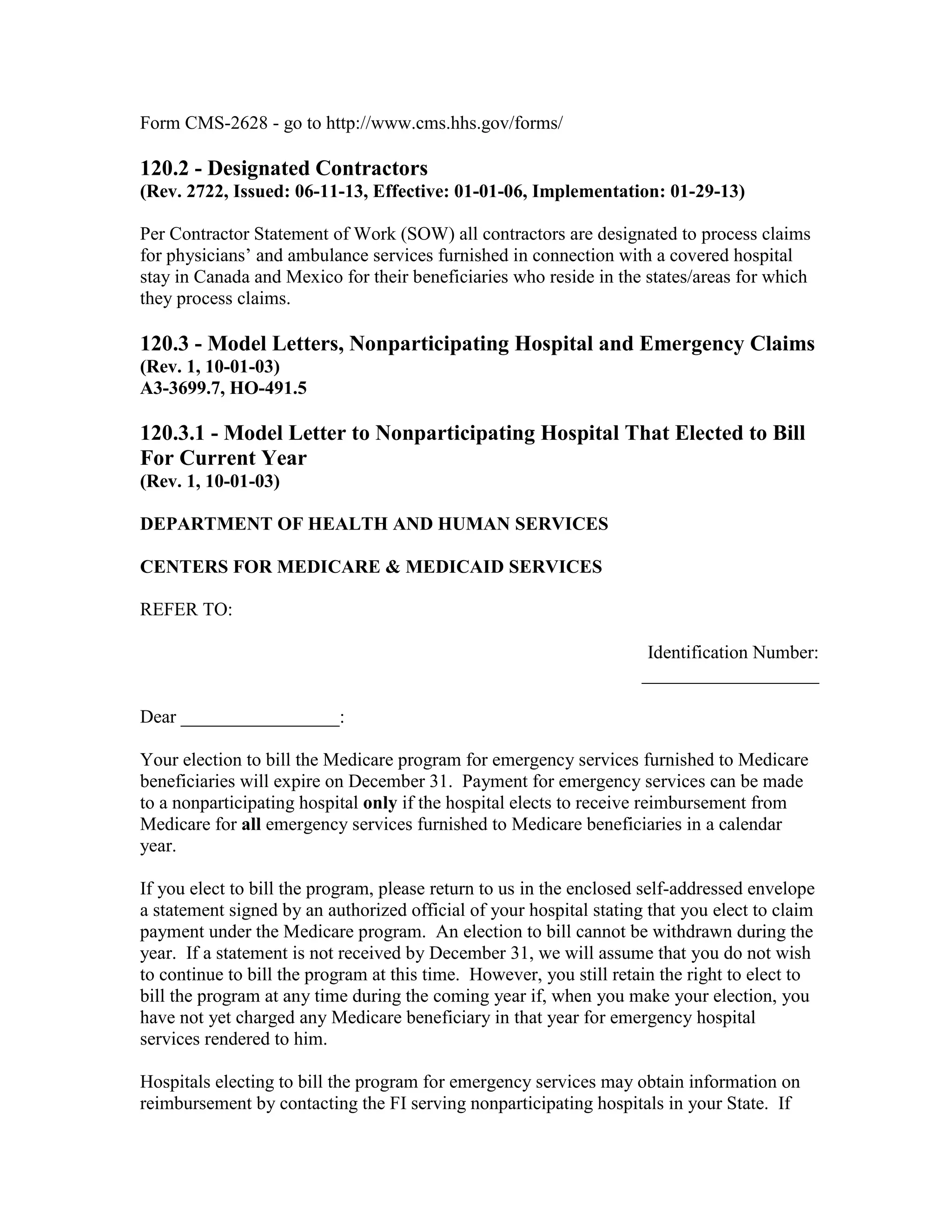

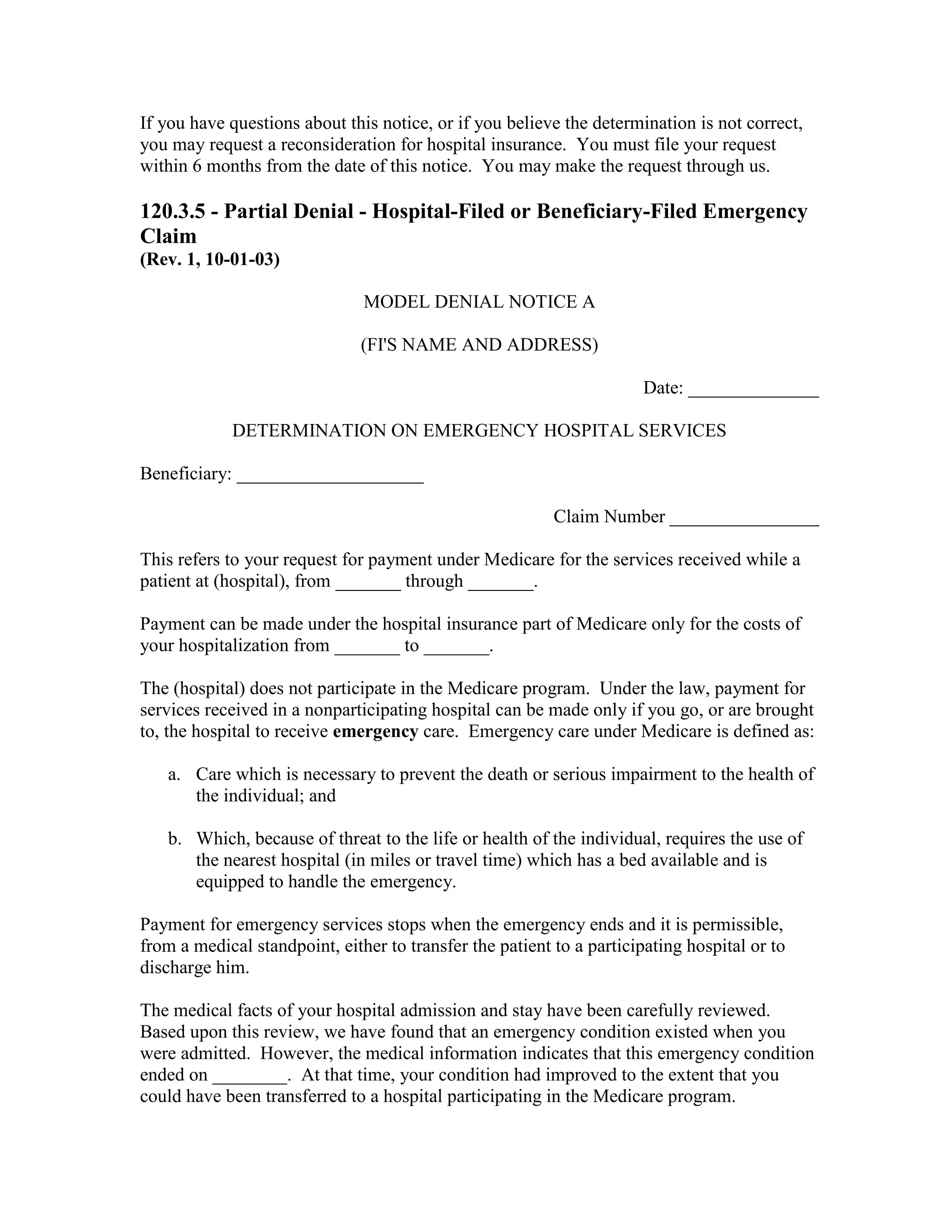

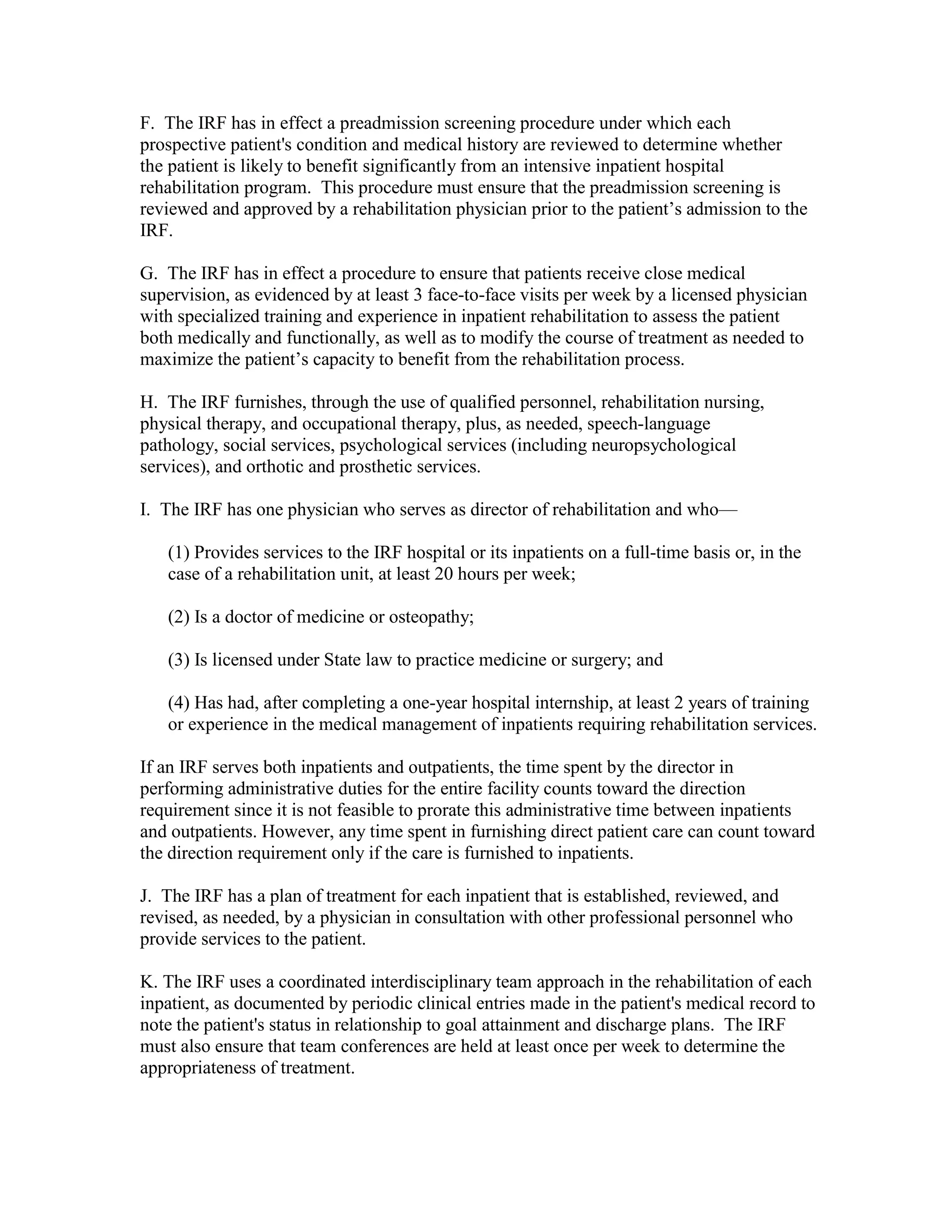

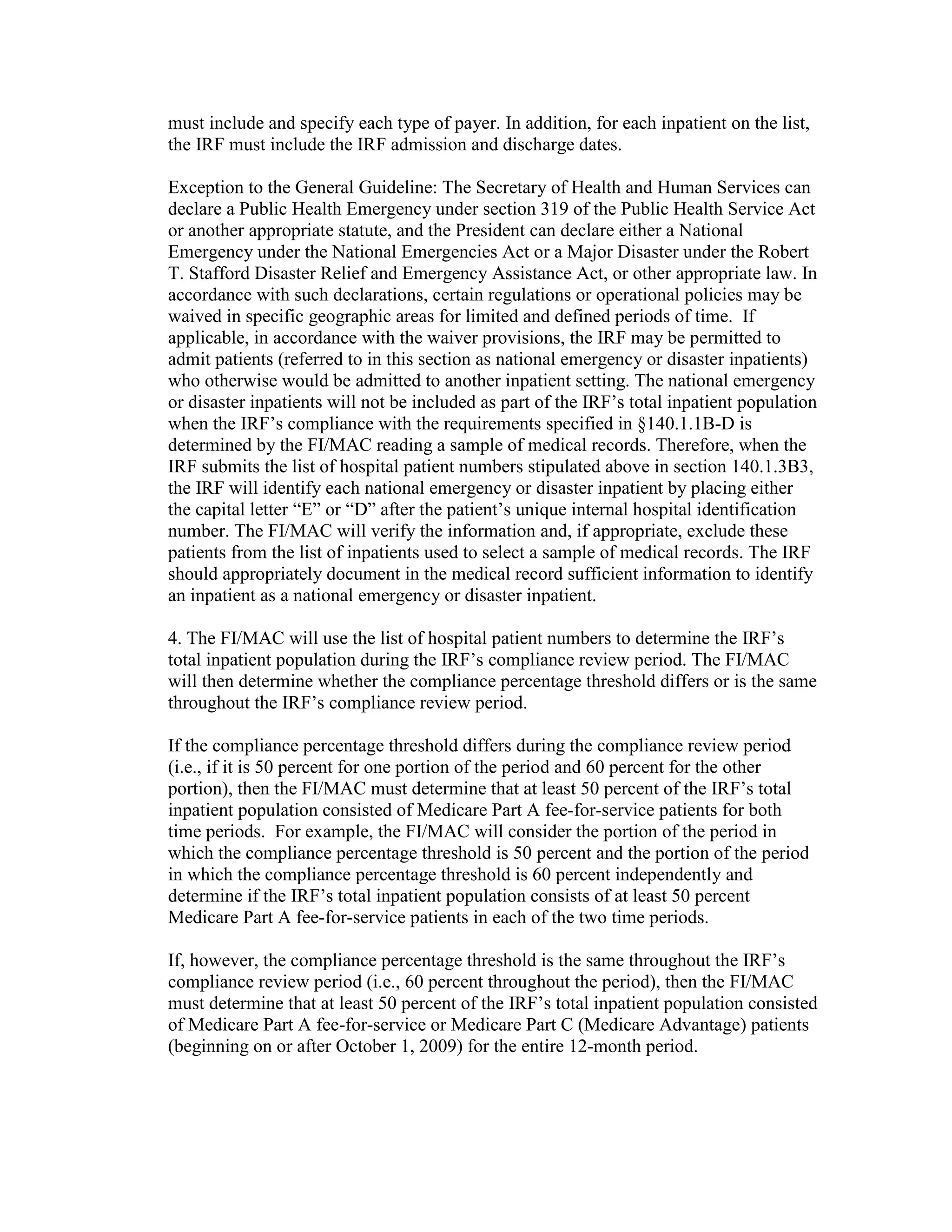

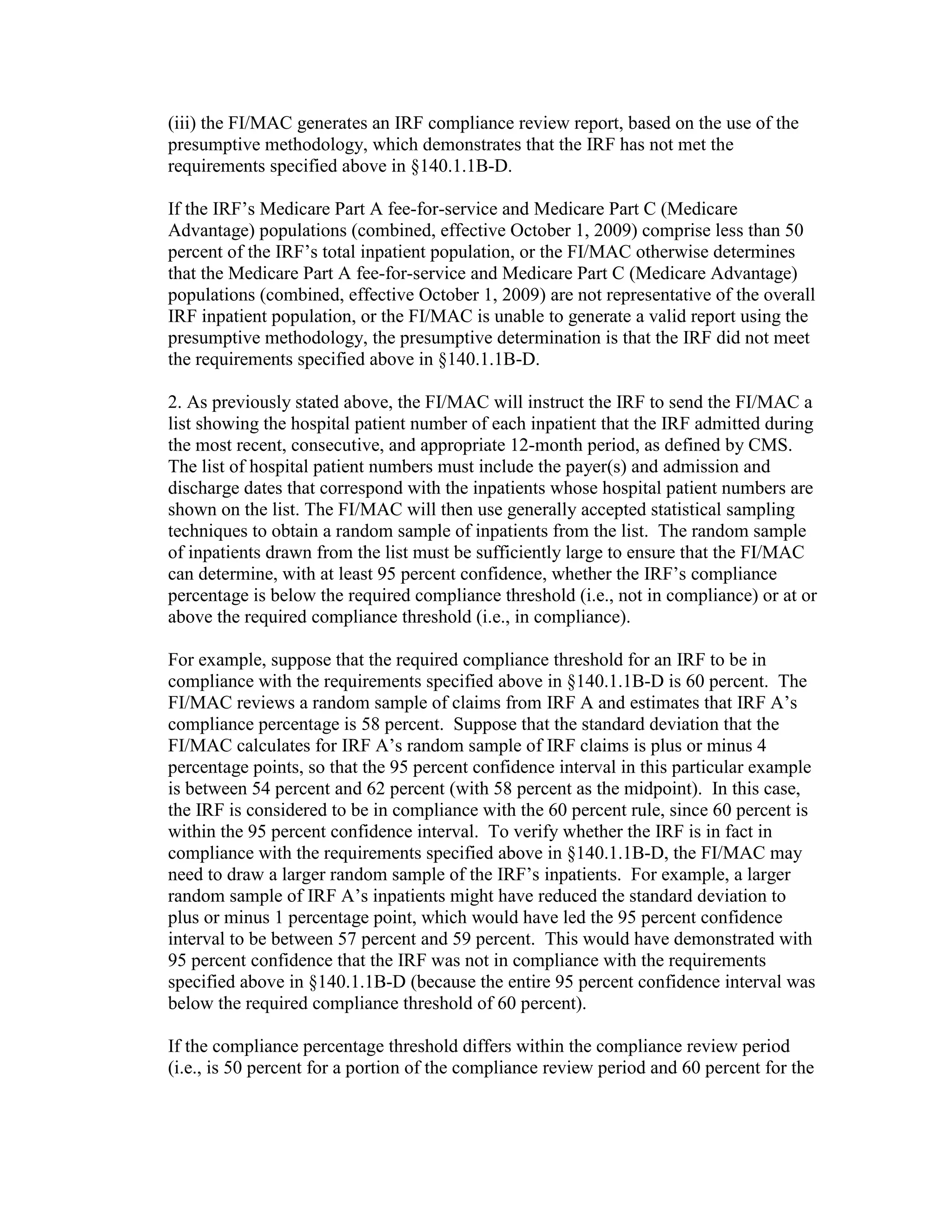

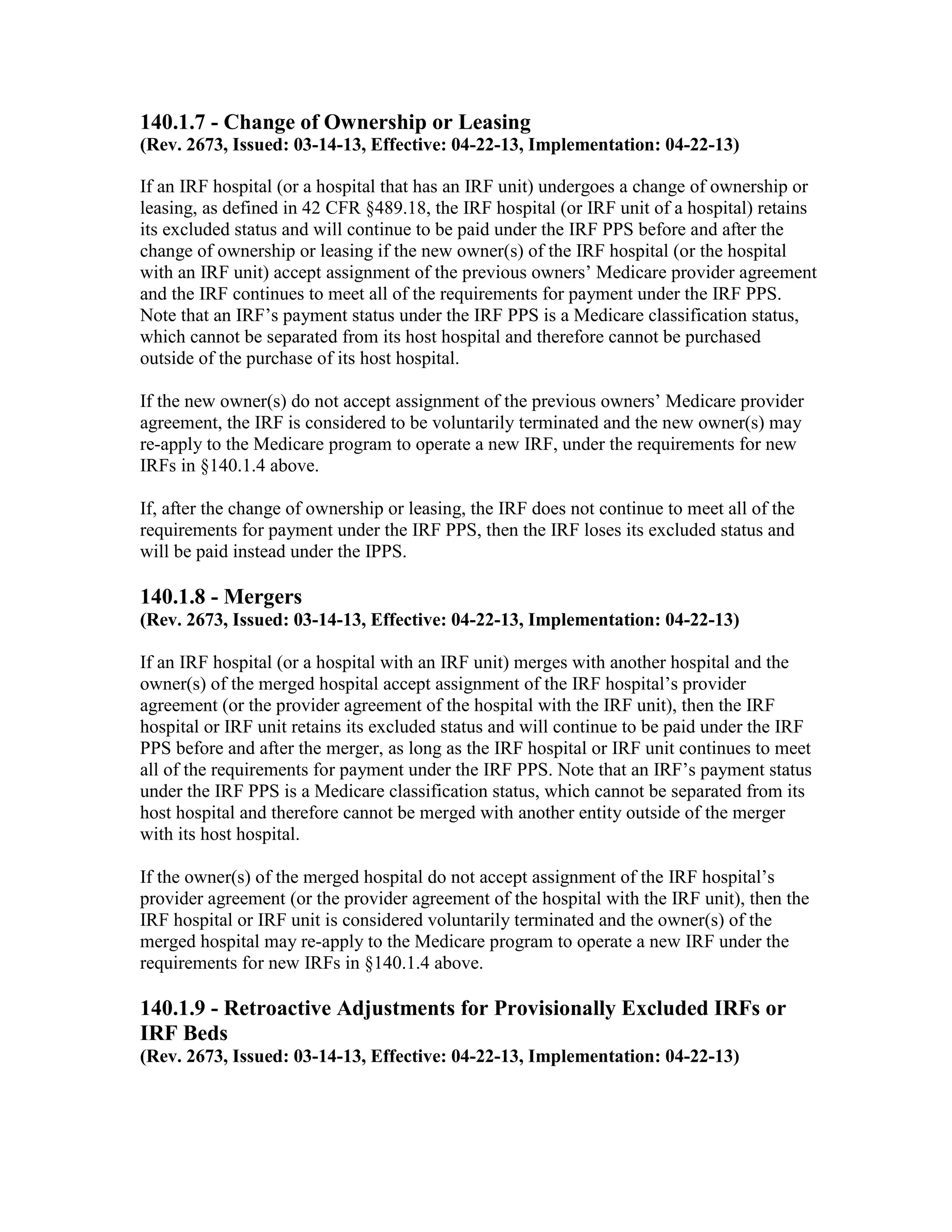

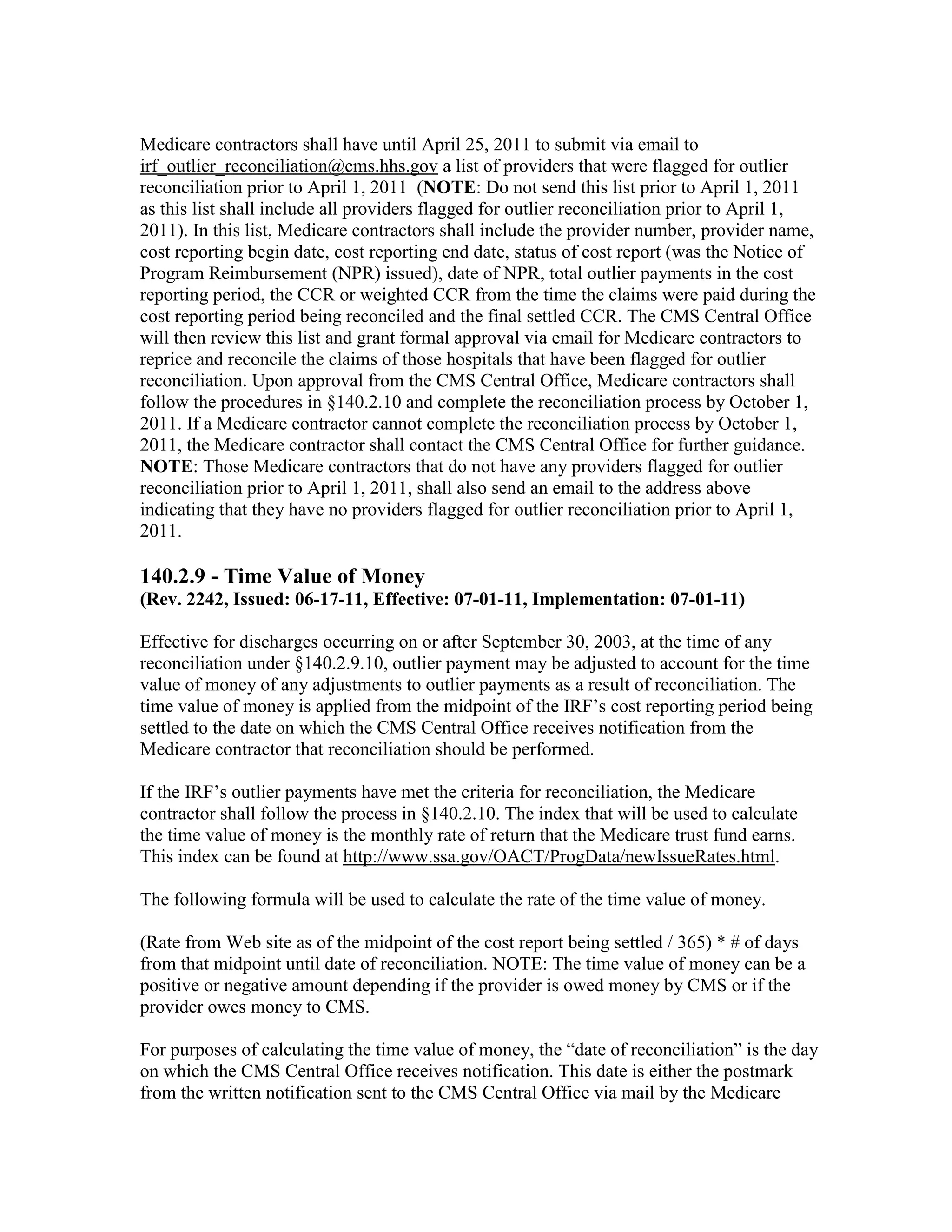

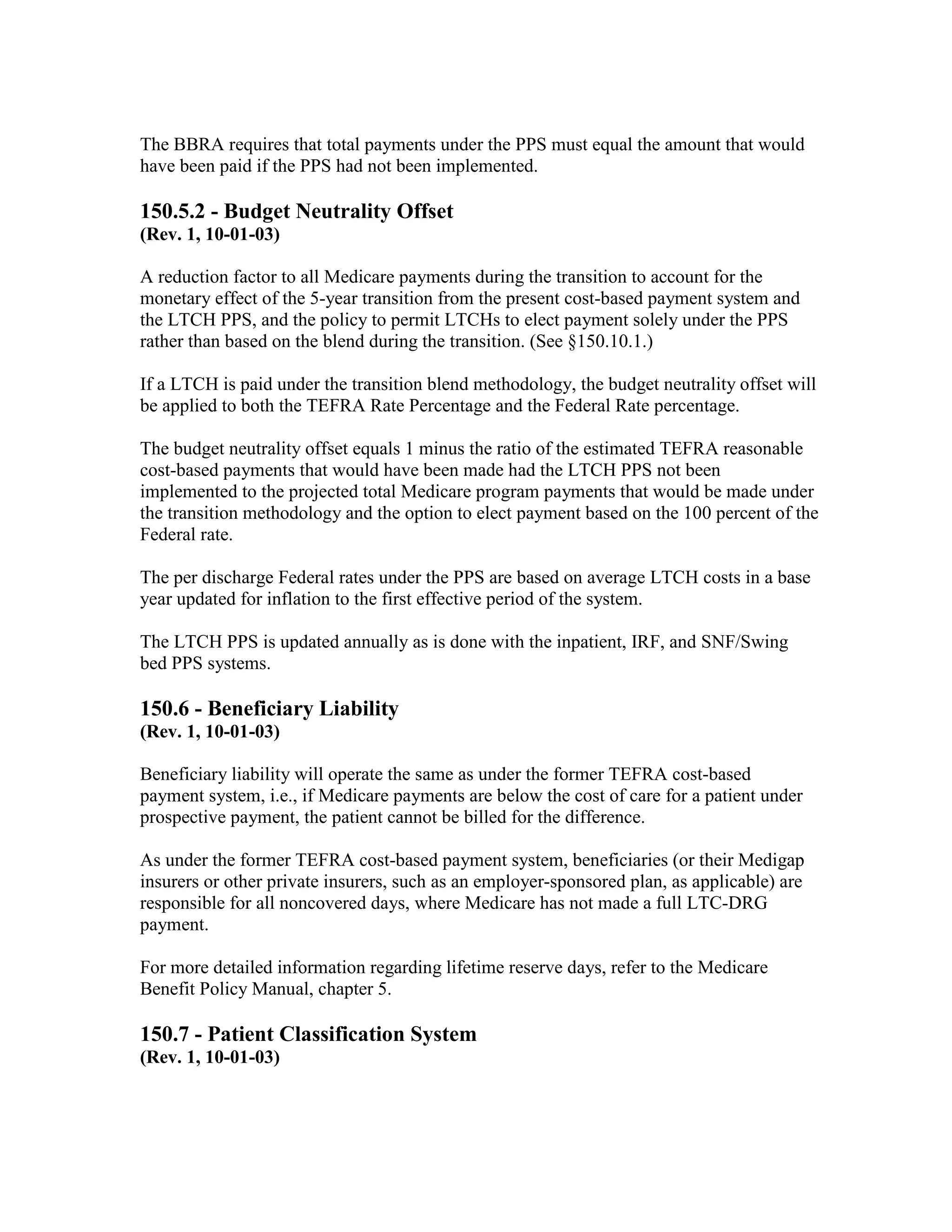

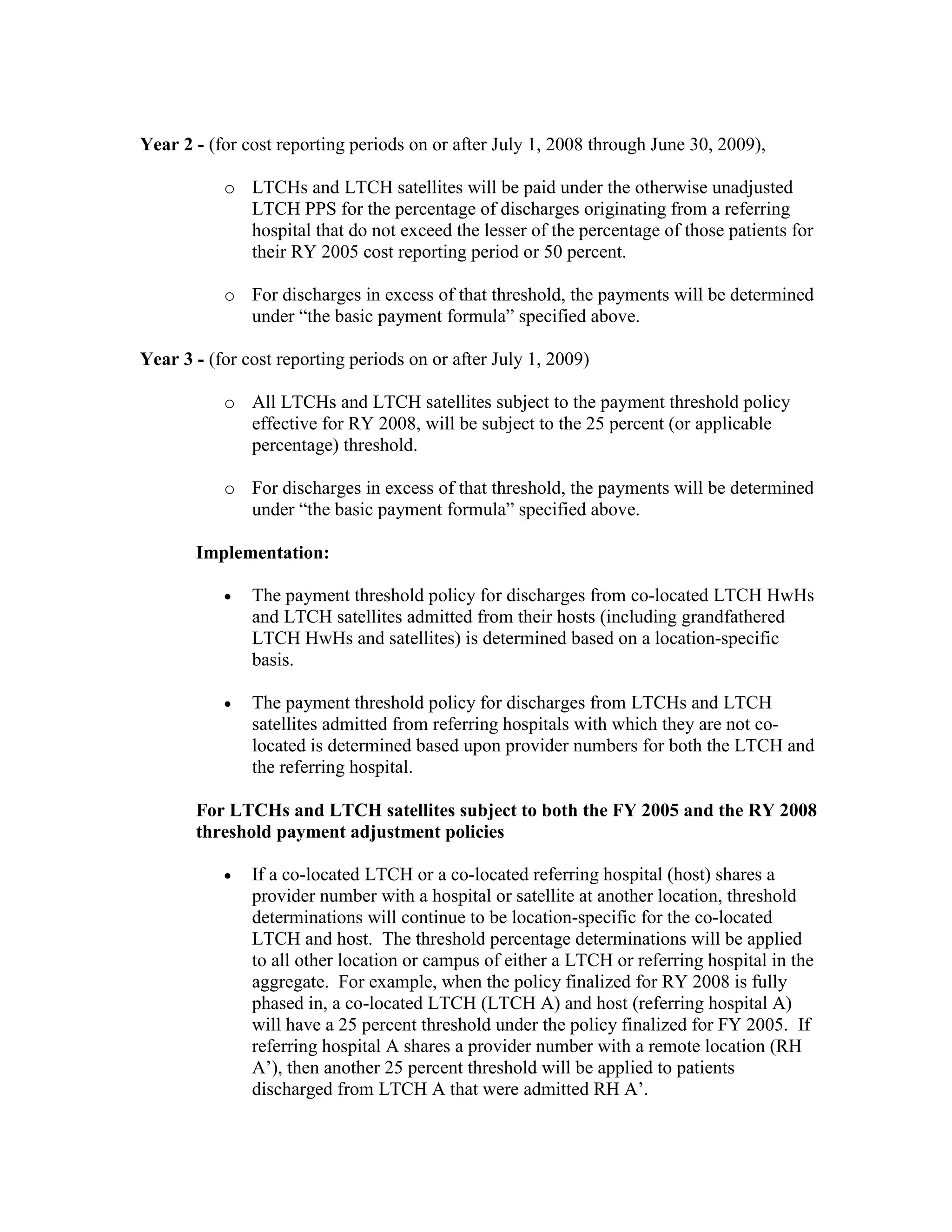

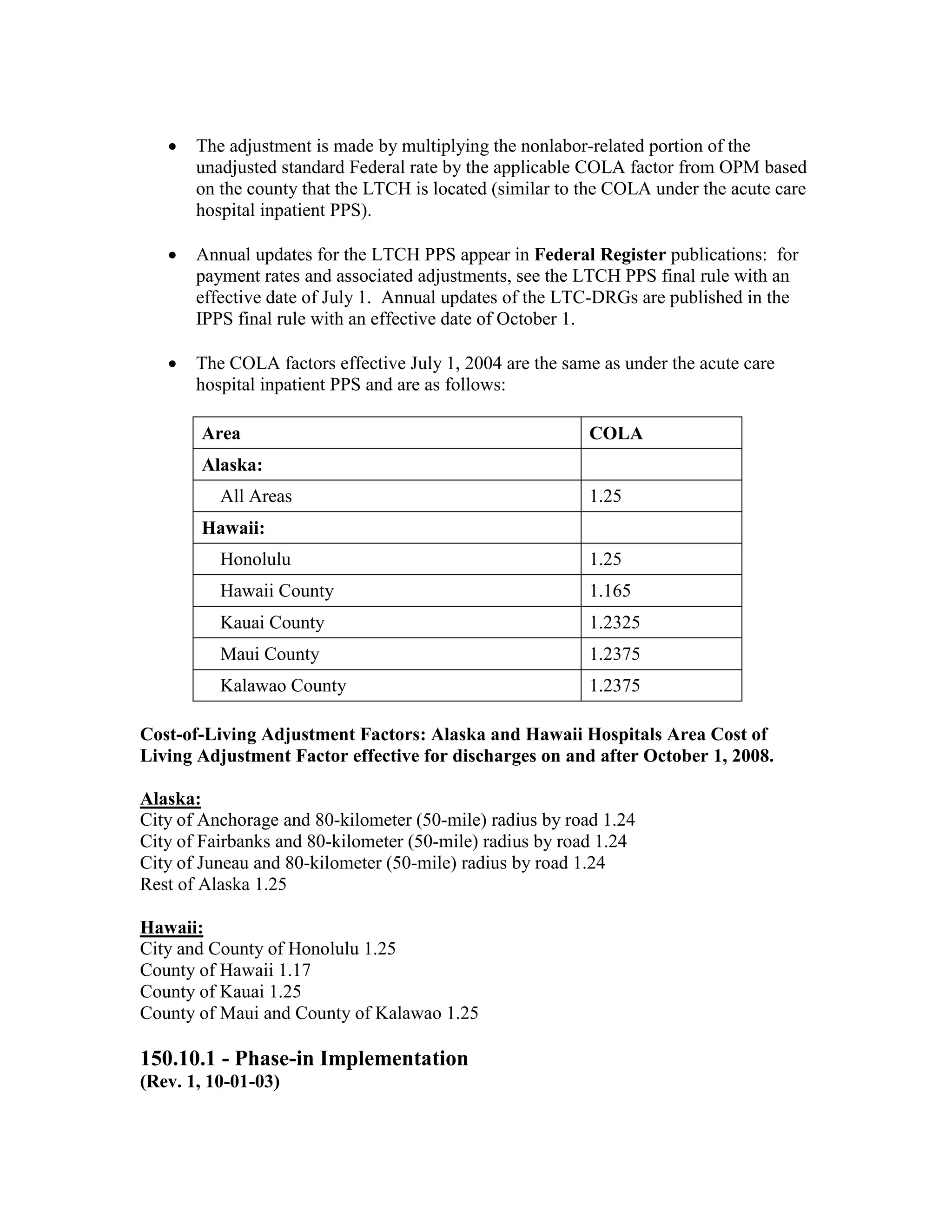

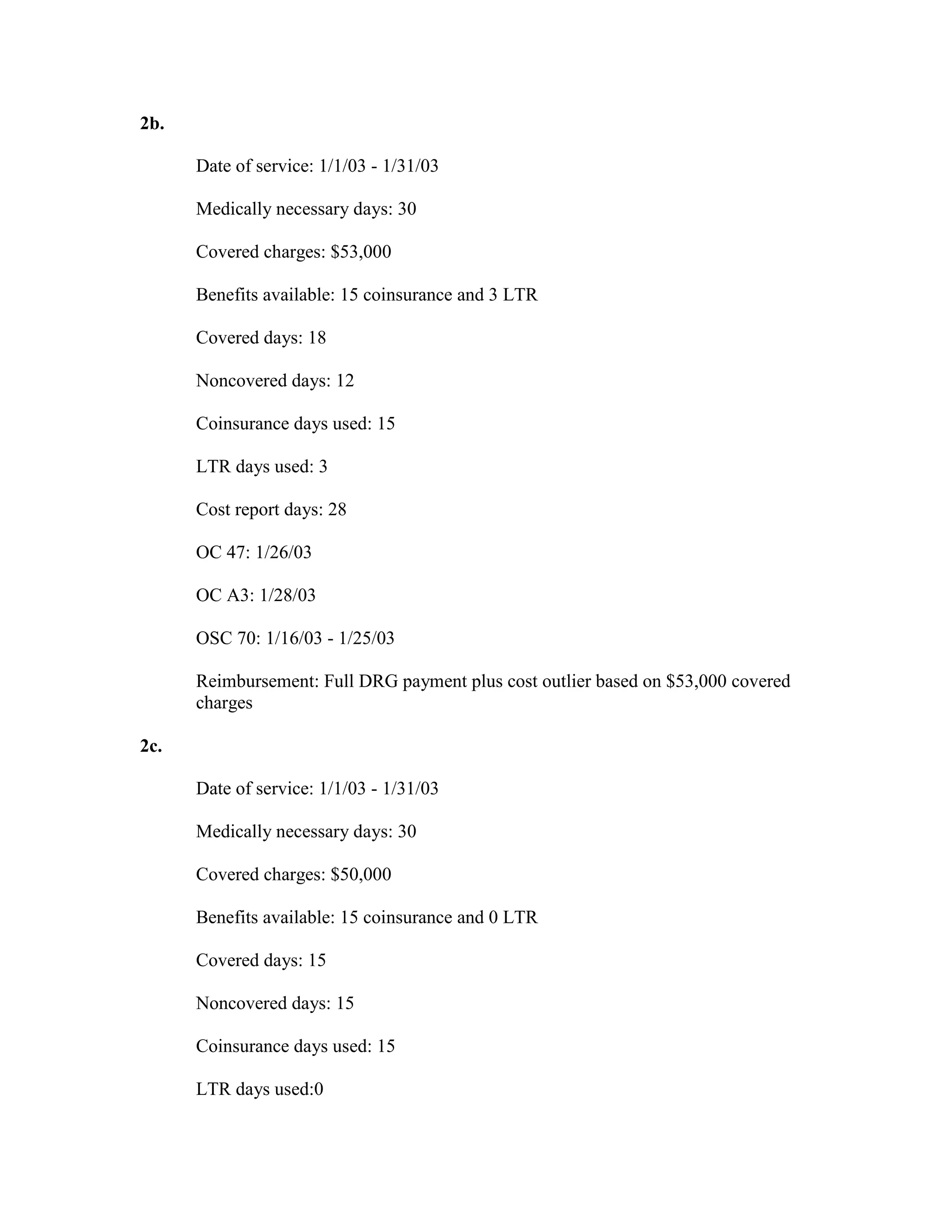

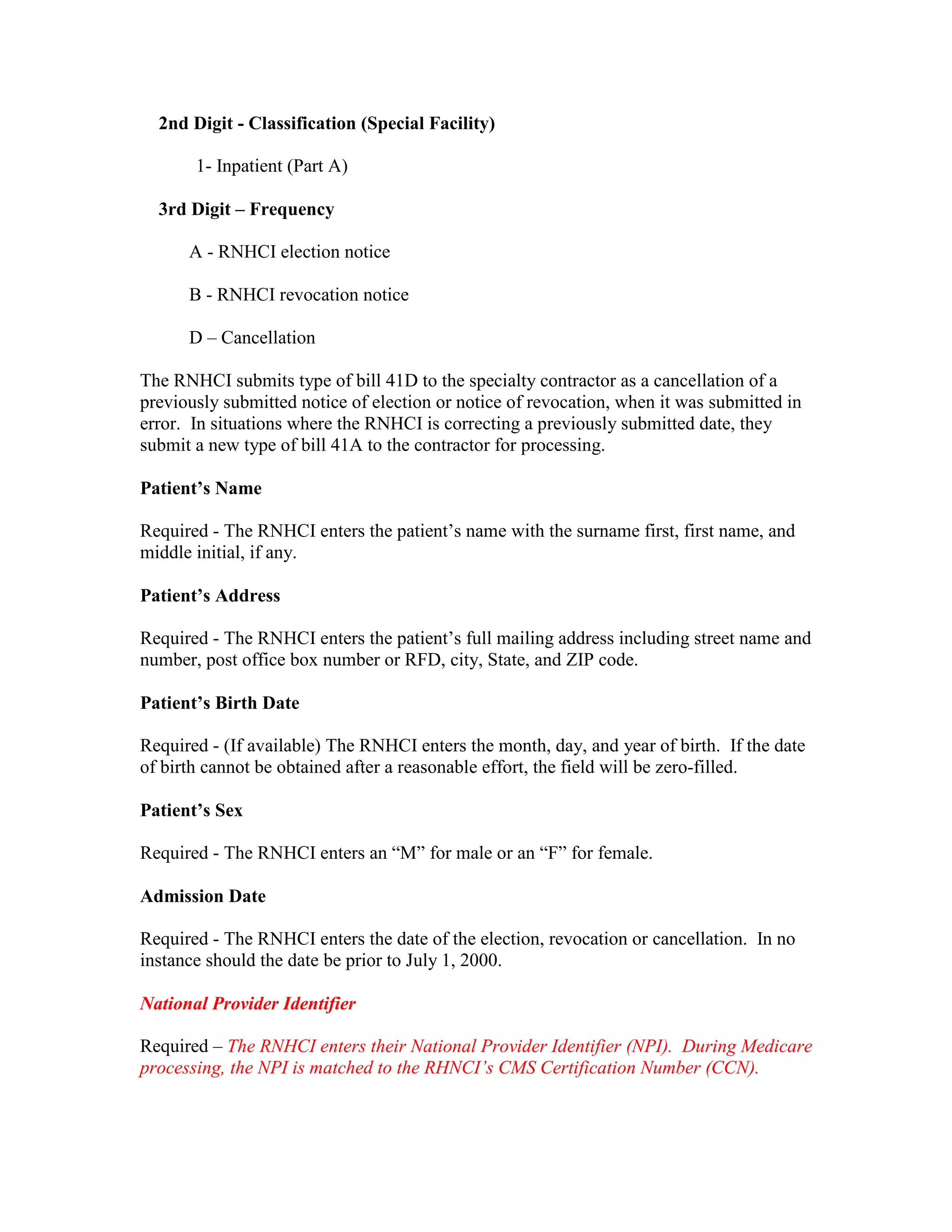

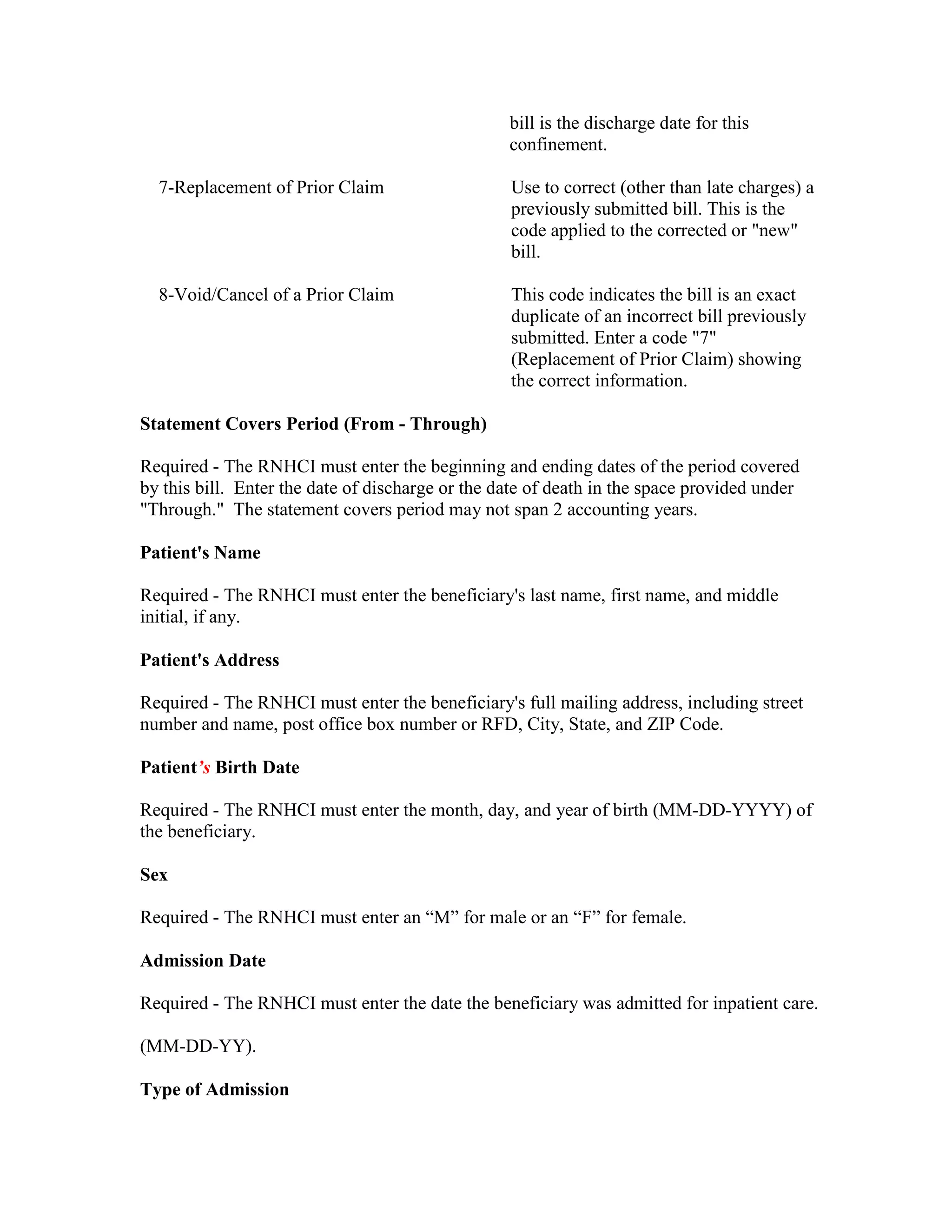

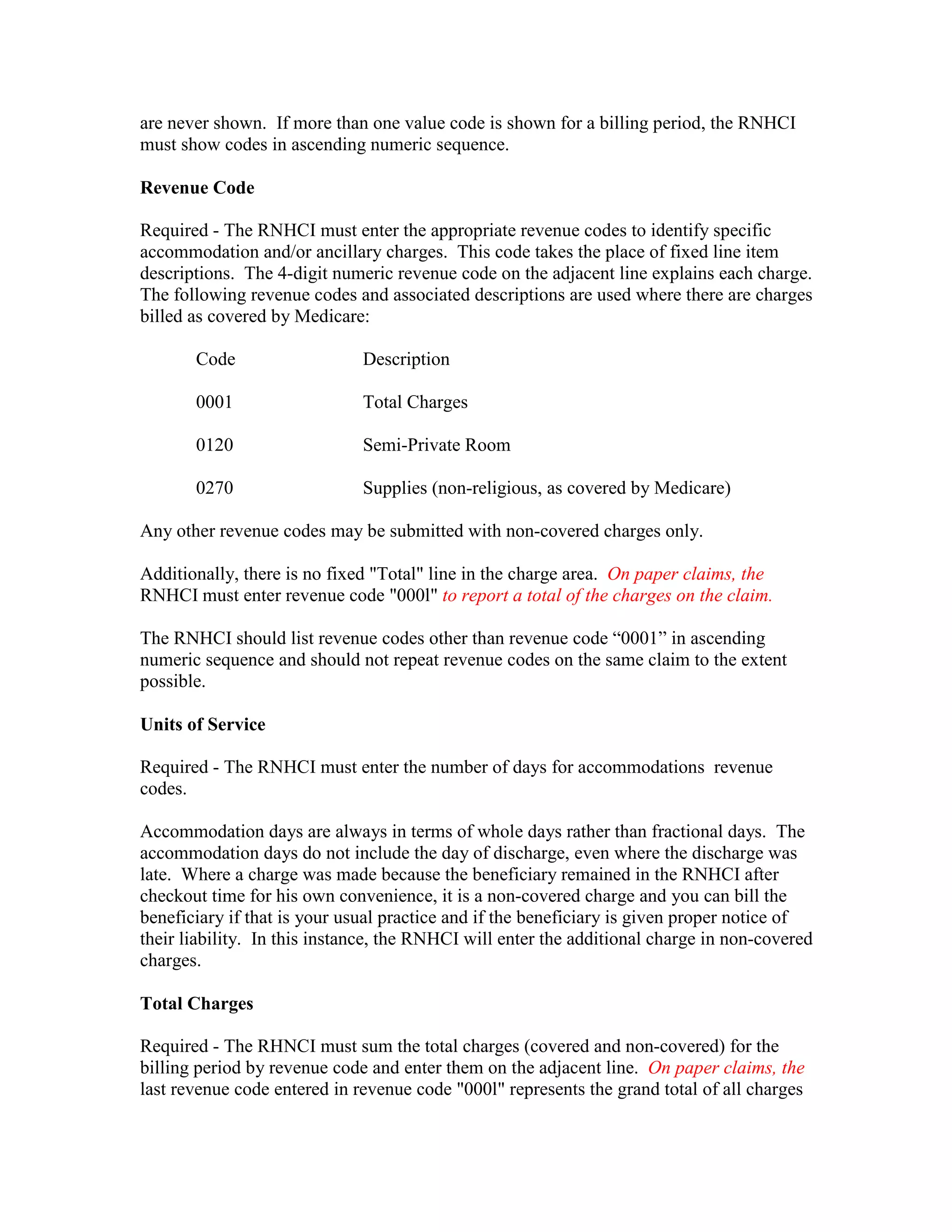

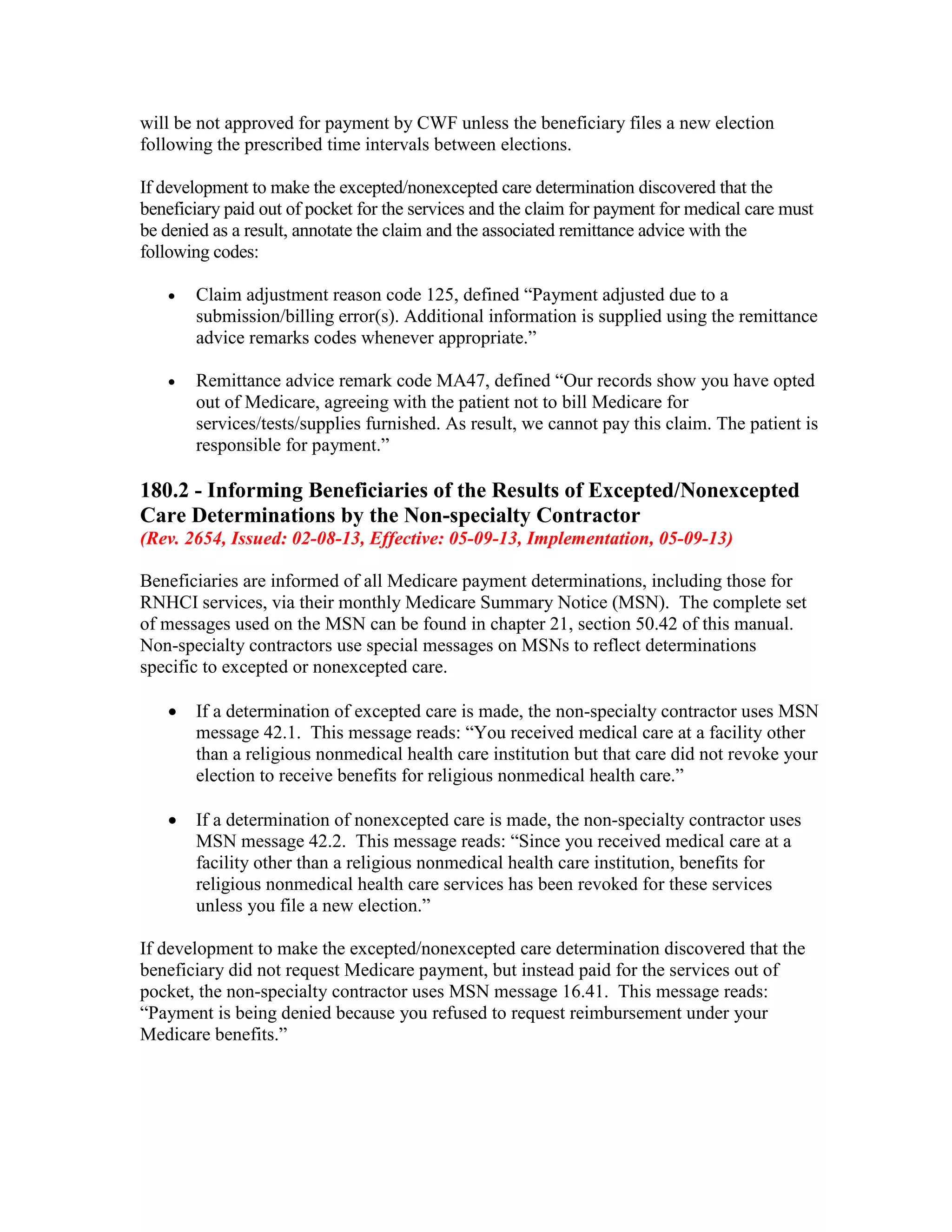

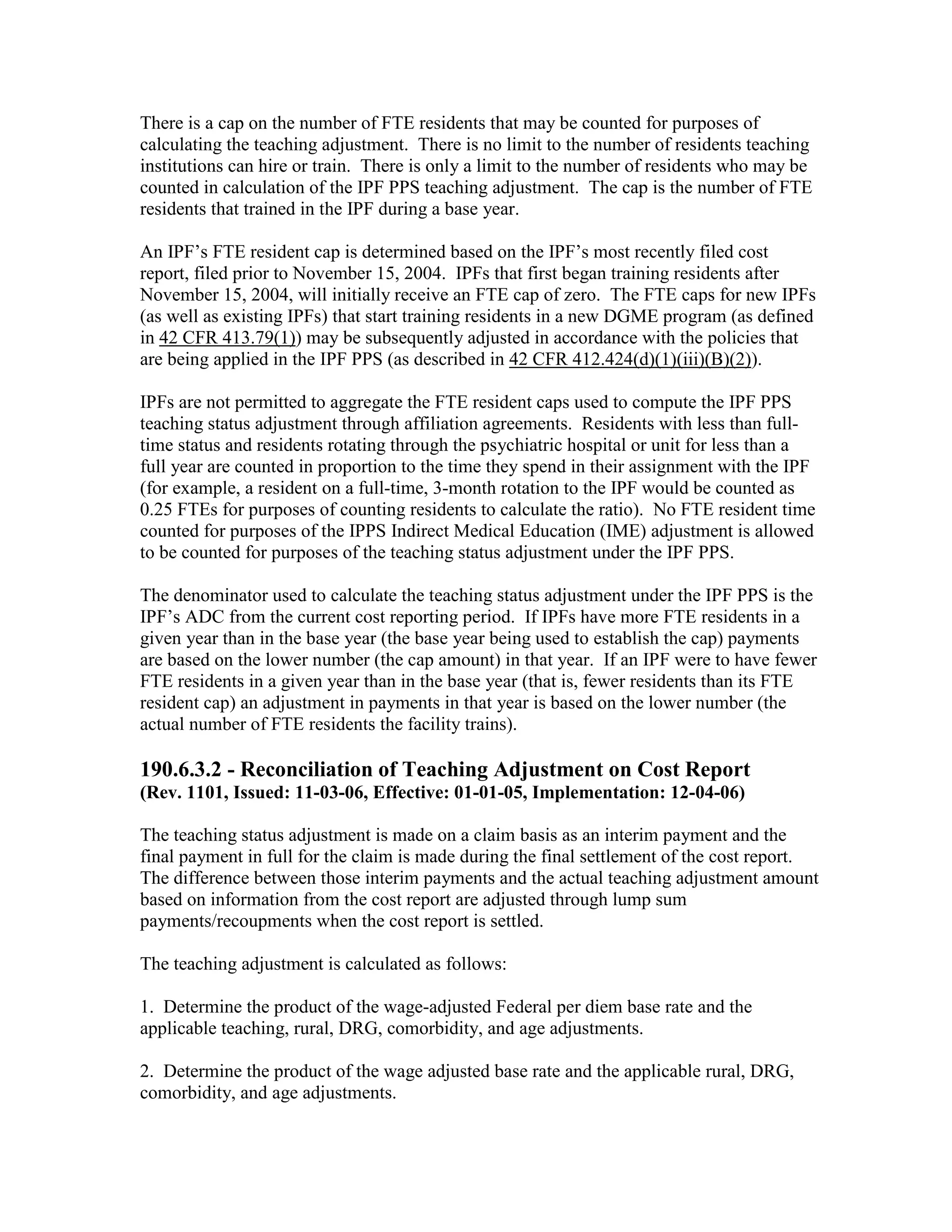

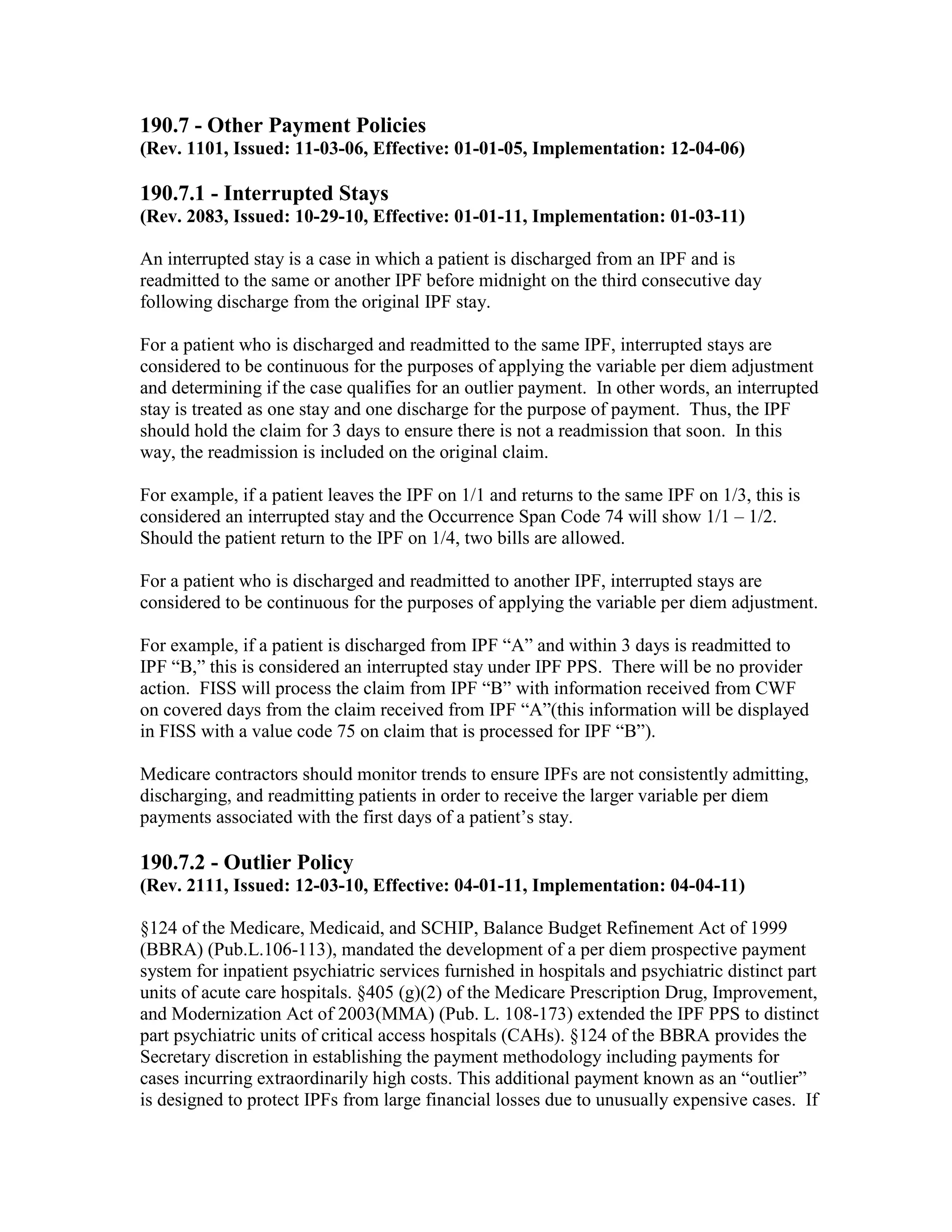

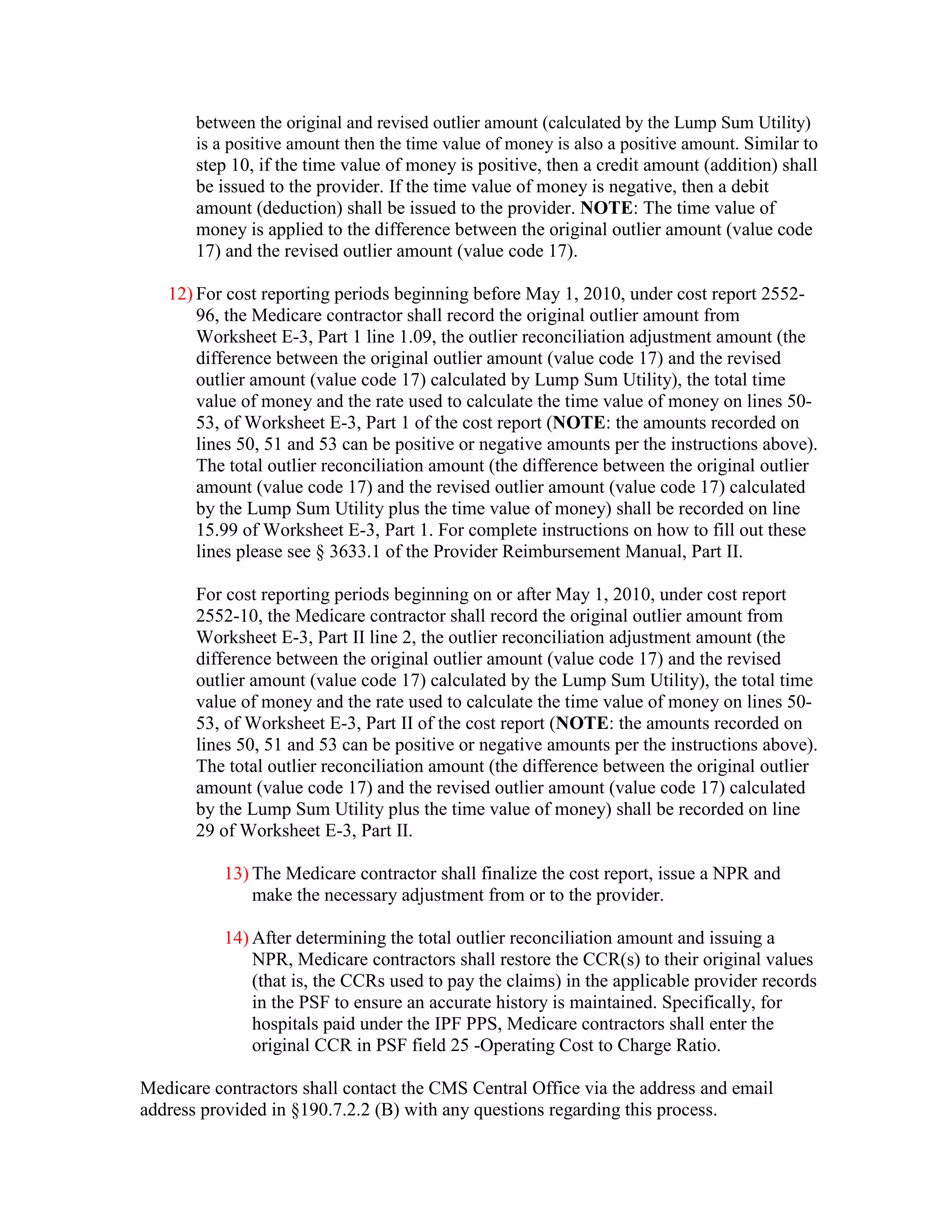

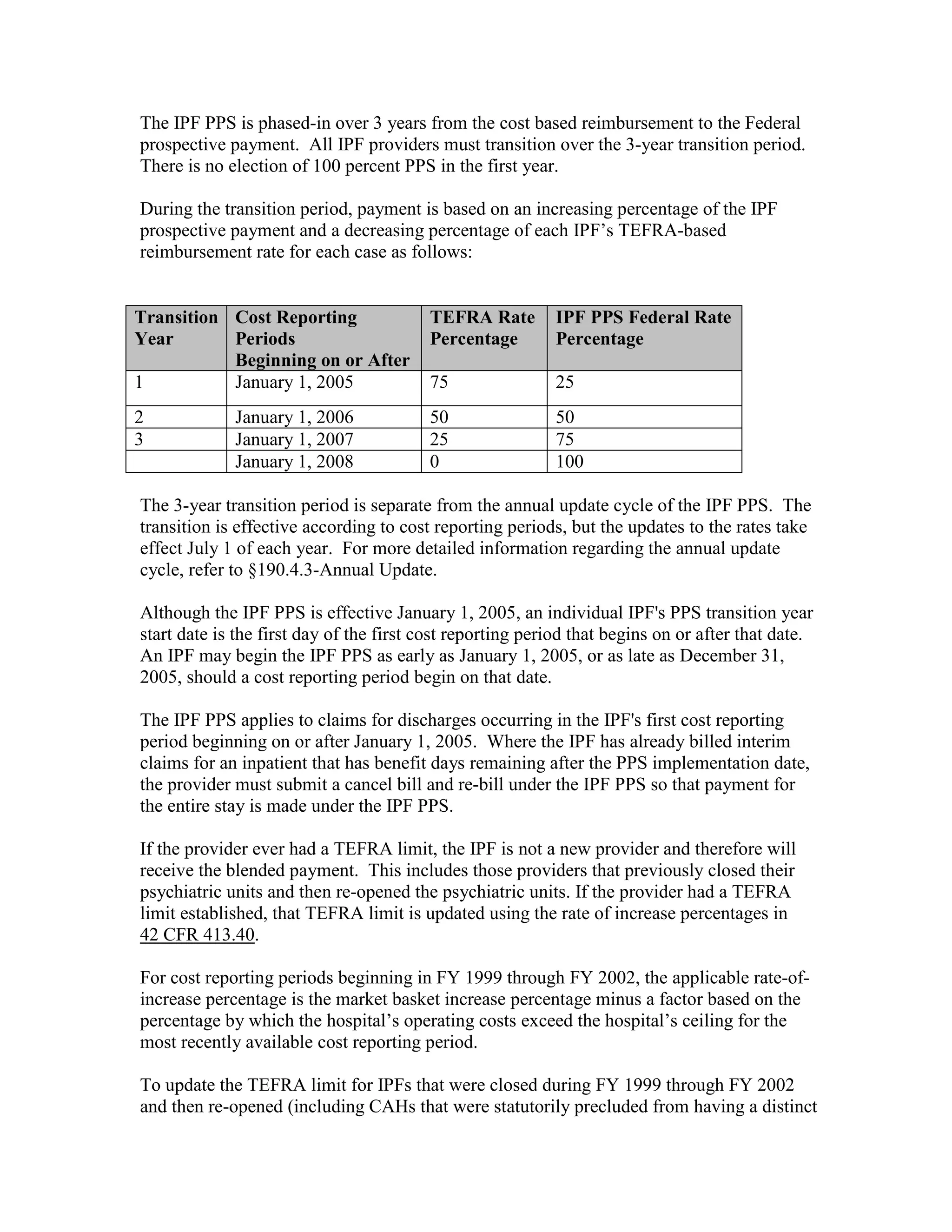

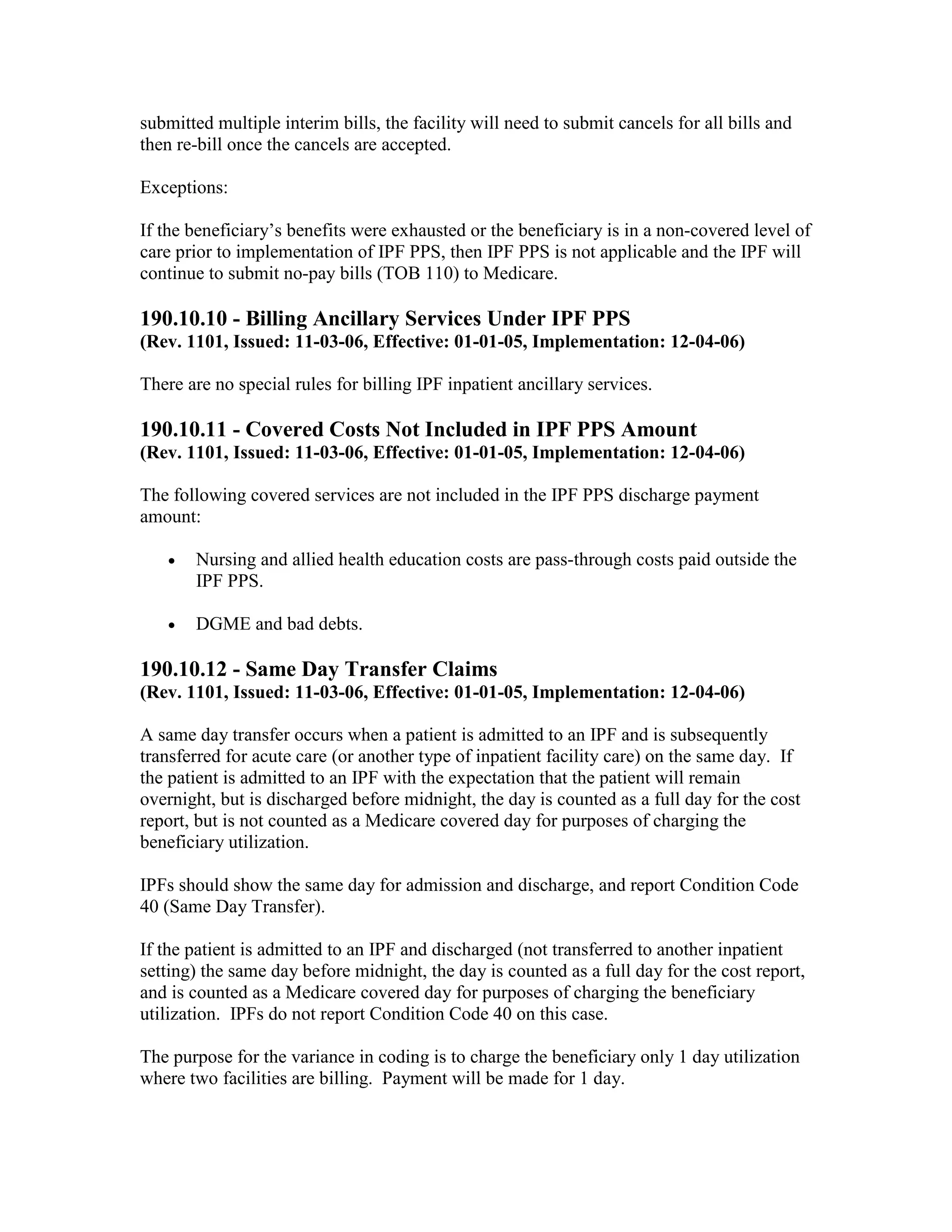

Urban Hospitals

0-99 Beds

100+ Beds (No Change in Law)

Rural Hospitals

Sole Community Hospitals

(SCH)

Rural Referral Centers (RRC)

Both SCH and RRC

Other Rural Hospitals

0-499Beds

Qualifying DSH

Percent

≥15%, <19.3%

≥19.3%

≥15%,<20.2%

≥20.2%

Adjustment Computation

≥15%, <19.3%

≥19.3%,<30%

≥30%

≥15%,<19.3%

≥19.3%,<30%

≥30%

≥15%

2.5% + [.65 x (DSH pct.-15%)]

5.25%

10%

2.5% + [.65 x (DSH pct.-15%)]

5.25%

5.25% + [.6 x (DSH pct.-30%)]

higher of SCH or RRC adjustment

2.5% + [.65 x (DSH pct.-15)]

5.25%

2.5% + [.65 x (DSH pct.-15%)]

5.88% + [.825 x (DSH pct.-20.2%)]

≥15%,<19.3%

2.5% + [.65 x (DSH pct.-15%)]

≥19.3%

5.25%

500+ Beds (No Change in

≥15%,<20.2%

2.5% + [.65 x (DSH pct.-15%)]

Law)

≥20.2%

5.88% + [.825 x (DSH pct. -20.2%)]

These new rates as well as changes to the DSH adjustments are incorporated into Pricer

01.2. The formulas are spelled out in the statute.

20.3.3 – Prospective Payment Changes for Fiscal Year (FY) 2003

(Rev. 1, 10-01-03)

A-02-084

The PPS changes for FY2003 were published in the Federal Register on August 1, 2002.

All changes are effective for hospital discharges occurring on or after October 1, 2002,

unless otherwise noted.

ICD-9-CM coding changes are effective October 1, 2002. The new ICD-9-CM codes are

listed, along with their diagnosis-related group (DRG) classifications in Tables 6a and 6b

in the final rule for PPS changes for FY 2003. The ICD-9-CM codes that have been

replaced by expanded codes or other codes, or have been deleted are included in Tables 6c

and 6d. The revised code titles are in Tables 6e and 6f of the same final rule. GROUPER

20.0 assigns each case into a DRG on the basis of the diagnosis and procedure codes and

demographic information (that is age, sex, and discharge status) and is effective with

discharges occurring on or after October 1, 2002. Medicare Code Editor (MCE) 19.0 and

Outpatient Code Editor (OCE) versions 18.0 and 3.20 use the new ICD-9-CM codes to

validate coding for discharges and outpatient services effective October 1, 2002.

Additional changes for FY 2003 are:](https://image.slidesharecdn.com/medicareclaimsprocessingmanual-131226001413-phpapp01/75/Medicare-claims-processing-manual-80-2048.jpg)

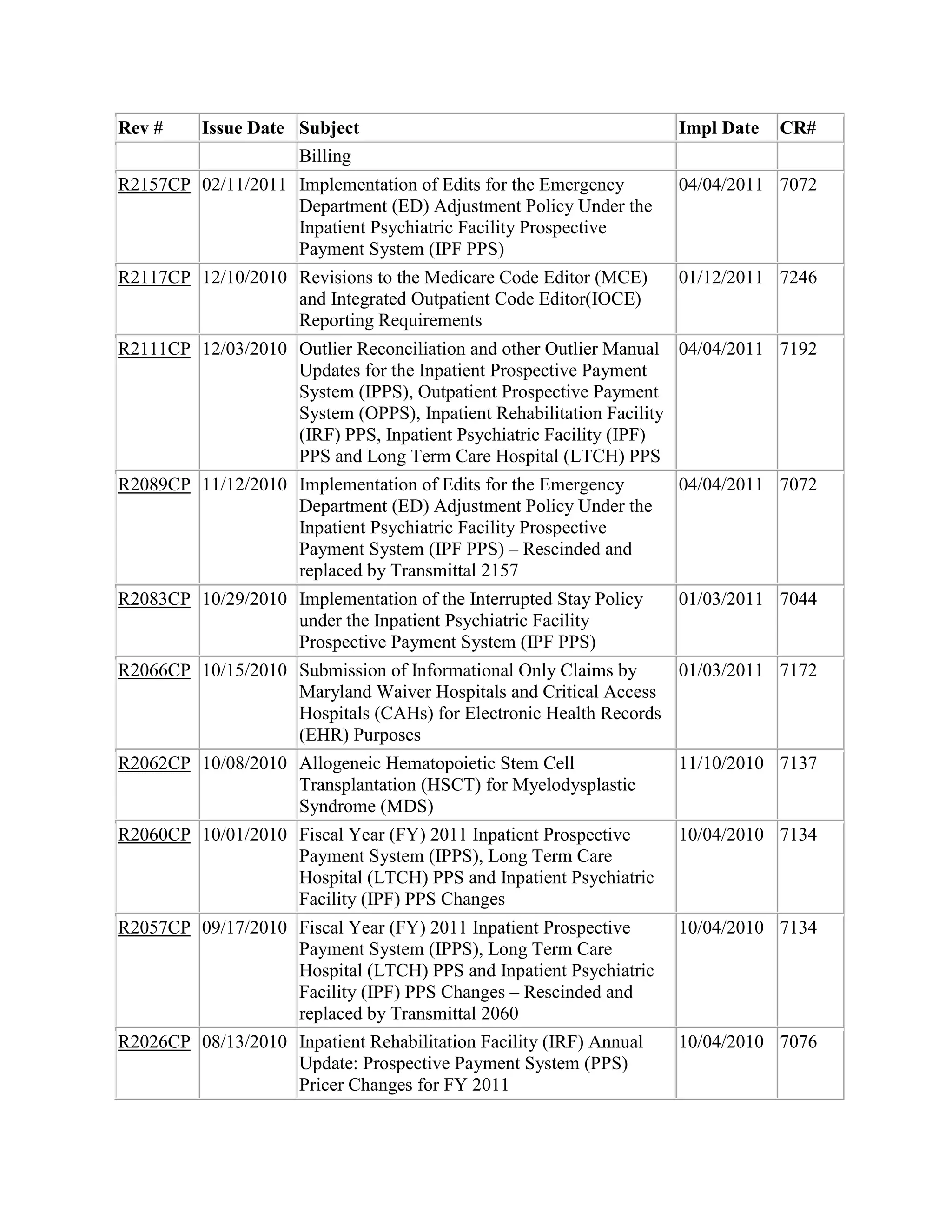

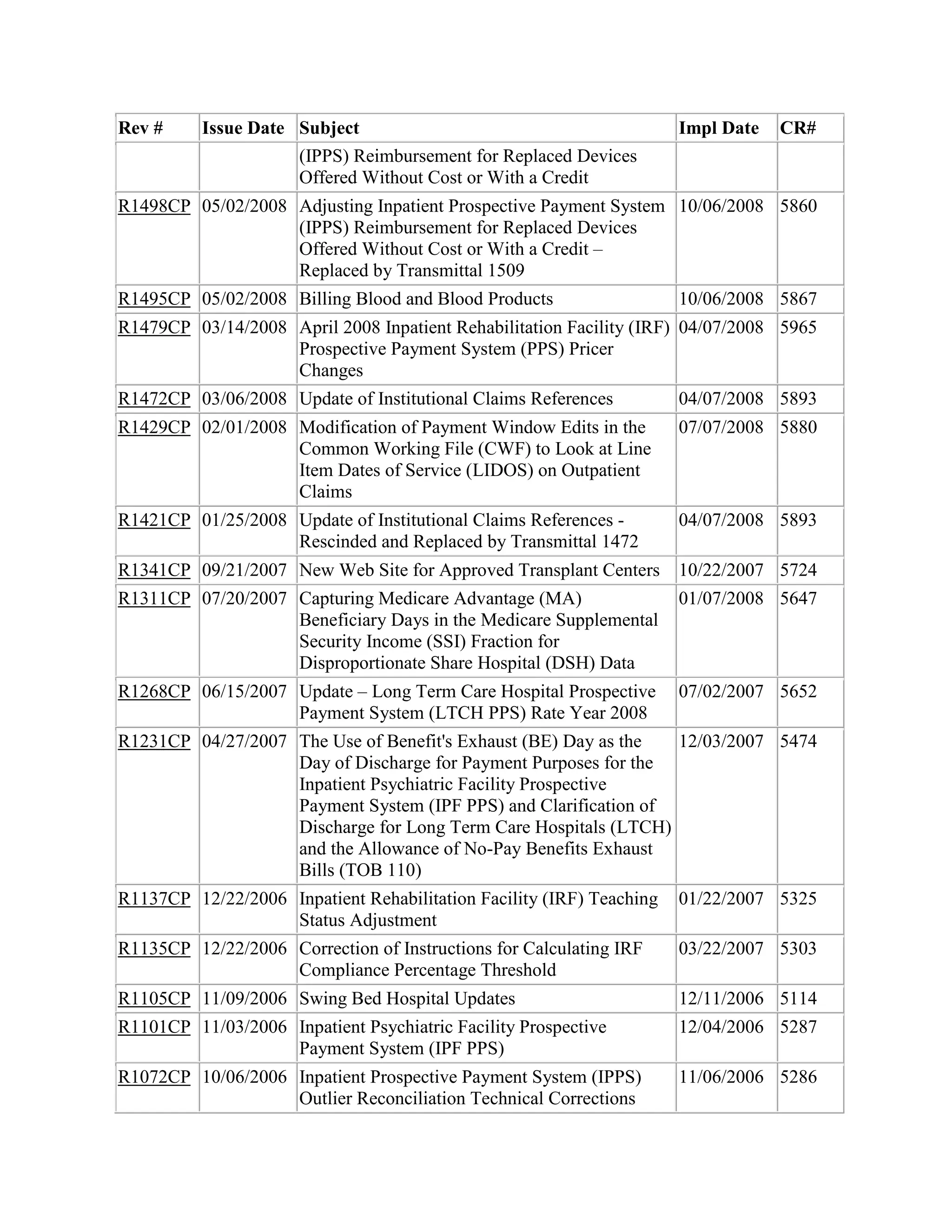

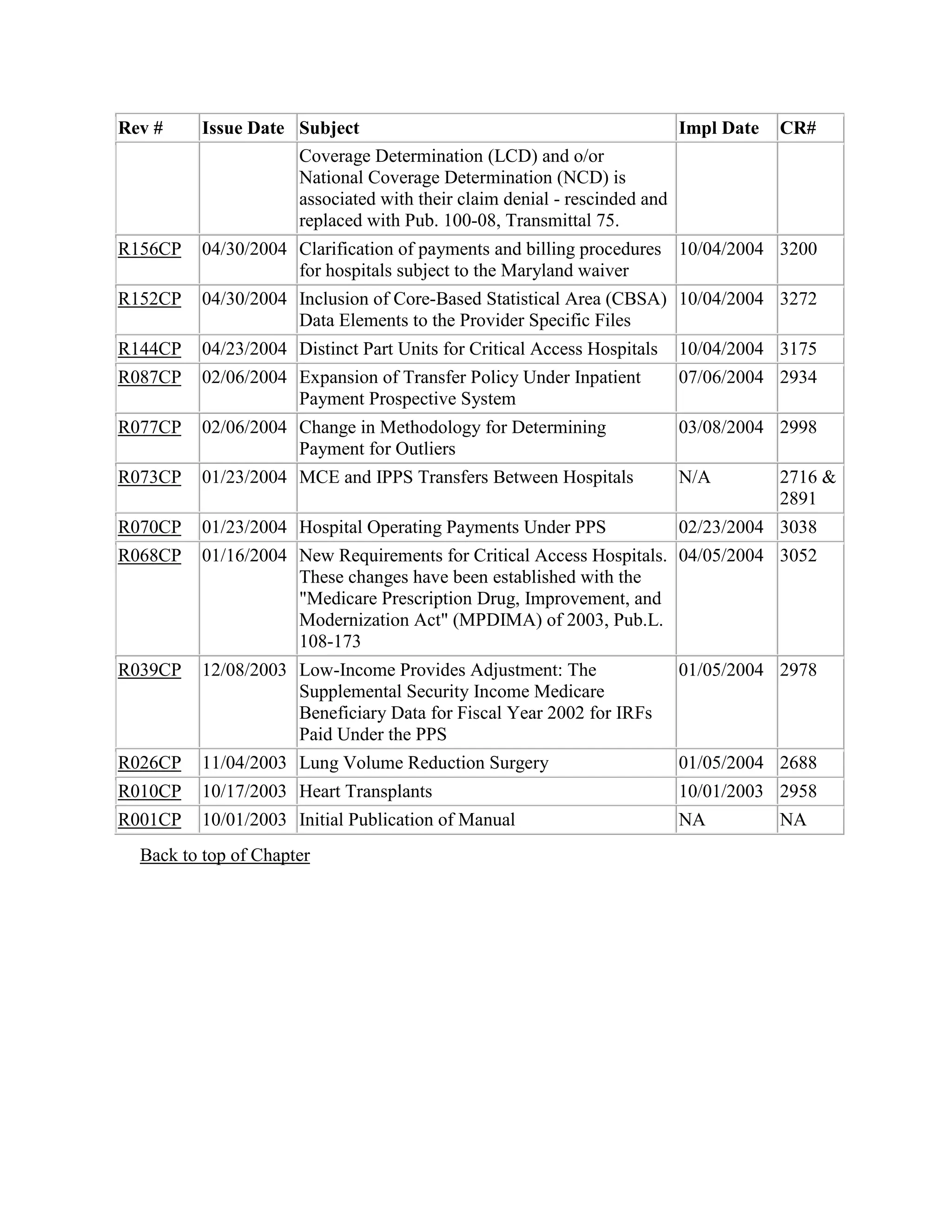

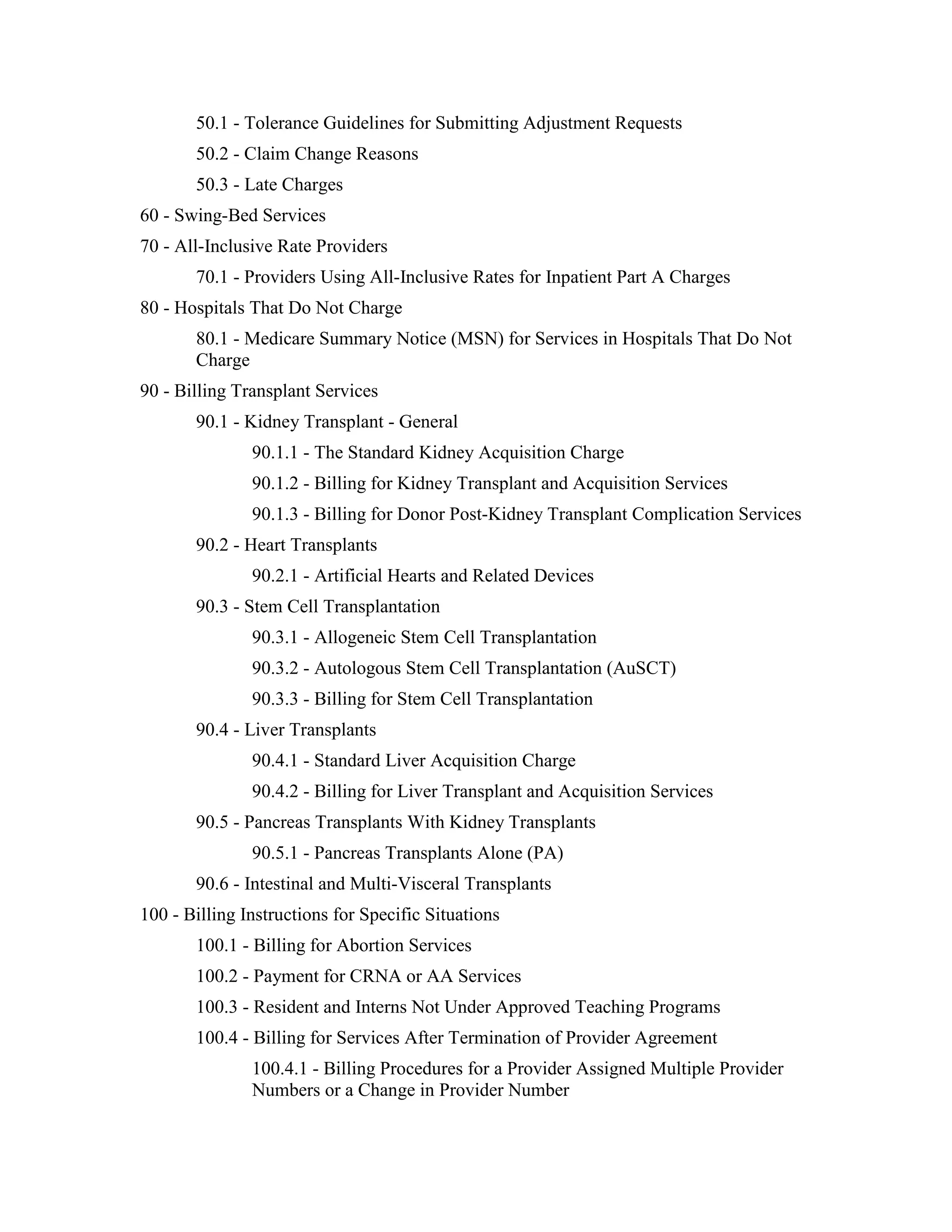

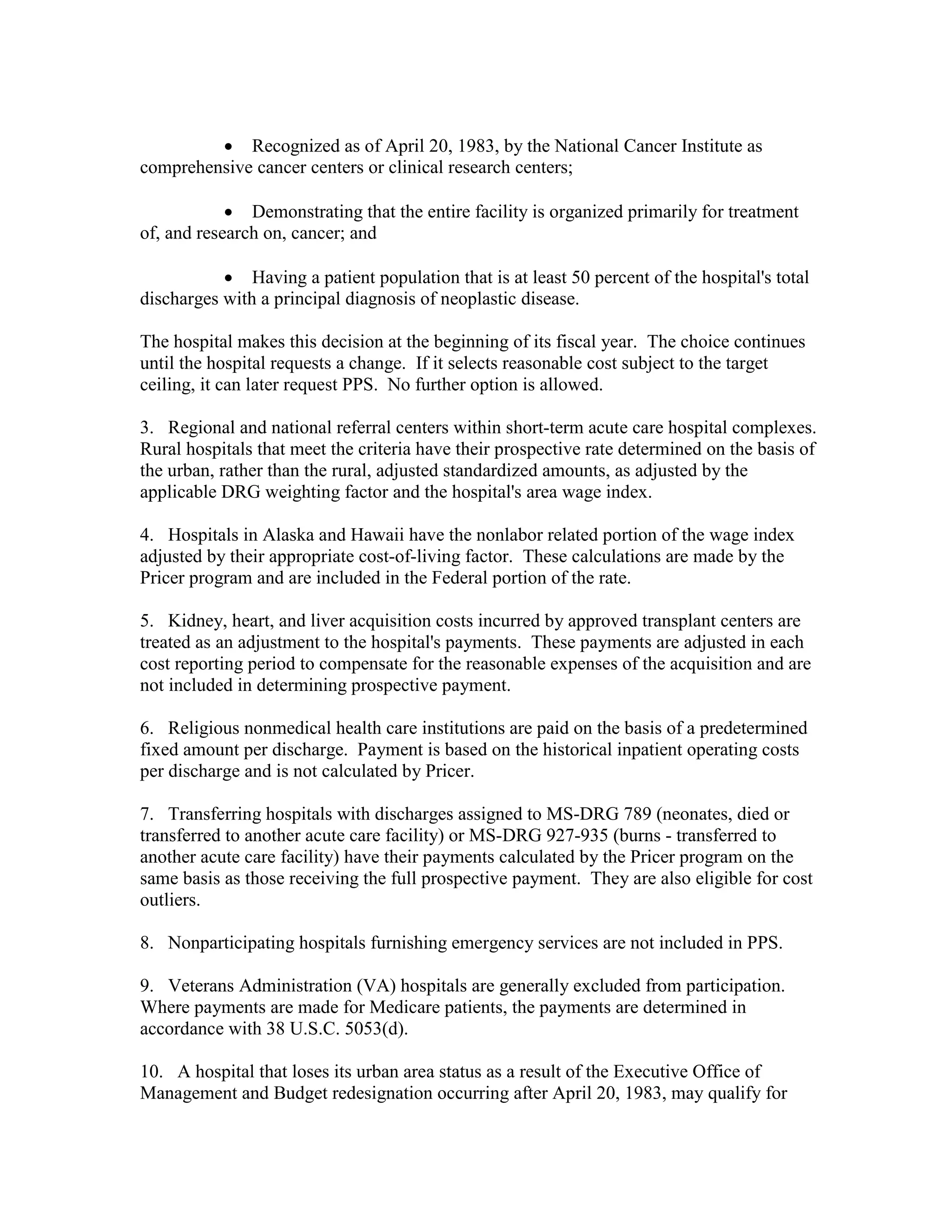

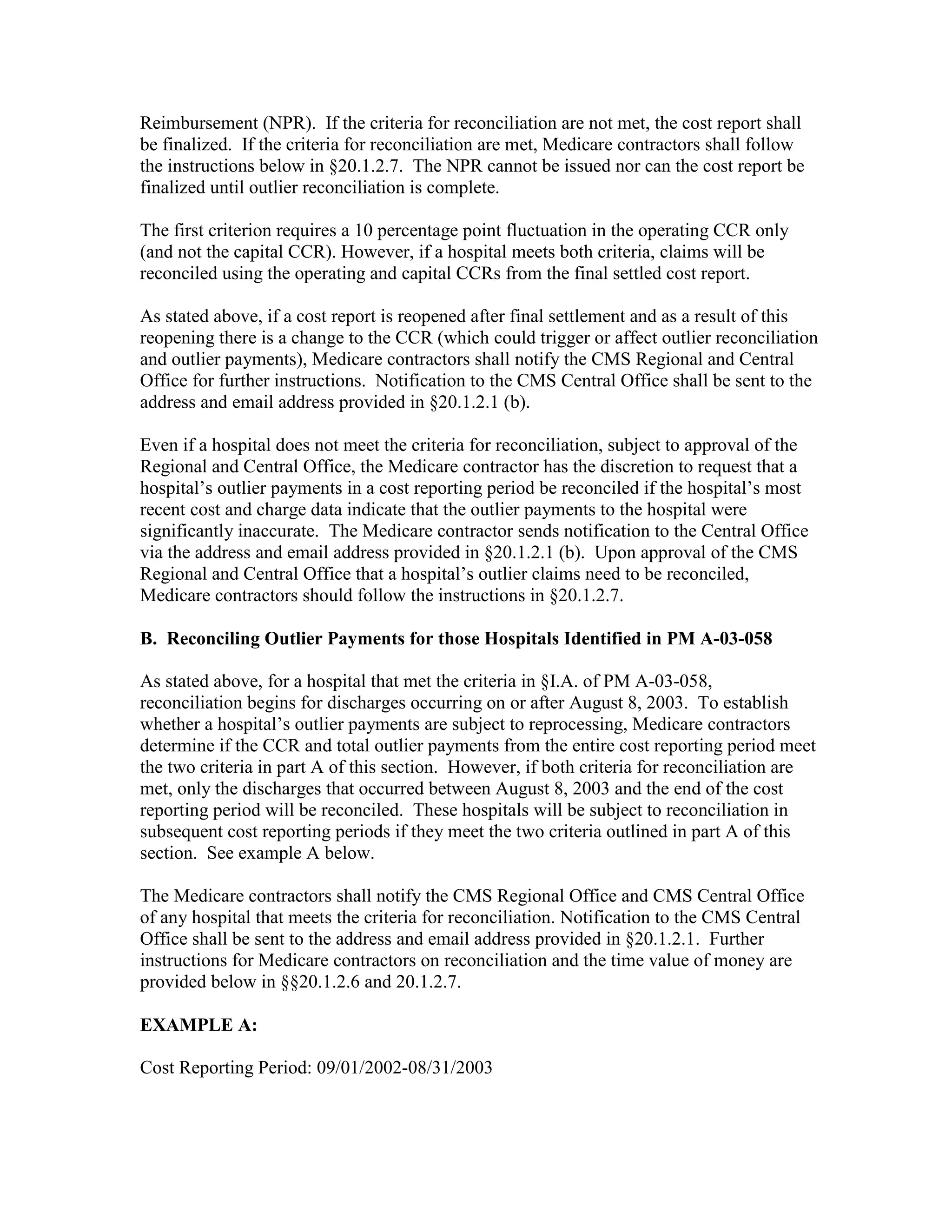

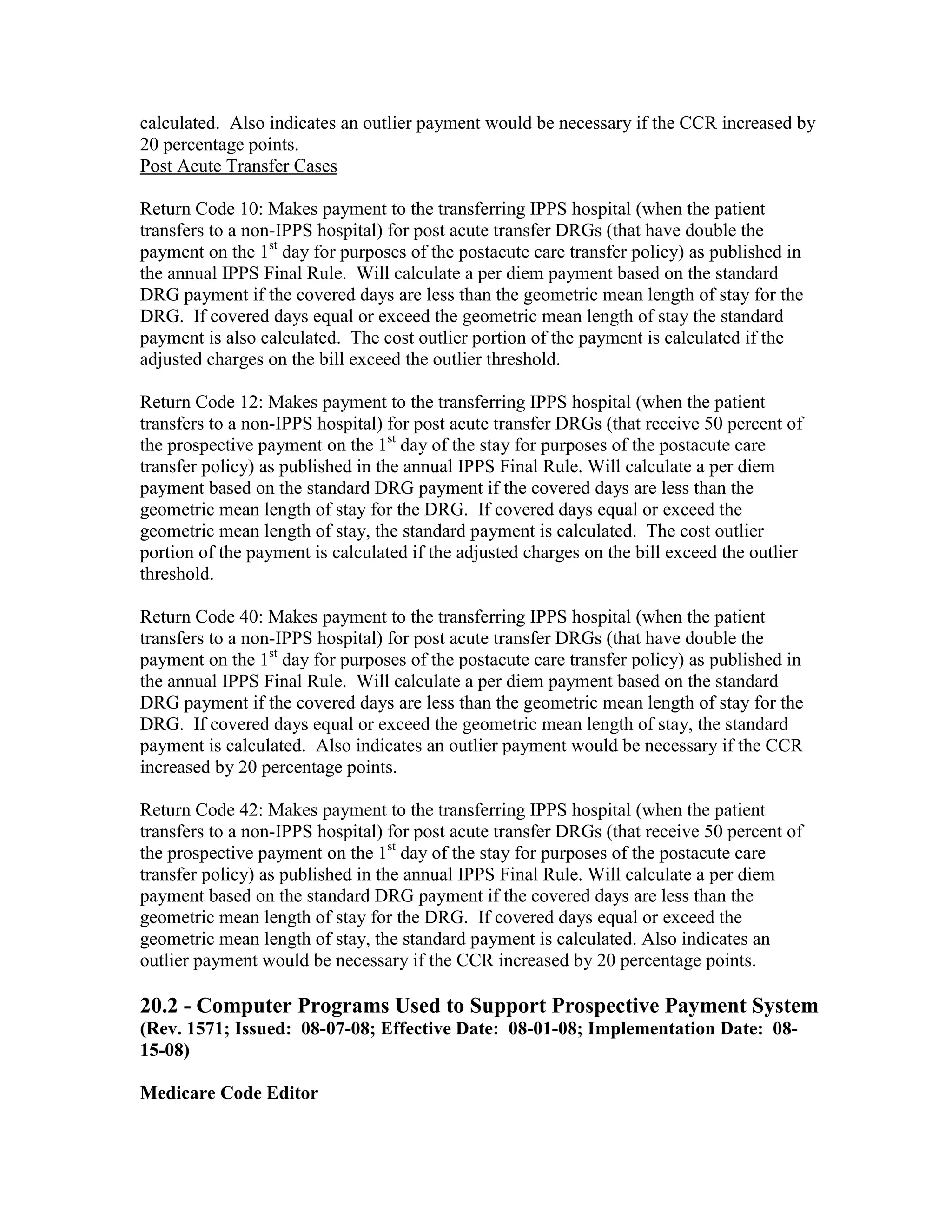

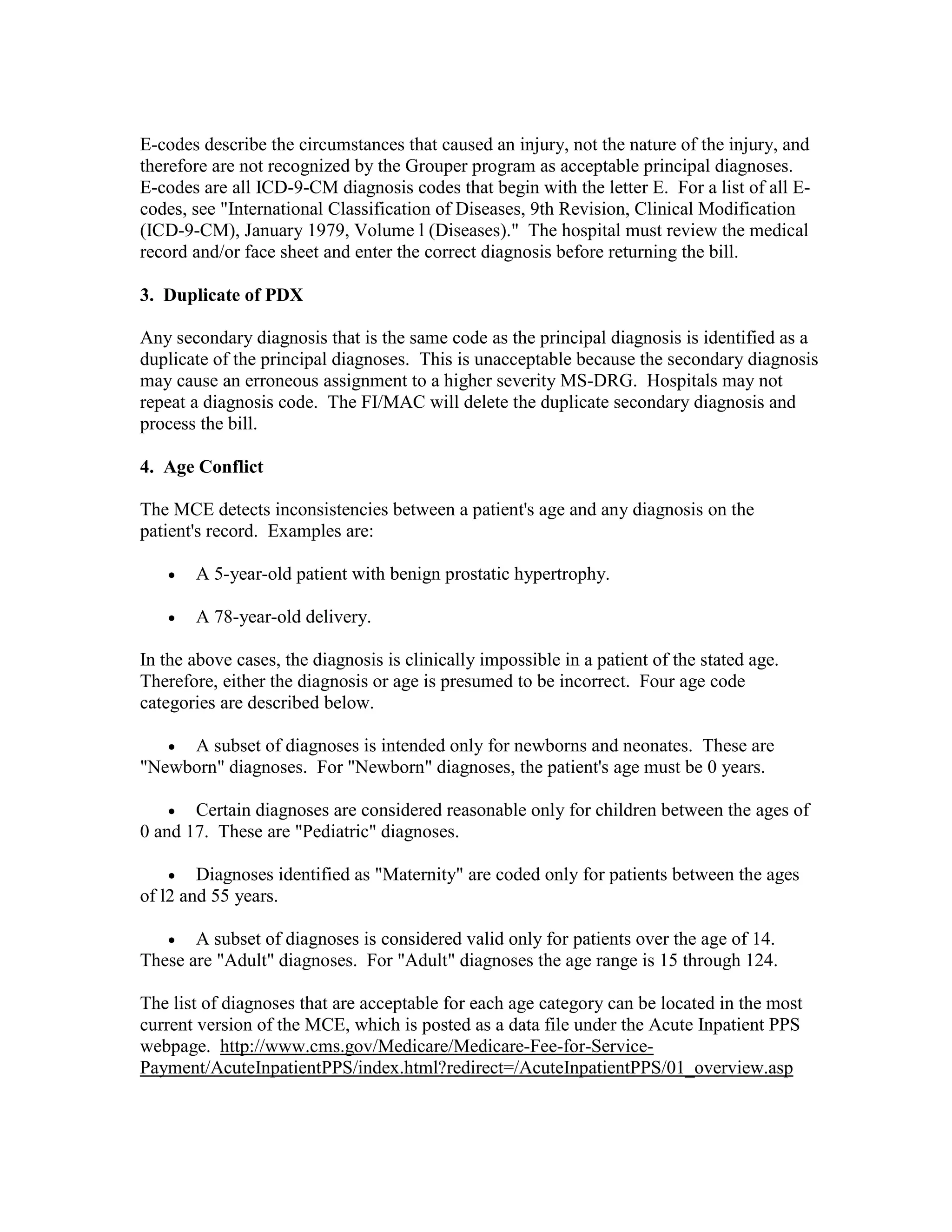

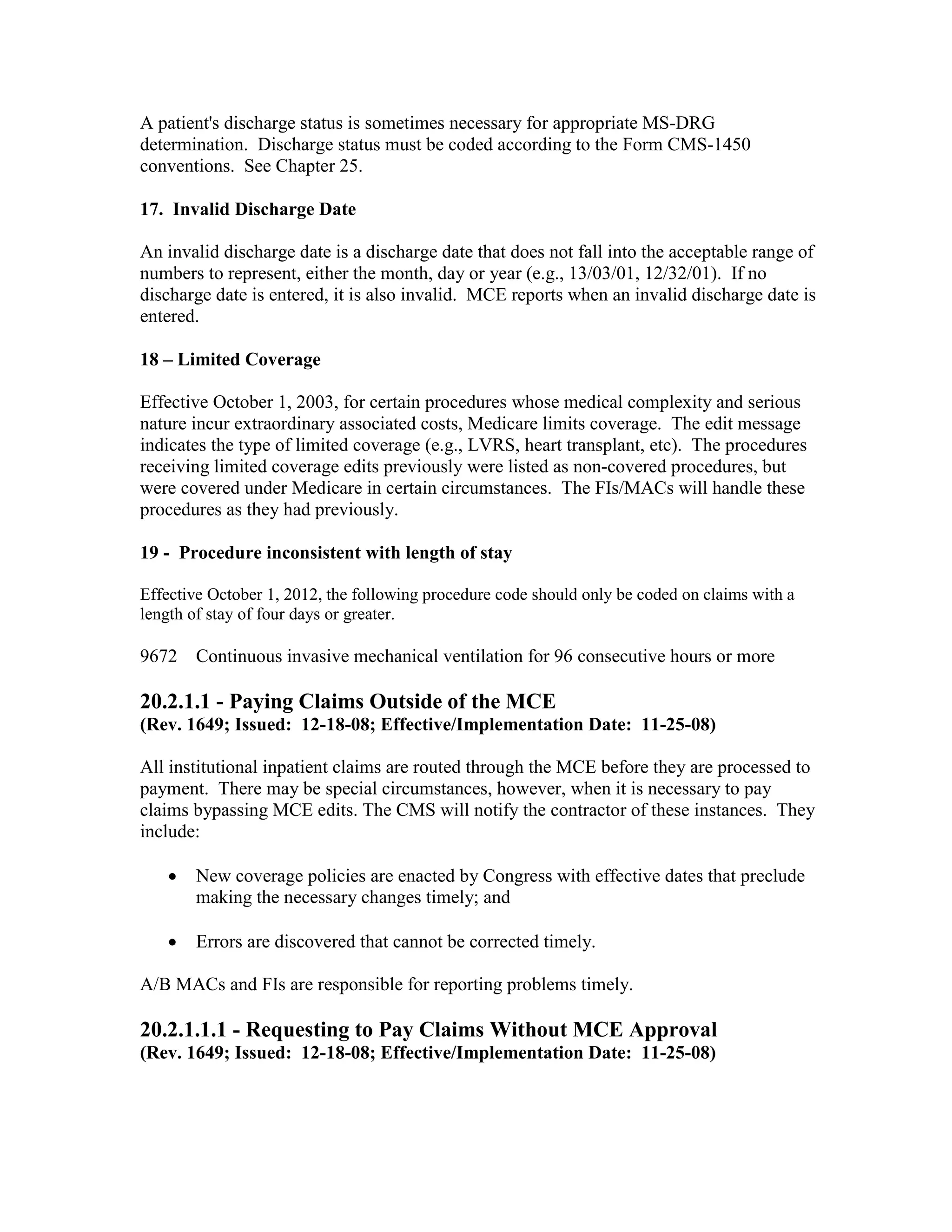

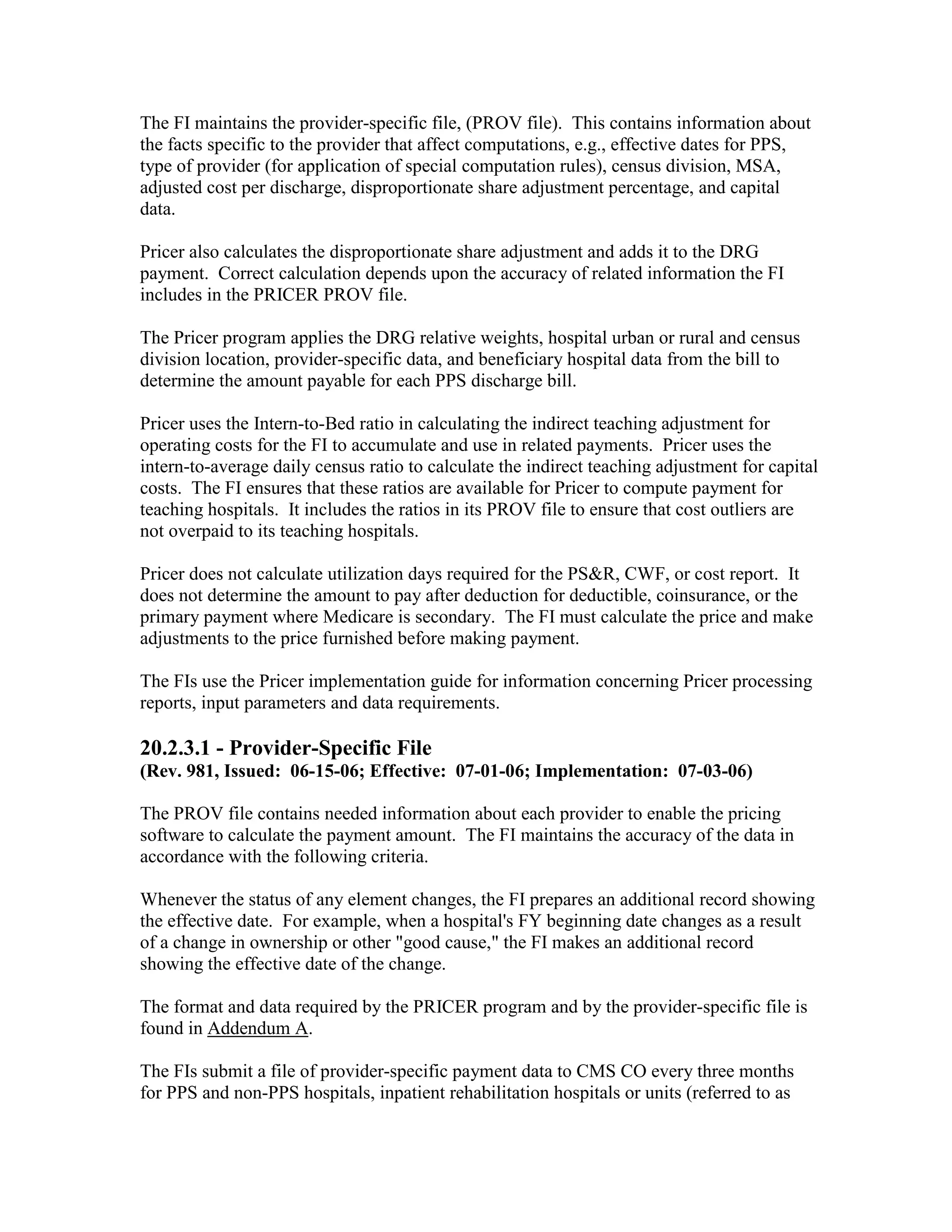

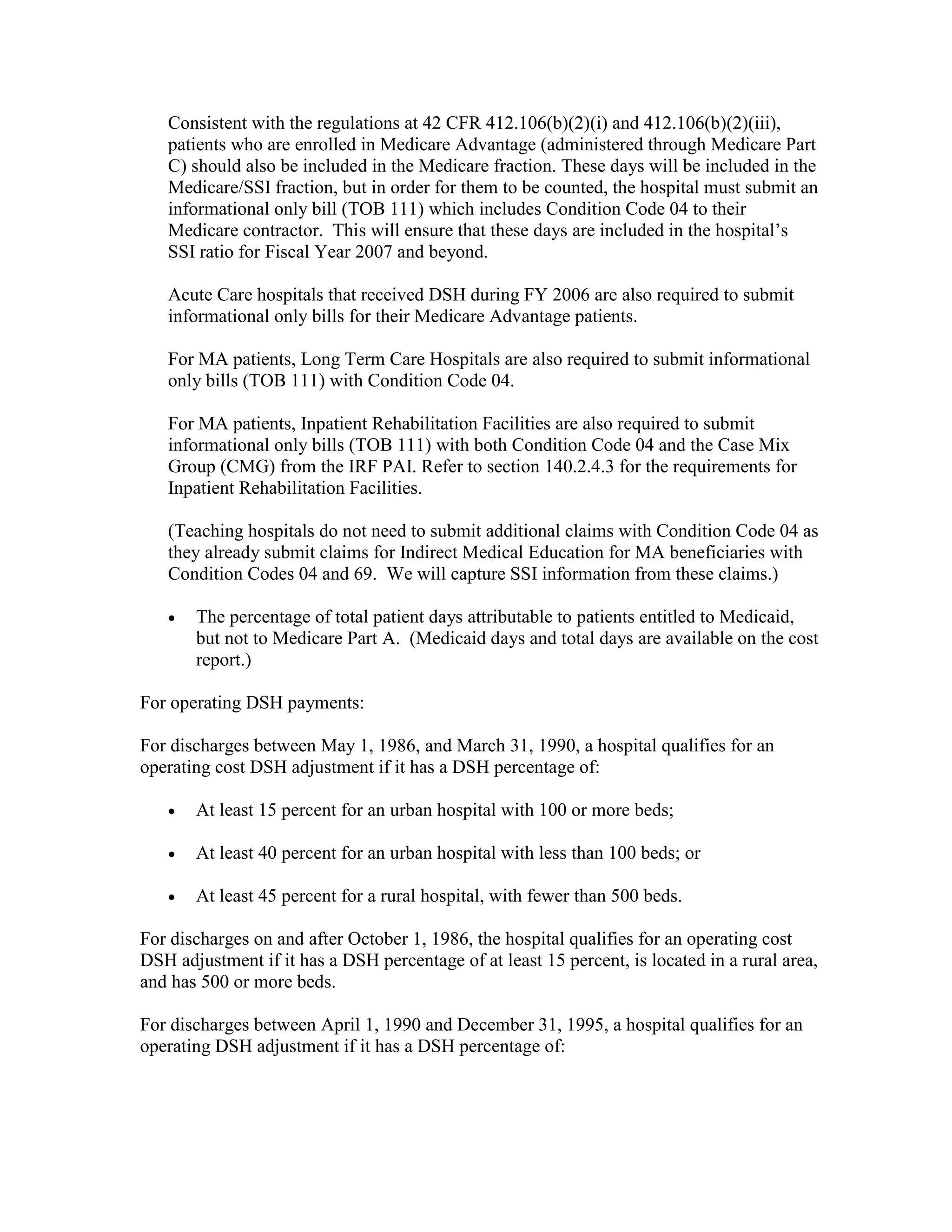

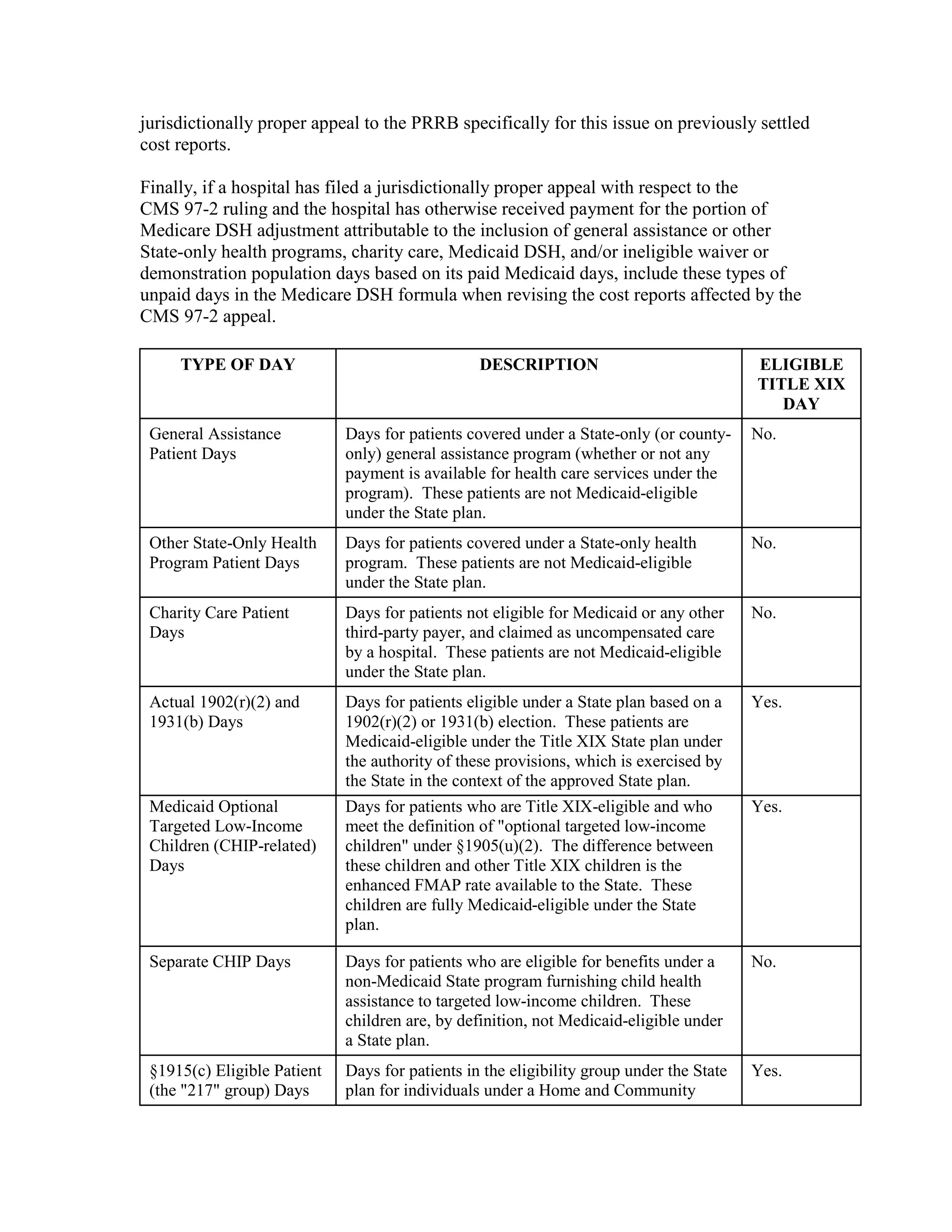

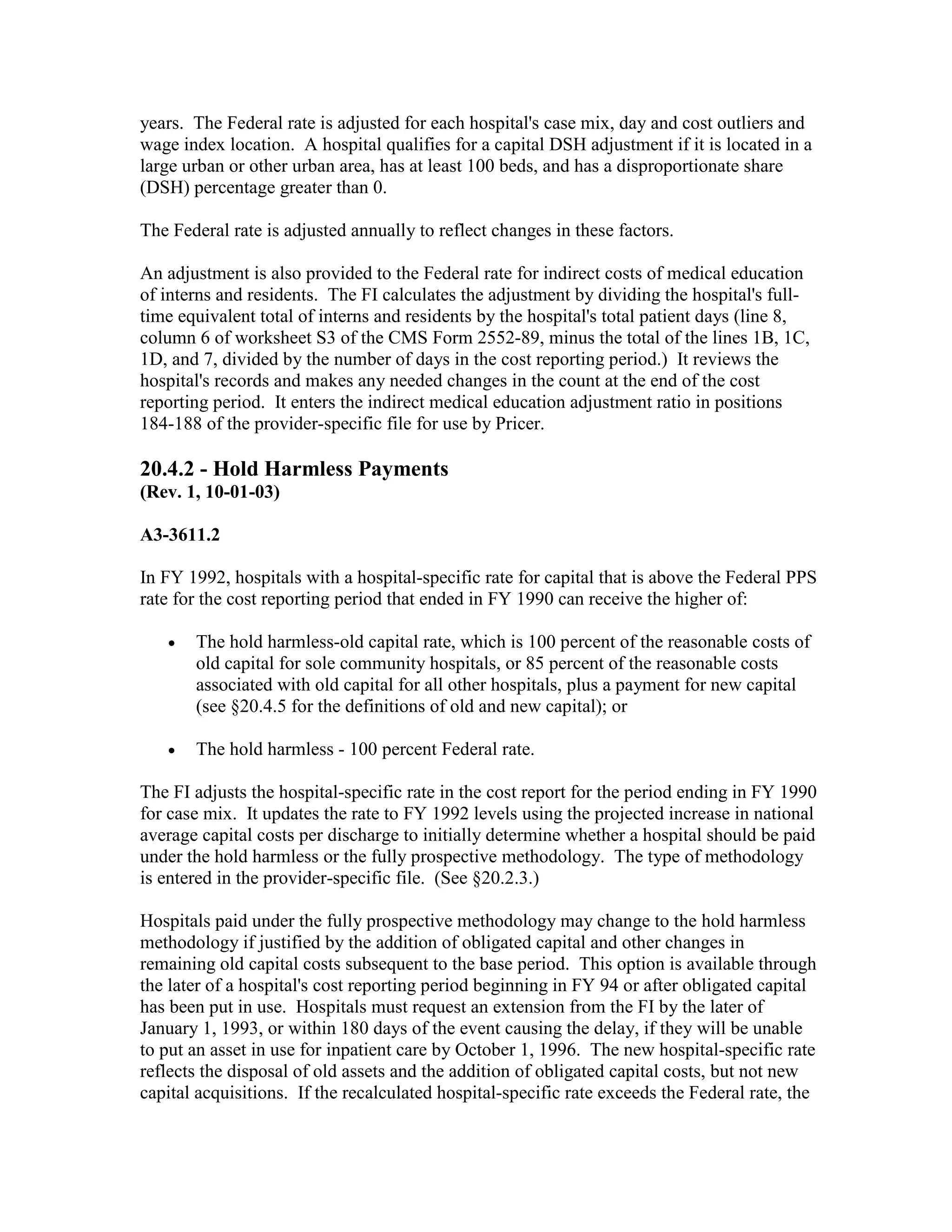

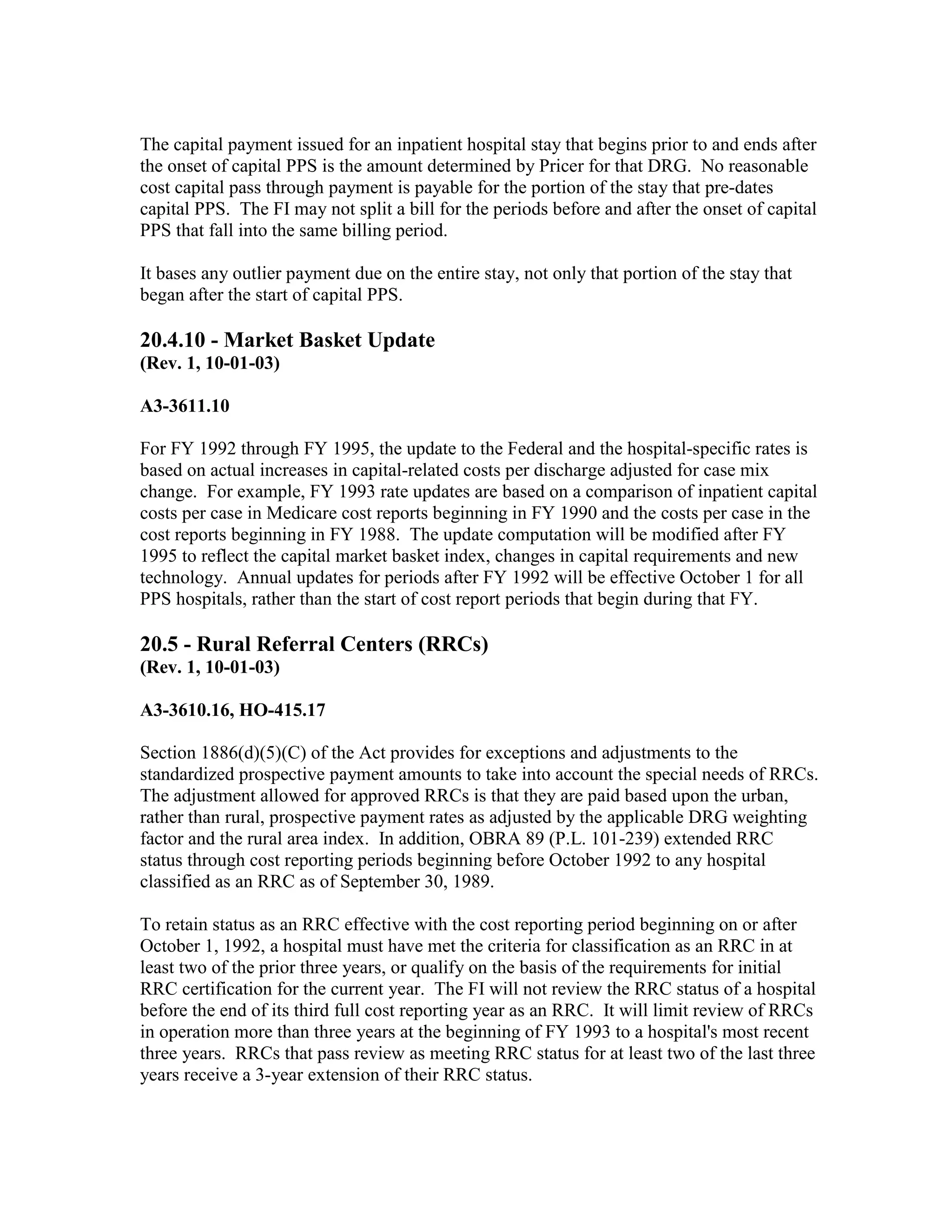

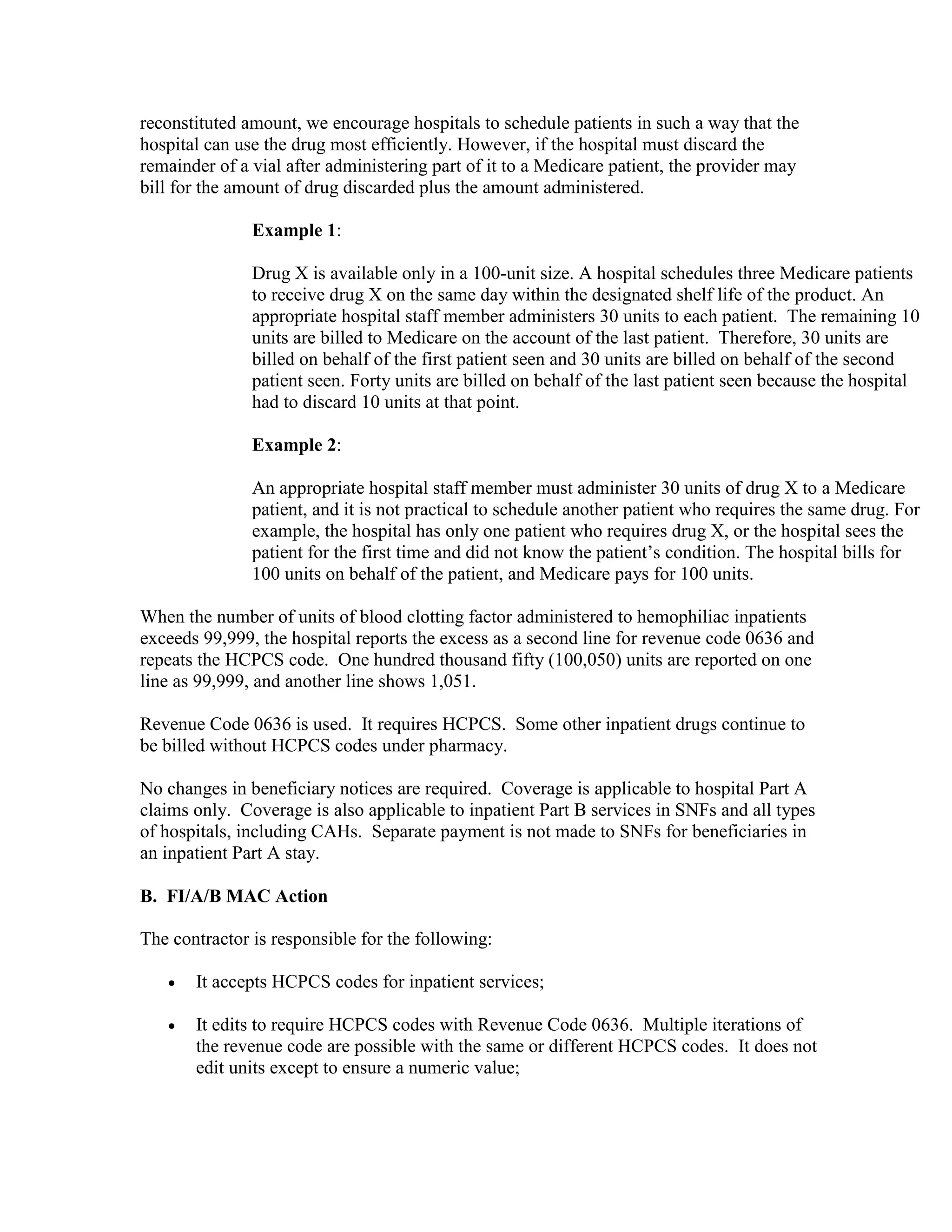

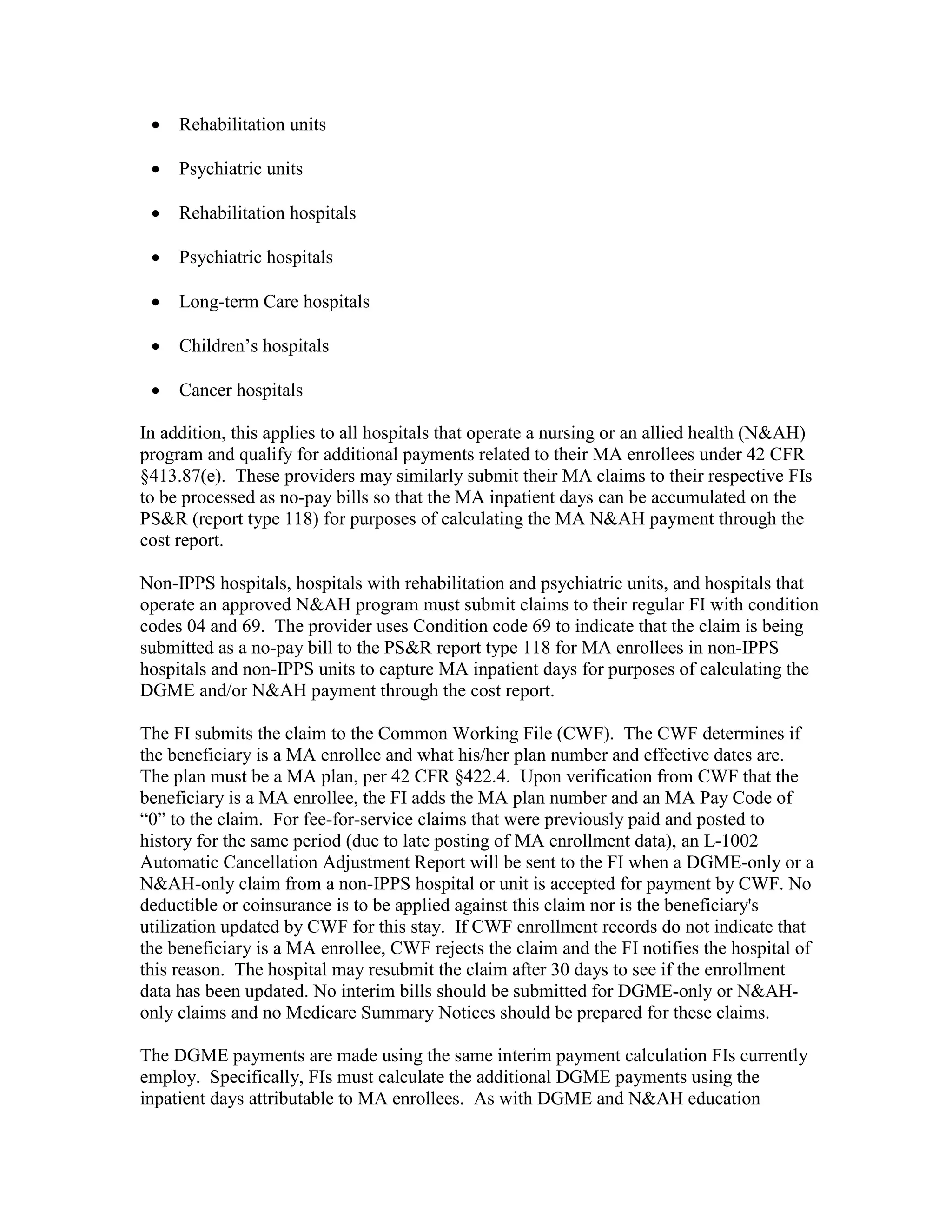

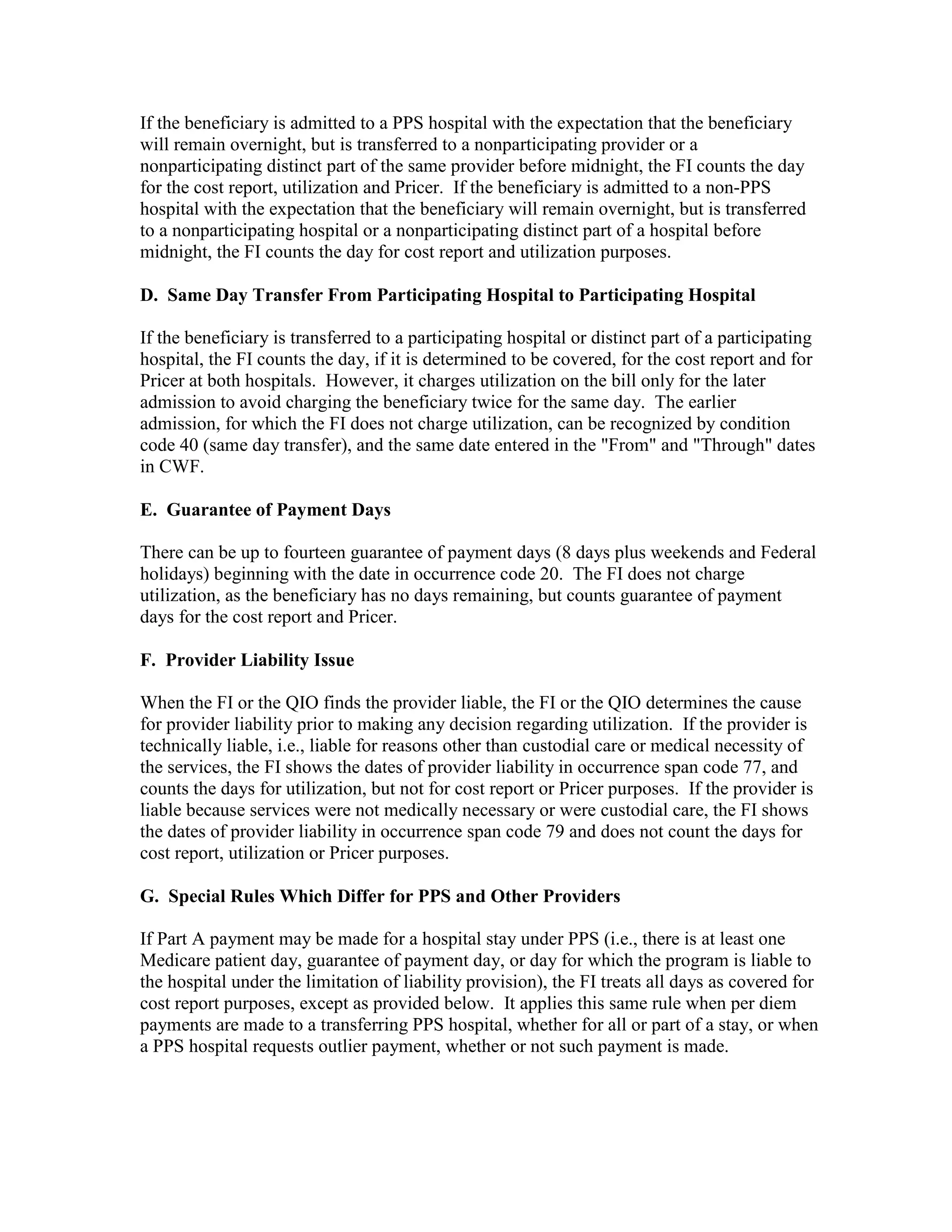

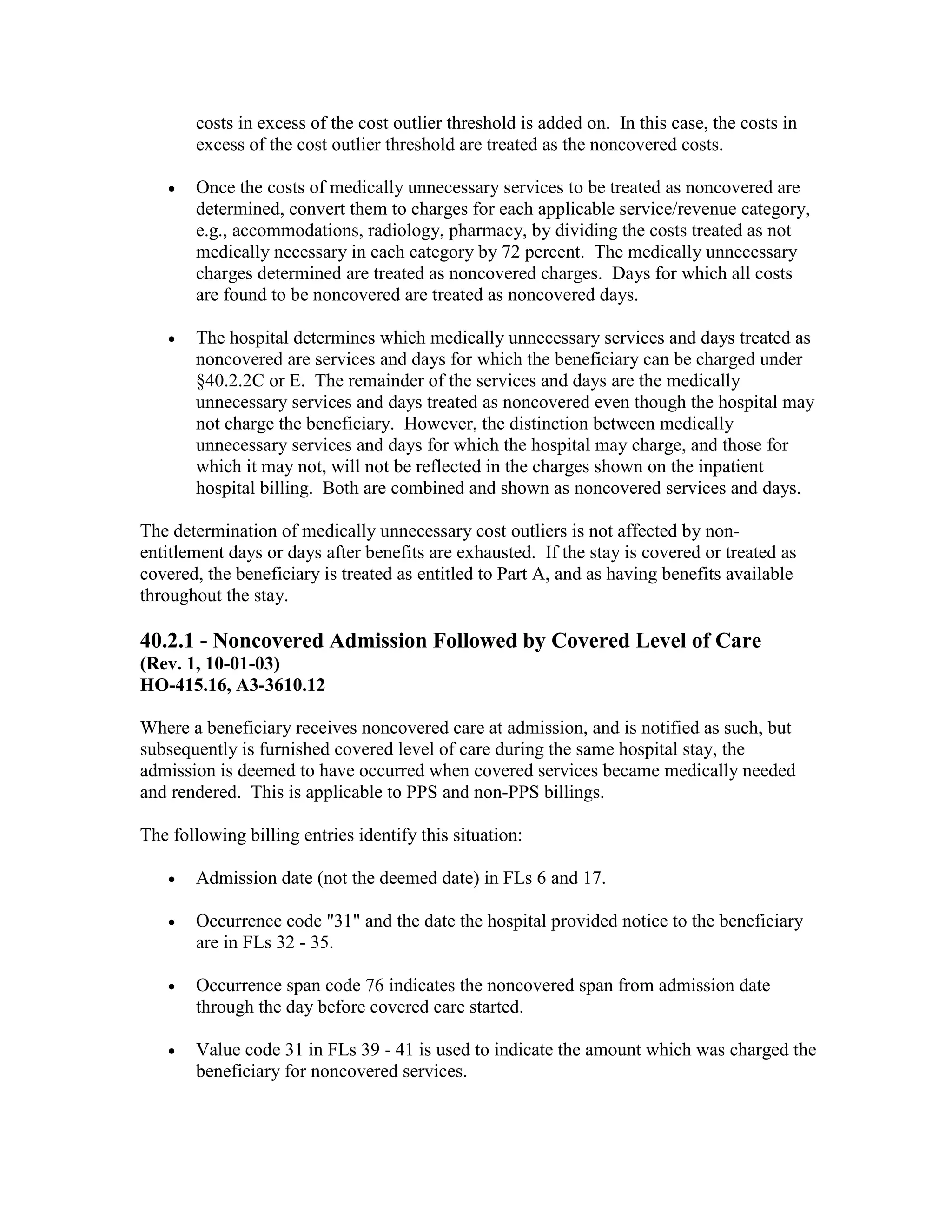

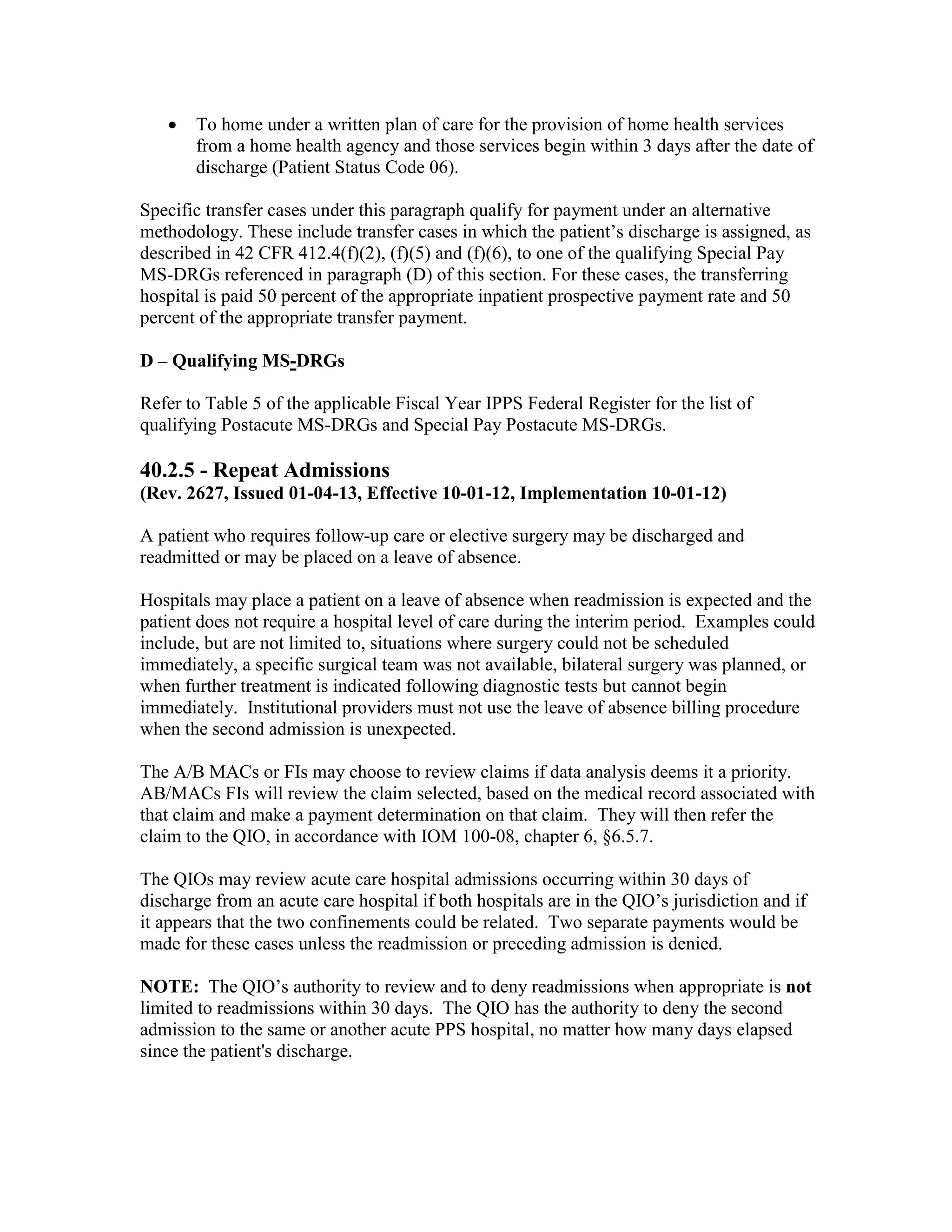

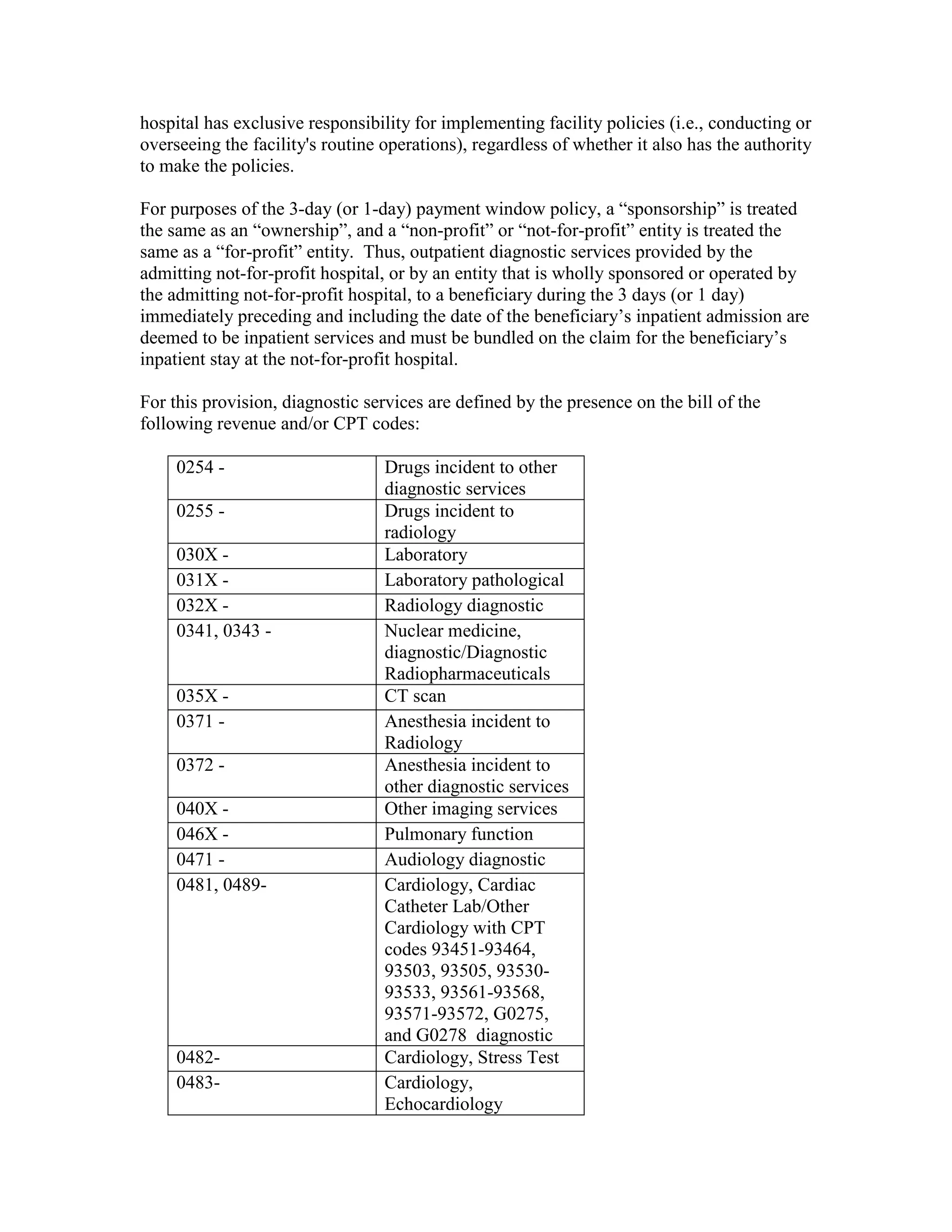

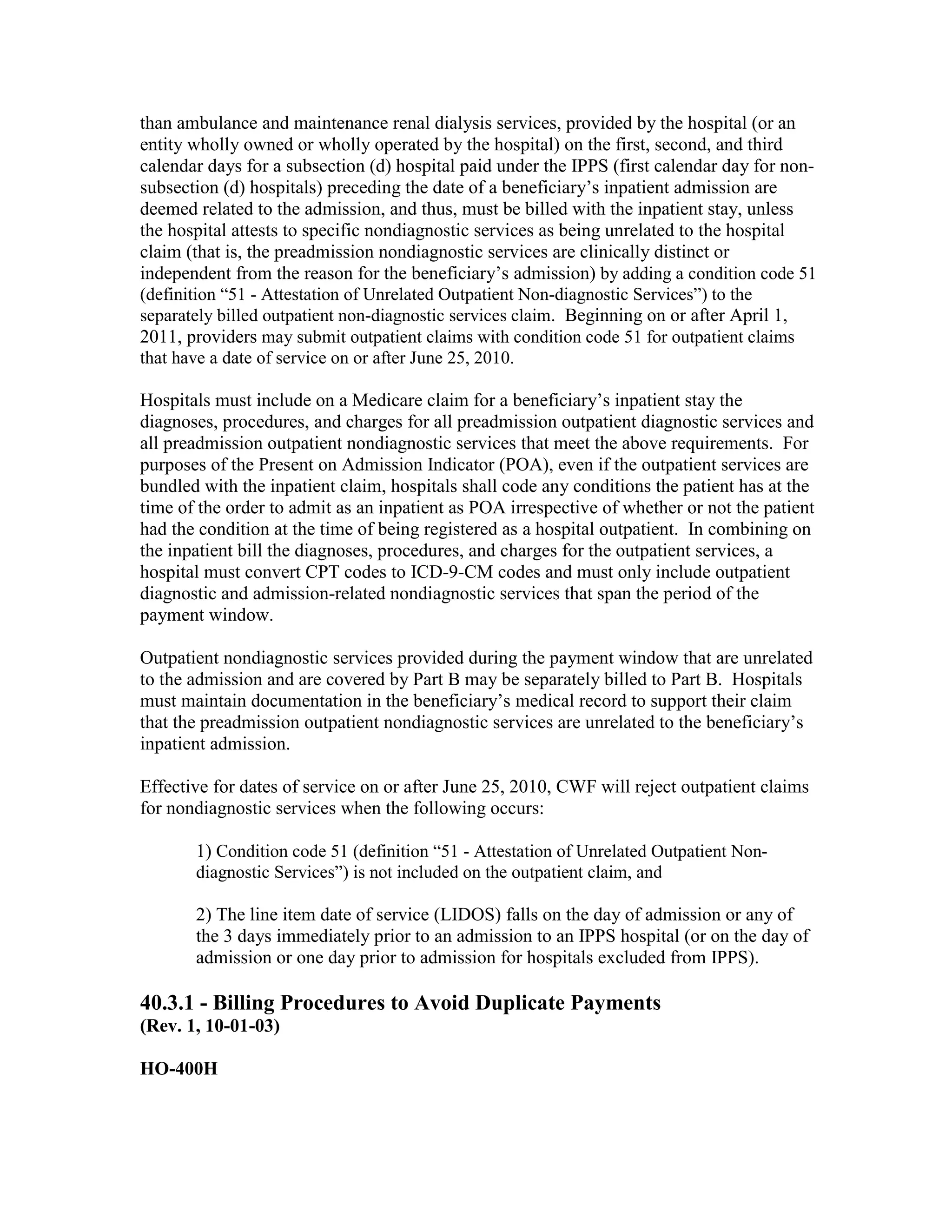

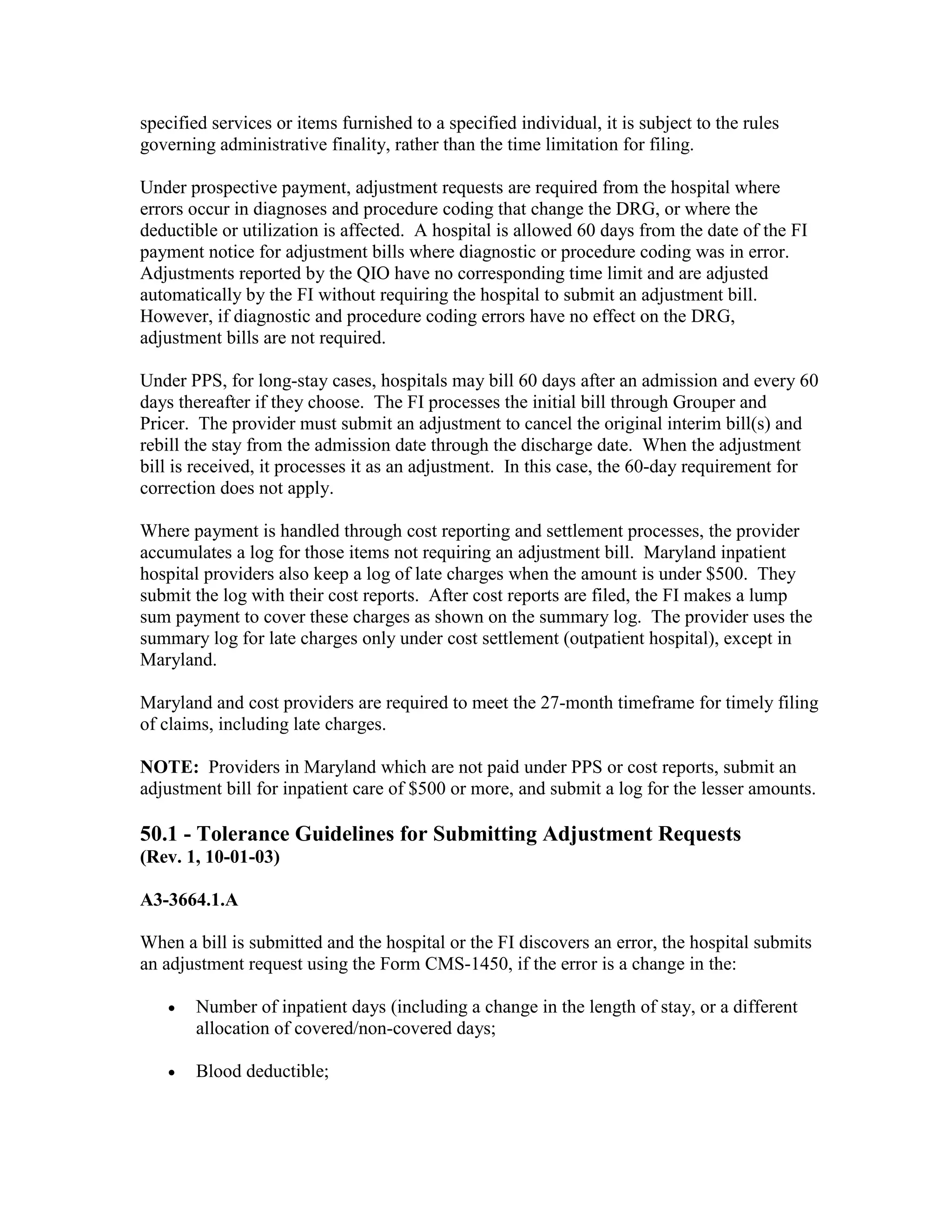

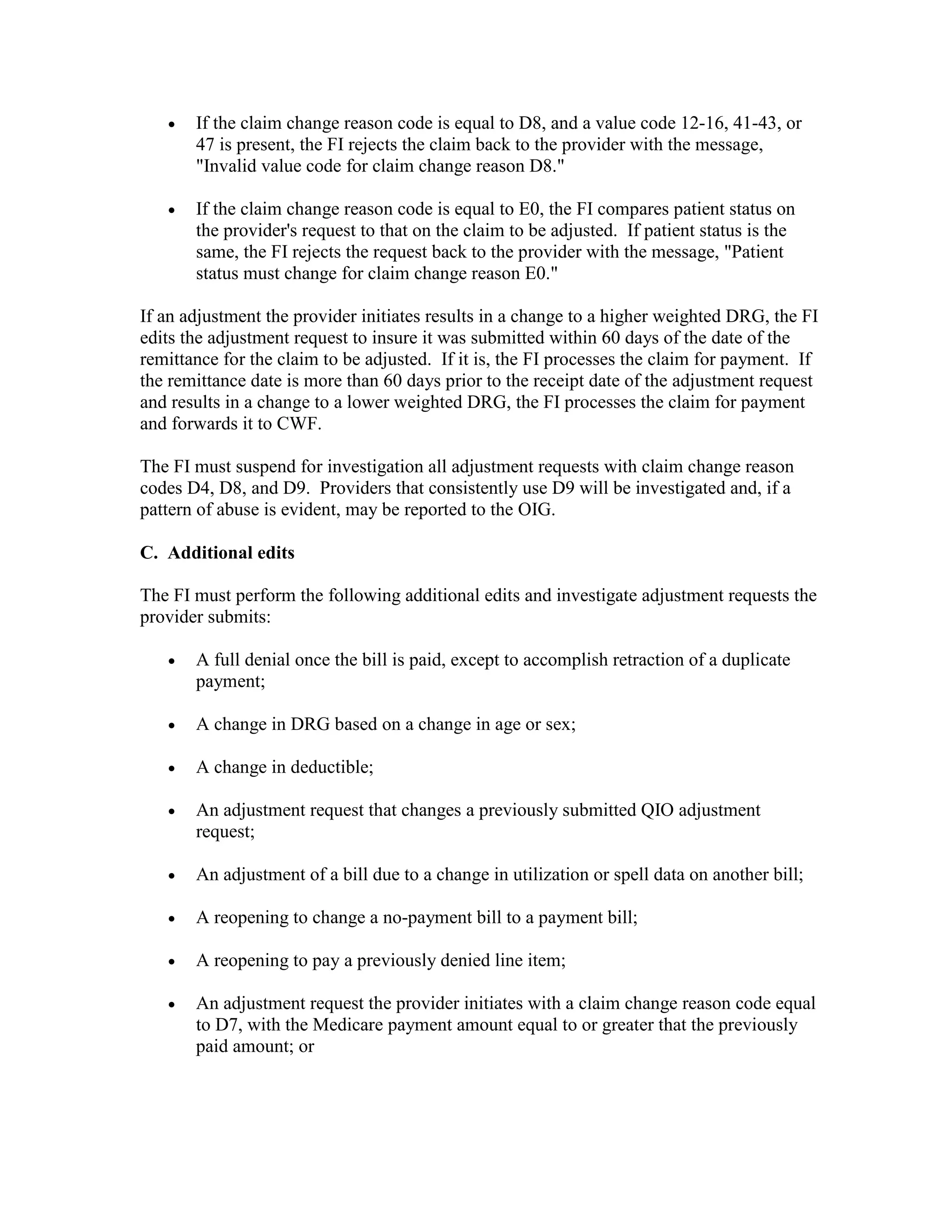

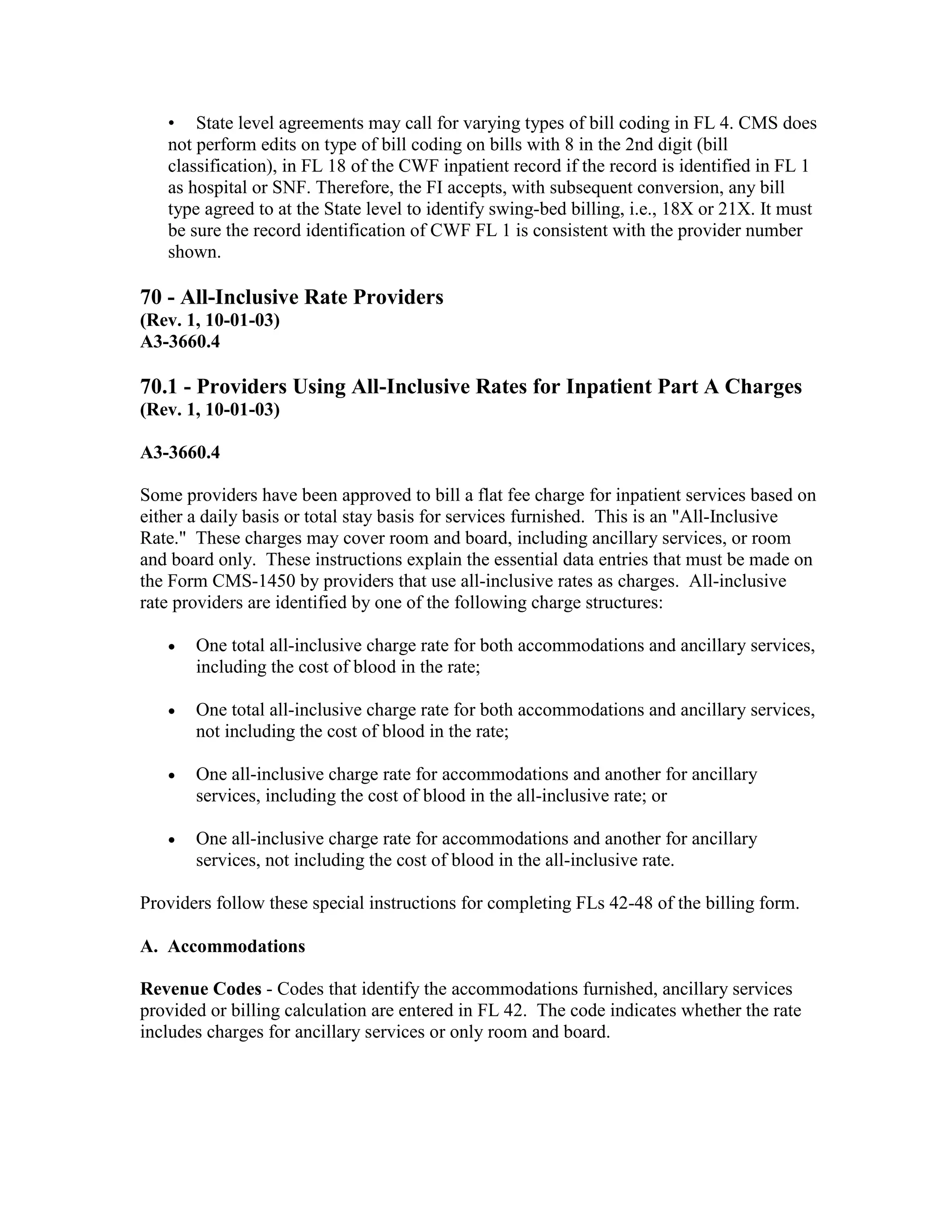

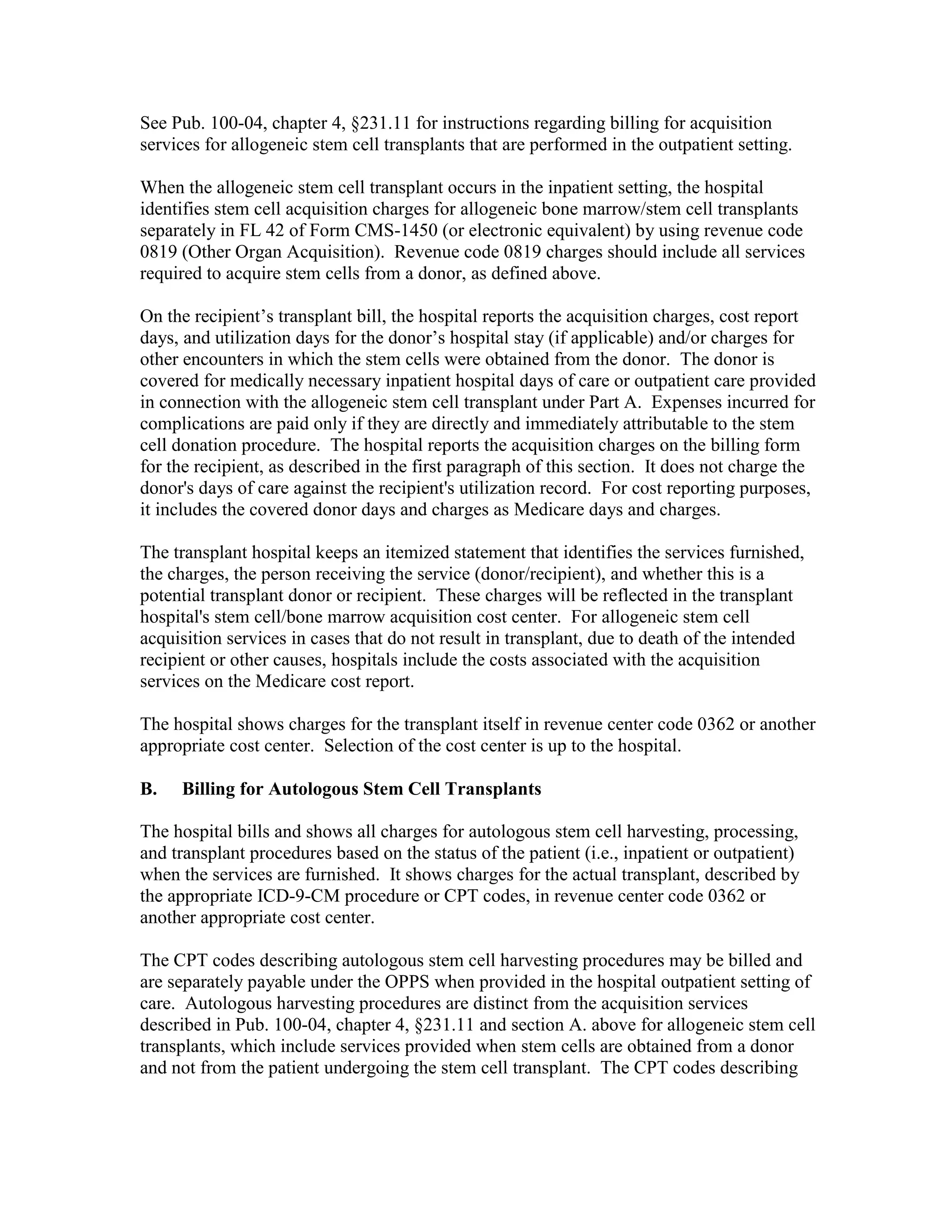

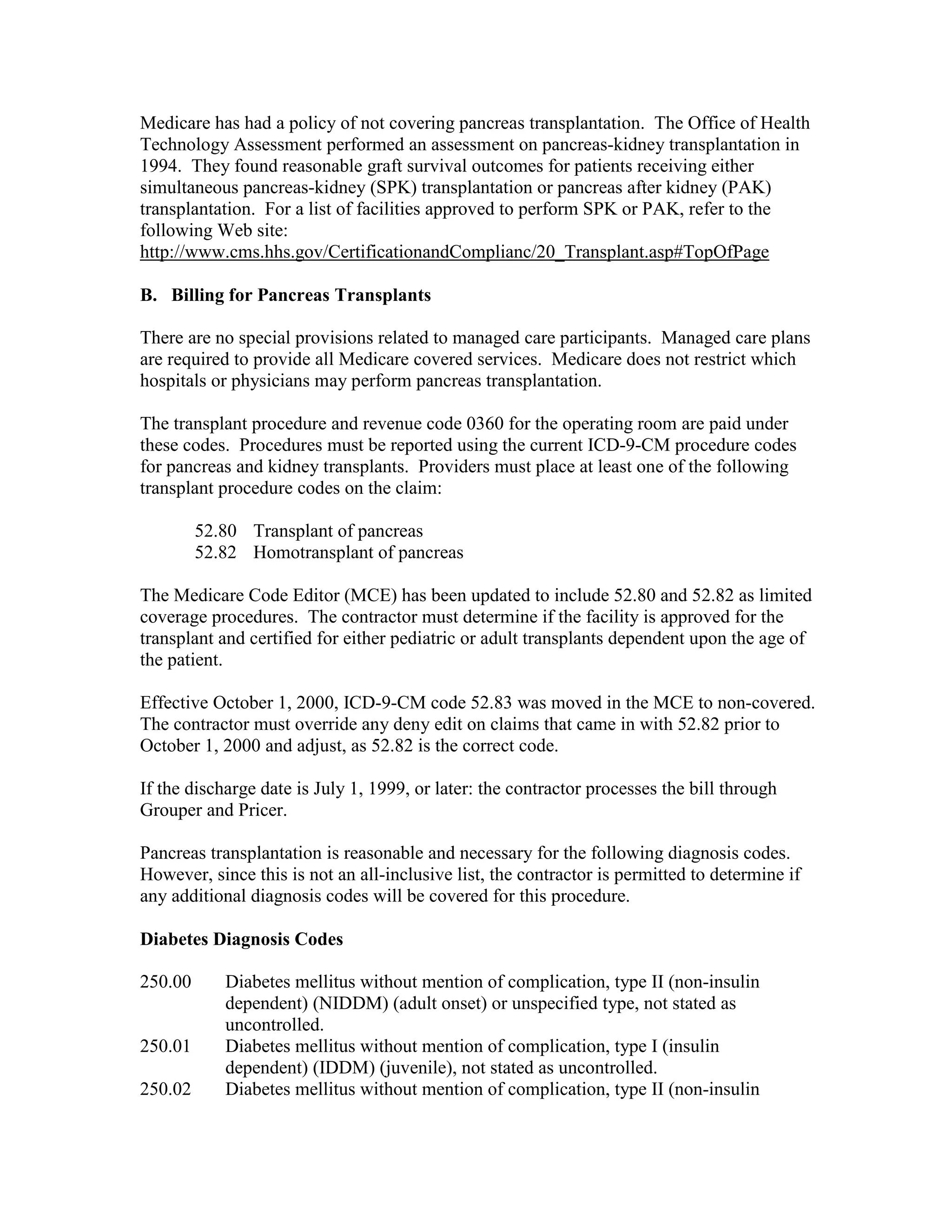

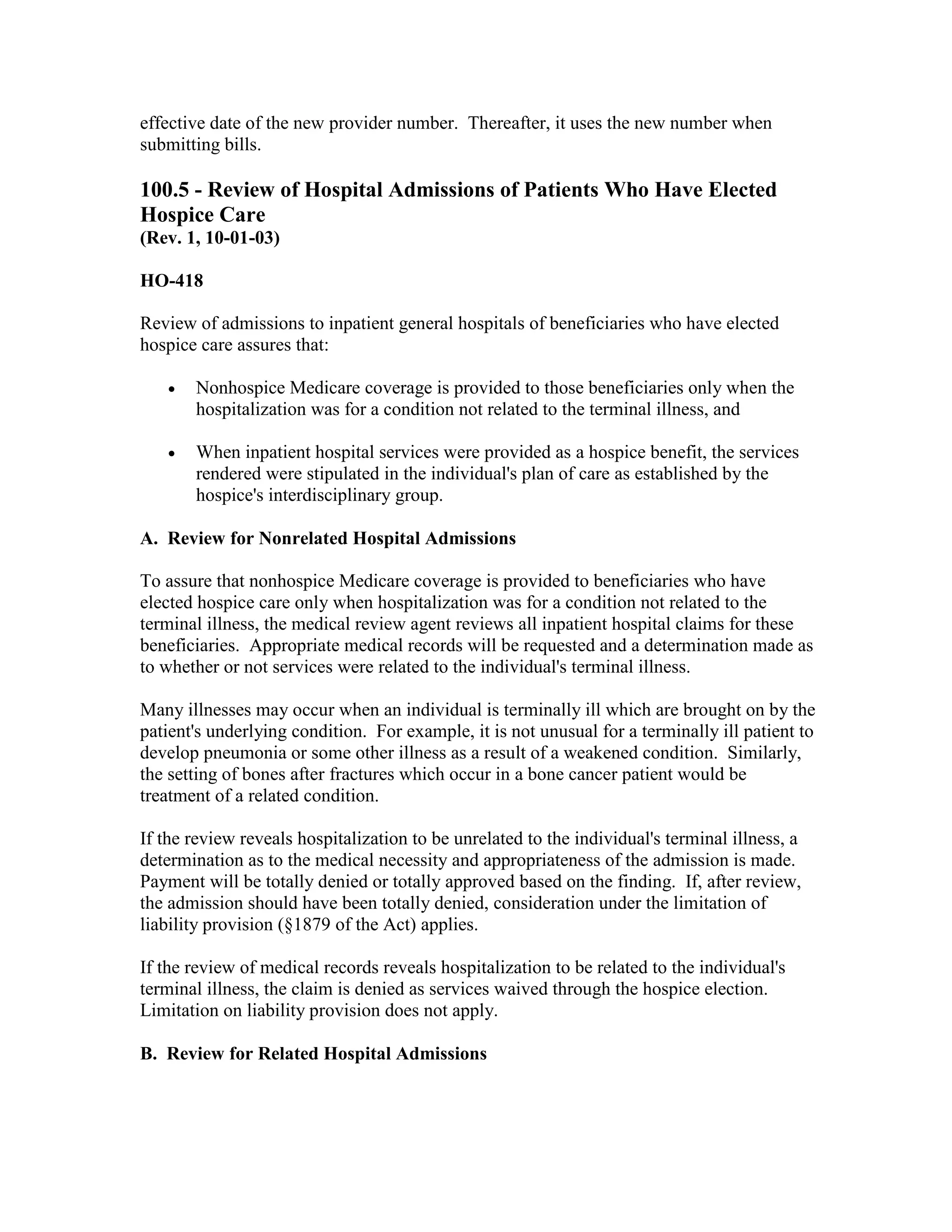

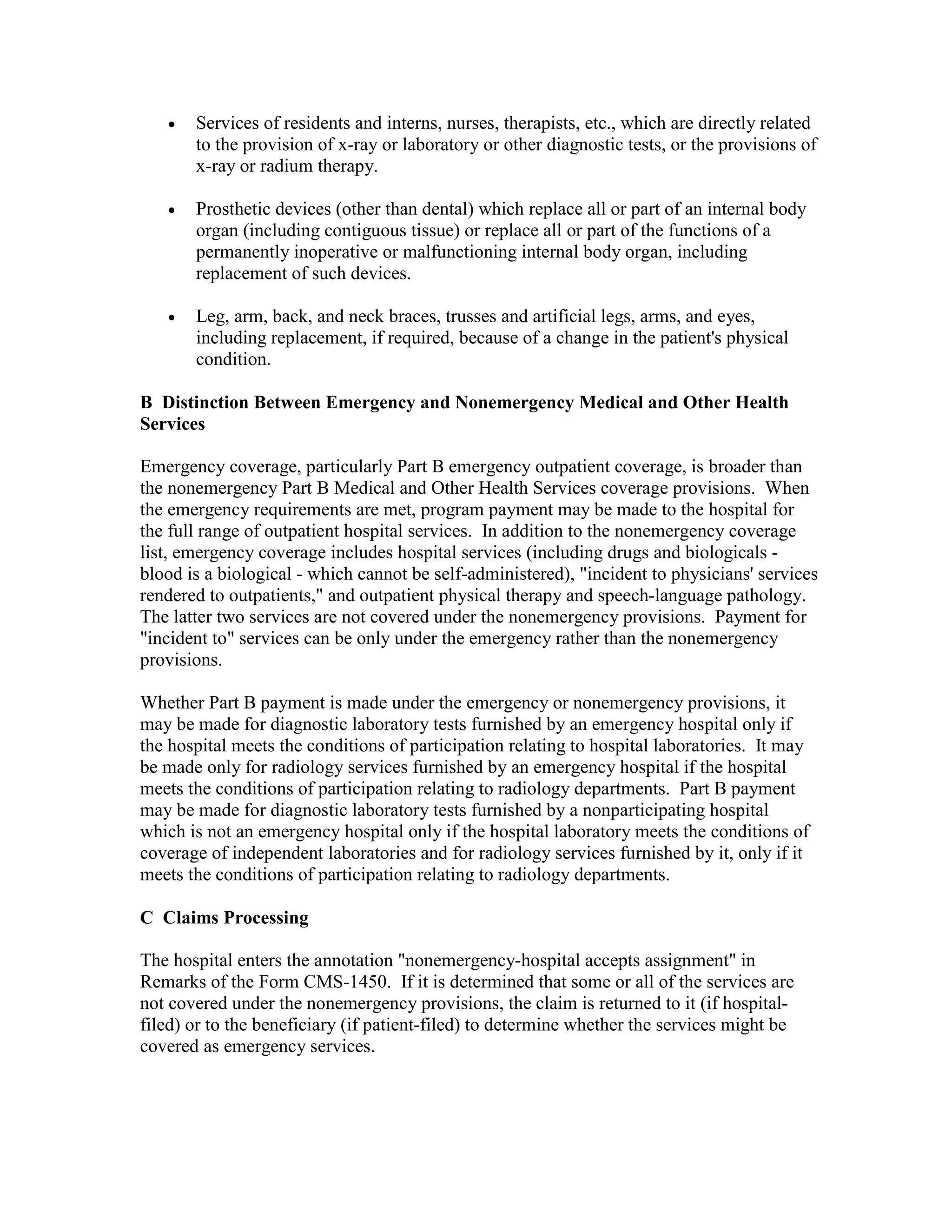

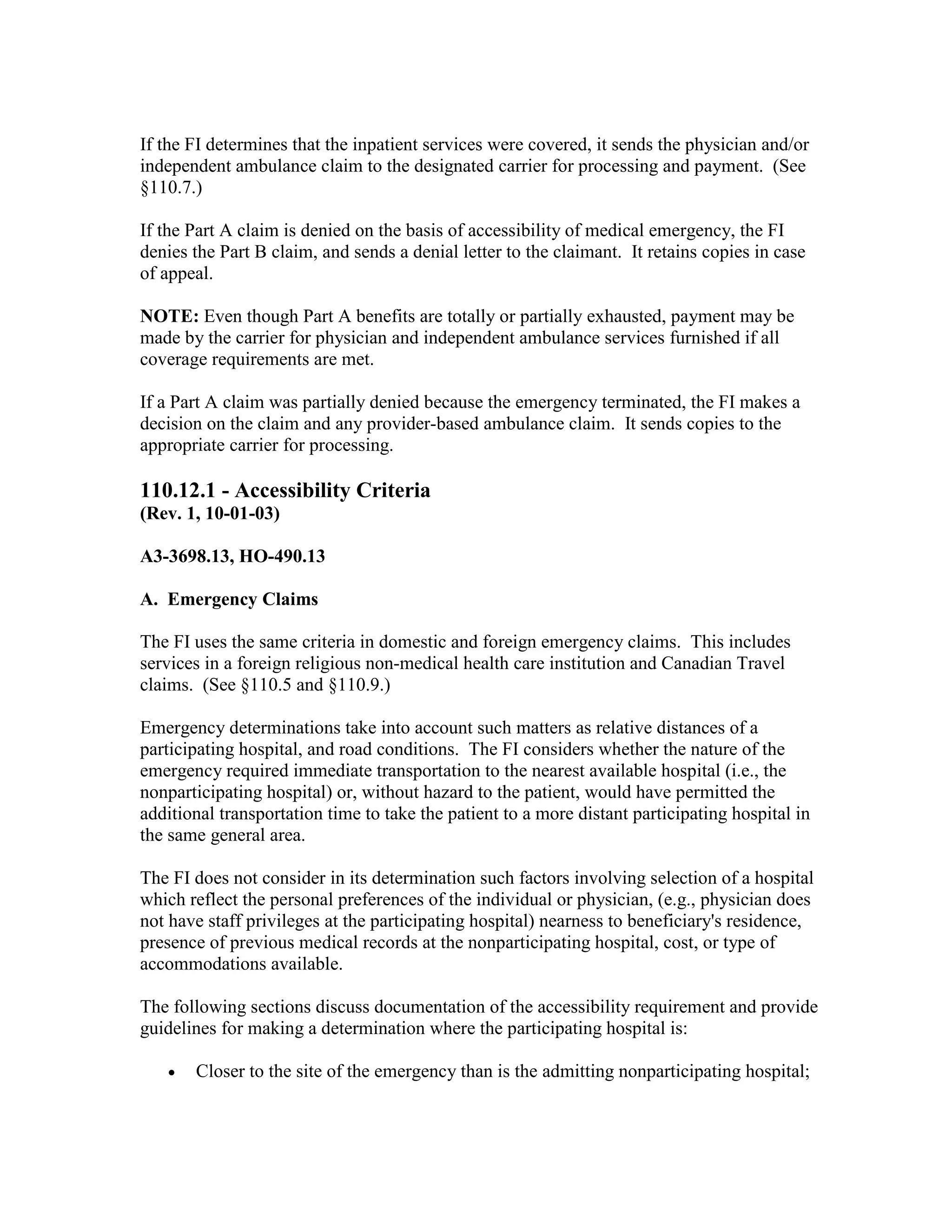

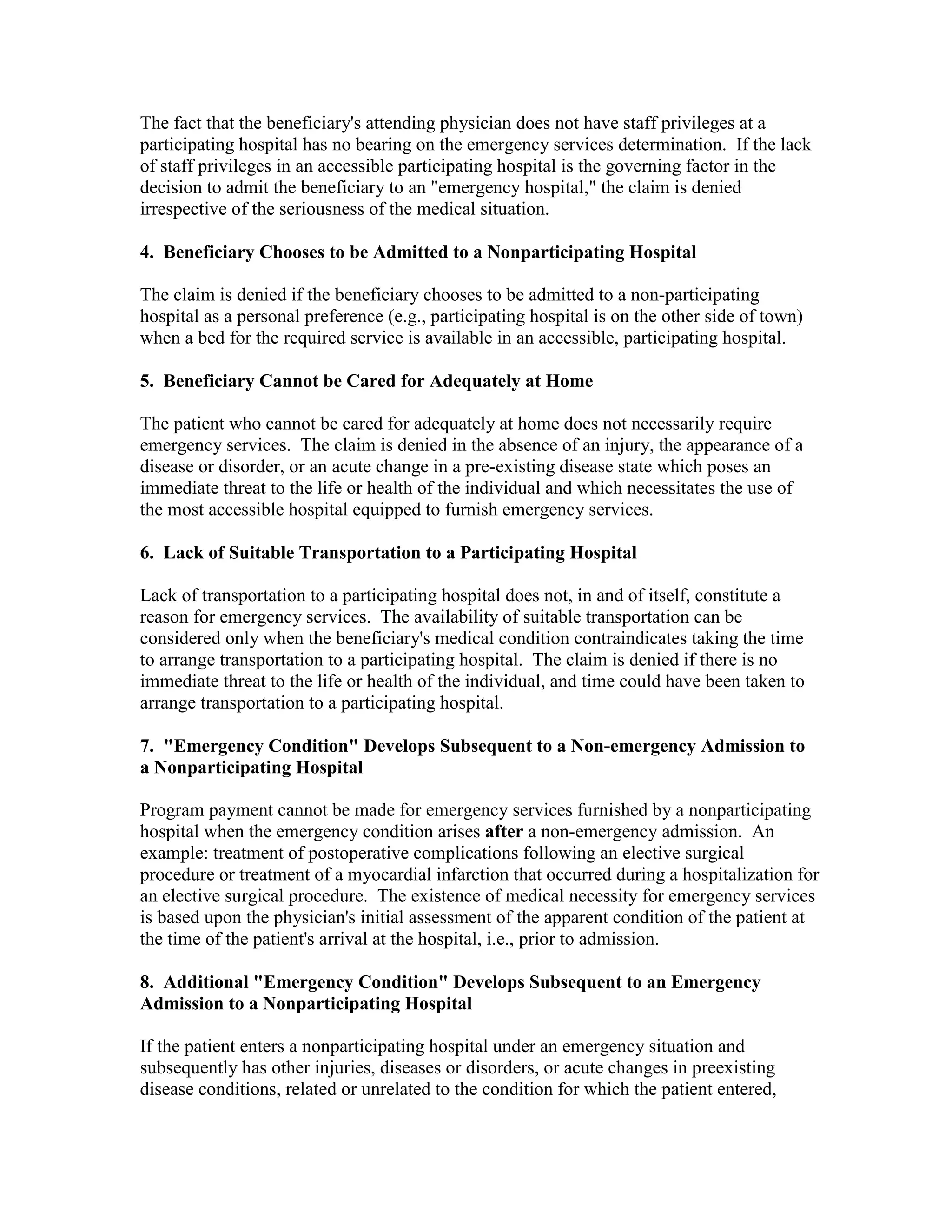

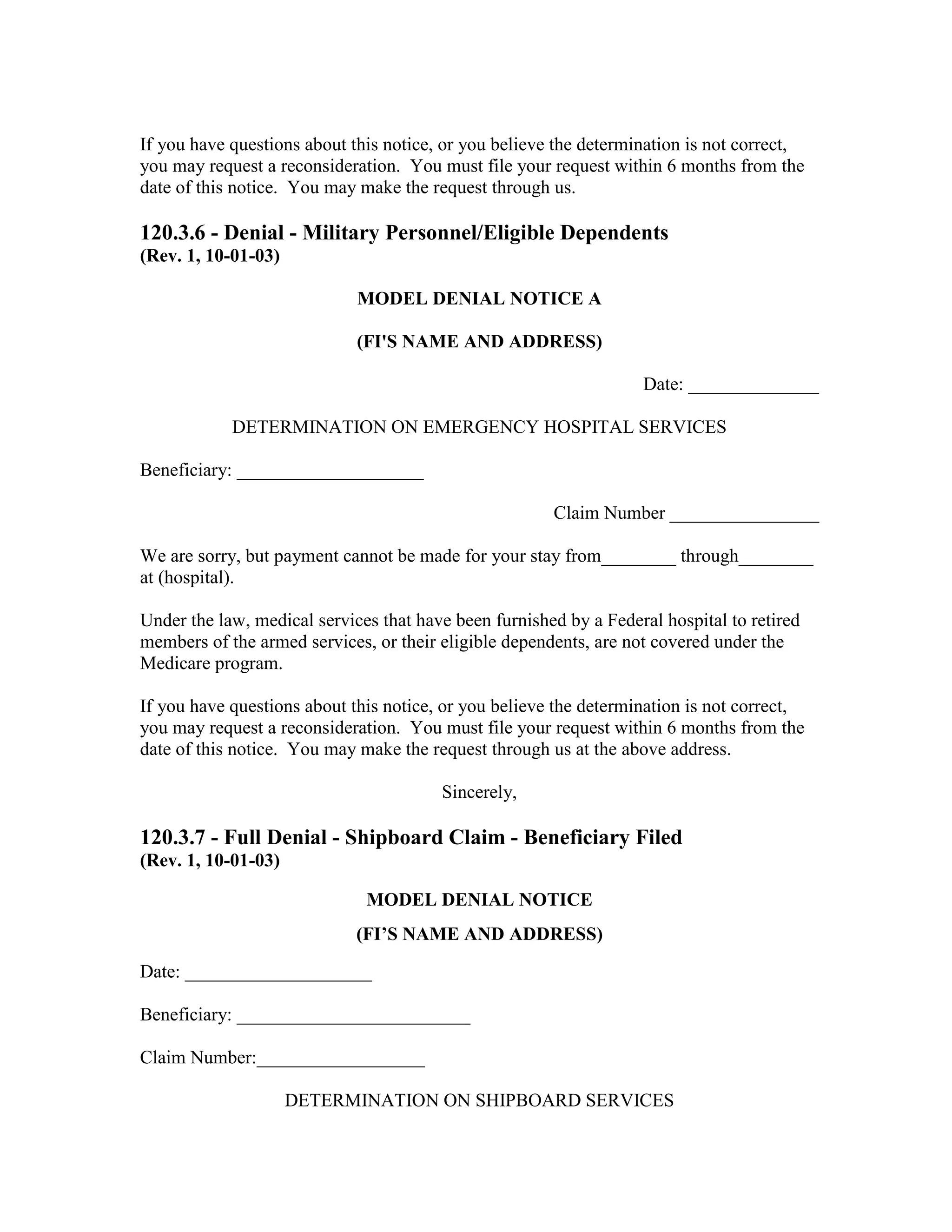

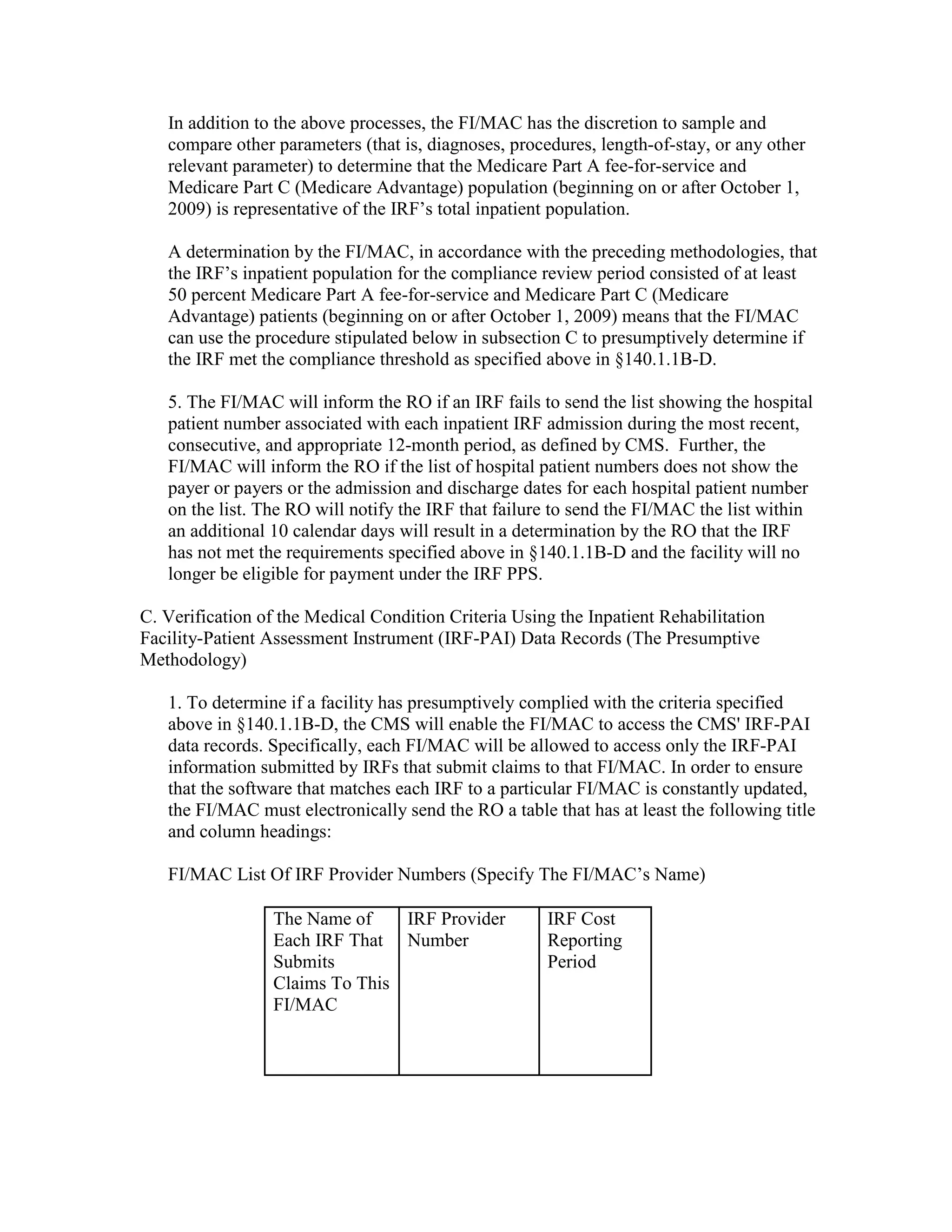

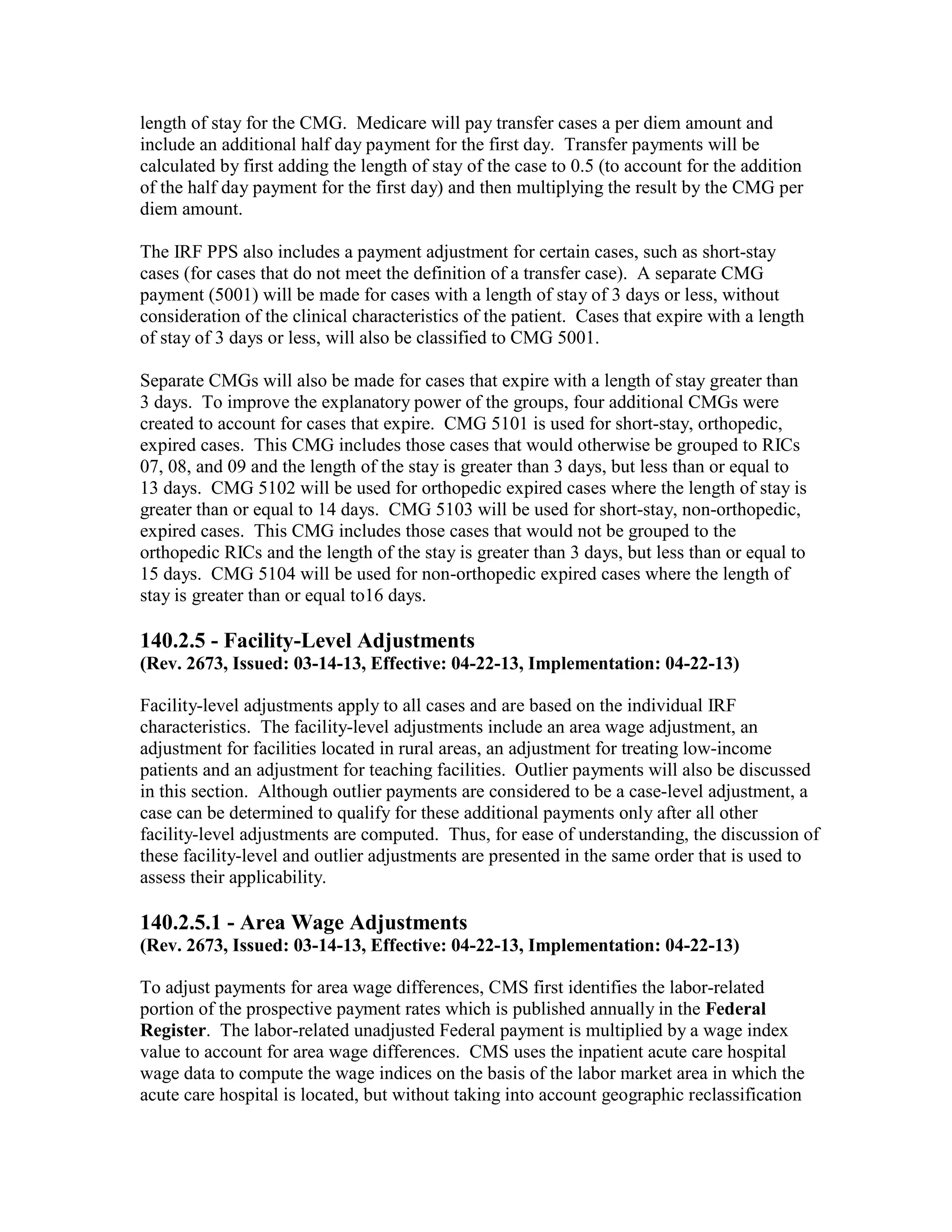

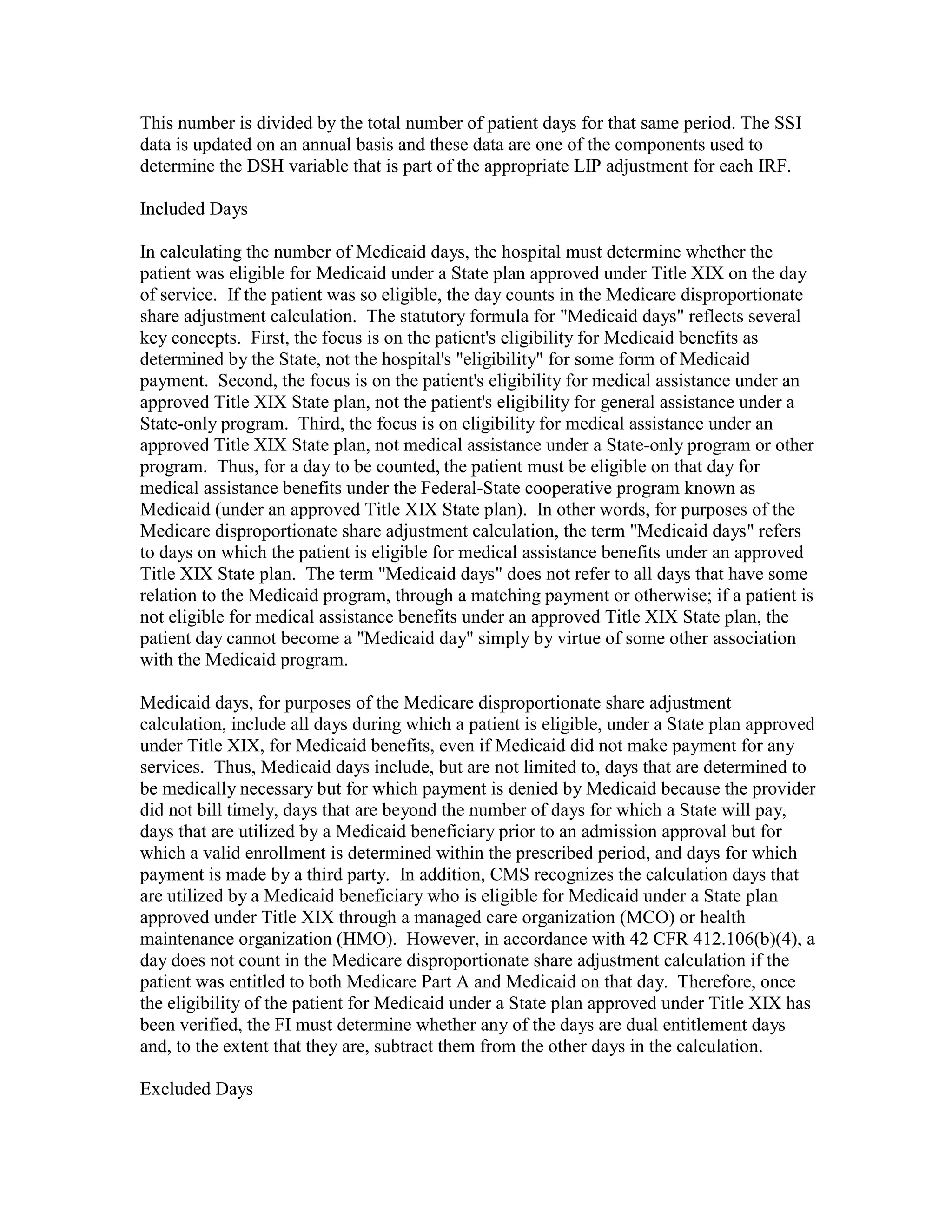

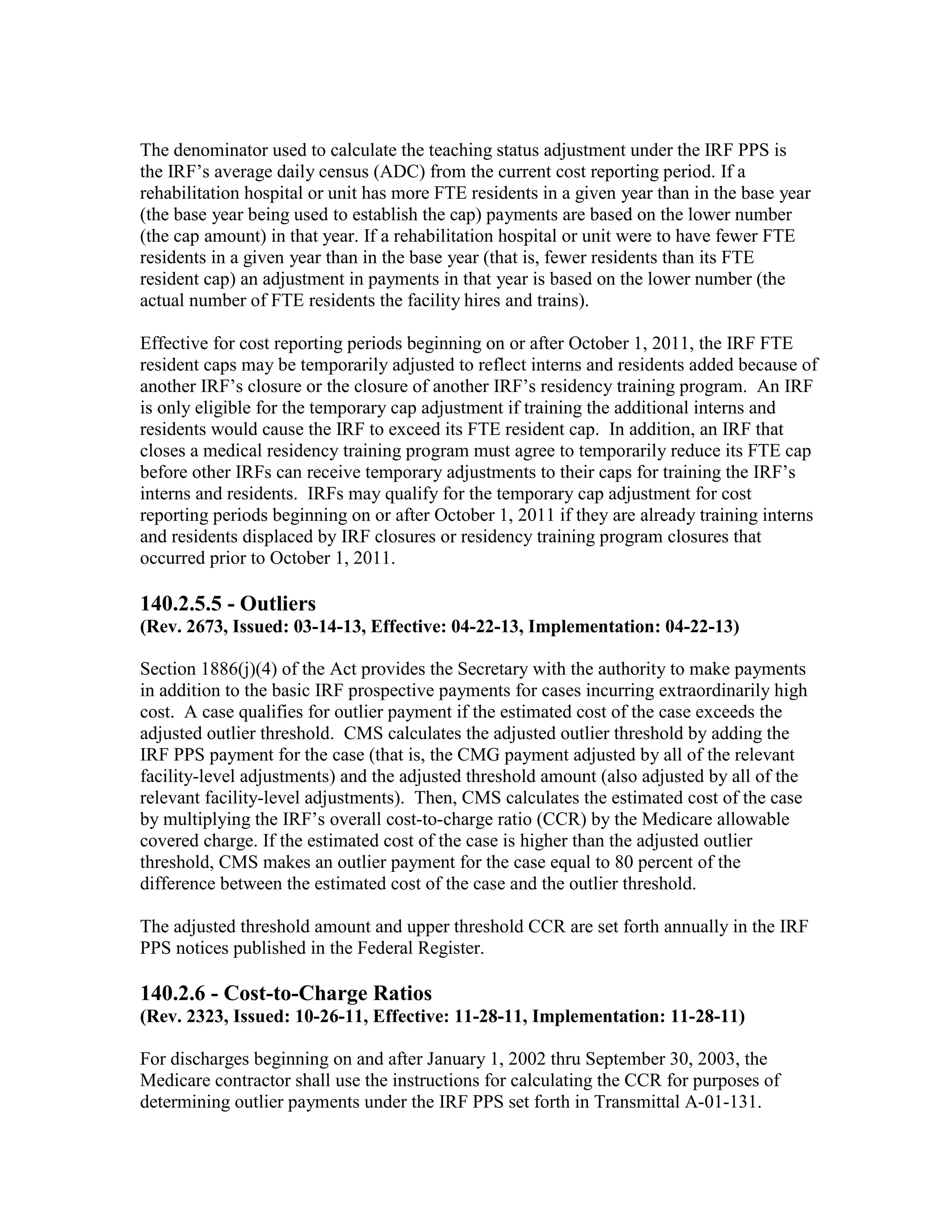

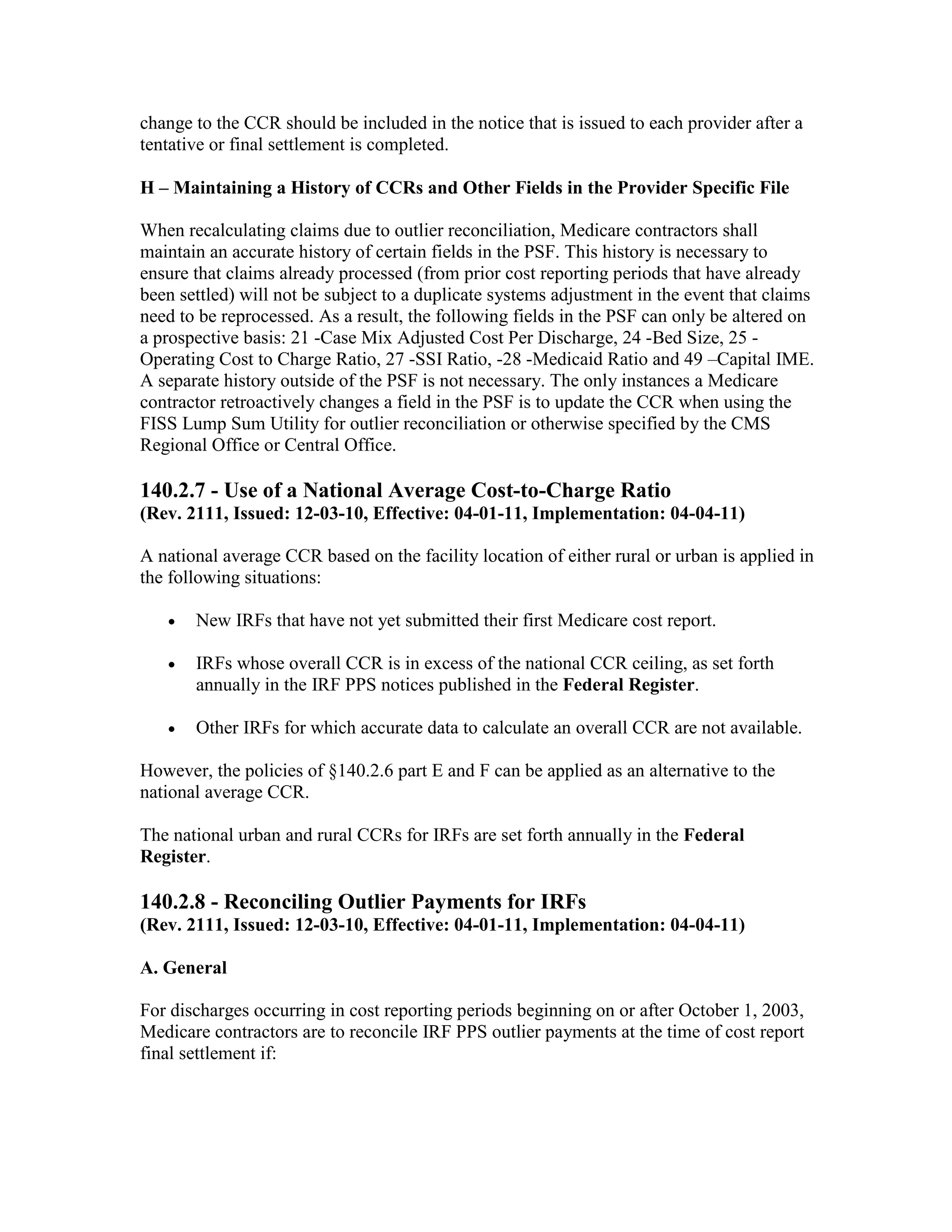

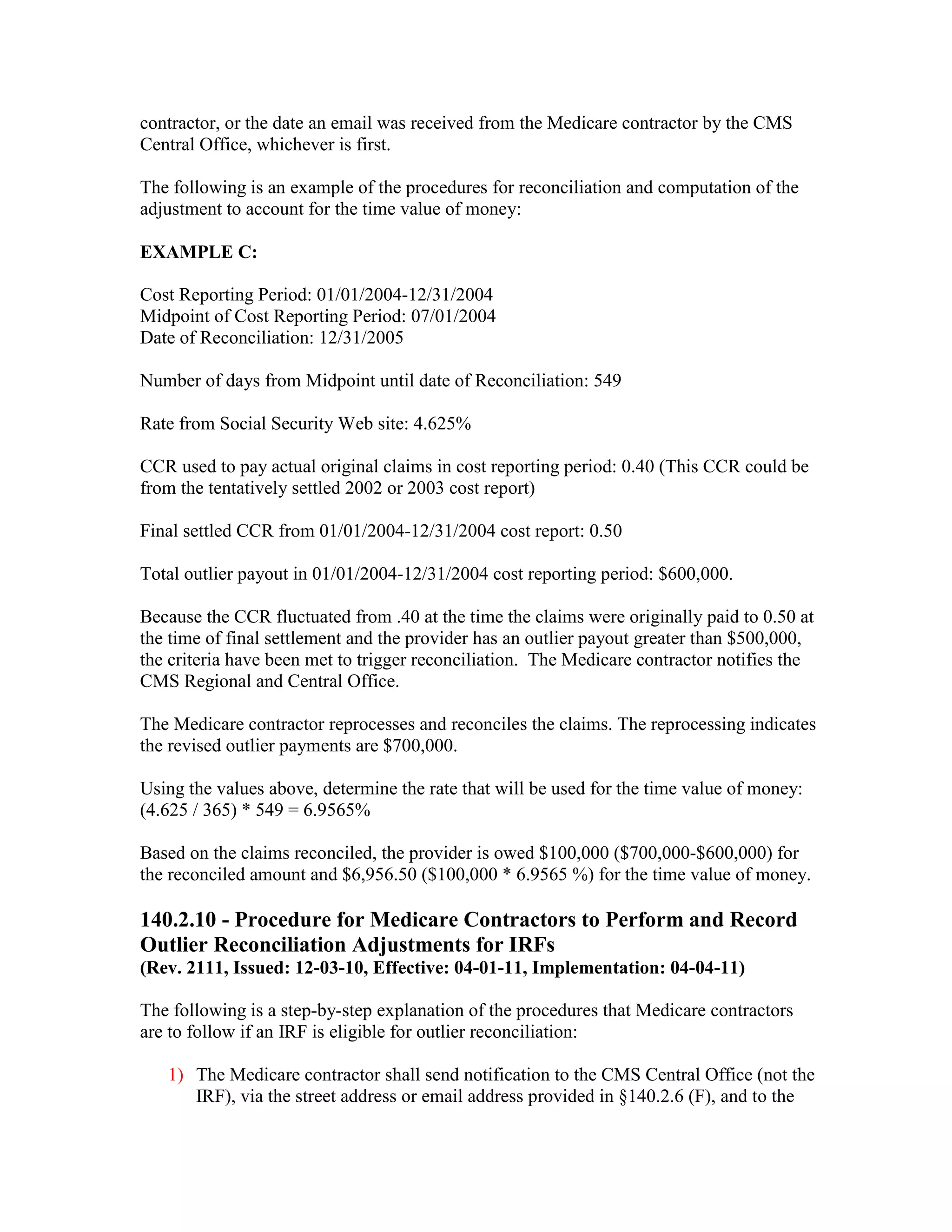

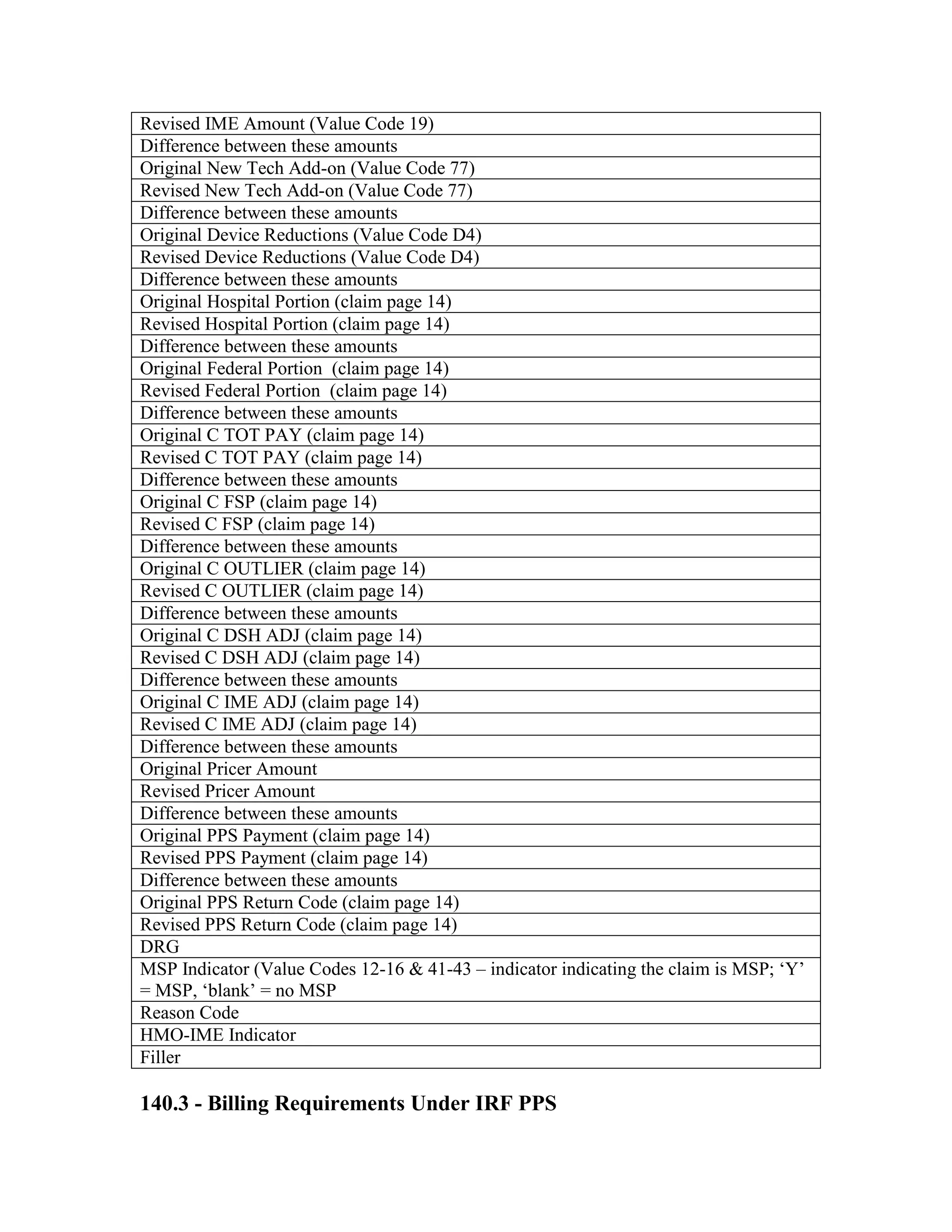

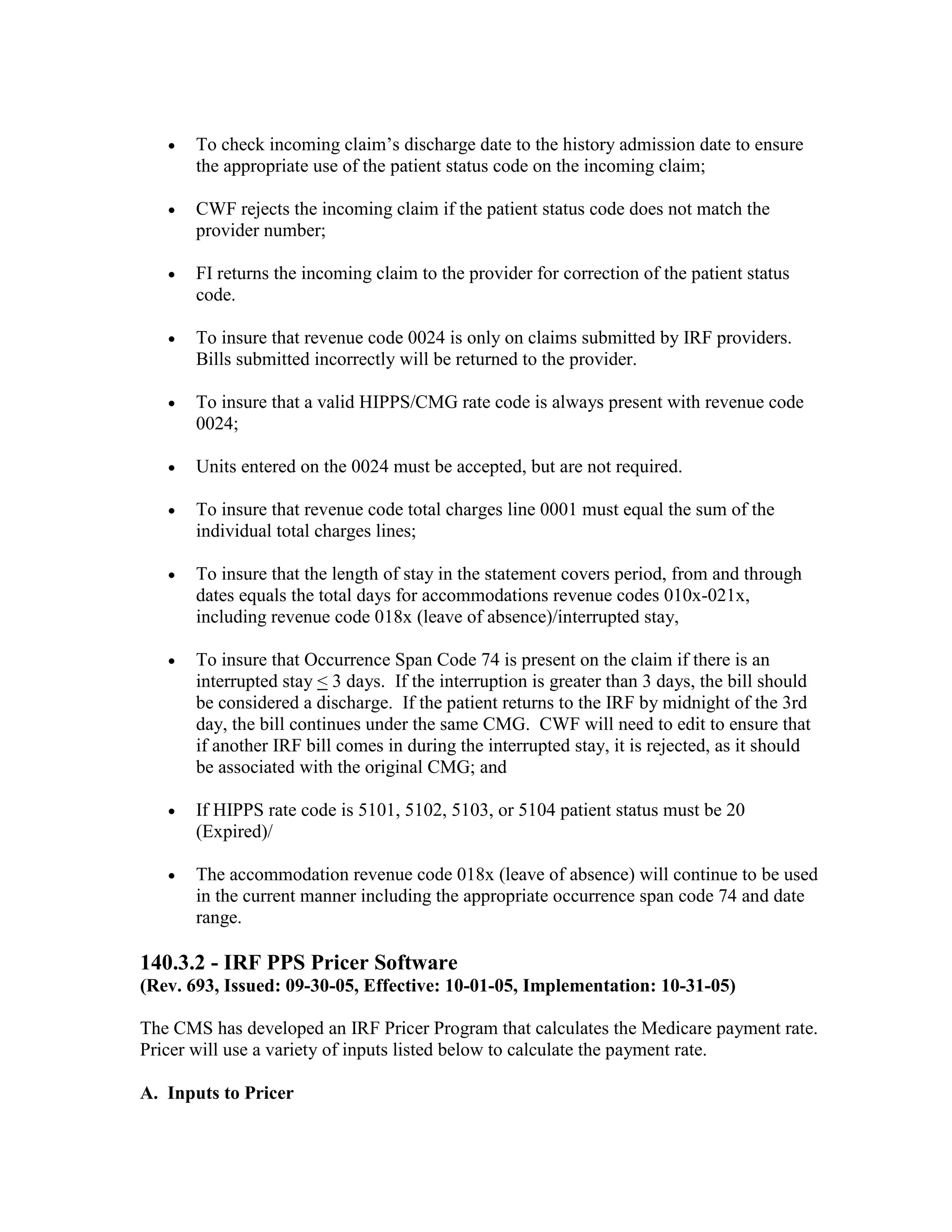

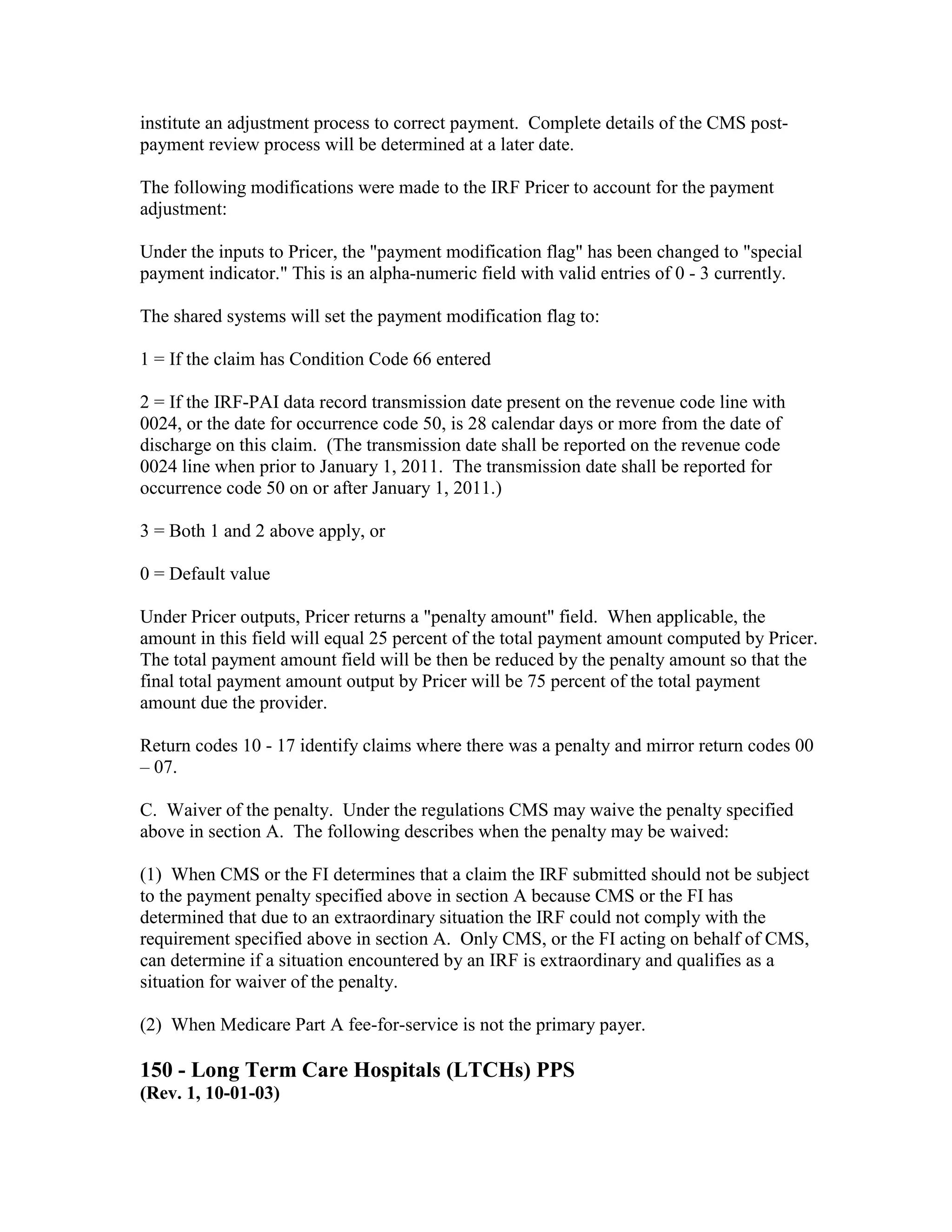

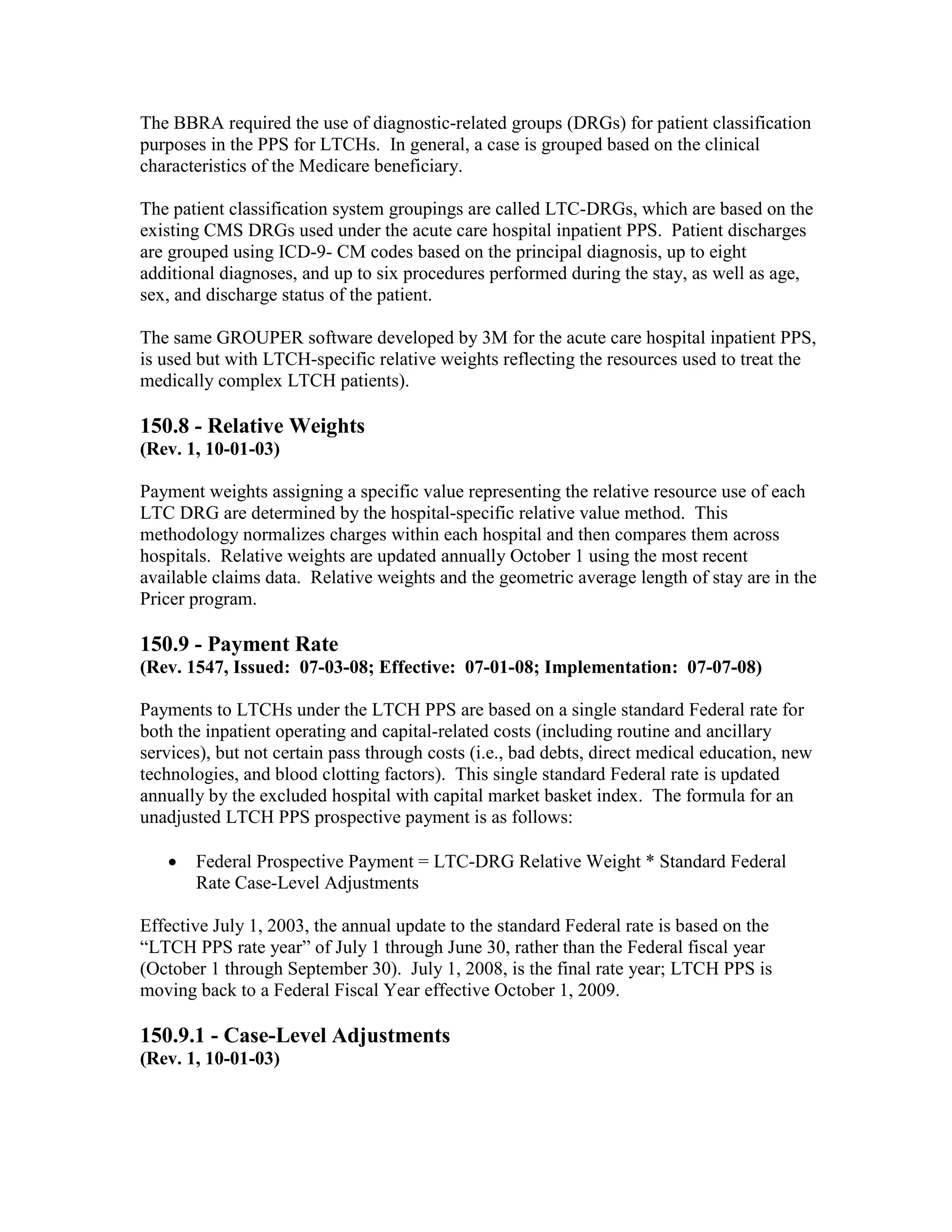

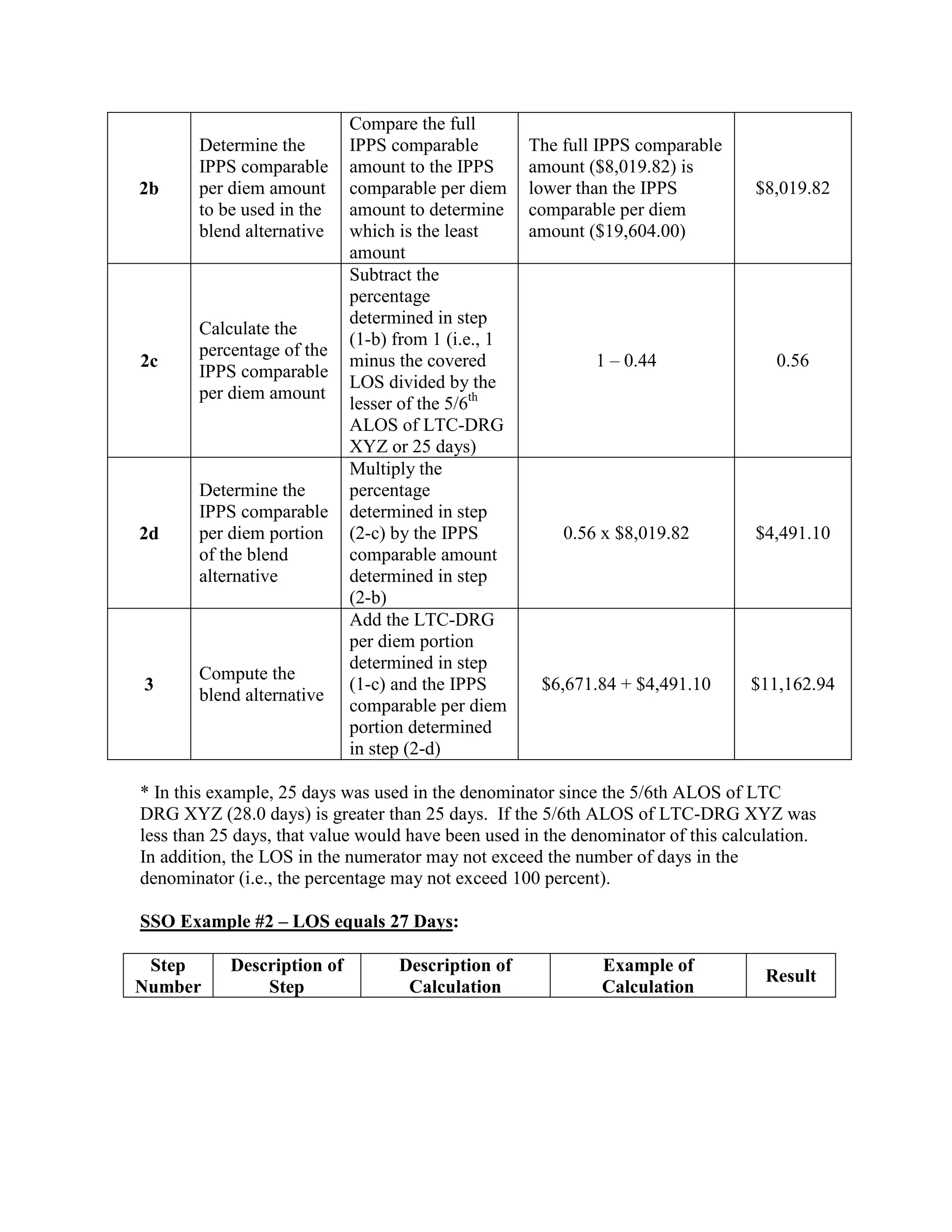

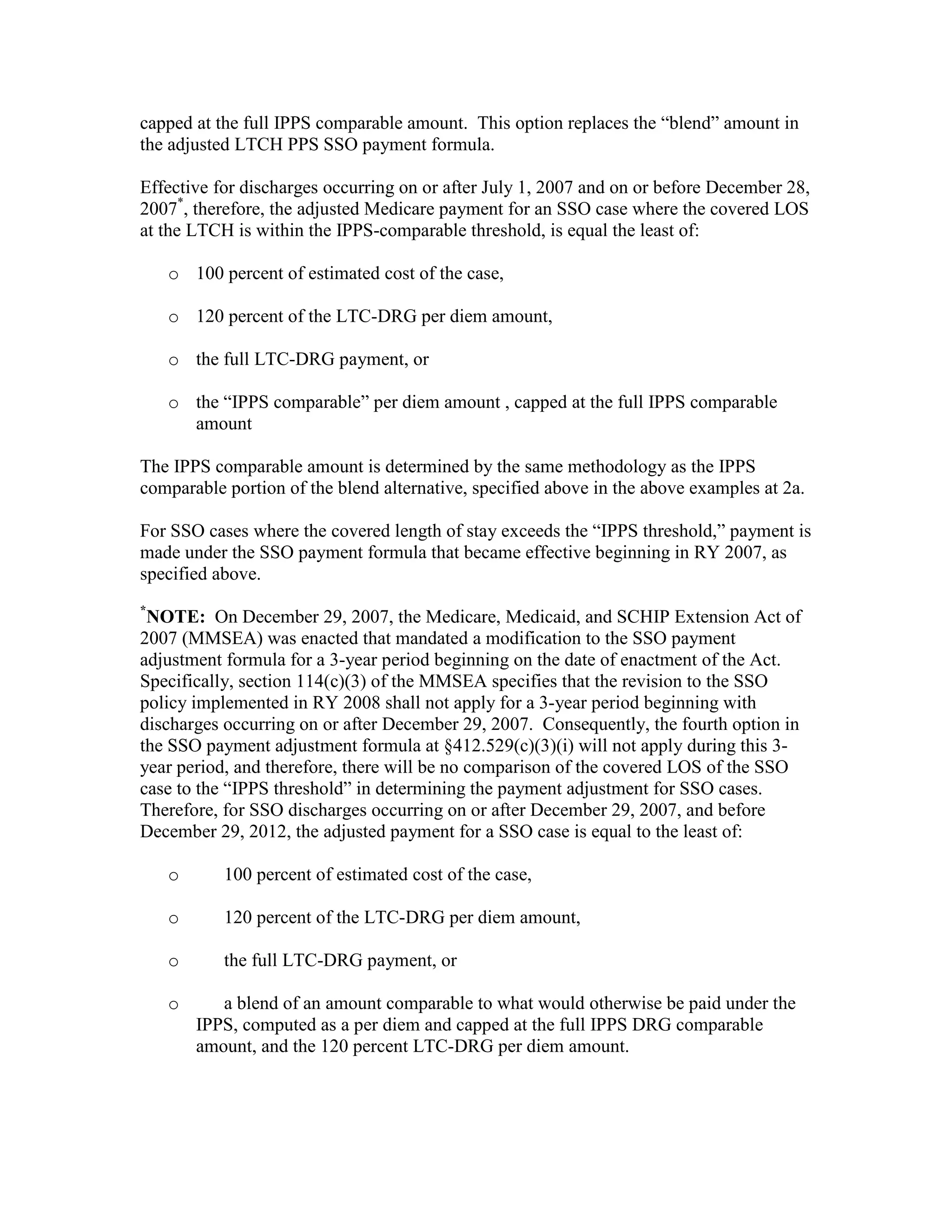

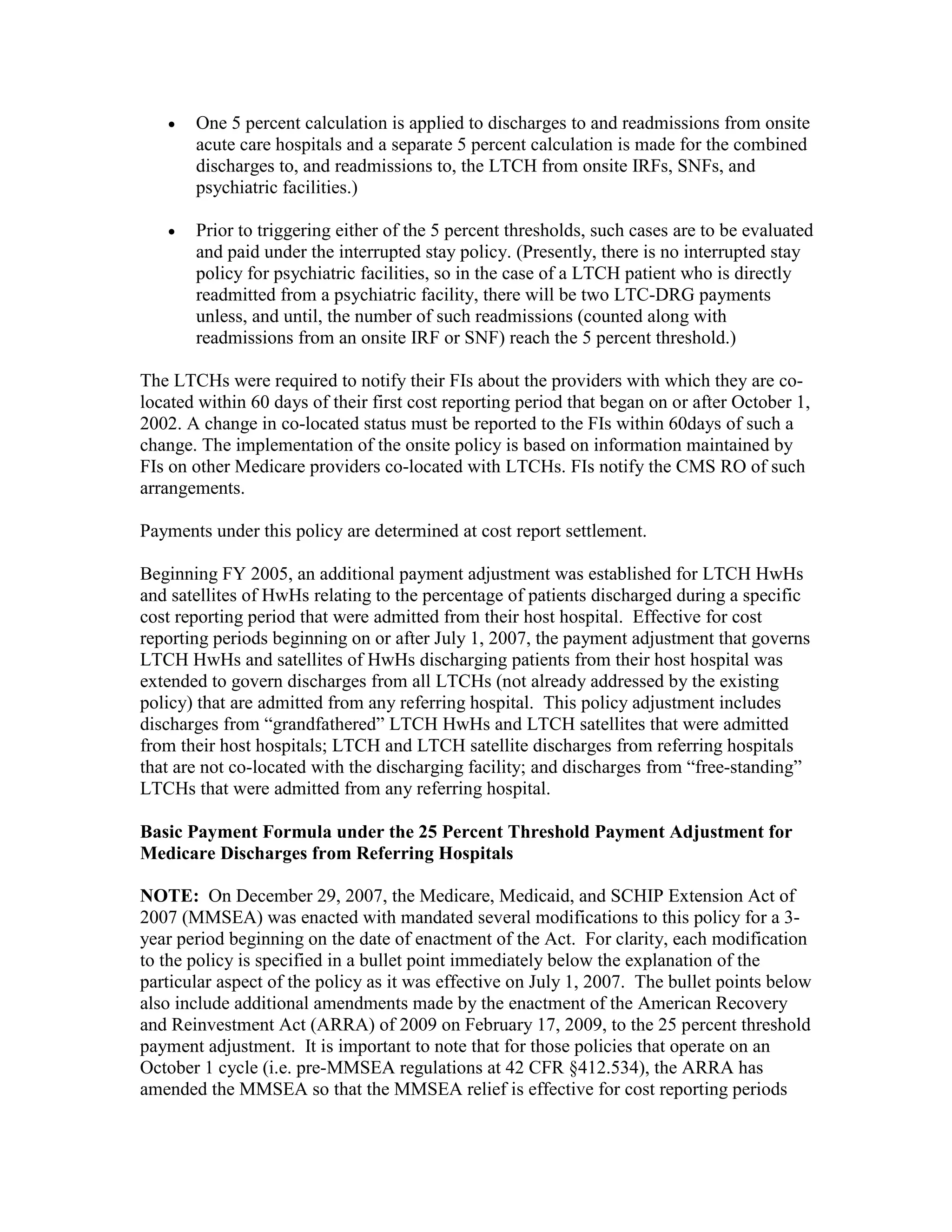

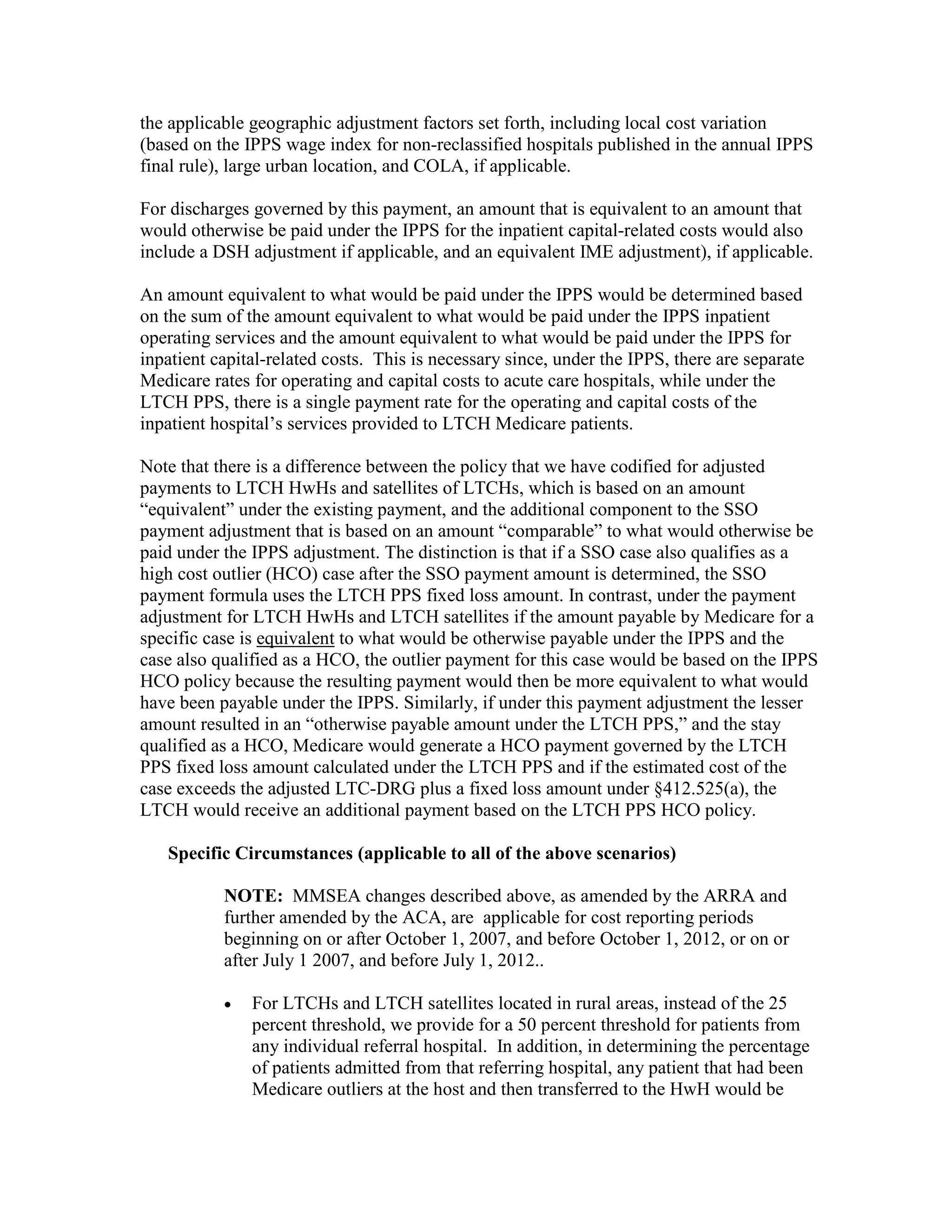

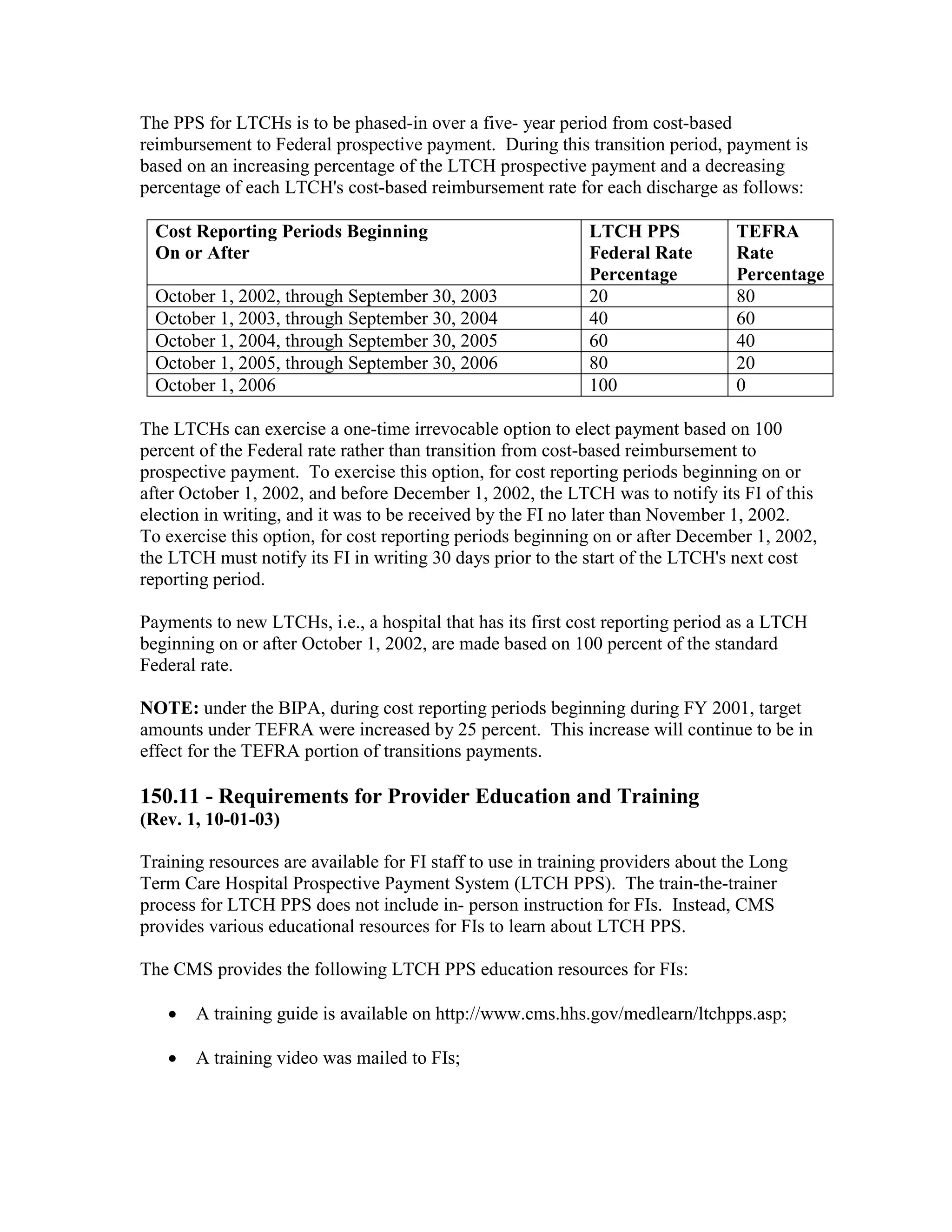

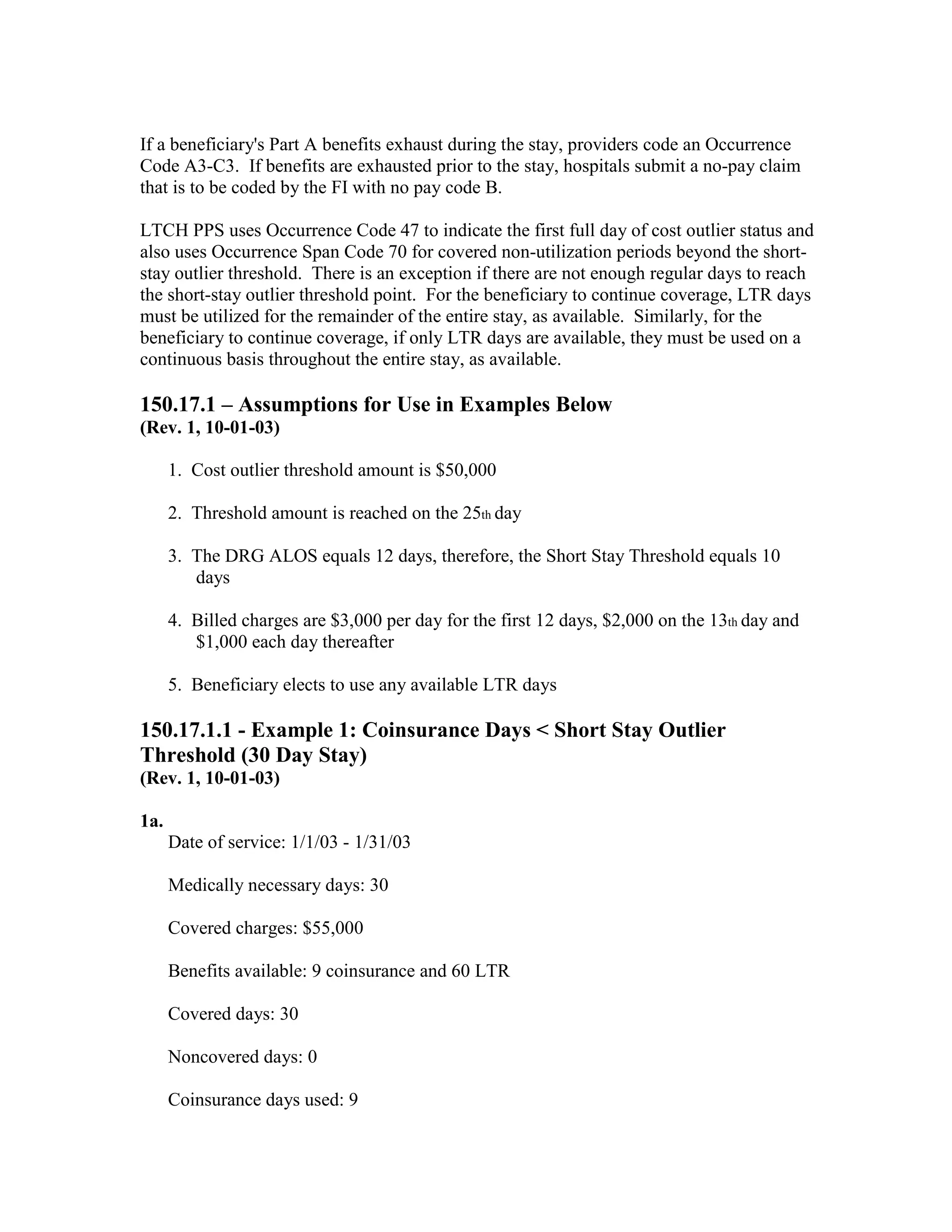

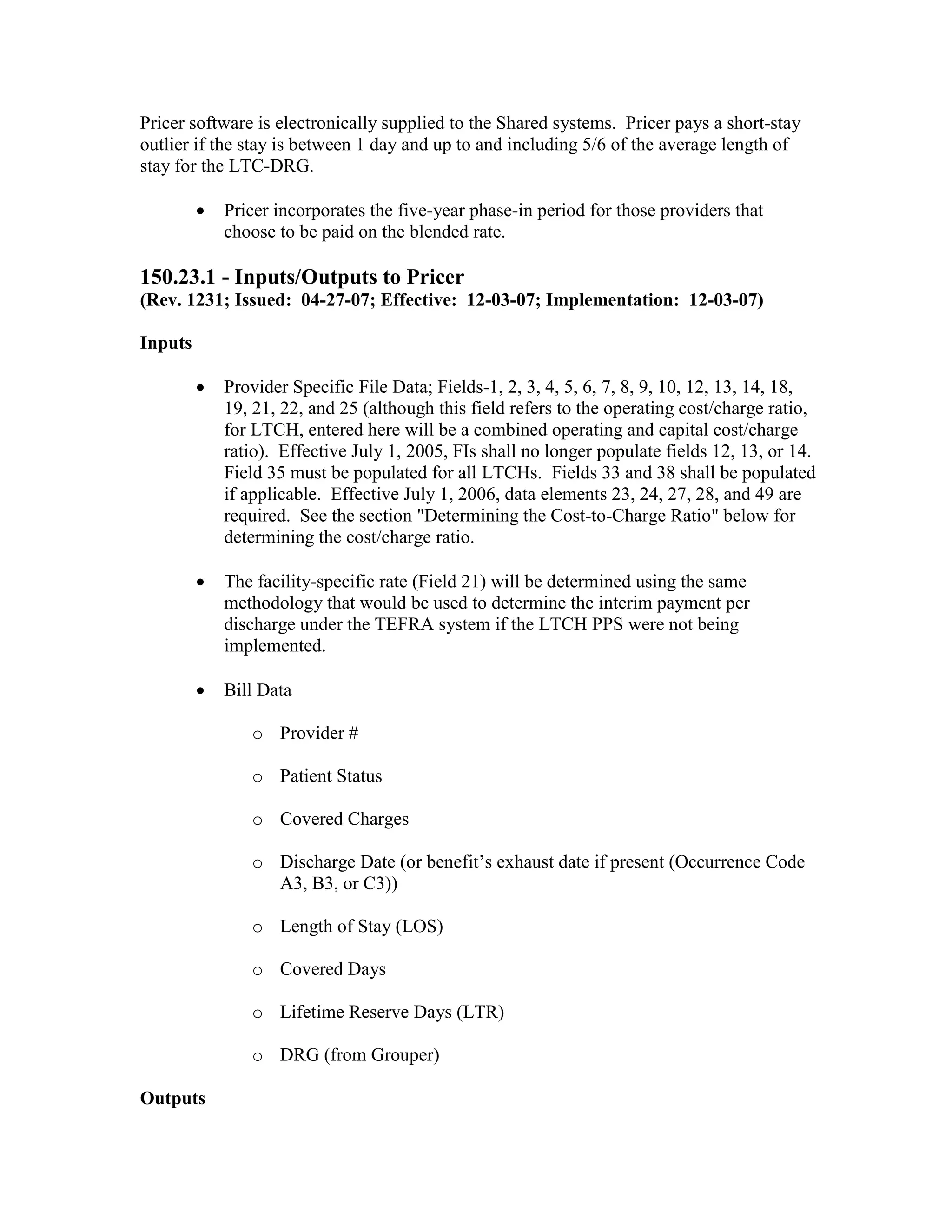

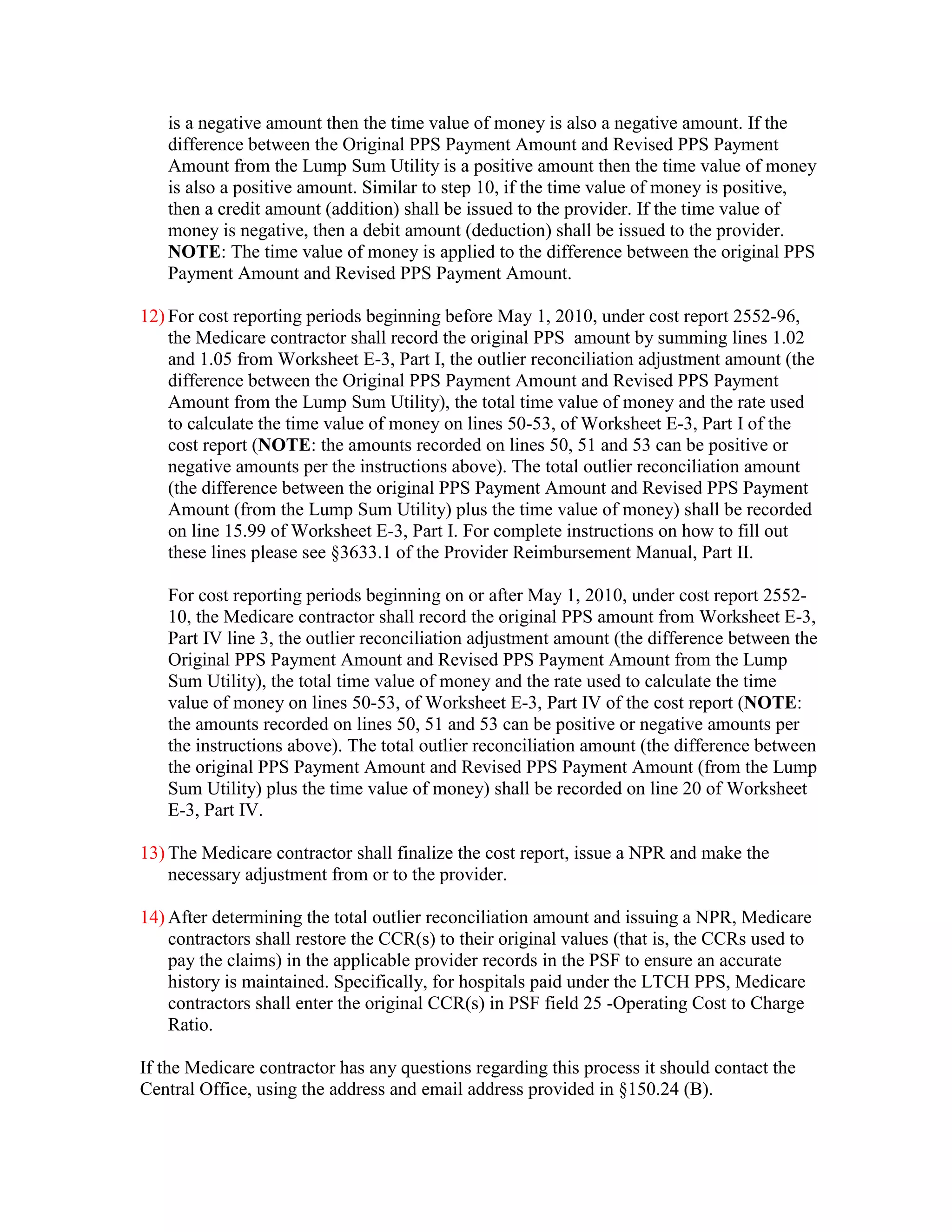

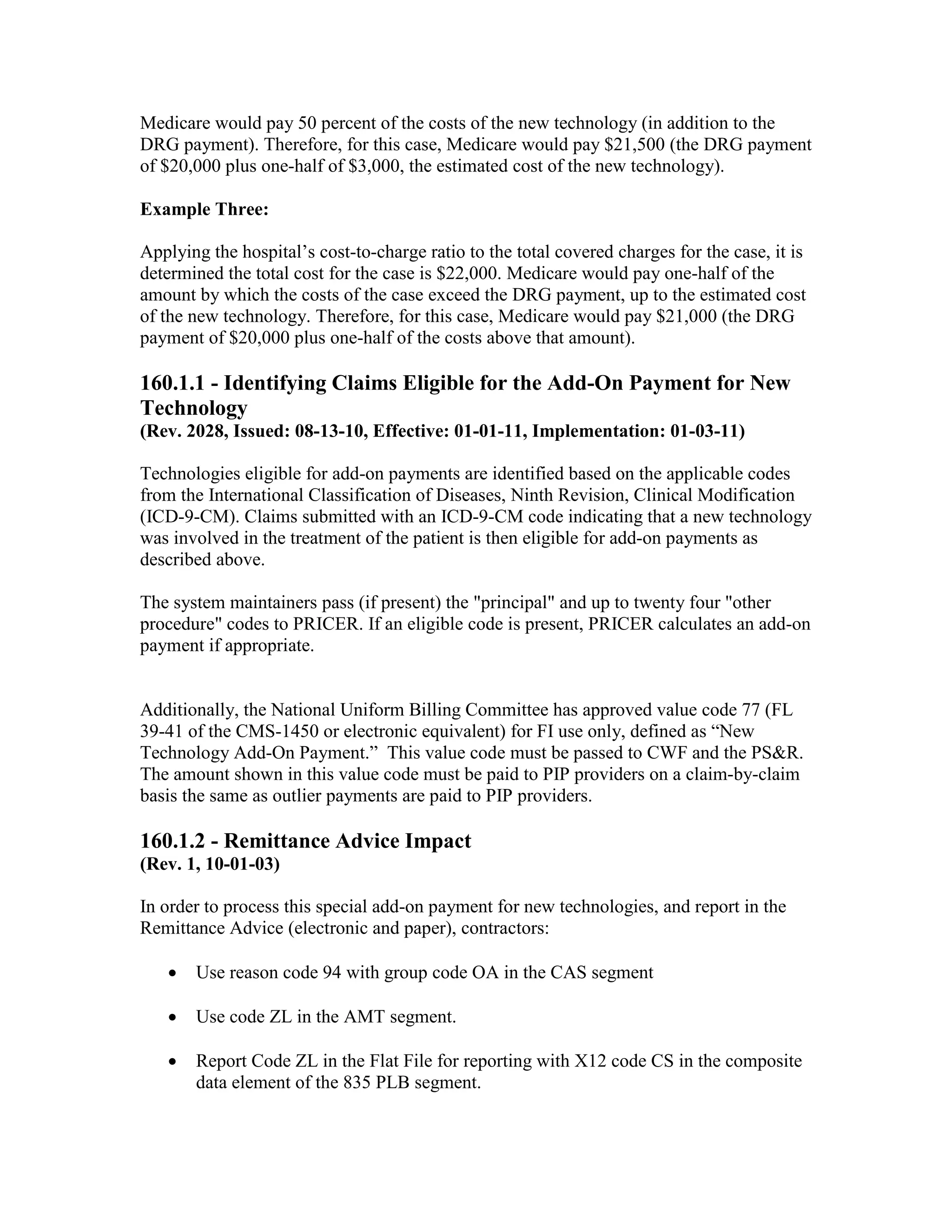

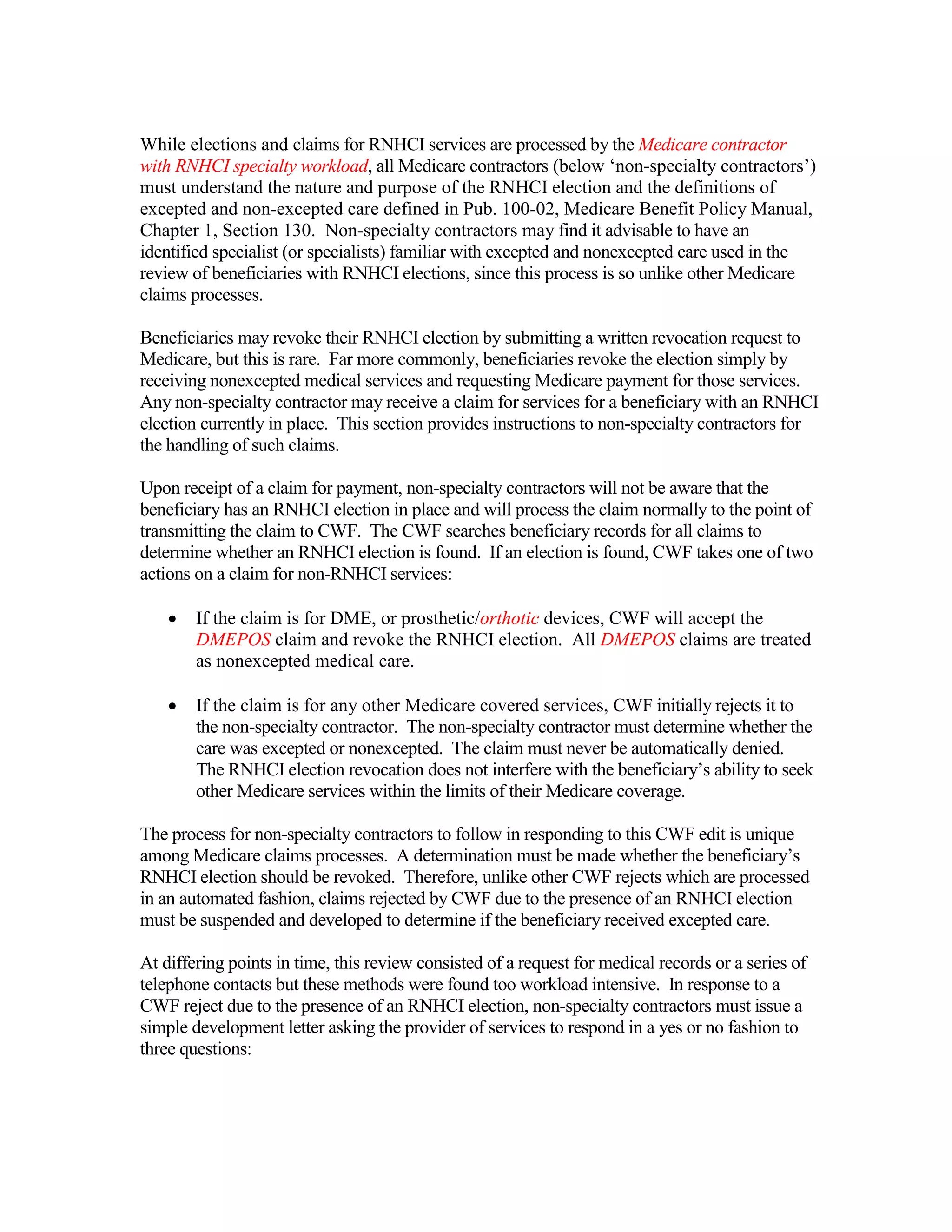

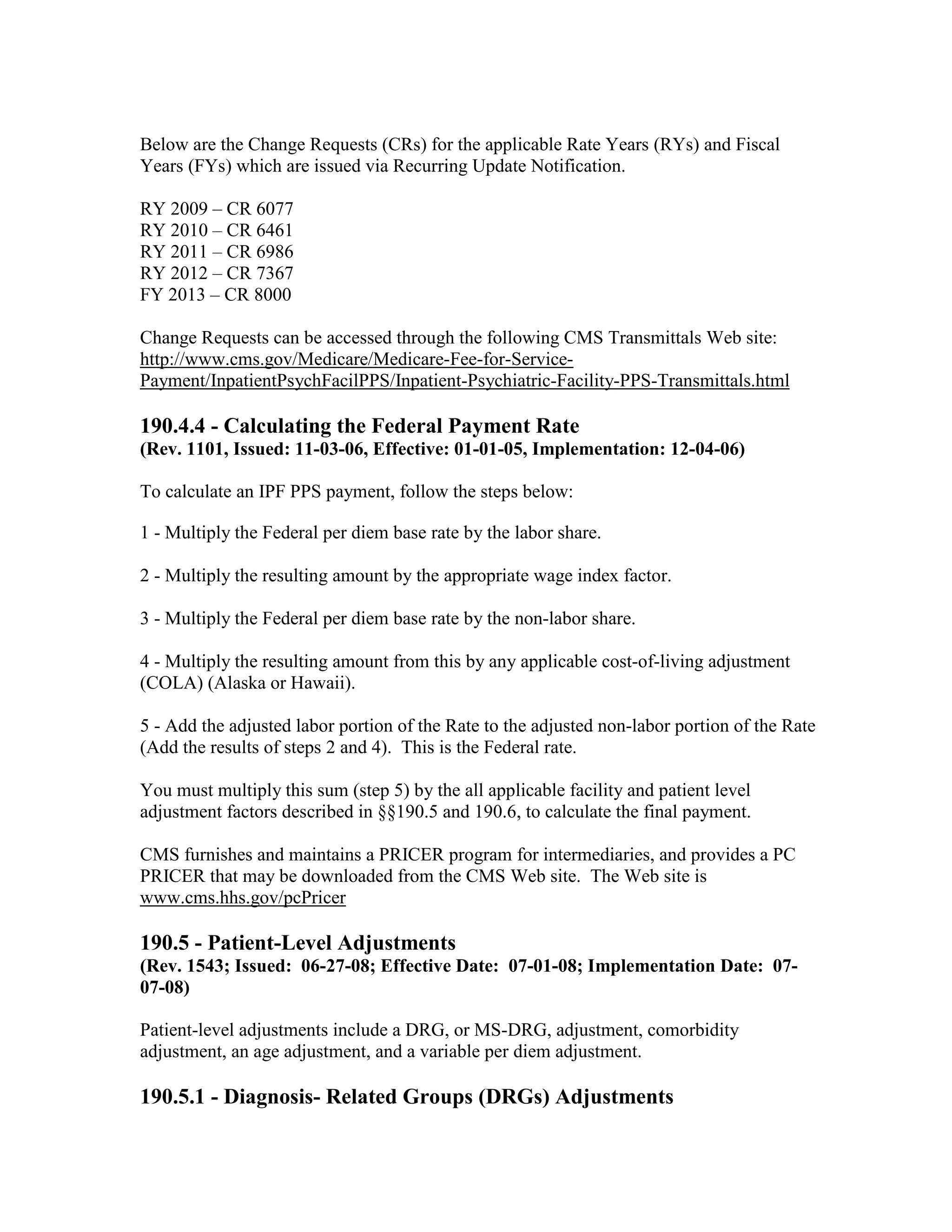

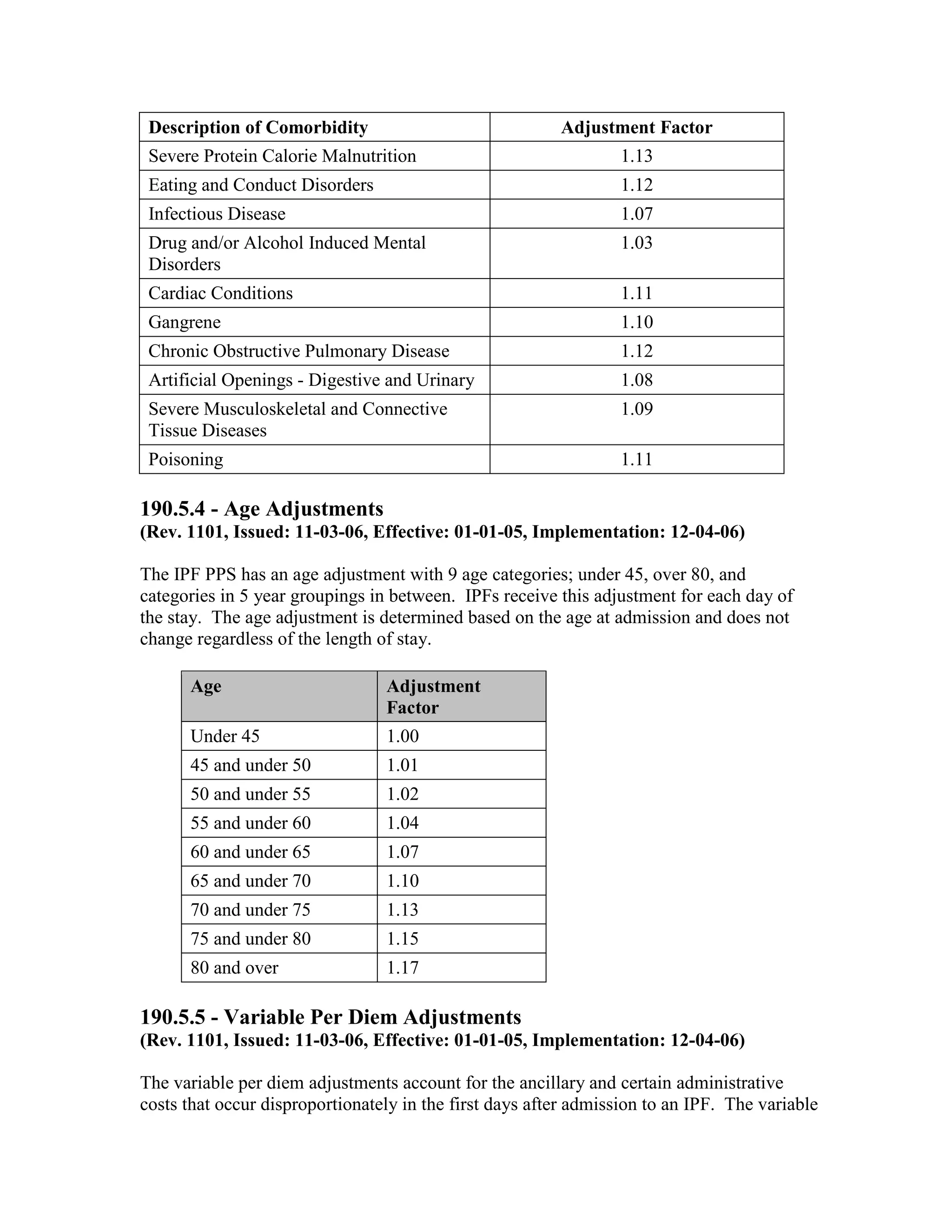

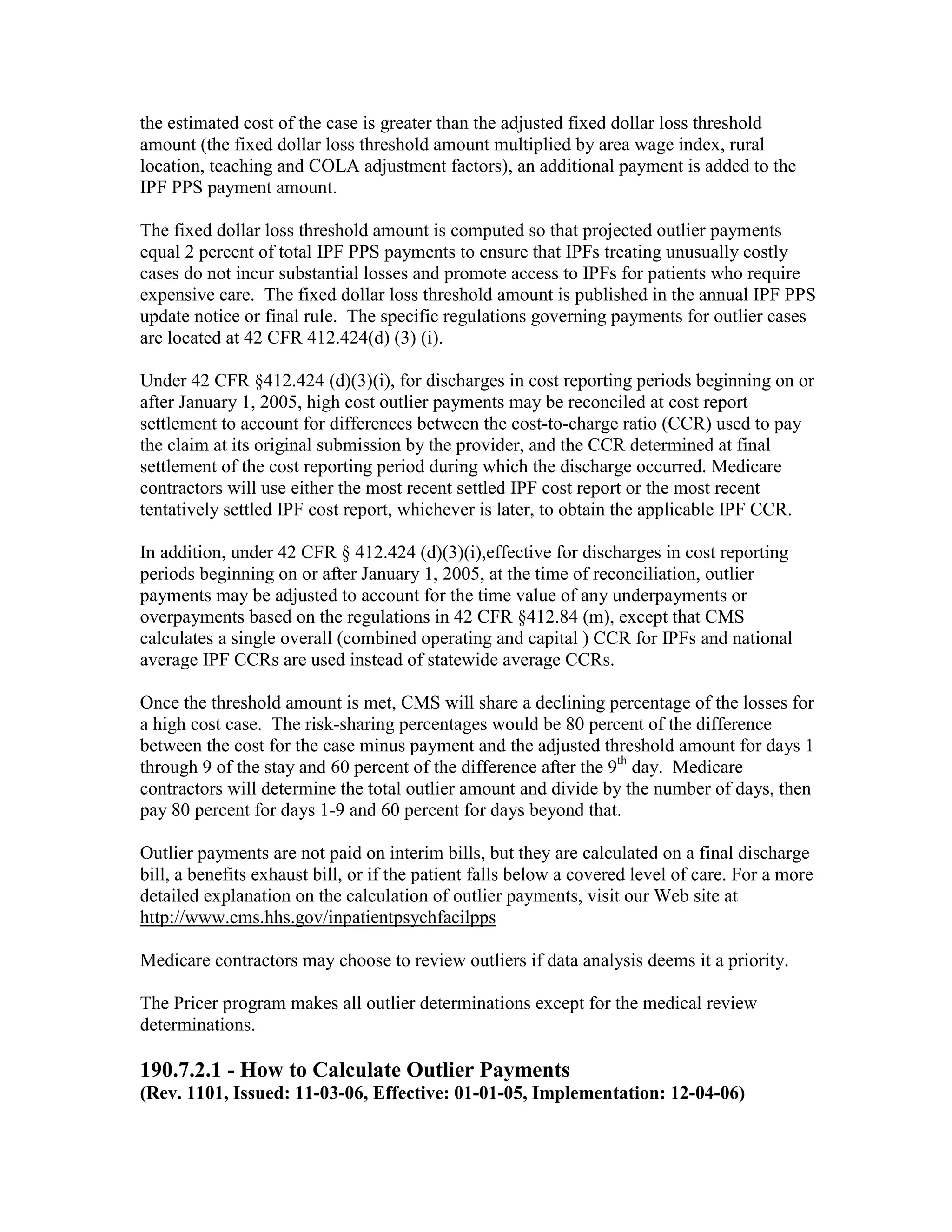

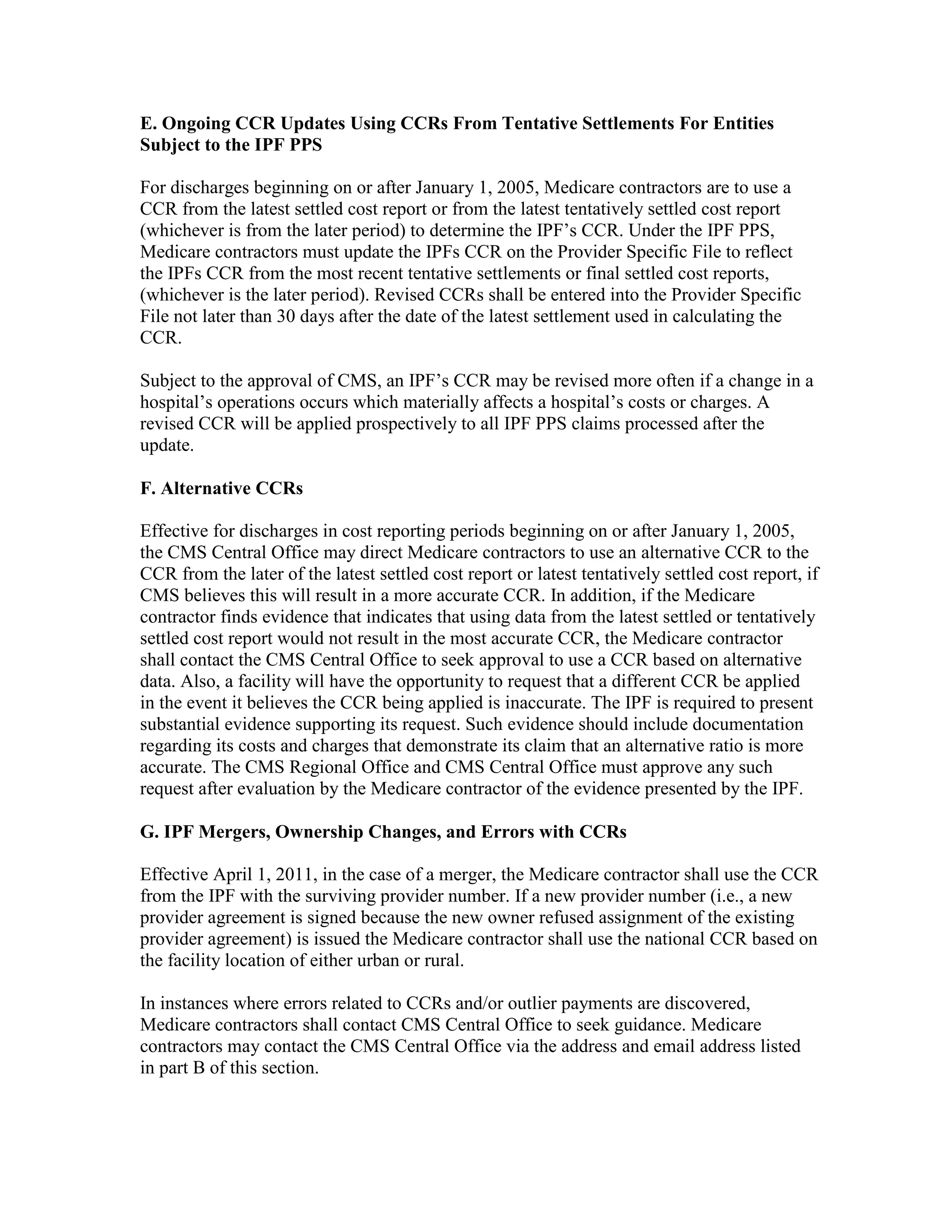

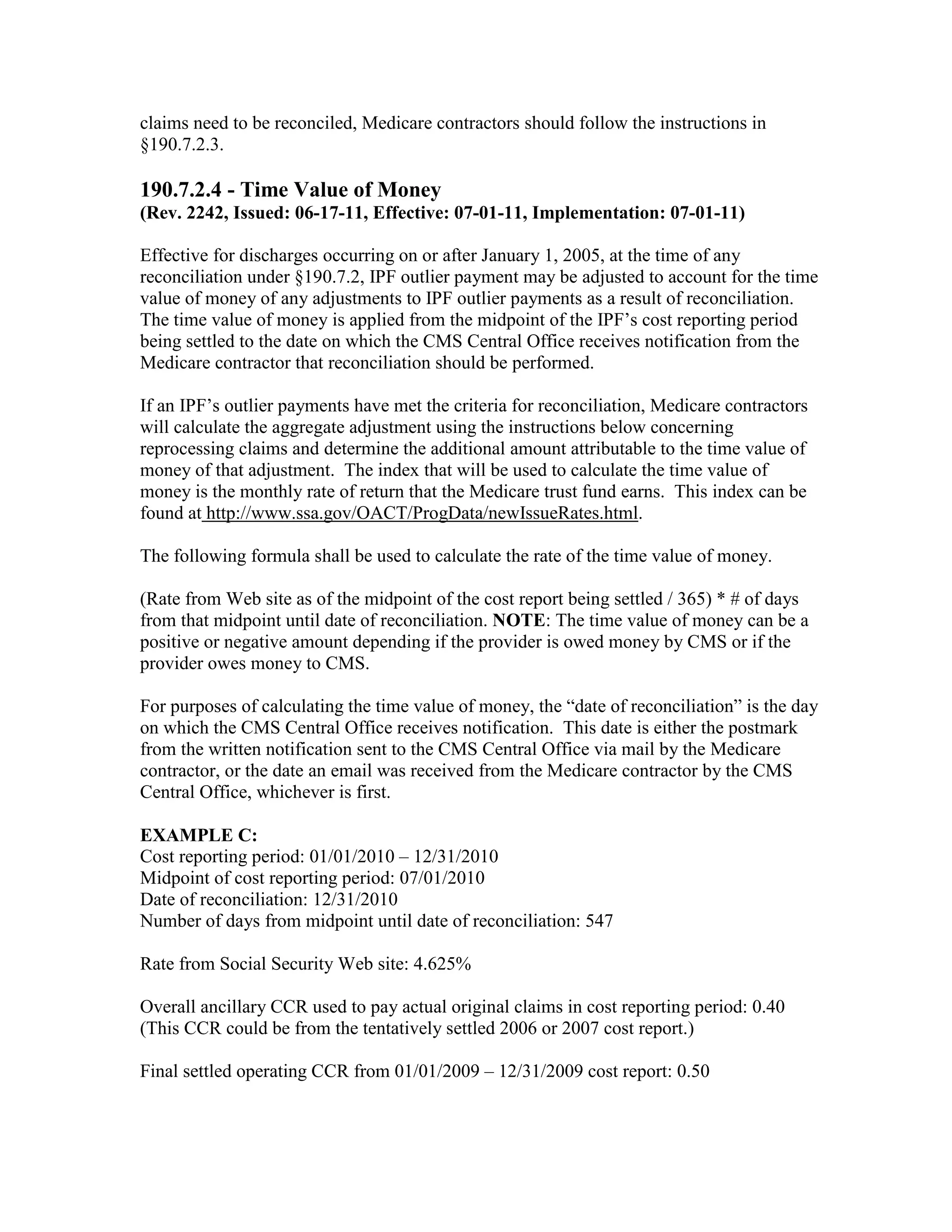

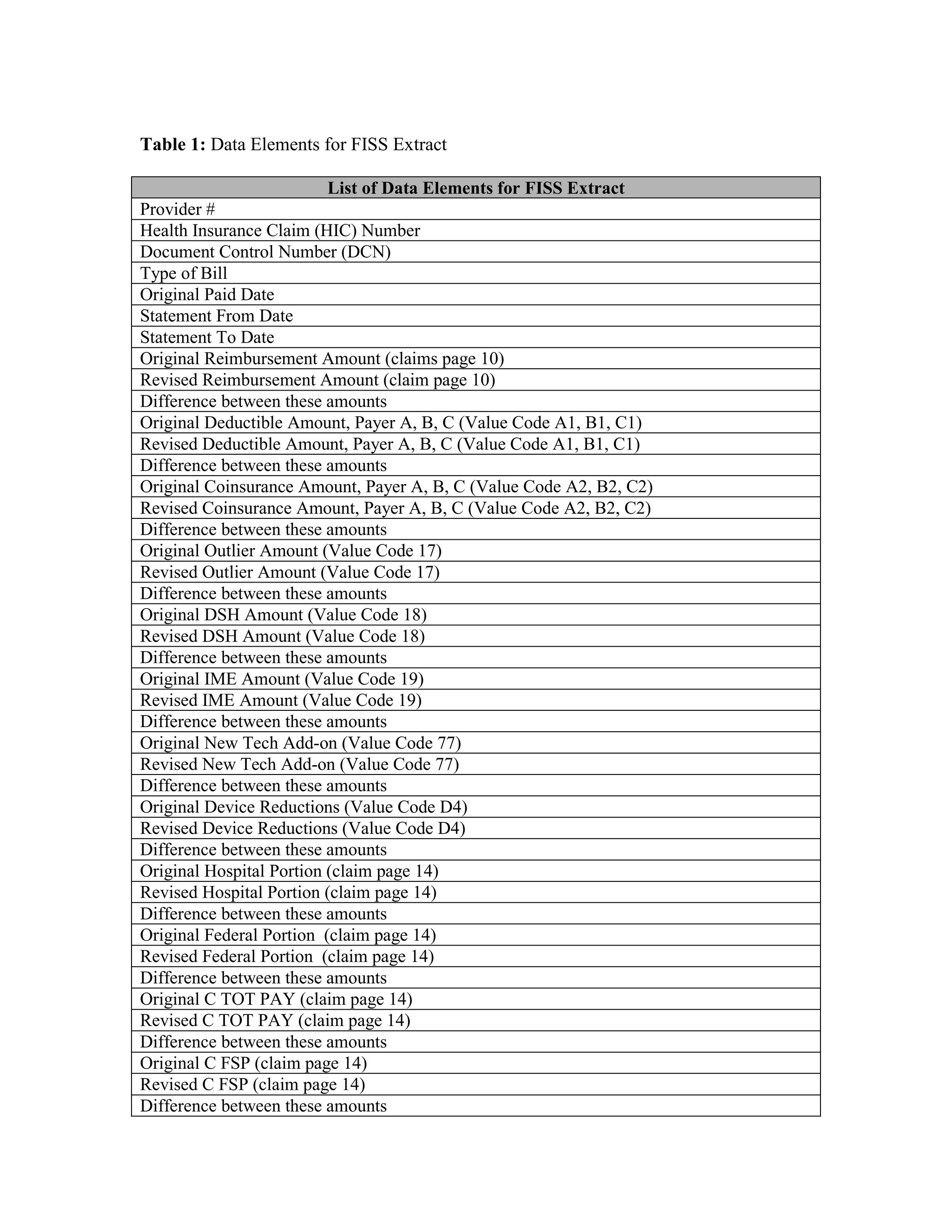

![•

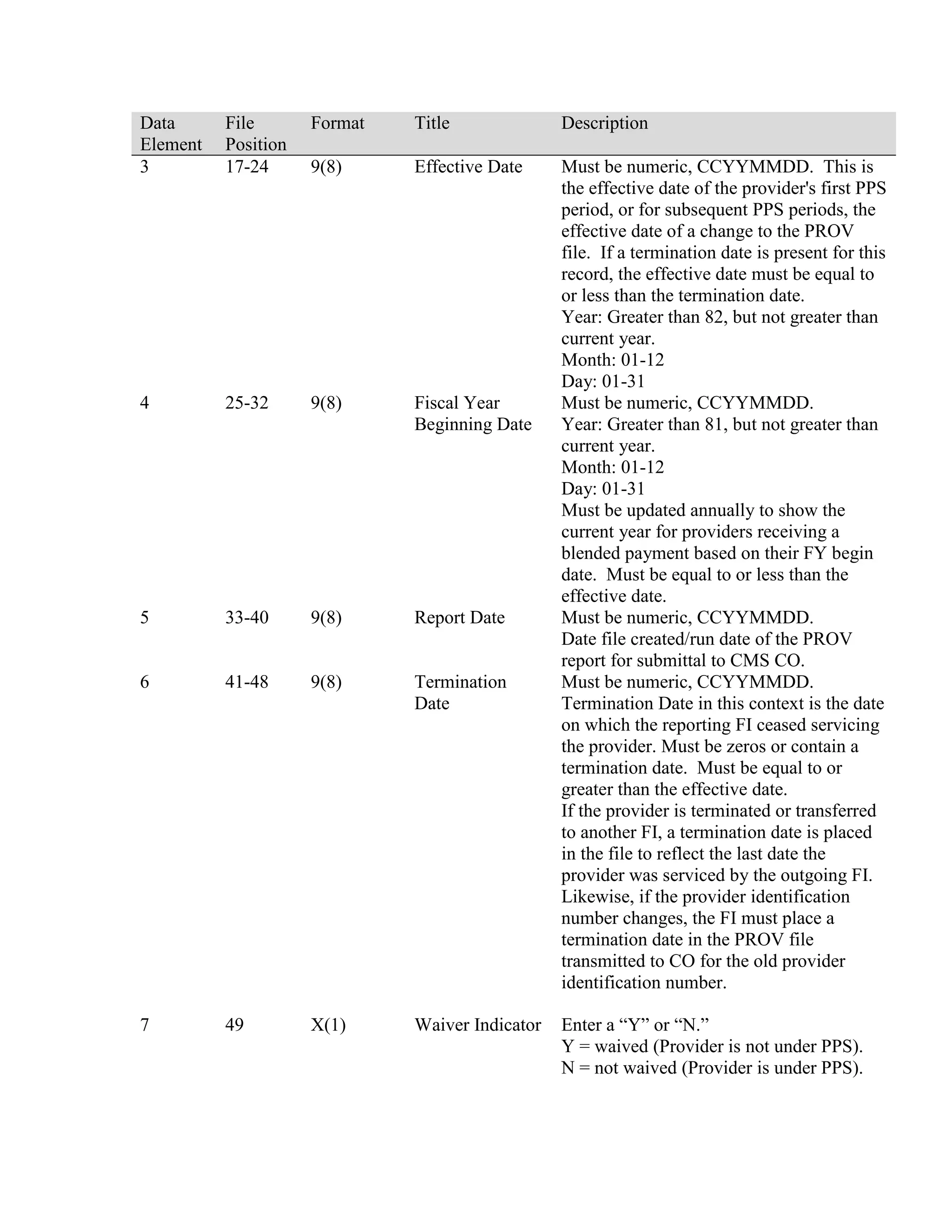

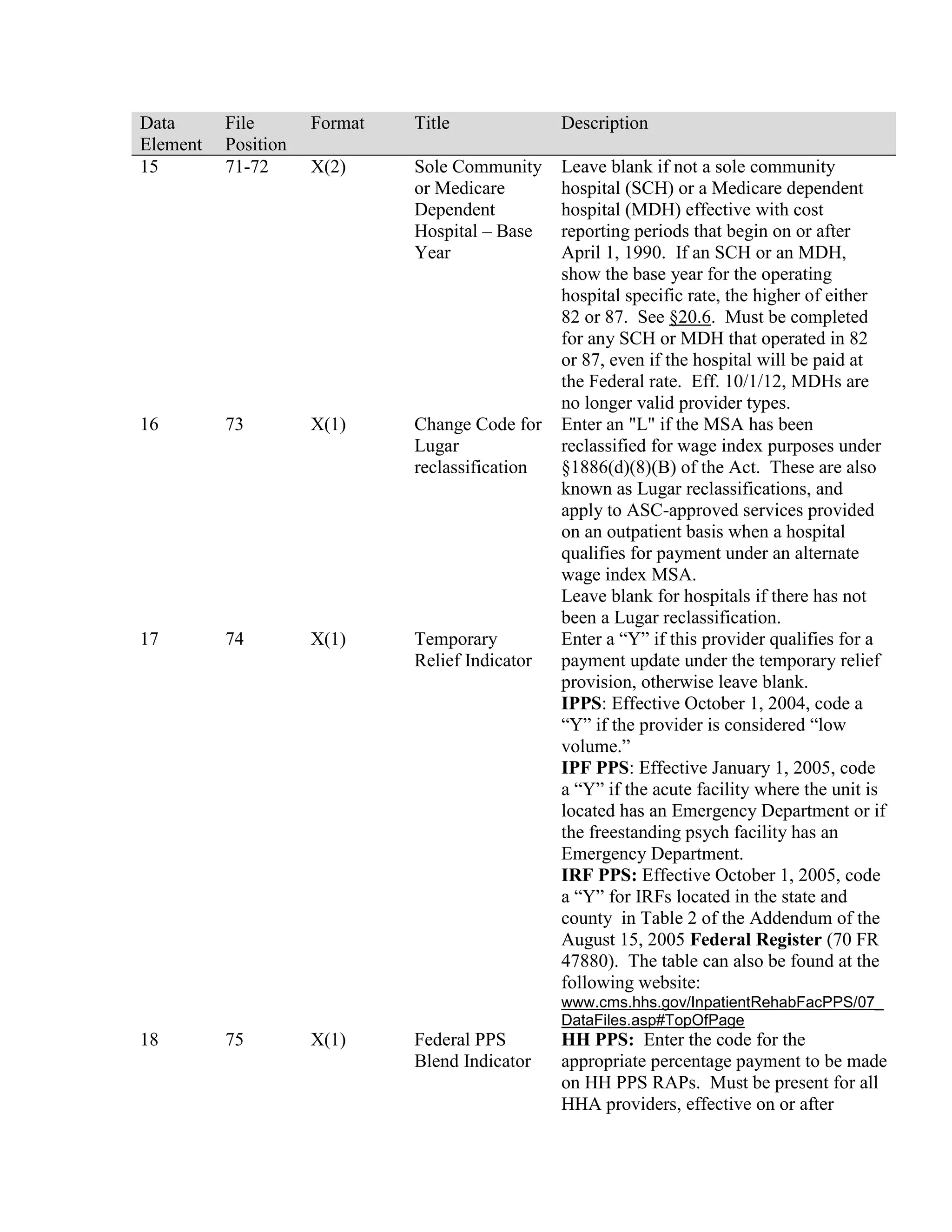

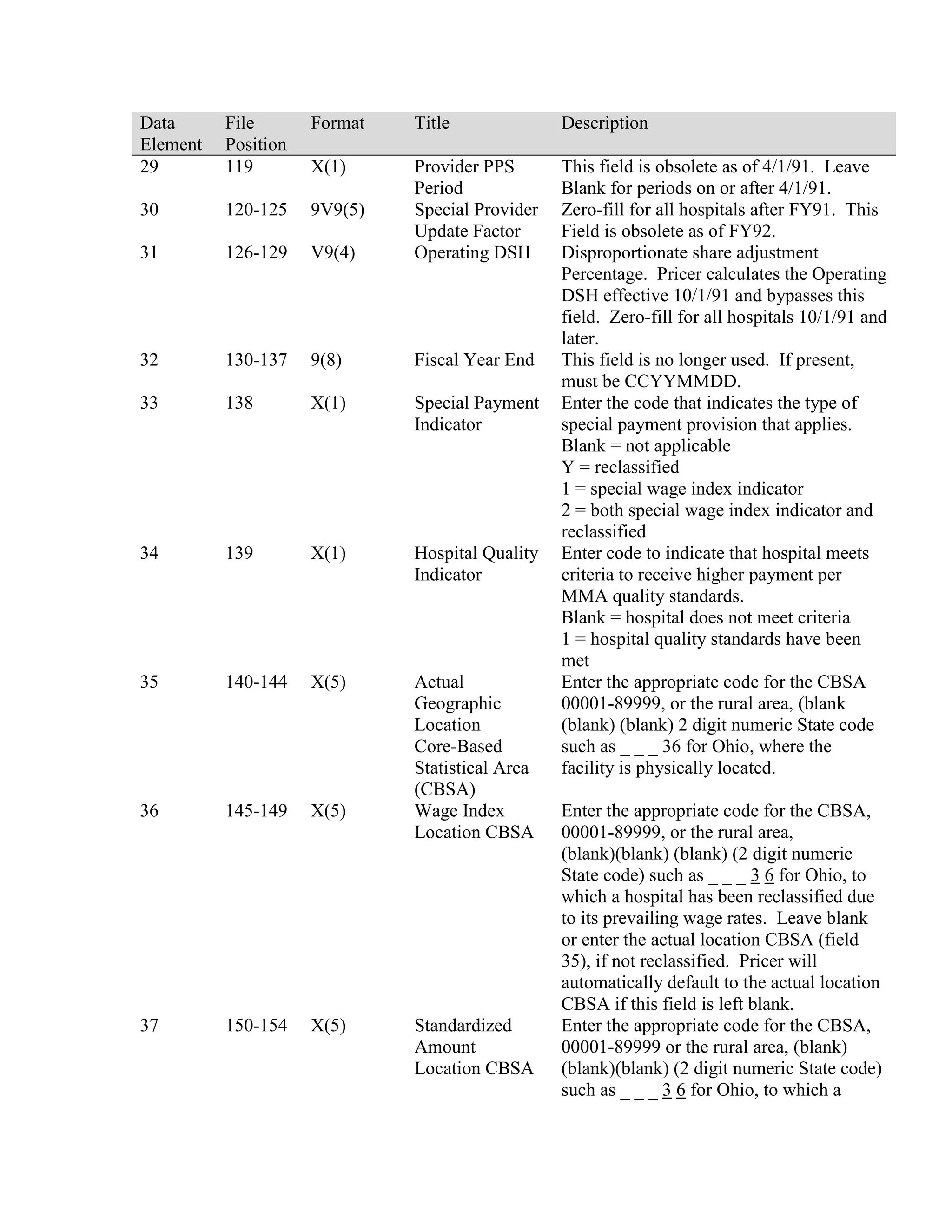

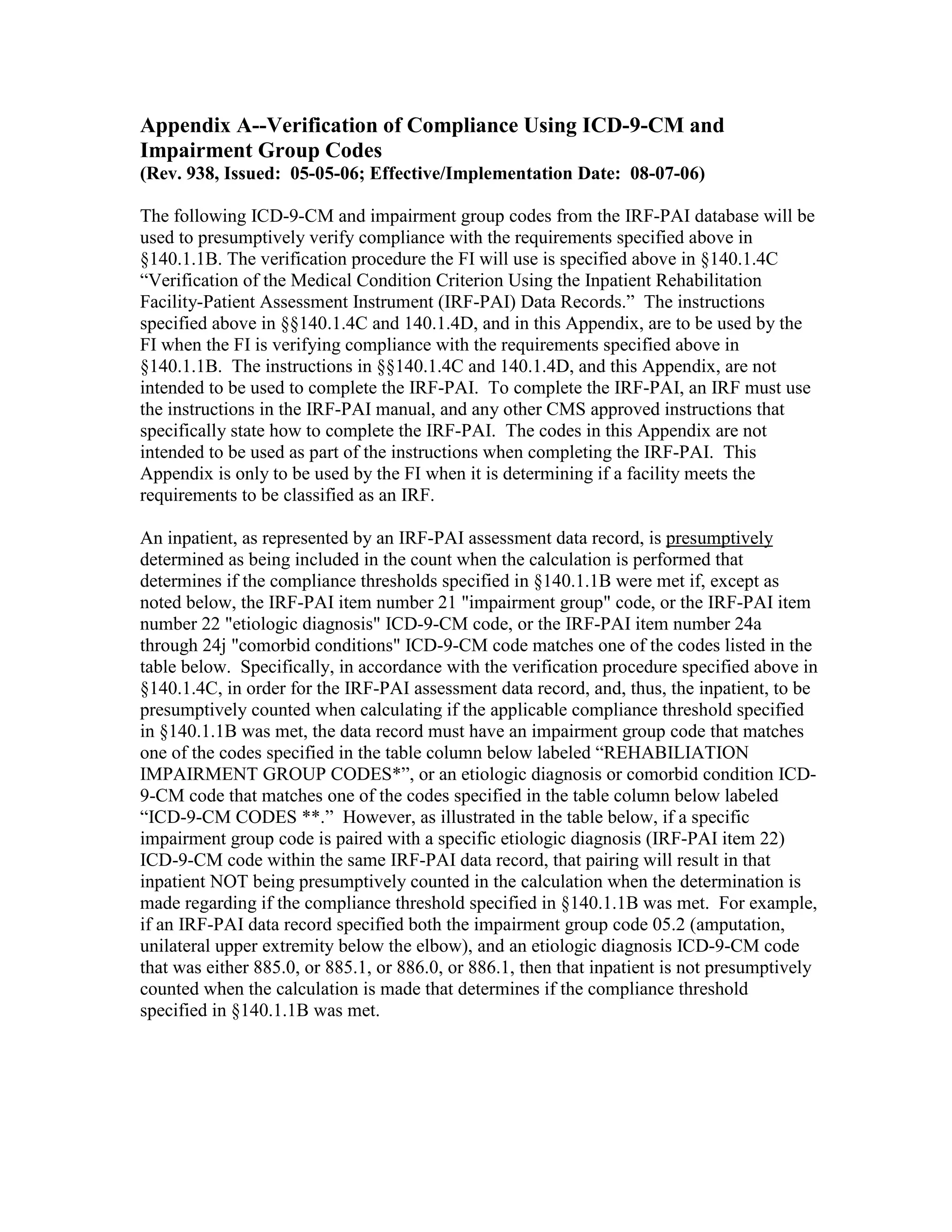

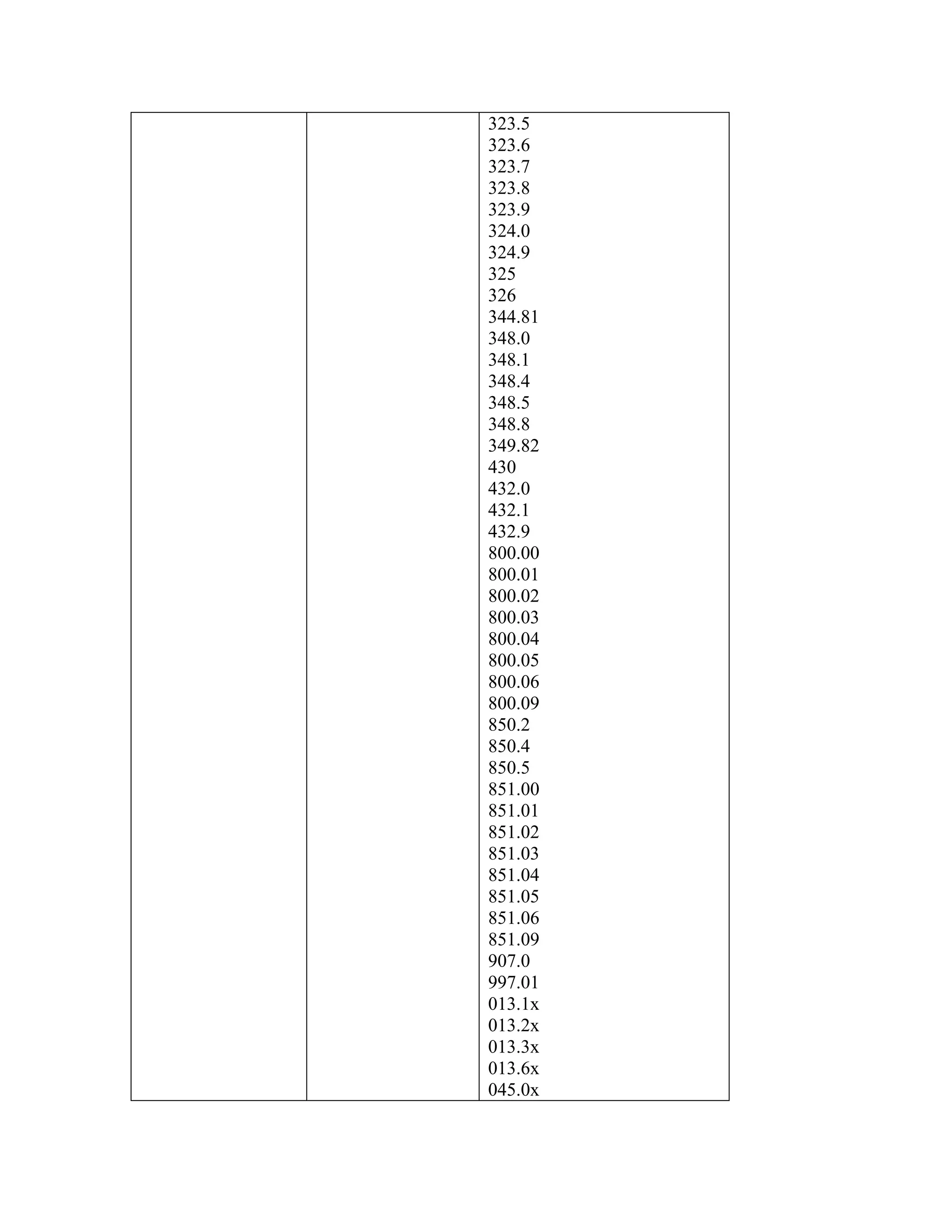

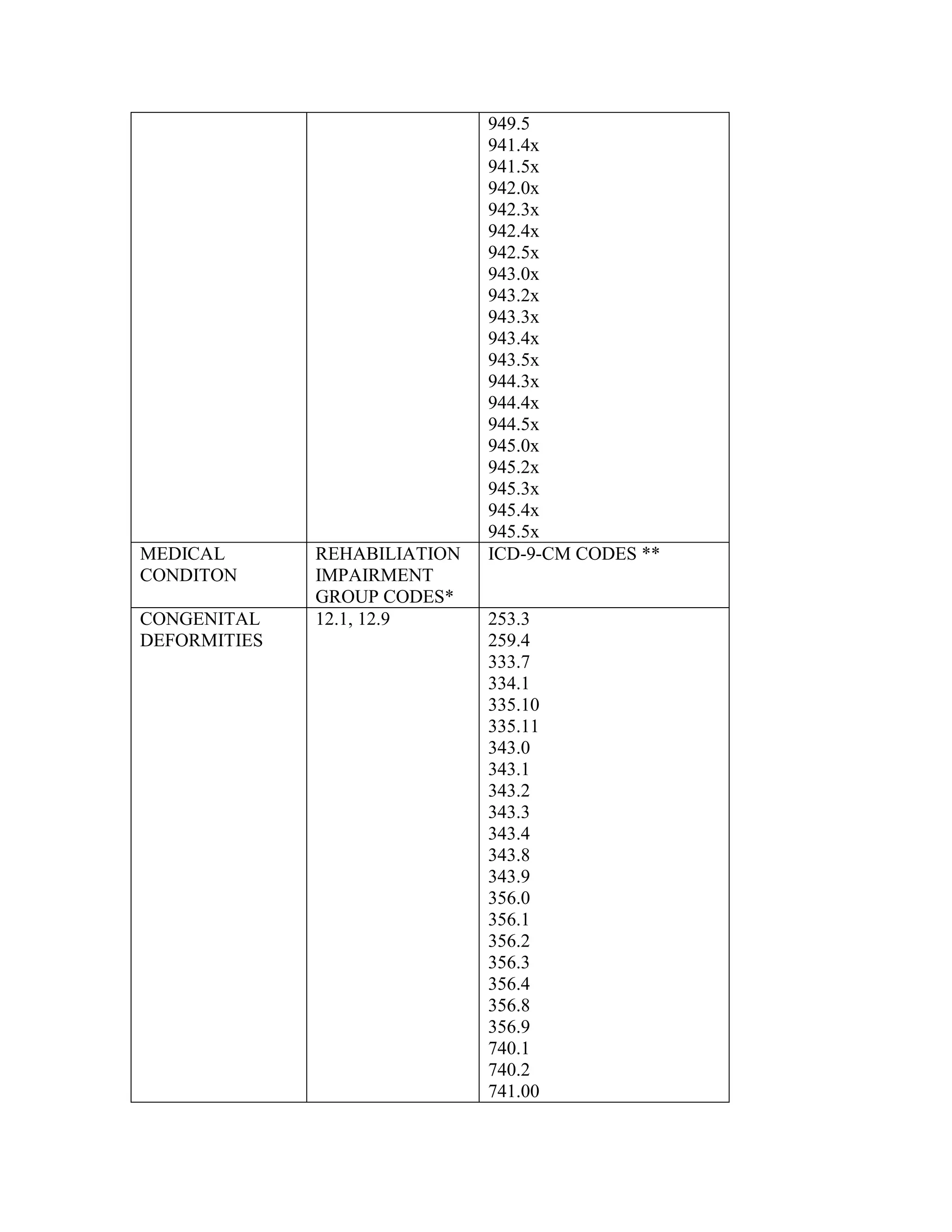

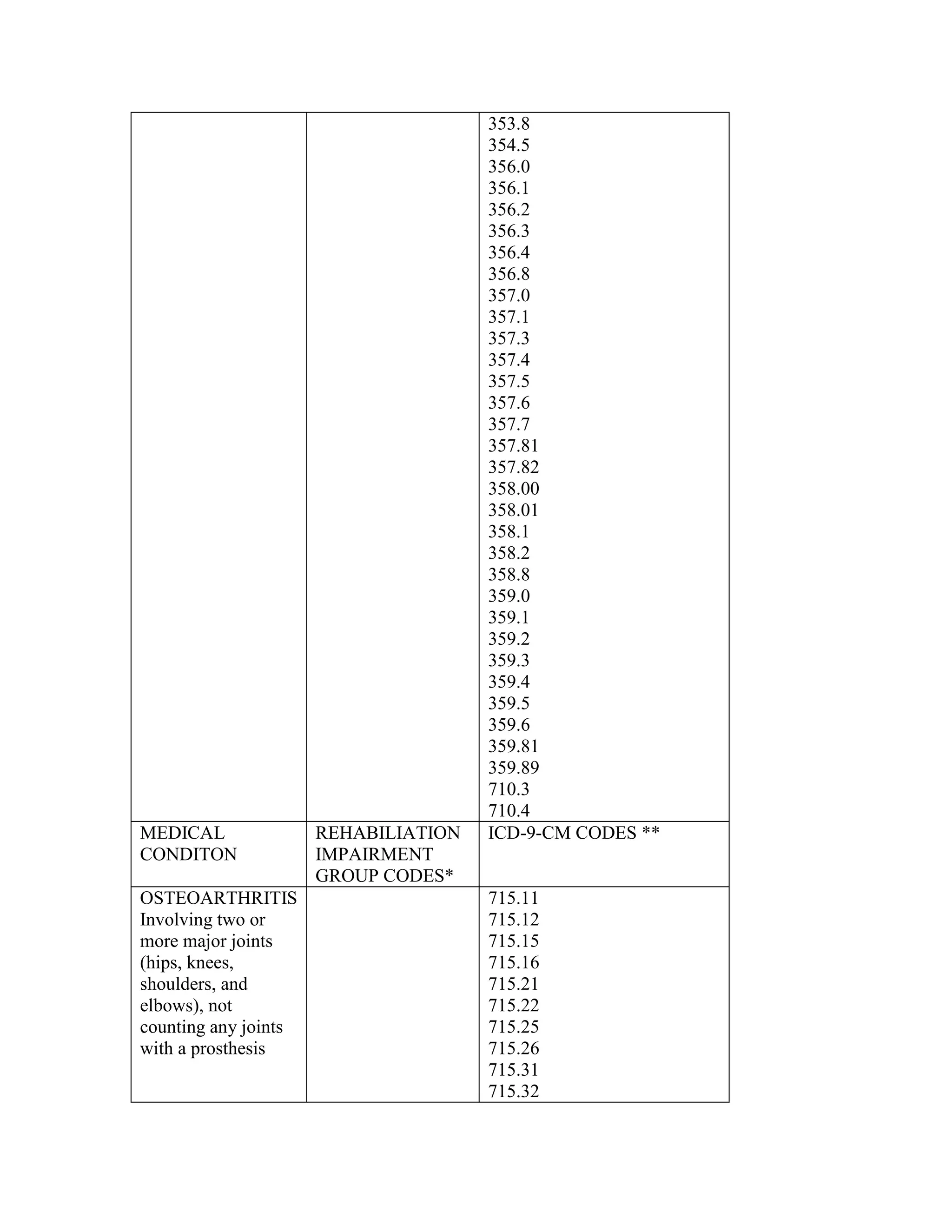

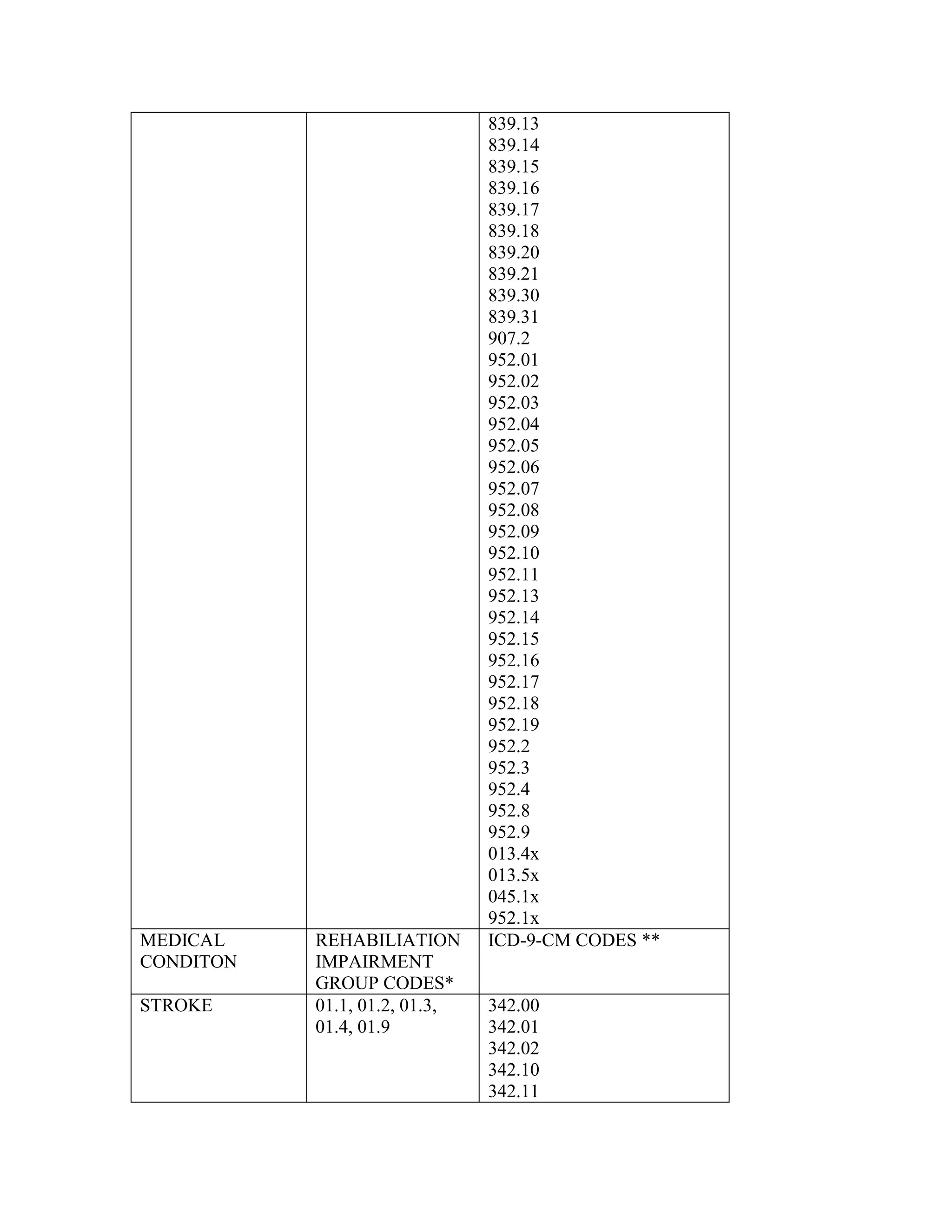

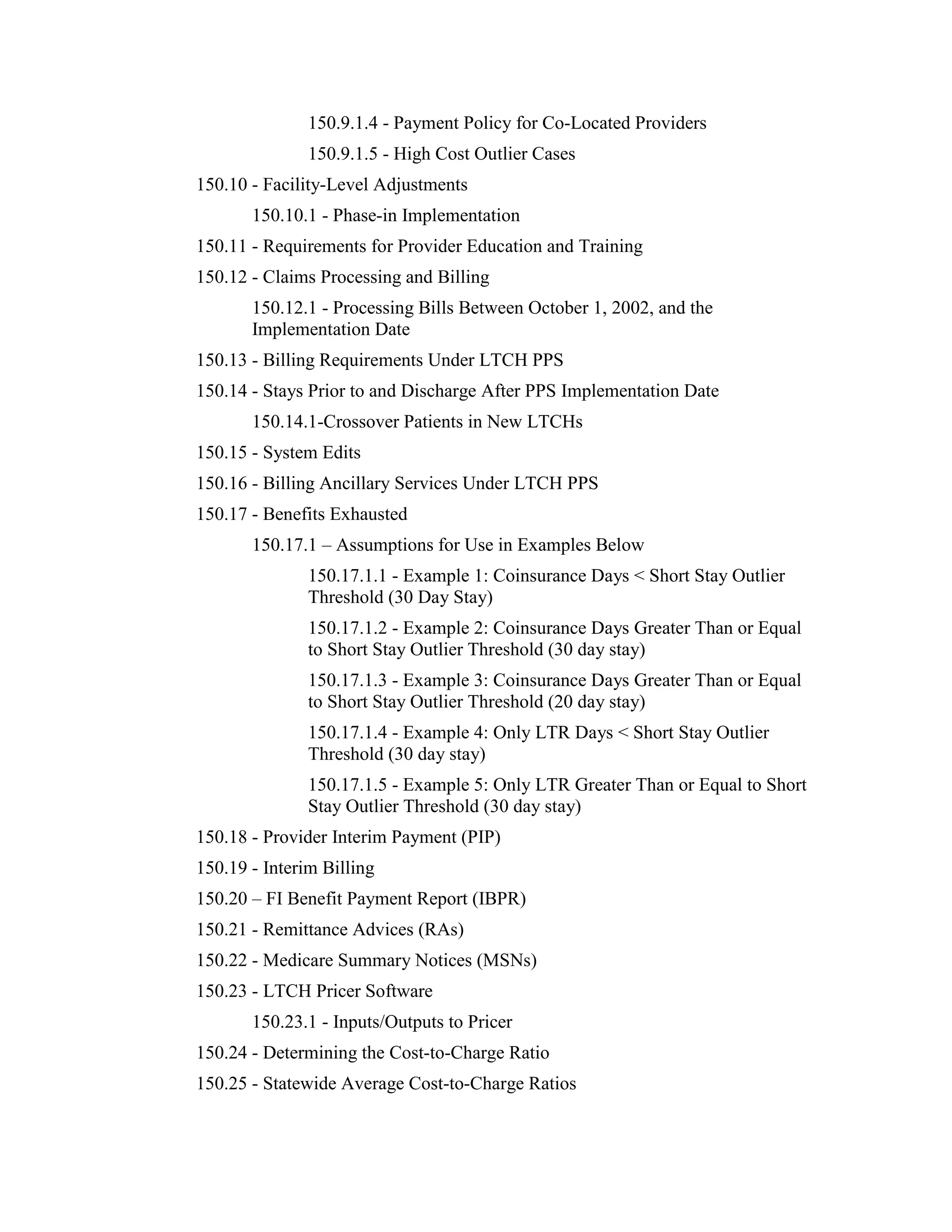

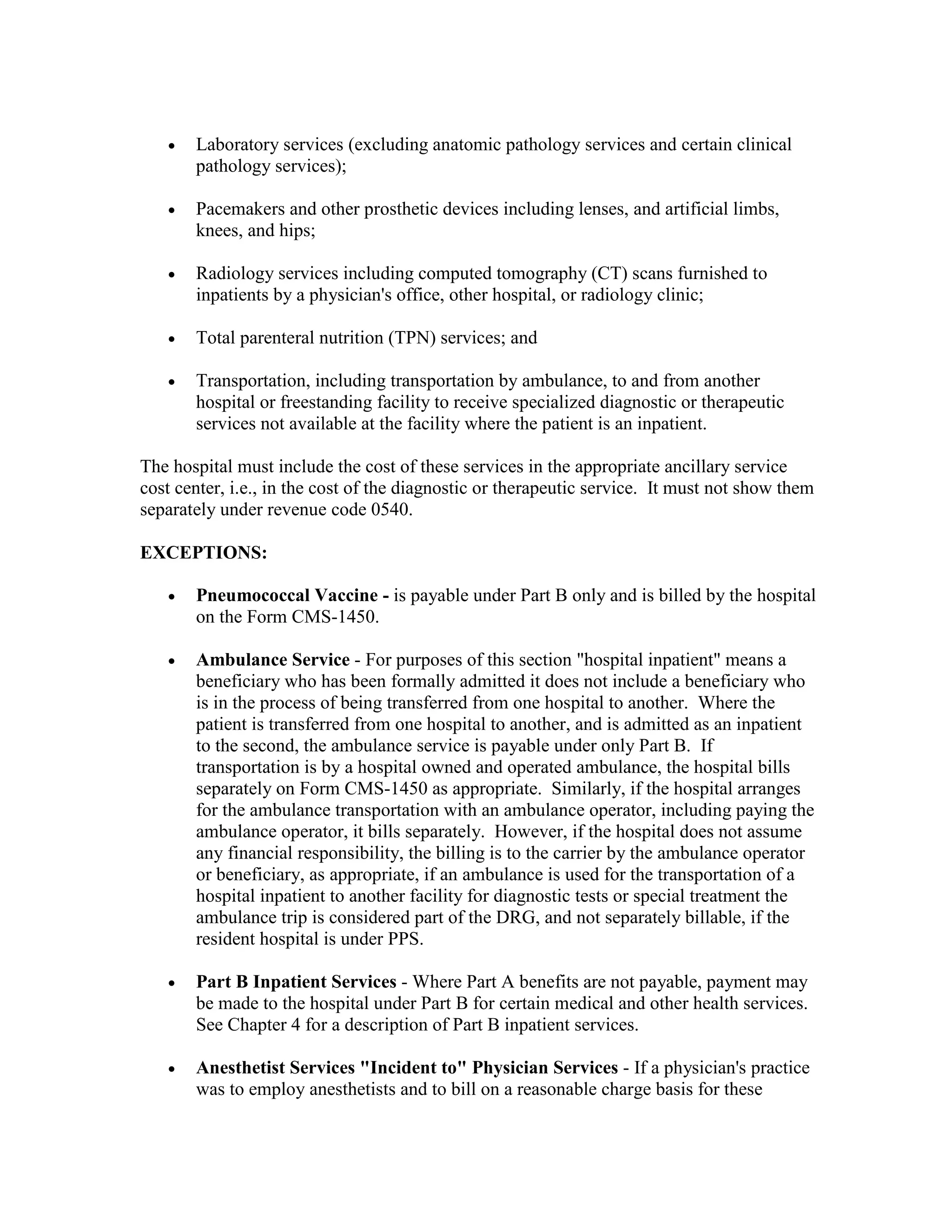

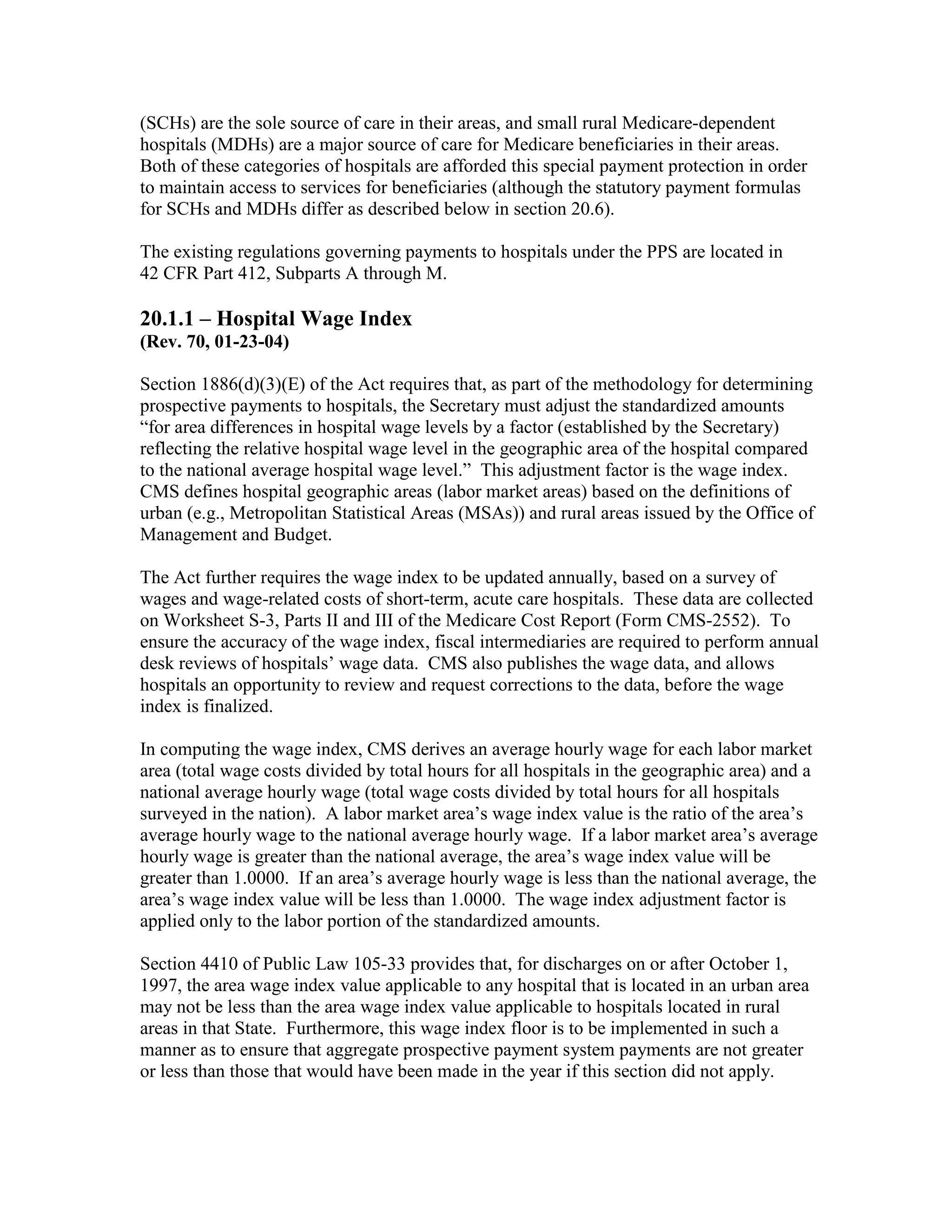

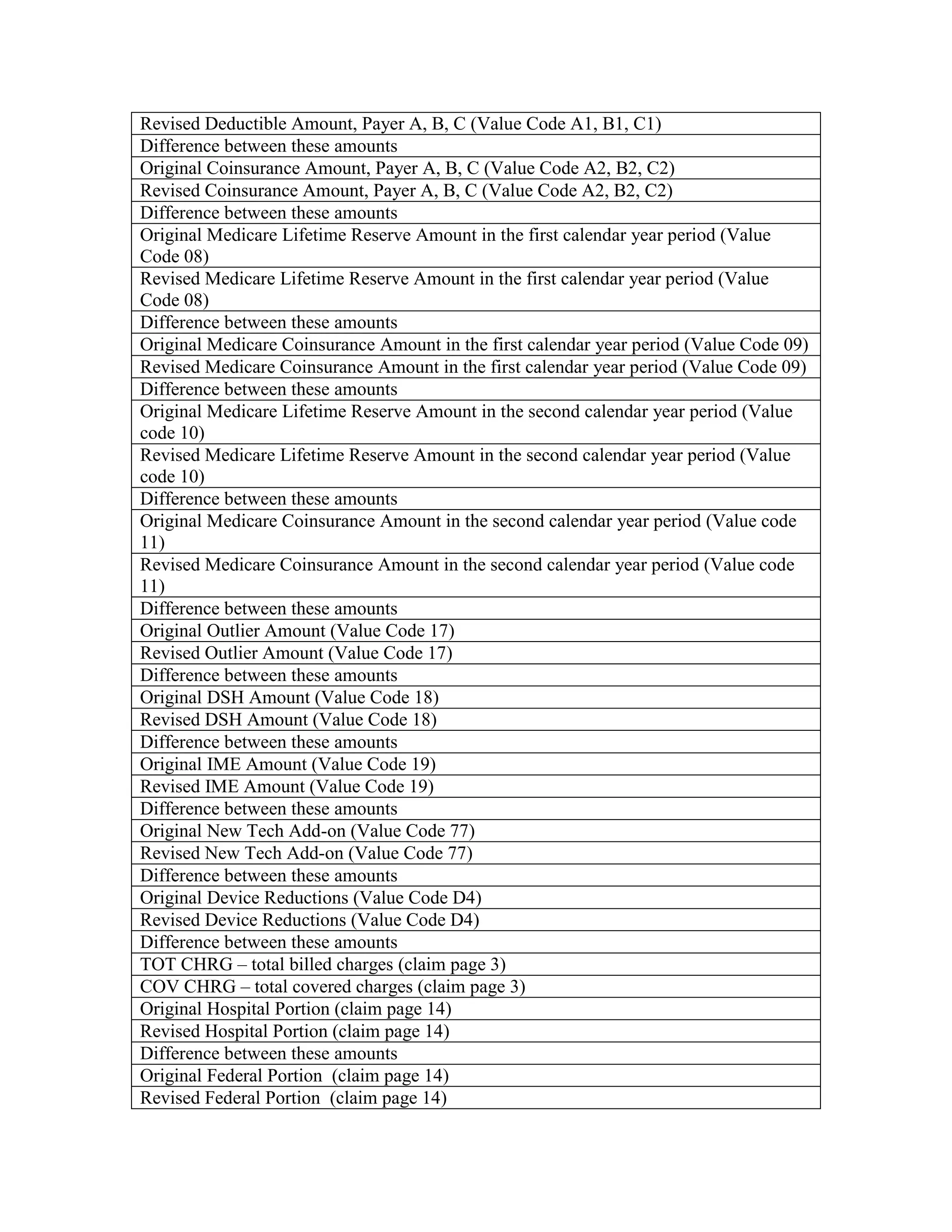

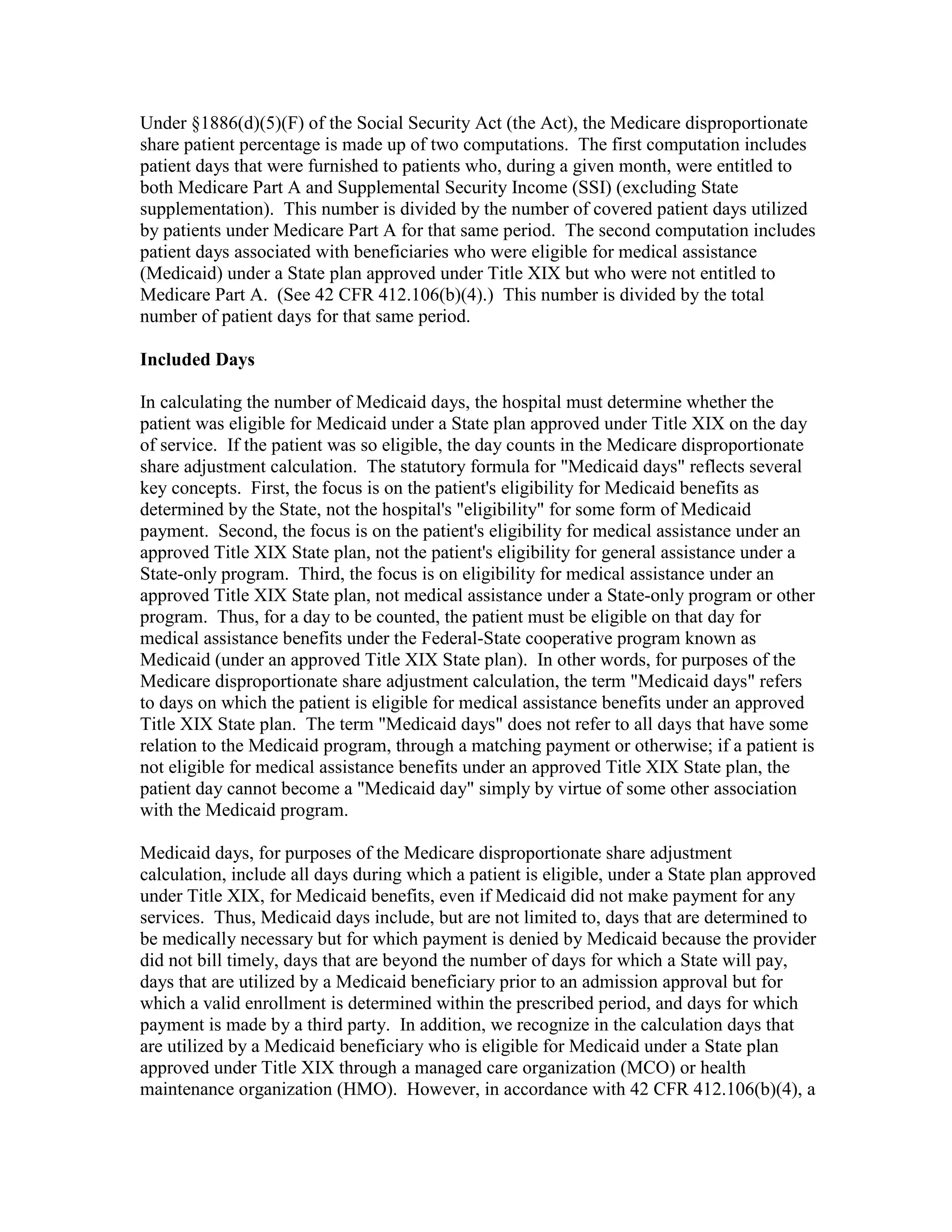

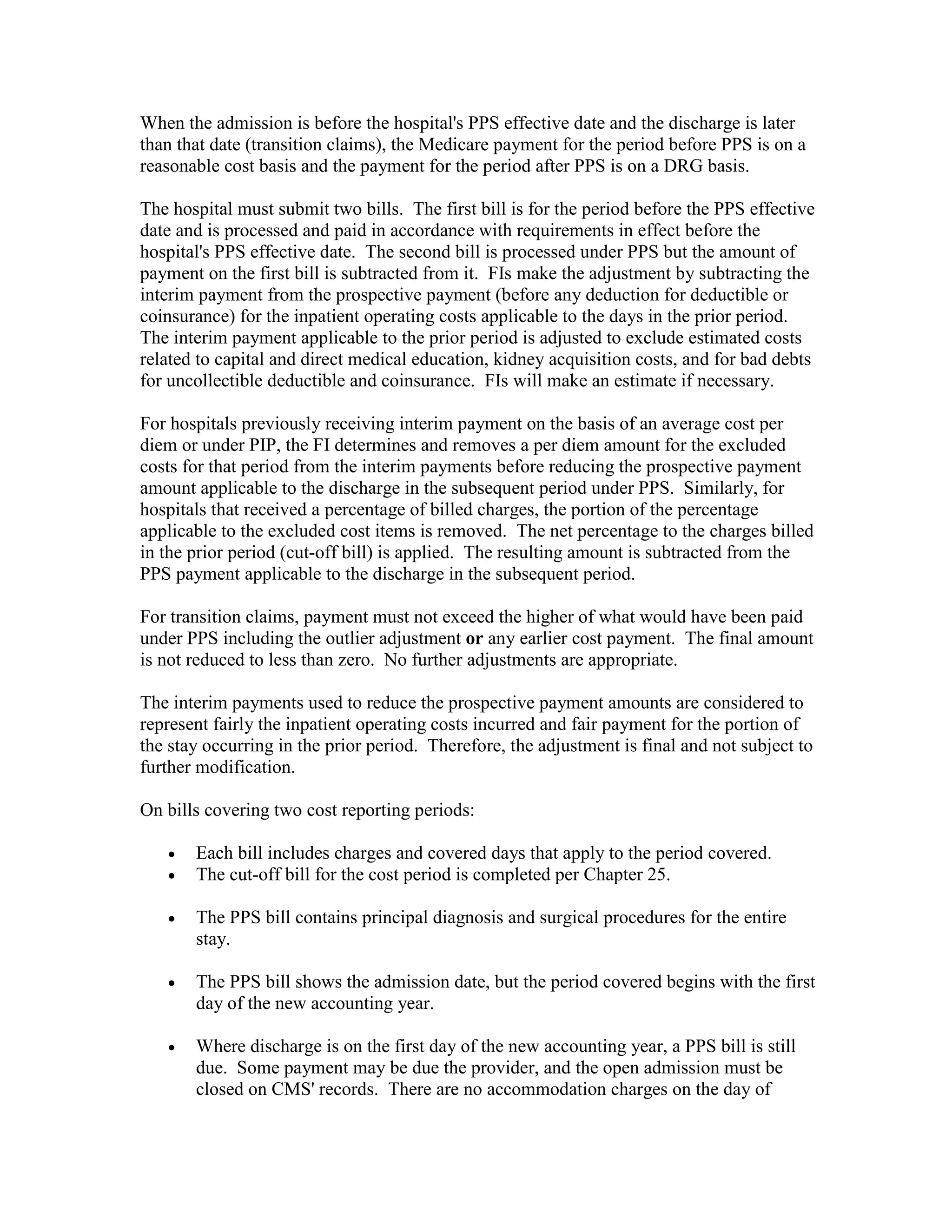

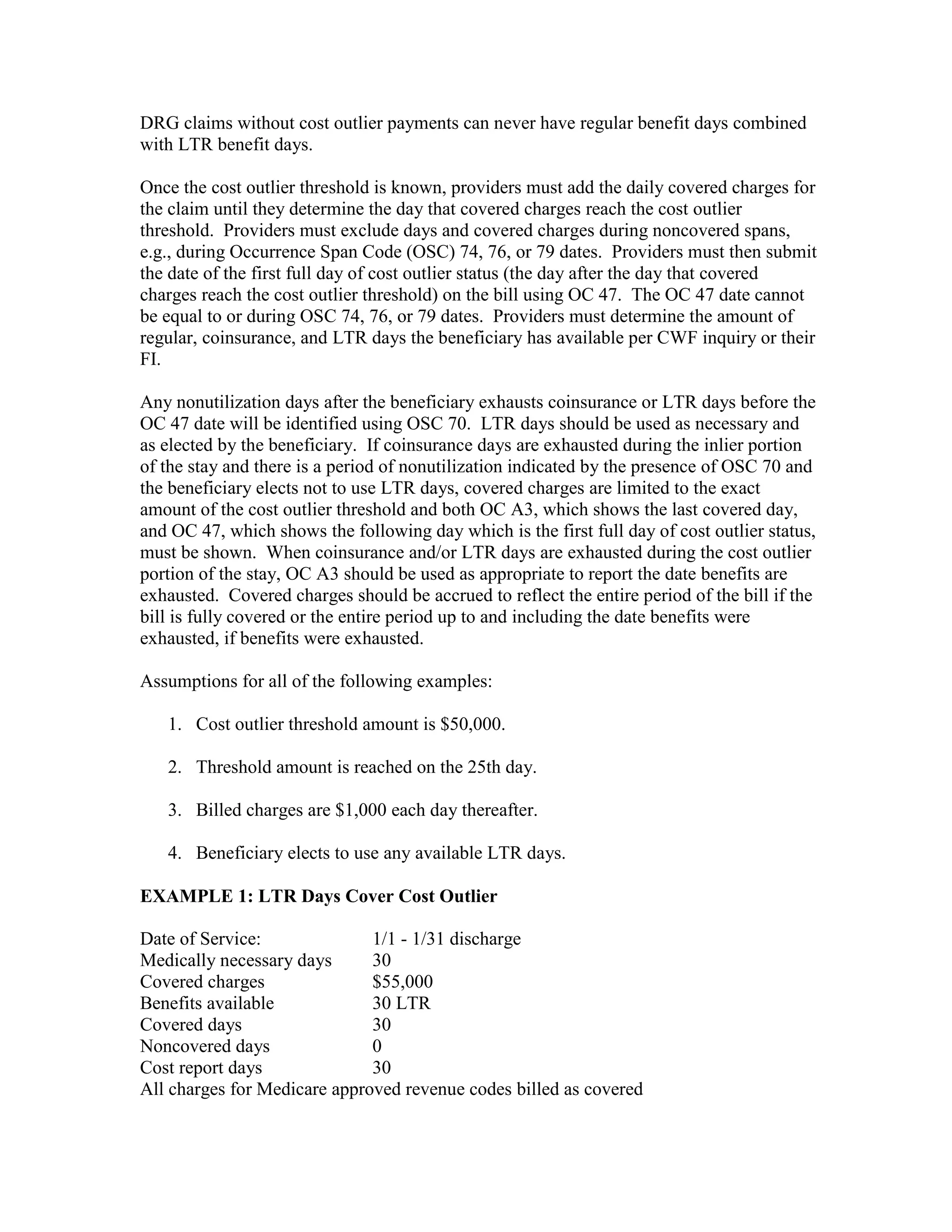

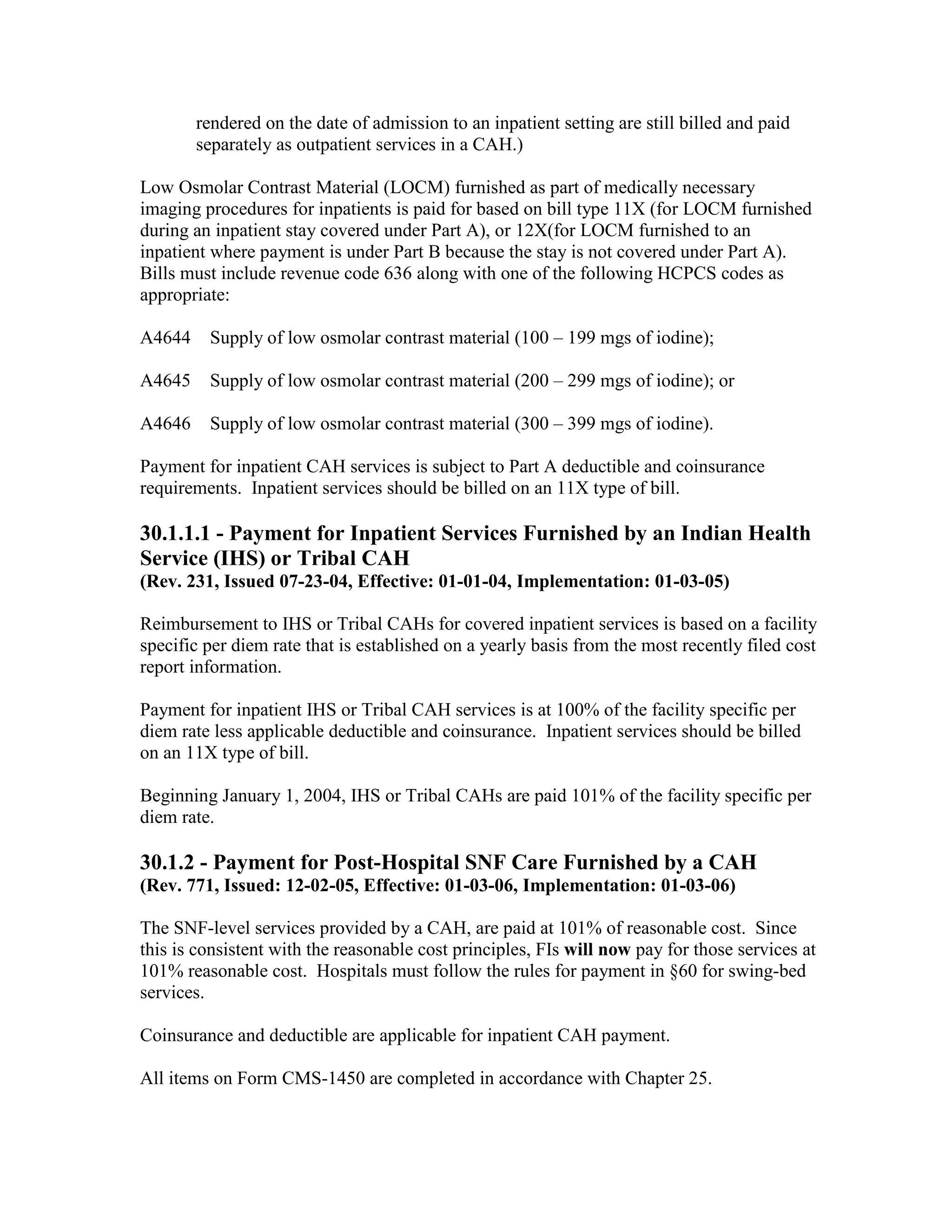

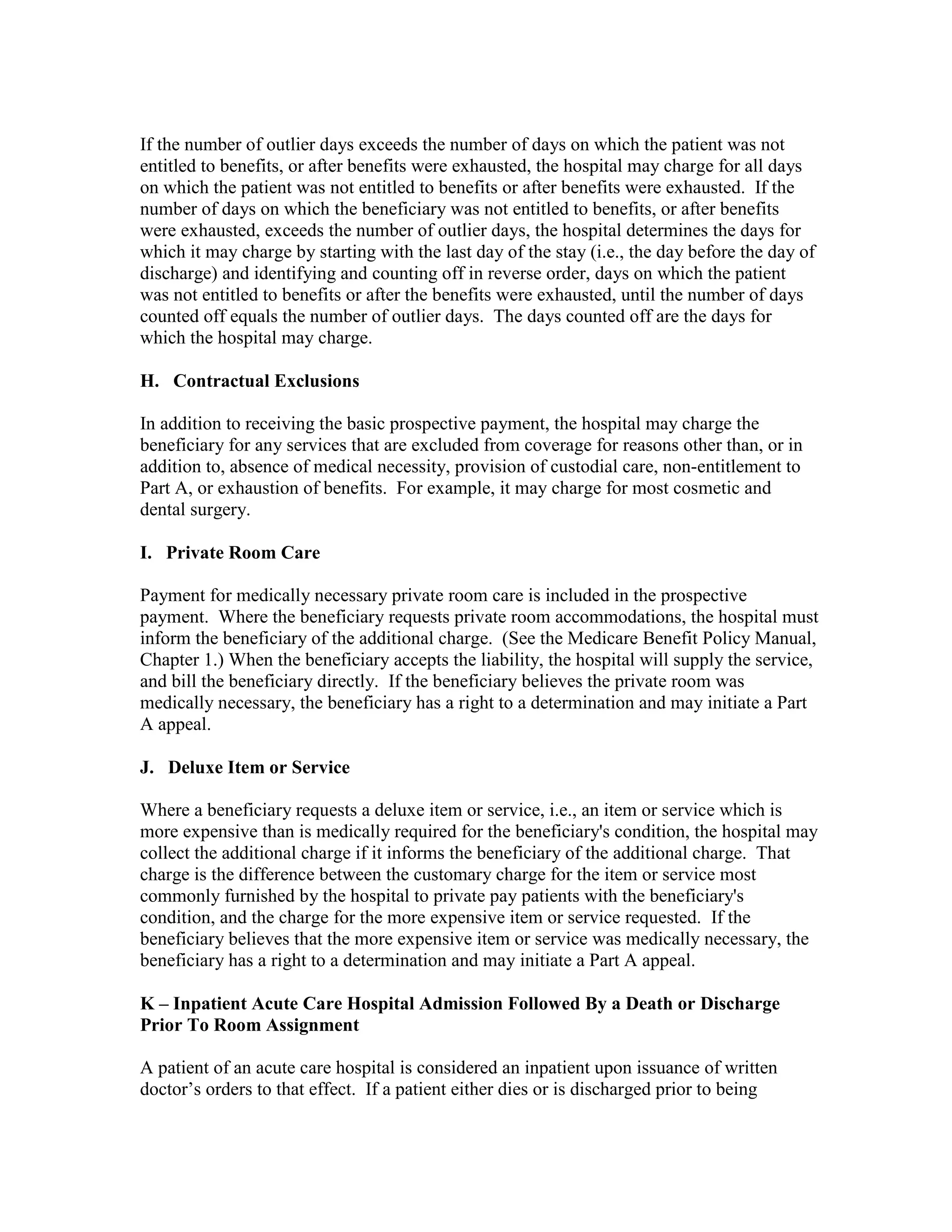

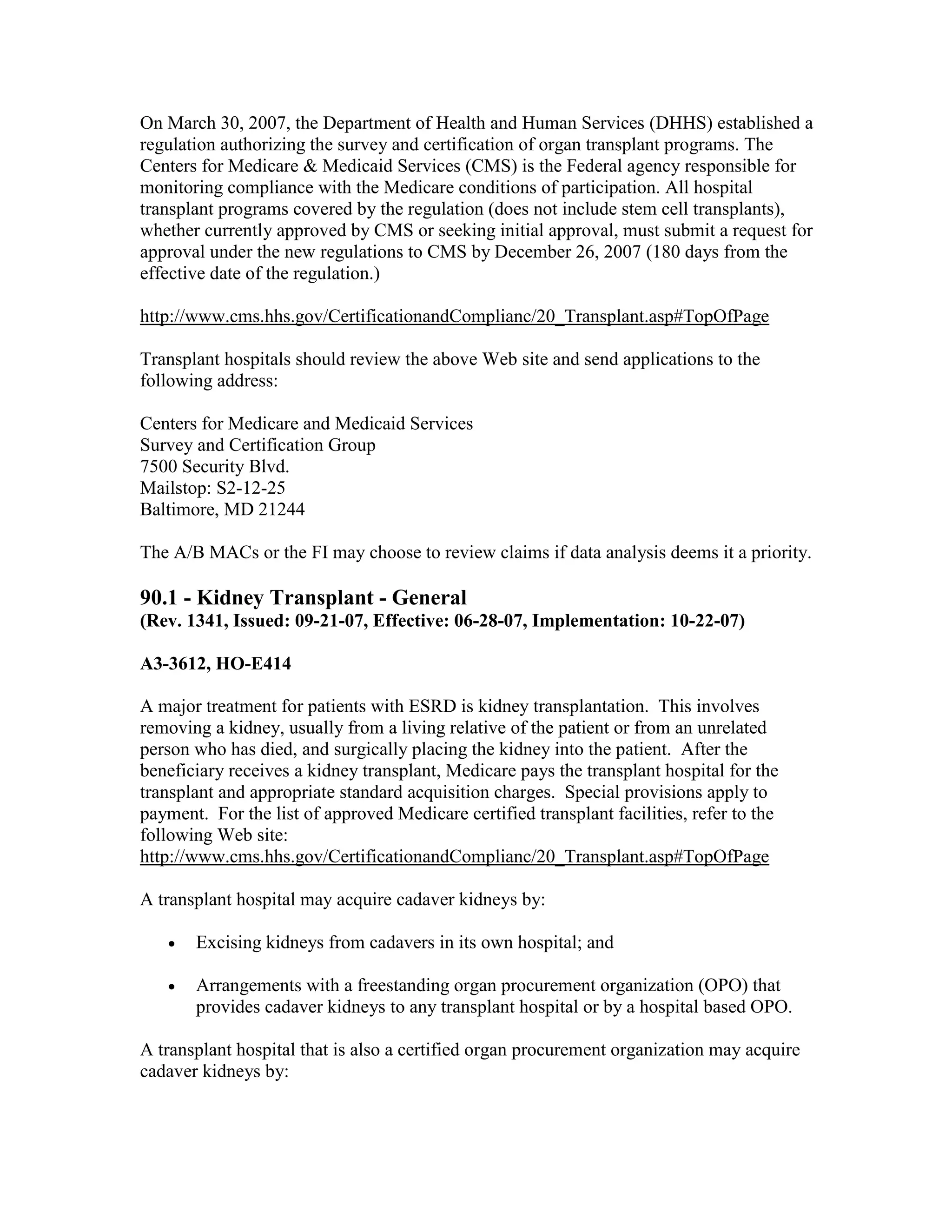

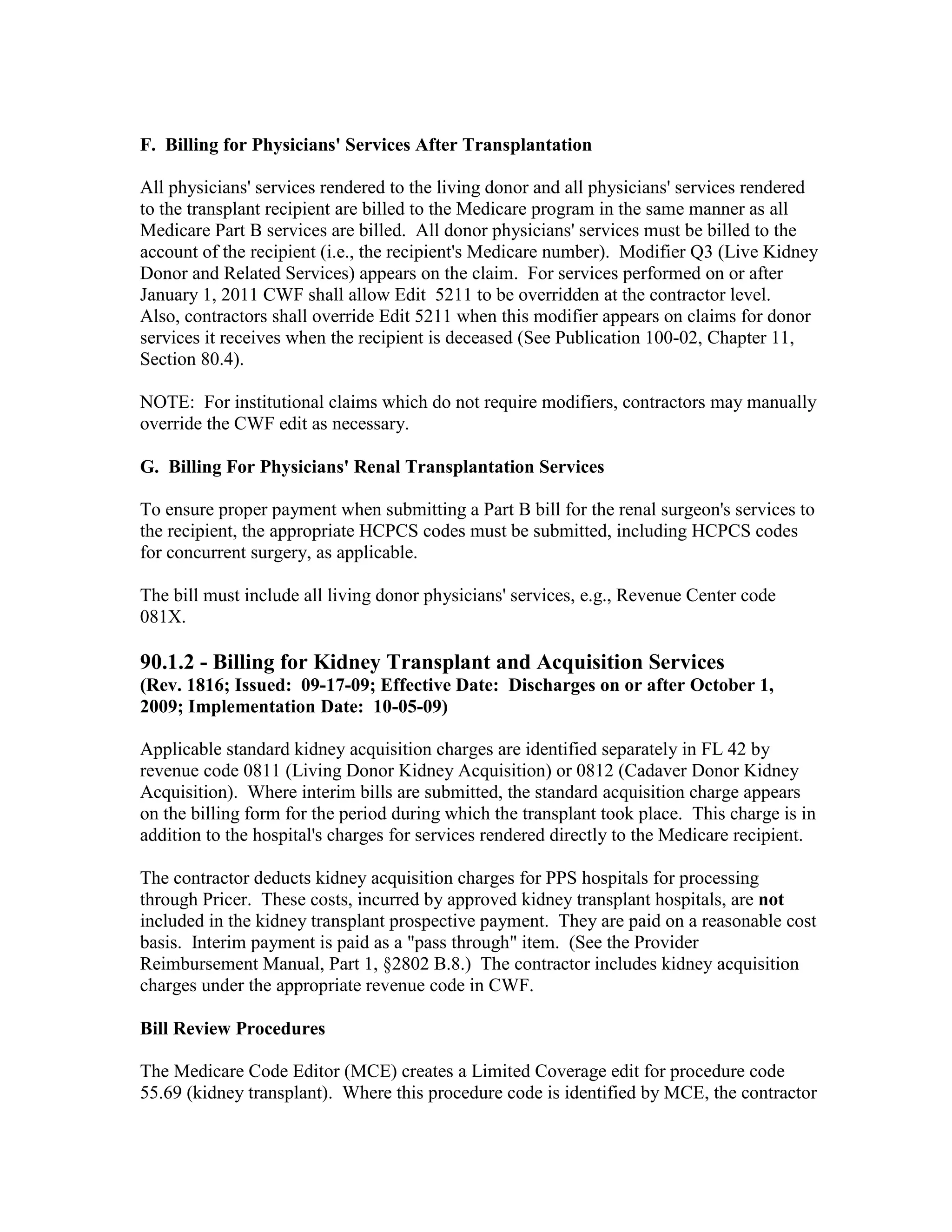

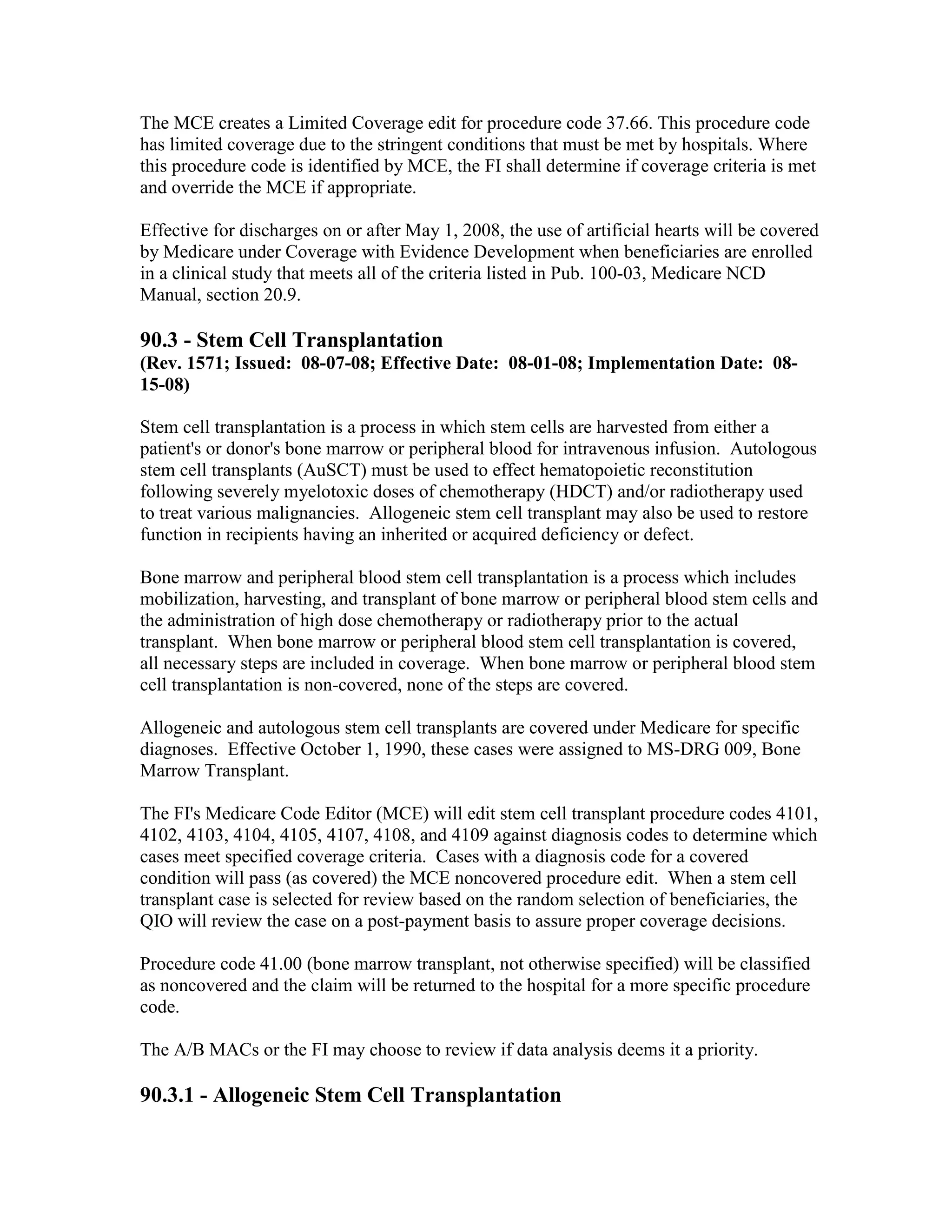

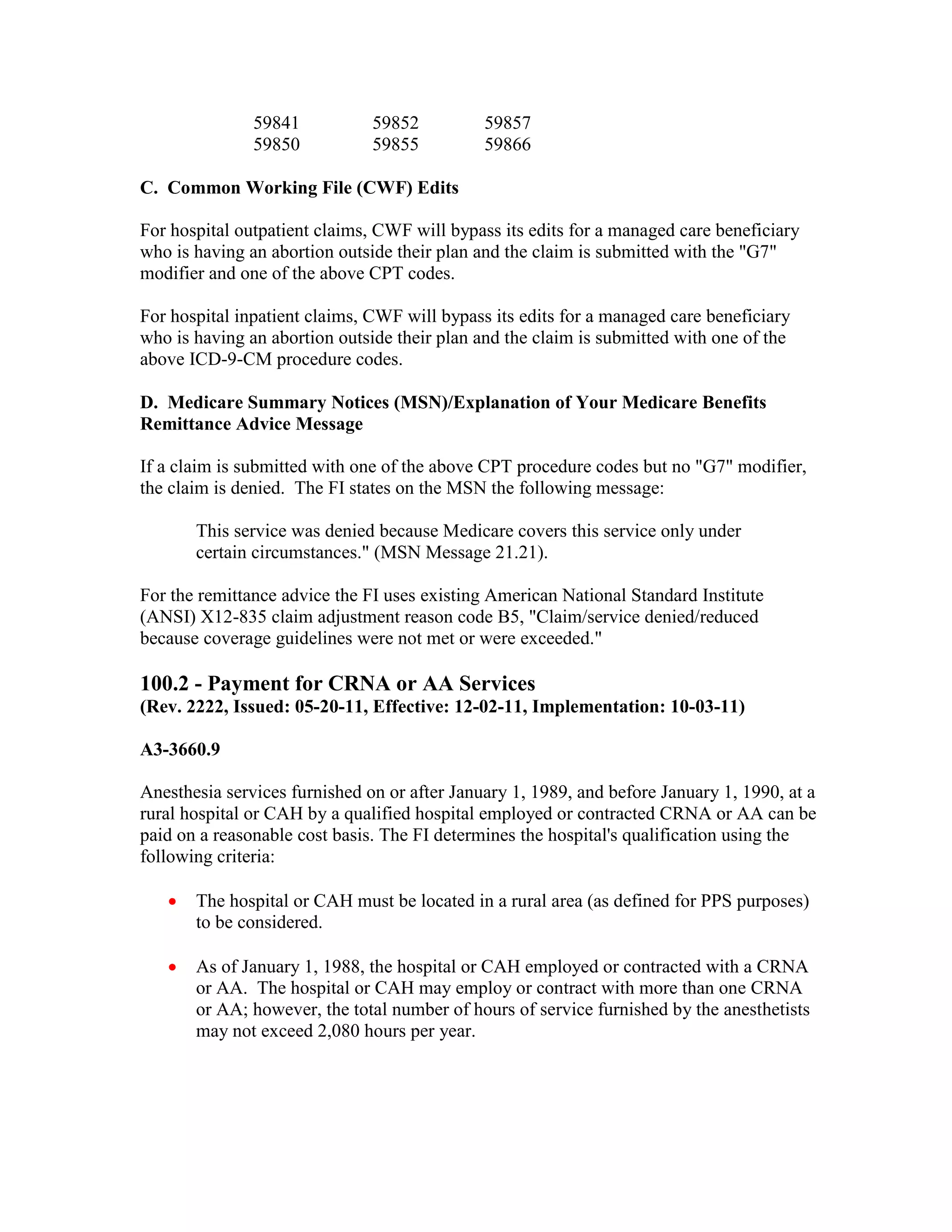

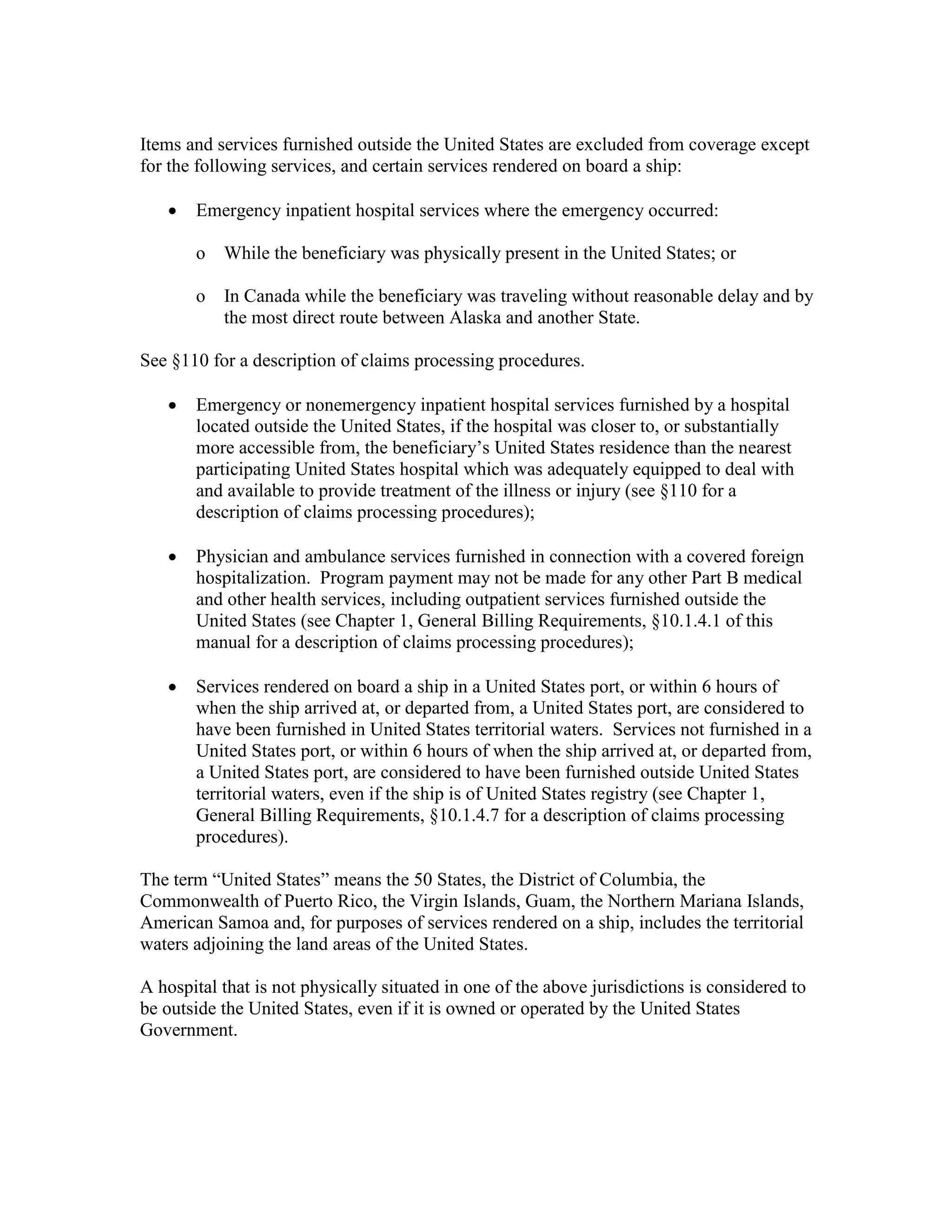

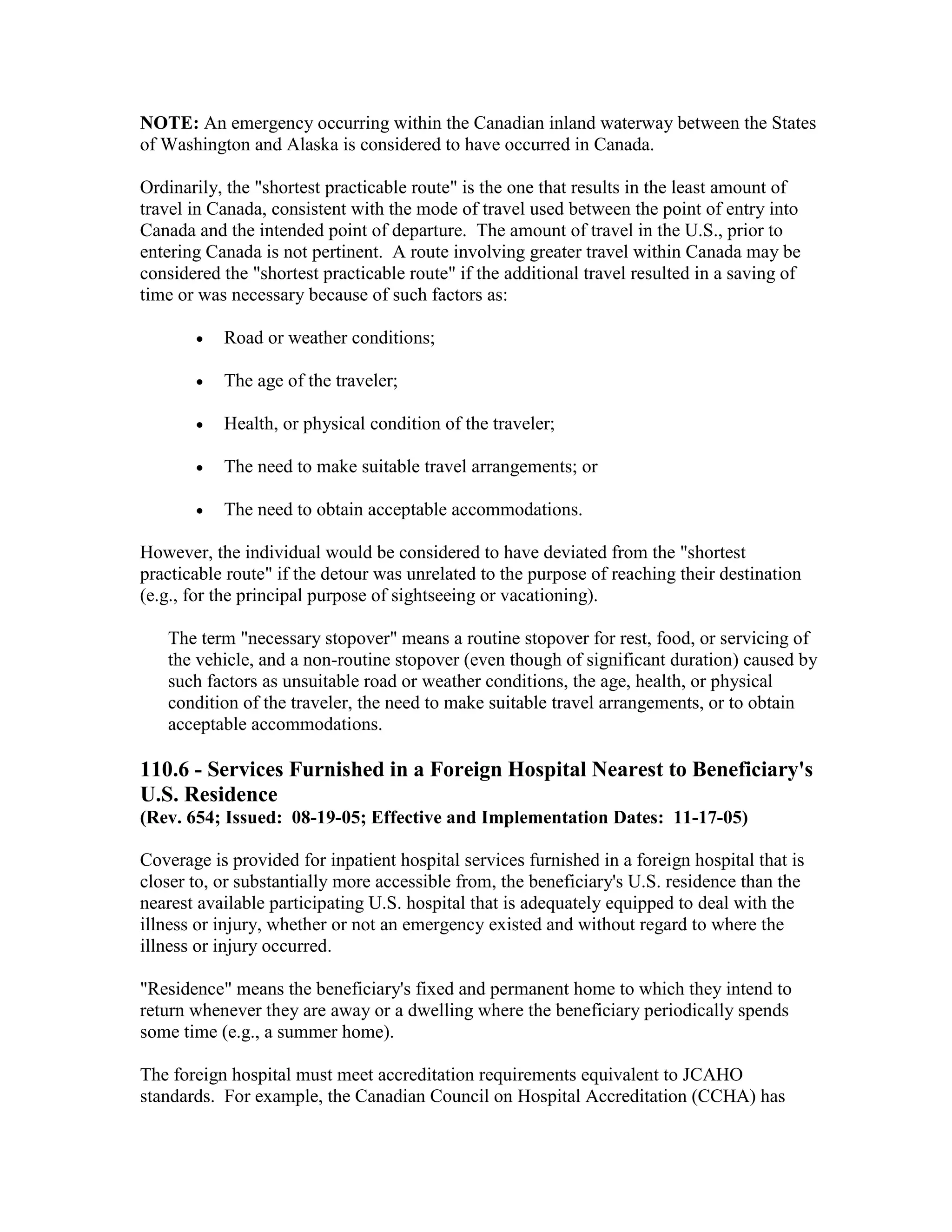

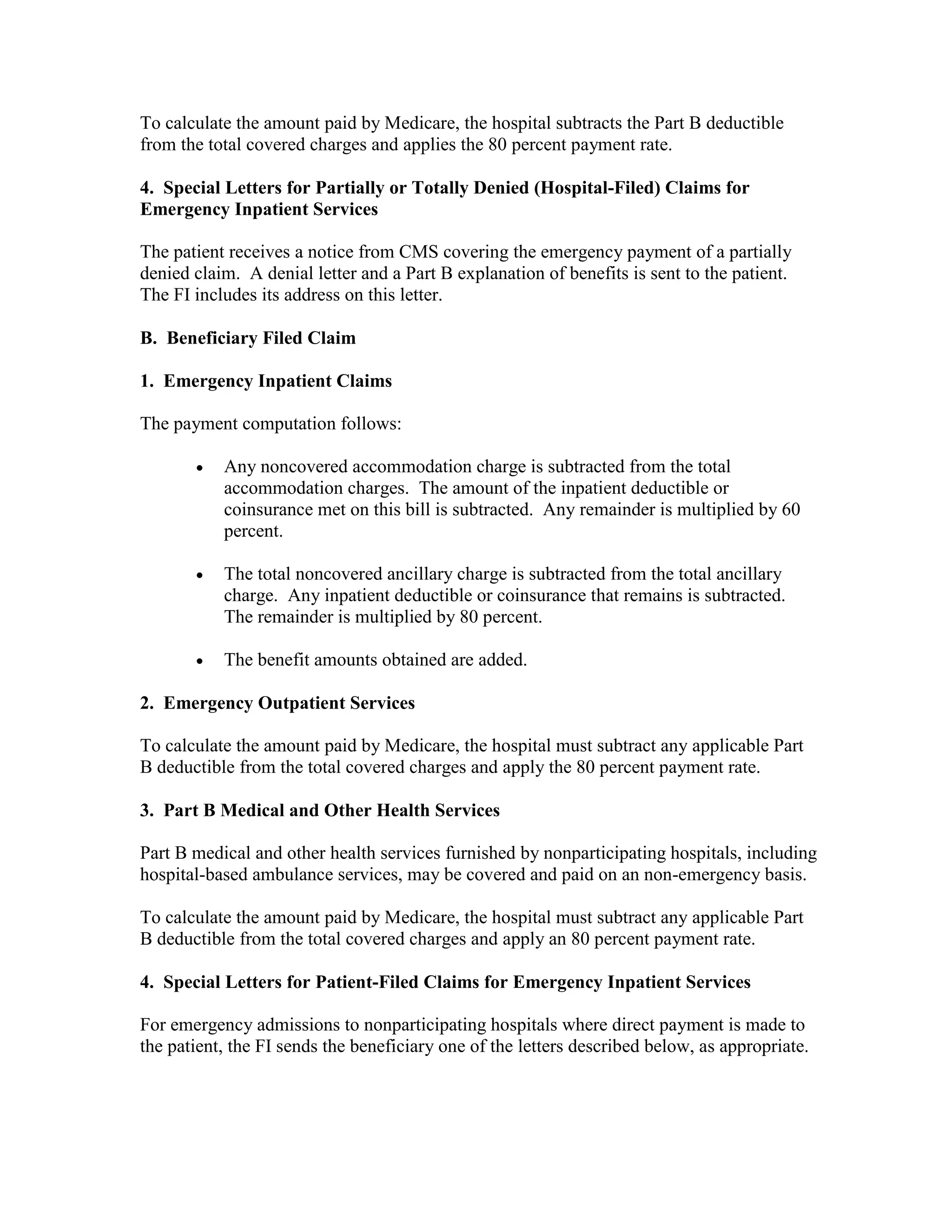

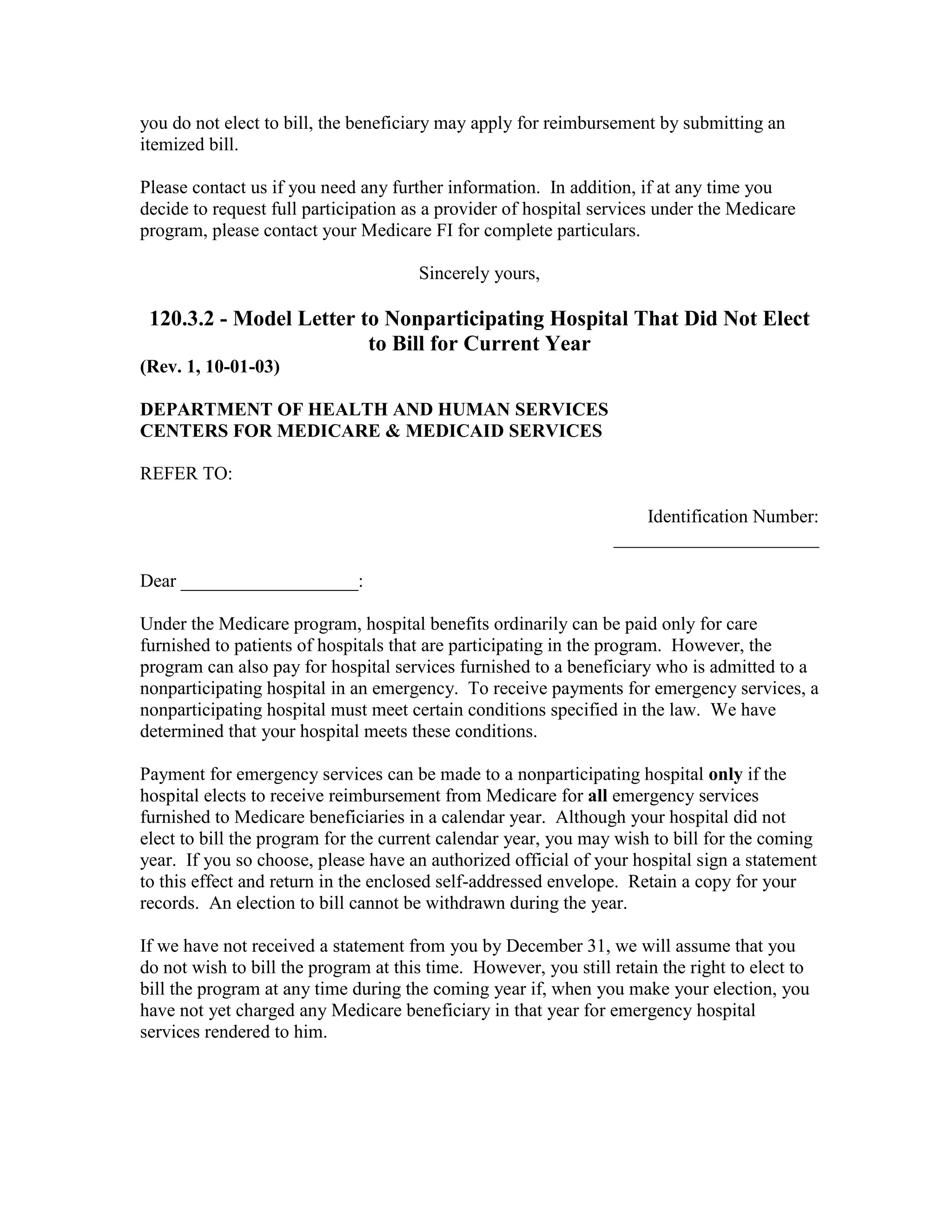

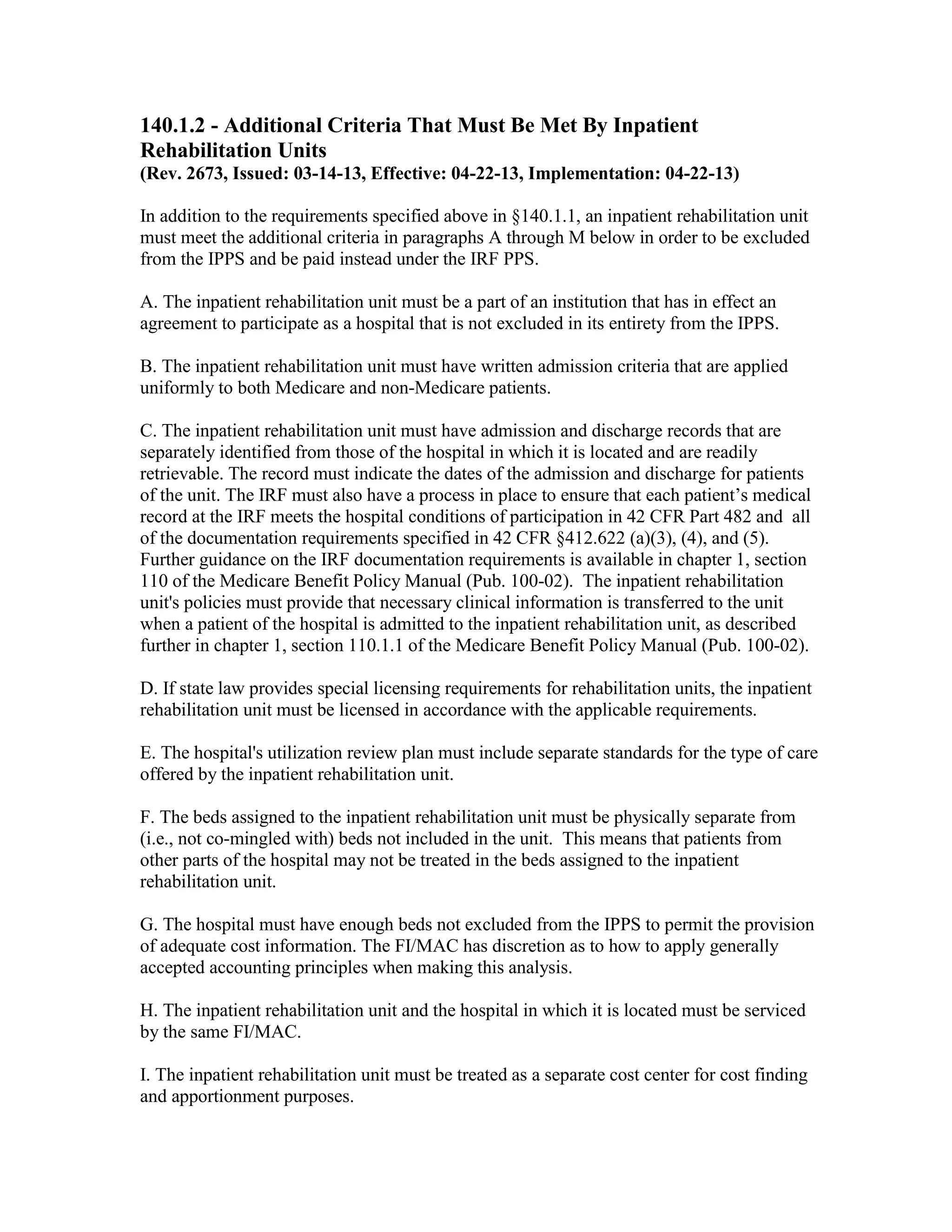

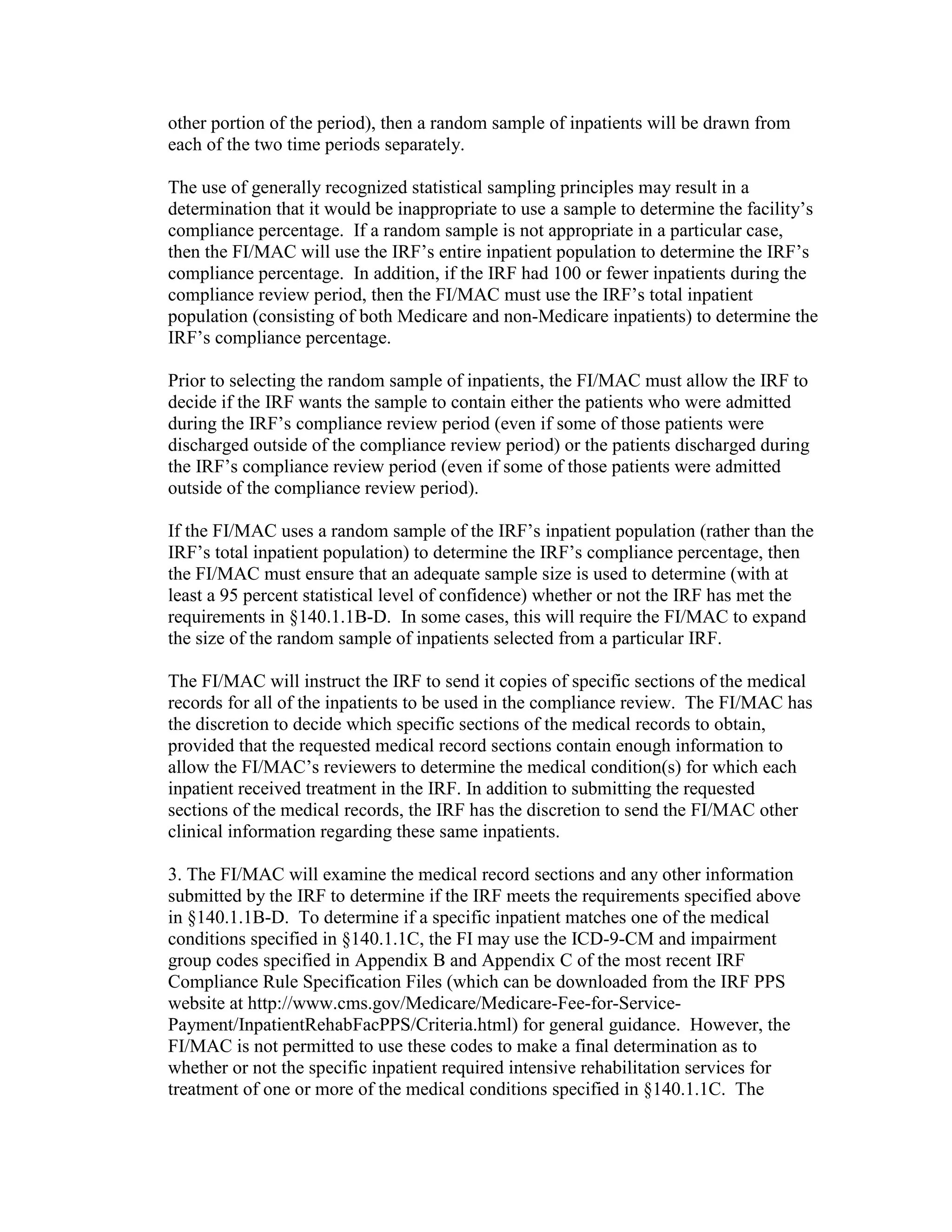

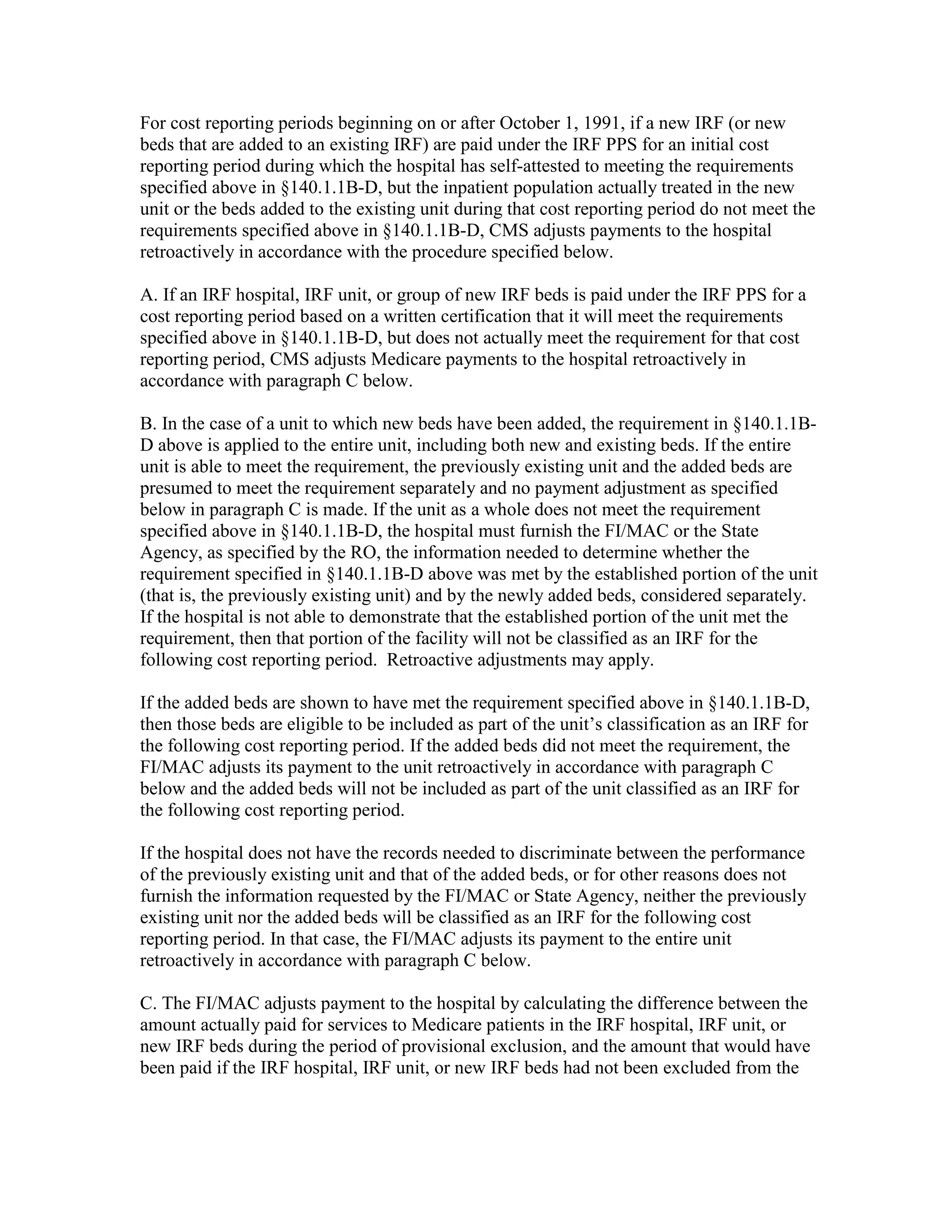

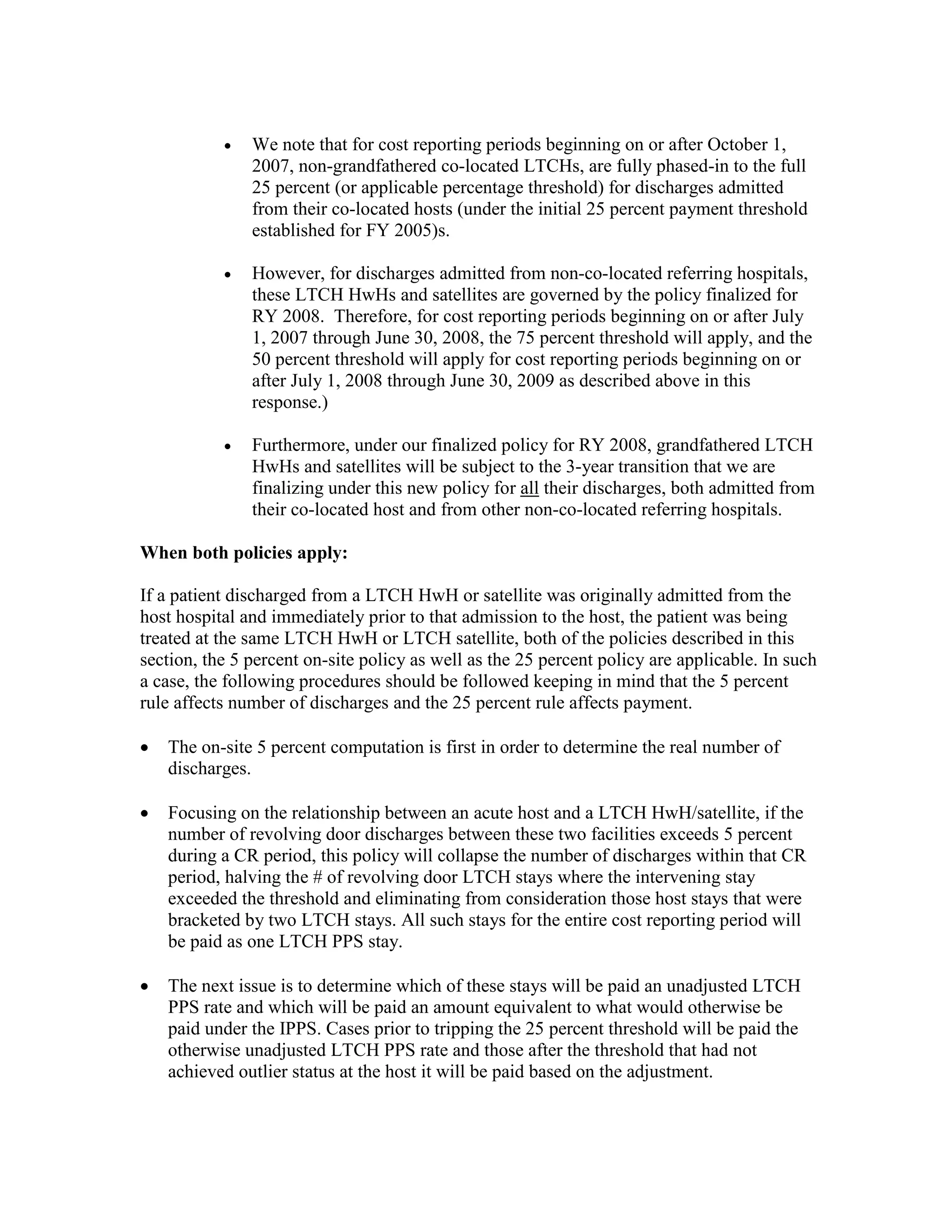

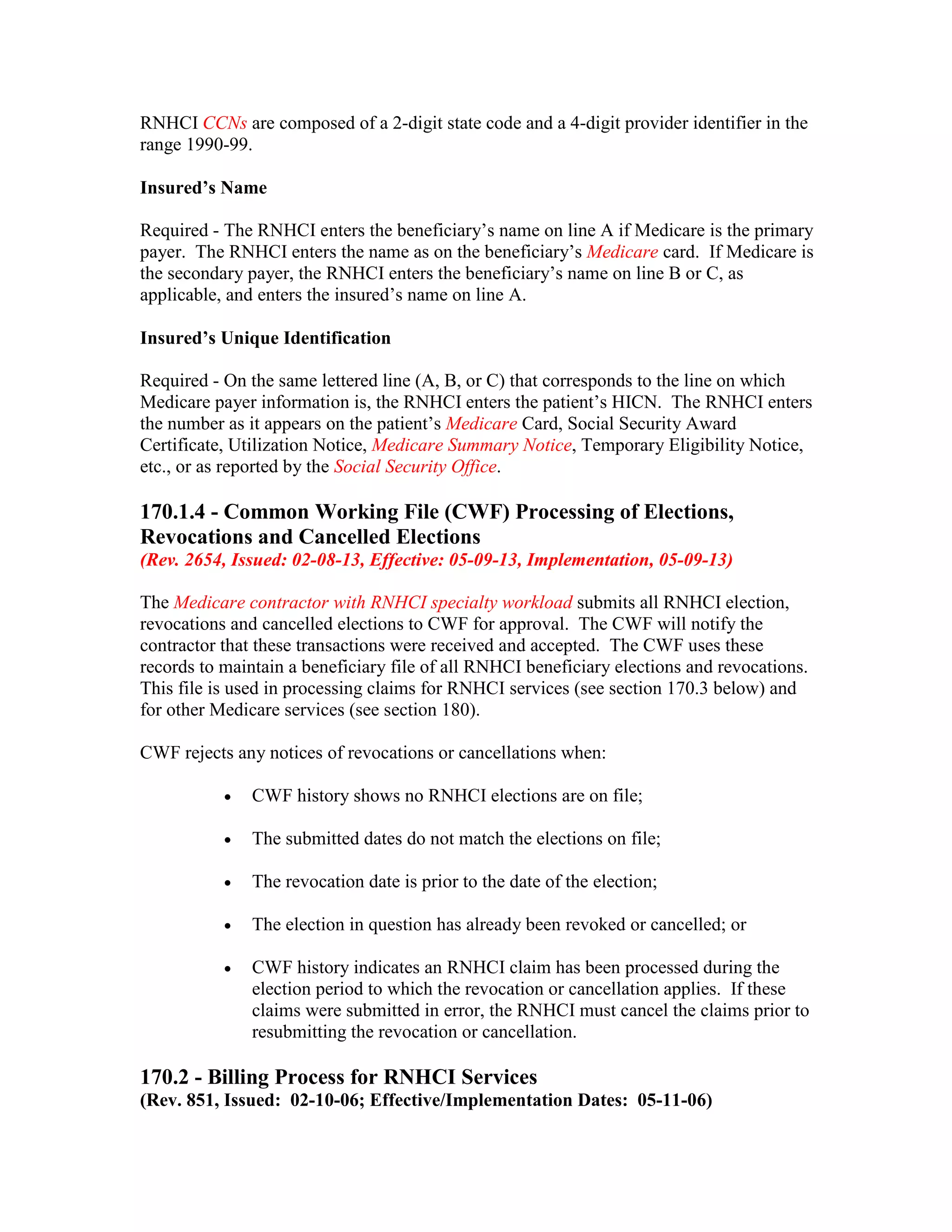

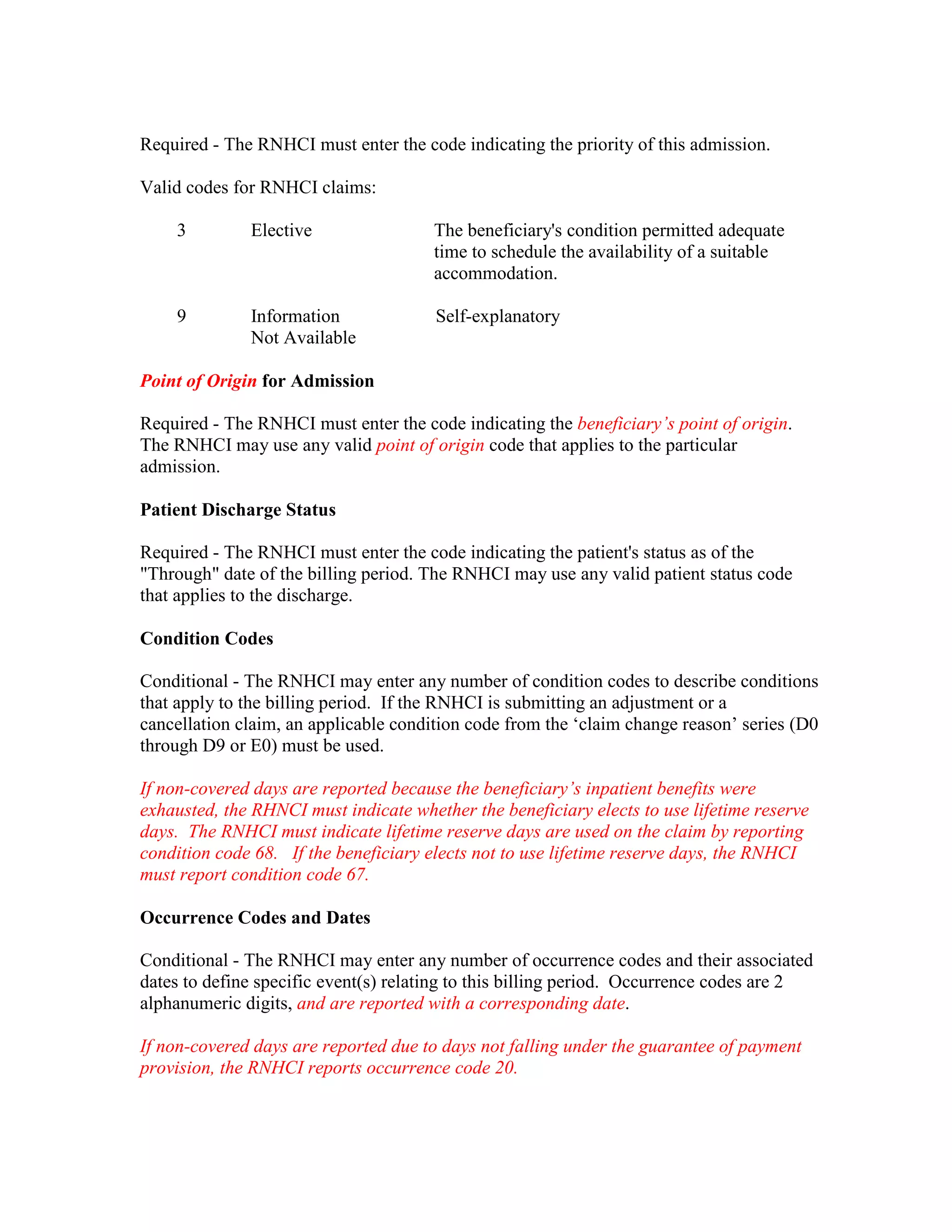

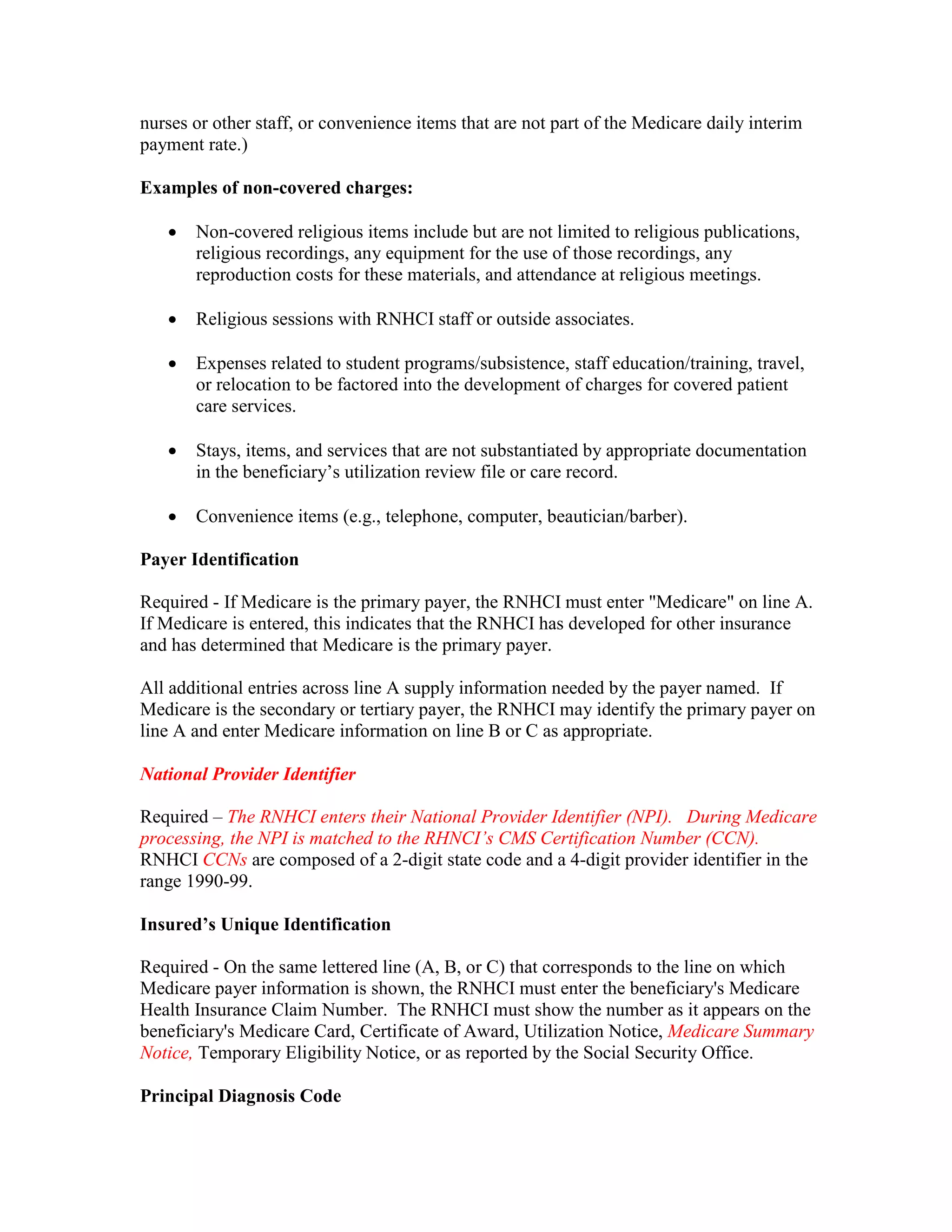

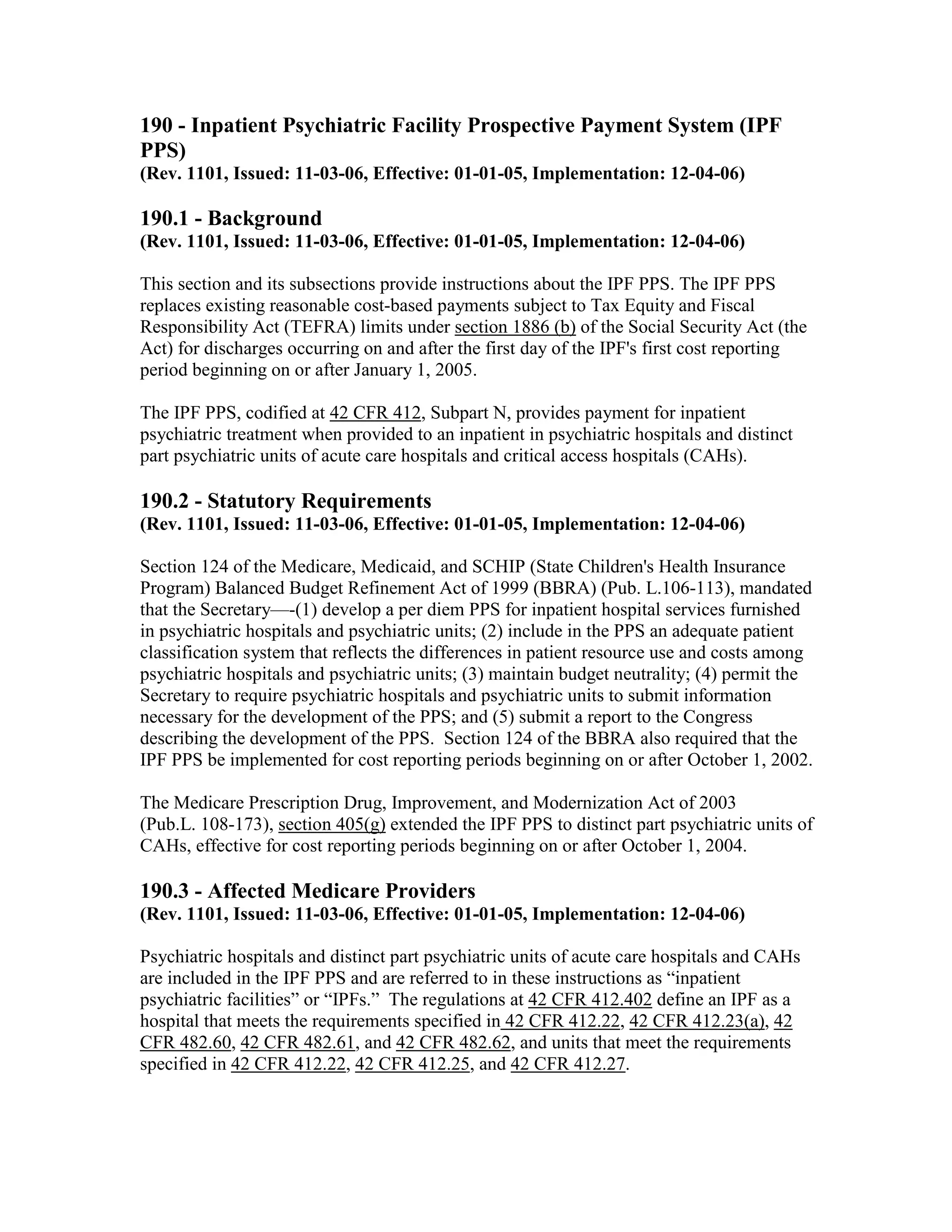

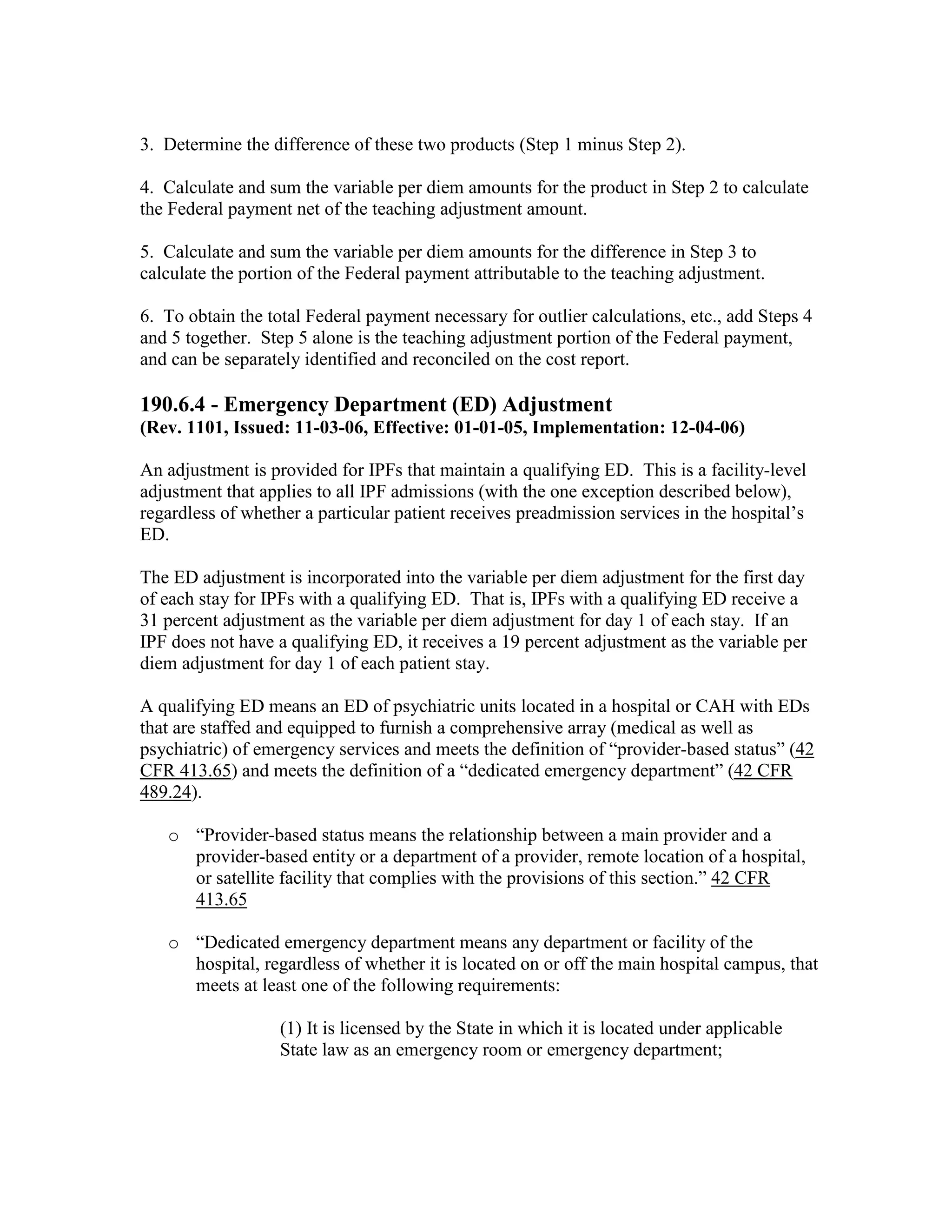

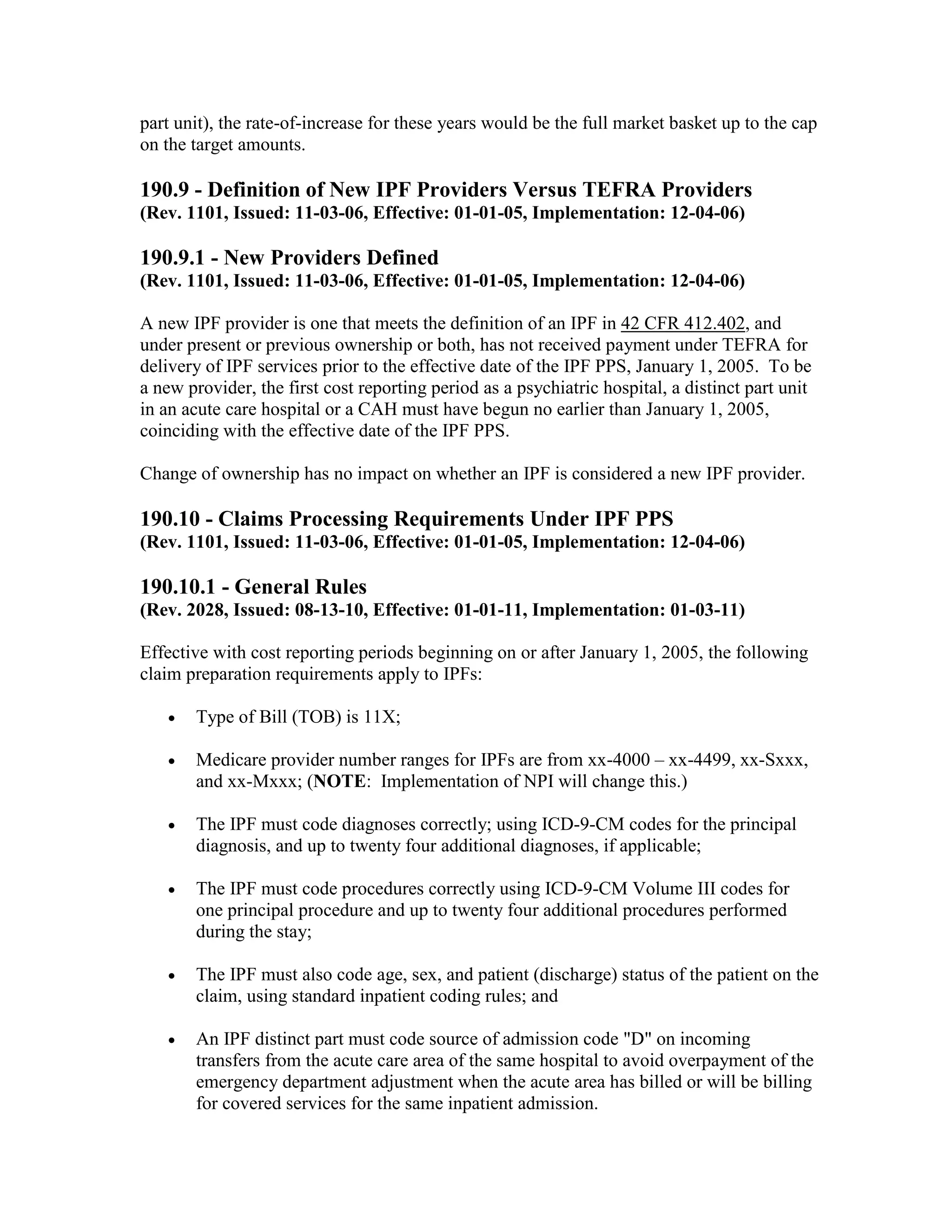

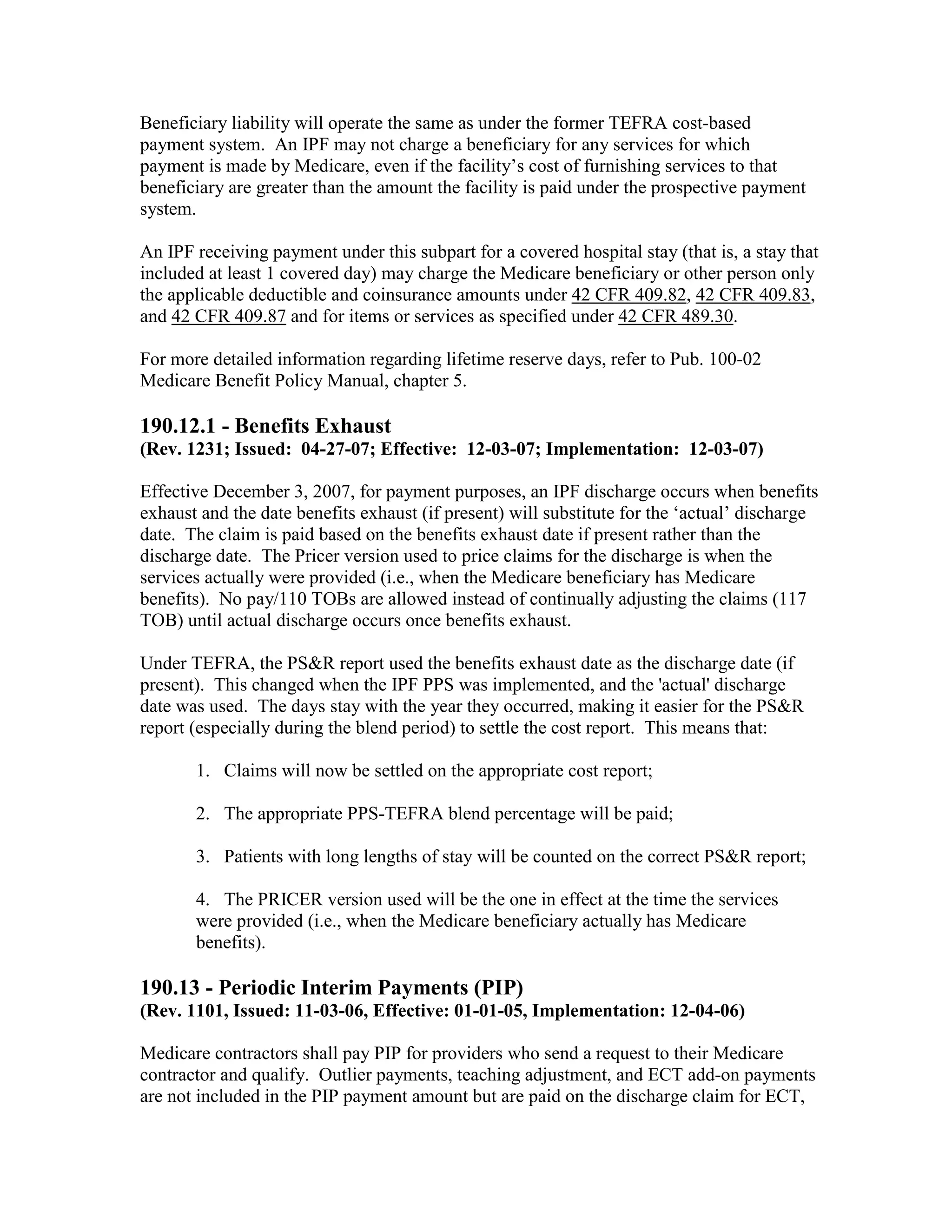

The standardized amount update factor is 2.95 percent for all hospitals.

•

The hospital specific update factor is 2.95 percent for all hospitals.

•

The common fixed loss cost outlier threshold in FY 2003 is equal to the PPS rate

for the DRG, Indirect Medical Education (IME), and Disproportionate Share

Hospital (DSH) plus $33,560.

•

The marginal cost factor for cost outliers remains 80 percent.

•

The 2003 Federal capital rate is $407.01 and the Puerto Rico capital rate is

$198.29.

•

The FY 2003 outlier adjustment factor is 0.948999 for the operating standardized

amount.

•

The FY 2003 outlier adjustment factor for Puerto Rico is 0.981651 for the

operating standardized amount. Also new for FY 03, there is an outlier adjustment

factor of 0.965325 for operating national/Puerto Rican blend.

•

Payments under the DSH provision are not reduced in FY 2003.

•

The IME formula is 1.35*[(1+ resident-to-bed ratio)**. 405-1] for FY 2003.

•

The revised hospital wage indexes and geographic adjustment factors are

contained in Tables 4a (urban areas), 4b (rural areas) and 4c (redesignated

hospitals) of section VI of the addendum to the PPS final rule.

•

Grouper 20.0 and MCE 19.0 for discharges occurring on or after October 1, 2002

replace earlier versions of the software.

See Addendum: Hospital Reclassifications and Redesignations by Individual Hospital –

FY2003.

20.3.4 – Prospective Payment Changes for Fiscal Year (FY) 2004 and

Beyond

(Rev. 73, 01-23-04)

The IPPS changes for FY 2004 were published in the Federal Register on August 1, 2003.

All changes are effective for hospital discharges occurring on or after October 1, 2003.

Additional changes were listed in a Correction Notice to the Federal Register on October

6, 2003, and a One Time Notification (Pub. 100-20, Transmittal 16, published on October

31, 2003).

Changes to the inpatient prospective payment system occur every October. Specific](https://image.slidesharecdn.com/medicareclaimsprocessingmanual-131226001413-phpapp01/75/Medicare-claims-processing-manual-81-2048.jpg)

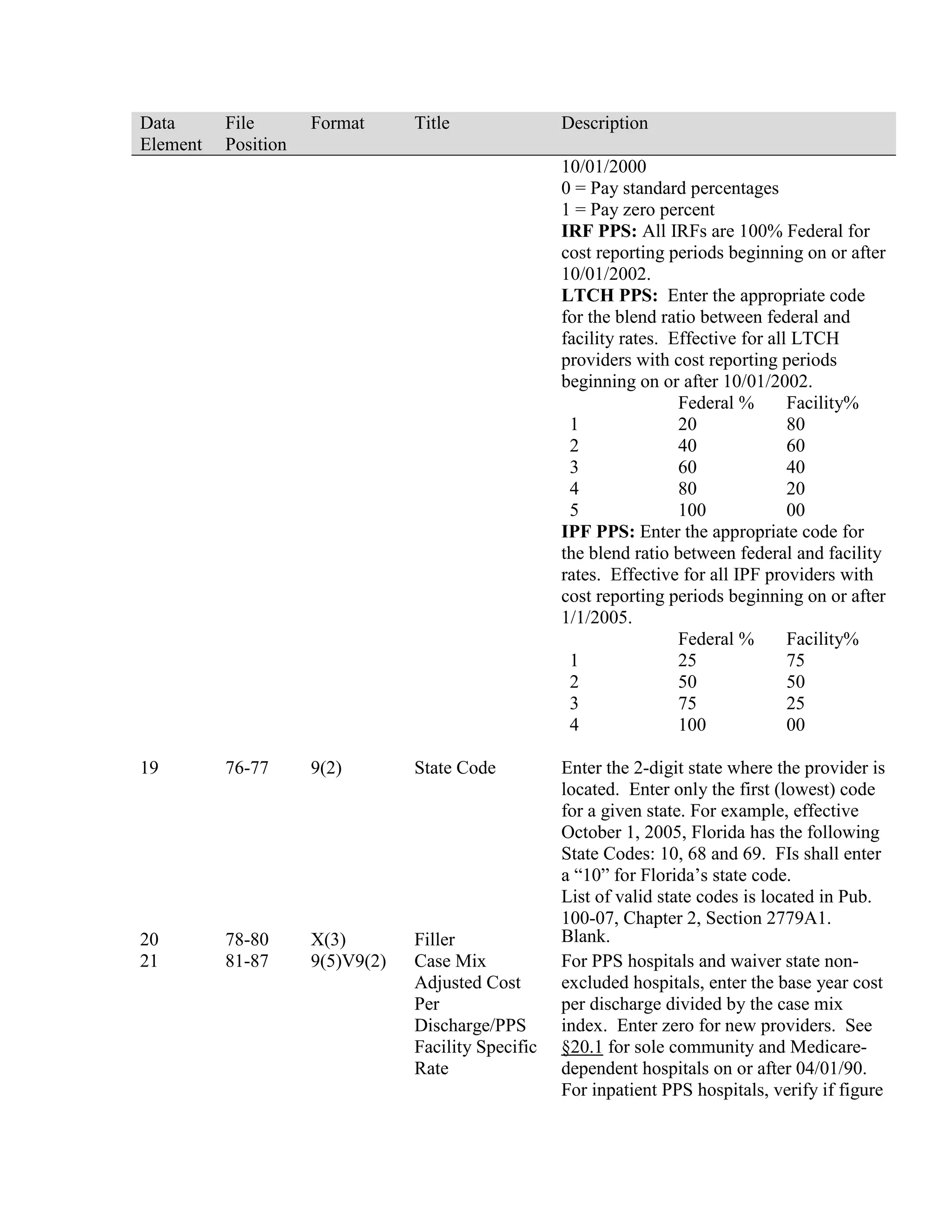

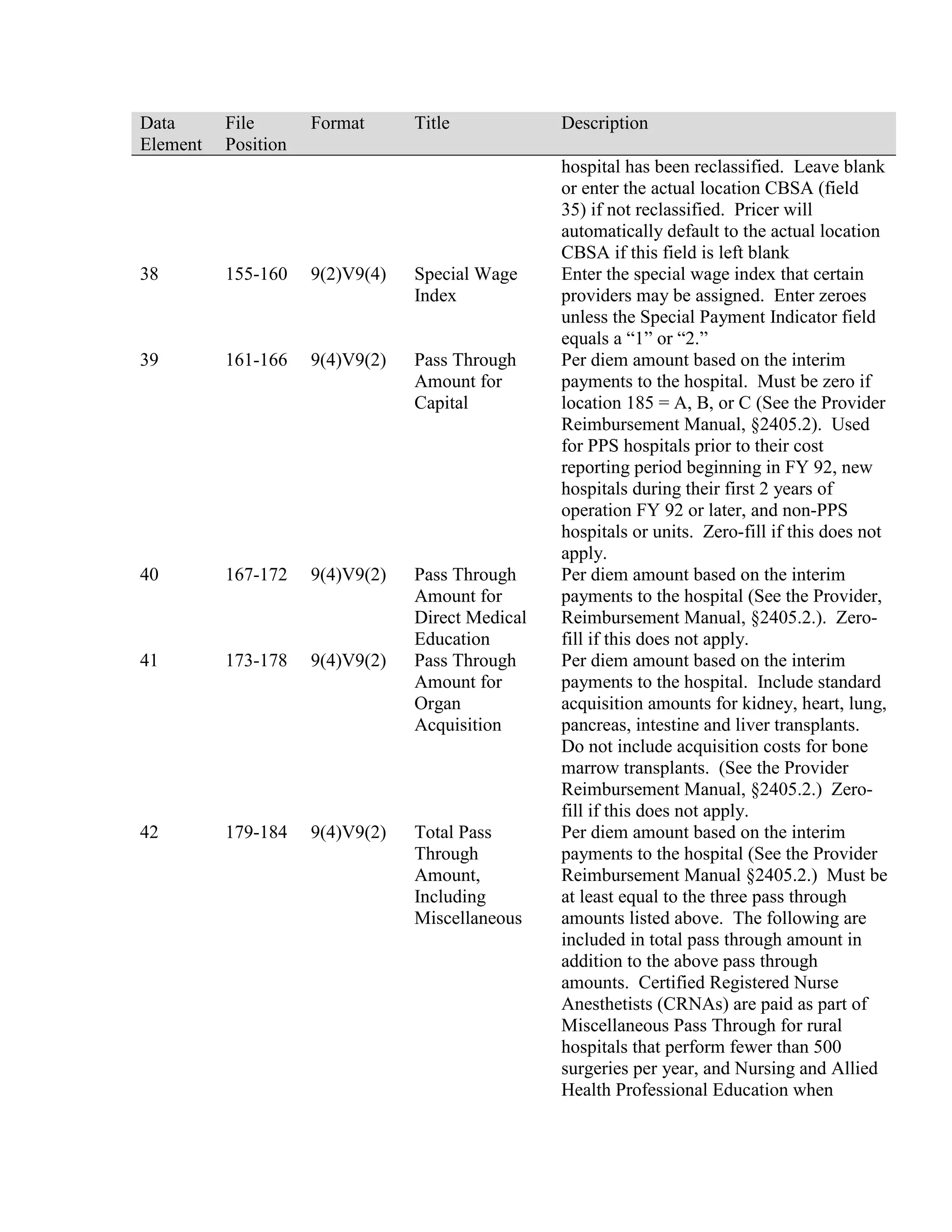

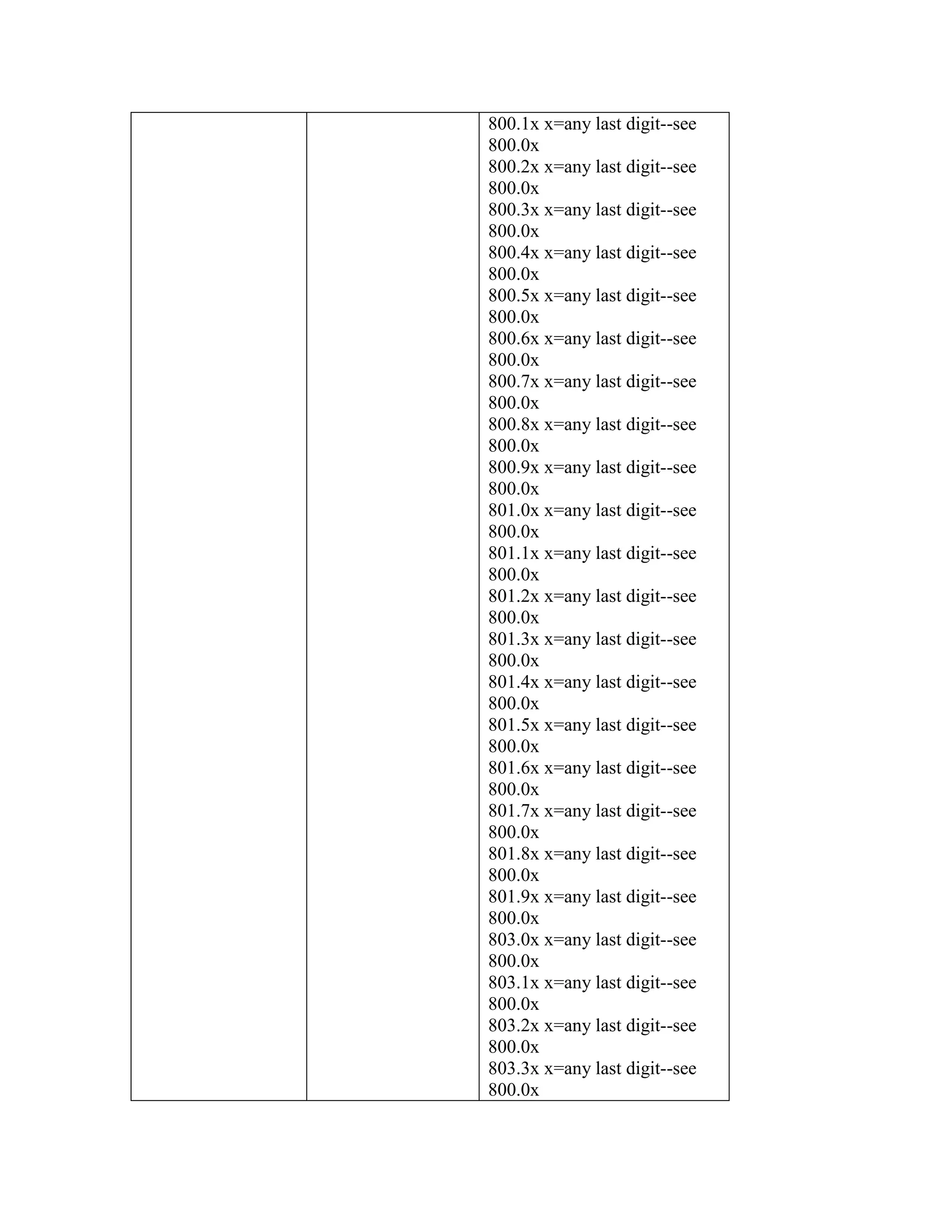

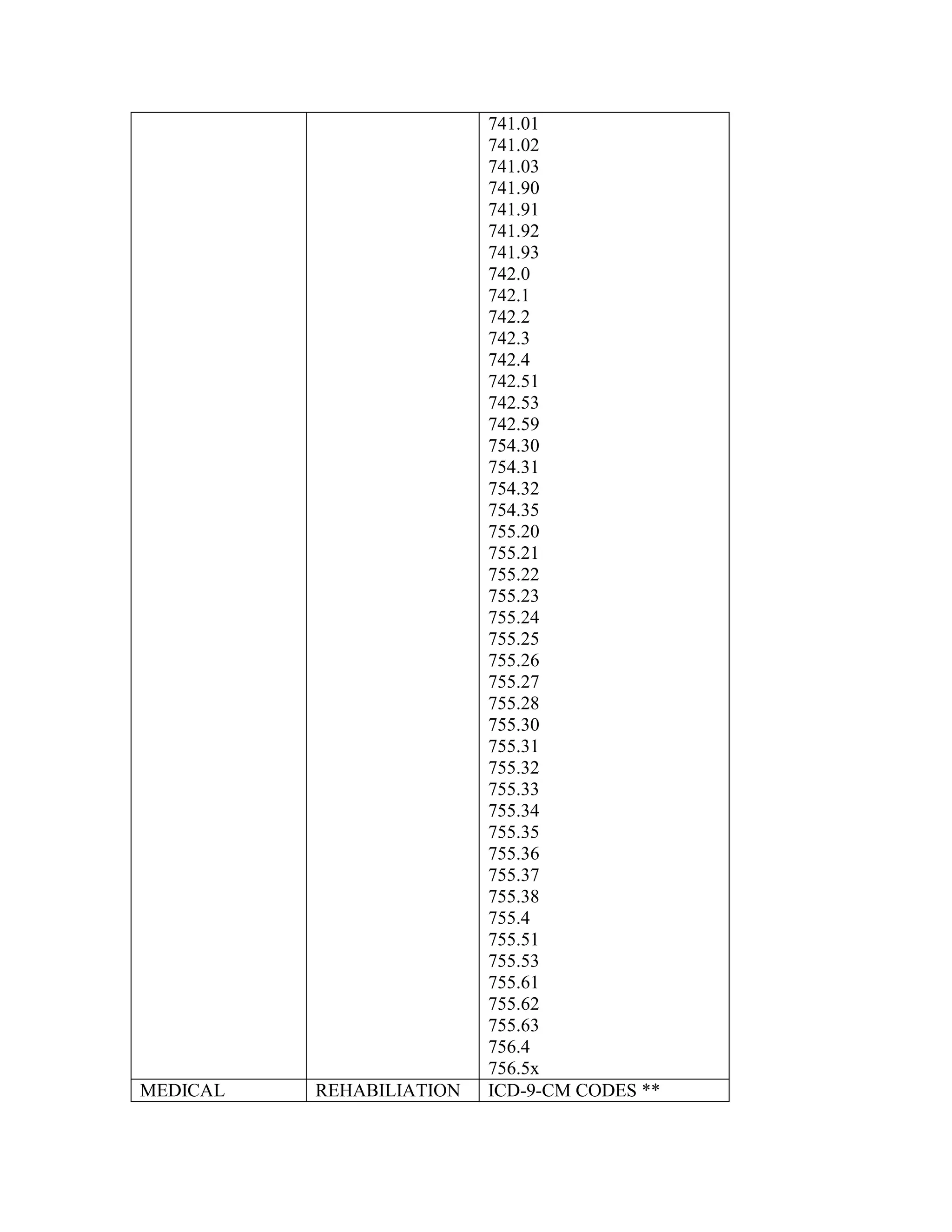

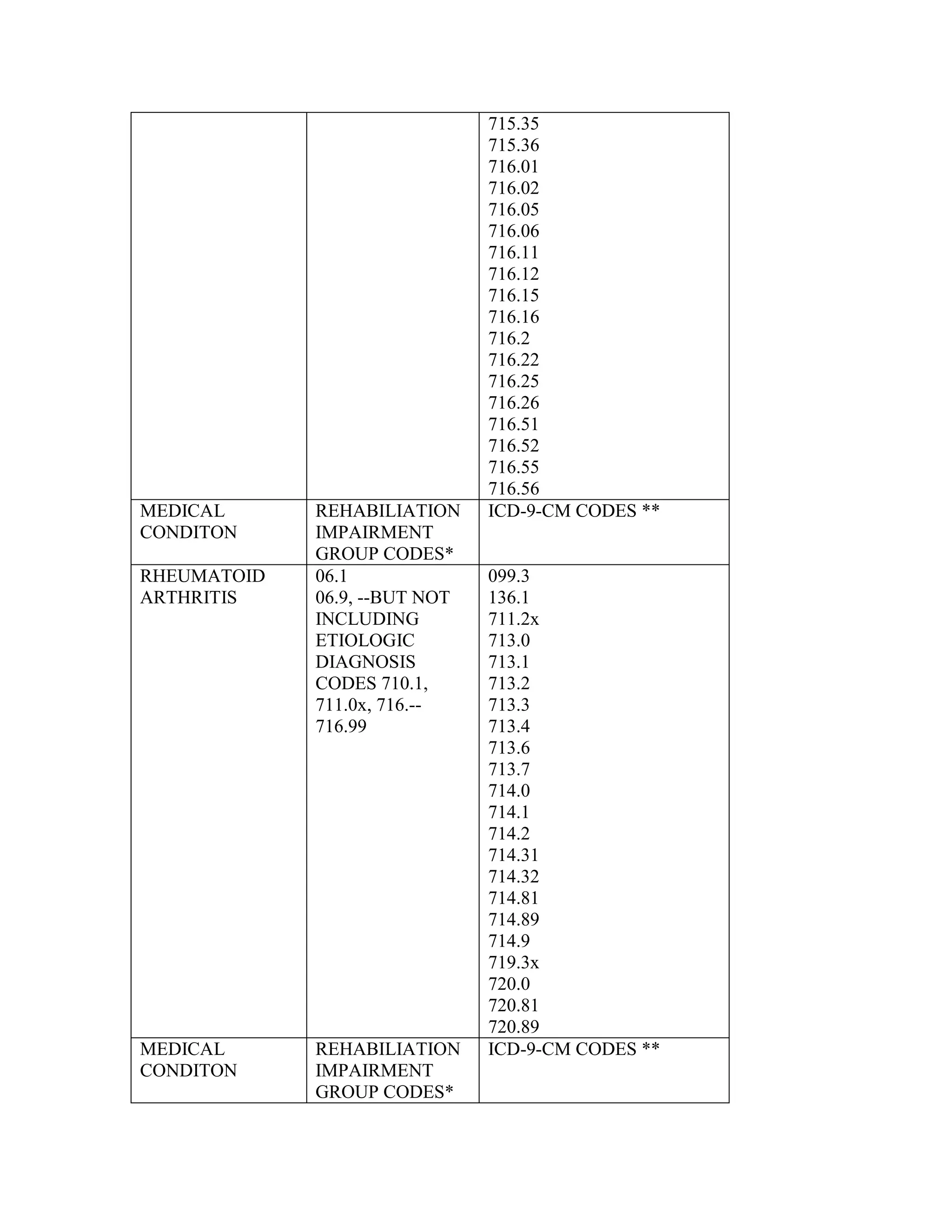

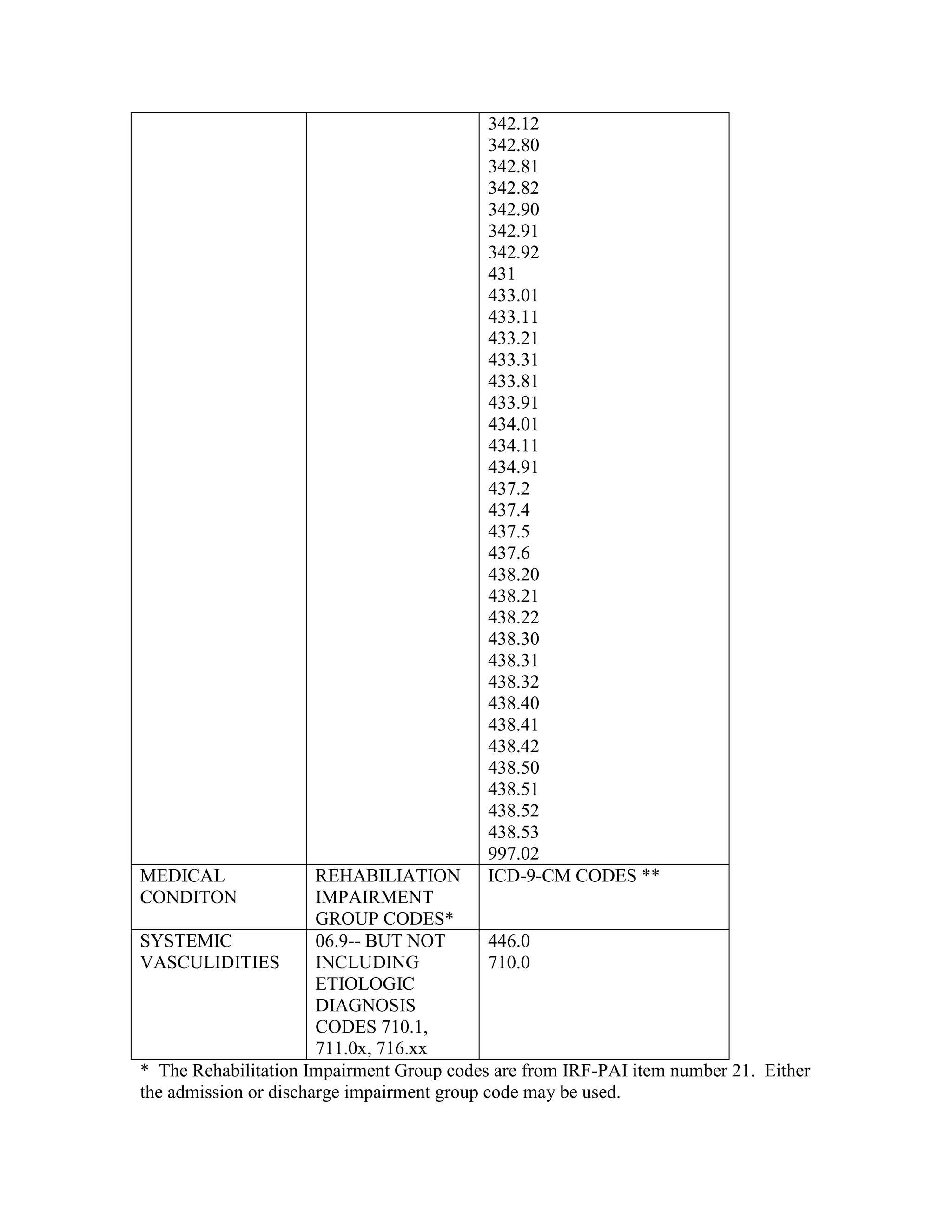

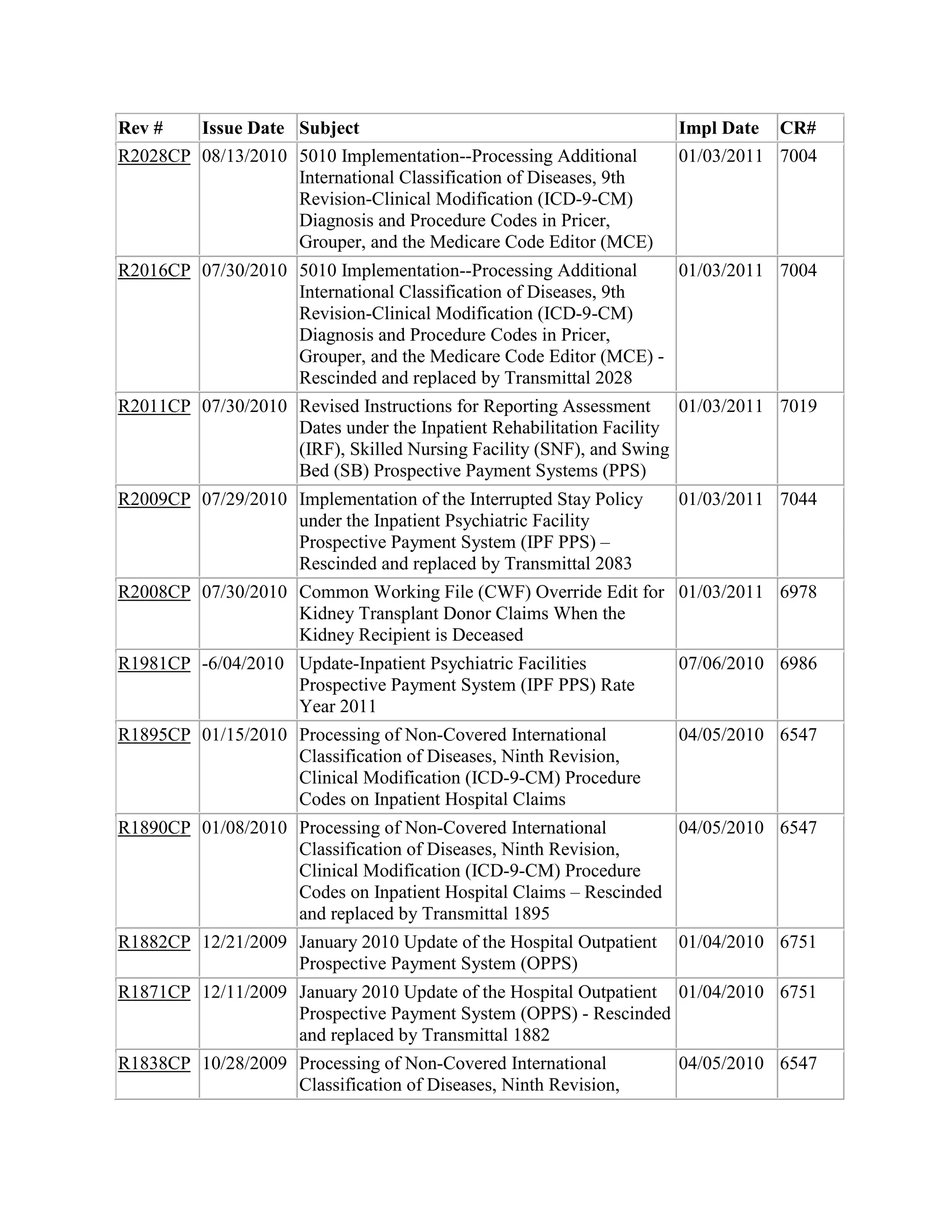

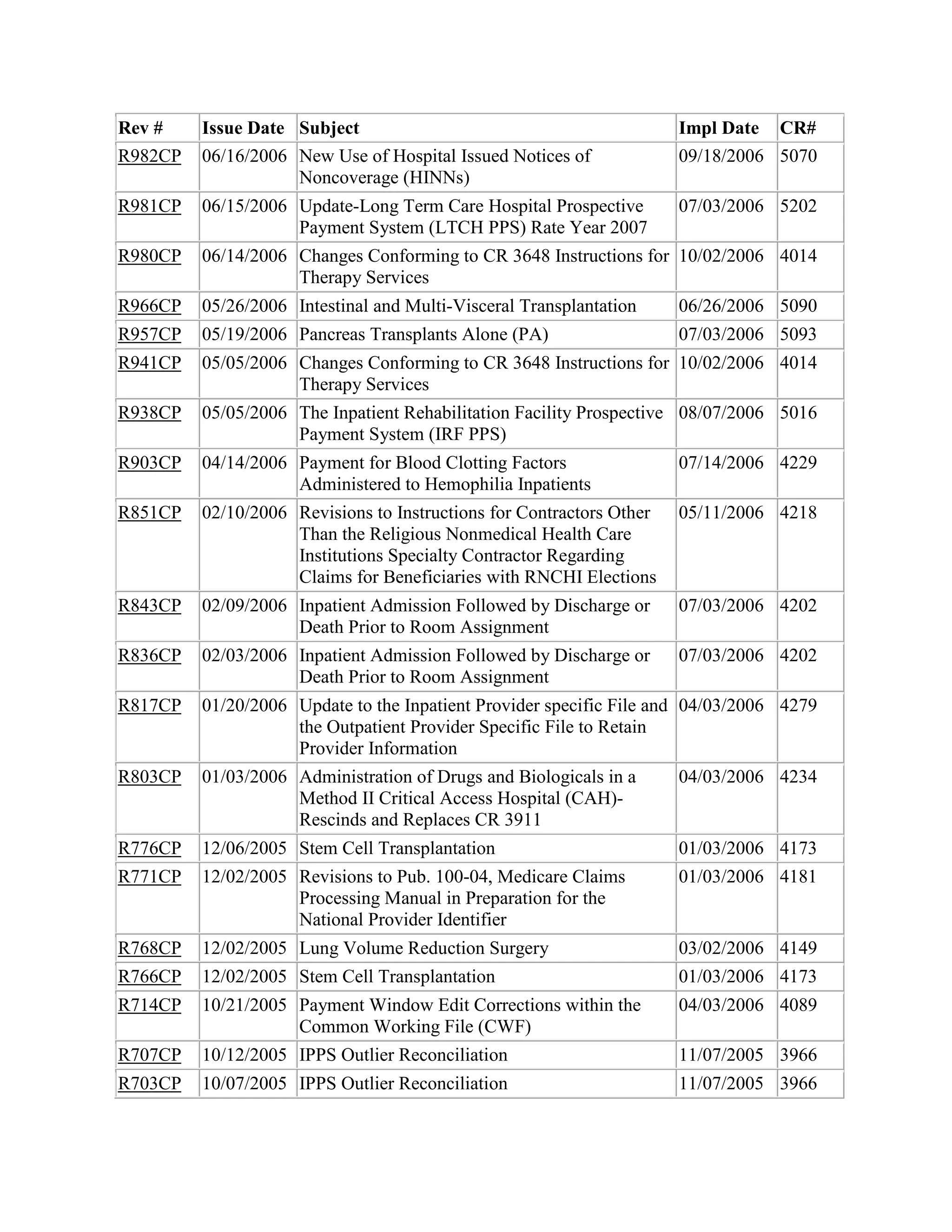

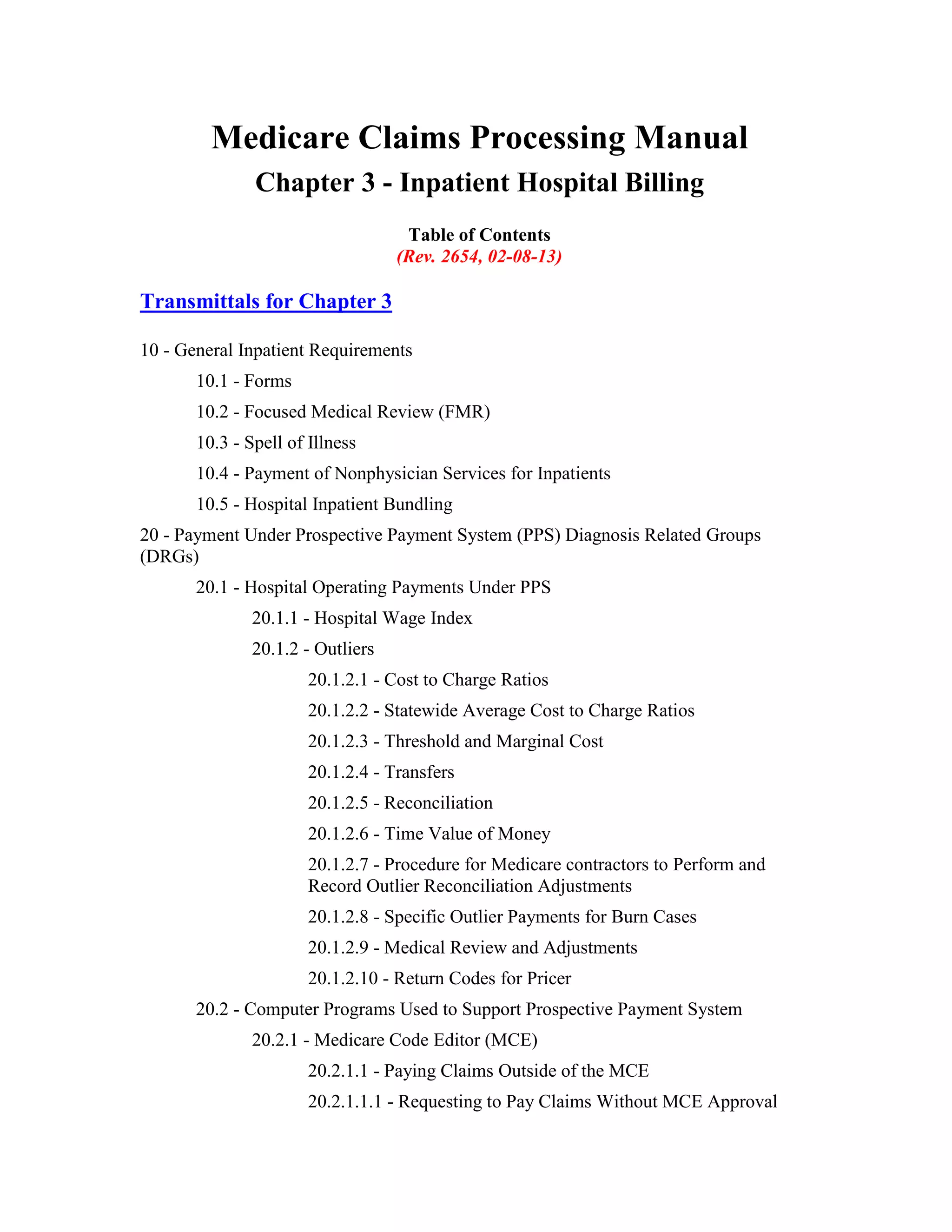

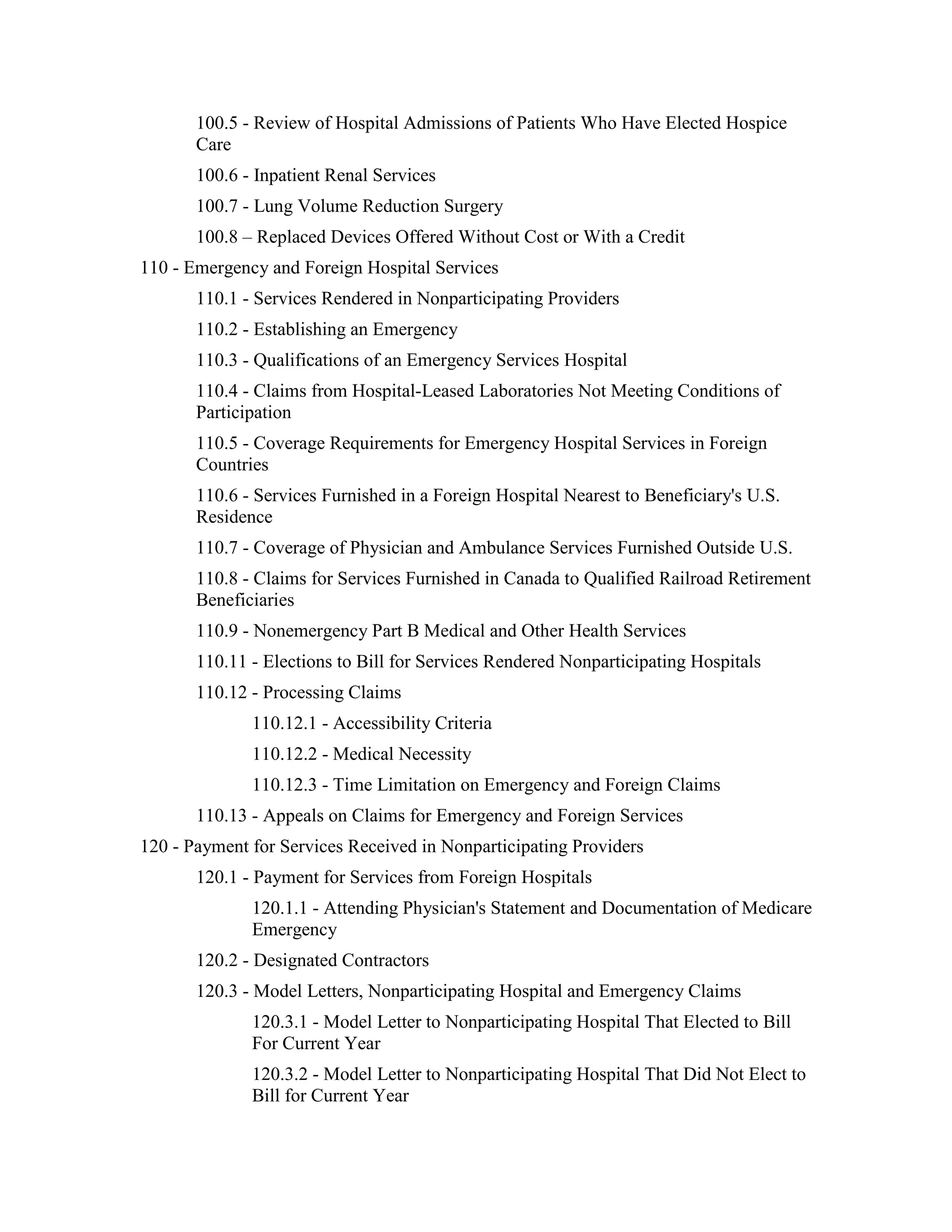

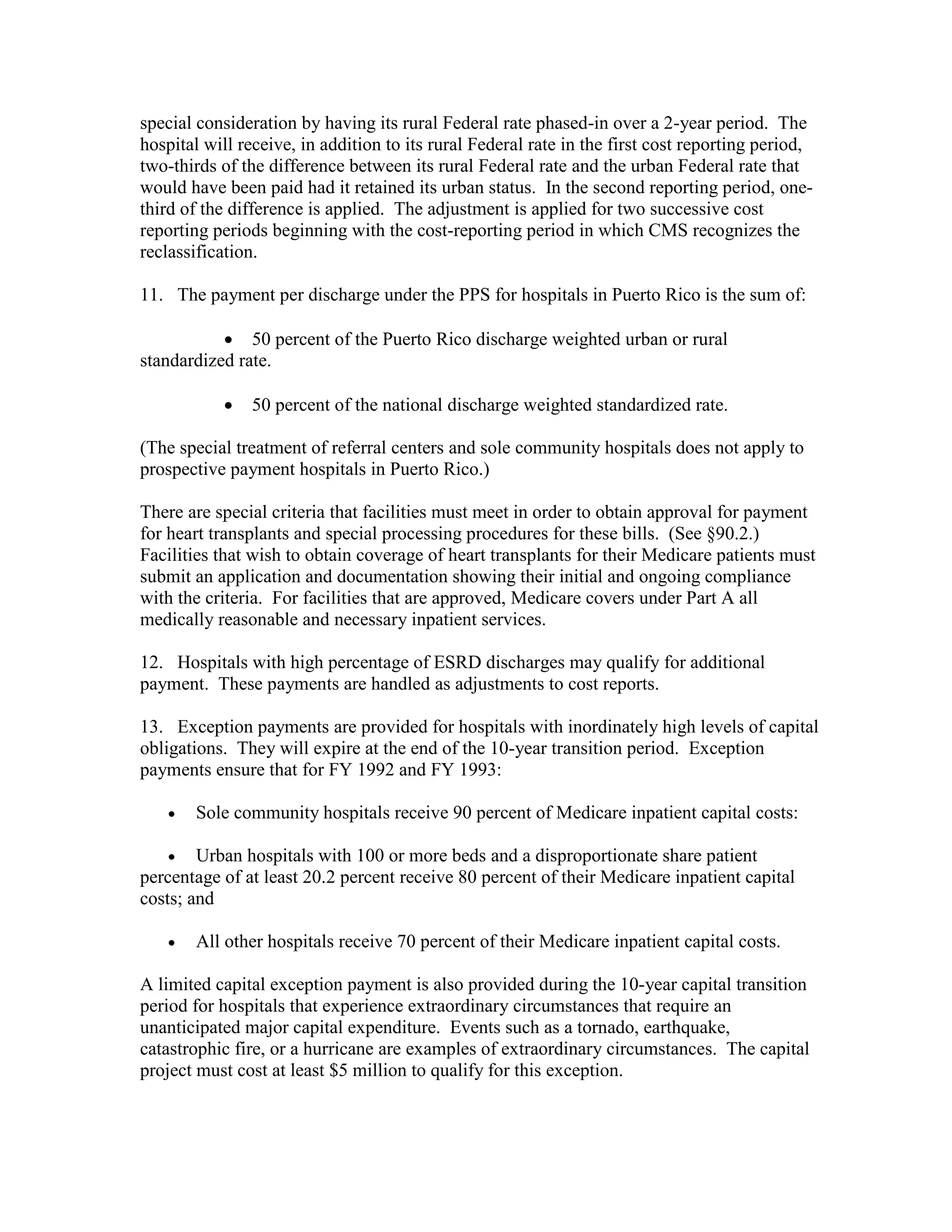

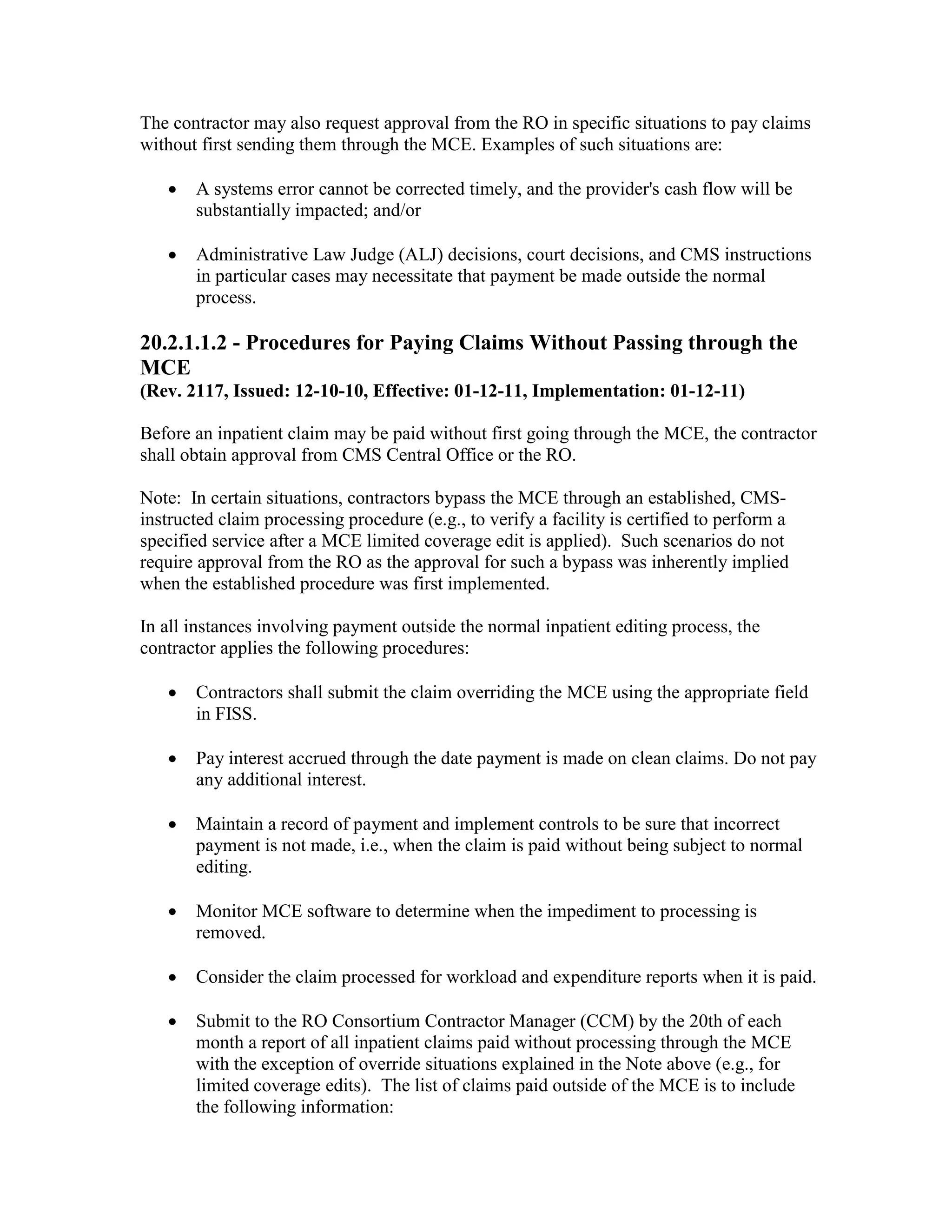

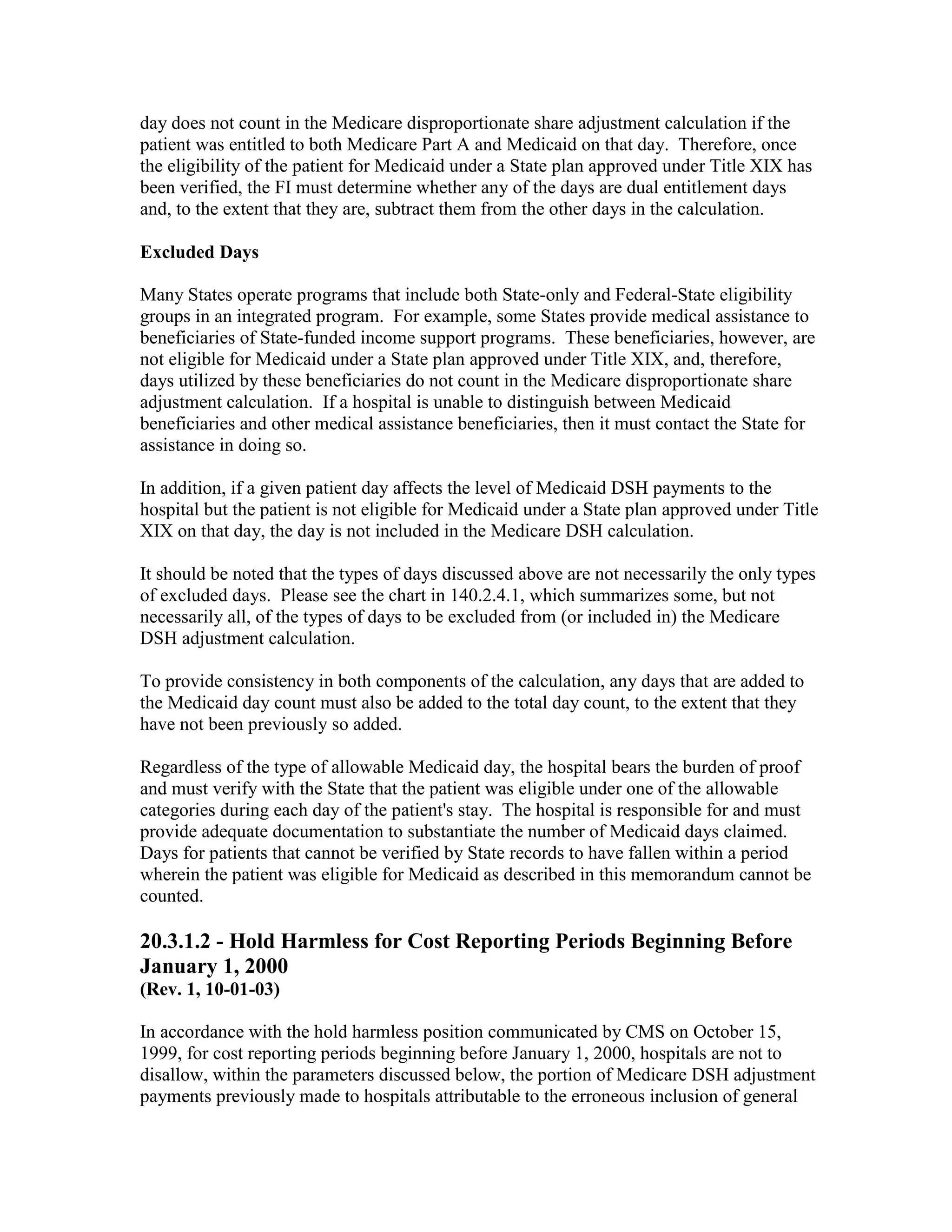

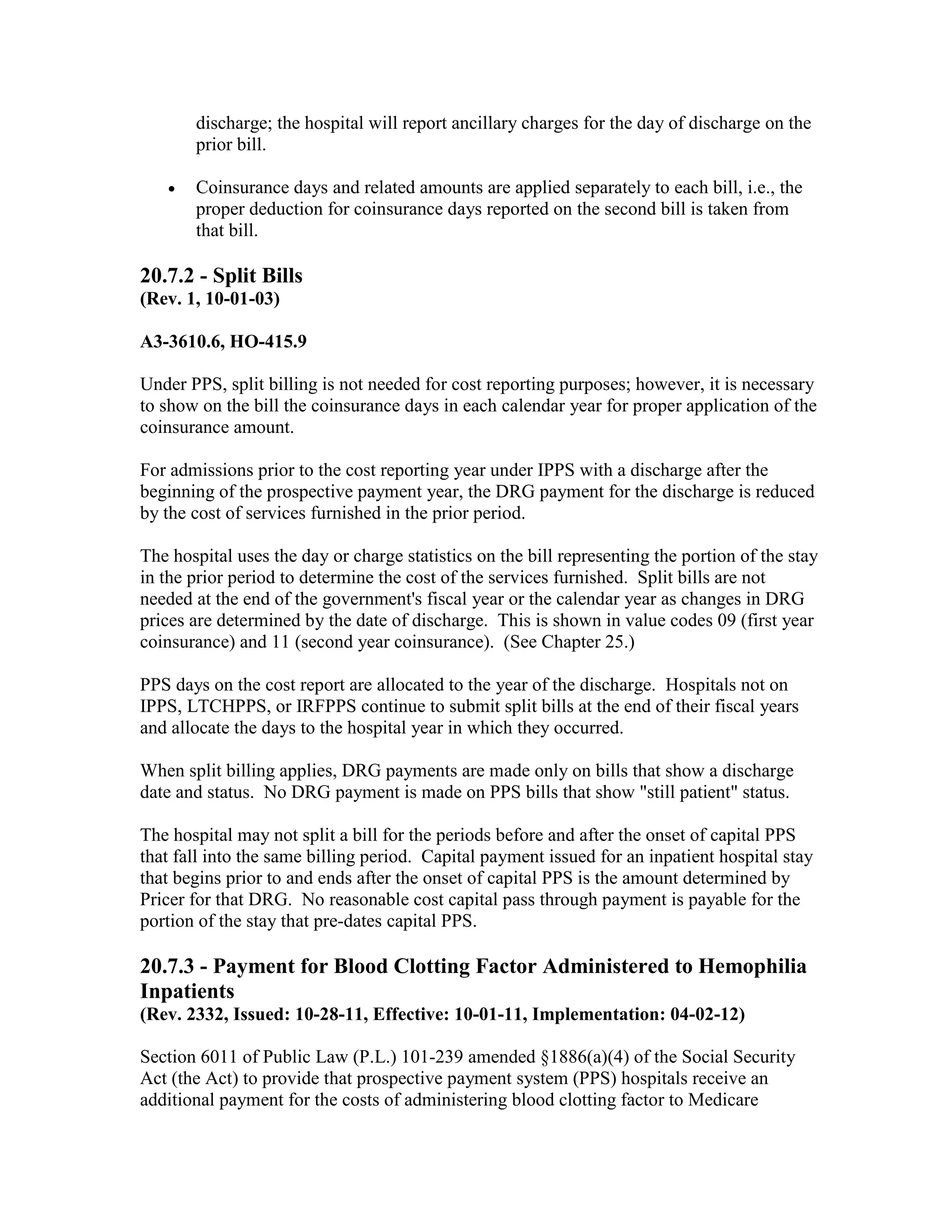

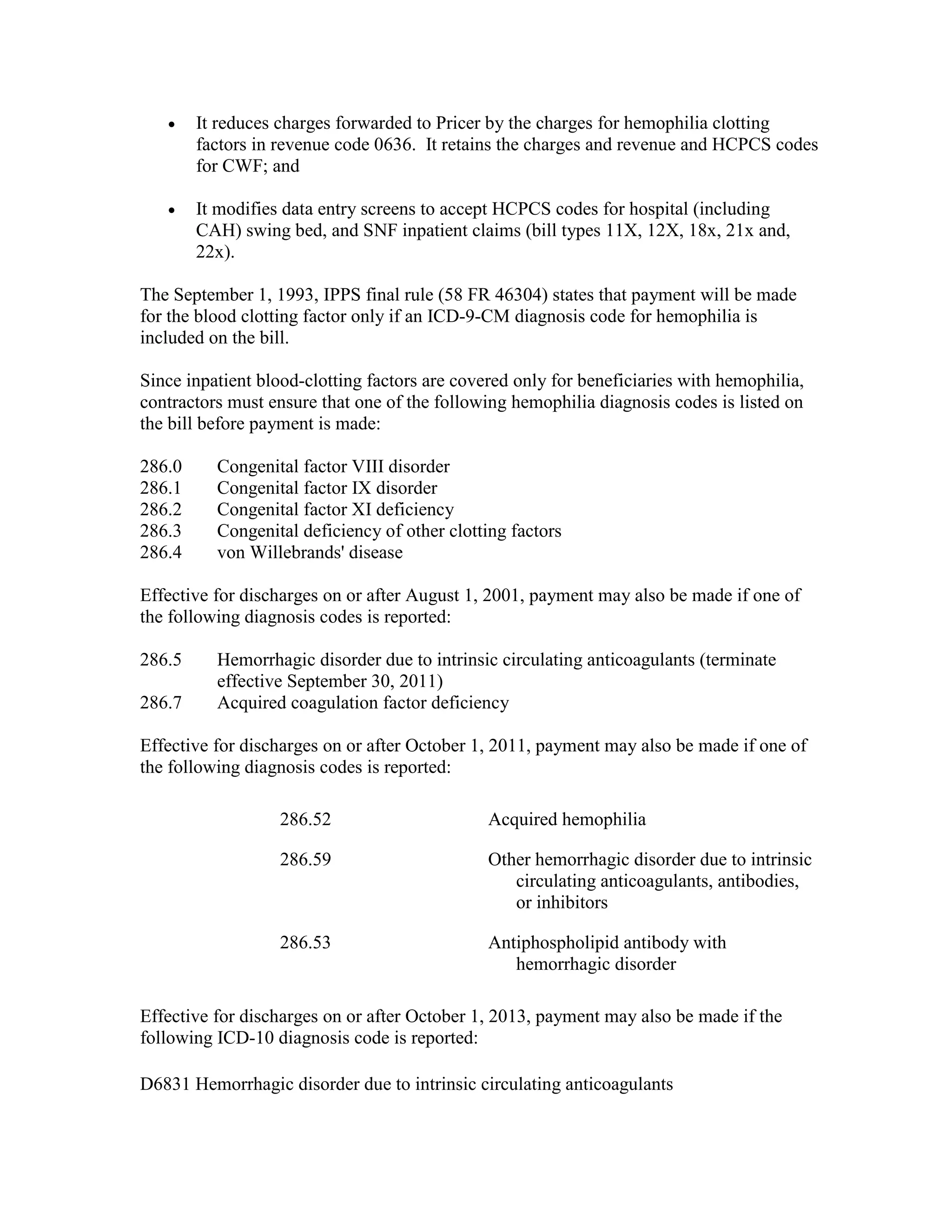

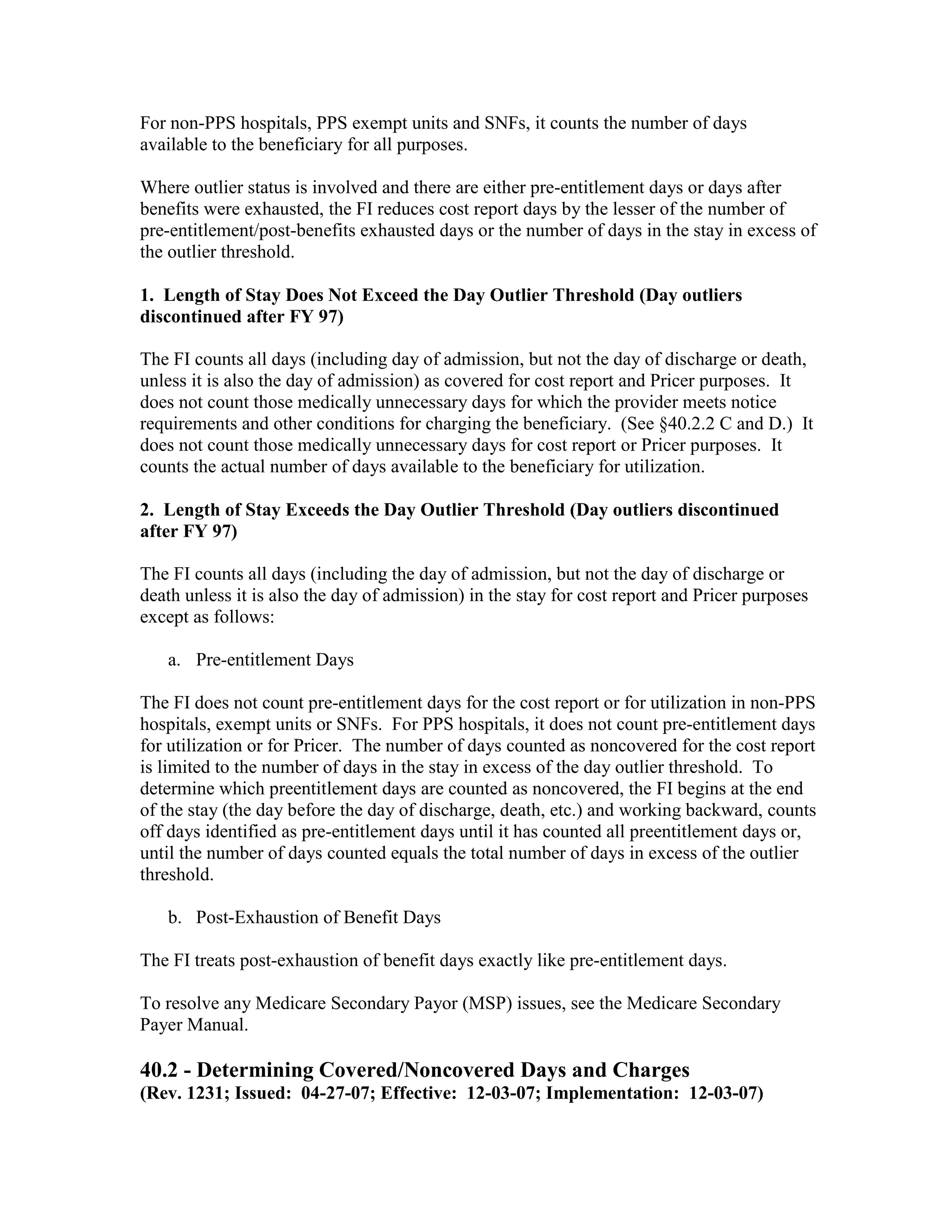

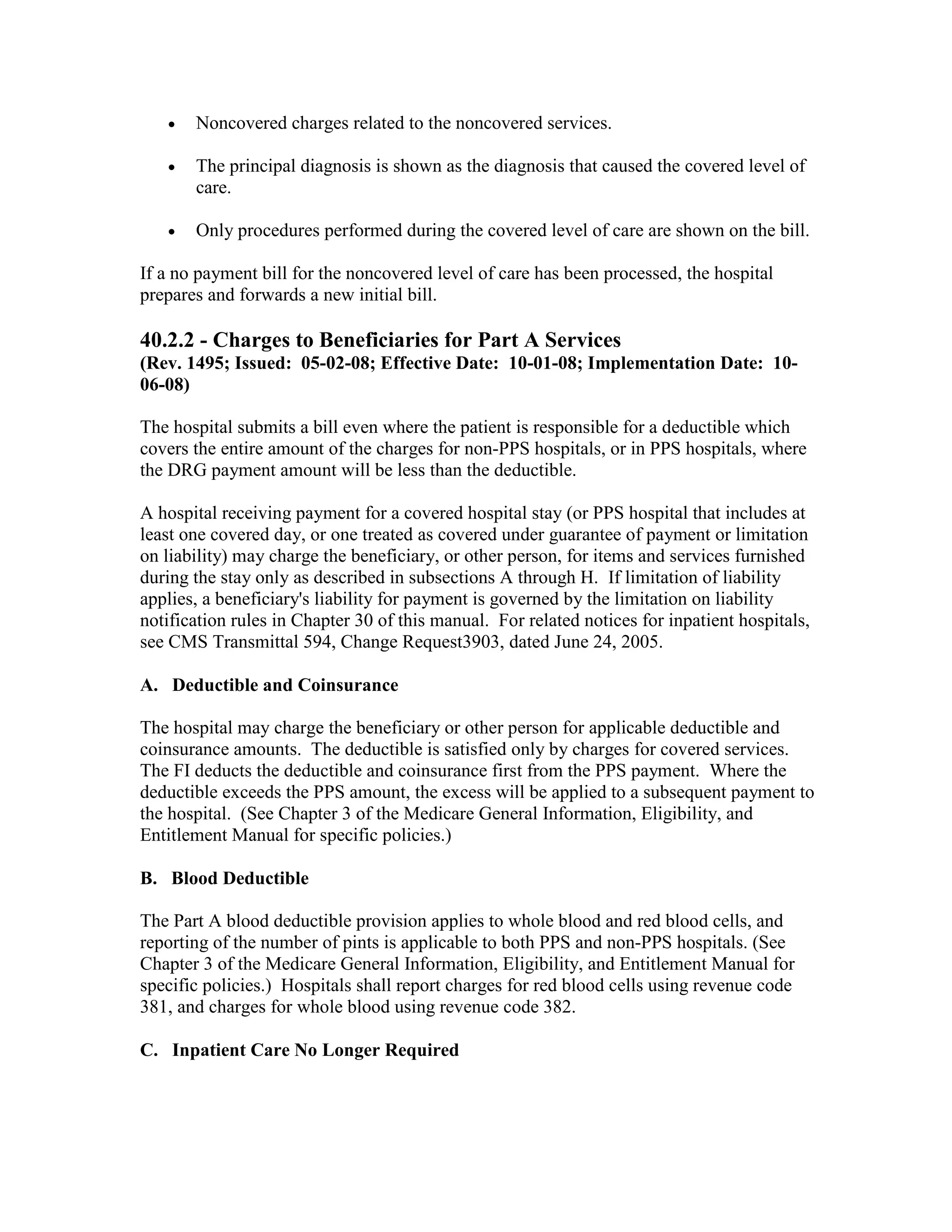

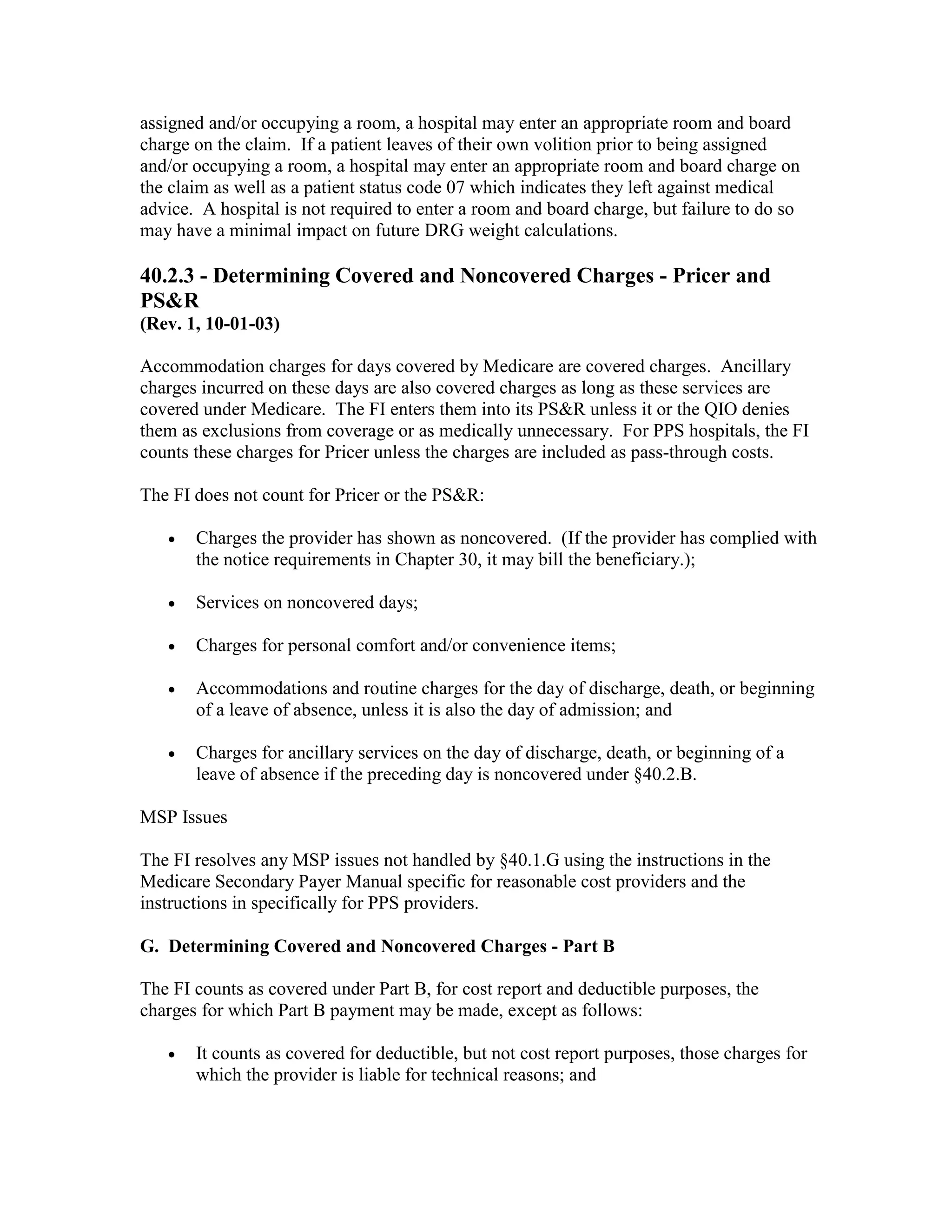

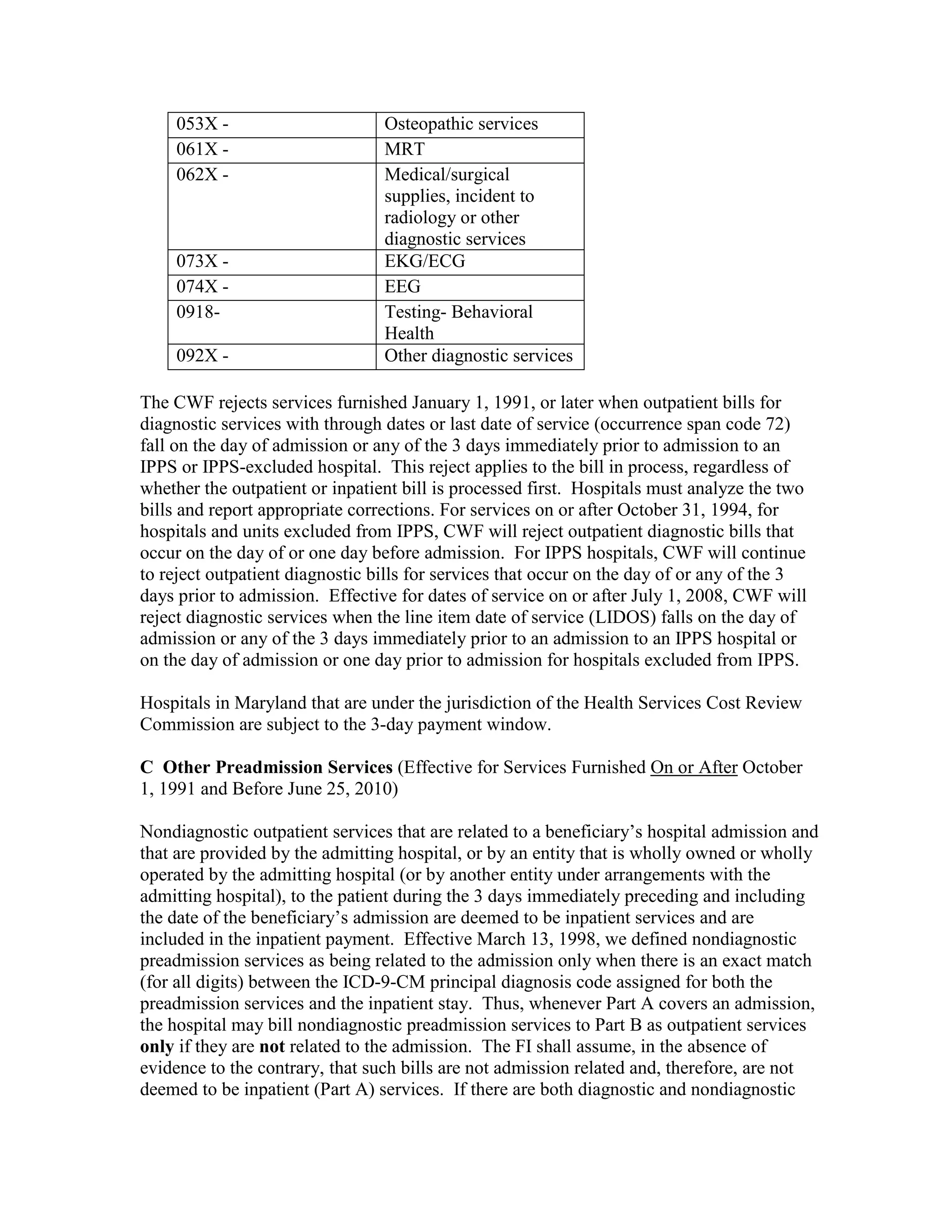

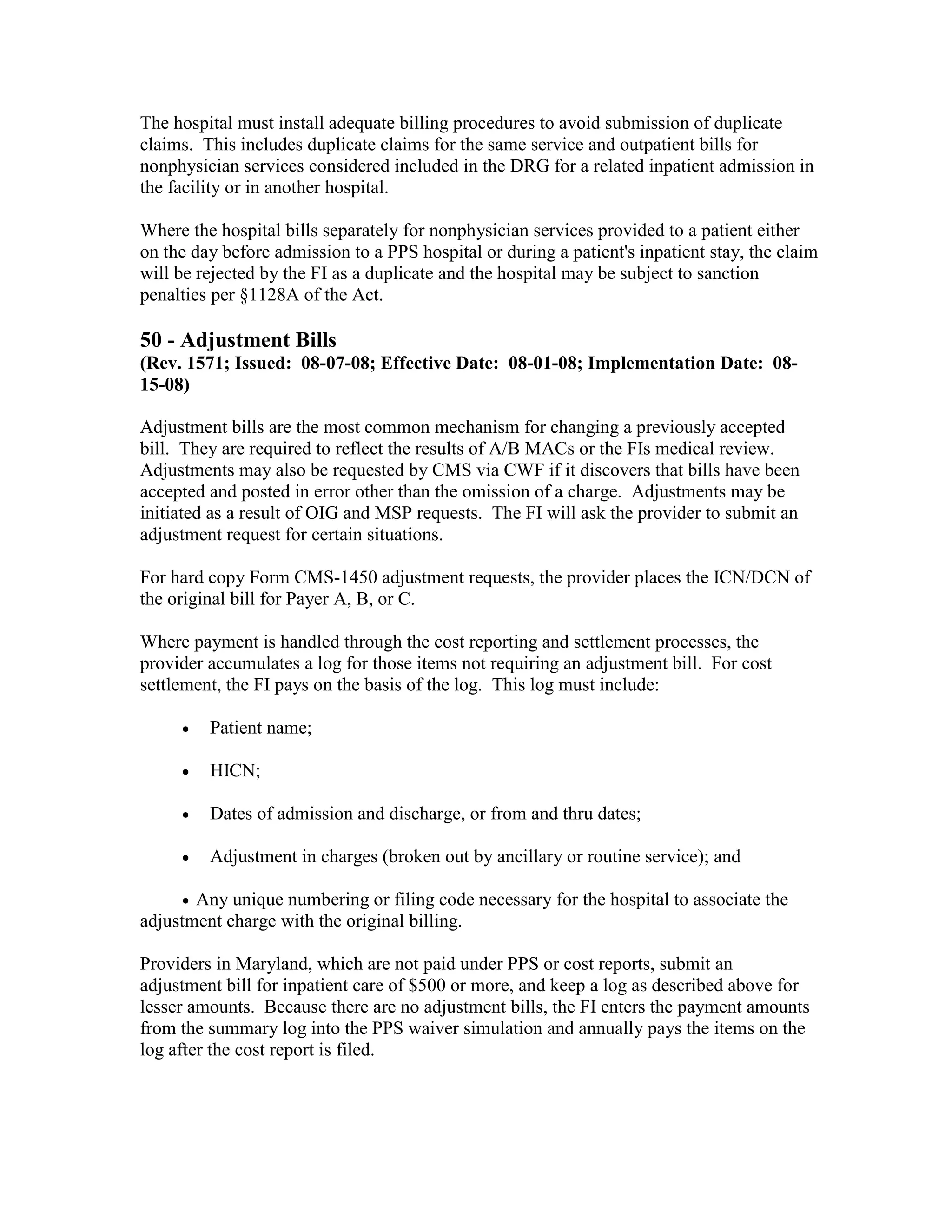

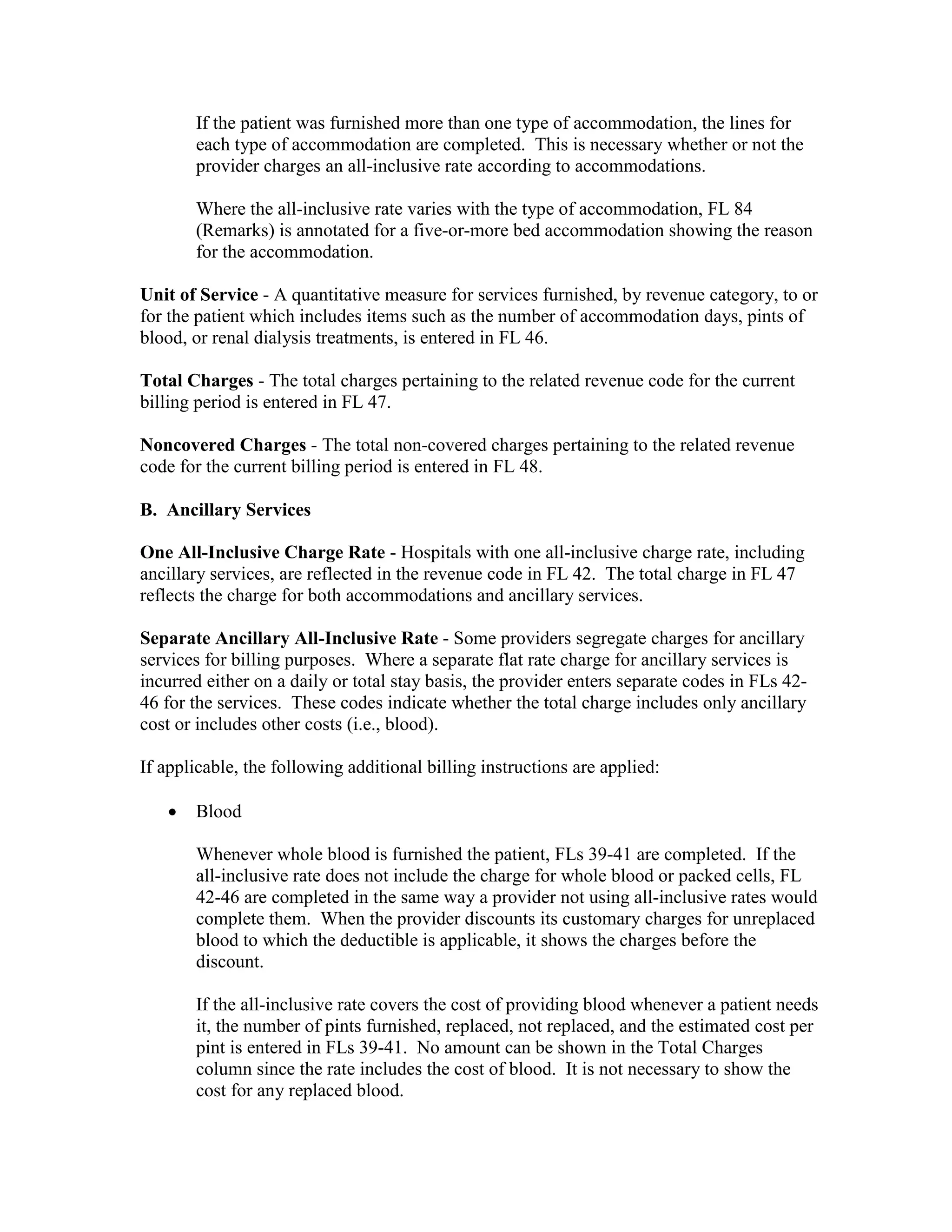

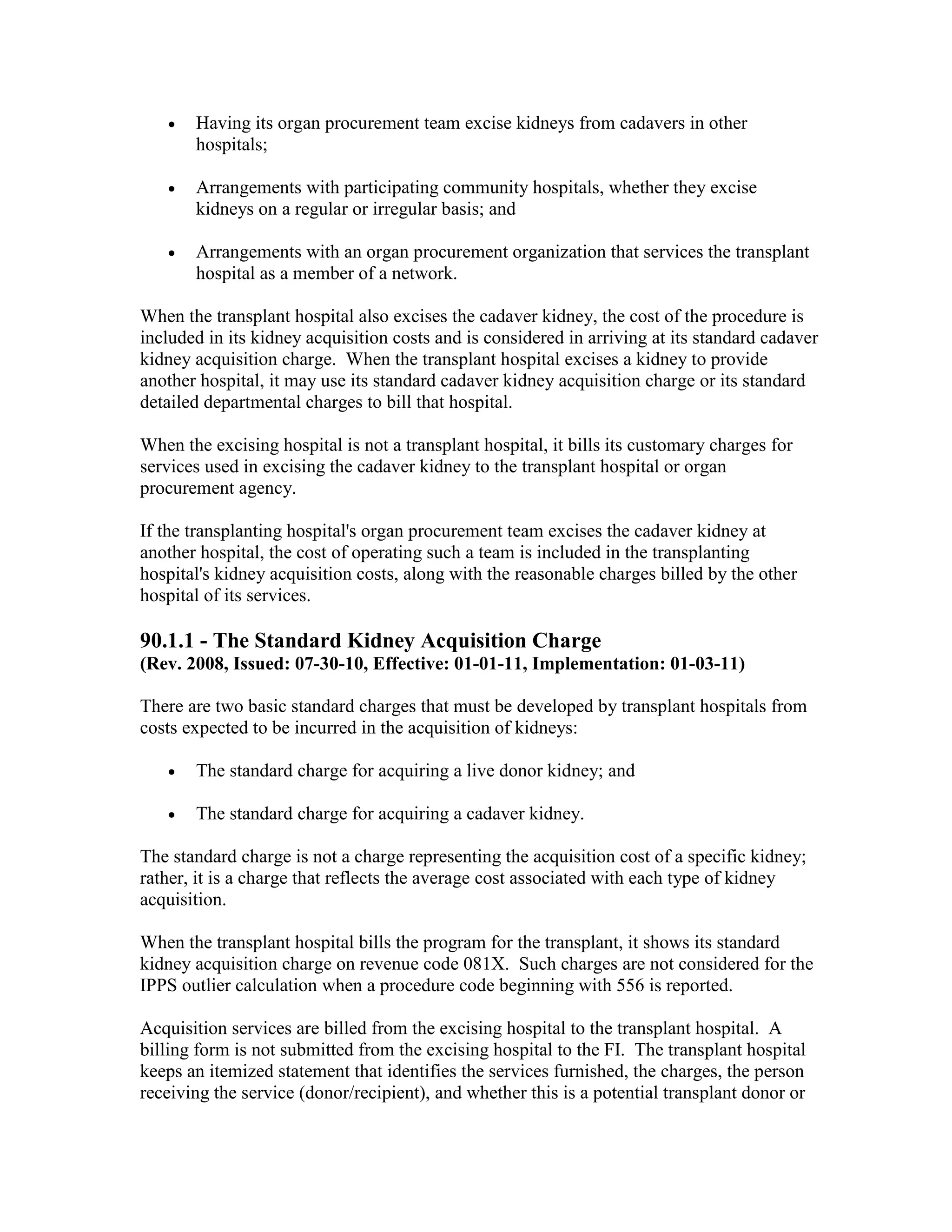

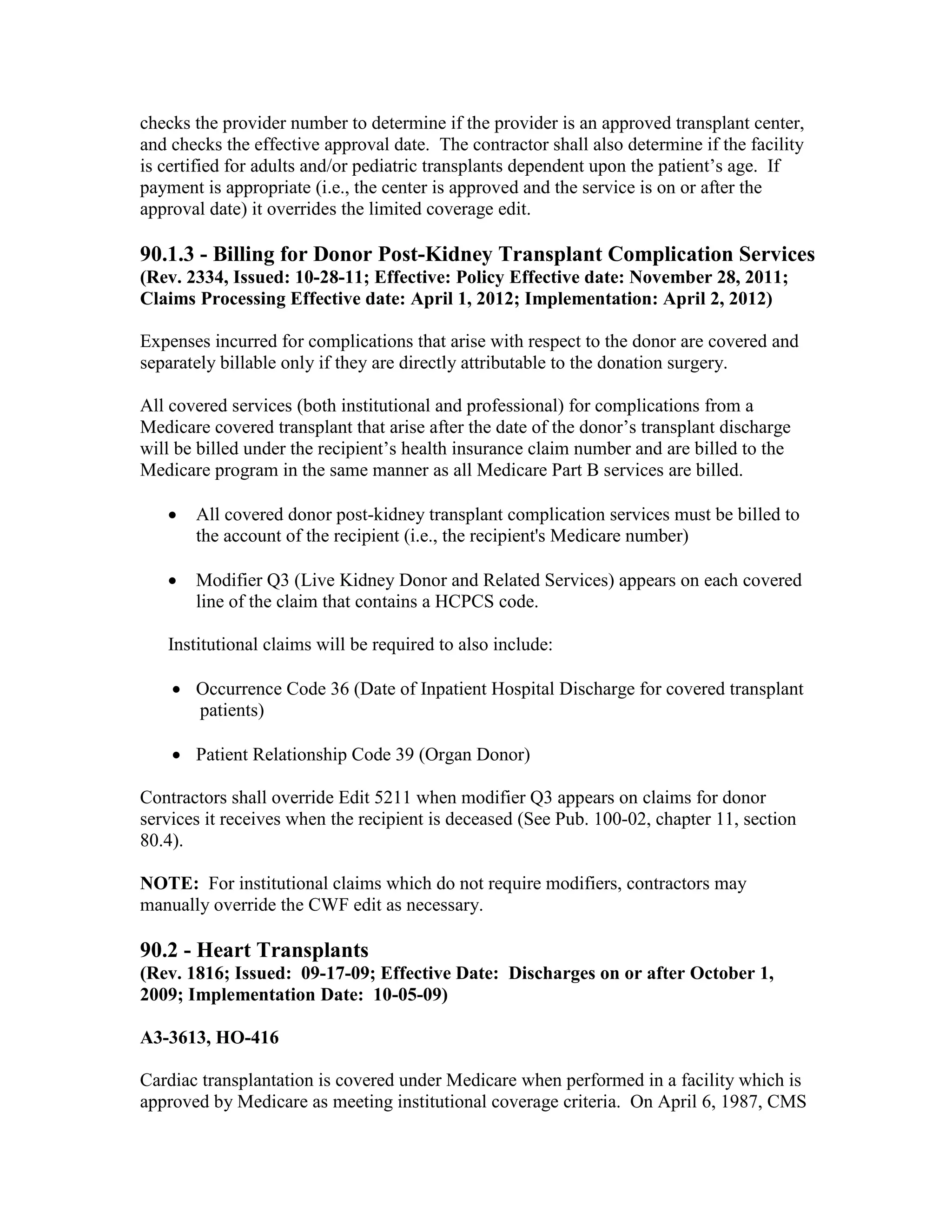

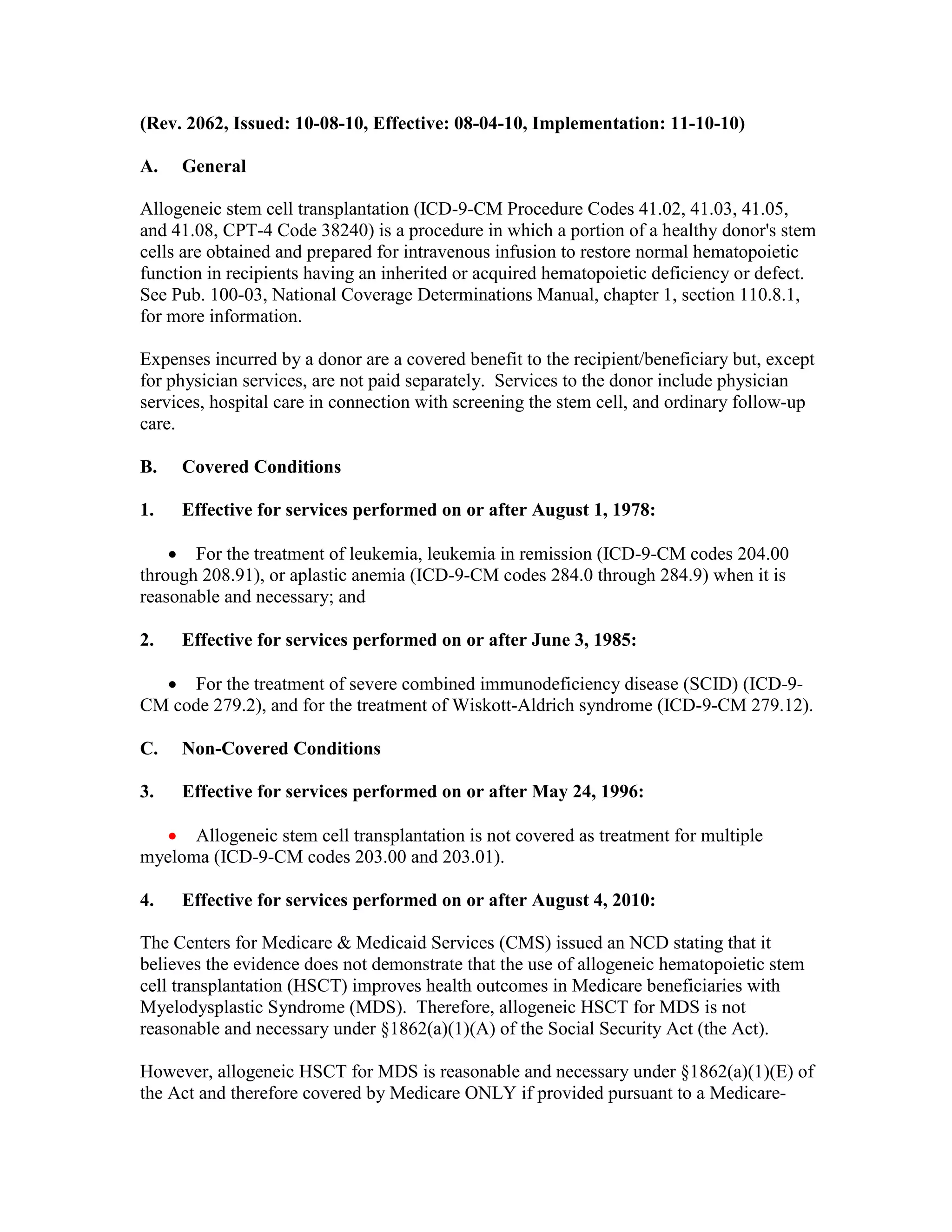

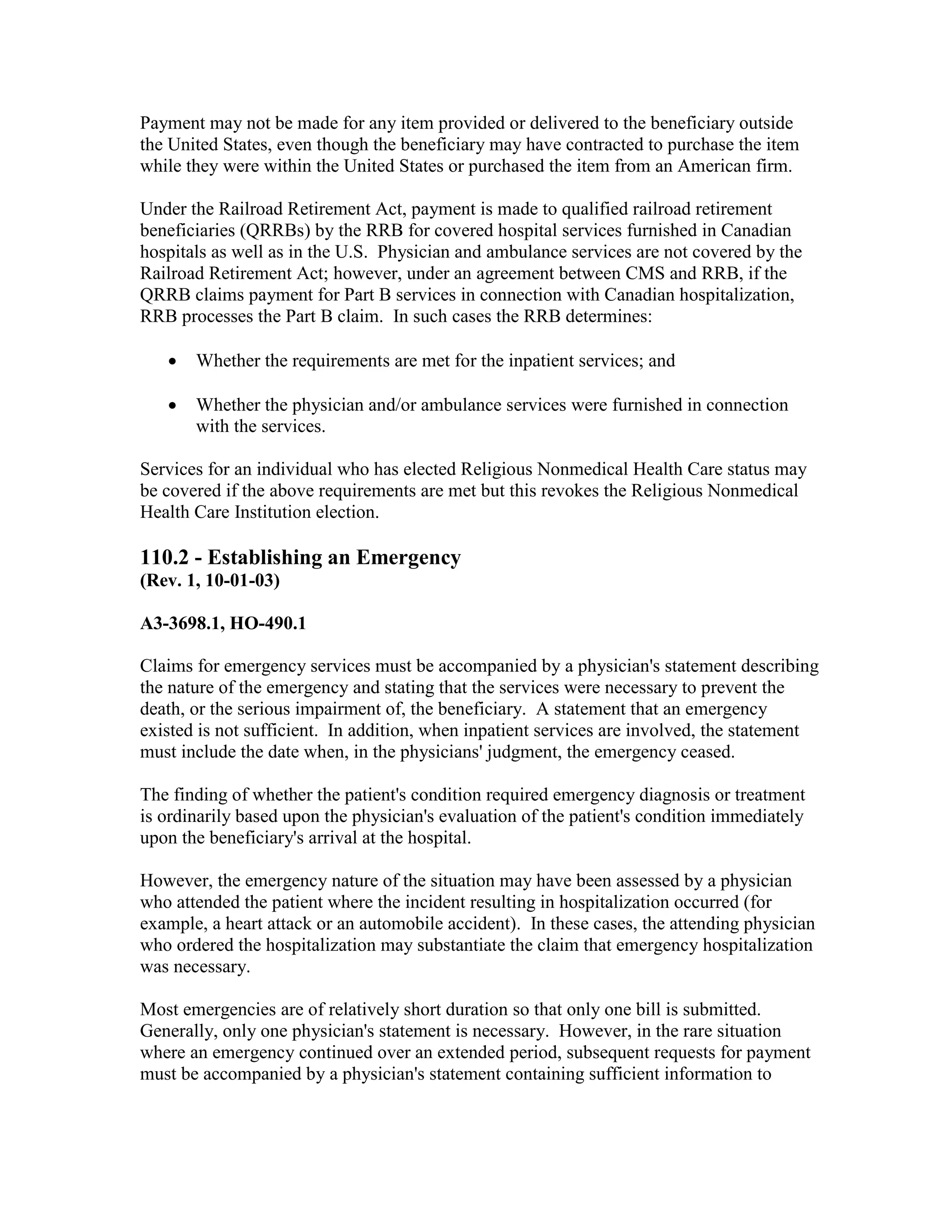

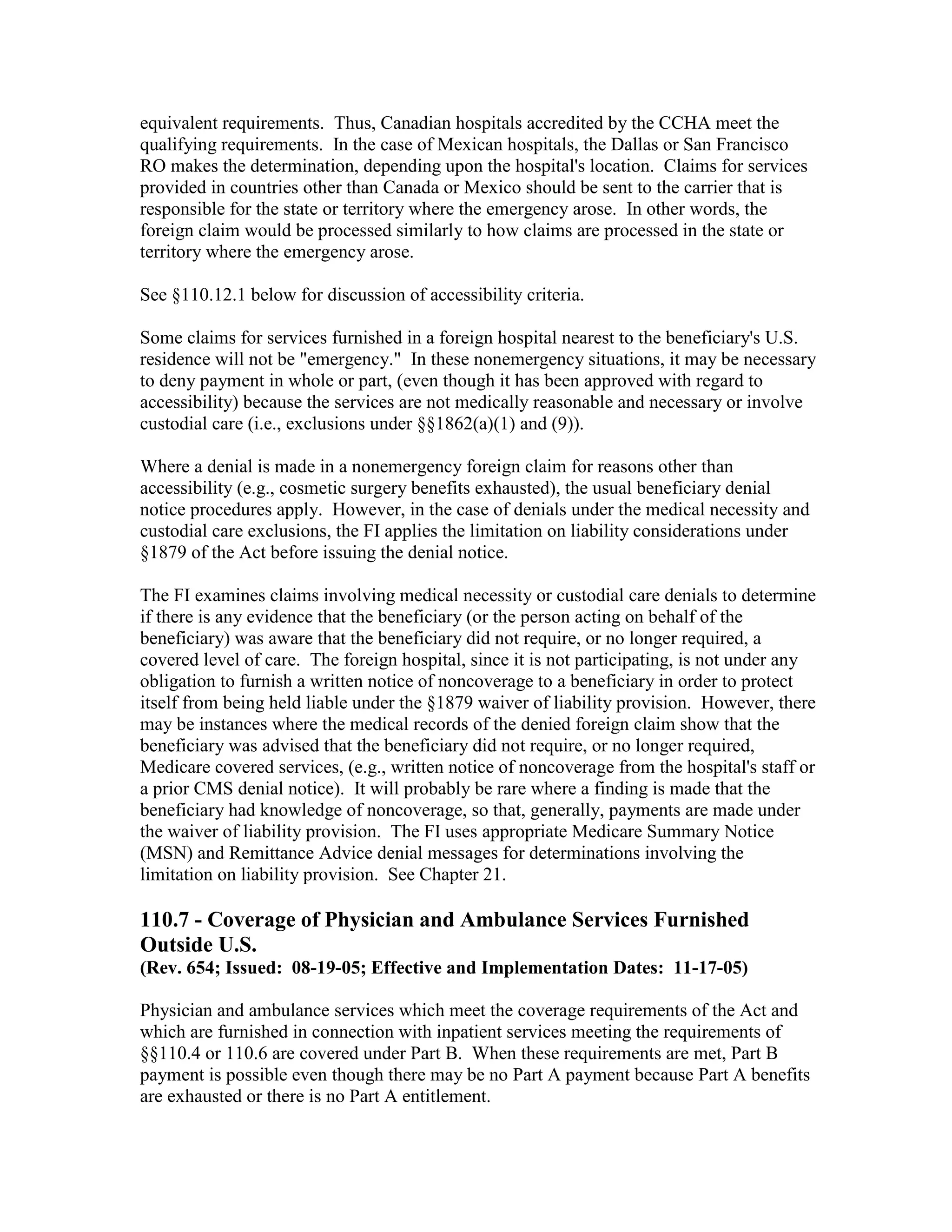

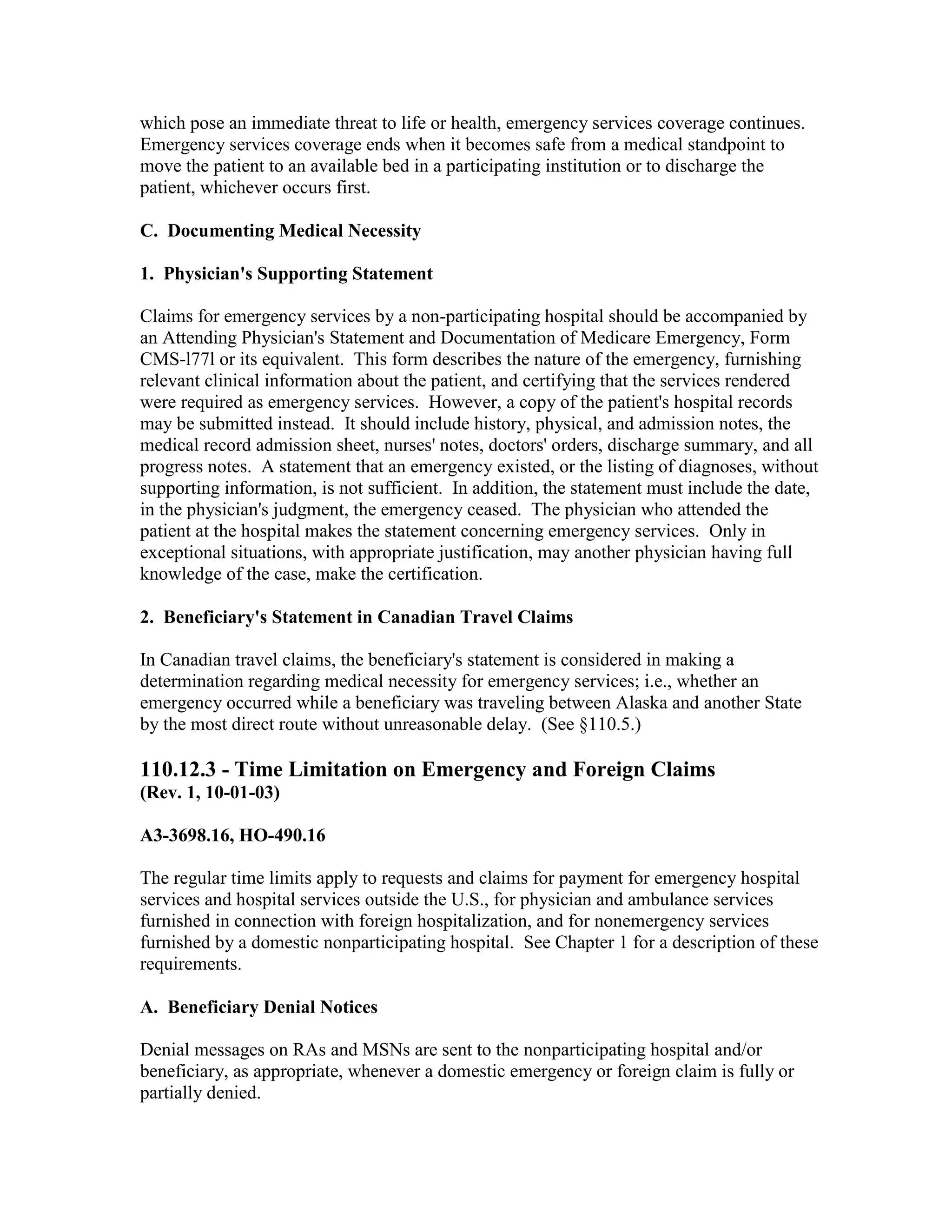

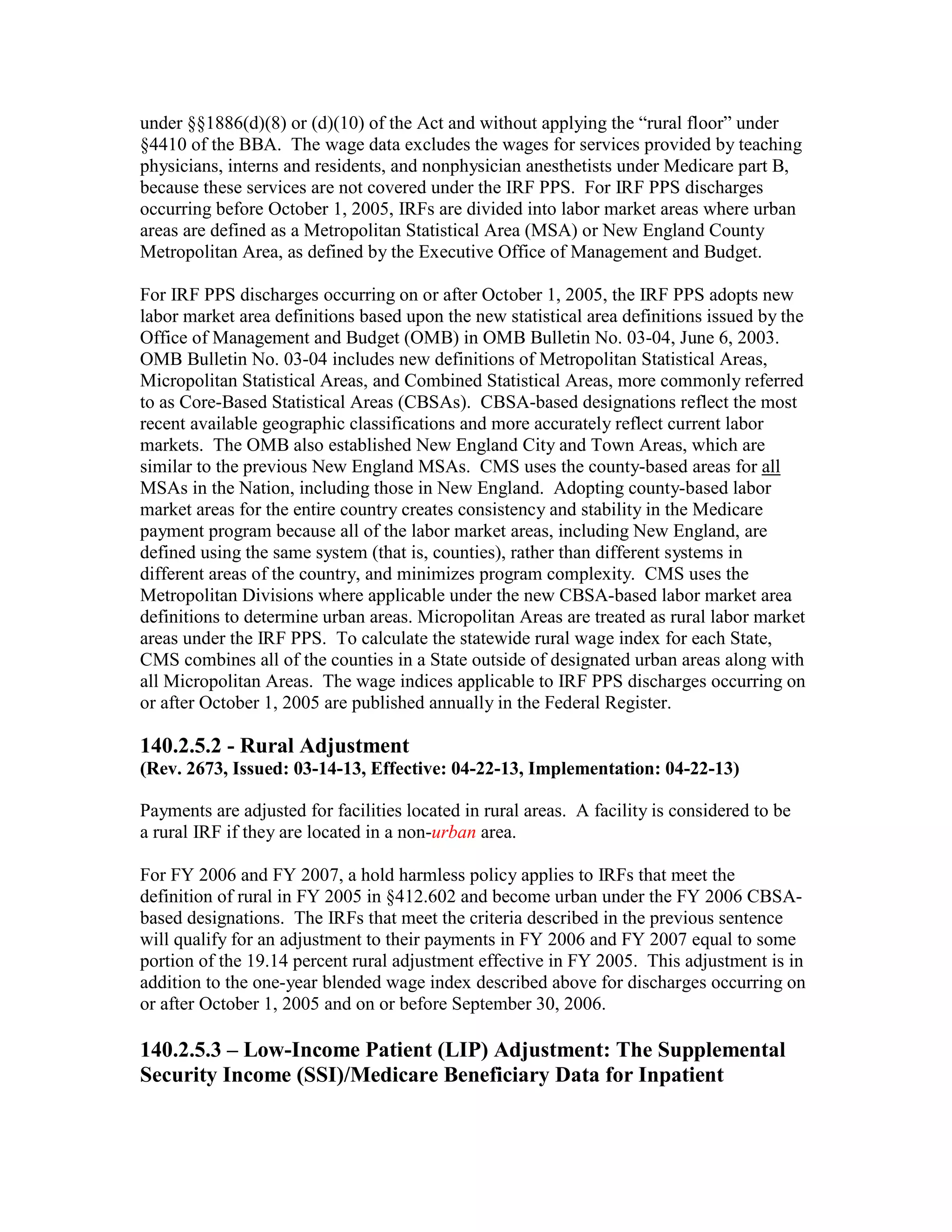

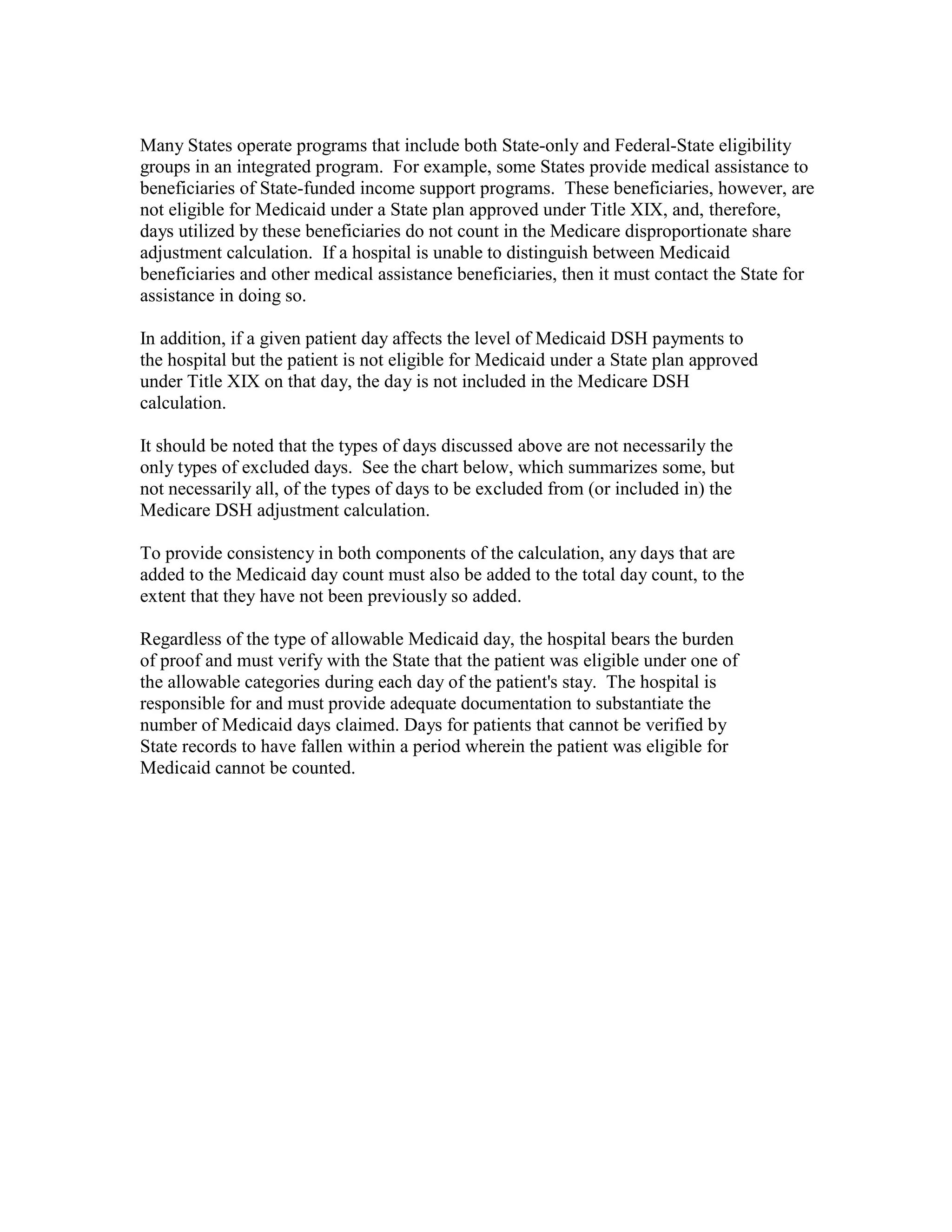

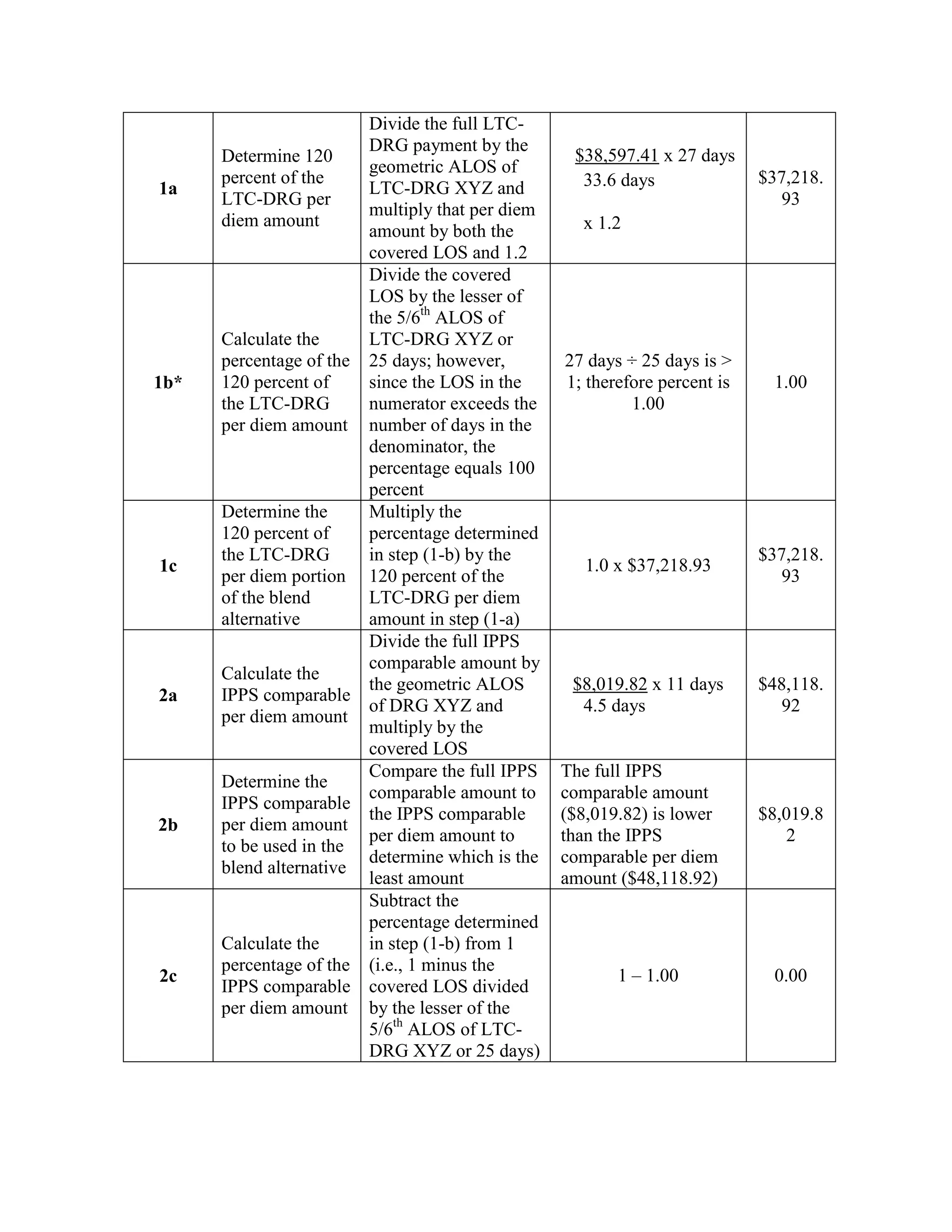

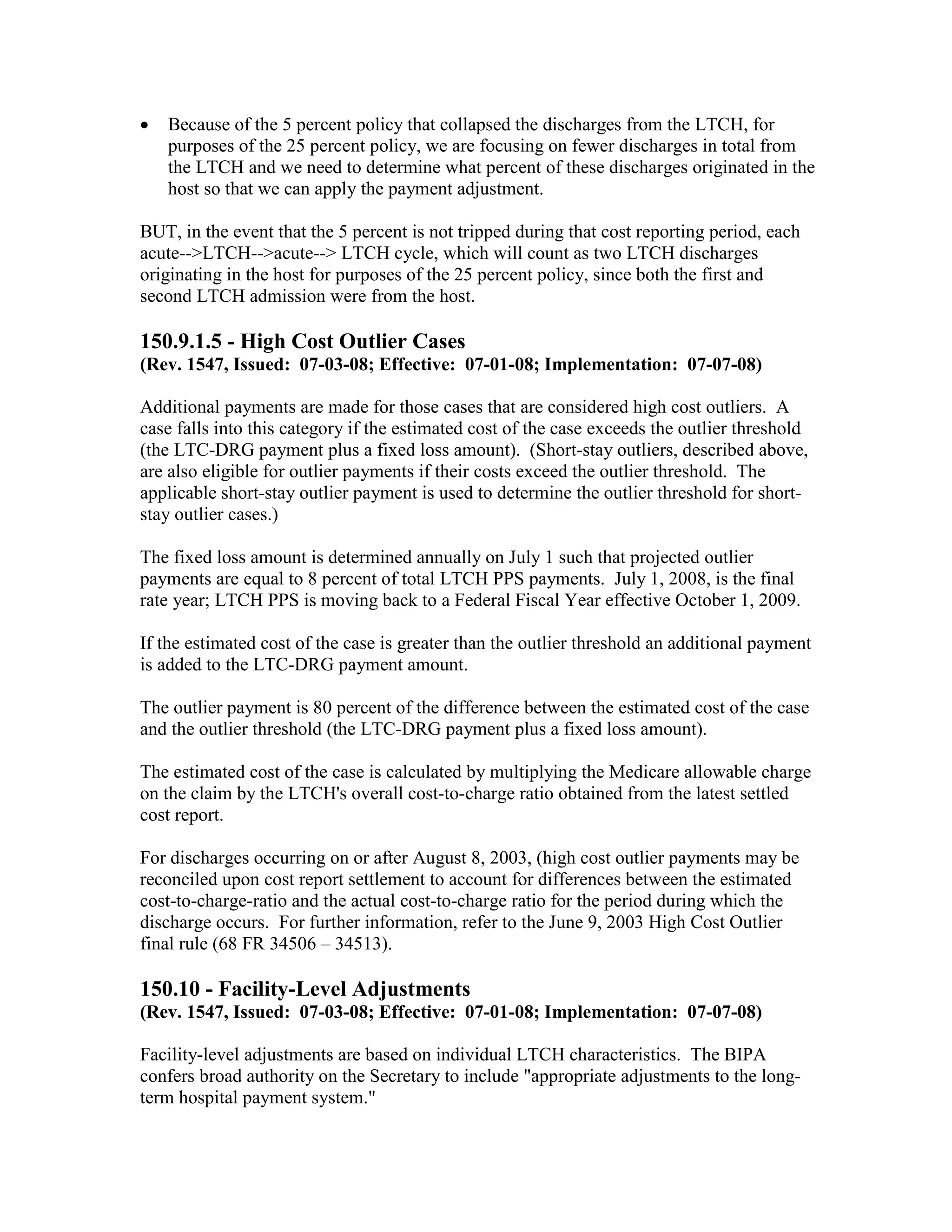

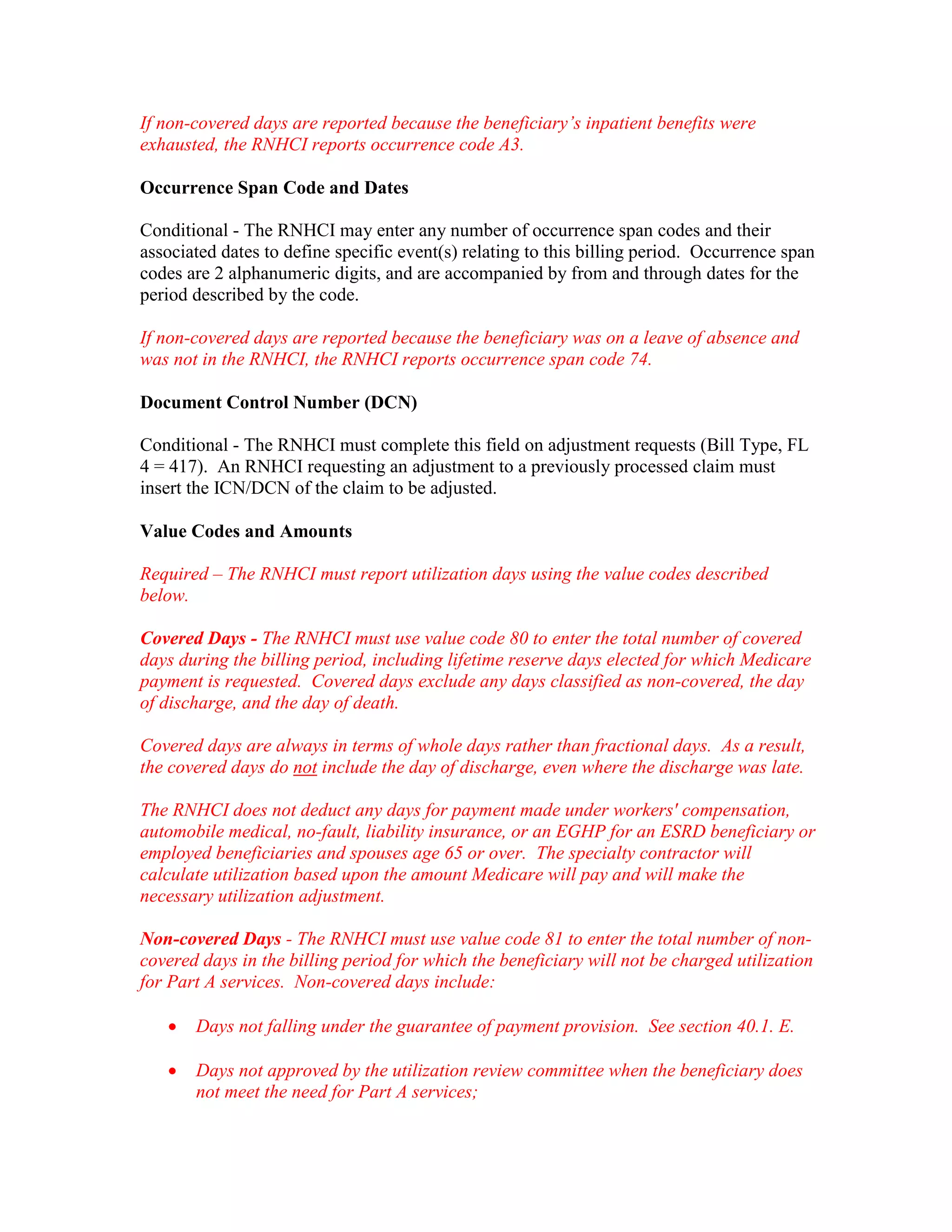

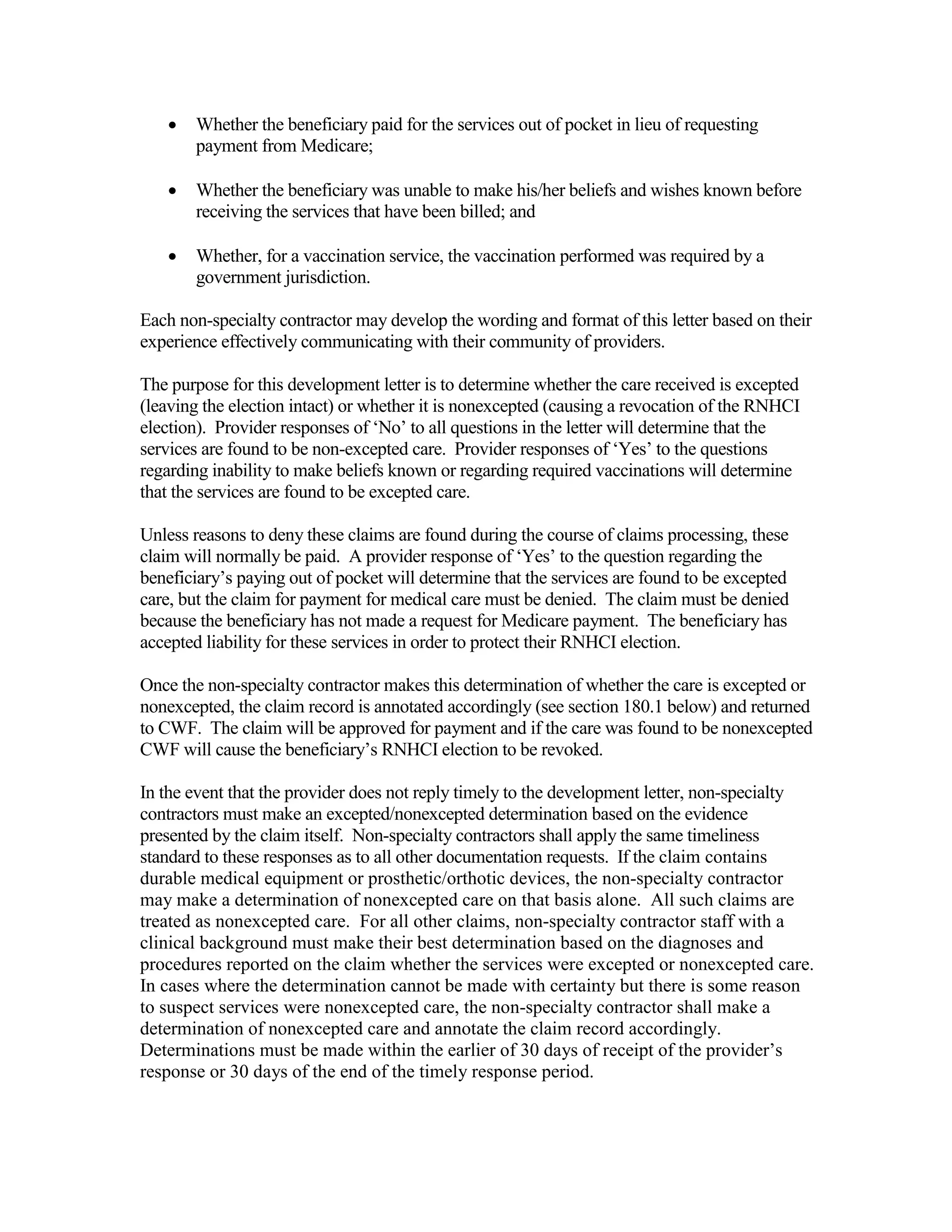

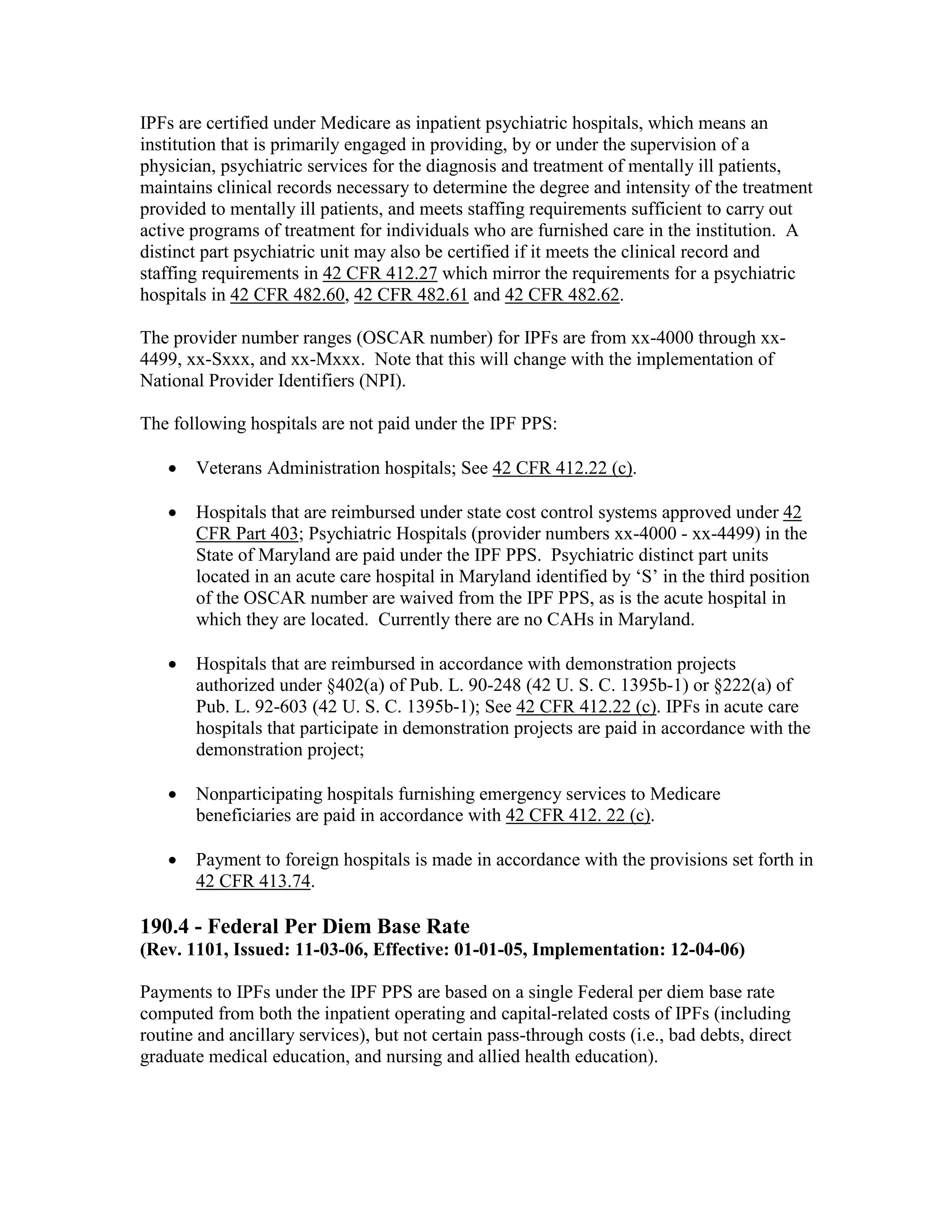

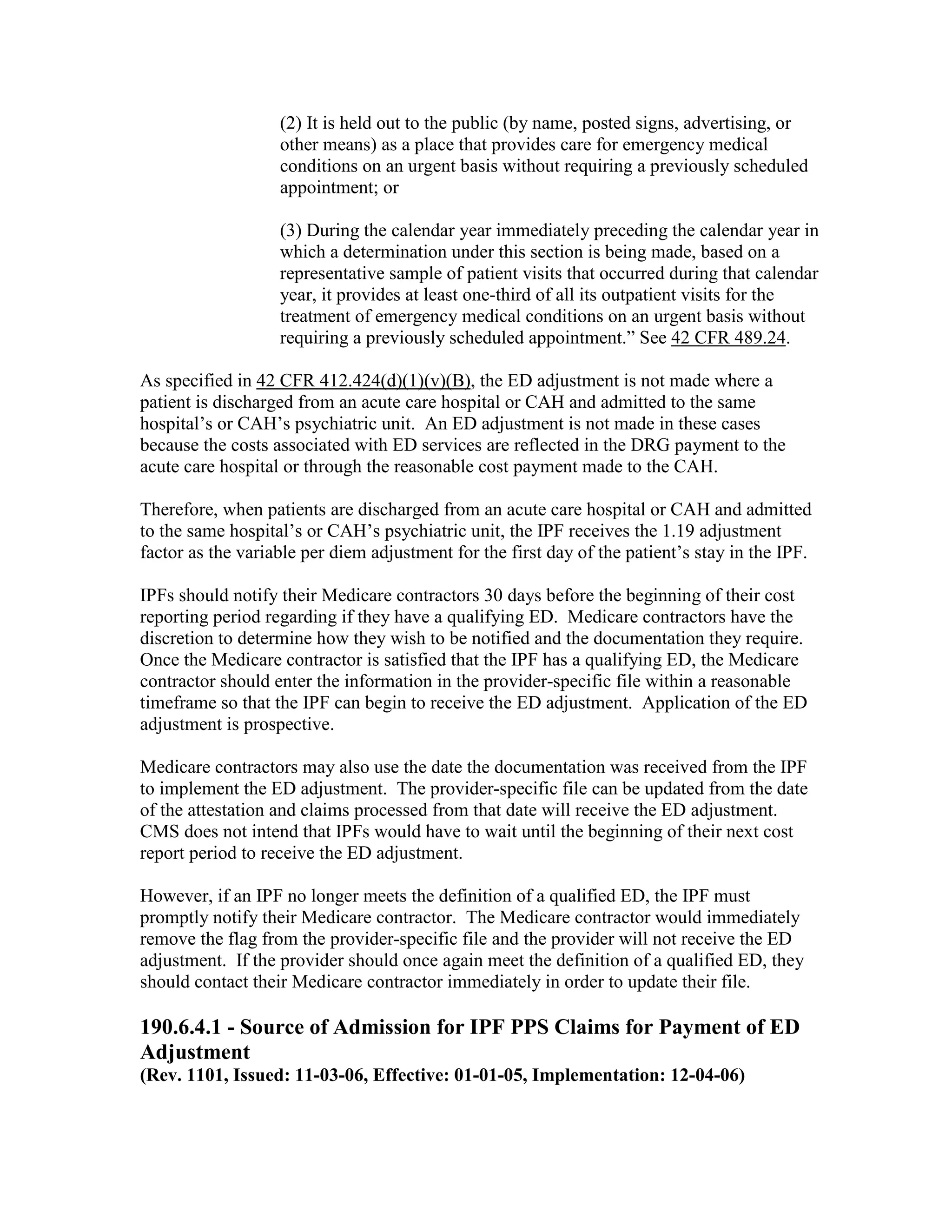

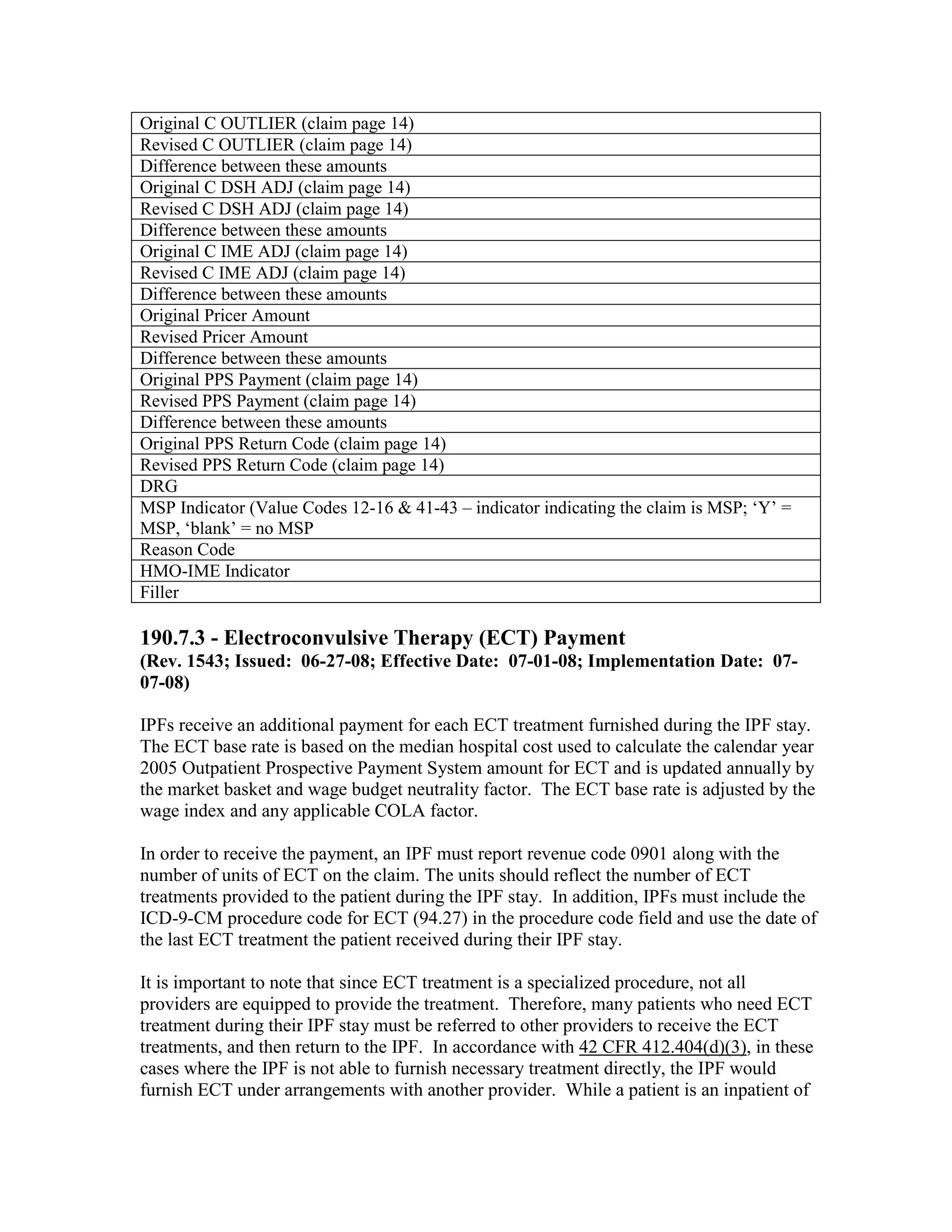

![and/or urine] or in bone marrow infiltration, sustained for at least 1 month), and those in

responsive relapse, and adequate cardiac, renal, pulmonary, and hepatic function.

3. Effective for services performed on or after March 15, 2005, when recognized clinical

risk factors are employed to select patients for transplantation, high-dose melphalan

(HDM), together with AuSCT, in treating Medicare beneficiaries of any age group with

primary amyloid light-chain (AL) amyloidosis who meet the following criteria:

1.

Amyloid deposition in 2 or fewer organs; and,

2.

Cardiac left ventricular ejection fraction (EF) of 45% or greater.

C. Noncovered Conditions

Insufficient data exist to establish definite conclusions regarding the efficacy of

autologous stem cell transplantation for the following conditions:

•

Acute leukemia not in remission (ICD-9-CM codes 204.00, 205.00, 206.00,

207.00 and 208.00);

•

Chronic granulocytic leukemia (ICD-9-CM codes 205.10 and 205.11);

•

Solid tumors (other than neuroblastoma) (ICD-9-CM codes 140.0-199.1);

•

Multiple myeloma (ICD-9-CM code 203.00 and 238.6), through September 30,

2000.

•

Tandem transplantation (multiple rounds of autologous stem cell

transplantation) for patients with multiple myeloma (ICD-9-CM code 203.00

and 238.6)

•

Non-primary (AL) amyloidosis (ICD-9-CM code 277.3), effective October 1,

2000; or

•

Primary (AL) amyloidosis (ICD-9-CM code 277.3) for Medicare beneficiaries

age 64 or older, effective October 1, 2000, through March 14, 2005.

NOTE: Coverage for conditions other than these specifically designated as covered or

non-covered is left to the FI's discretion.

90.3.3 - Billing for Stem Cell Transplantation

(Rev. 1882, Issued: 12-21-09; Effective Date: 01-01-10; Implementation Date: 0104-10)

A.

Billing for Allogeneic Stem Cell Transplants](https://image.slidesharecdn.com/medicareclaimsprocessingmanual-131226001413-phpapp01/75/Medicare-claims-processing-manual-160-2048.jpg)

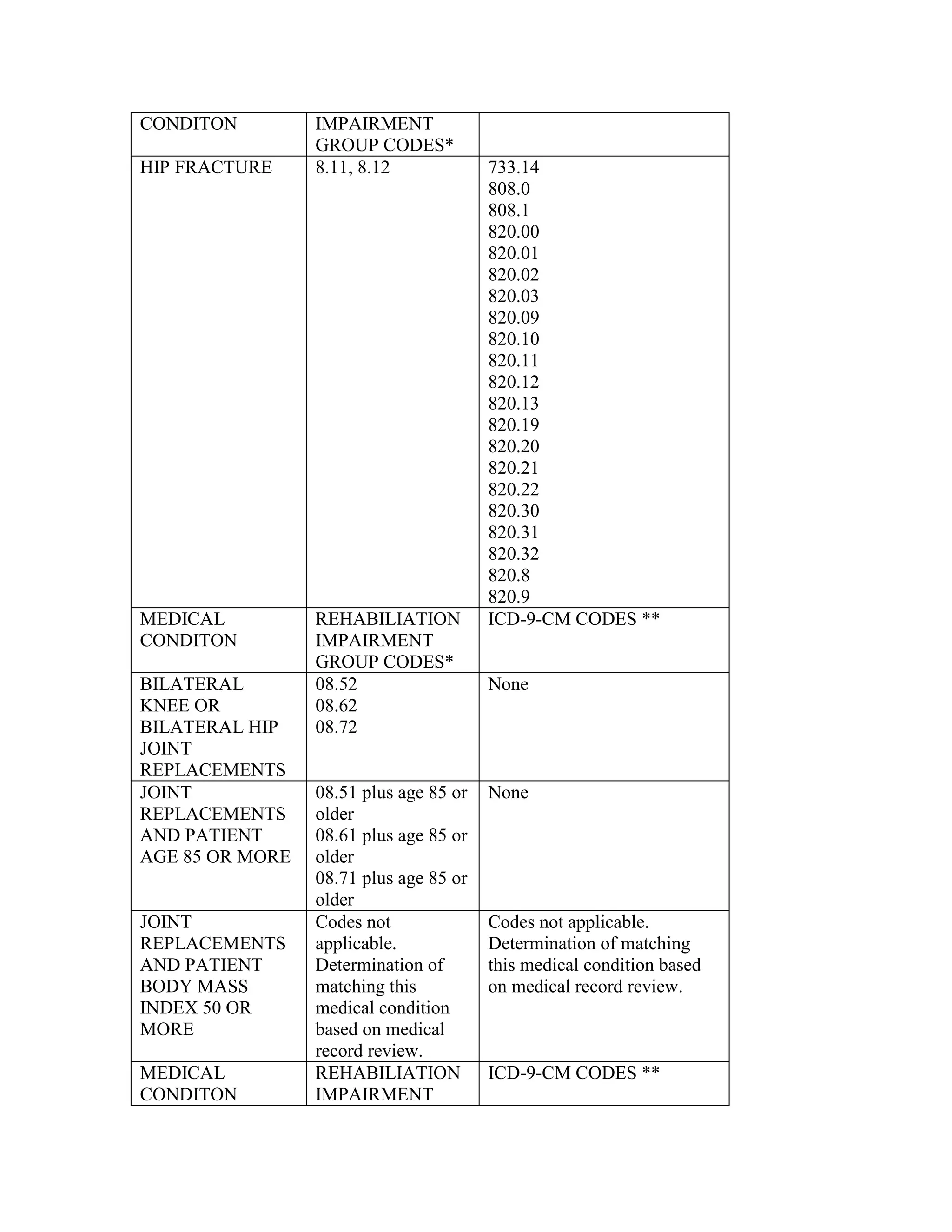

![transplant approval date, the contractor must suspend the claim for clerical review of the

operative report to determine whether the beneficiary has at least one of the covered

conditions listed when the diagnosis code is for a covered condition.

This review is not part of the contractor's medical review workload. Instead, the contractor

should complete this review as part of its claims processing workload.

Charges for ICD-9-CM procedure code 46.97 should be billed under revenue code 0360,

Operating Room Services.

For discharge dates on or after October 1, 2001, acquisition charges are billed under

revenue code 081X, Organ Acquisition. For discharge dates between April 1, 2001, and

September 30, 2001, hospitals were to report the acquisition charges on the claim, but

there was no interim pass-through payment made for these costs.

Bill the procedure used to obtain the donor's organ on the same claim, using appropriate

ICD-9-CM procedure codes.

The 11X bill type should be used when billing for intestinal transplants.

Immunosuppressive therapy for intestinal transplantation is covered and should be billed

consistent with other organ transplants under the current rules.

There is no specific ICD-9-CM diagnosis code for intestinal failure. Diagnosis codes exist

to capture the causes of intestinal failure. Some examples of intestinal failure include, but

are not limited to:

•

Volvulus 560.2,

•

Volvulus gastroschisis 756.79, other [congenital] anomalies of abdominal wall,

•

Volvulus gastroschisis 569.89, other specified disorders of intestine,

•

Necrotizing enterocolitis 777.5, necrotizing enterocolitis in fetus or newborn,

•

Necrotizing enterocolitis 014.8, other tuberculosis of intestines, peritoneum, and

mesenteric,

•

Necrotizing enterocolitis and splanchnic vascular thrombosis 557.0, acute vascular

insufficiency of intestine,

•

Inflammatory bowel disease 569.9, unspecified disorder of intestine,

•

Radiation enteritis 777.5, necrotizing enterocolitis in fetus or newborn, and

•

Radiation enteritis 558.1.](https://image.slidesharecdn.com/medicareclaimsprocessingmanual-131226001413-phpapp01/75/Medicare-claims-processing-manual-172-2048.jpg)

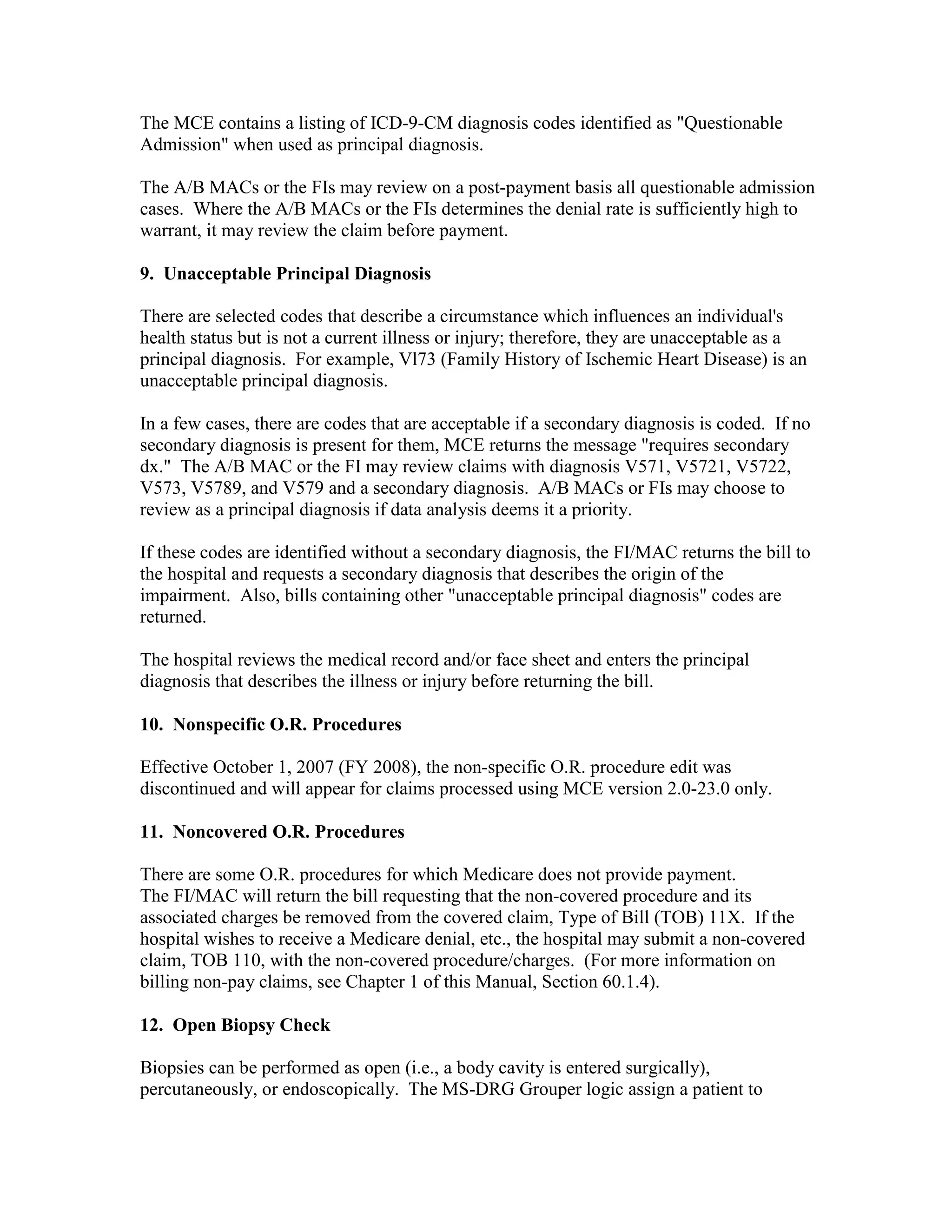

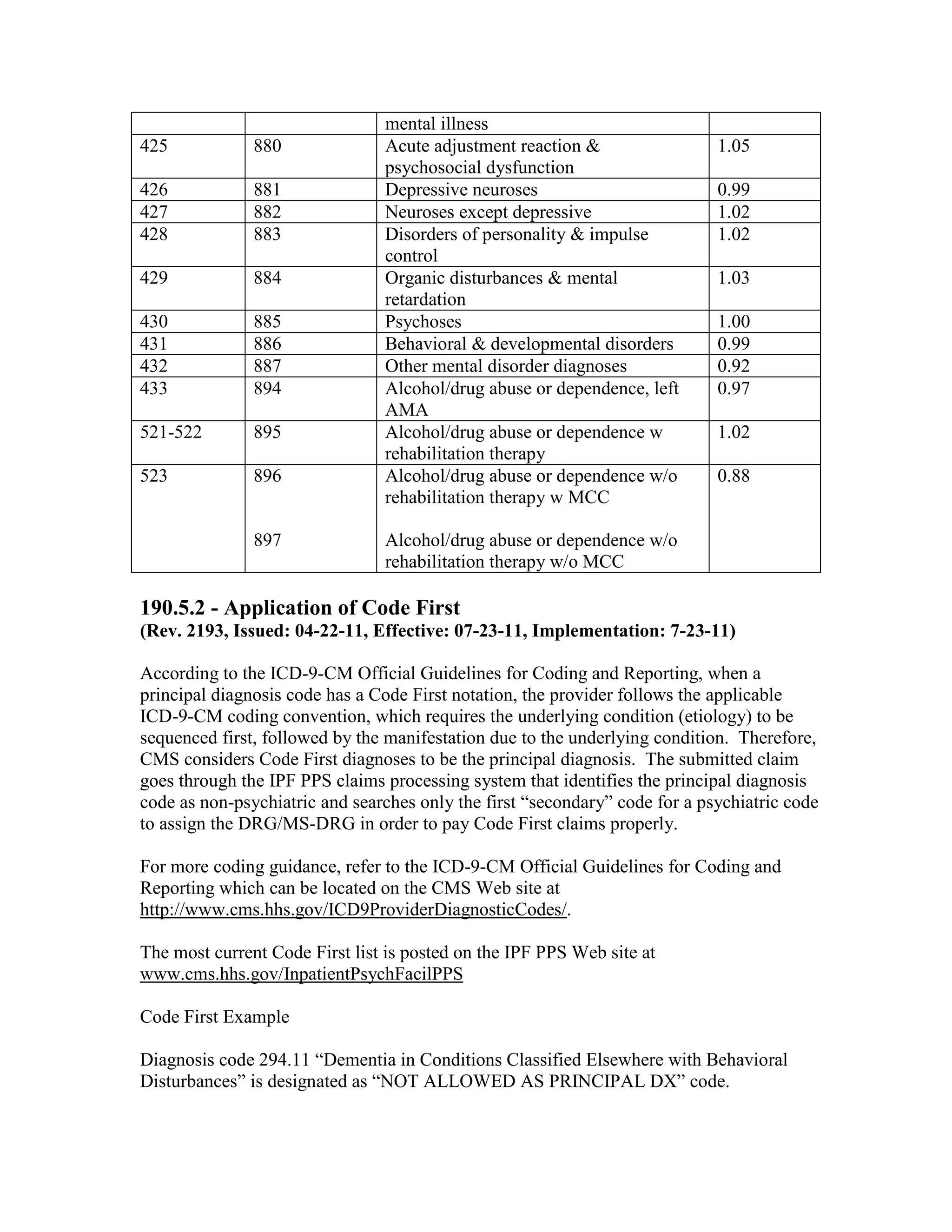

![Four digit code 294.1 “Dementia in Conditions Classified Elsewhere”, is designated as a

Code First diagnosis indicating that all 5 digit diagnosis codes that fall under the 294.1

category (codes 294.10 and 294.11) must follow the Code First rule. The 3 digit code 294

“Persistent Mental Disorders Due to Conditions Classified Elsewhere” appears in the ICD9-CM as follows:

294

PERSISTENT MENTAL DISORDERS DUE TO CONDITIONS CLASSIFIED

ELSEWHERE

294.1 Dementia in Conditions Classified Elsewhere

Code First any underlying physical condition, as:

Dementia in:

Alzheimer’s disease (331.0)

Cerebral lipidosis (330.1)

Dementia with Lewy bodies (331.82)

Dementia with Parkinsonism (331.81)

Epilepsy (345.0 – 345.9)

Frontal dementia (331.19)

Frontotemporal dementia (331.19)

General paresis [syphilis] (094.1)

Hepatolenticular degeneration (275.1)

Huntington’s chorea (333.4)

Jacob-Creutzfeldt disease (046.1)

Multiple sclerosis (340)

Pick's disease of the brain (331.11)

Polyarteritis nodosa (446.0)

Syphilis (094.1)

294.10 Dementia in Conditions Classified Elsewhere Without Behavioral Disturbances

NOT ALLOWED AS PRINCIPAL DX

294.11 Dementia in Conditions Classified Elsewhere With Behavioral Disturbances

NOT ALLOWED AS PRINCIPAL DX

According to Code First requirements, the provider would code the appropriate physical

condition first, for example, 333.4 “Huntington’s Chorea” as the principal diagnosis code](https://image.slidesharecdn.com/medicareclaimsprocessingmanual-131226001413-phpapp01/75/Medicare-claims-processing-manual-353-2048.jpg)

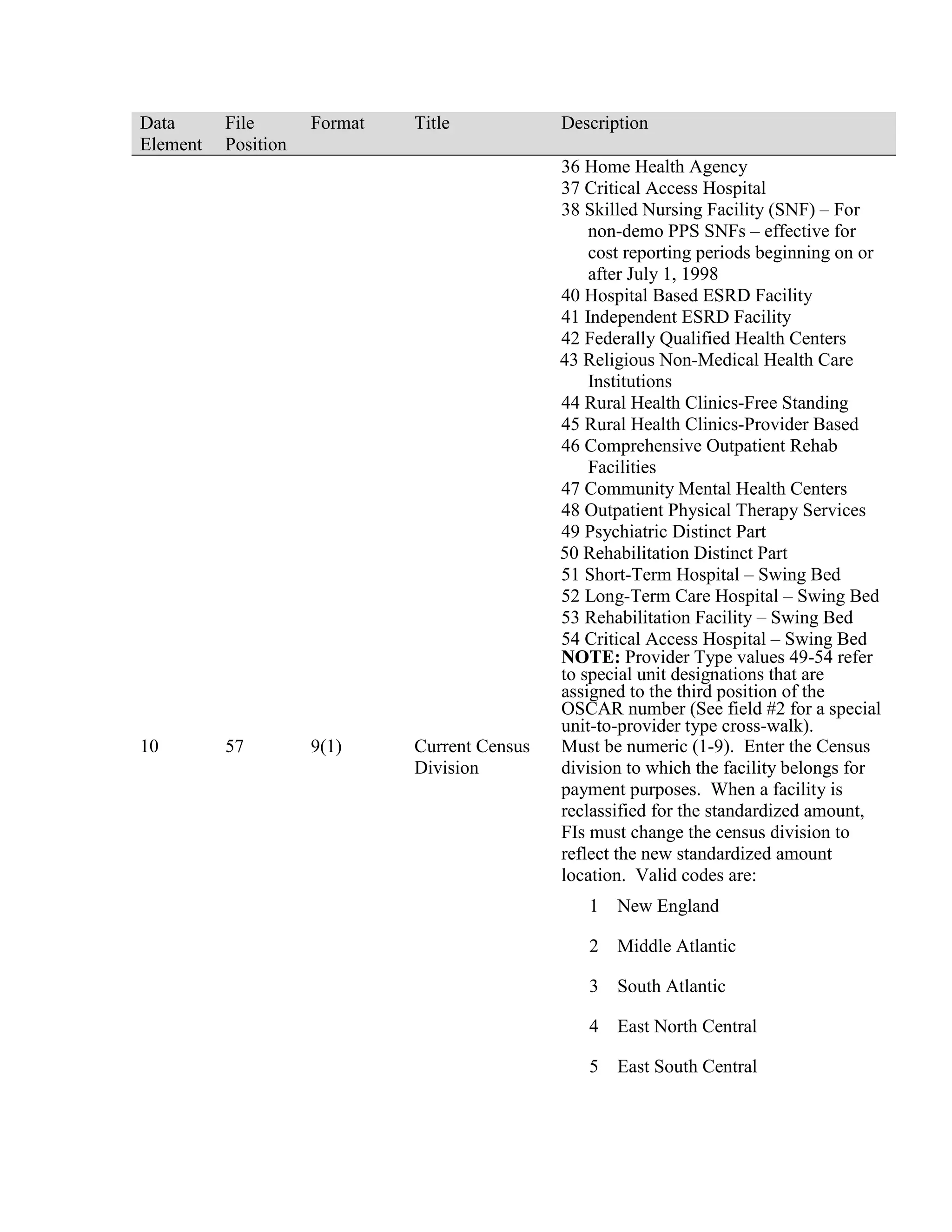

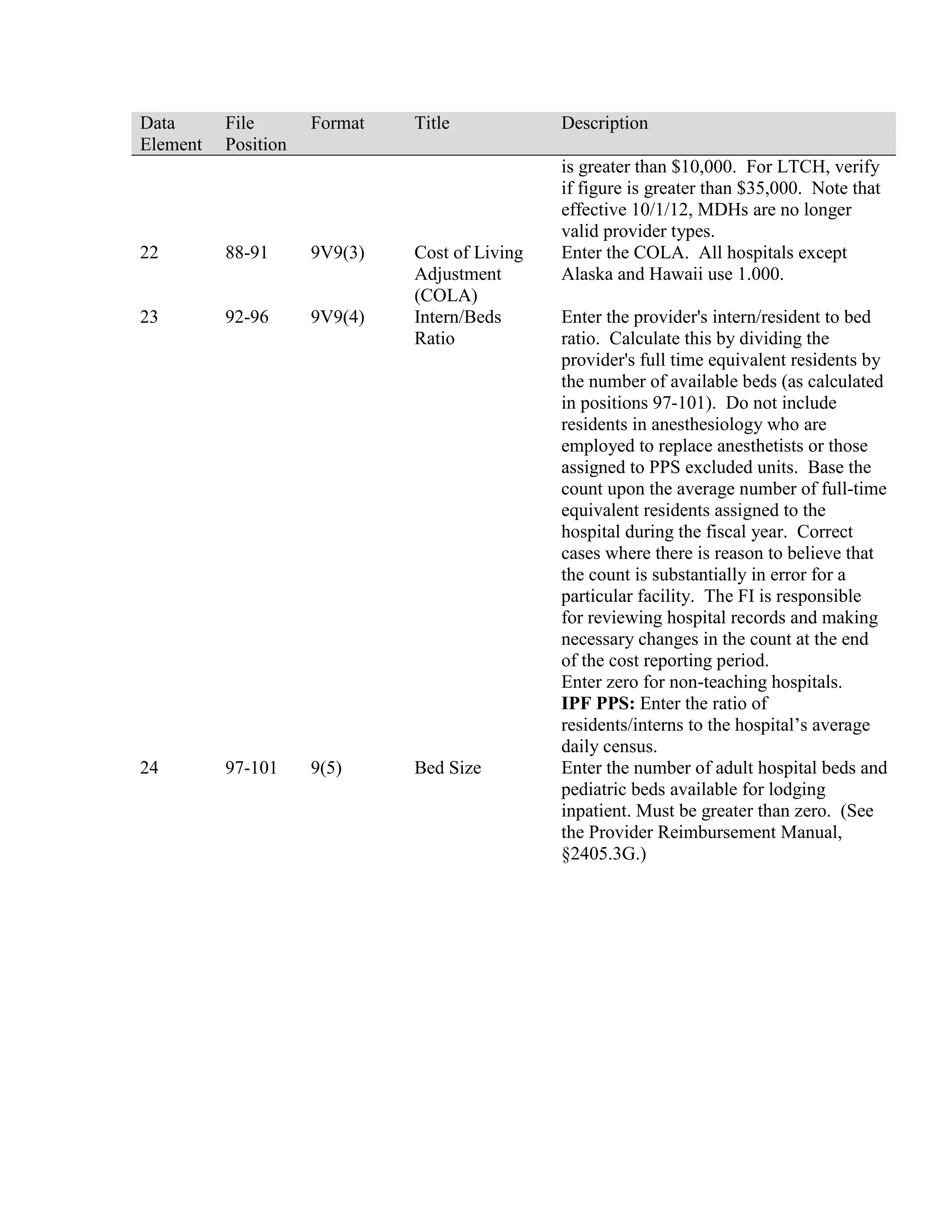

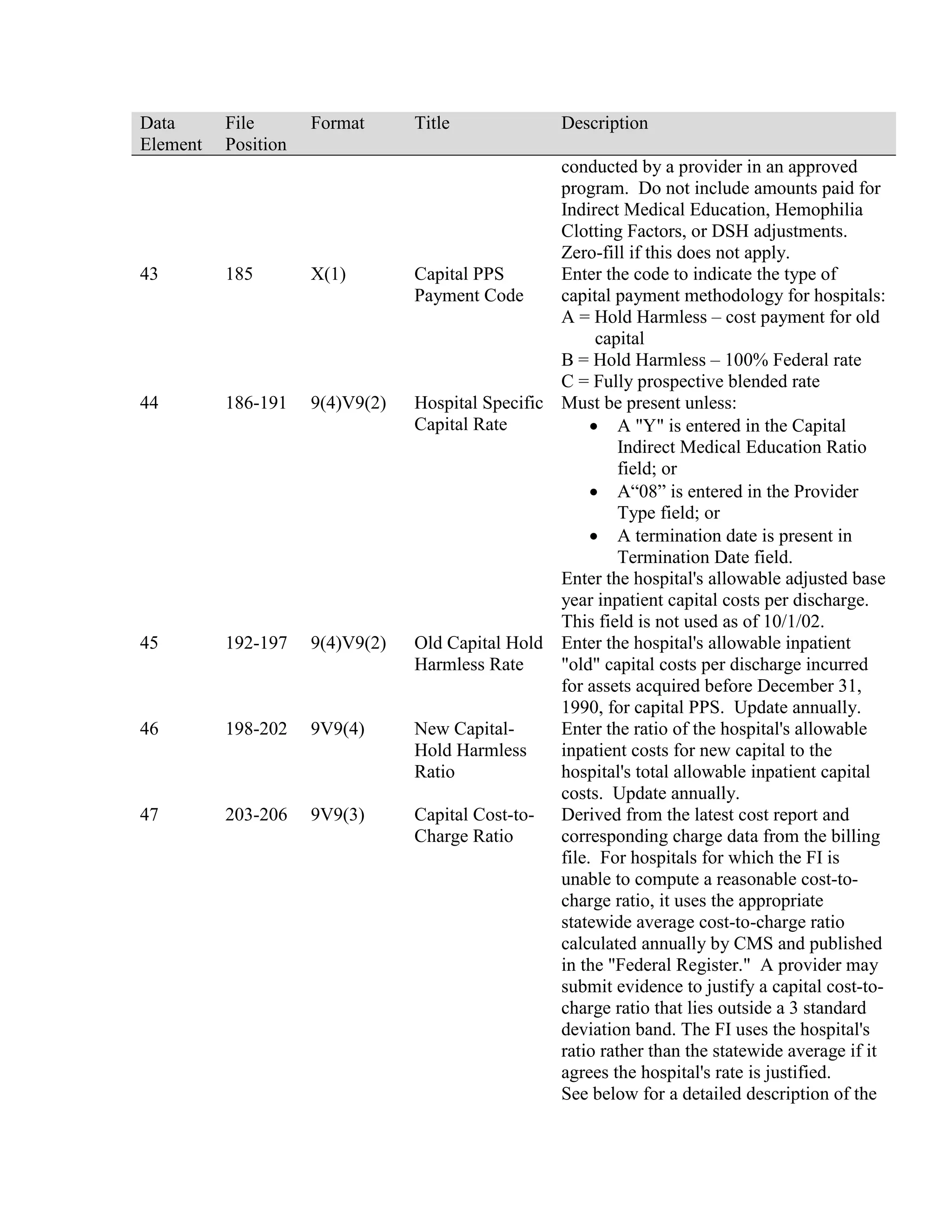

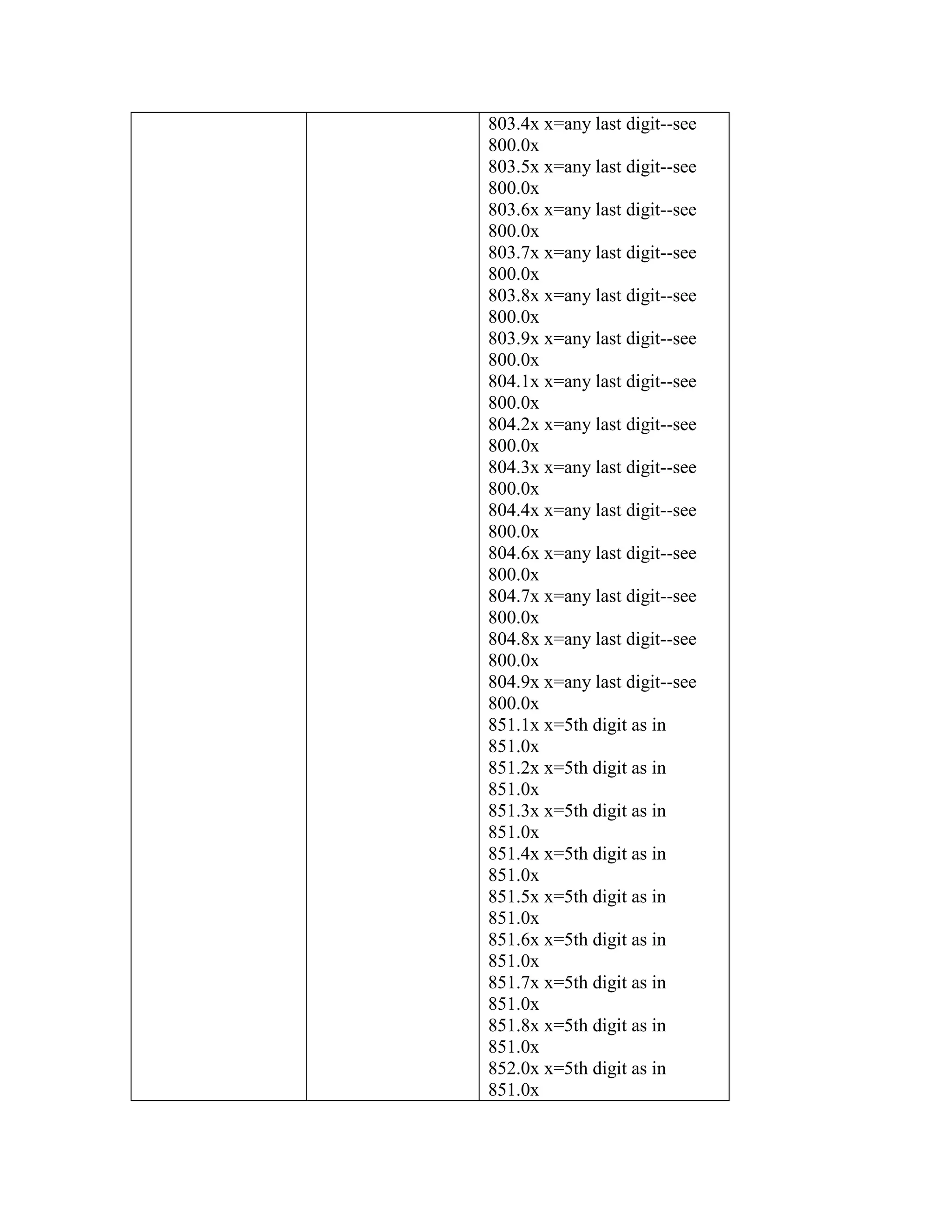

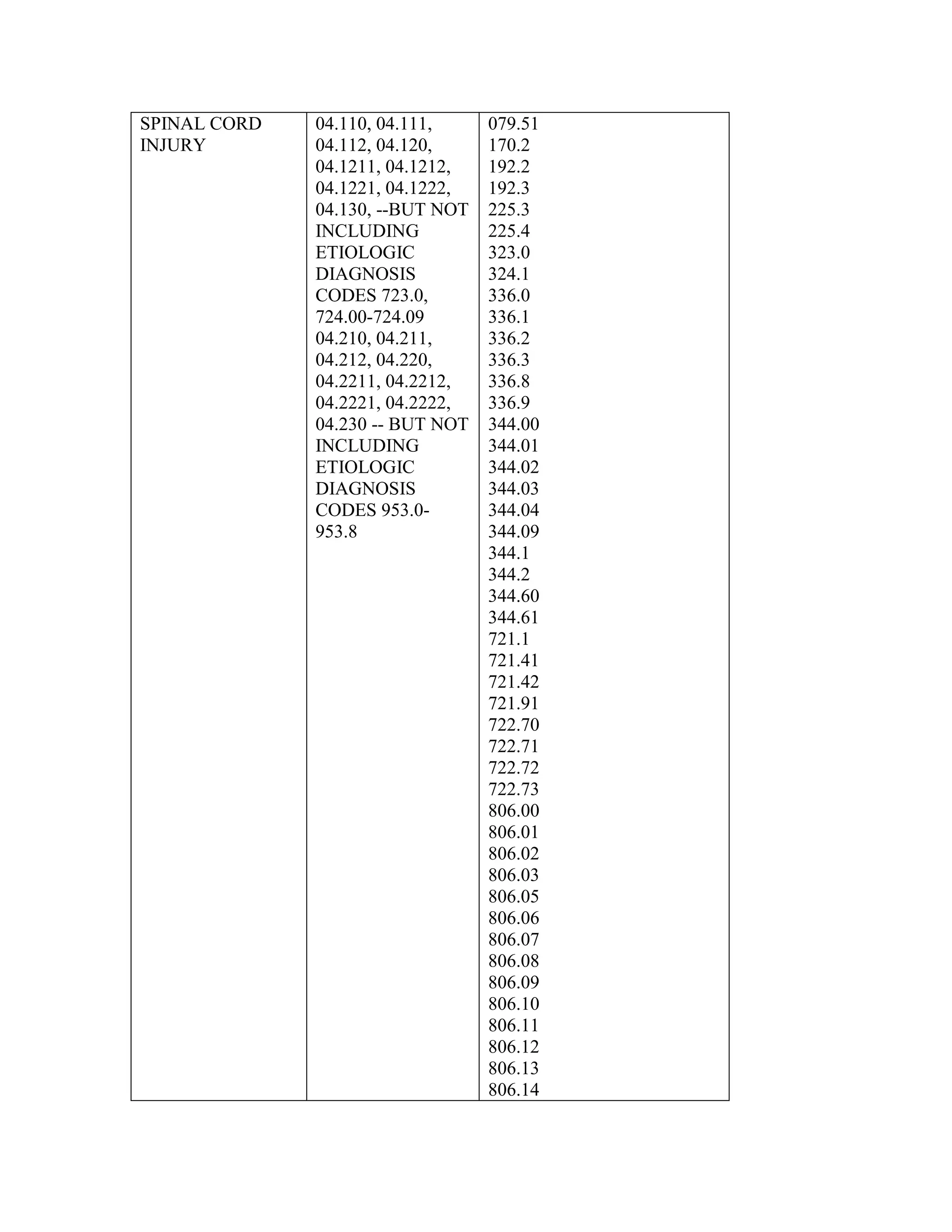

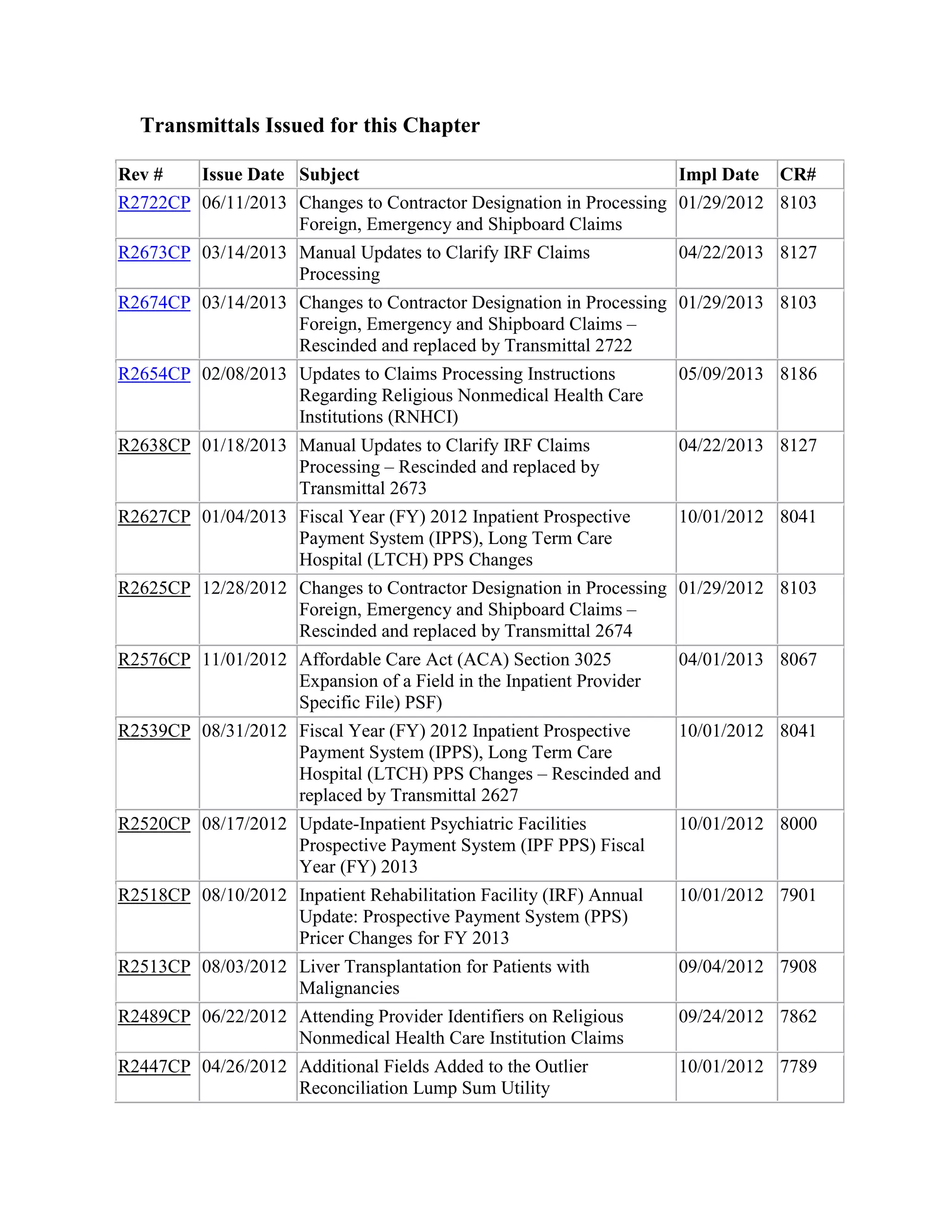

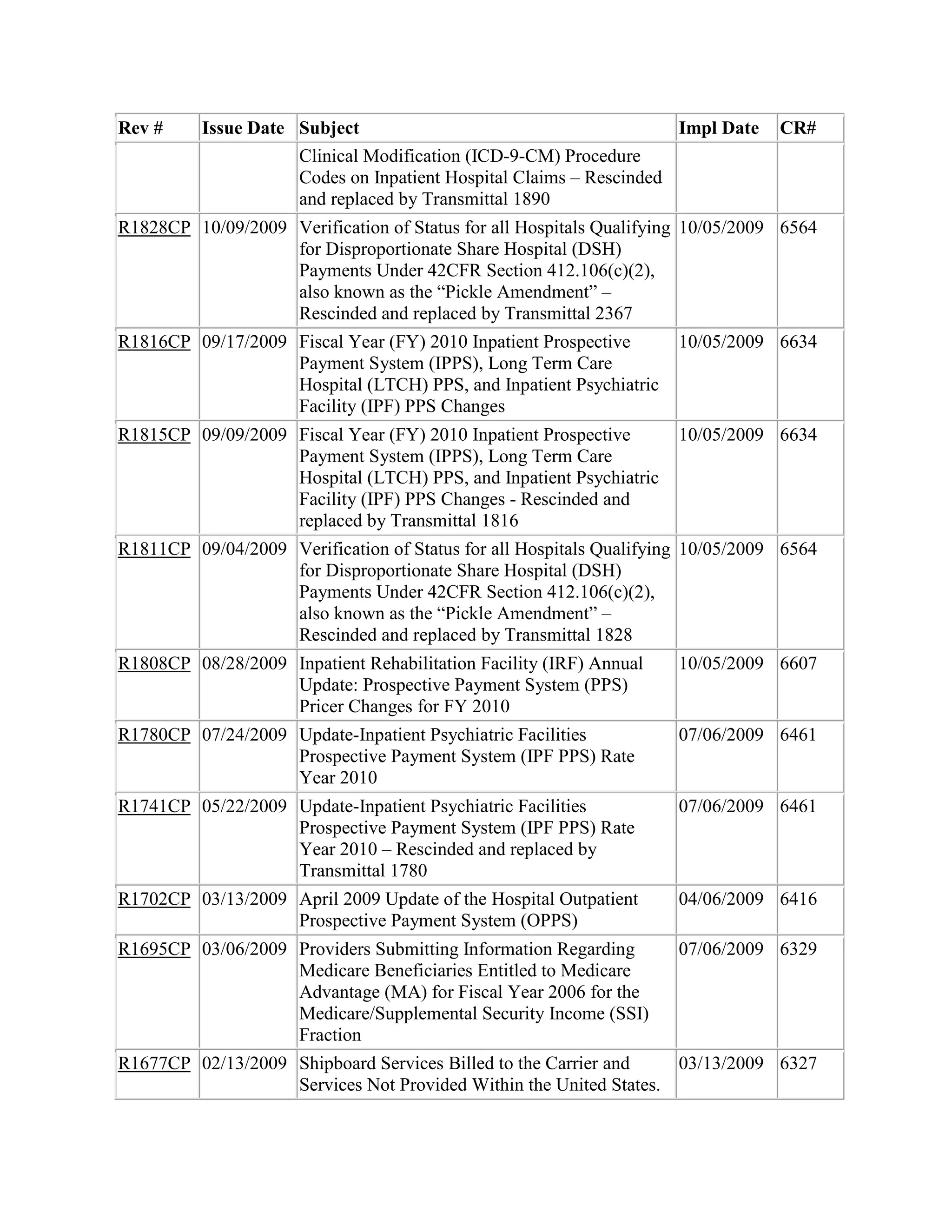

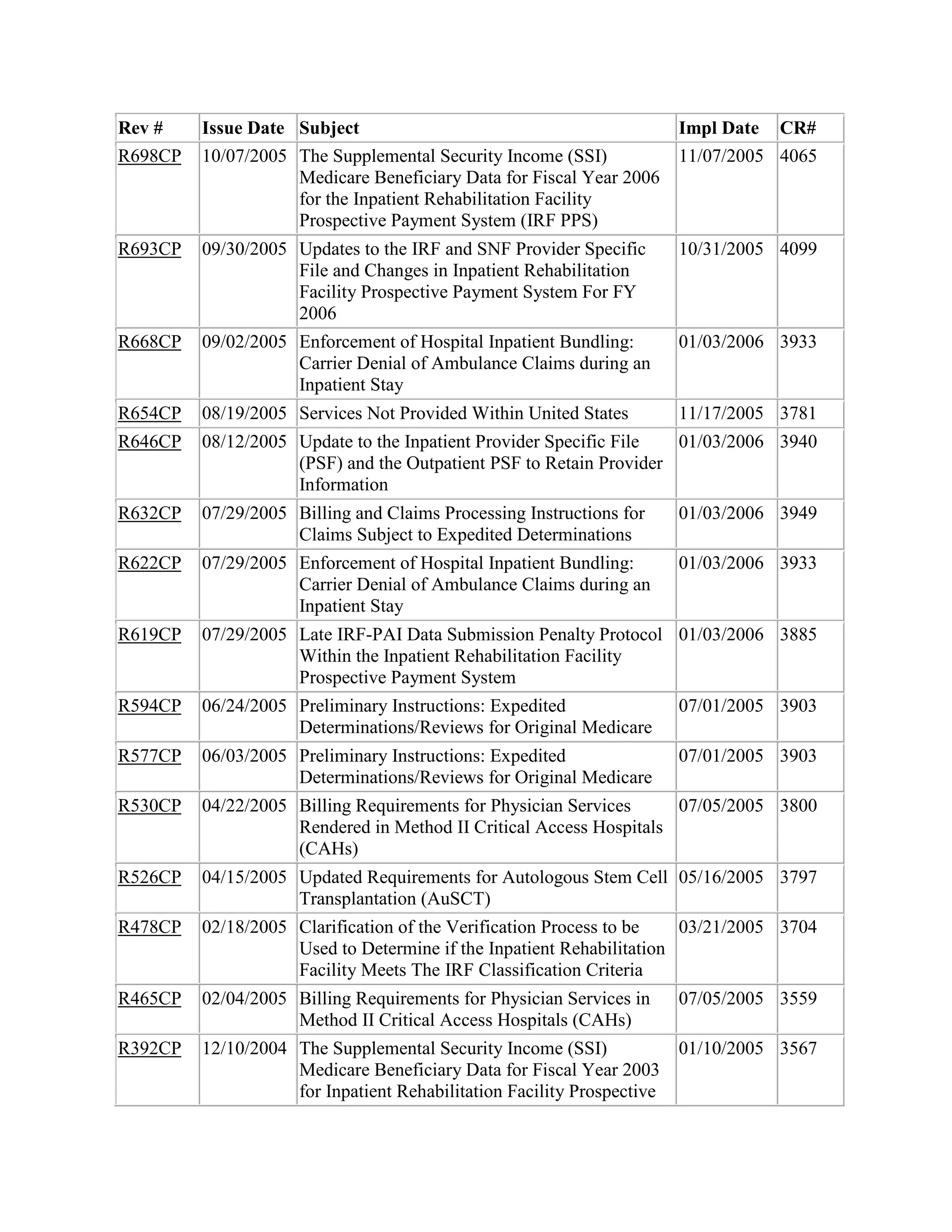

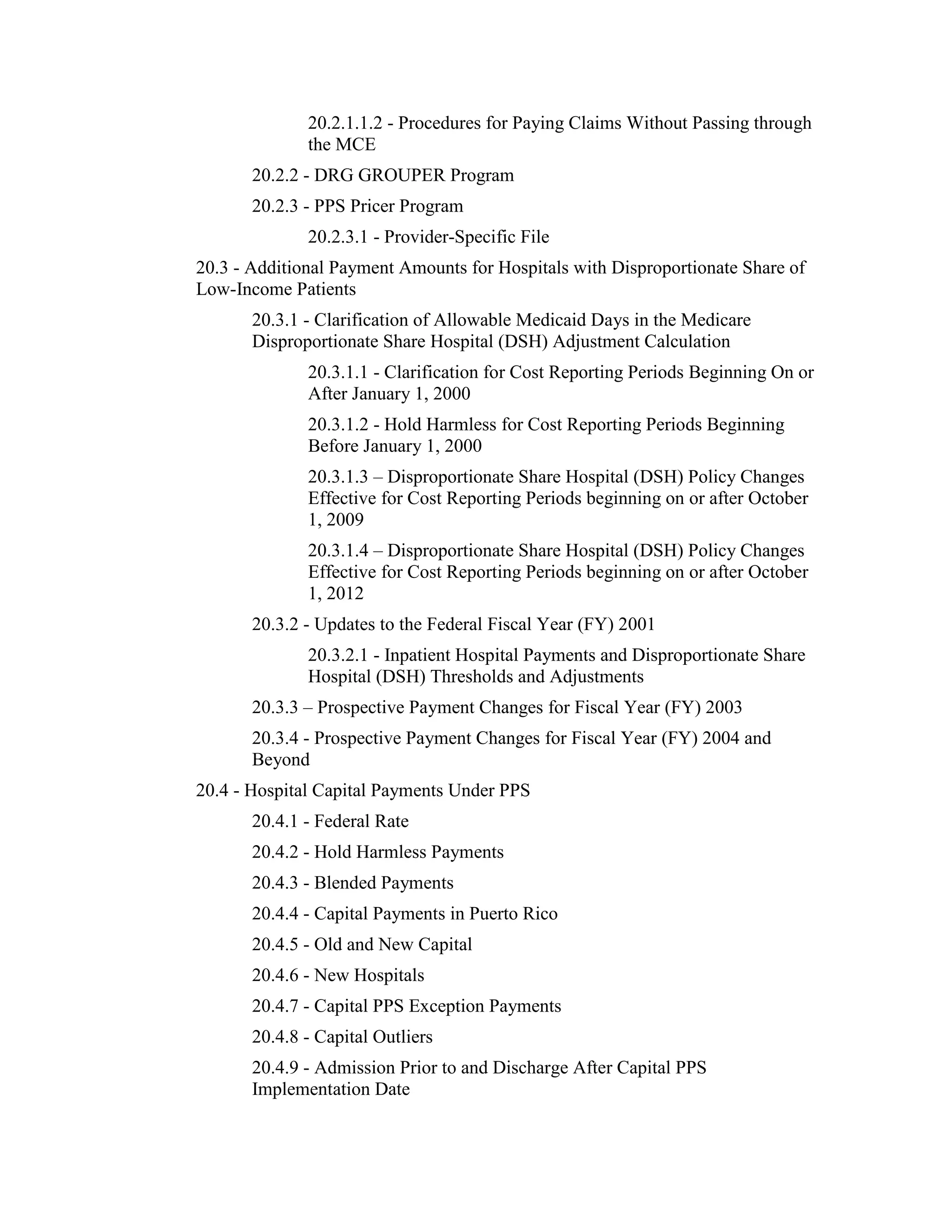

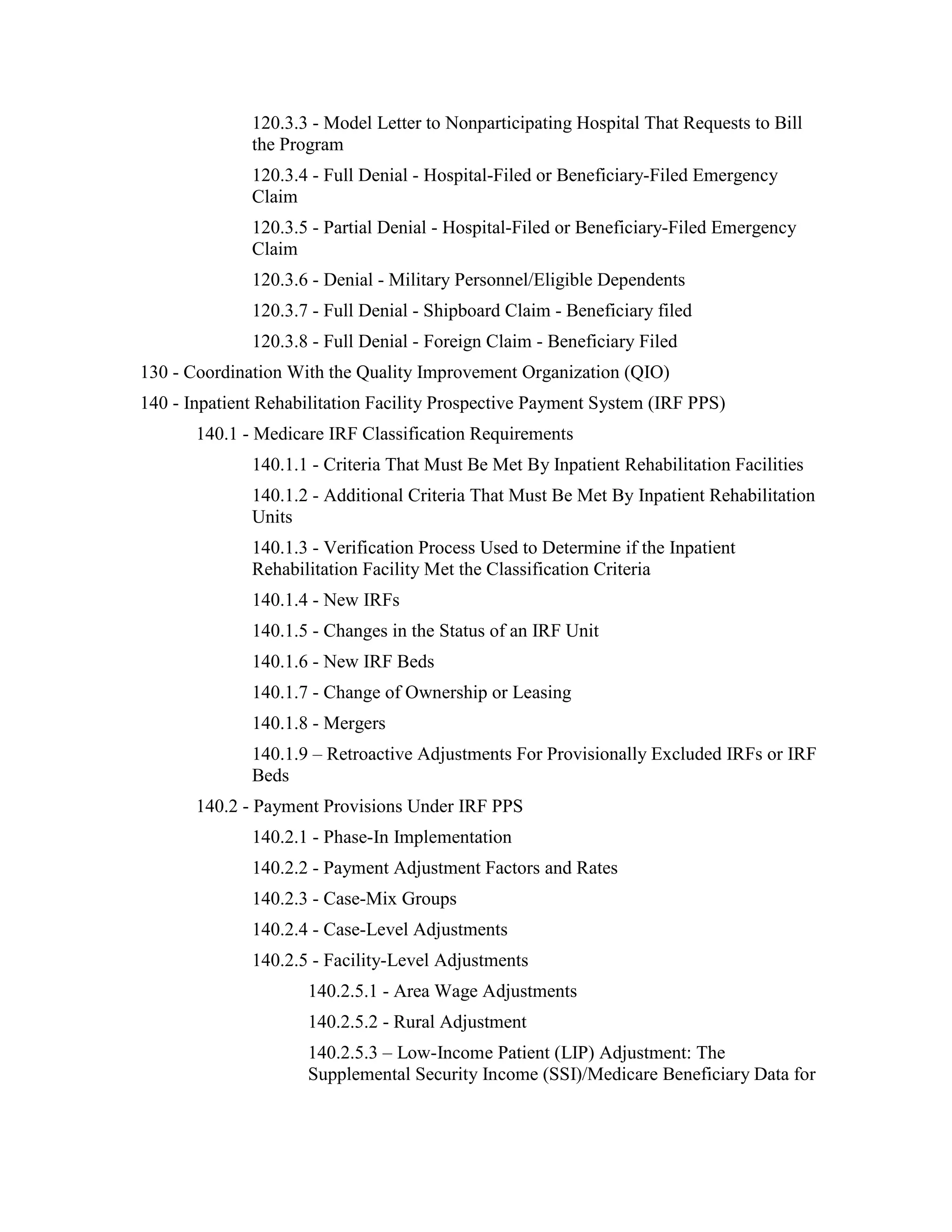

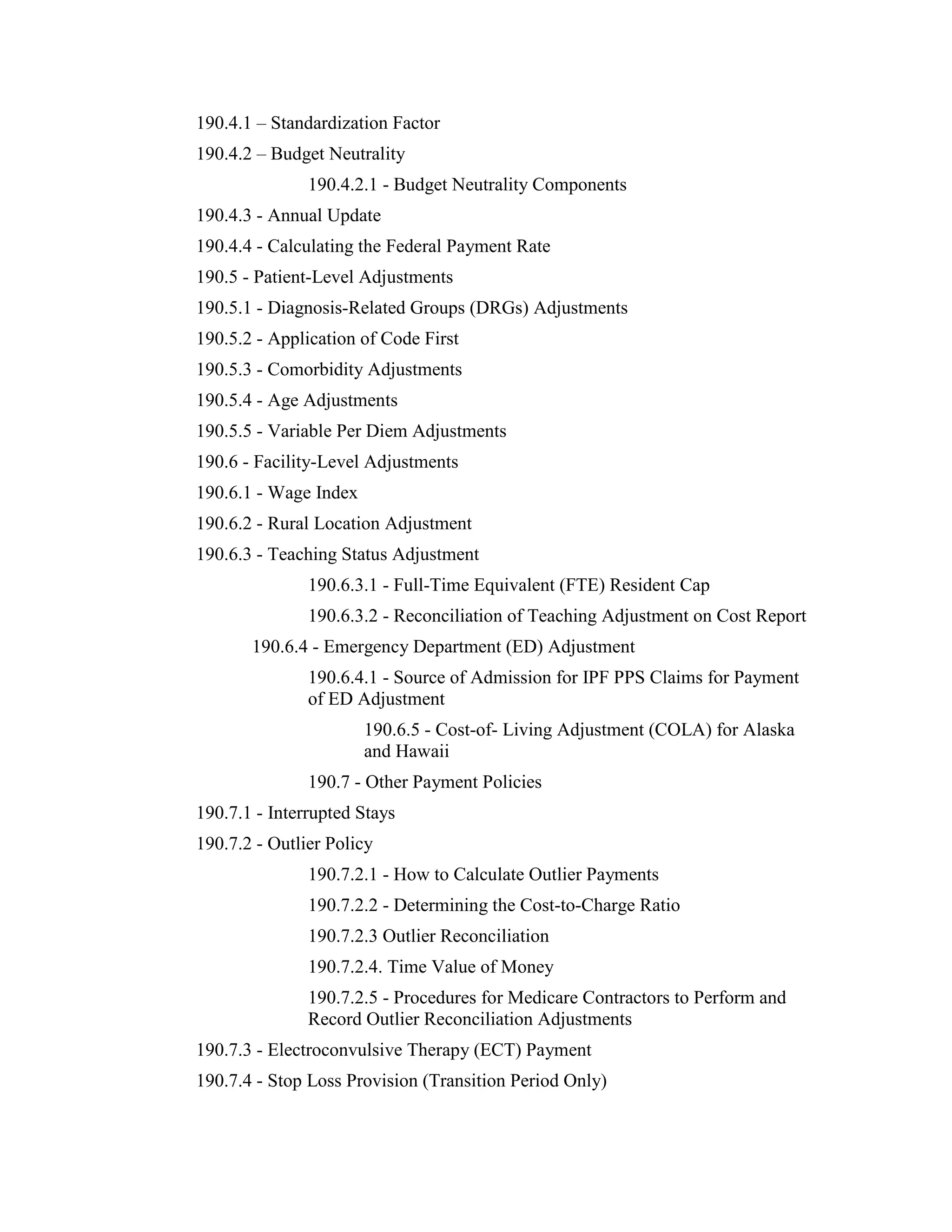

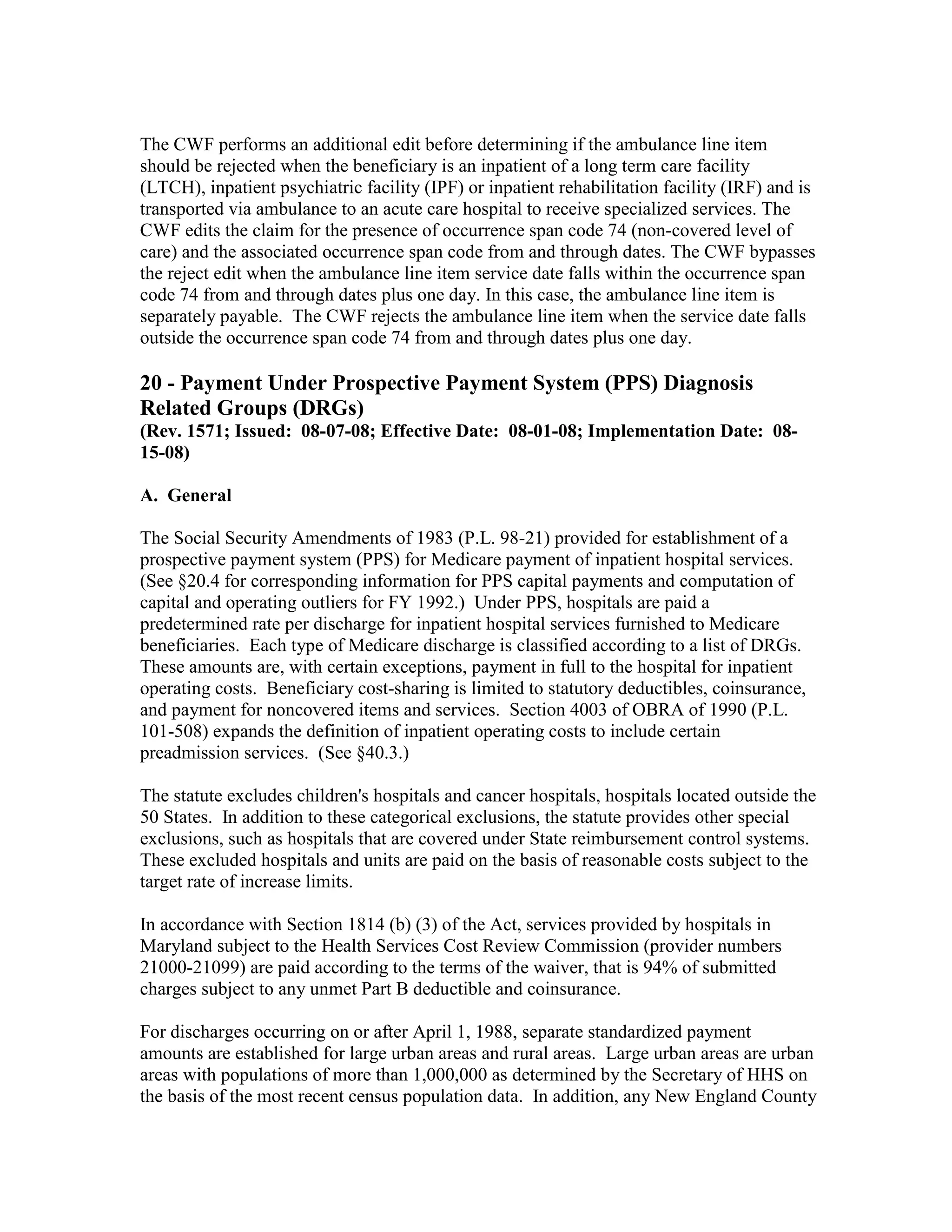

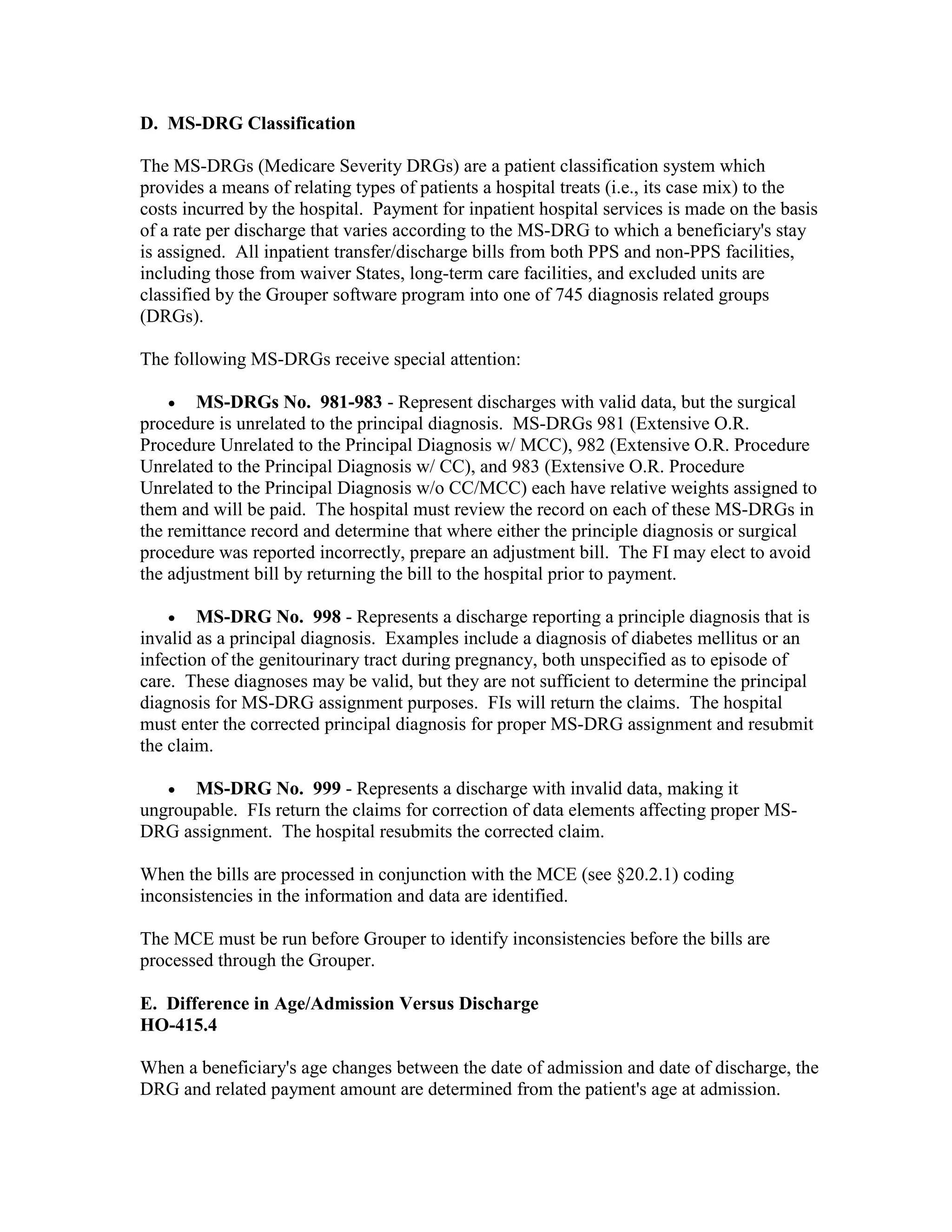

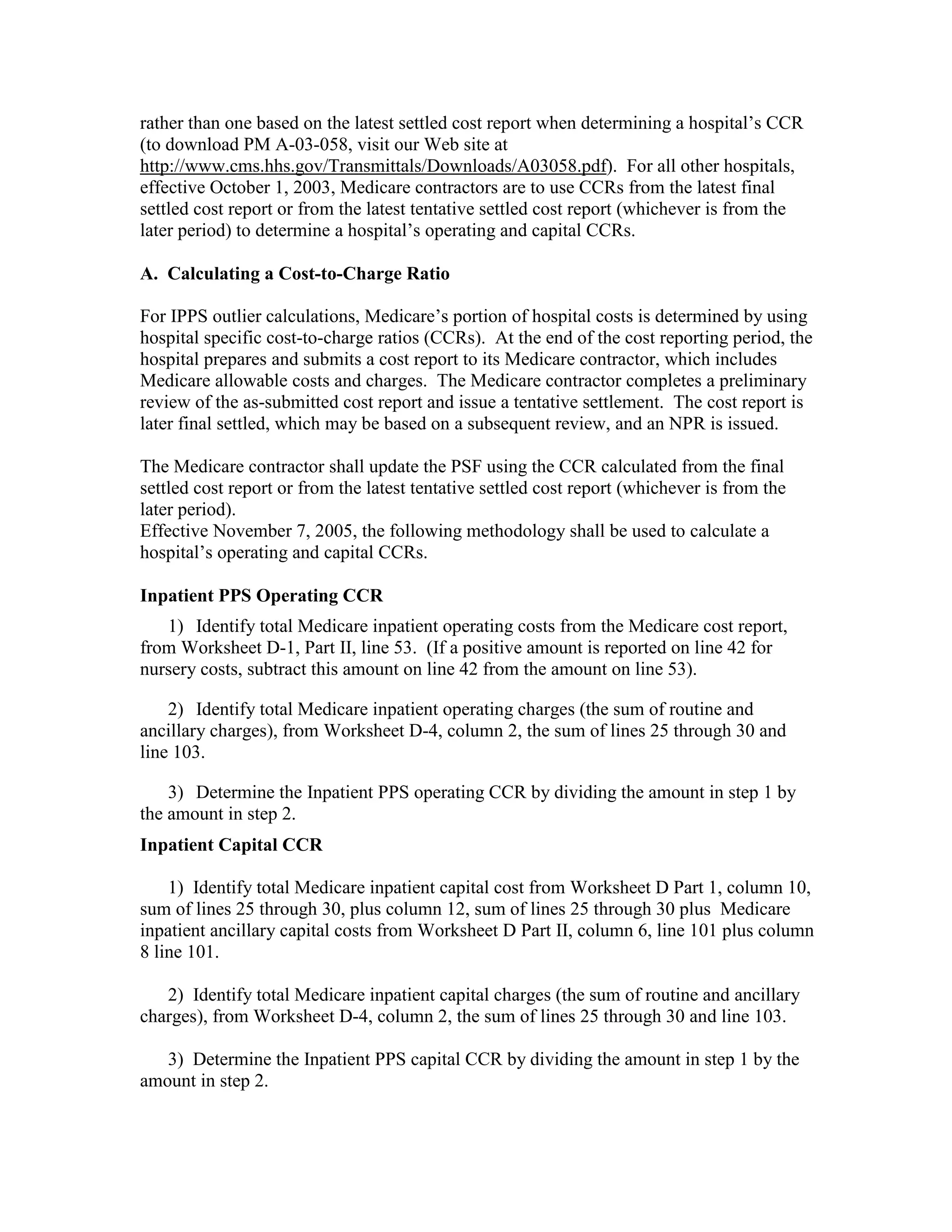

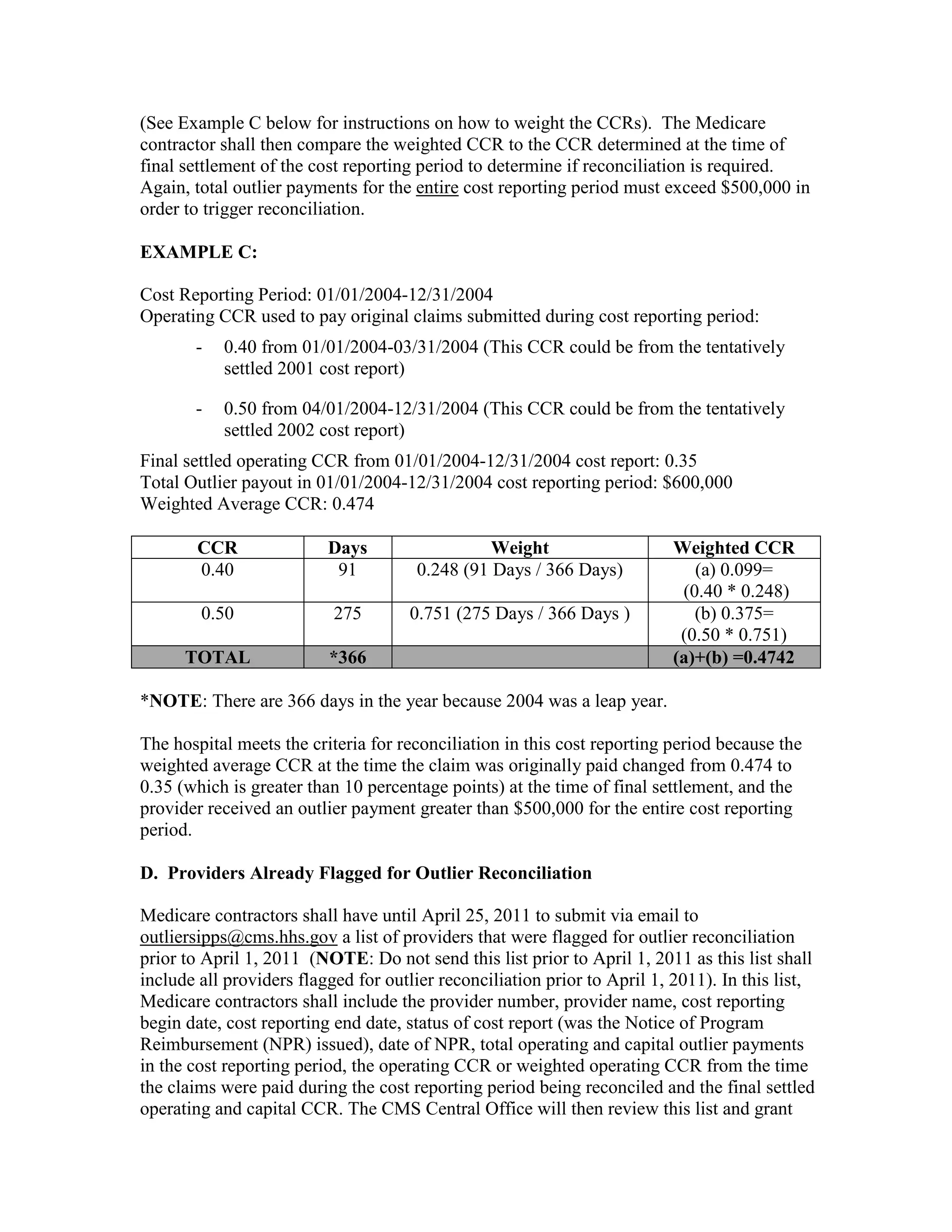

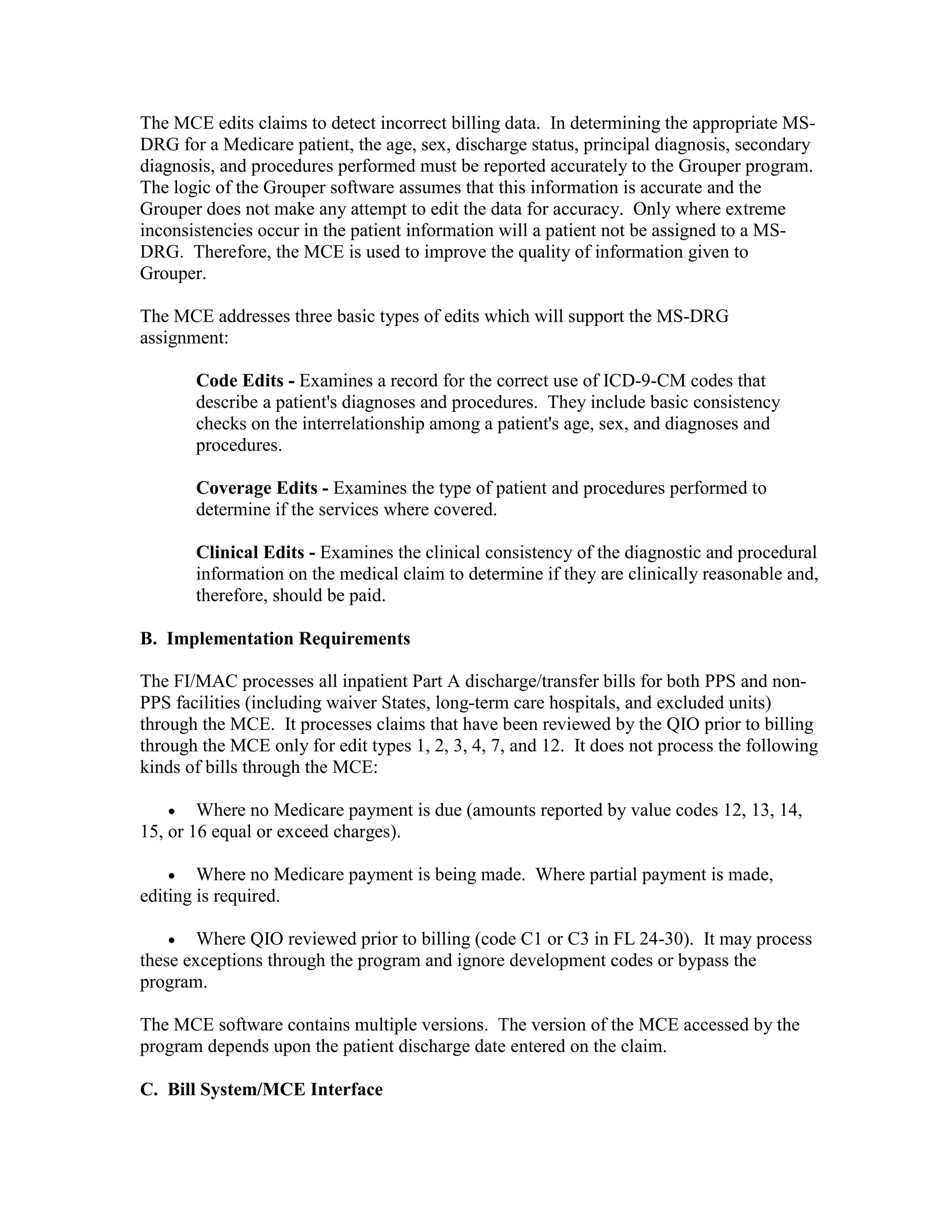

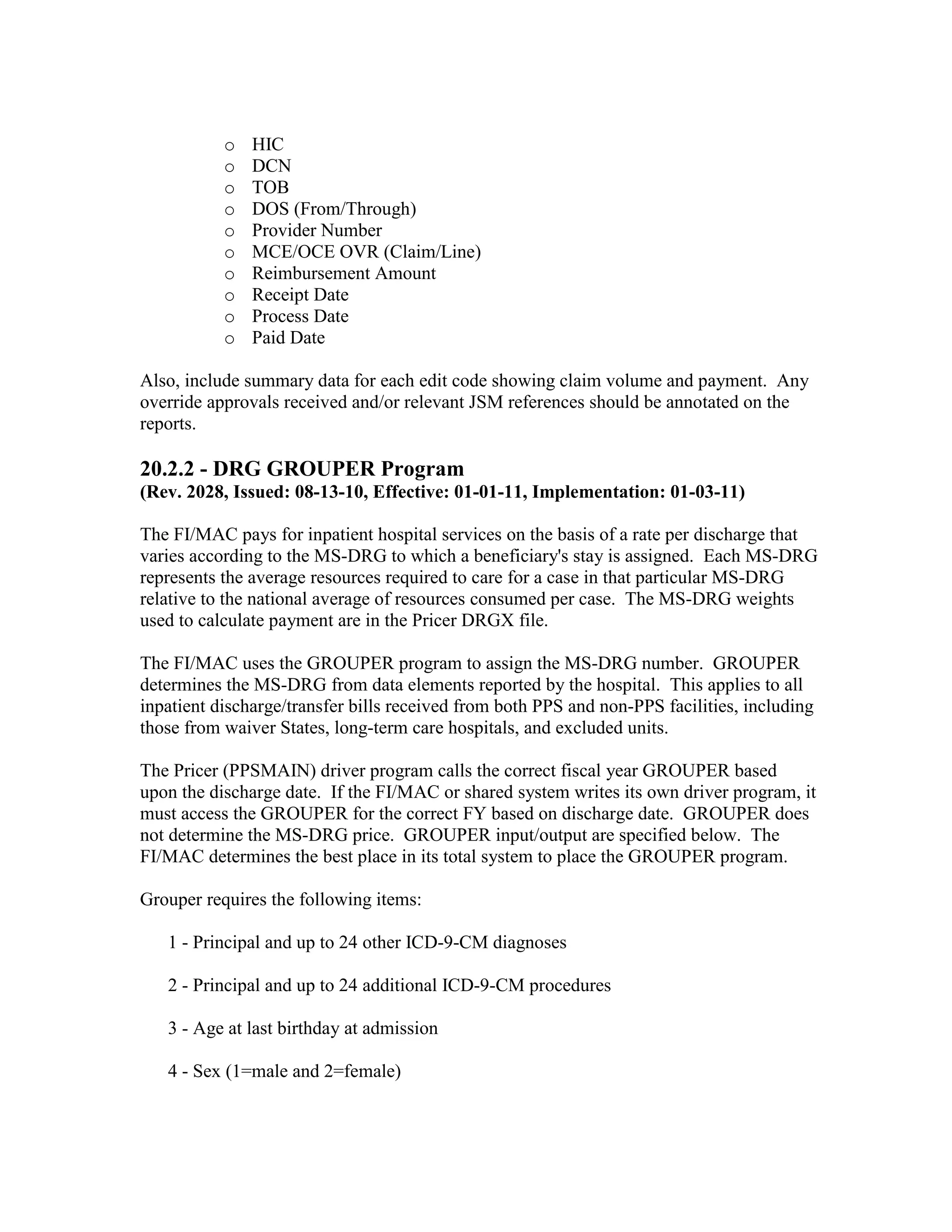

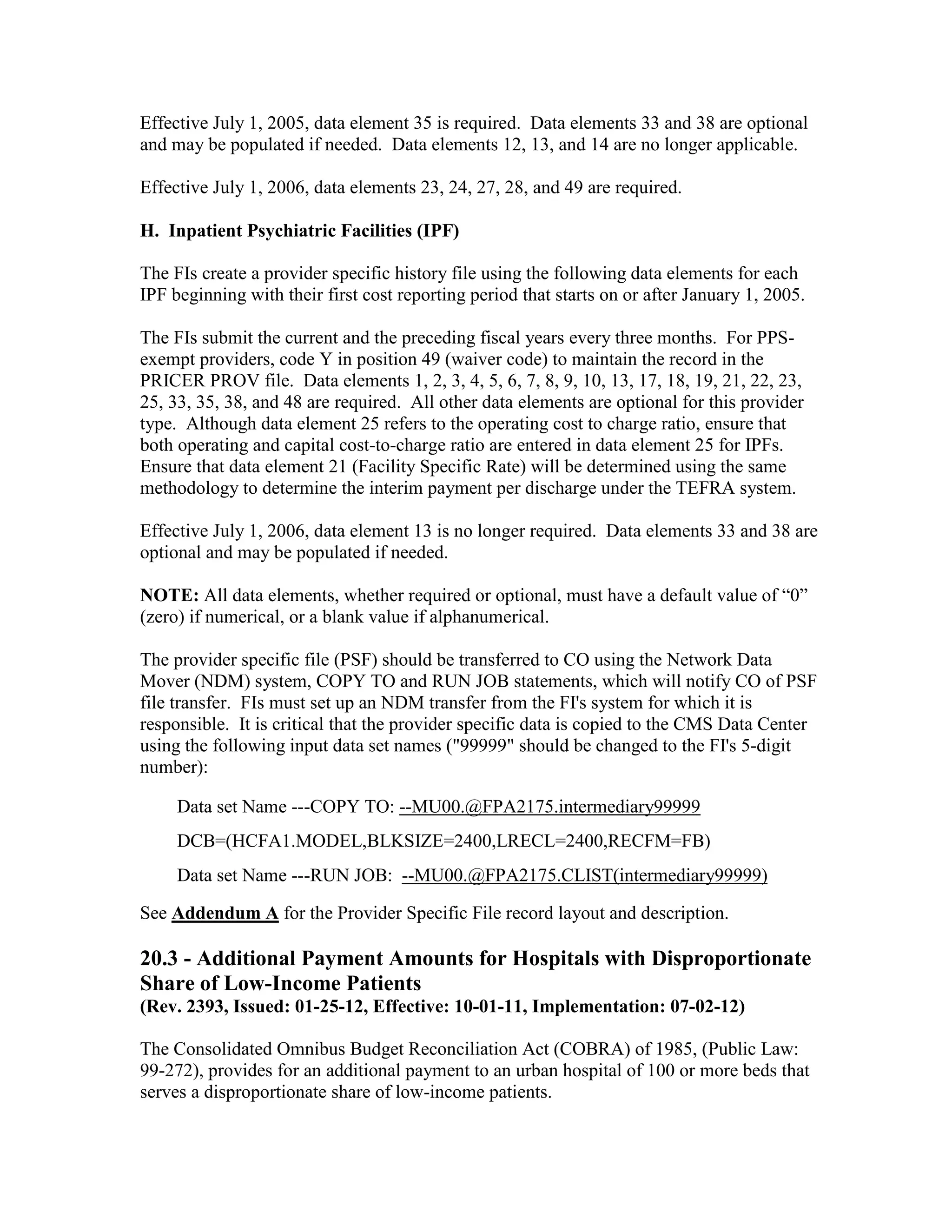

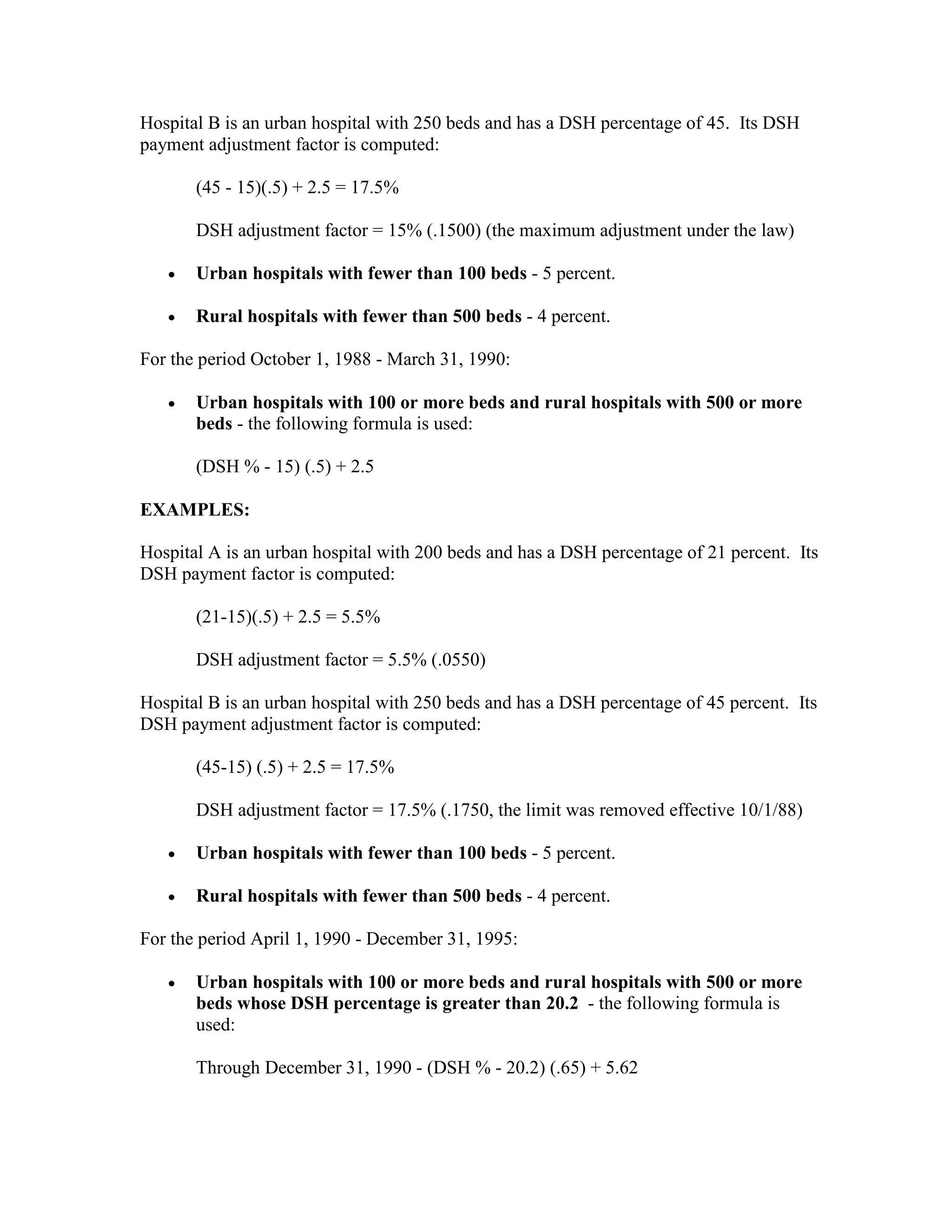

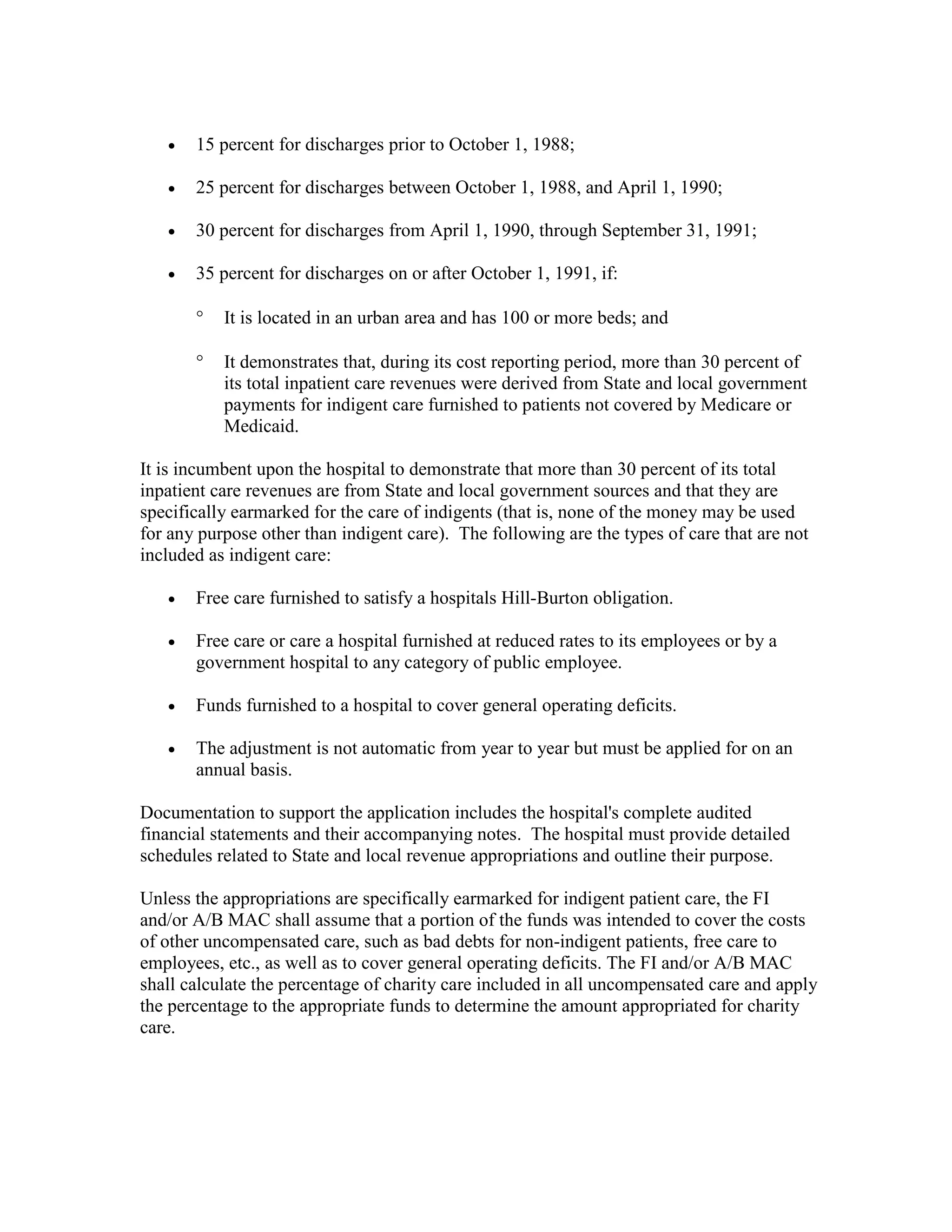

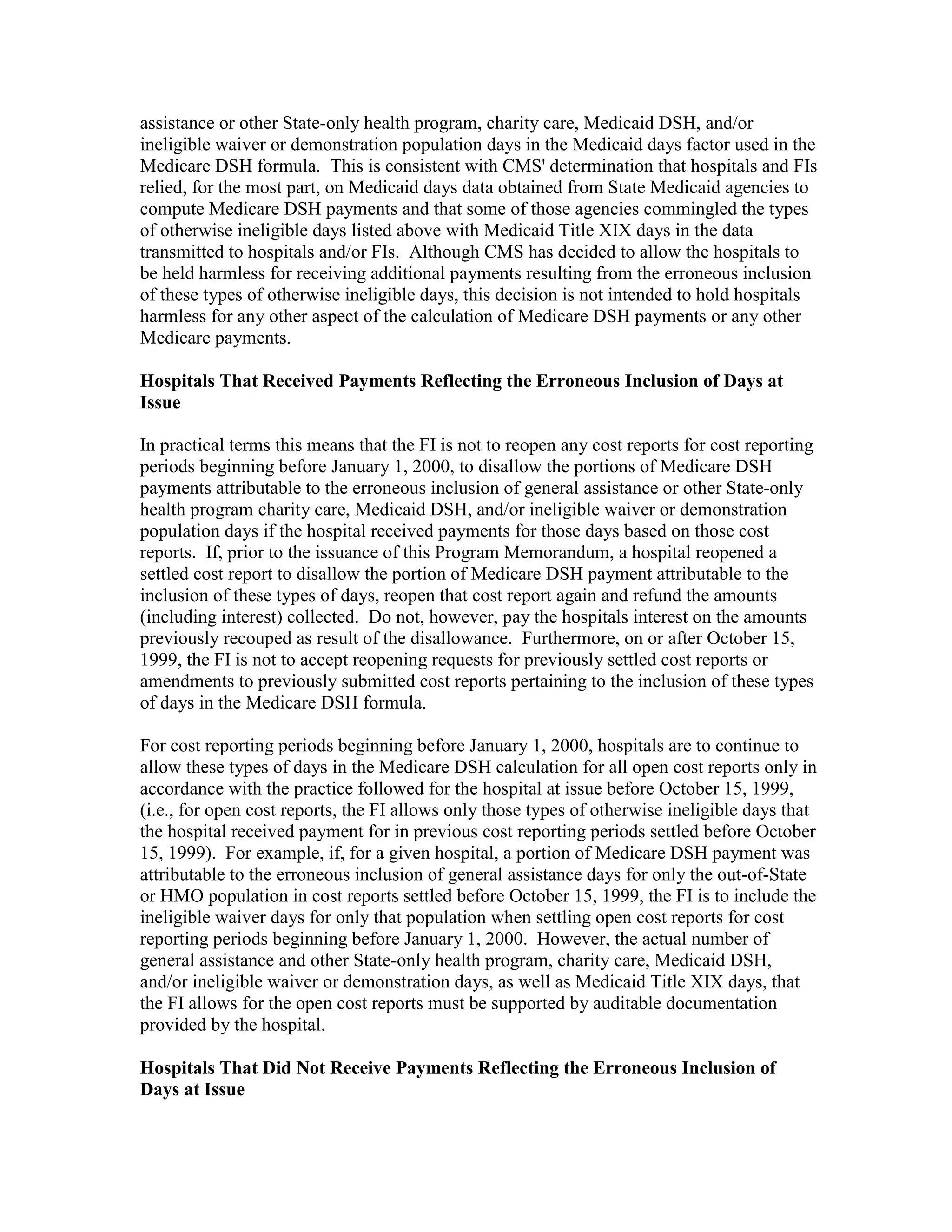

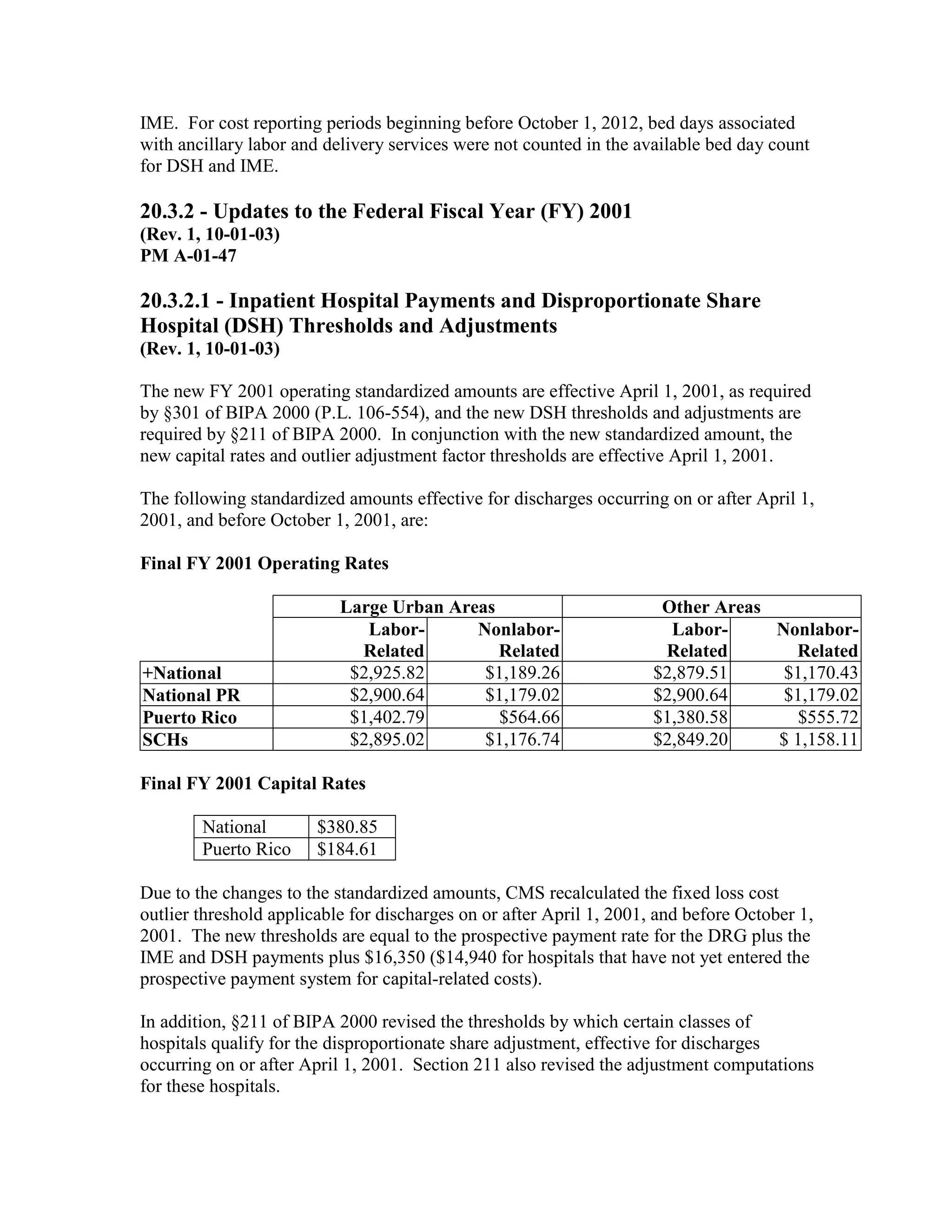

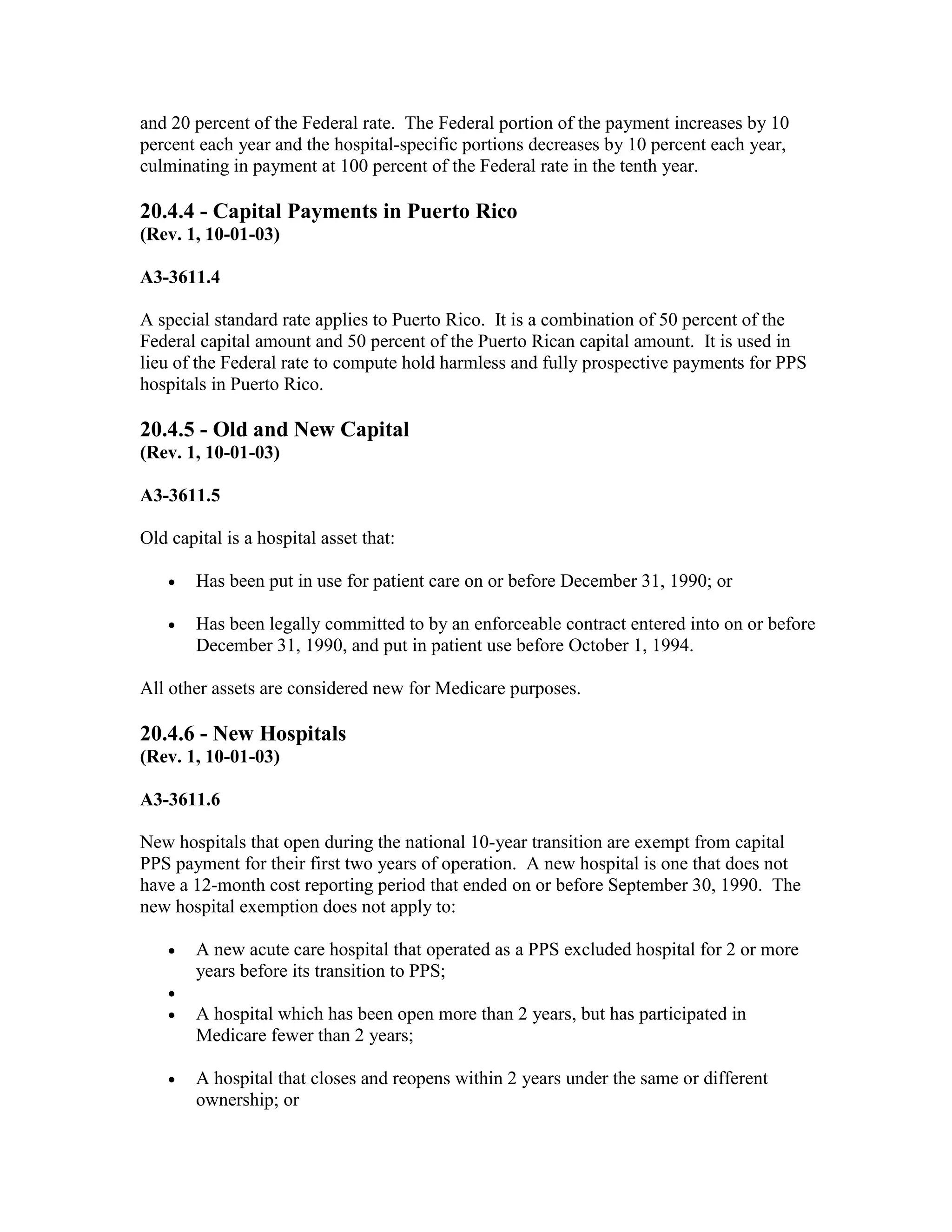

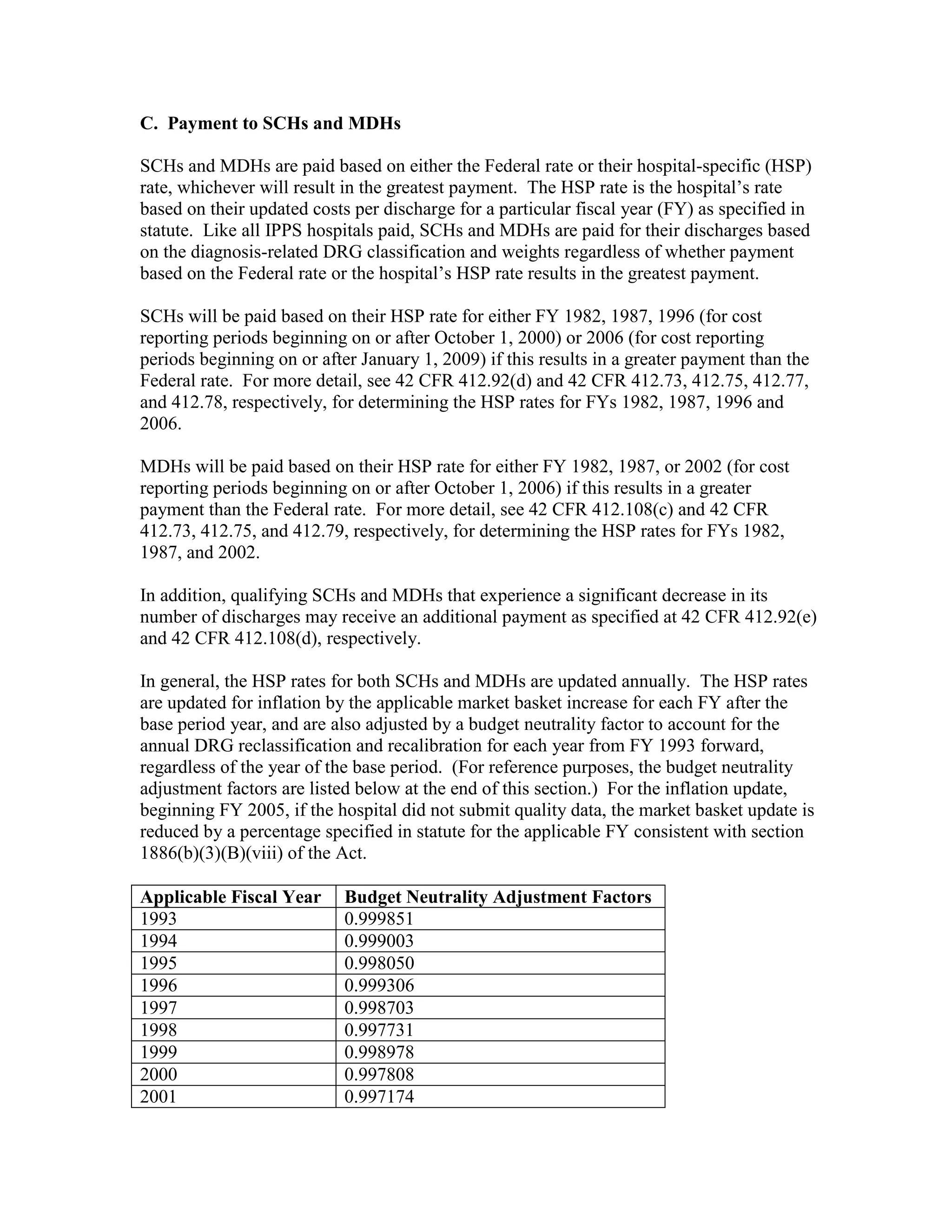

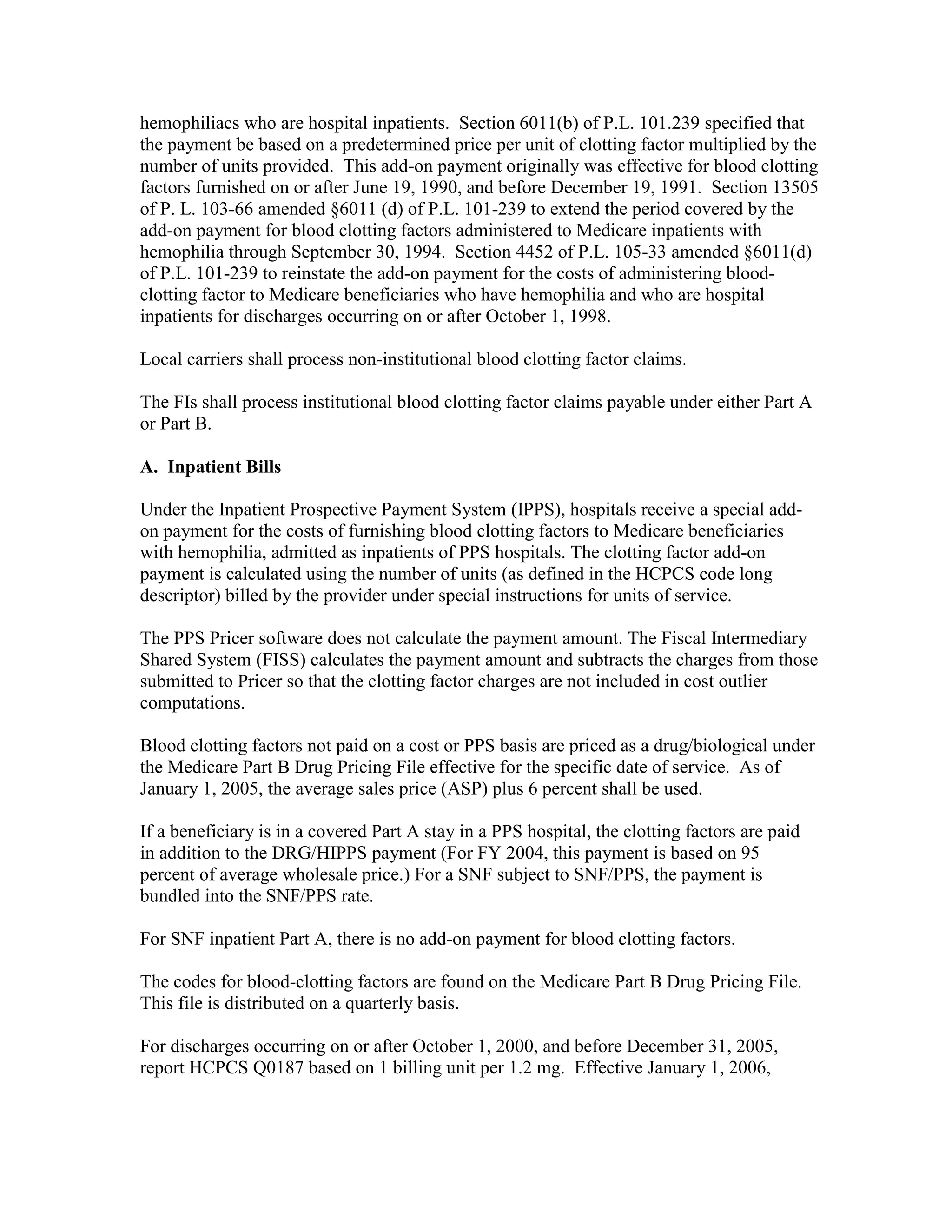

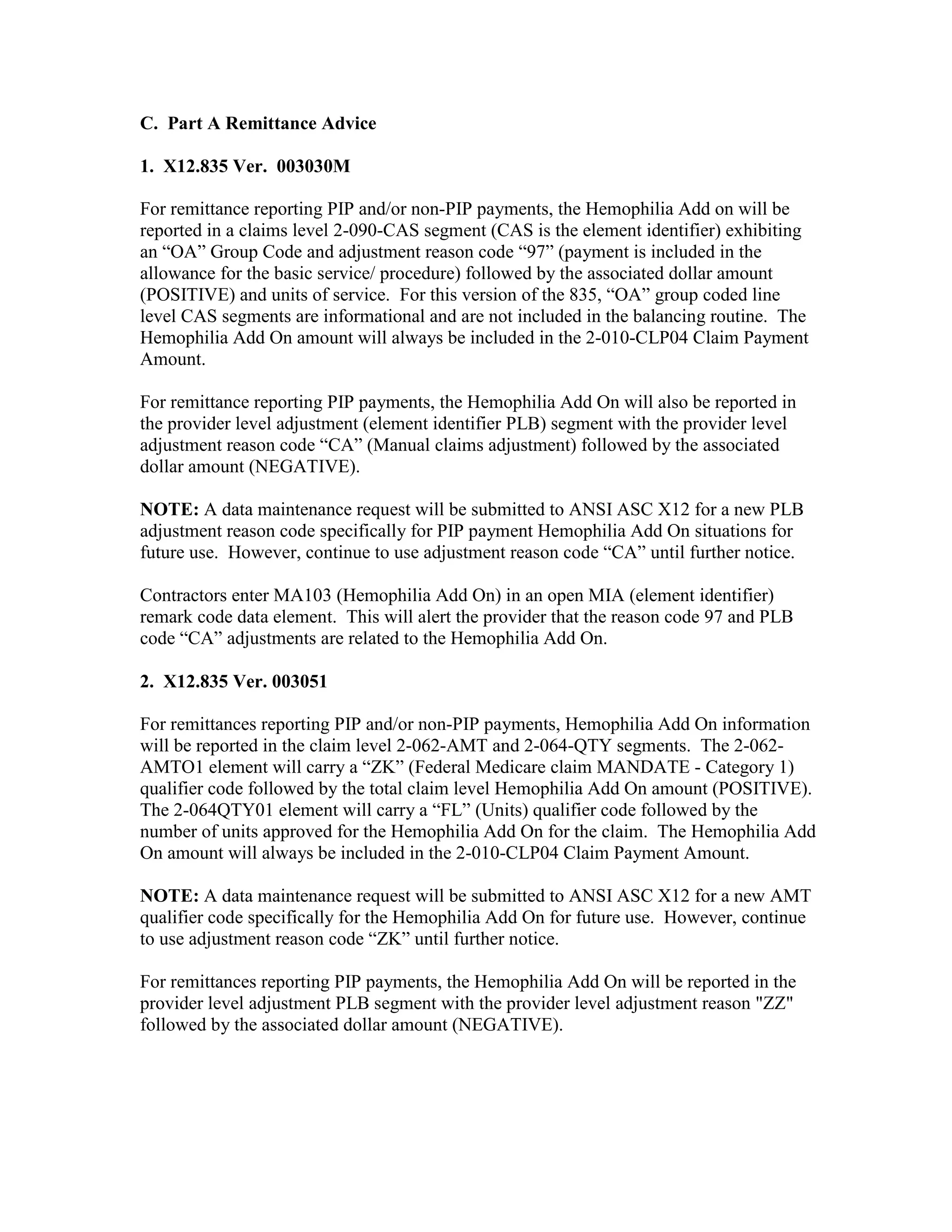

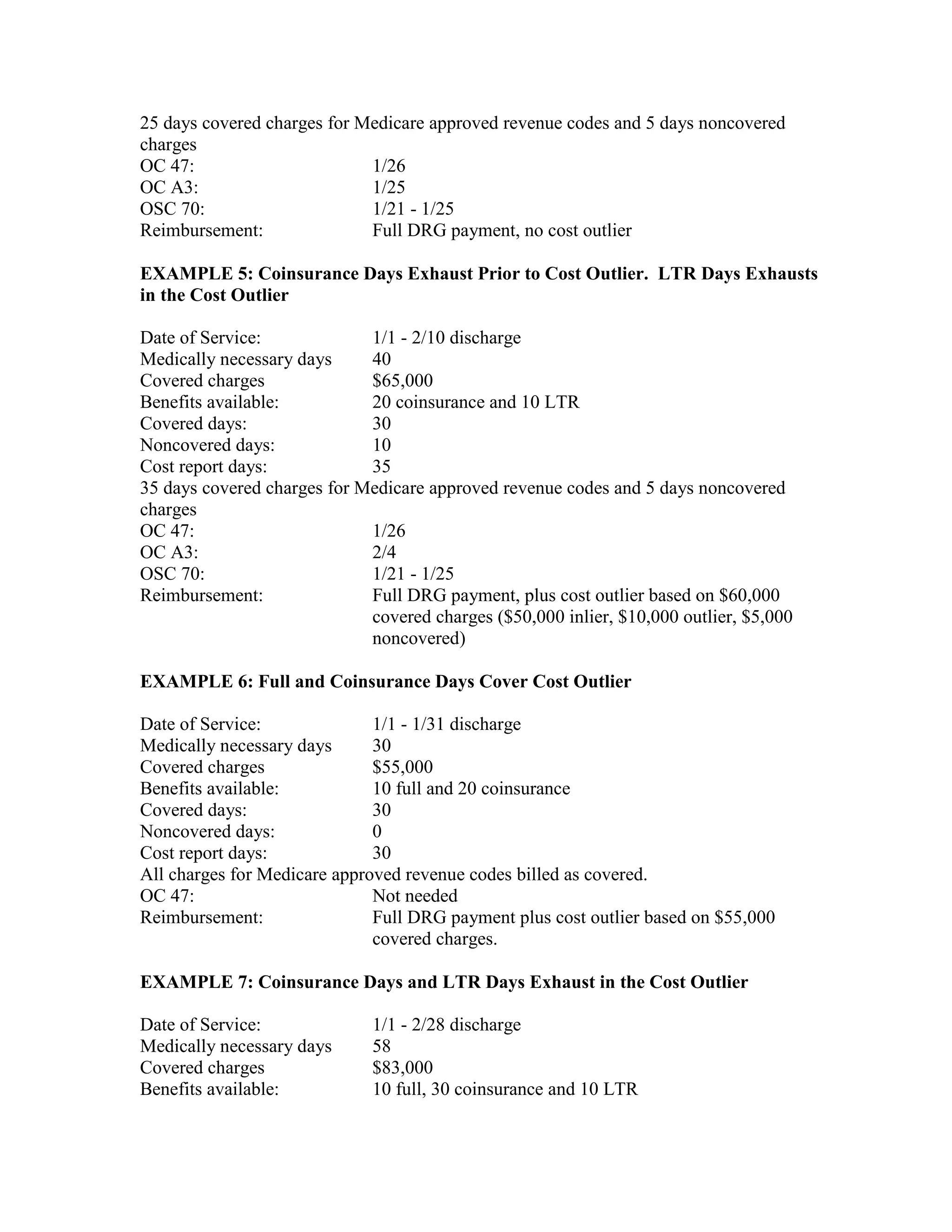

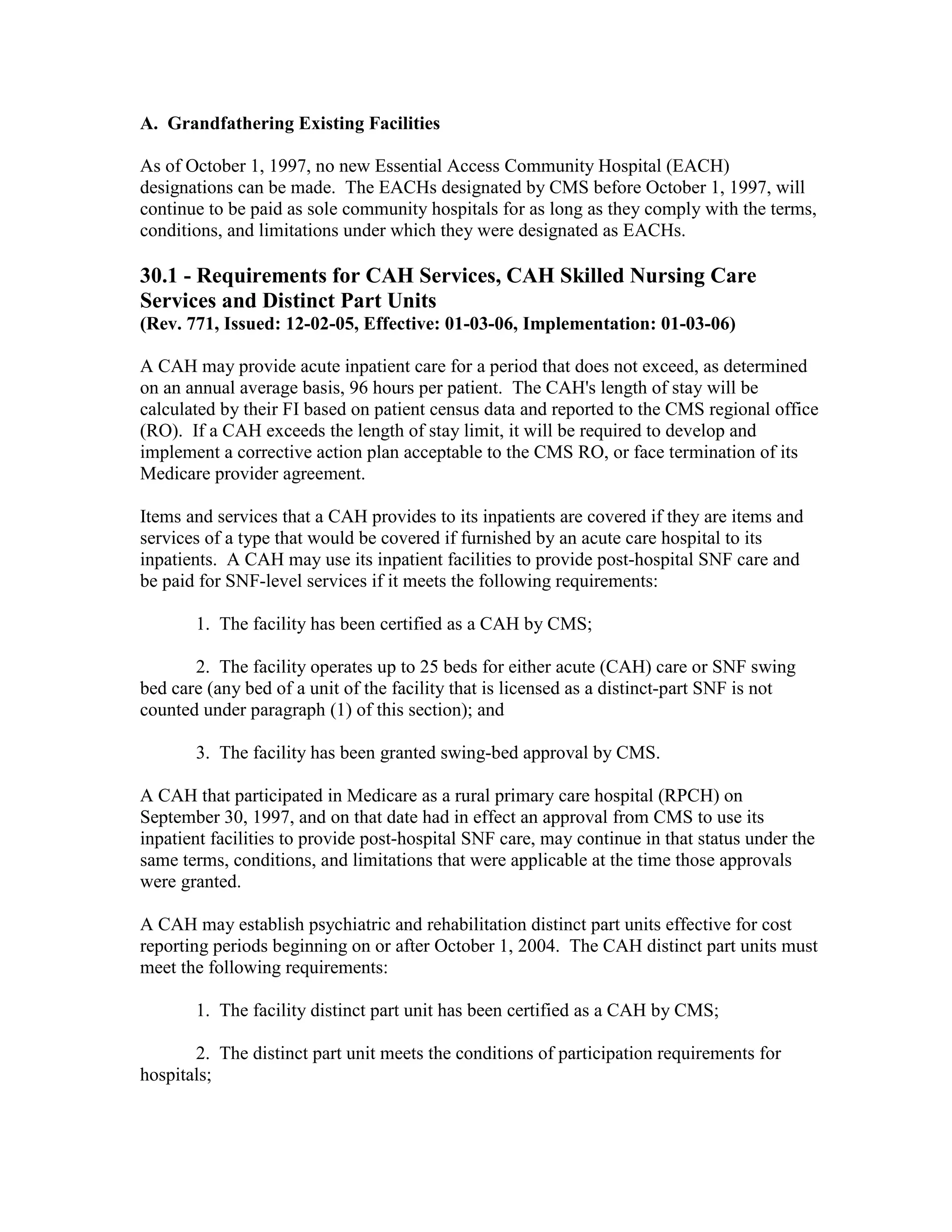

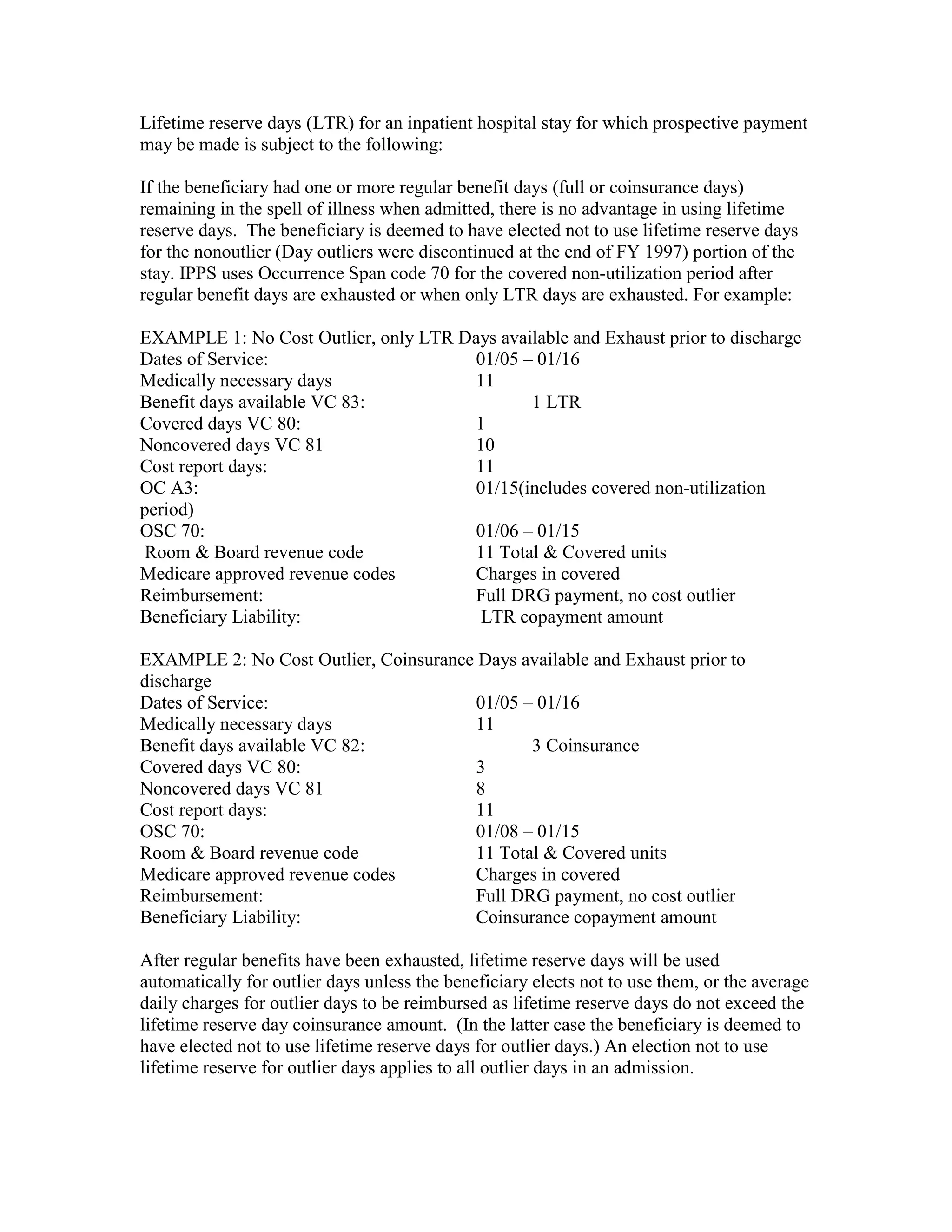

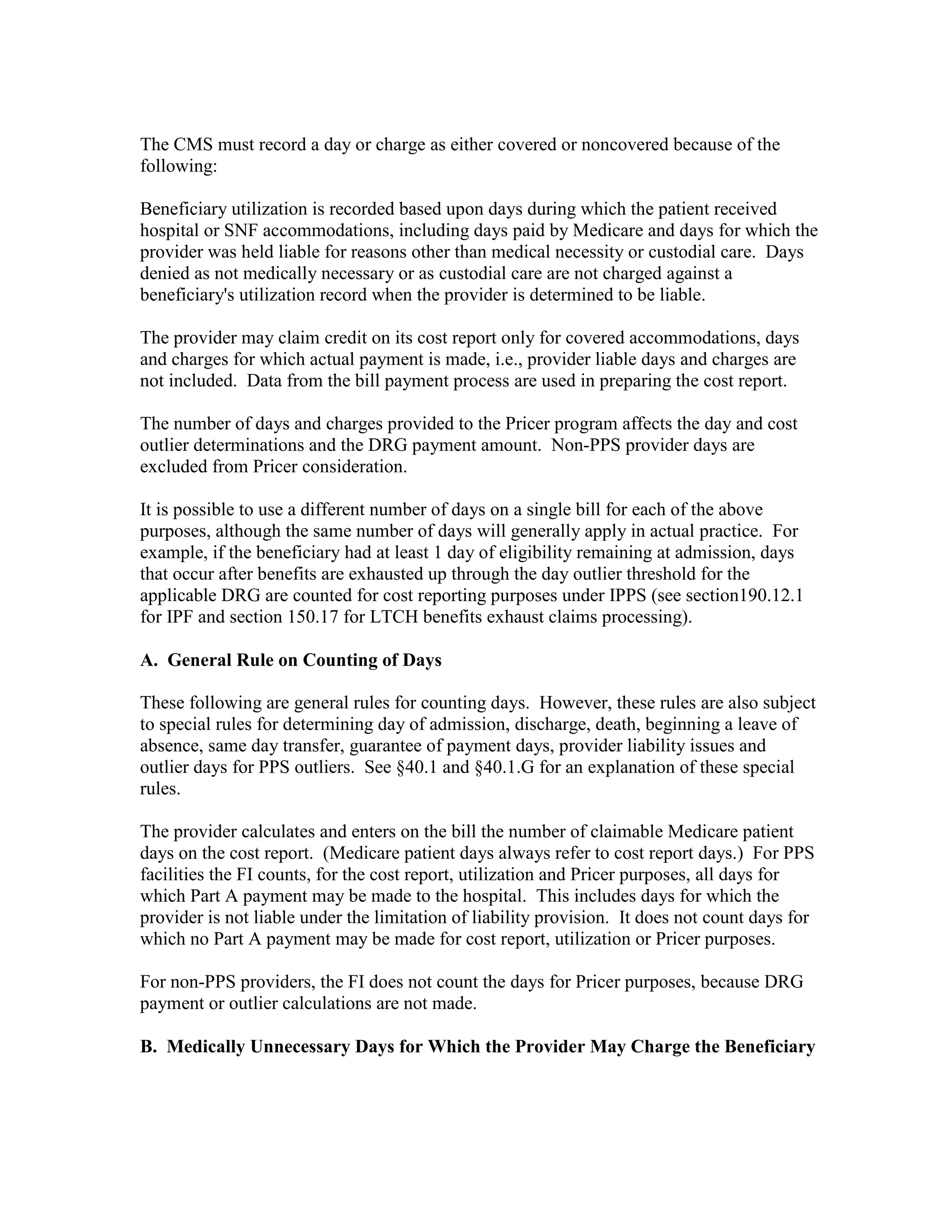

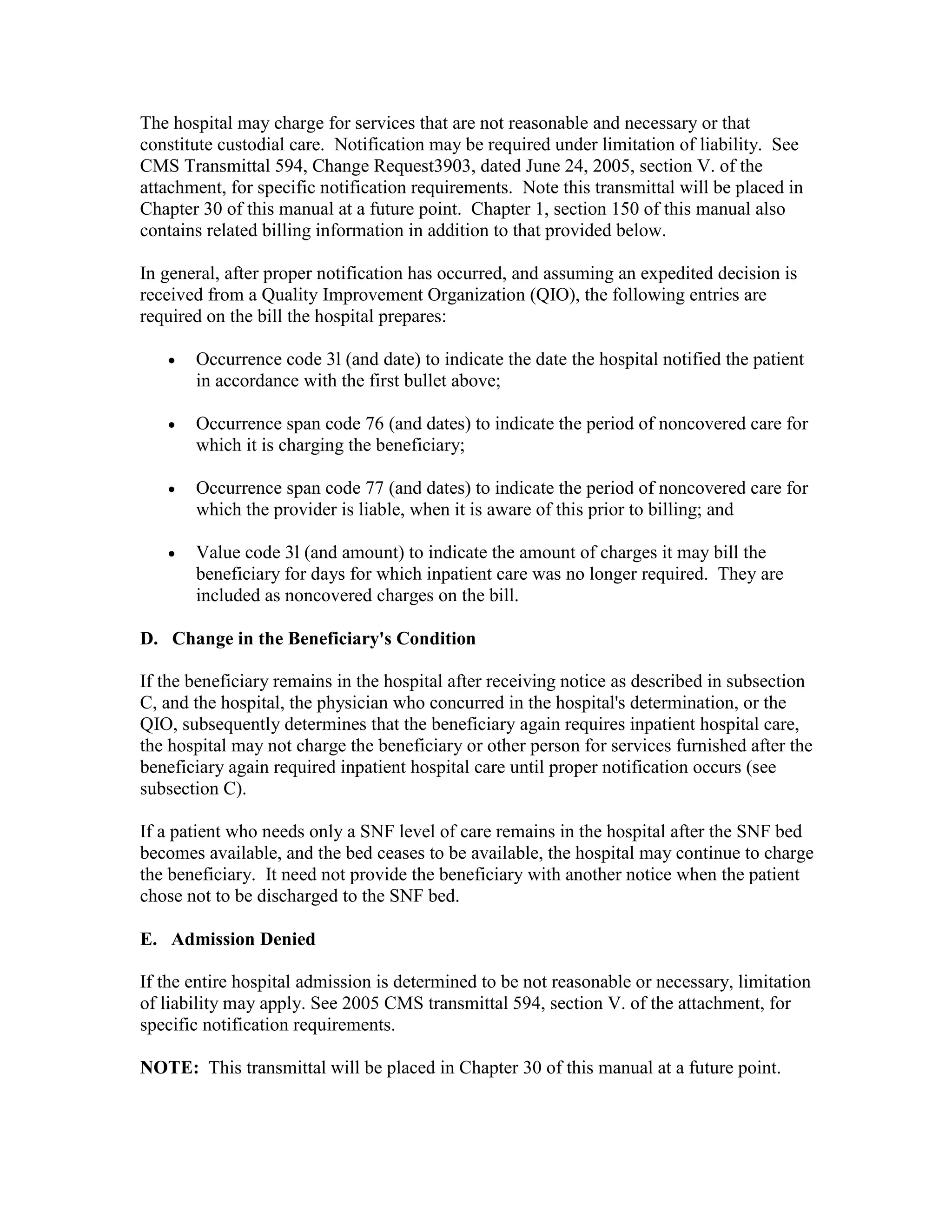

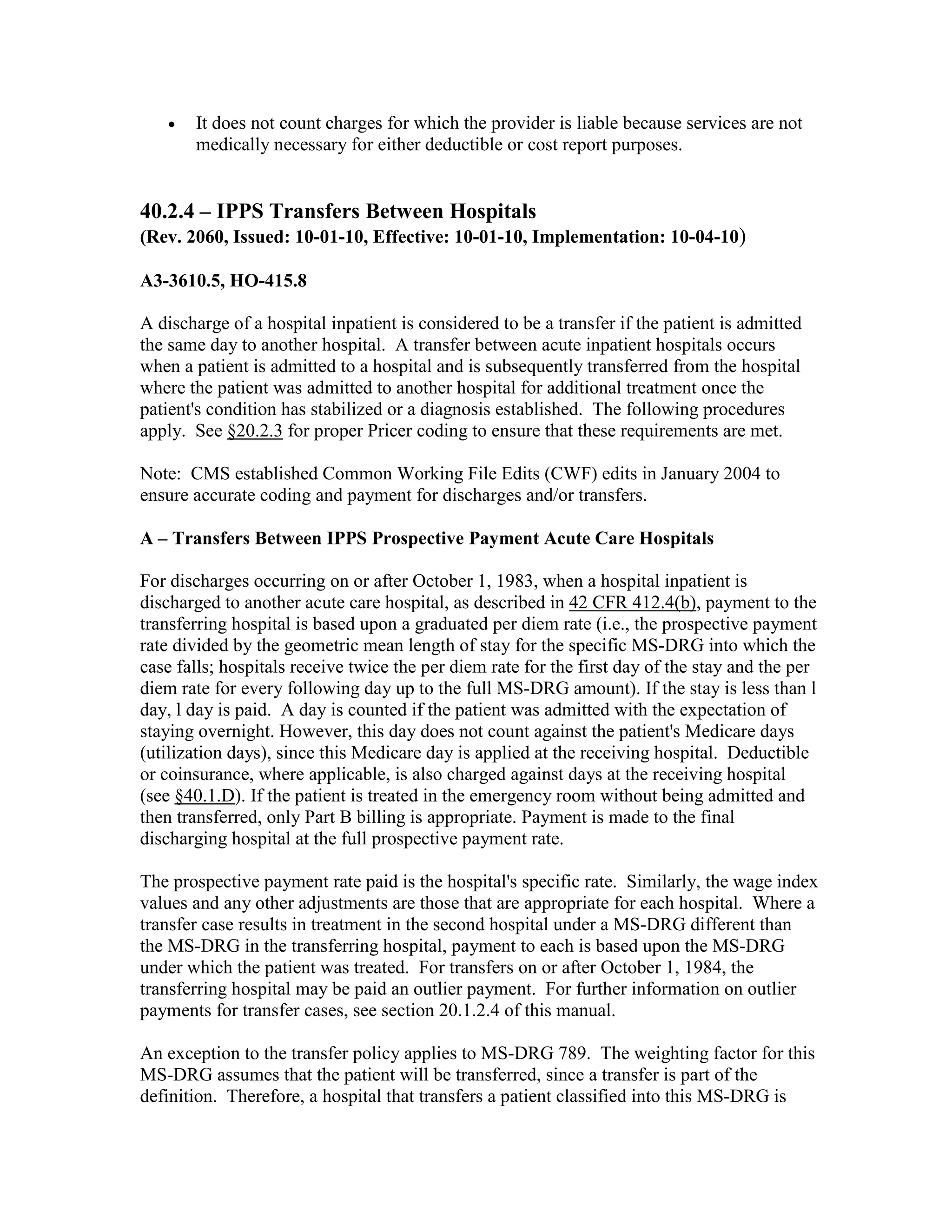

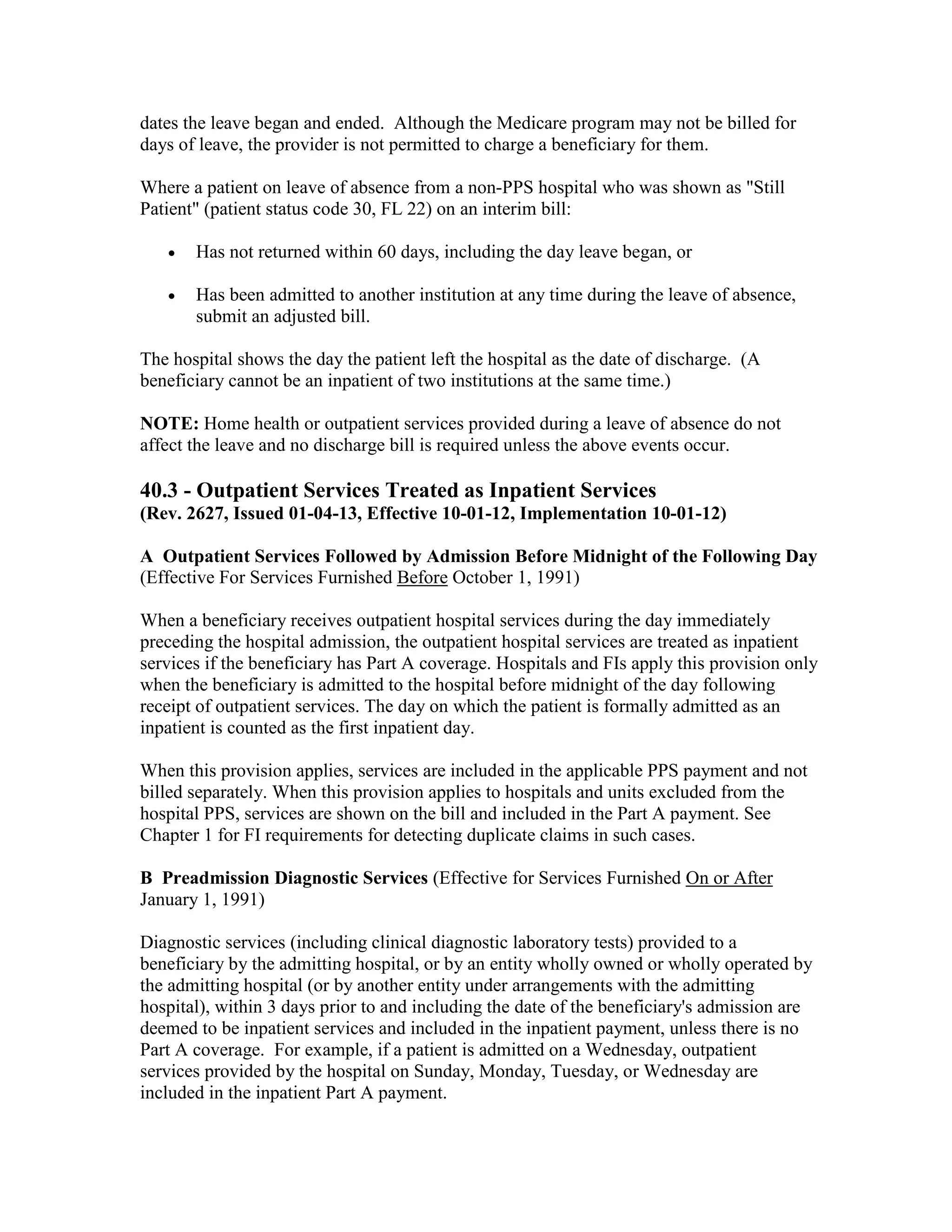

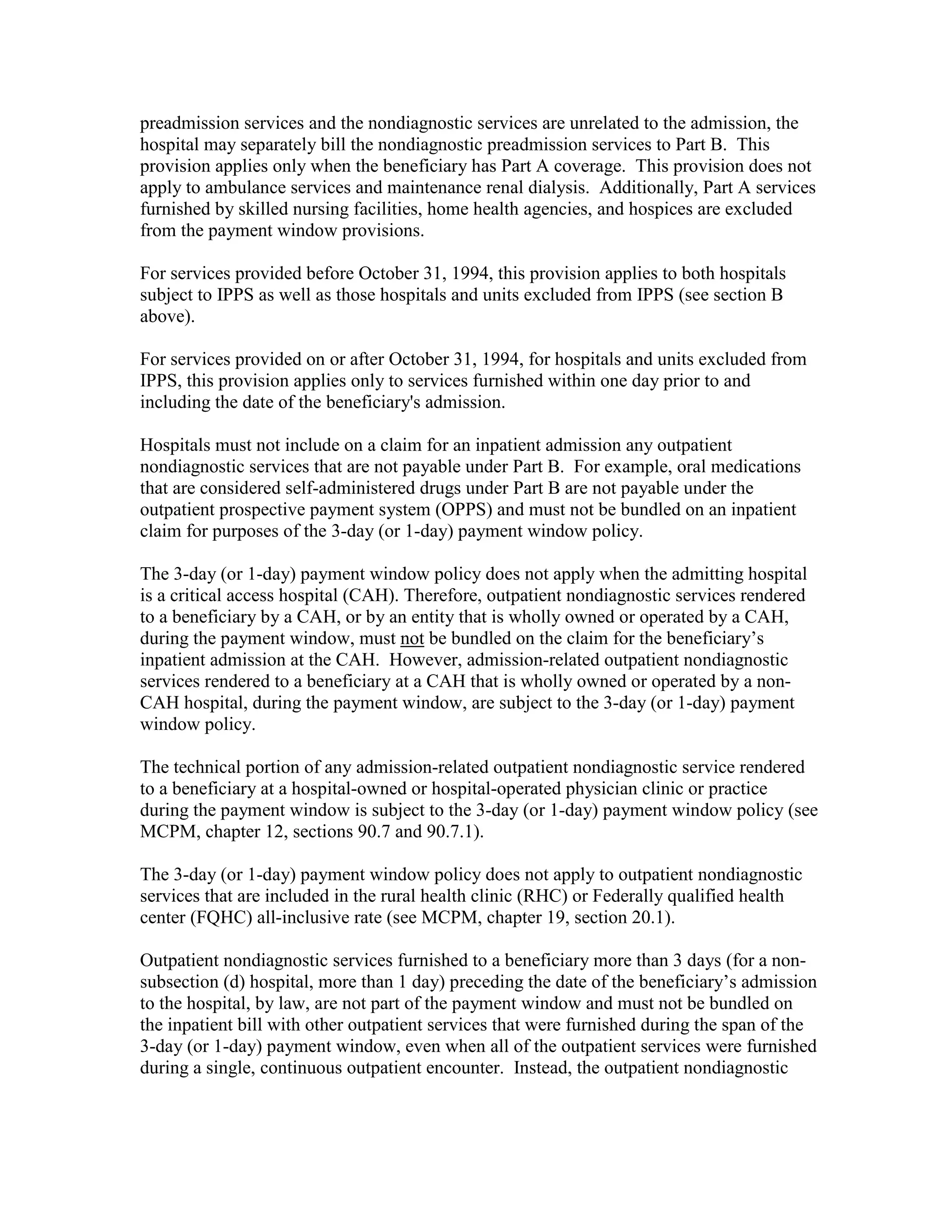

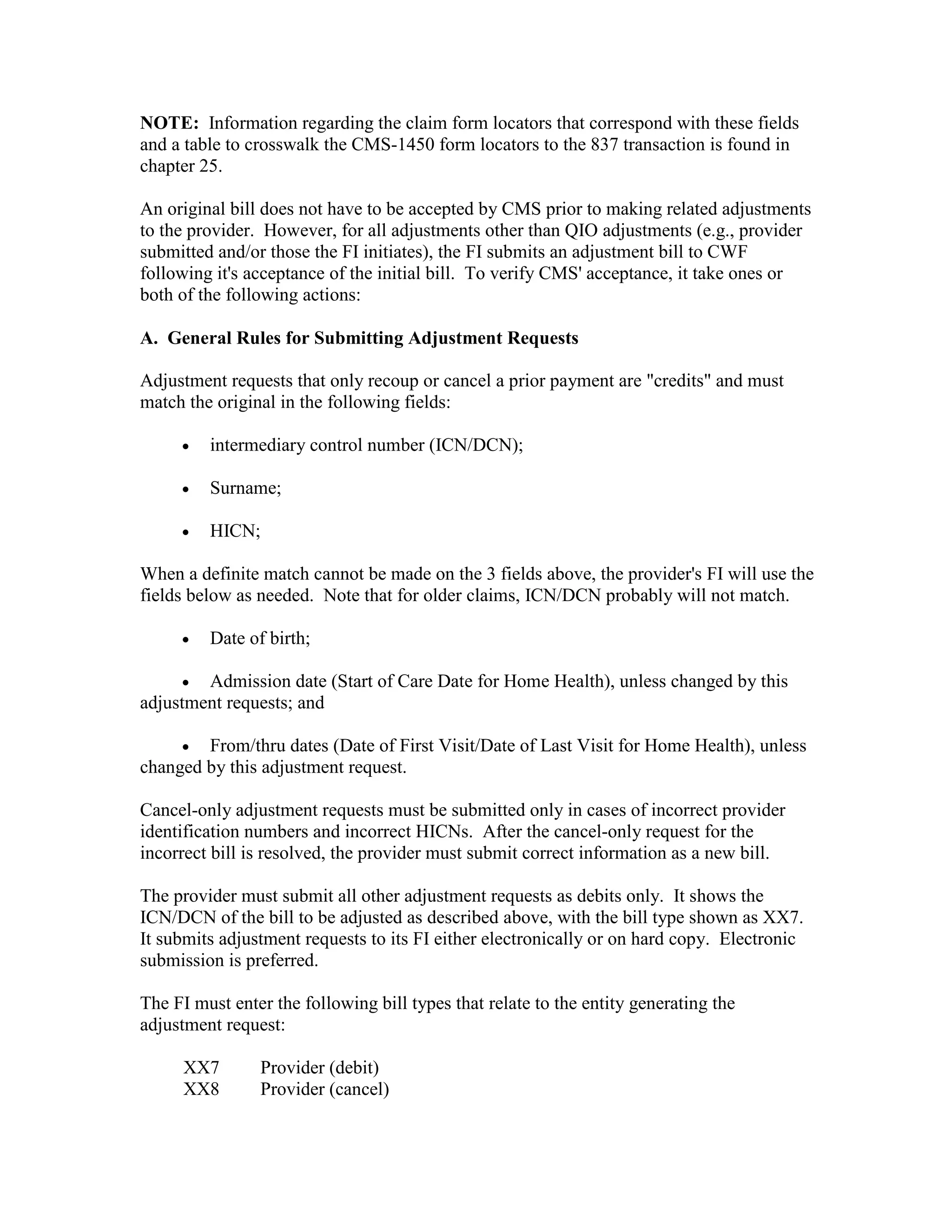

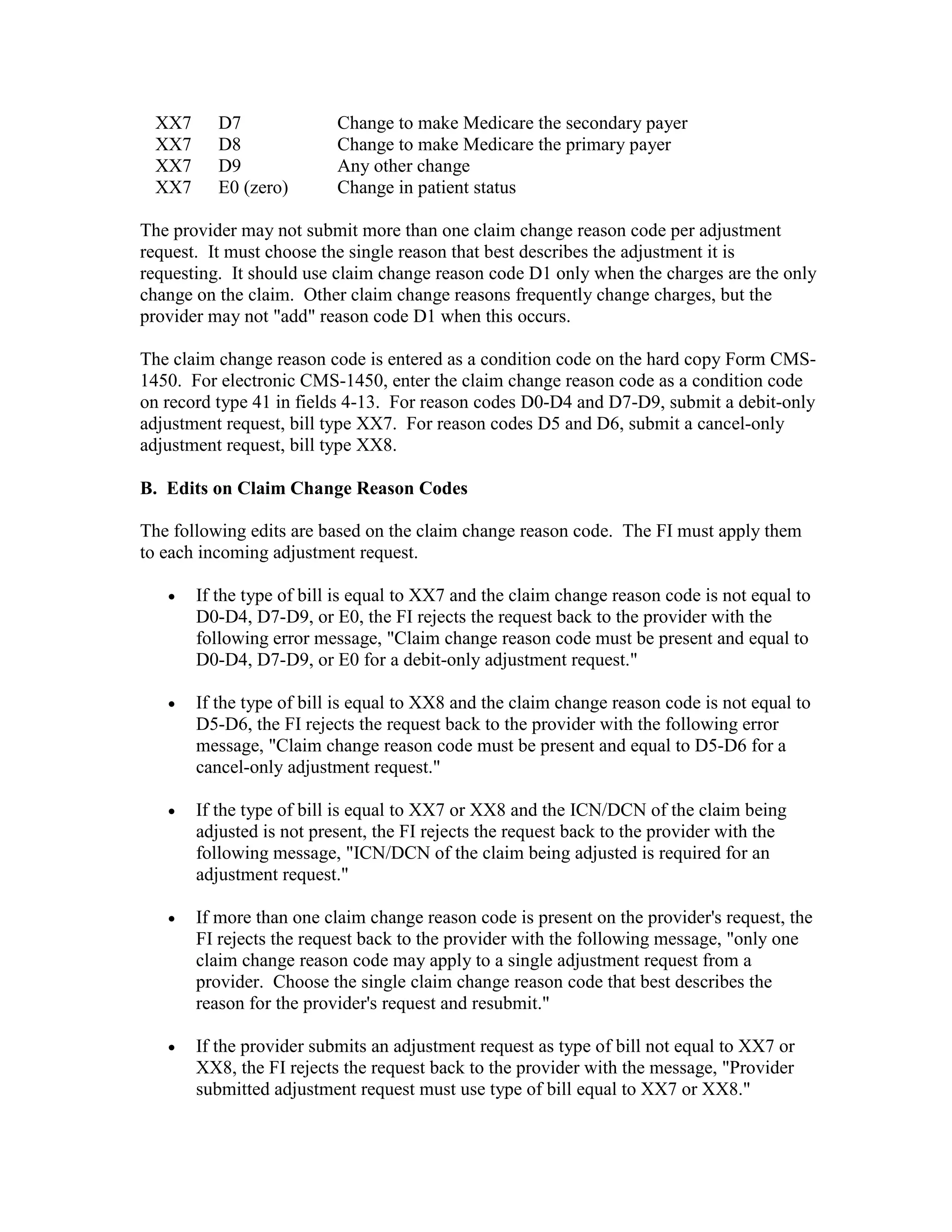

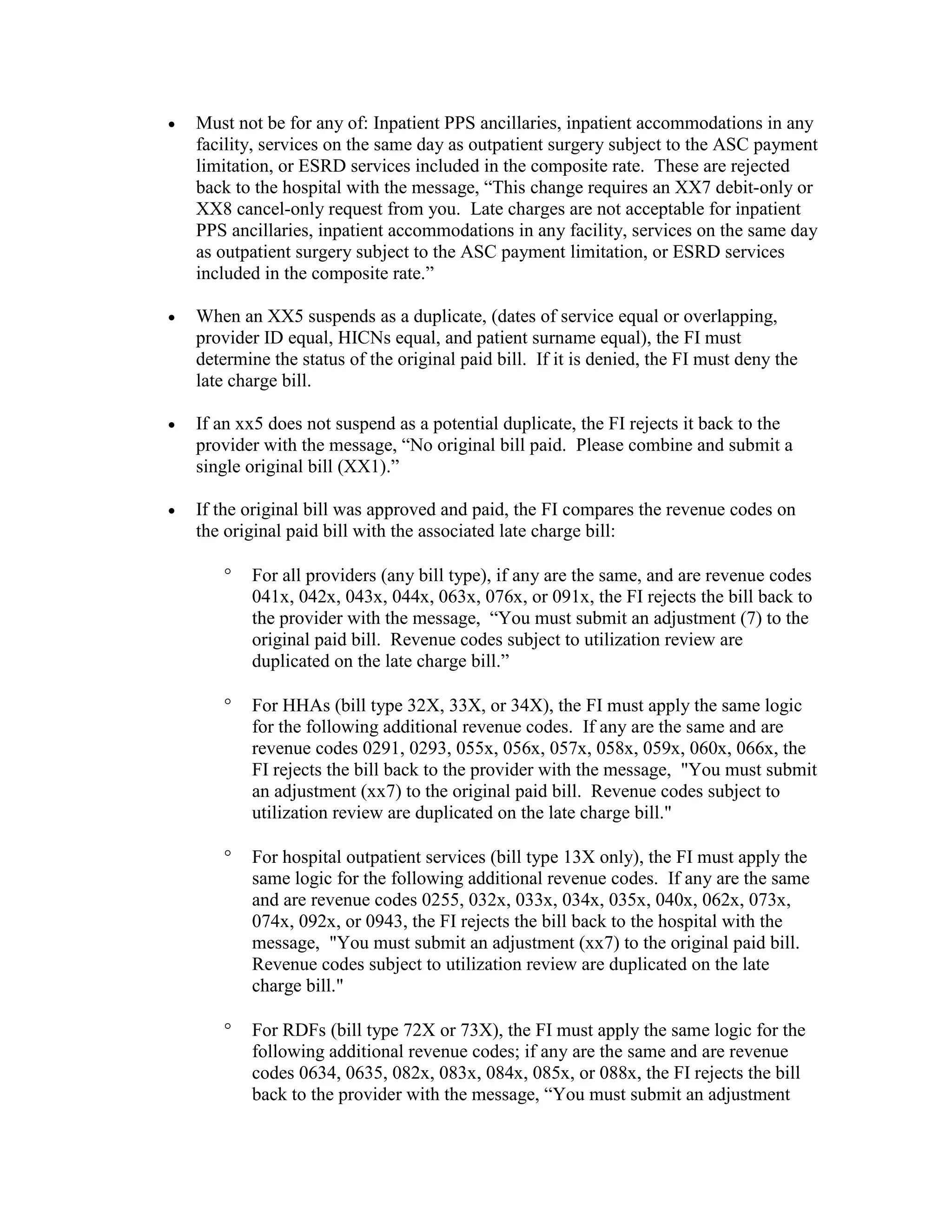

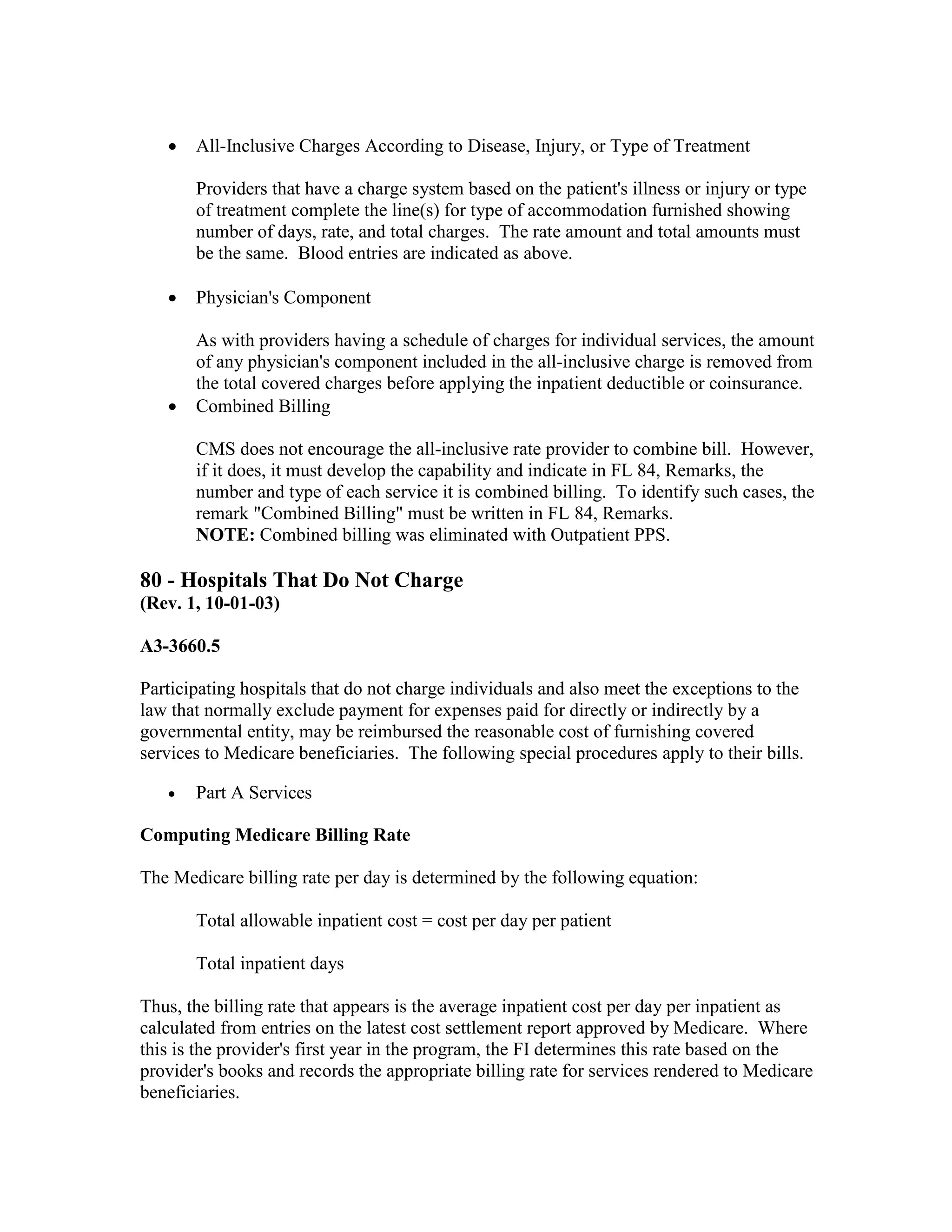

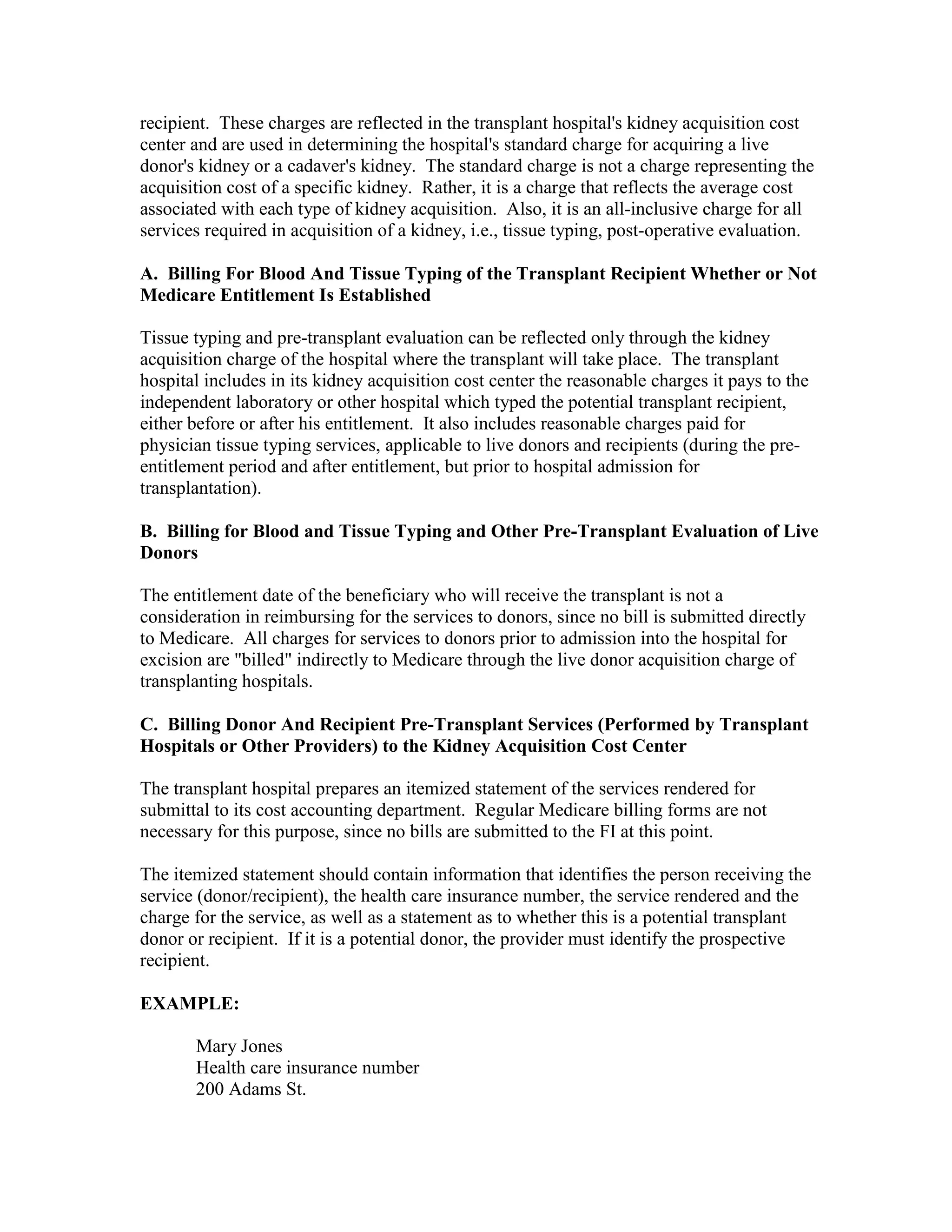

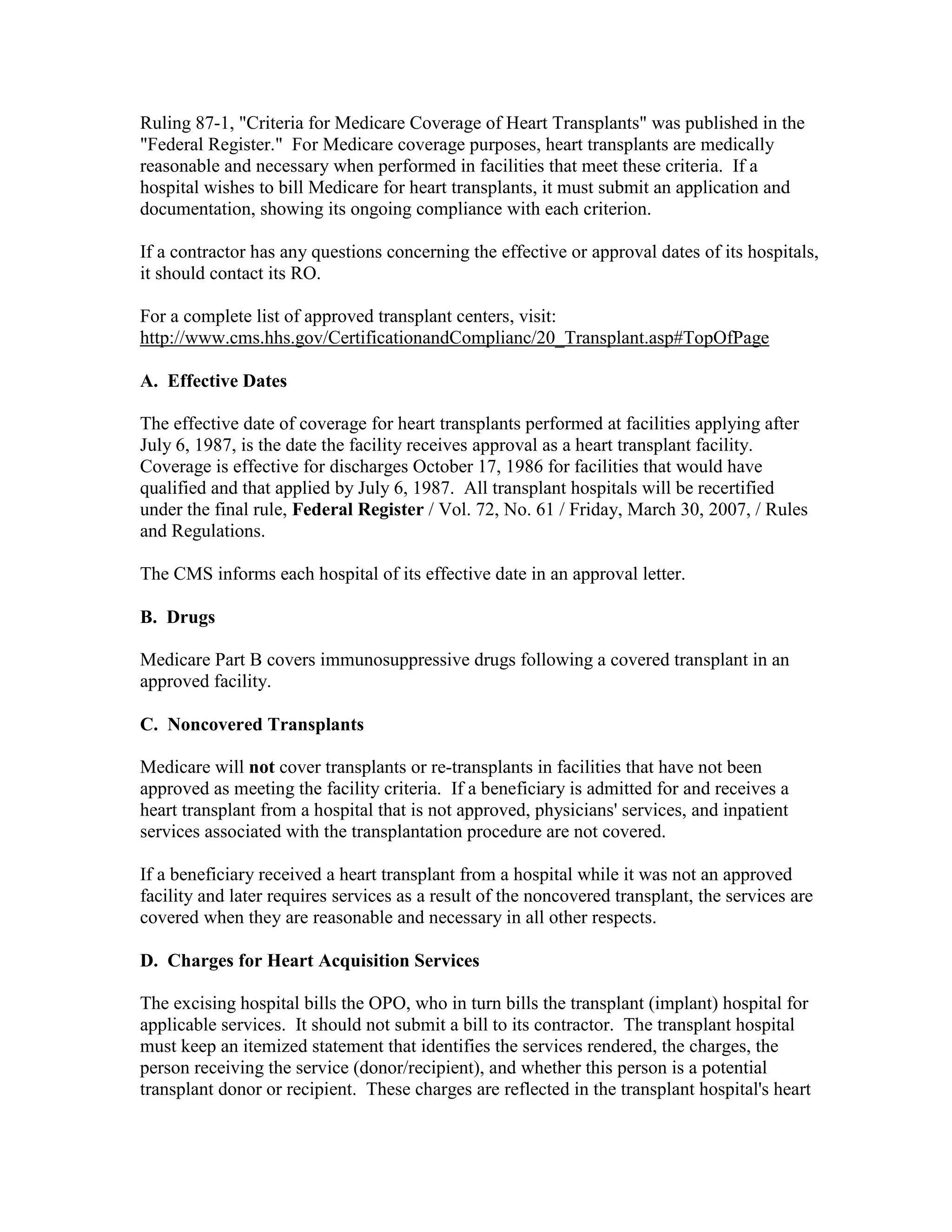

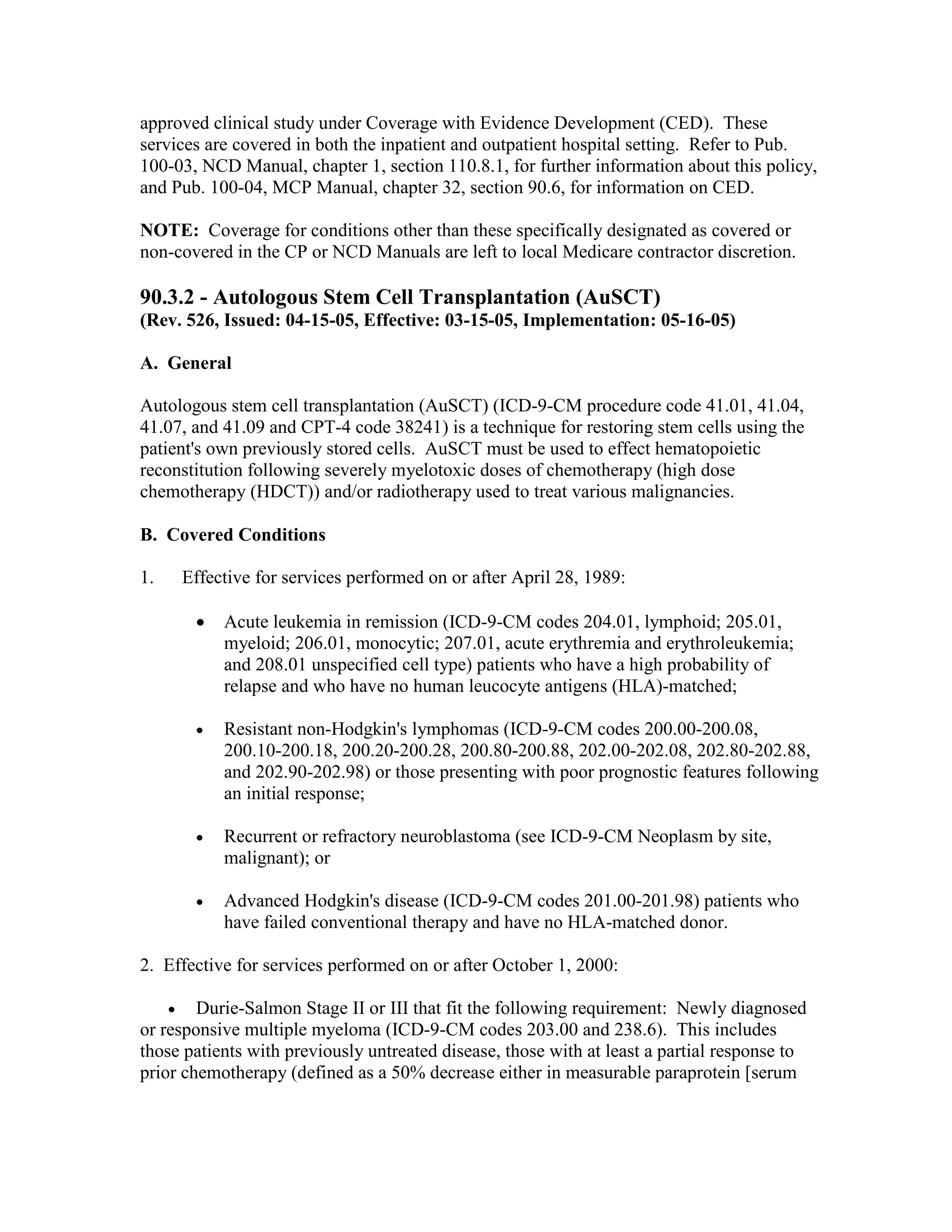

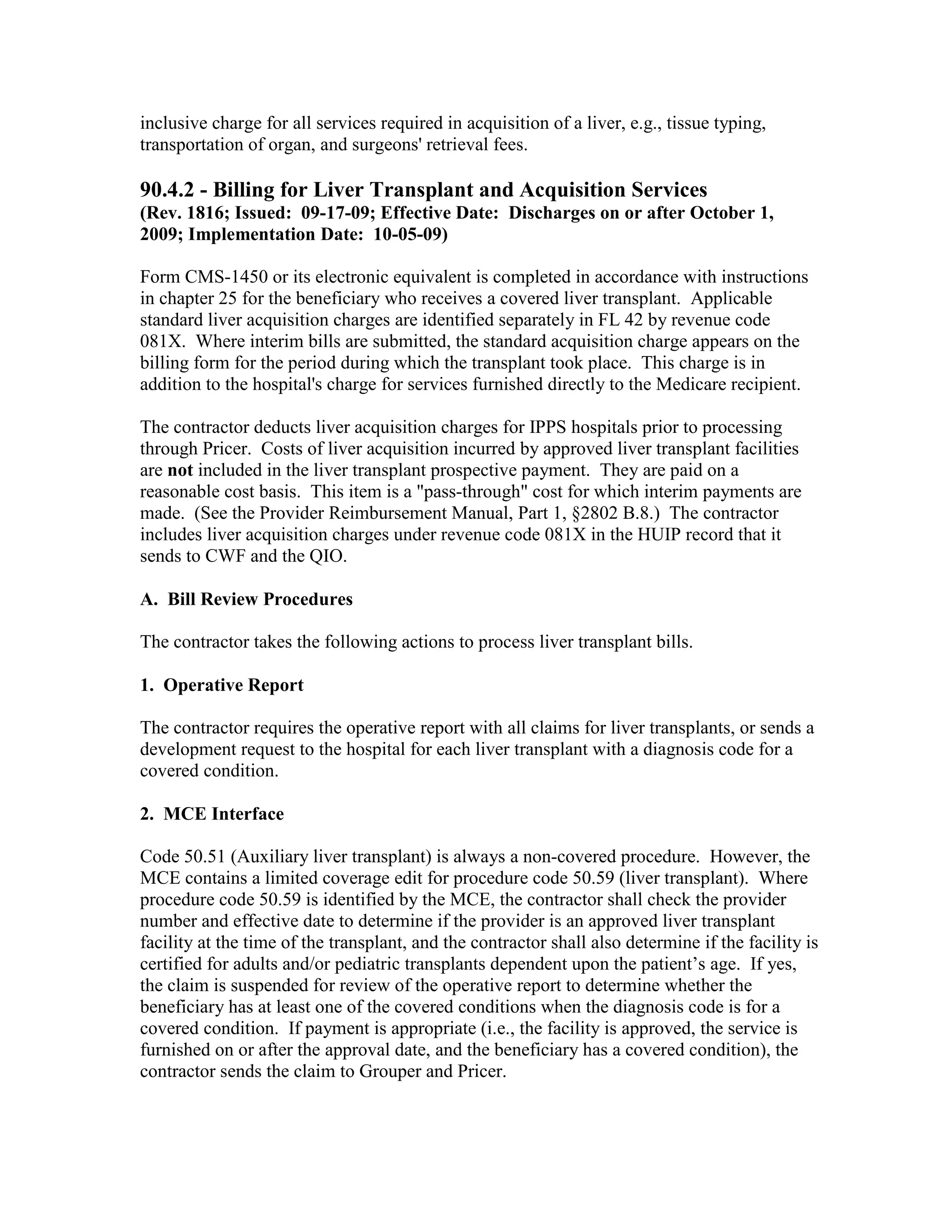

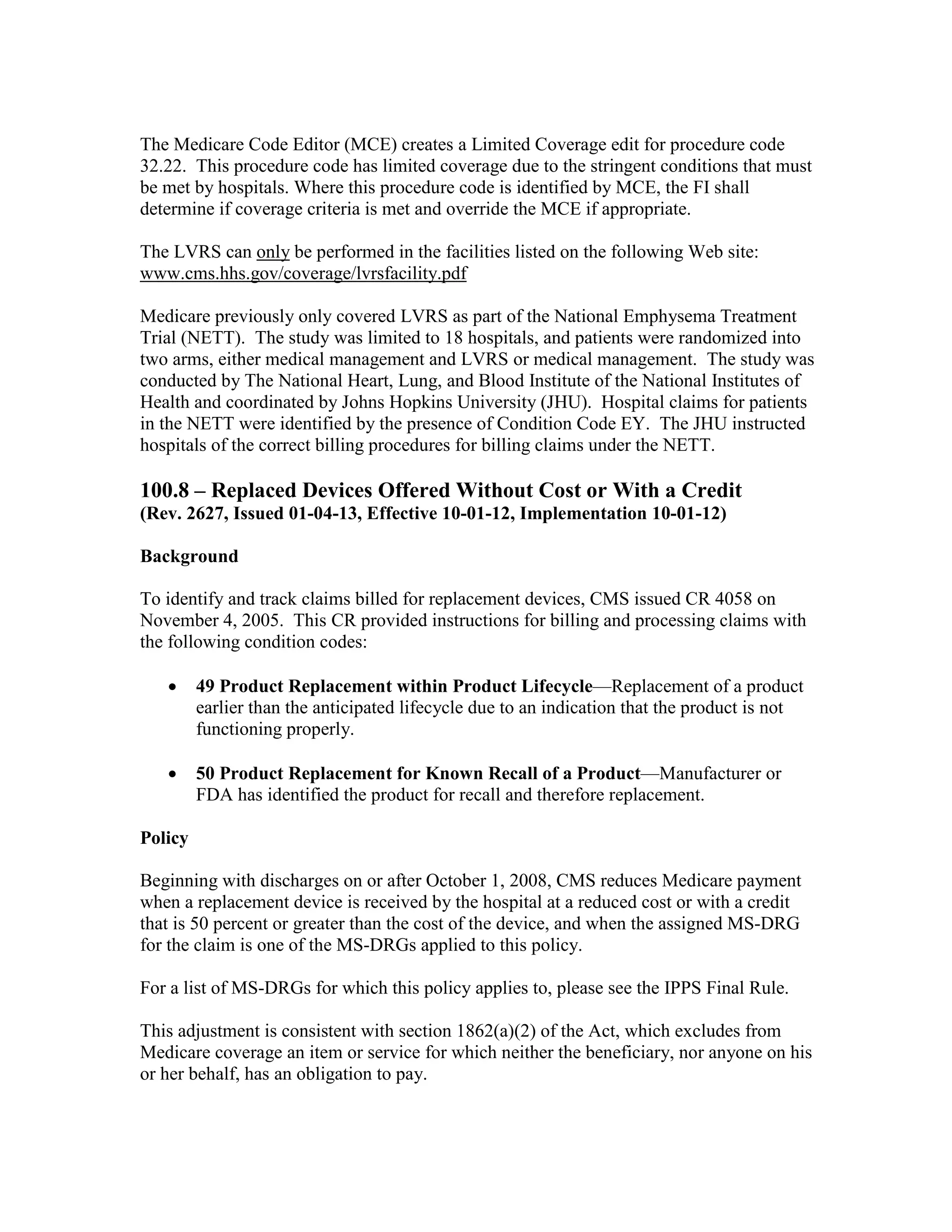

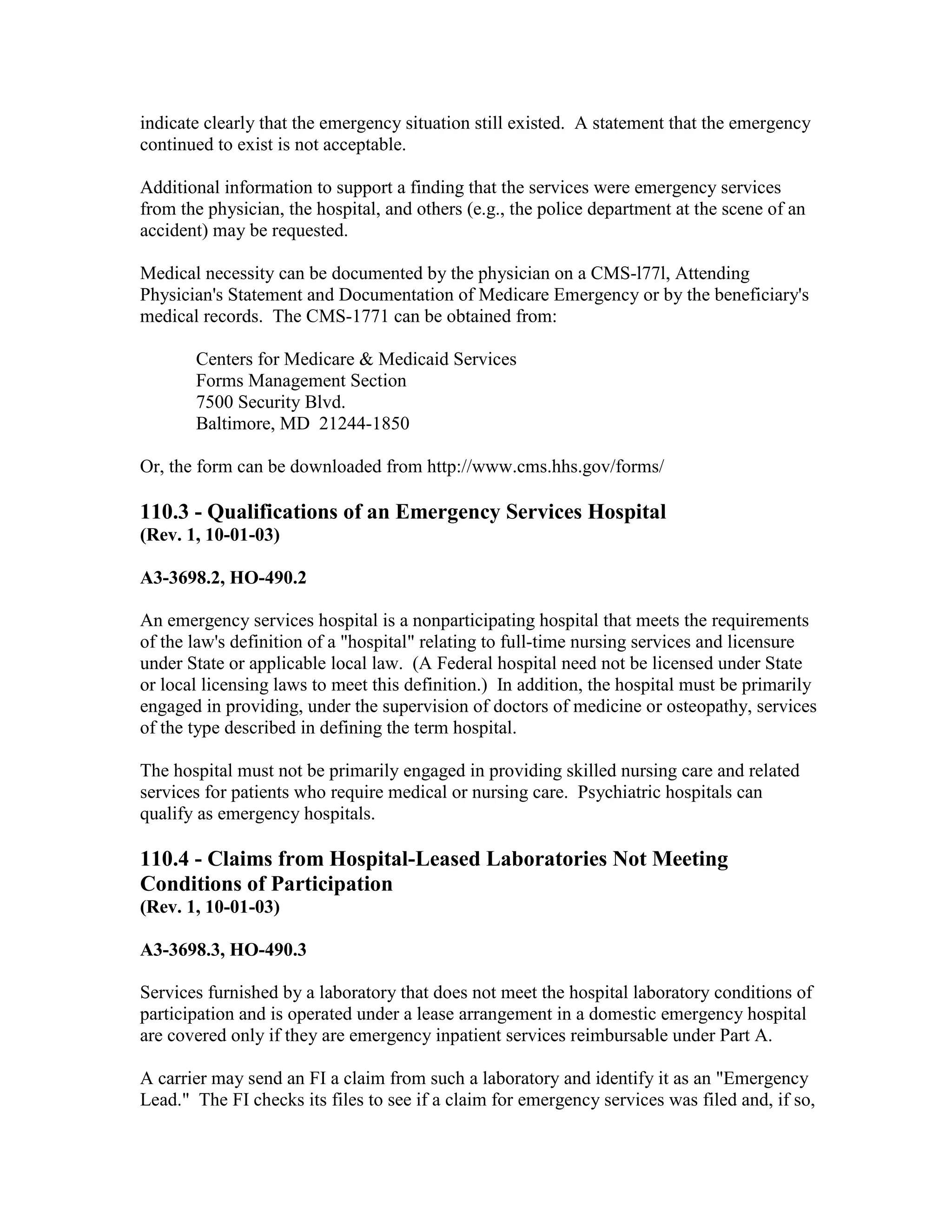

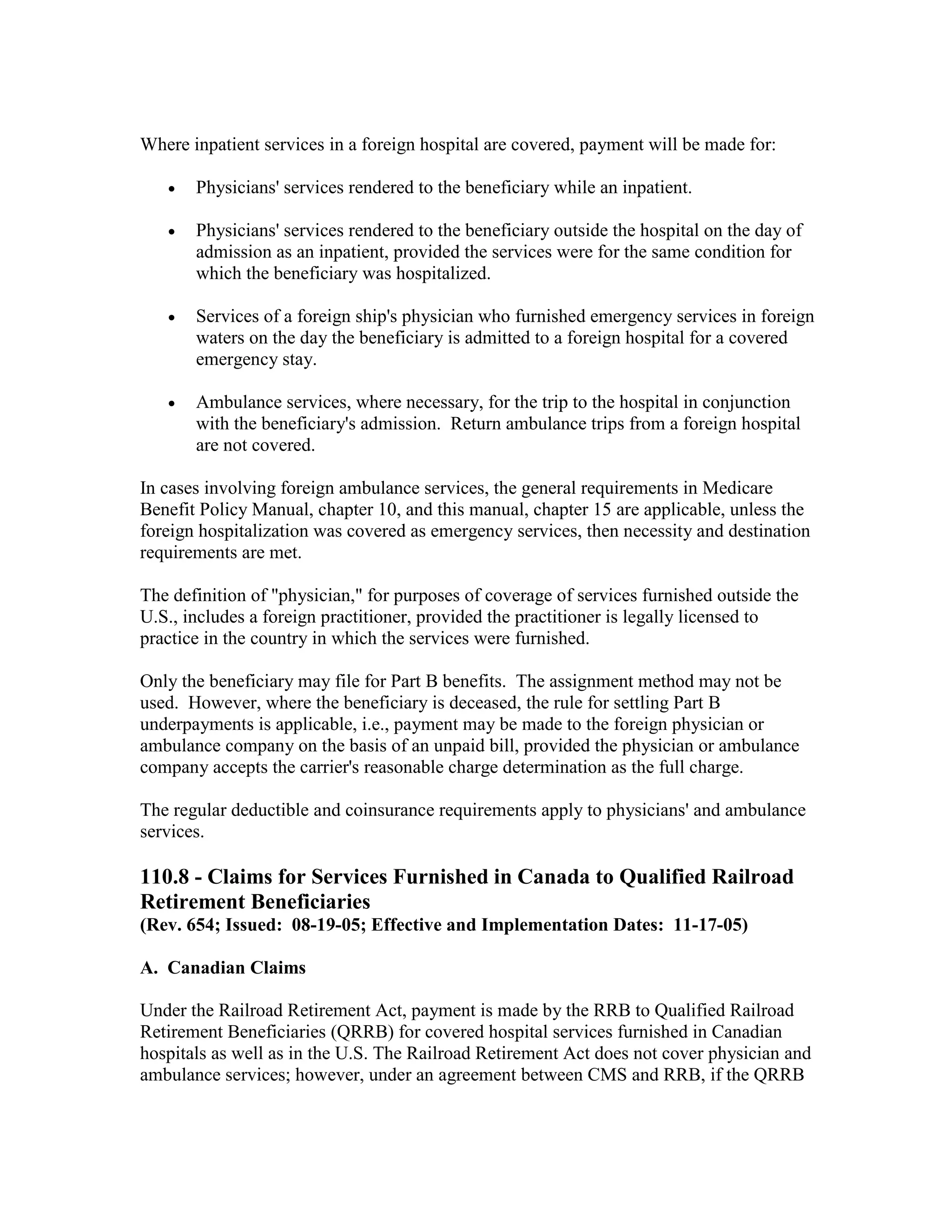

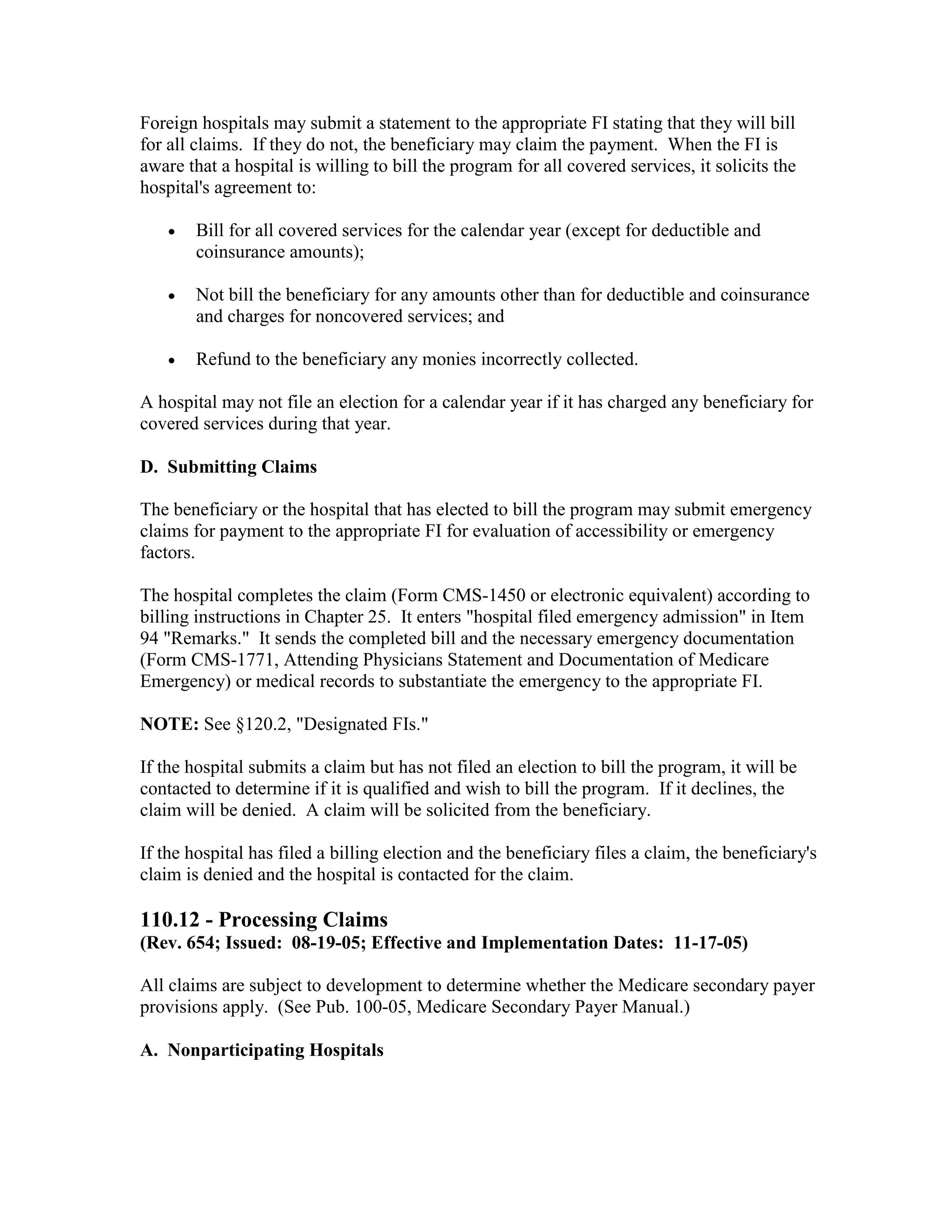

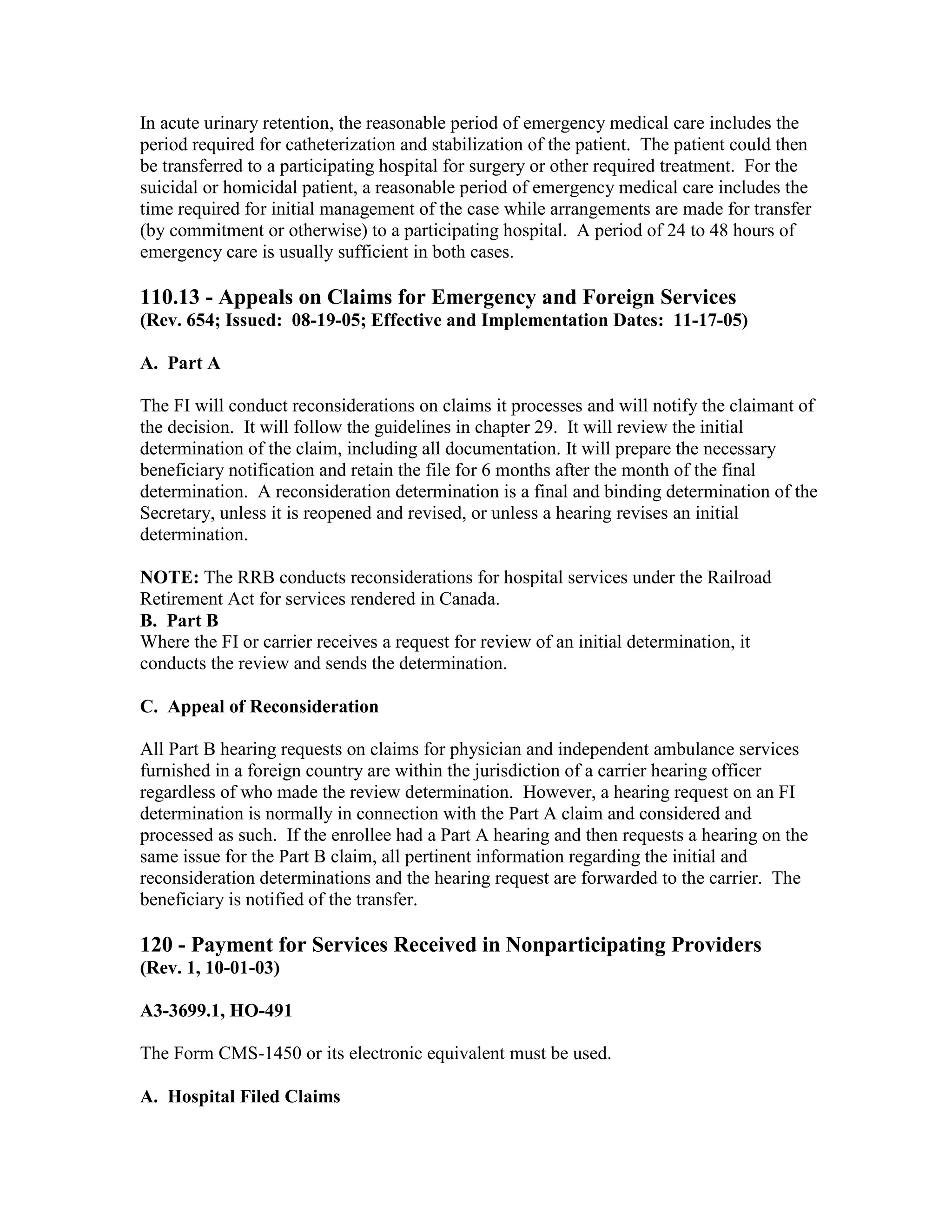

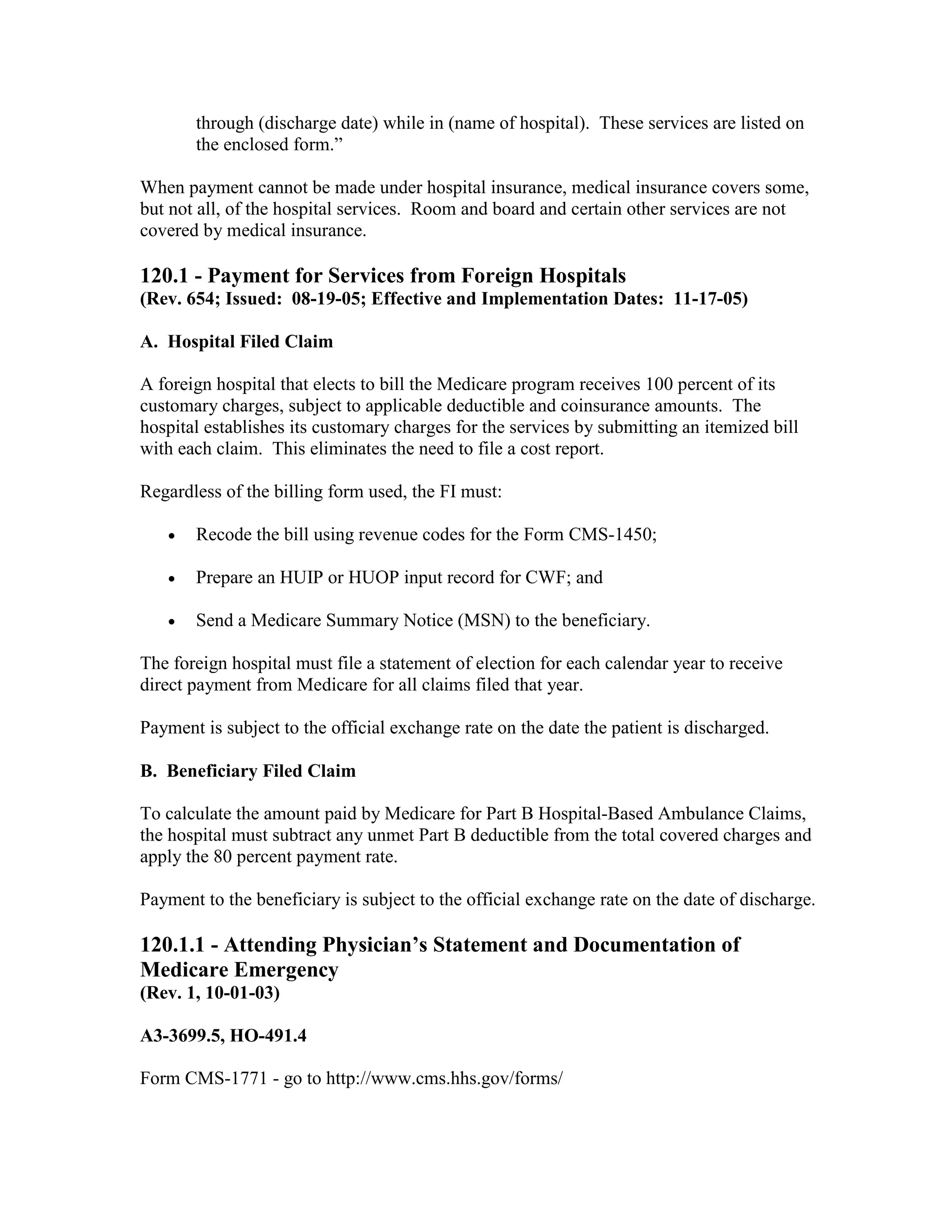

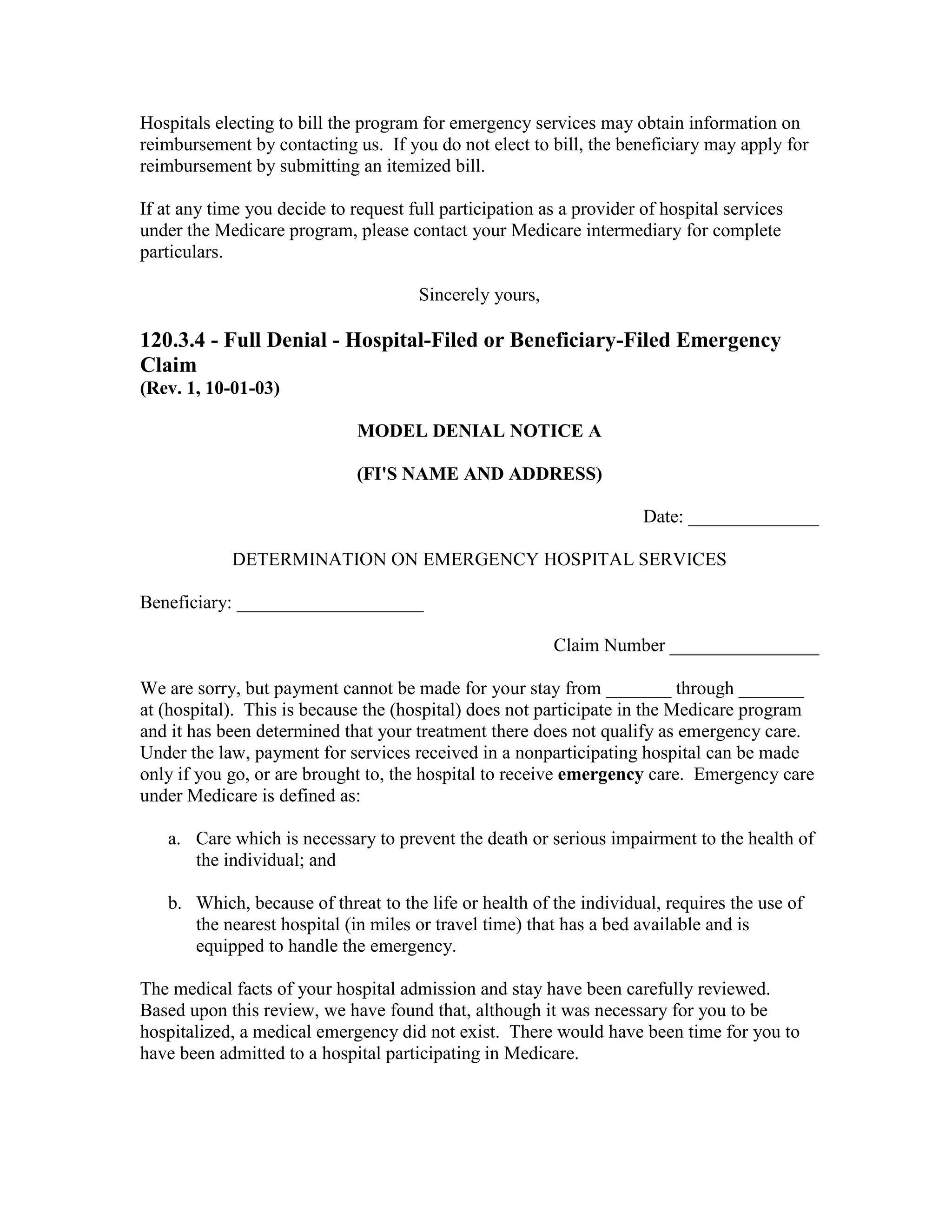

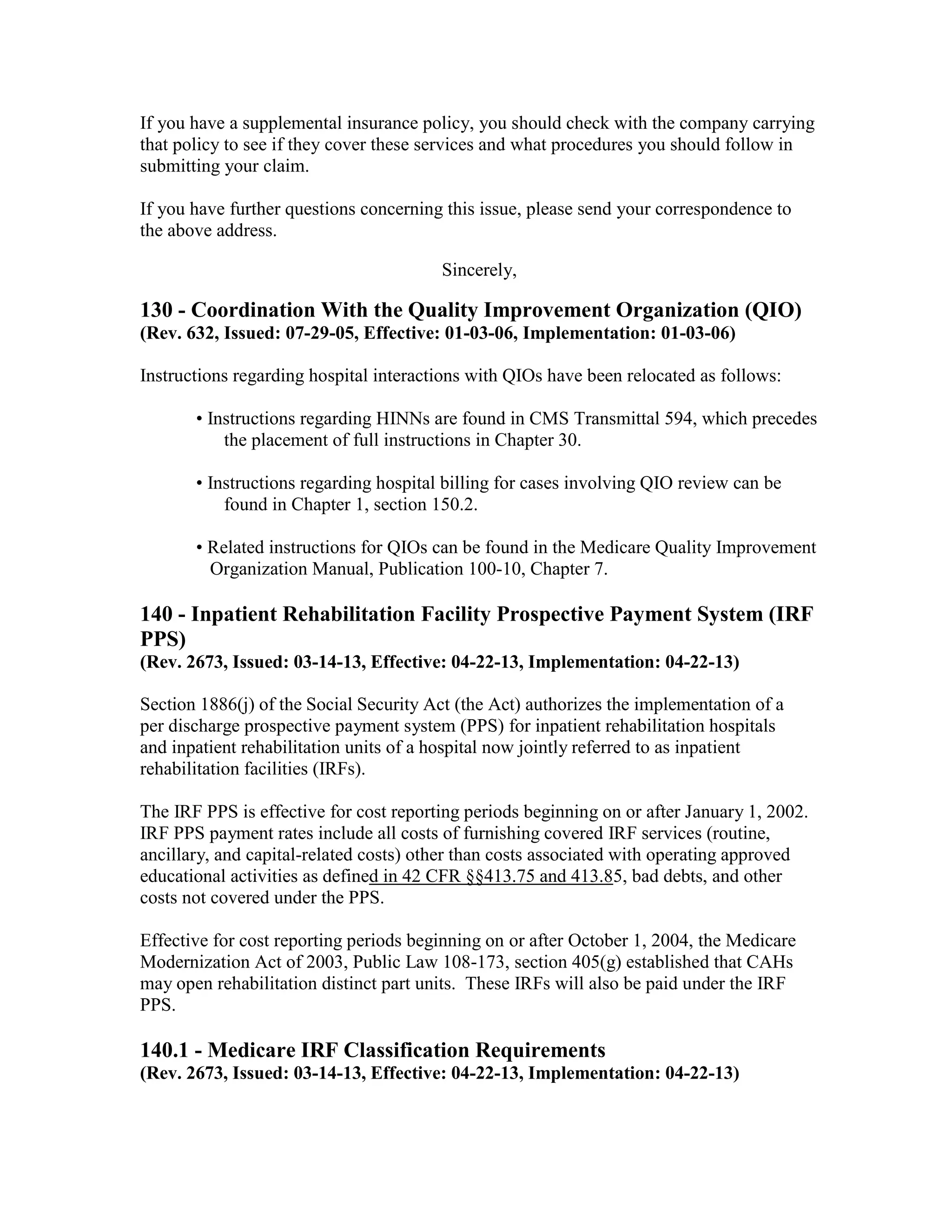

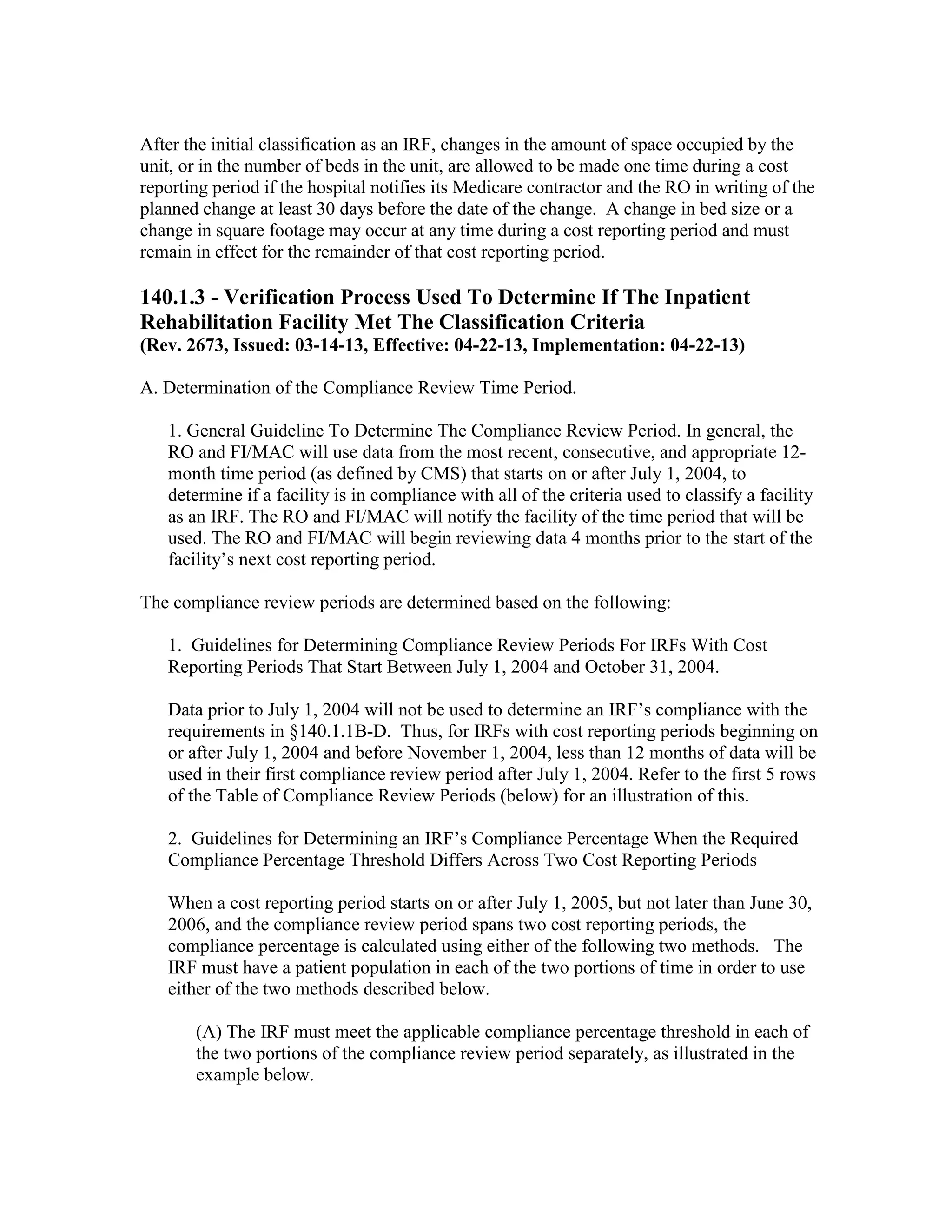

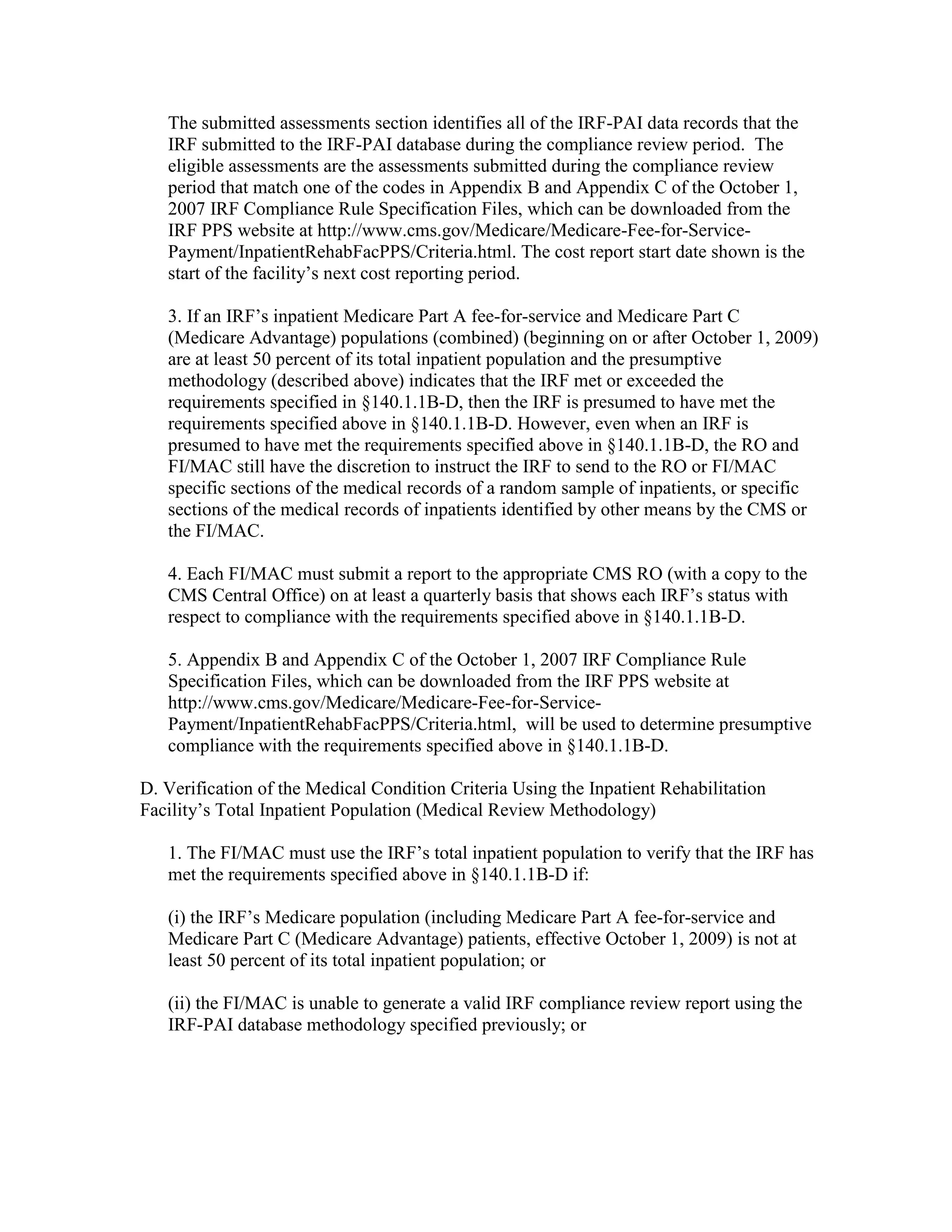

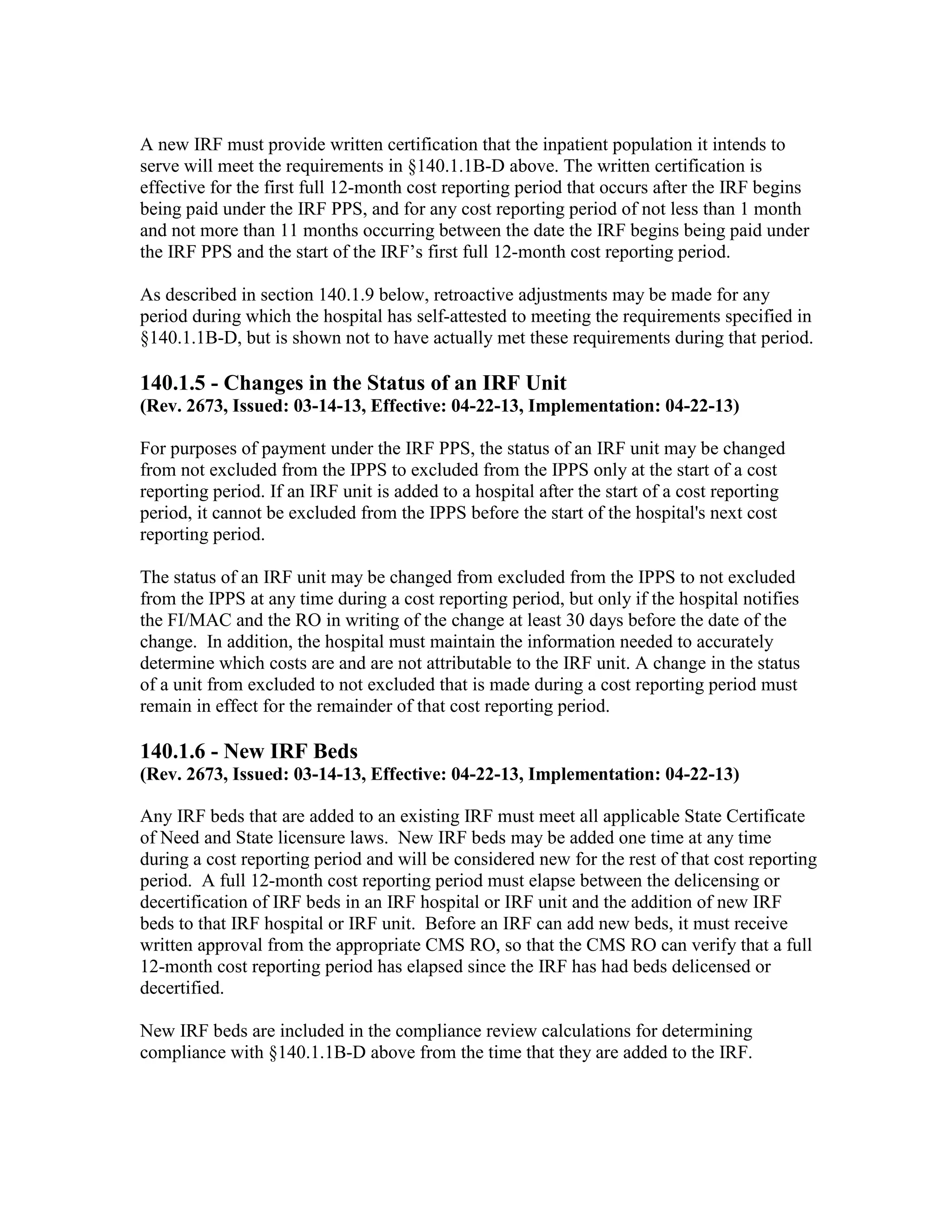

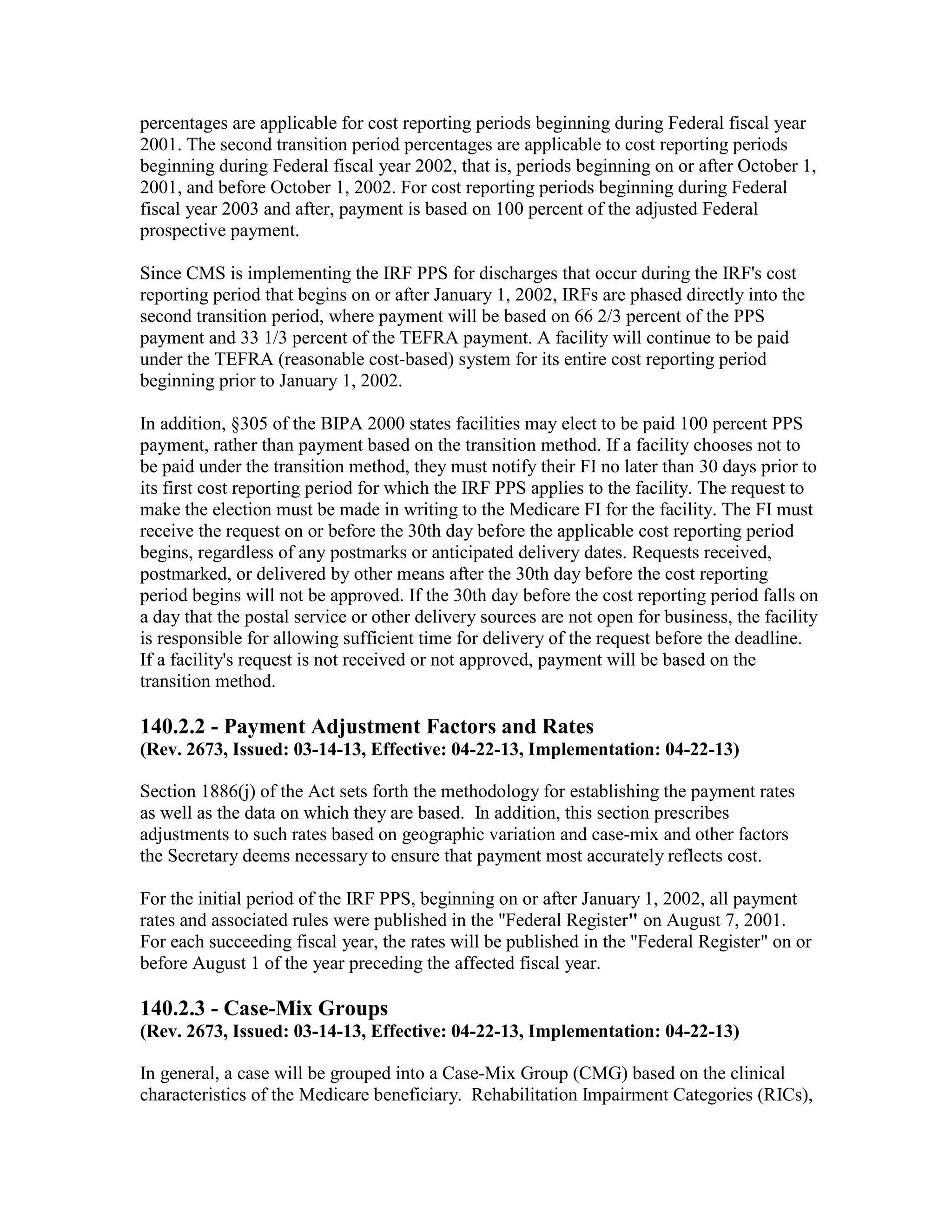

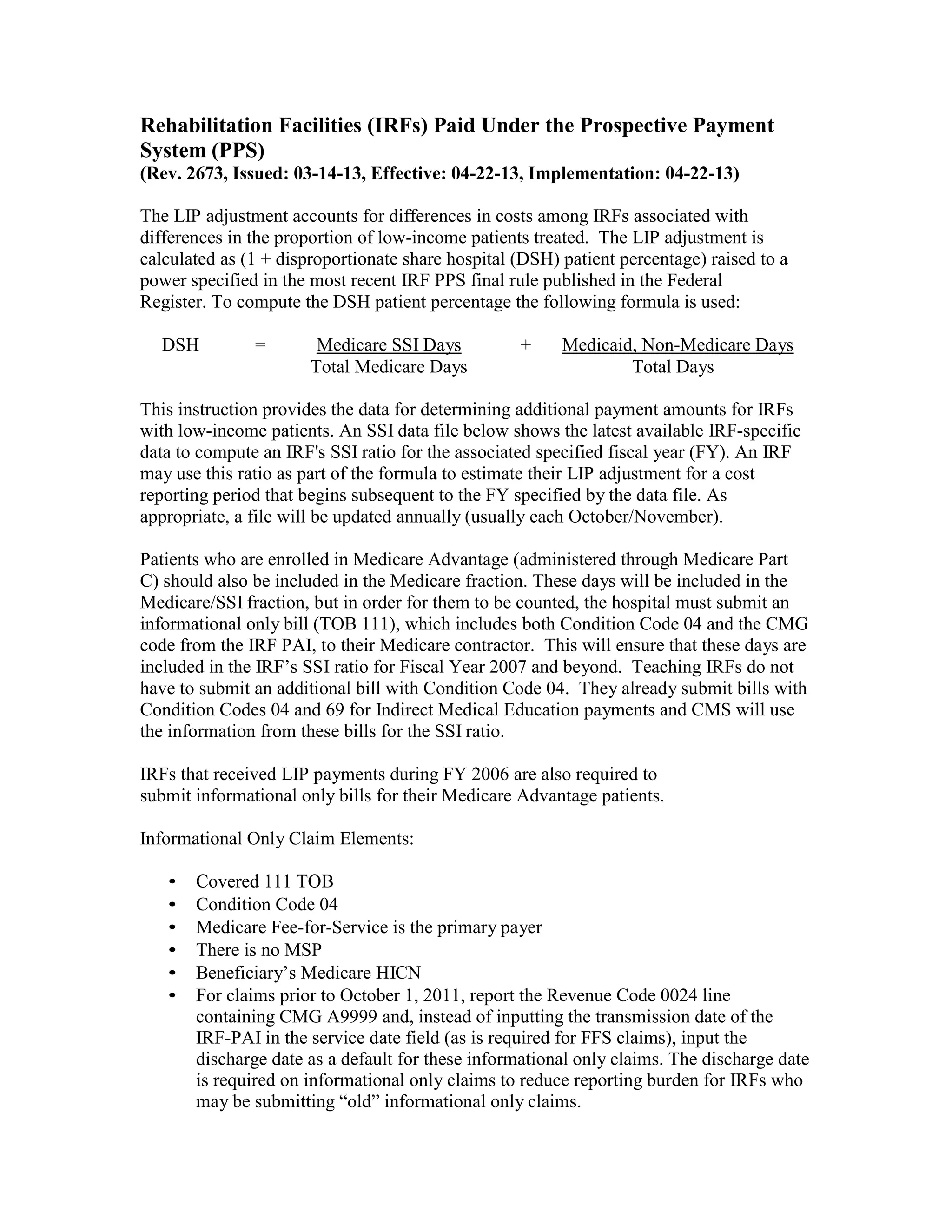

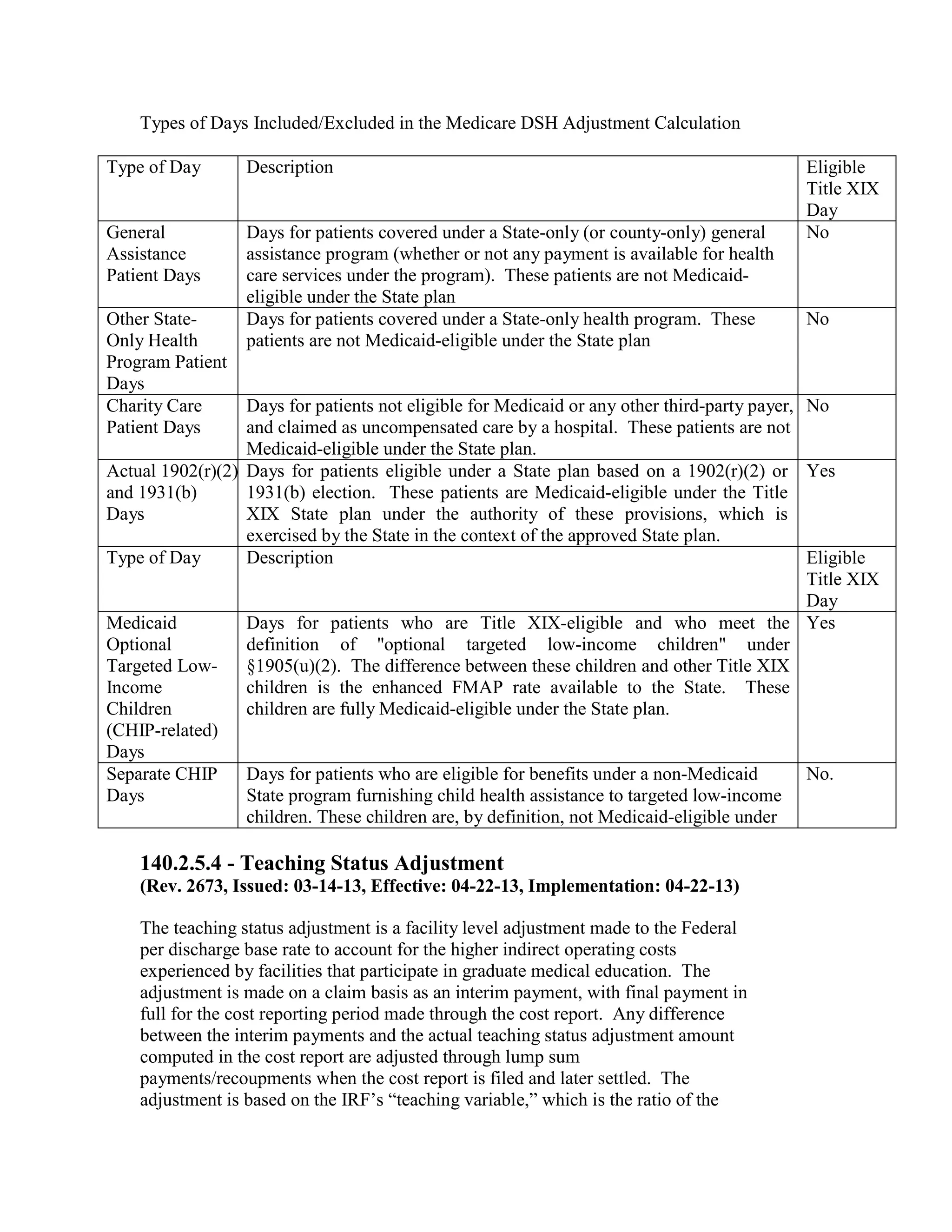

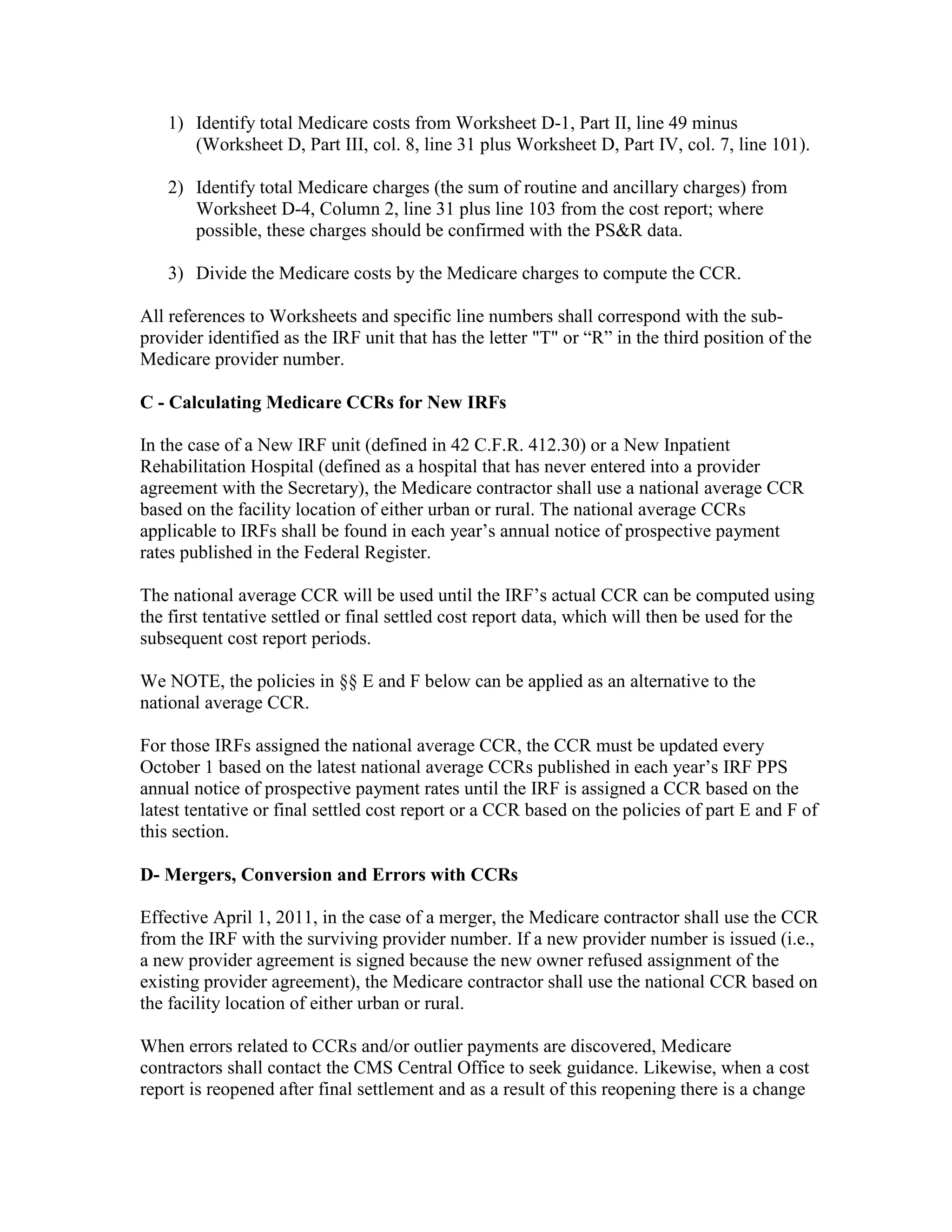

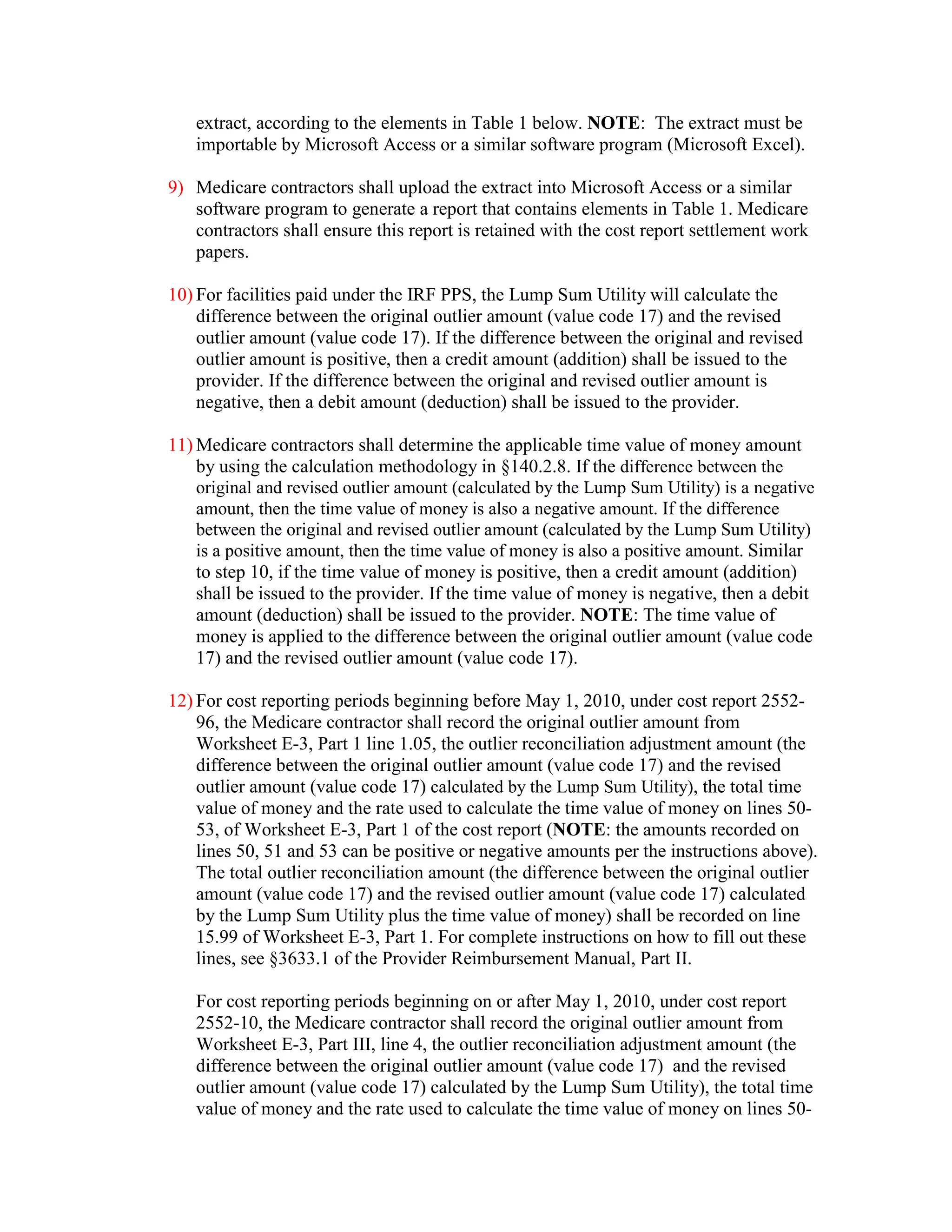

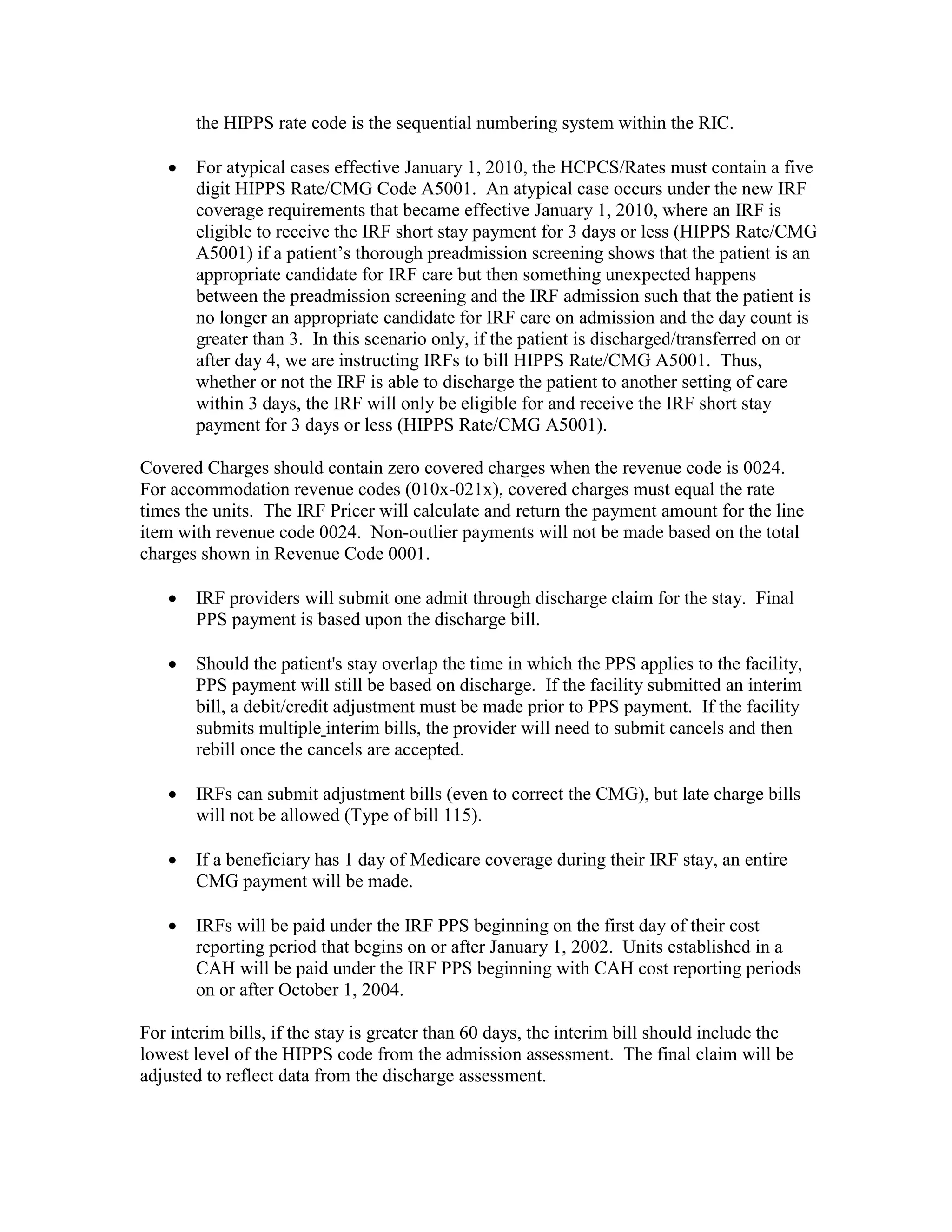

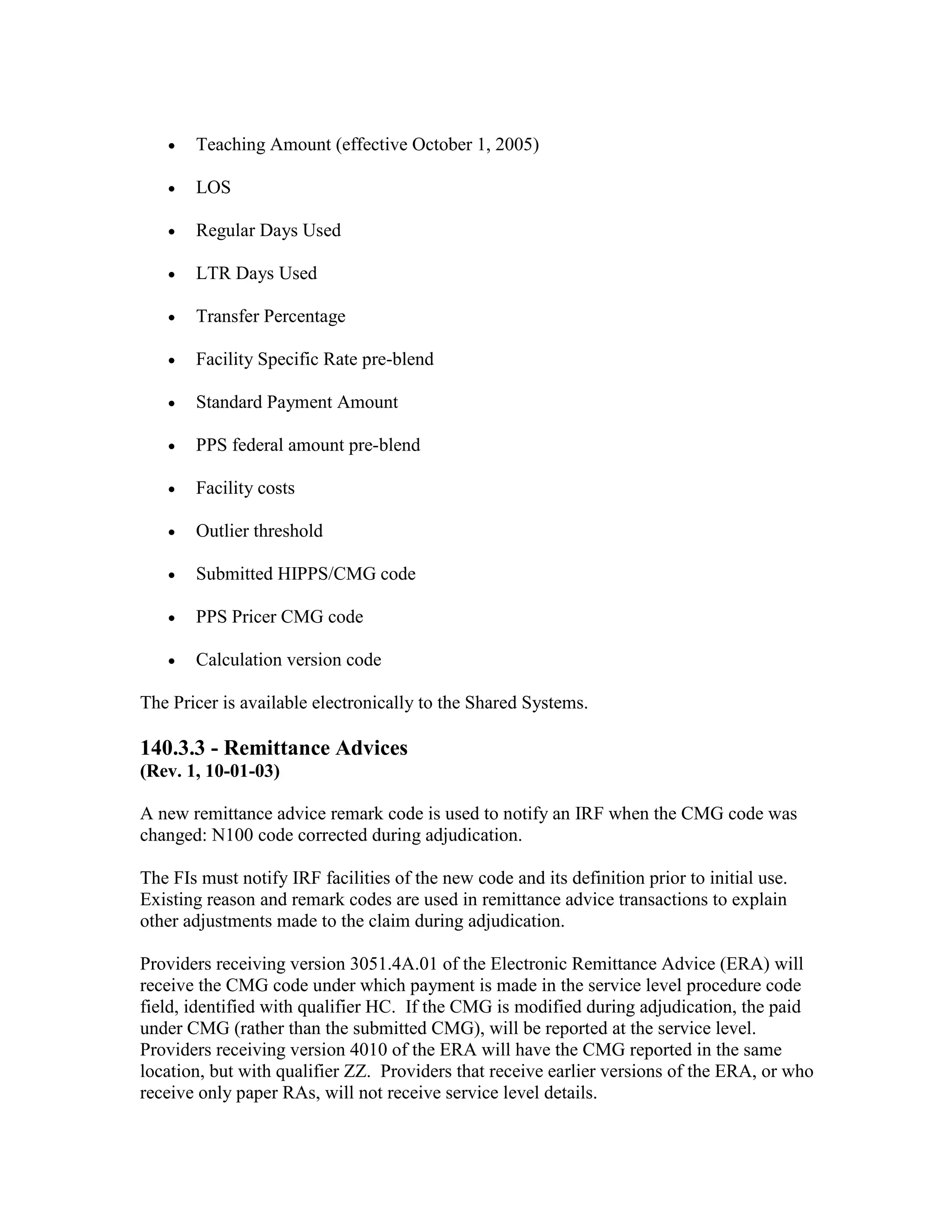

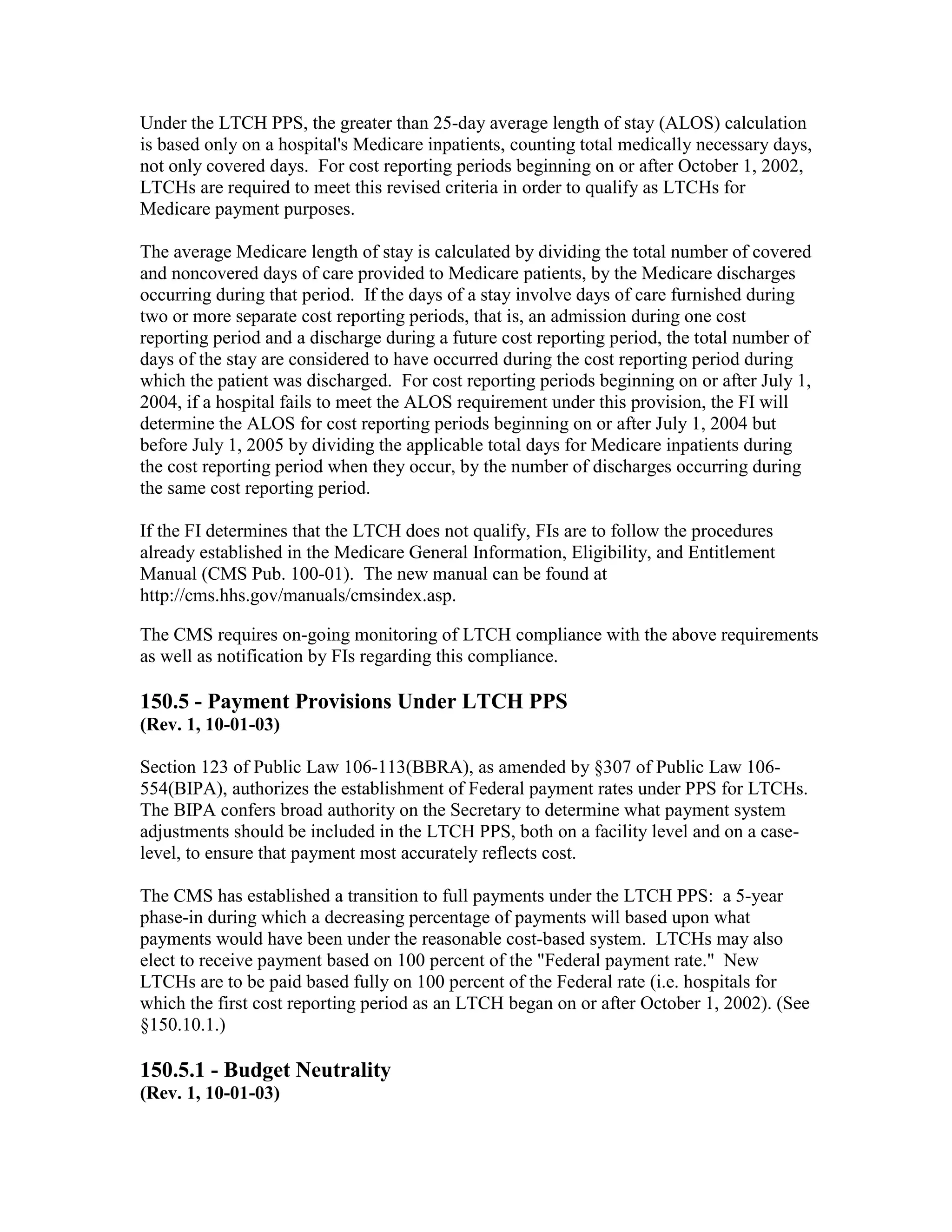

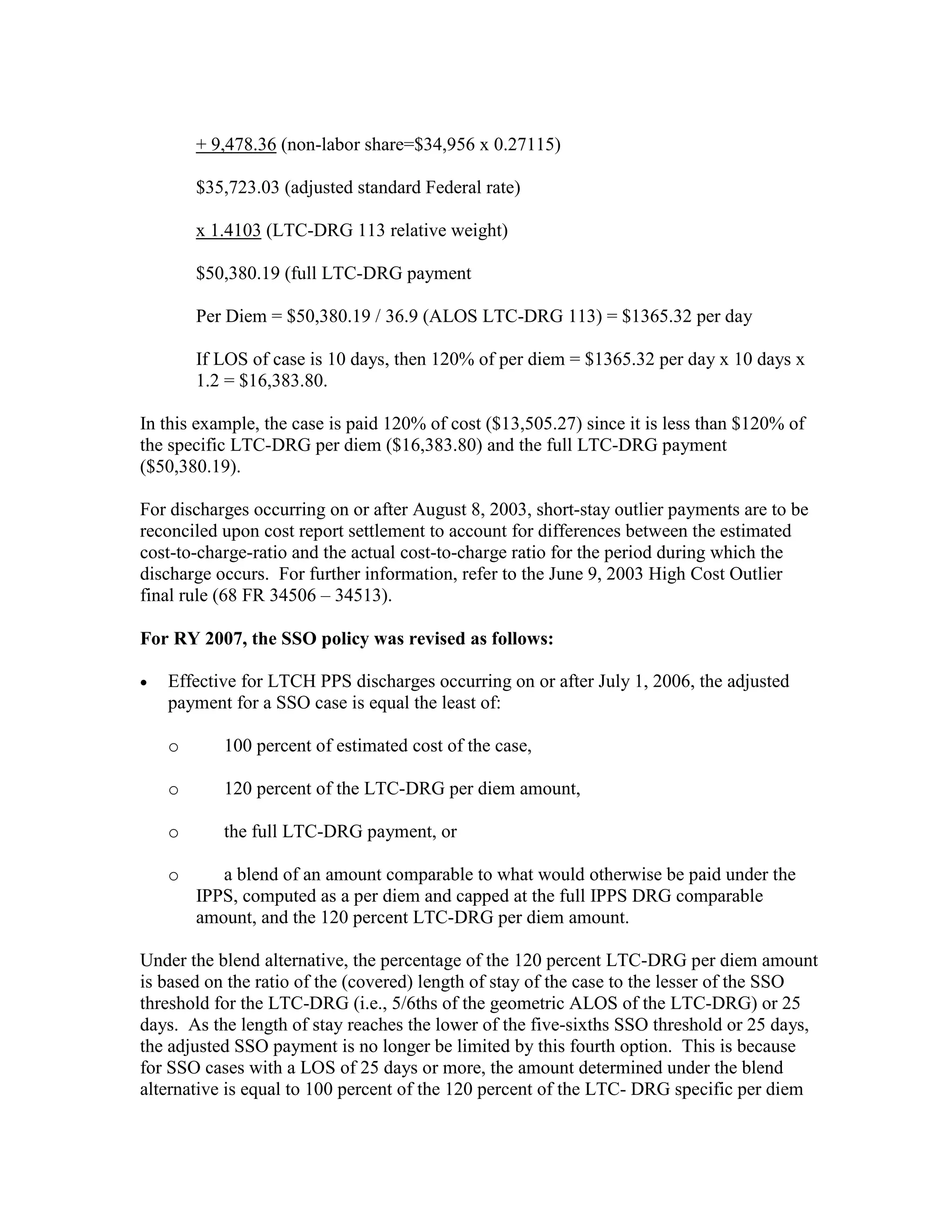

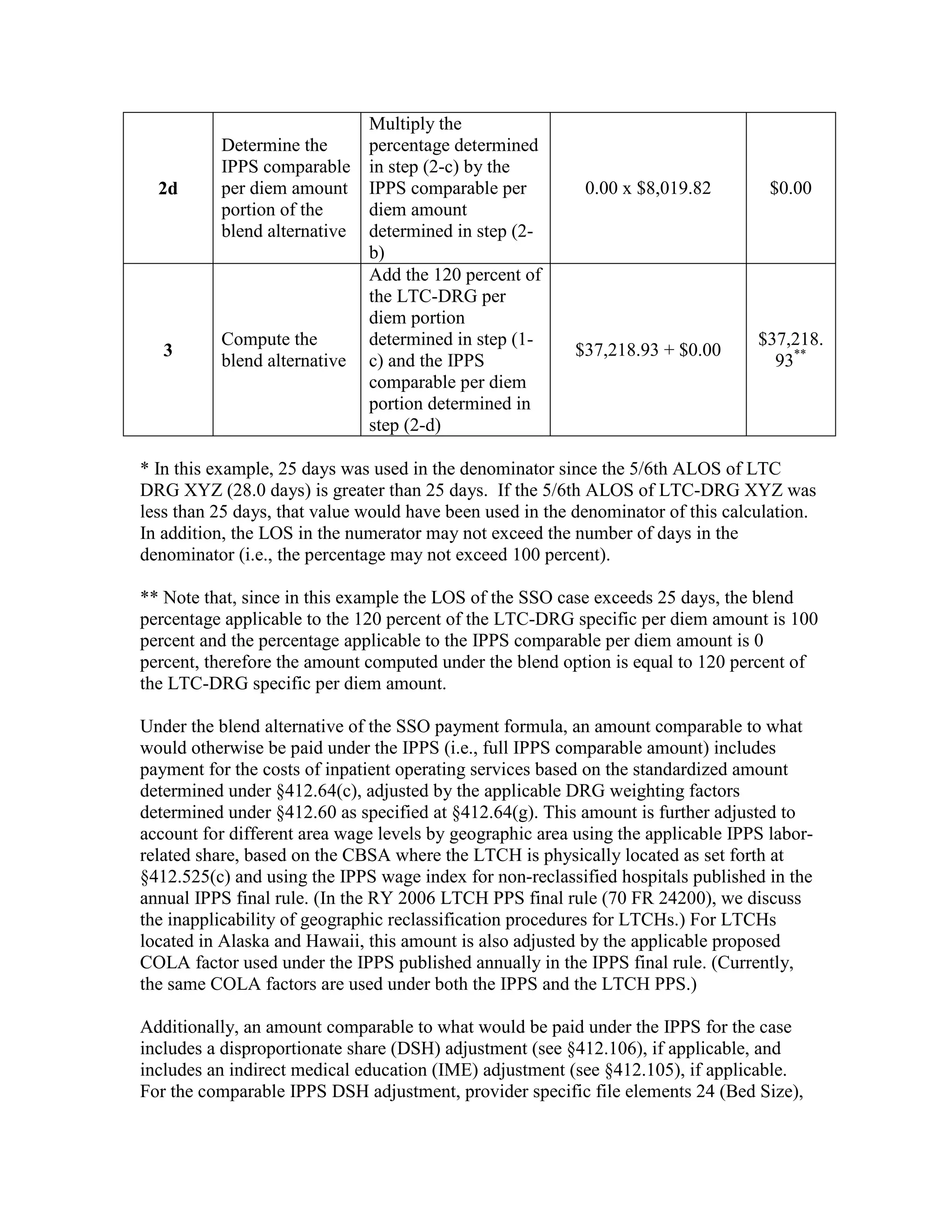

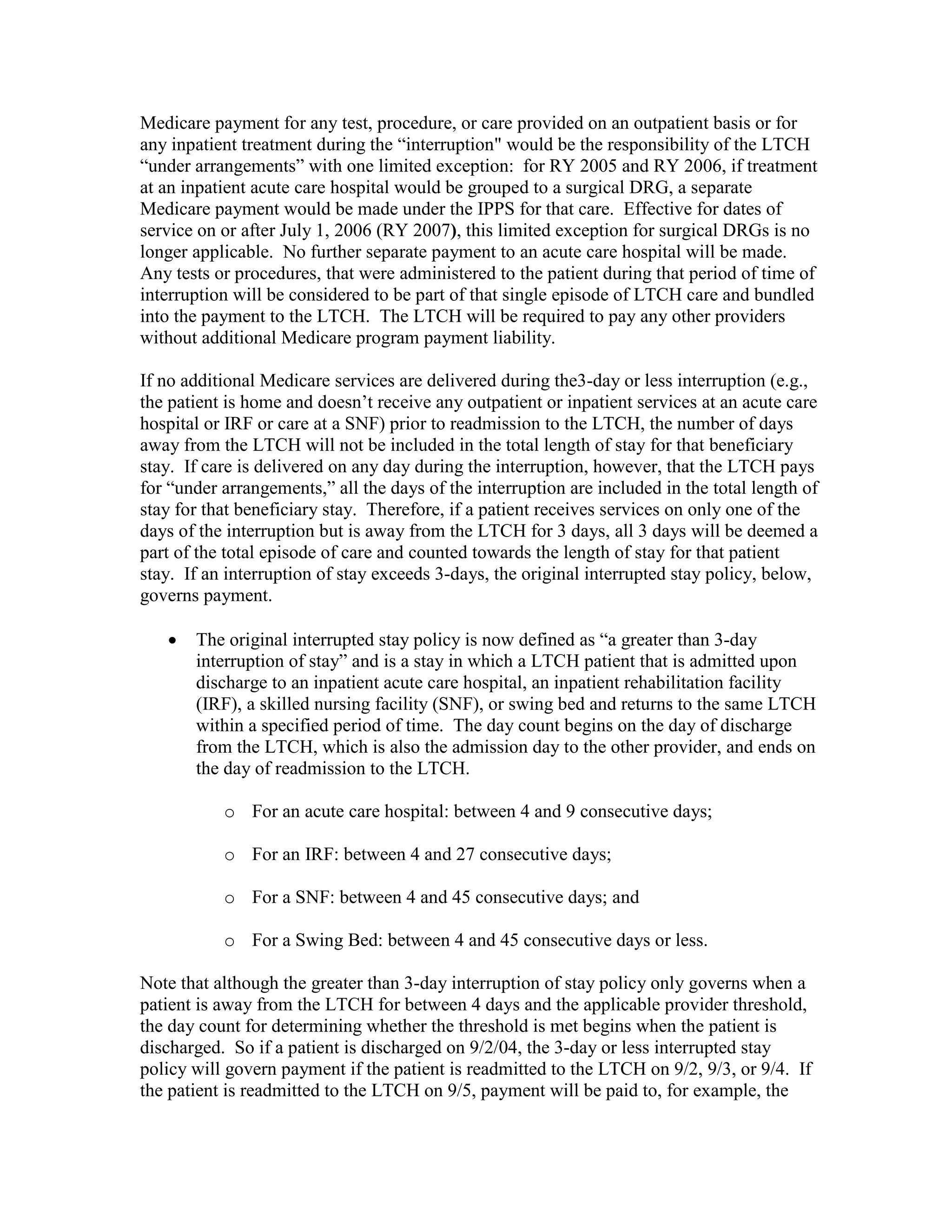

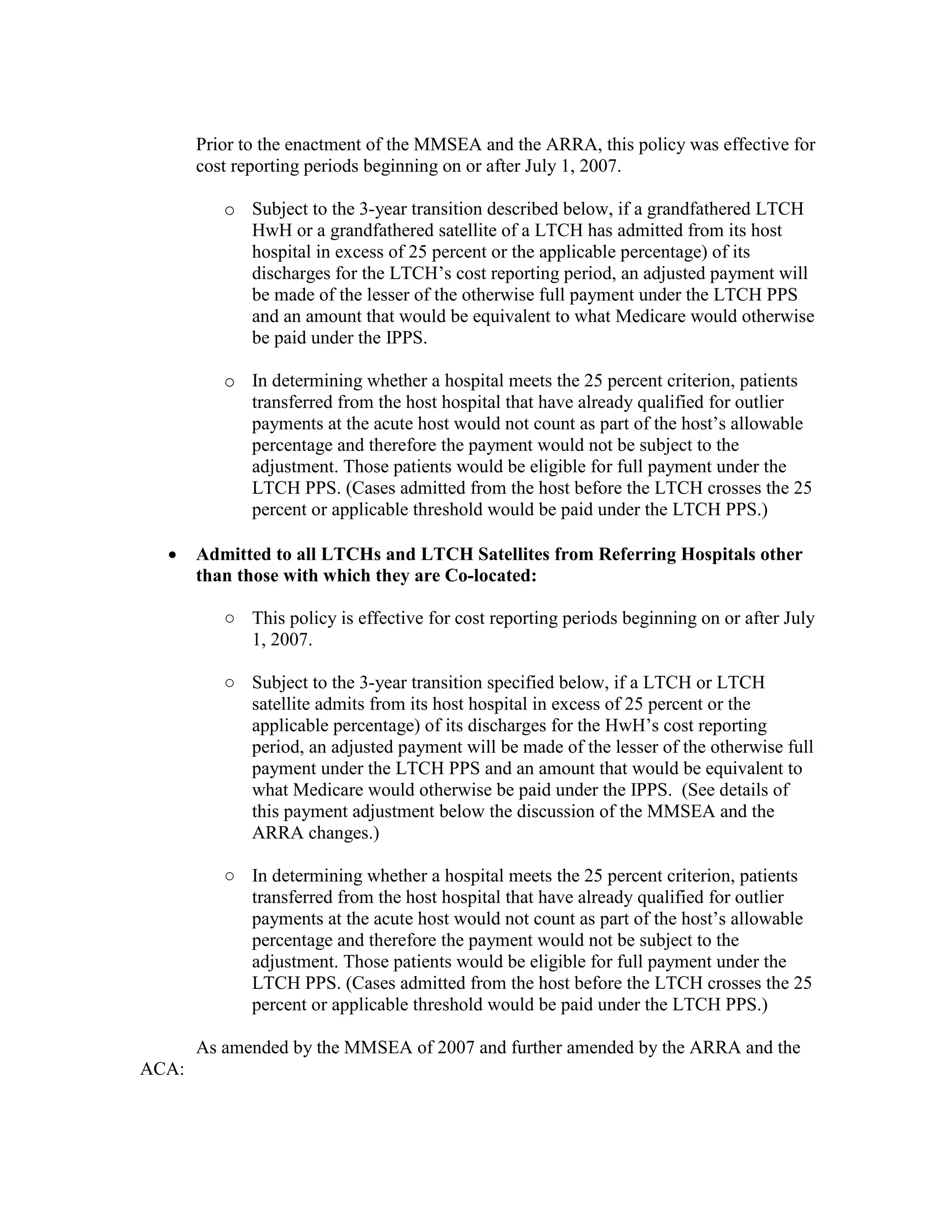

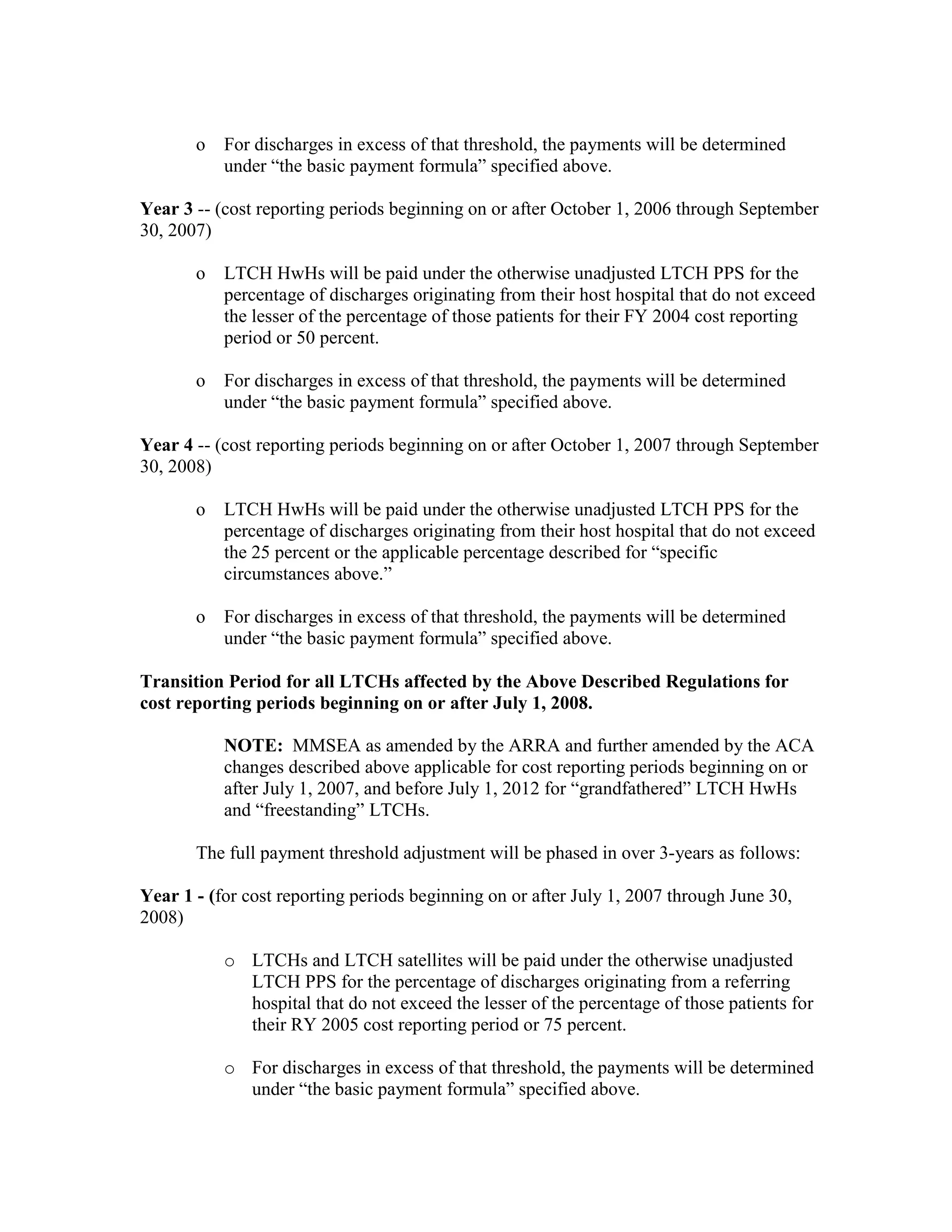

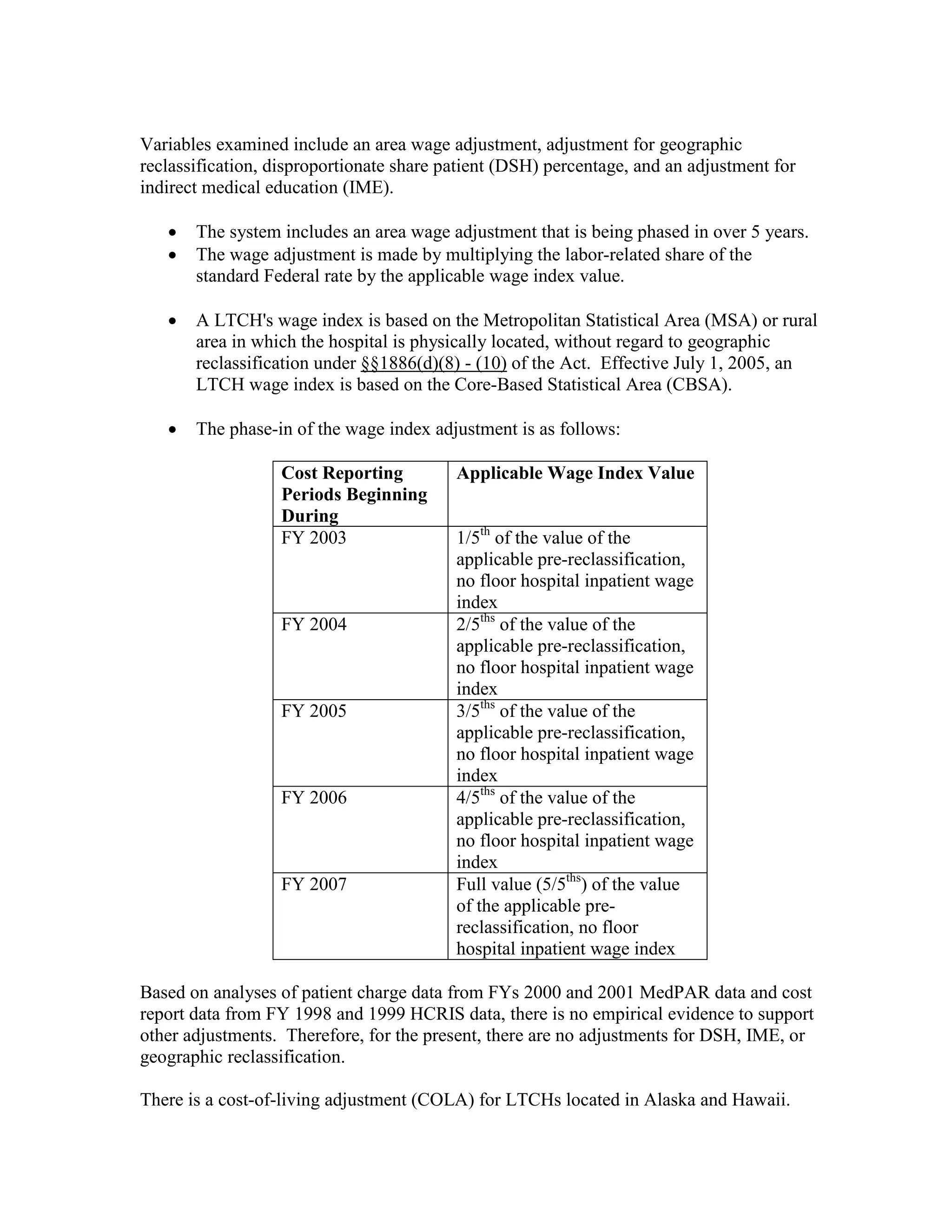

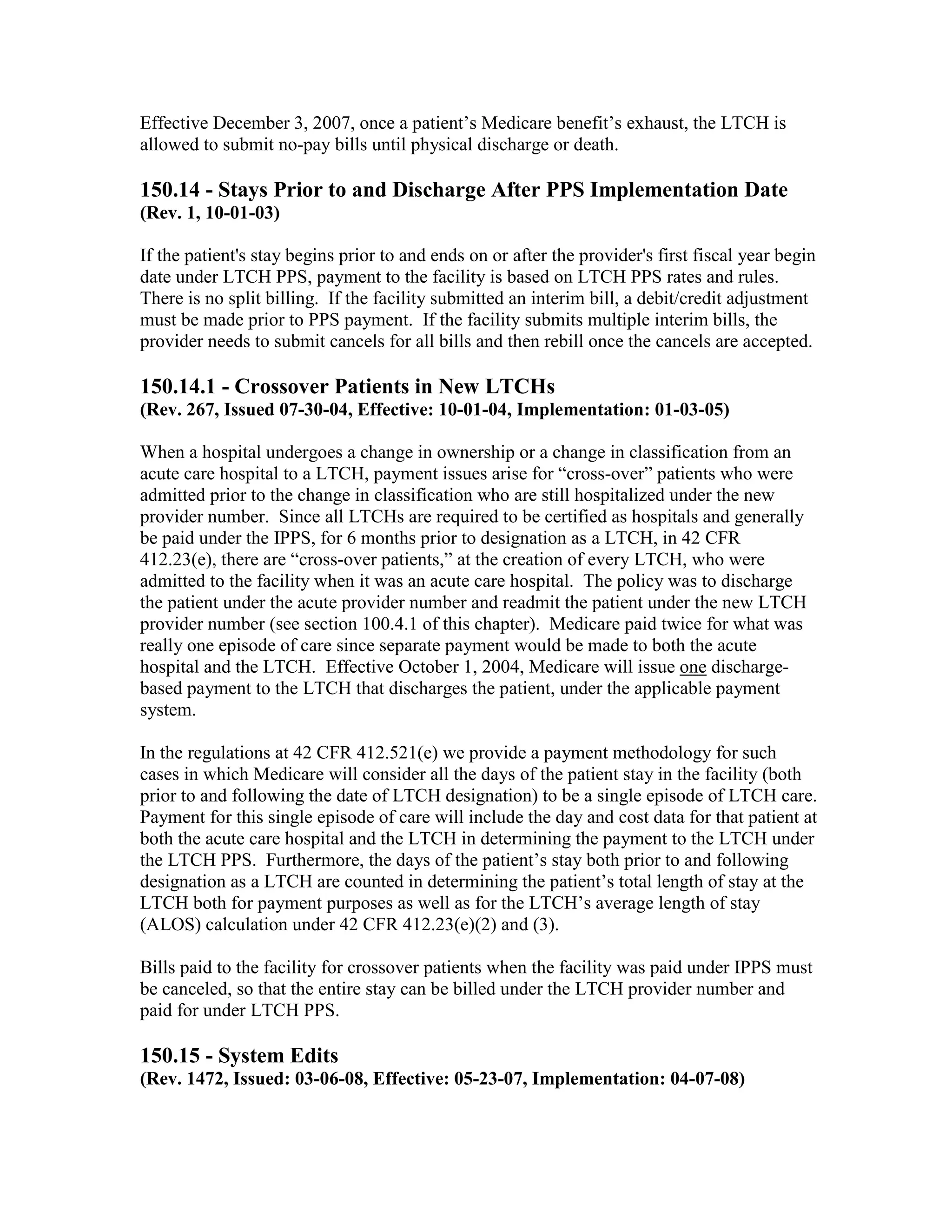

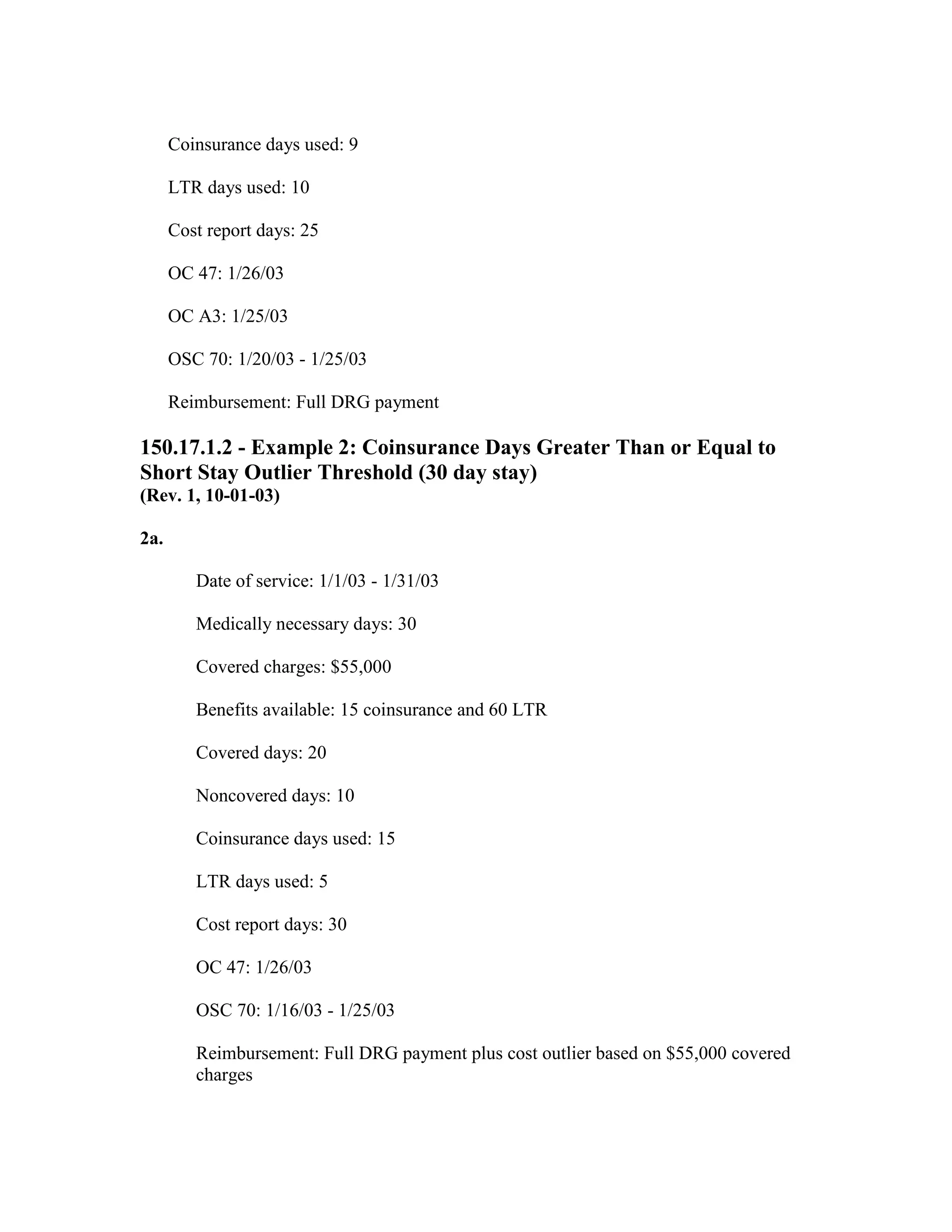

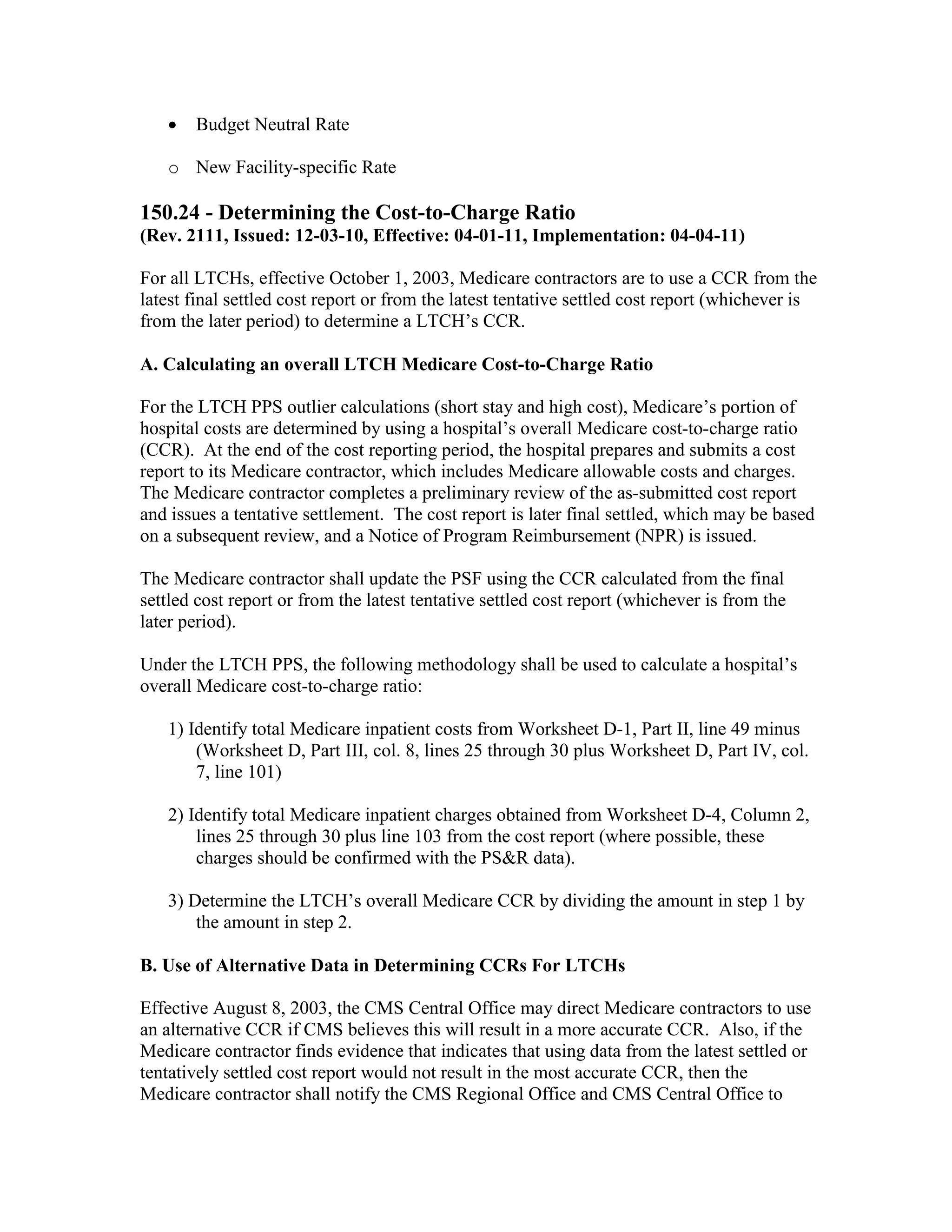

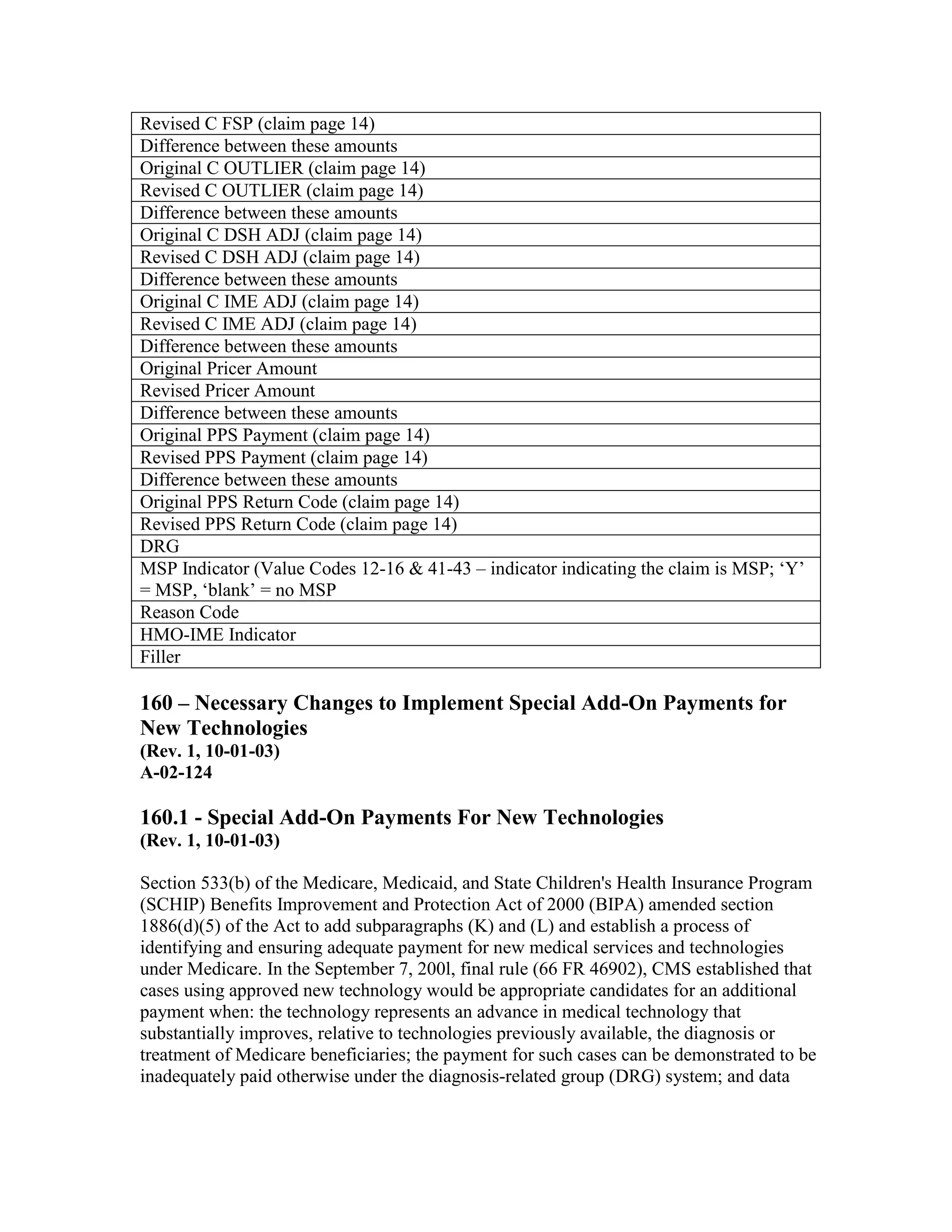

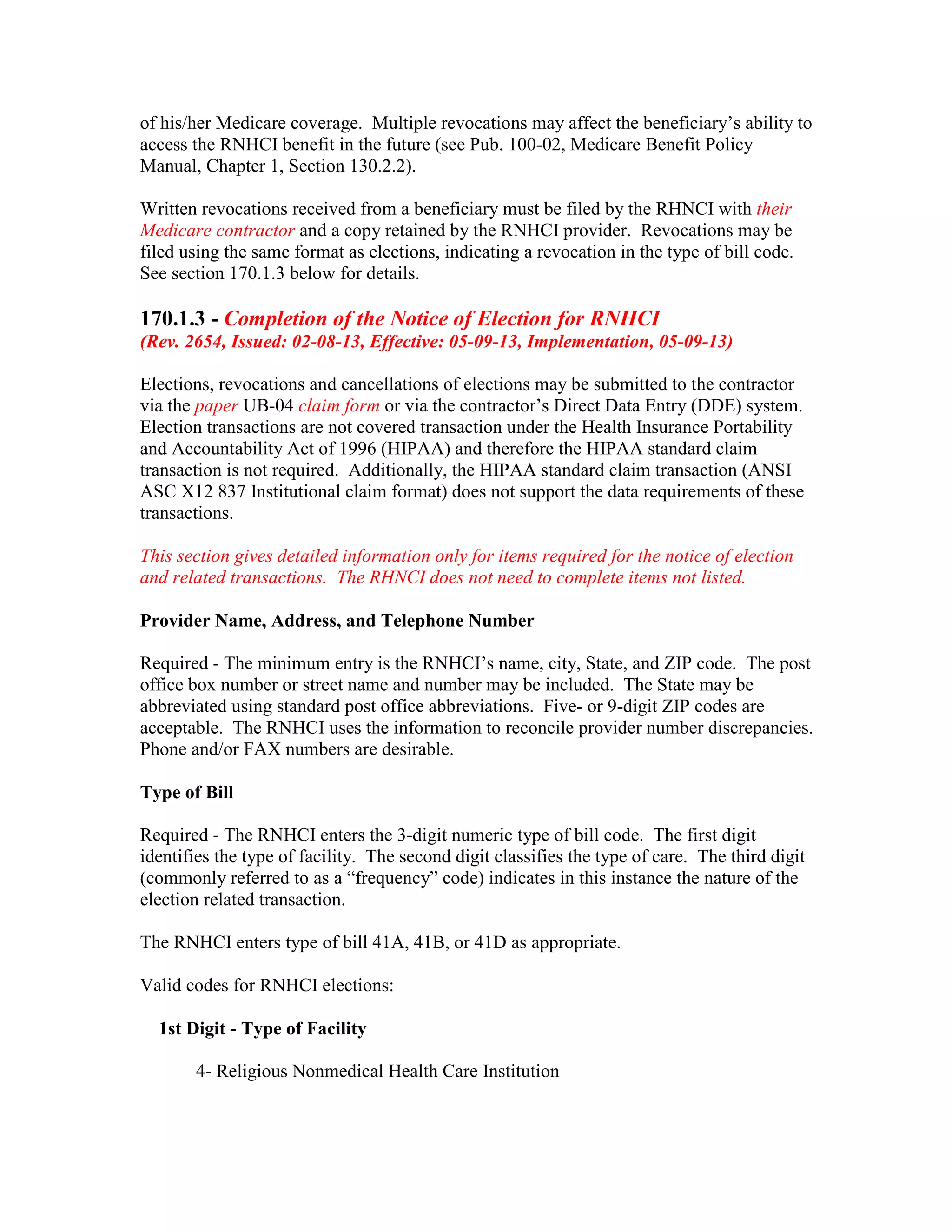

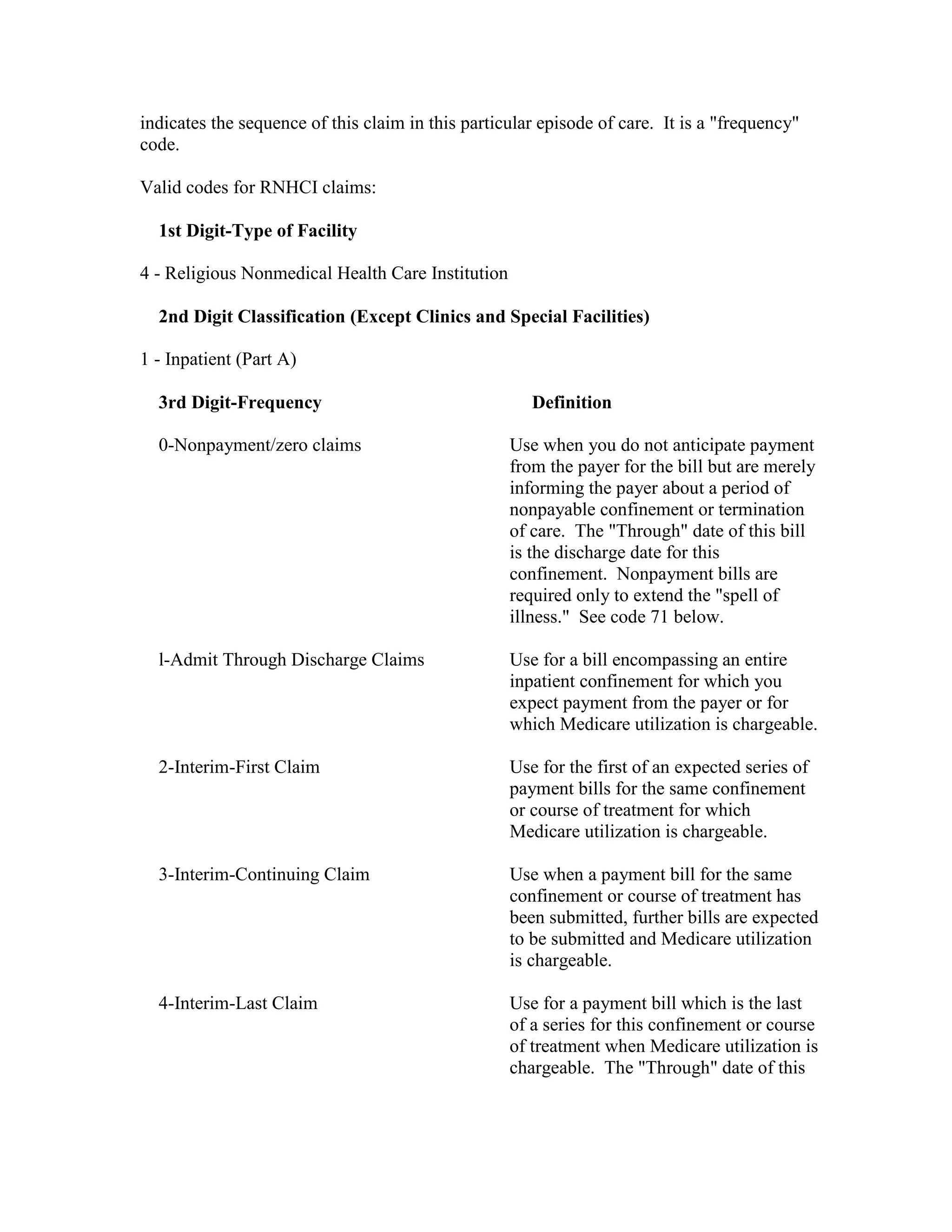

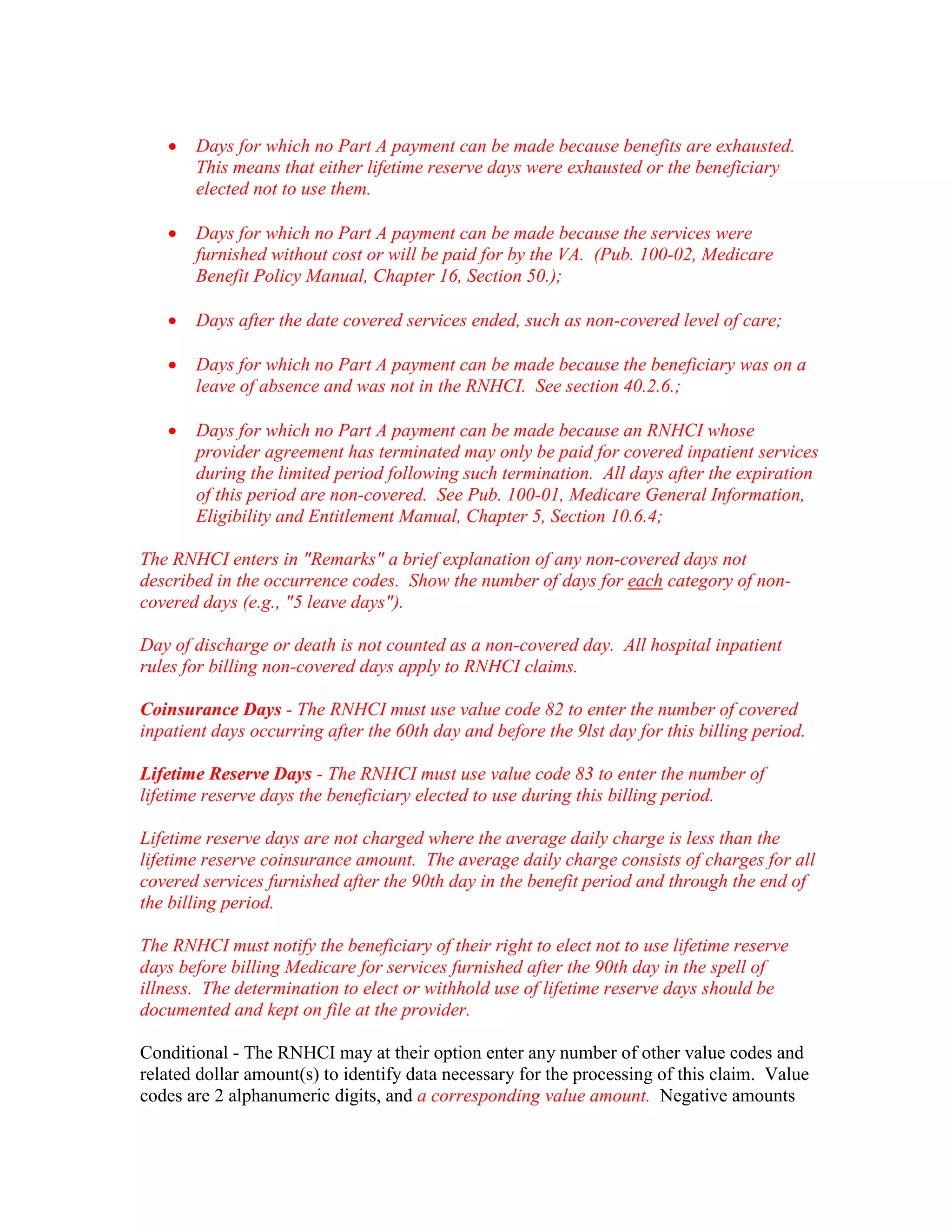

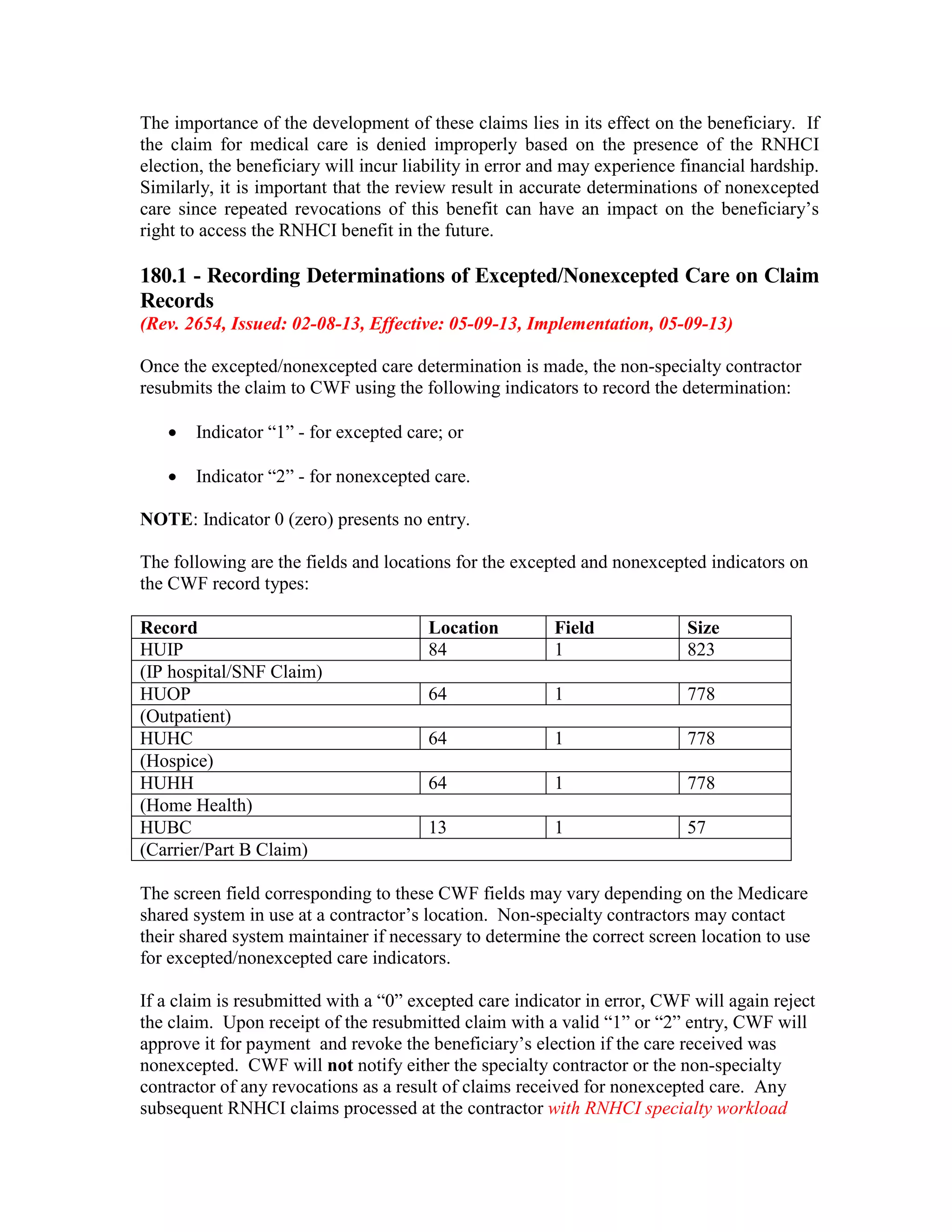

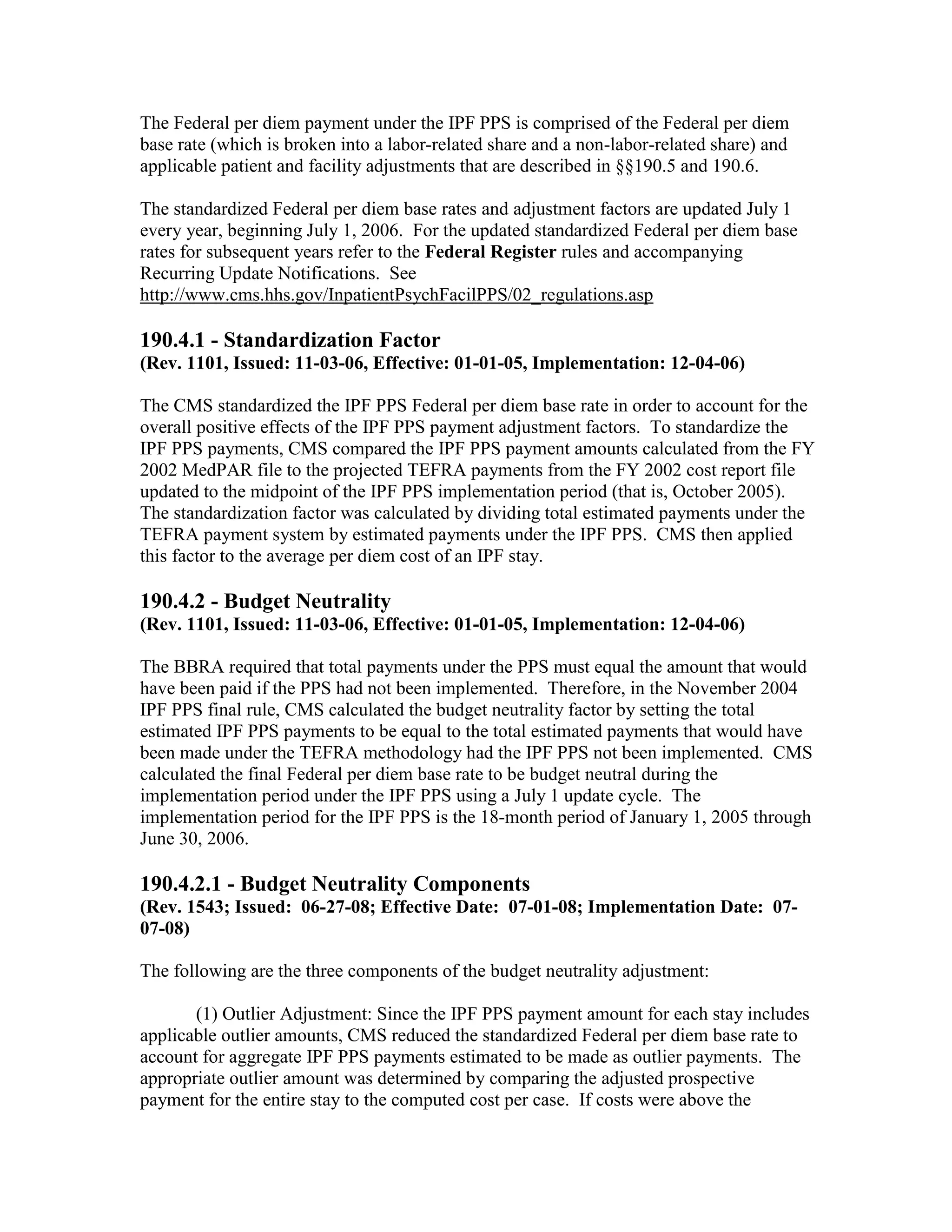

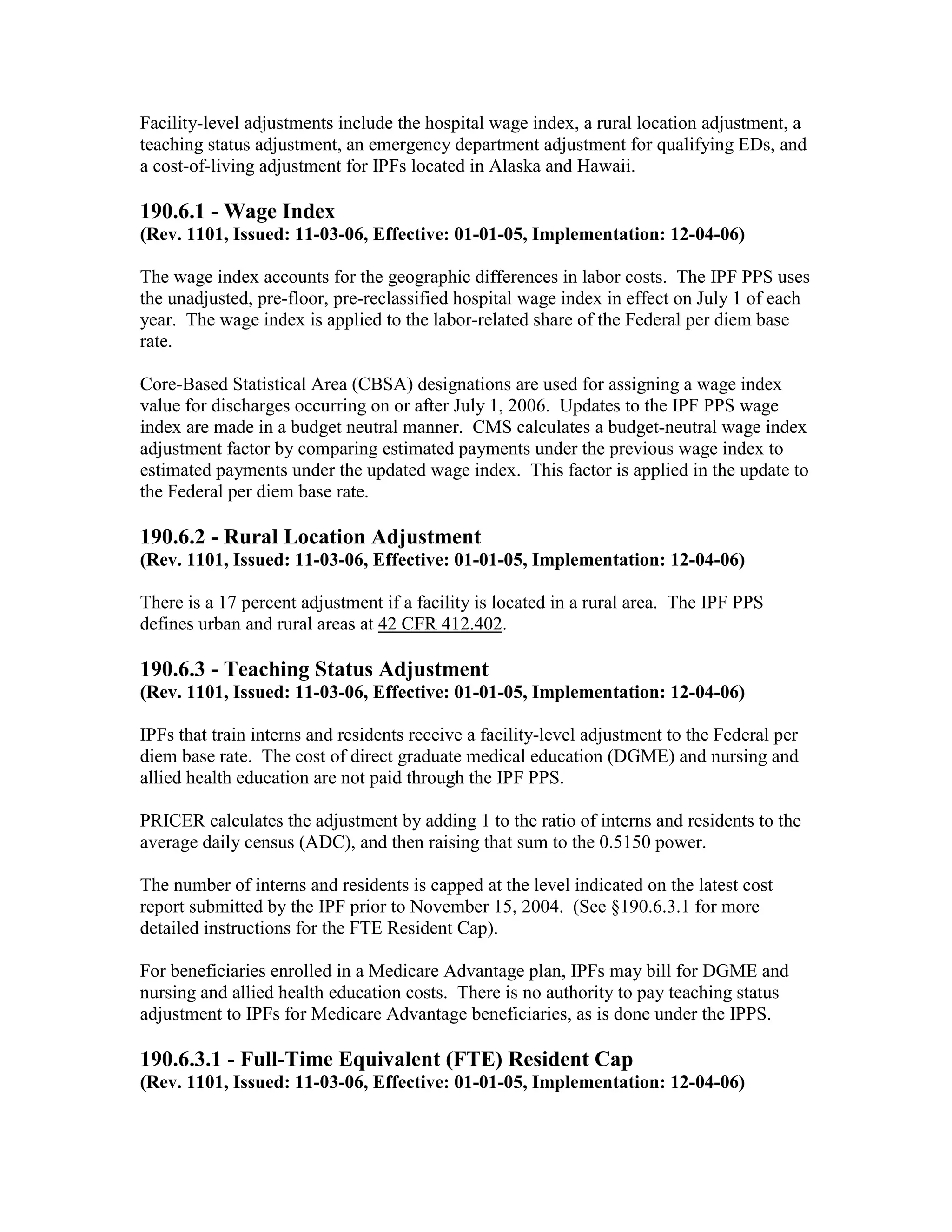

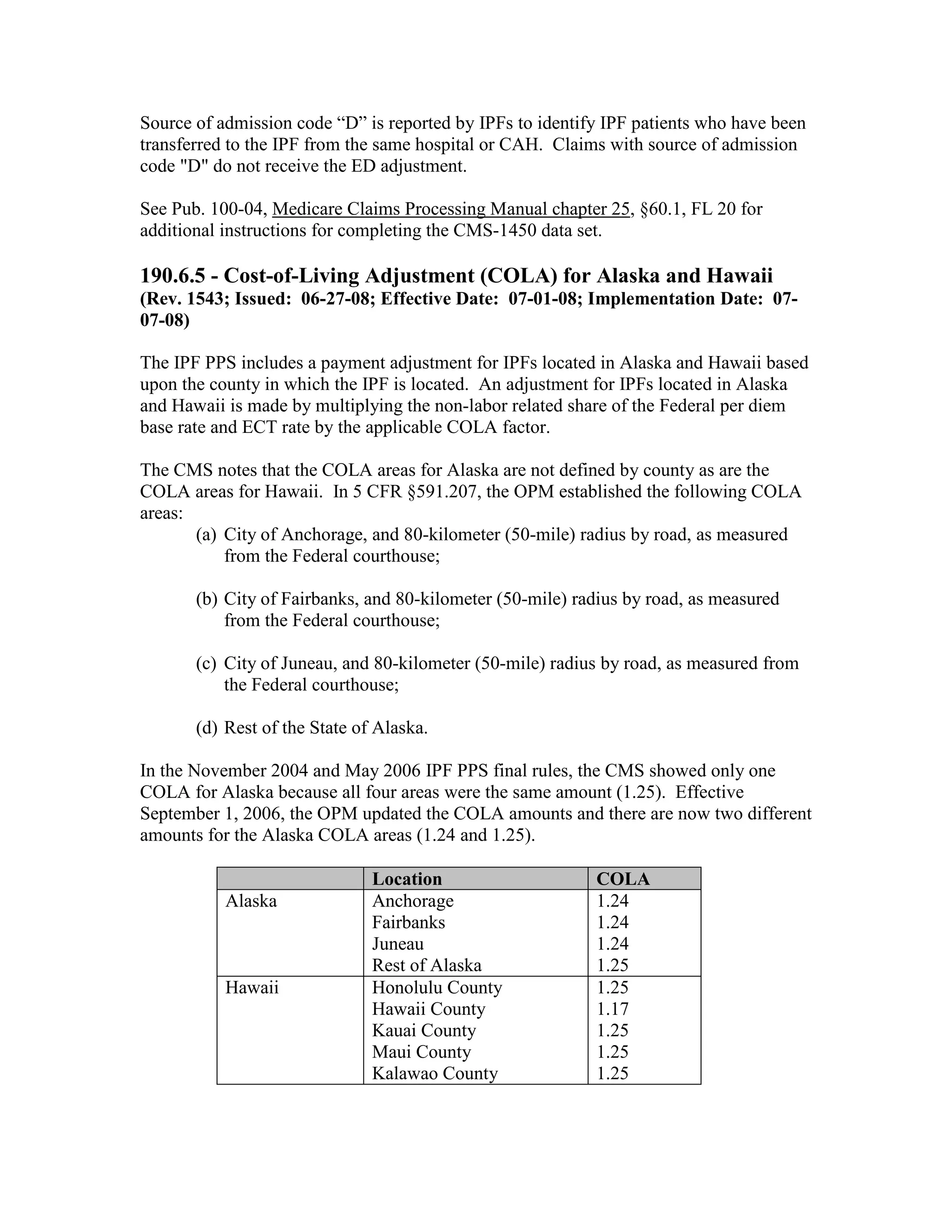

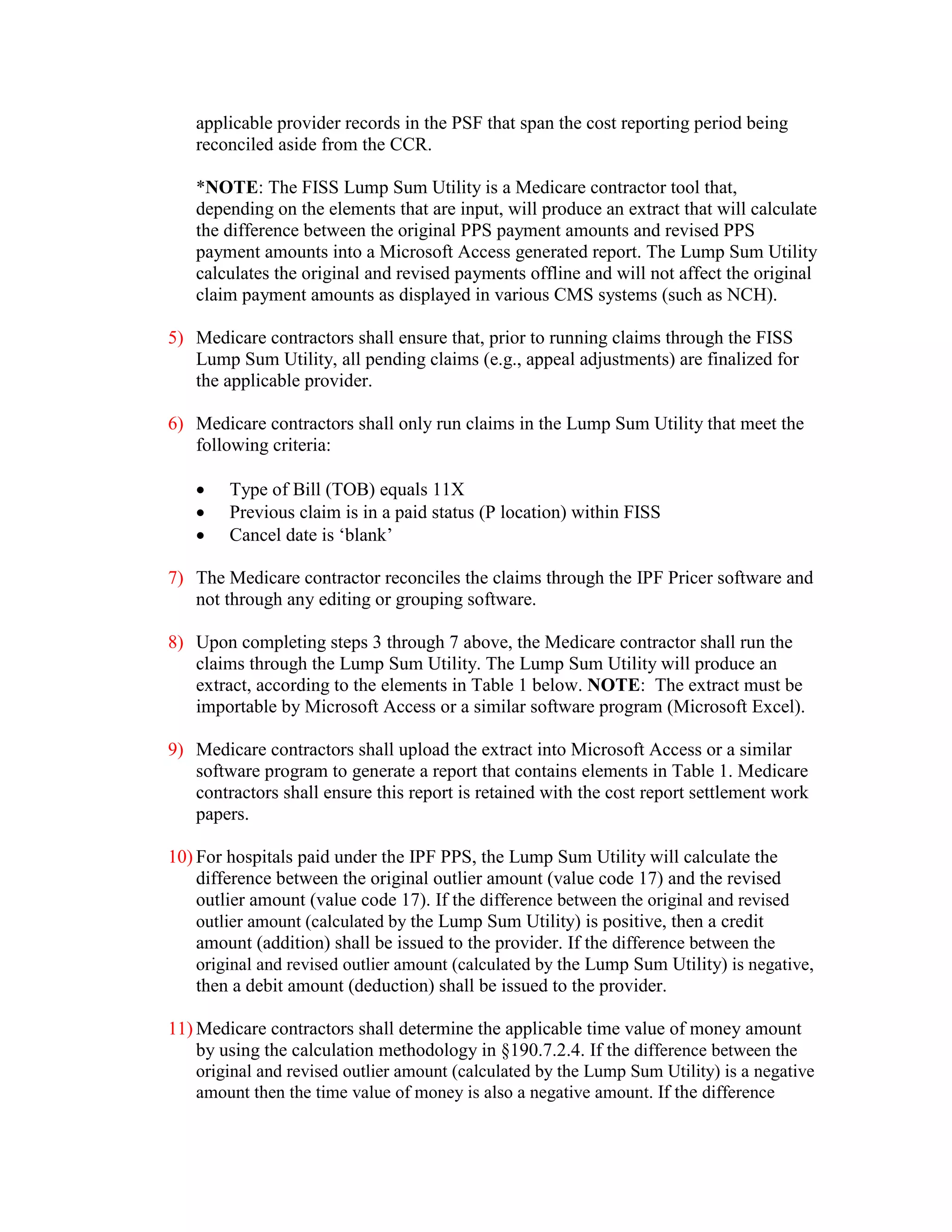

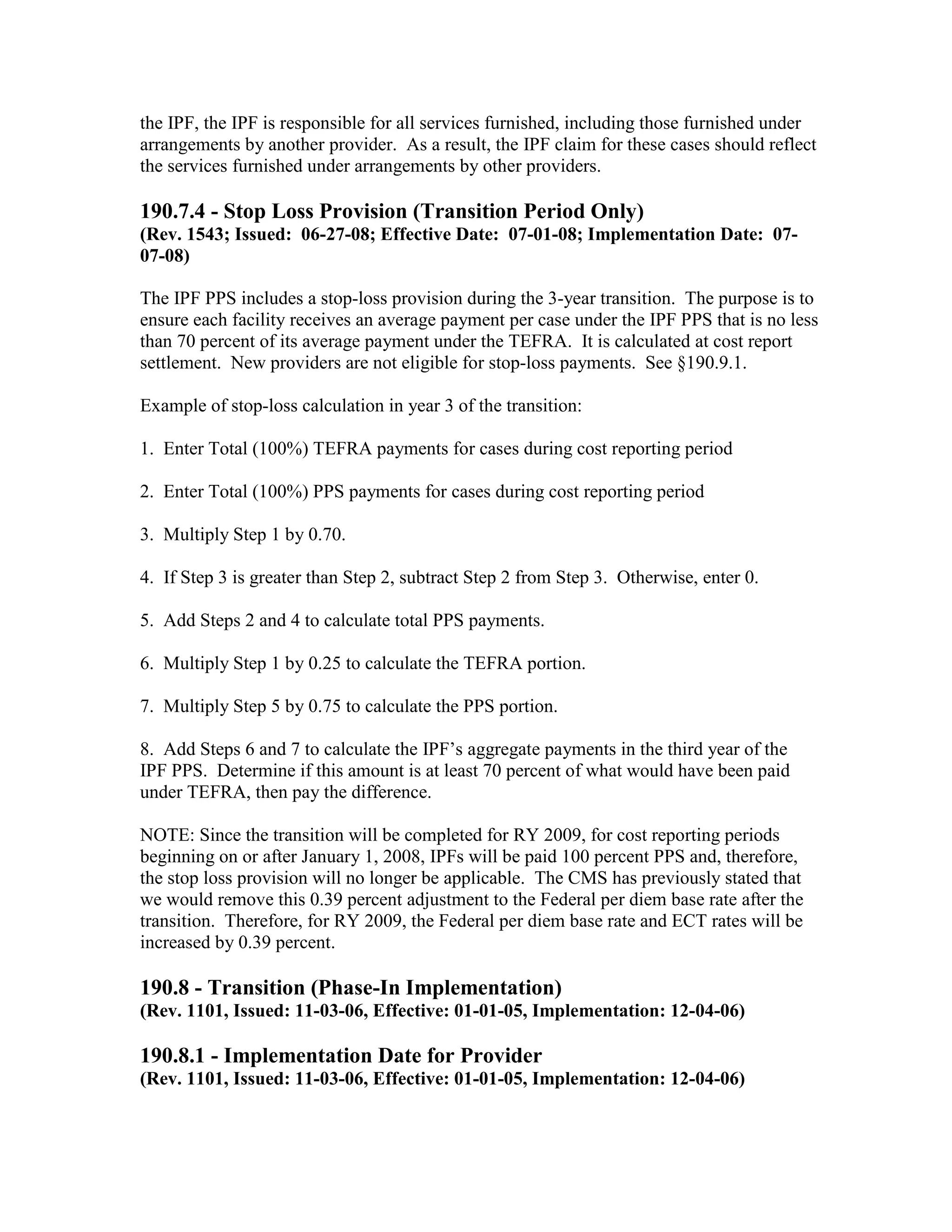

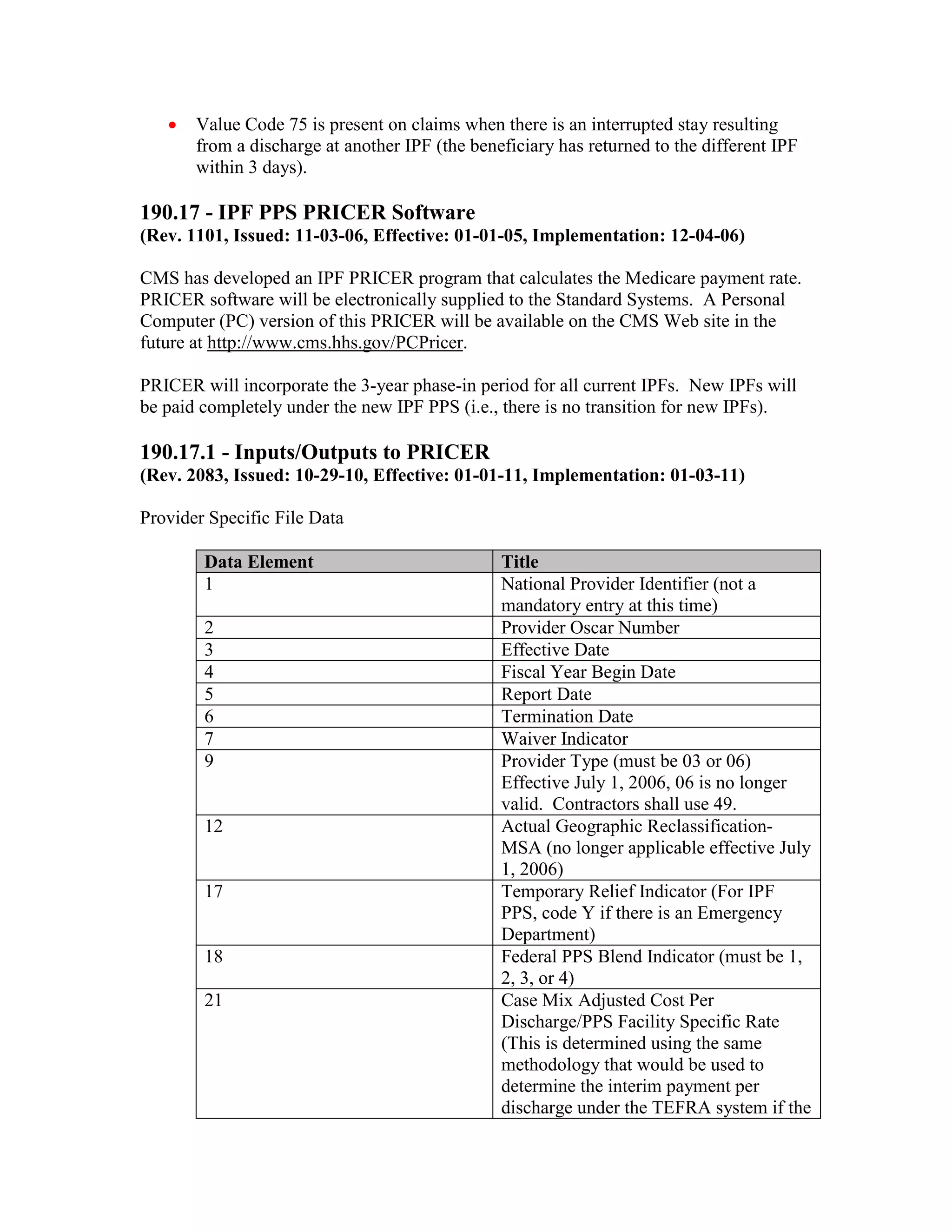

![National Labor Rate

Blend Year Calculation Version

200 - Electronic Health Record (EHR) Incentive Payments

(Rev. 2066, Issued: 10-15-10, Effective: 10-01-10, Implementation: 01-03-11)

The American Recovery and Reinvestment Act of 2009 (ARRA) (Pub. L. 111-5) provides

incentive payments for acute care hospitals (subsection (d) hospitals) and critical access

hospitals (CAHs) who are meaningful users of certified electronic health records (EHR)

technology.

200.1 – Payment Calculation

(Rev. 2066, Issued: 10-15-10, Effective: 10-01-10, Implementation: 01-03-11)

A - Incentive Payment Calculation for Subsection (d) Hospitals

[Initial Amount] x [Medicare Share] x [Transition Factor]

•

Initial Amount equals $2,000,000 + [$200 per discharge for the 1,150th – 23,000th

discharge]

•

Medicare Share equals Medicare/(Total*Charges), whereas:

o Medicare equals [number of Inpatient Bed Days for Part A Beneficiaries]

plus [number of Inpatient Bed Days for MA Beneficiaries]

o Total equals [number of Total Inpatient Bed Days]

o Charges equals [Total Charges minus Charges for Charity Care*] divided

by [Total Charges]

•

Transition Factor

Fiscal Year Fiscal Year that Eligible Hospital First Receives

the Incentive Payment

2011

2012

2013

2014

2011

1.00

2012

0.75

1.00

2013

0.50

0.75

1.00

2014

0.25

0.50

0.75

0.75

0.25

0.50

0.50

2015

2015

0.50](https://image.slidesharecdn.com/medicareclaimsprocessingmanual-131226001413-phpapp01/75/Medicare-claims-processing-manual-388-2048.jpg)