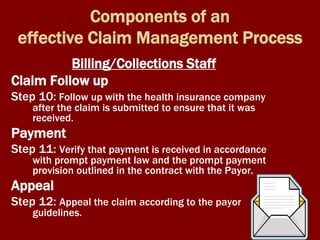

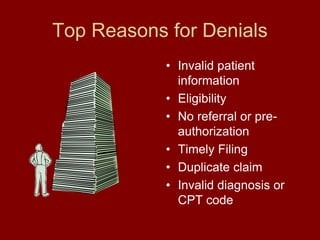

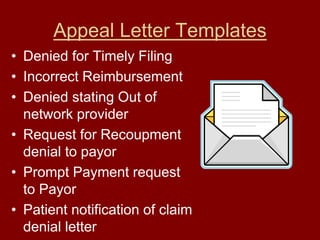

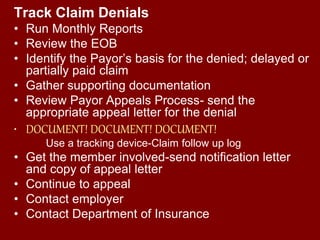

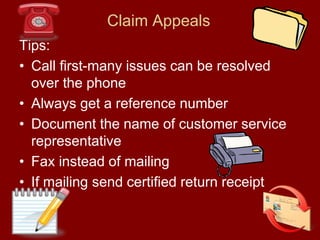

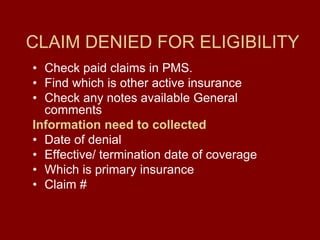

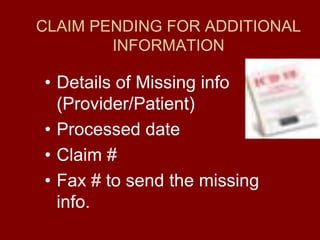

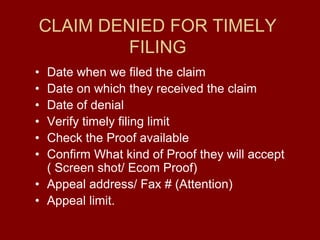

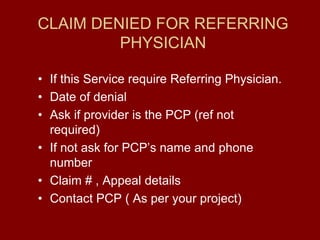

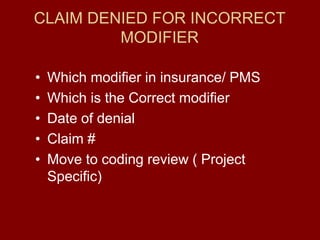

The document outlines the objectives and processes for effective denial management in claim processing, including identifying common reasons for denials and implementing a structured claim management process. Key components include patient registration, charge capture, claims processing, and appeals, with an emphasis on roles played by front office, clinical, and billing staff. It also provides tools and strategies for tracking claim denials and ensuring timely resolution through appeals and communication with insurance payors.