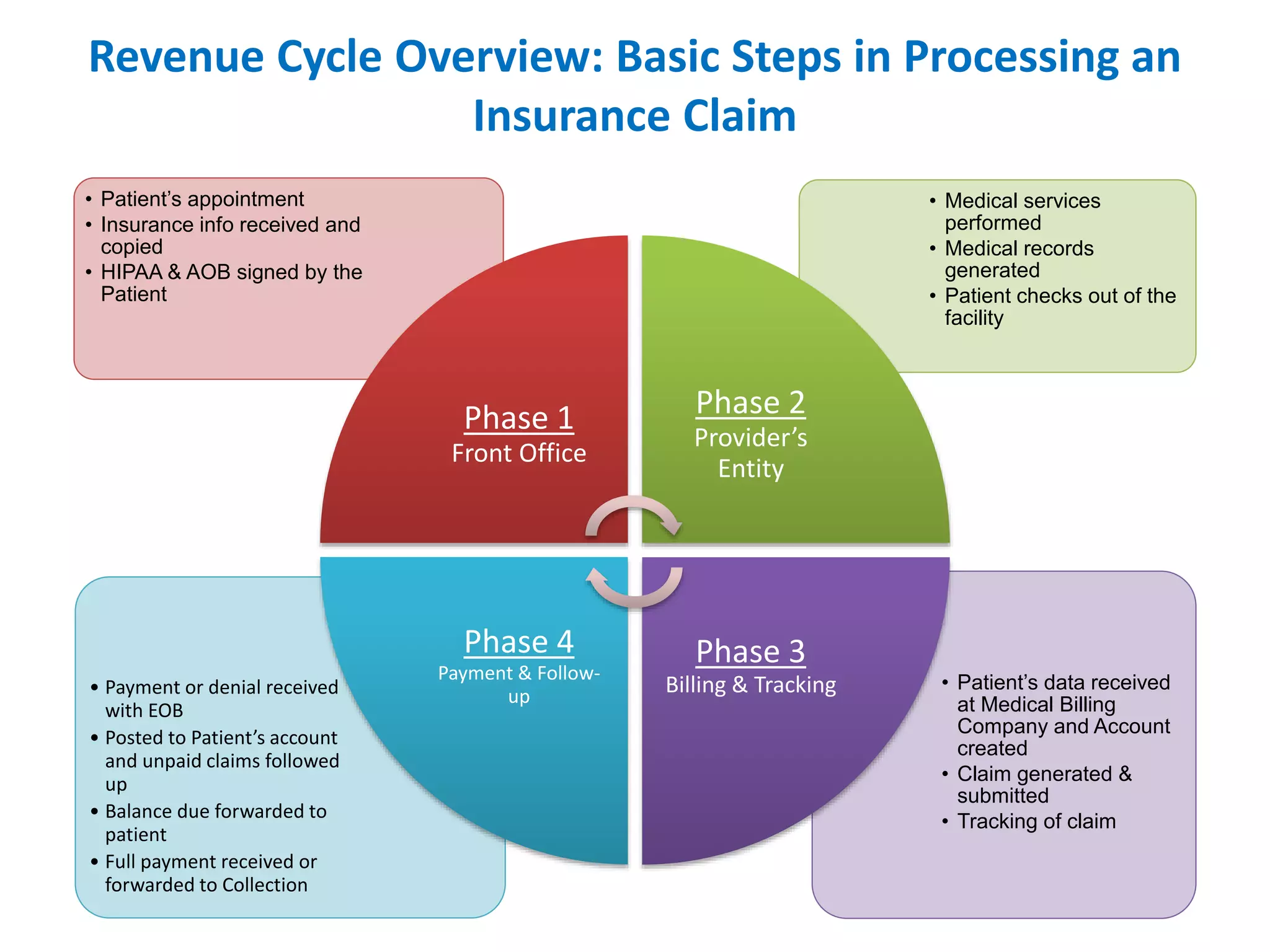

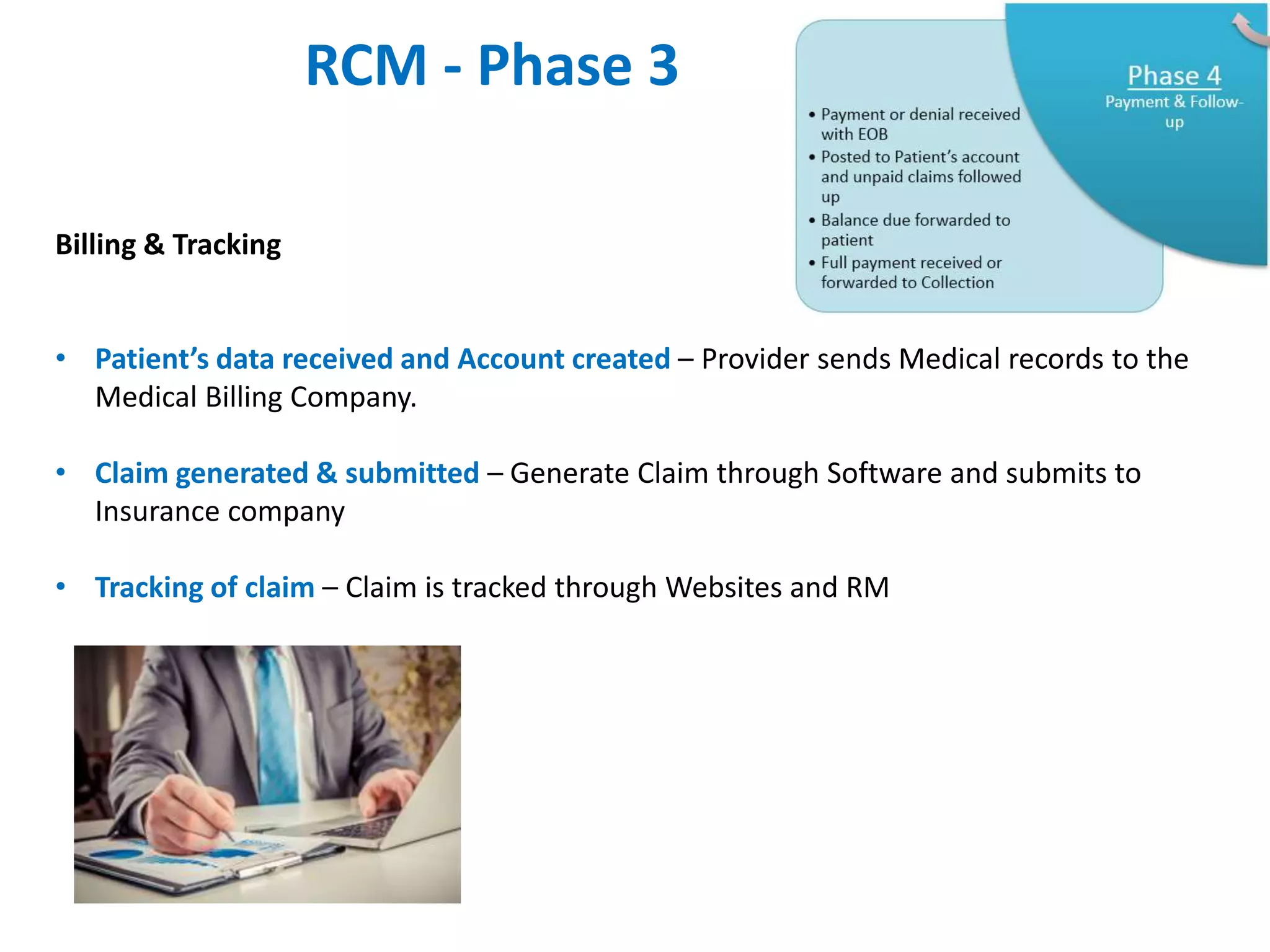

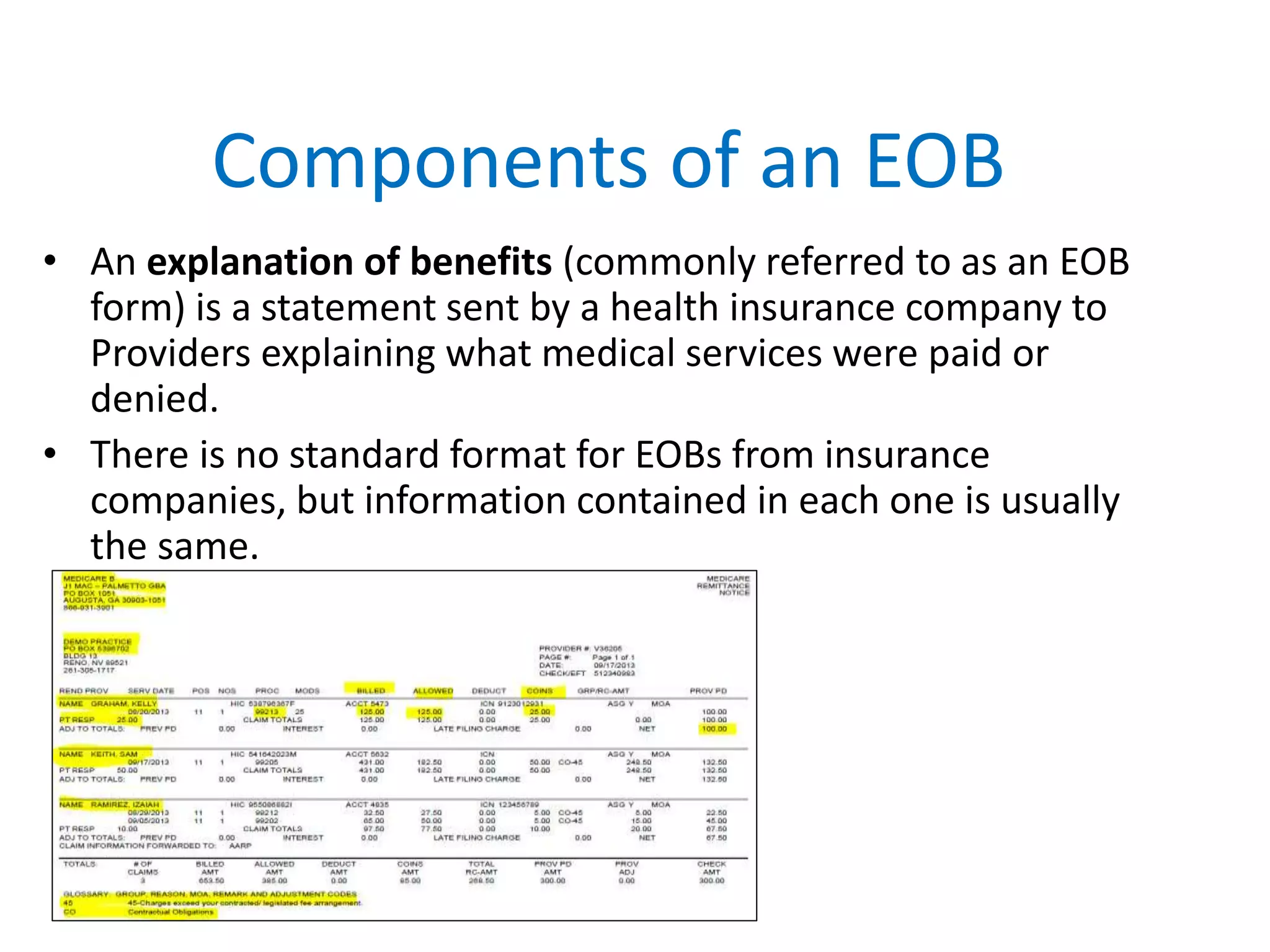

Revenue cycle management (RCM) in US healthcare tracks revenue from patients and insurance from appointment scheduling to payment acceptance. The process involves several phases: front office procedures, provider services, billing and tracking, and payment follow-up, with different methods for submitting claims, such as paper or electronic claims. Errors in this process can lead to delayed or denied payments, making efficient management crucial for healthcare providers.