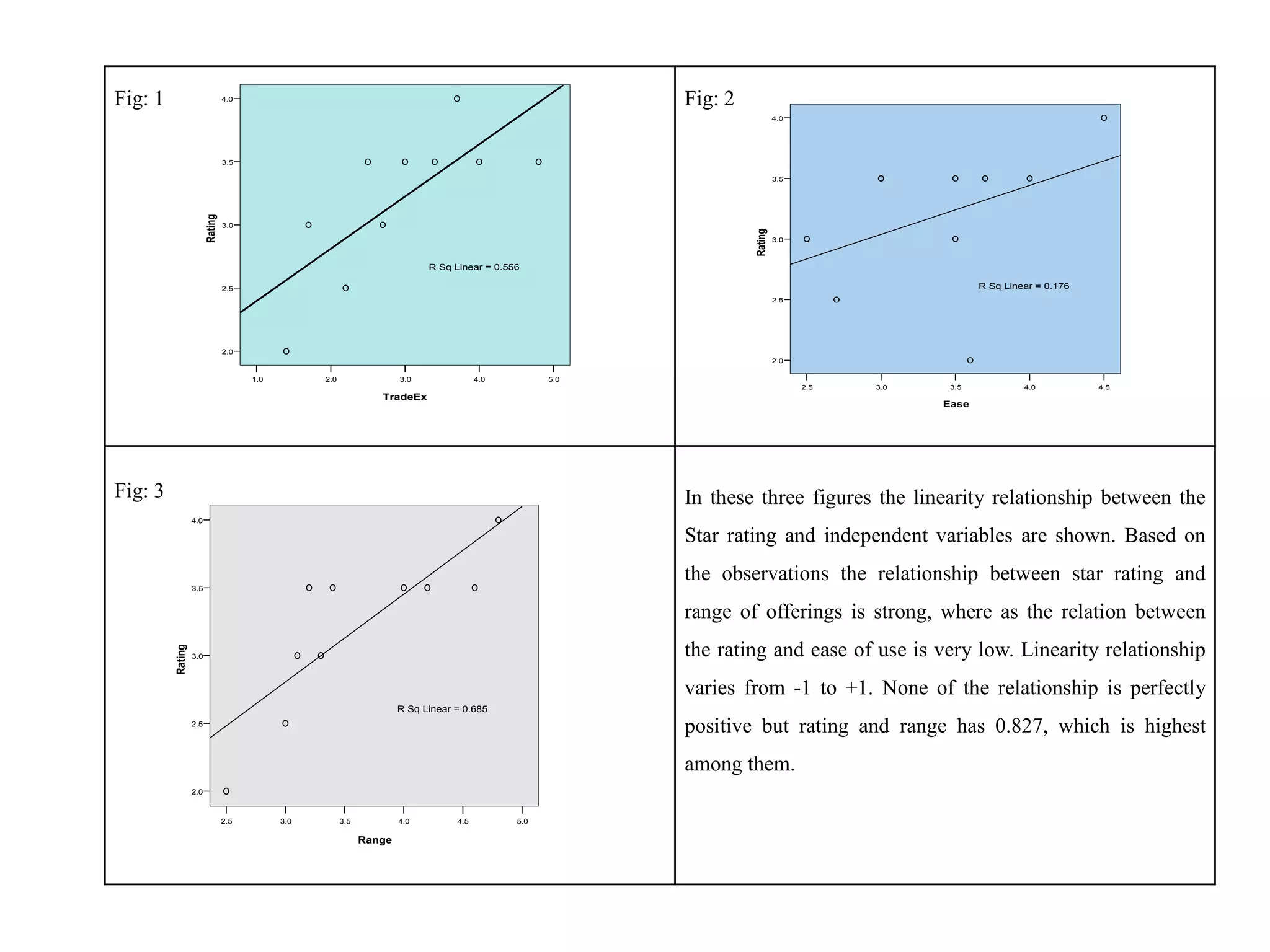

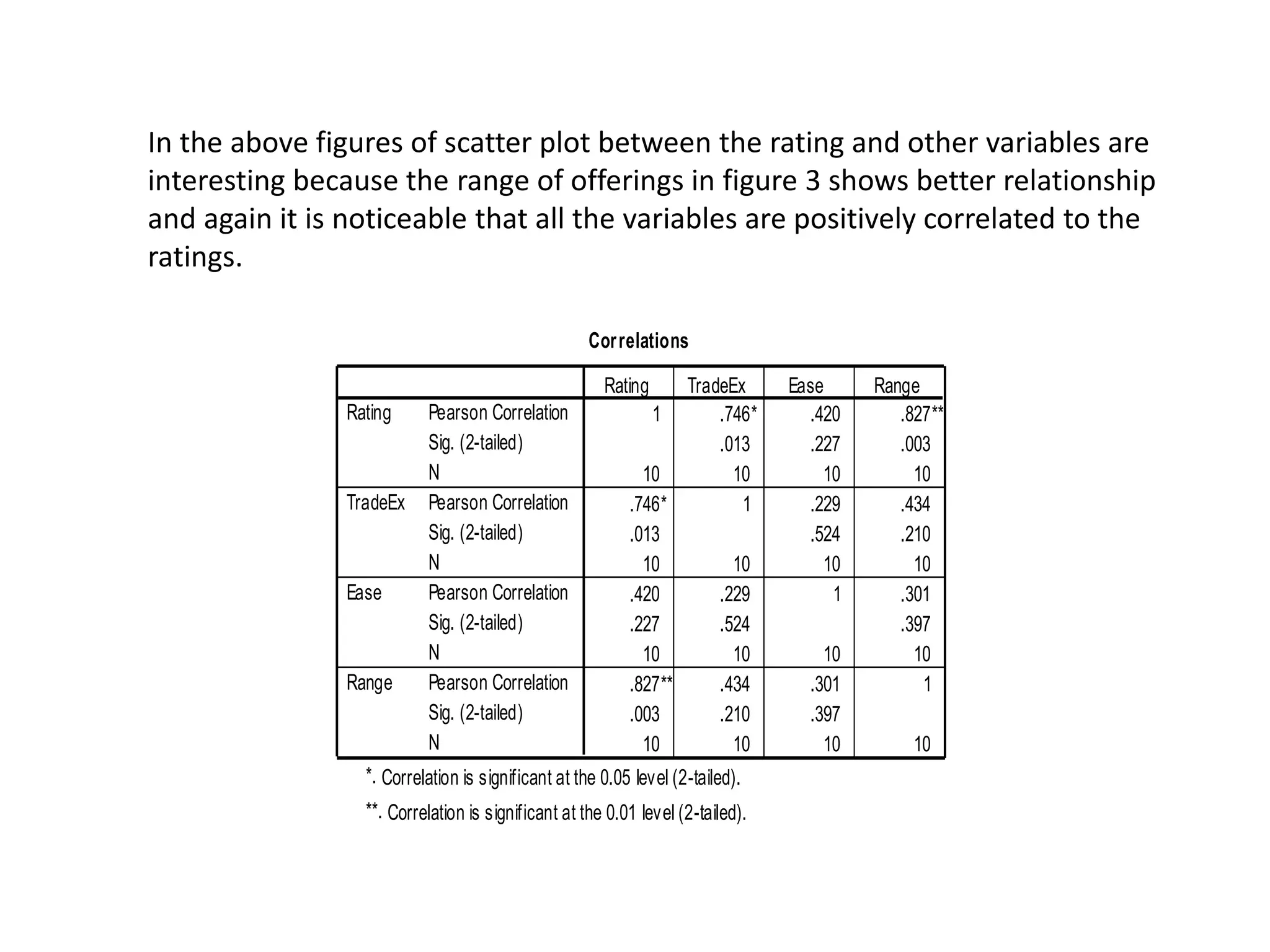

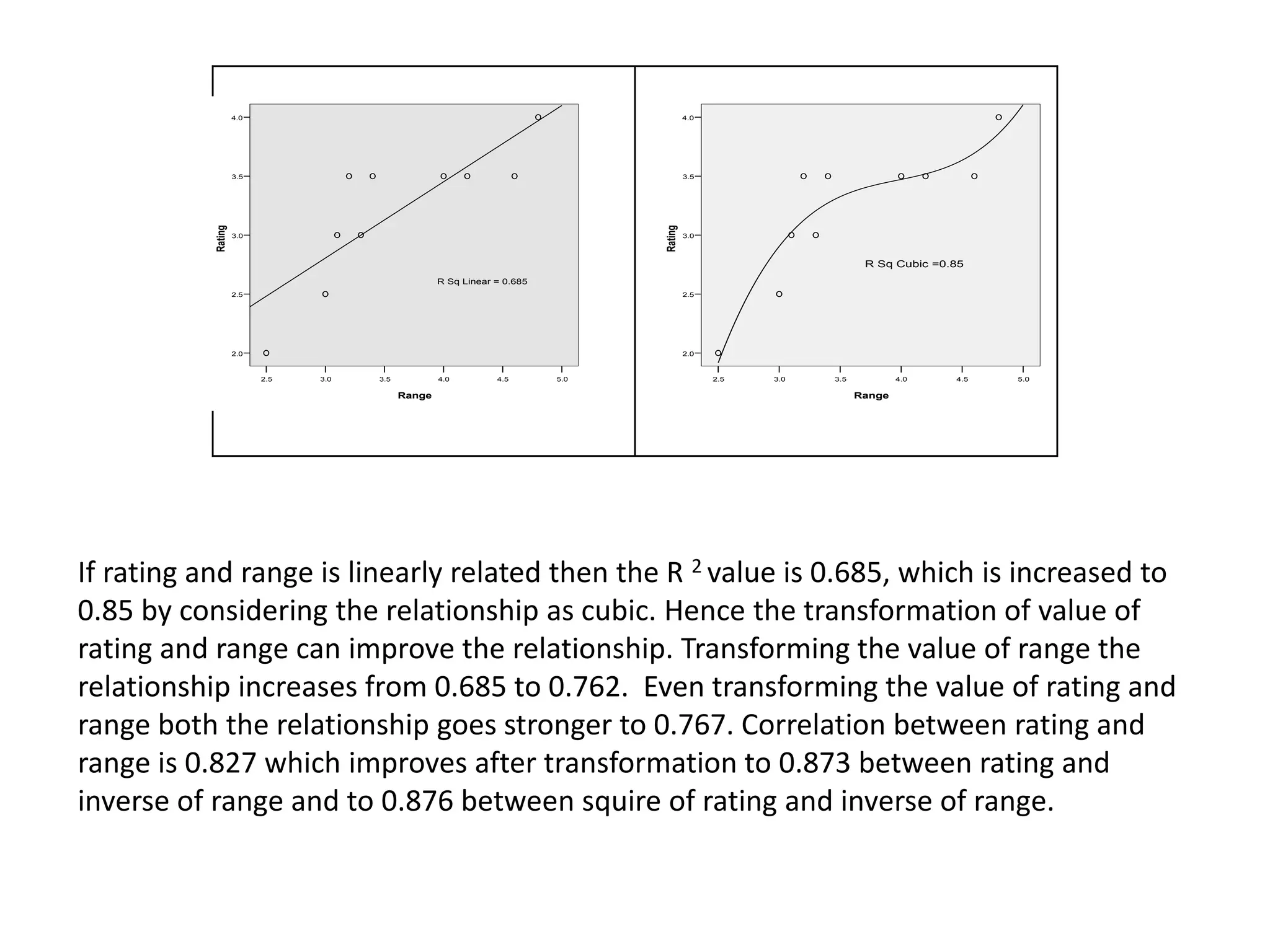

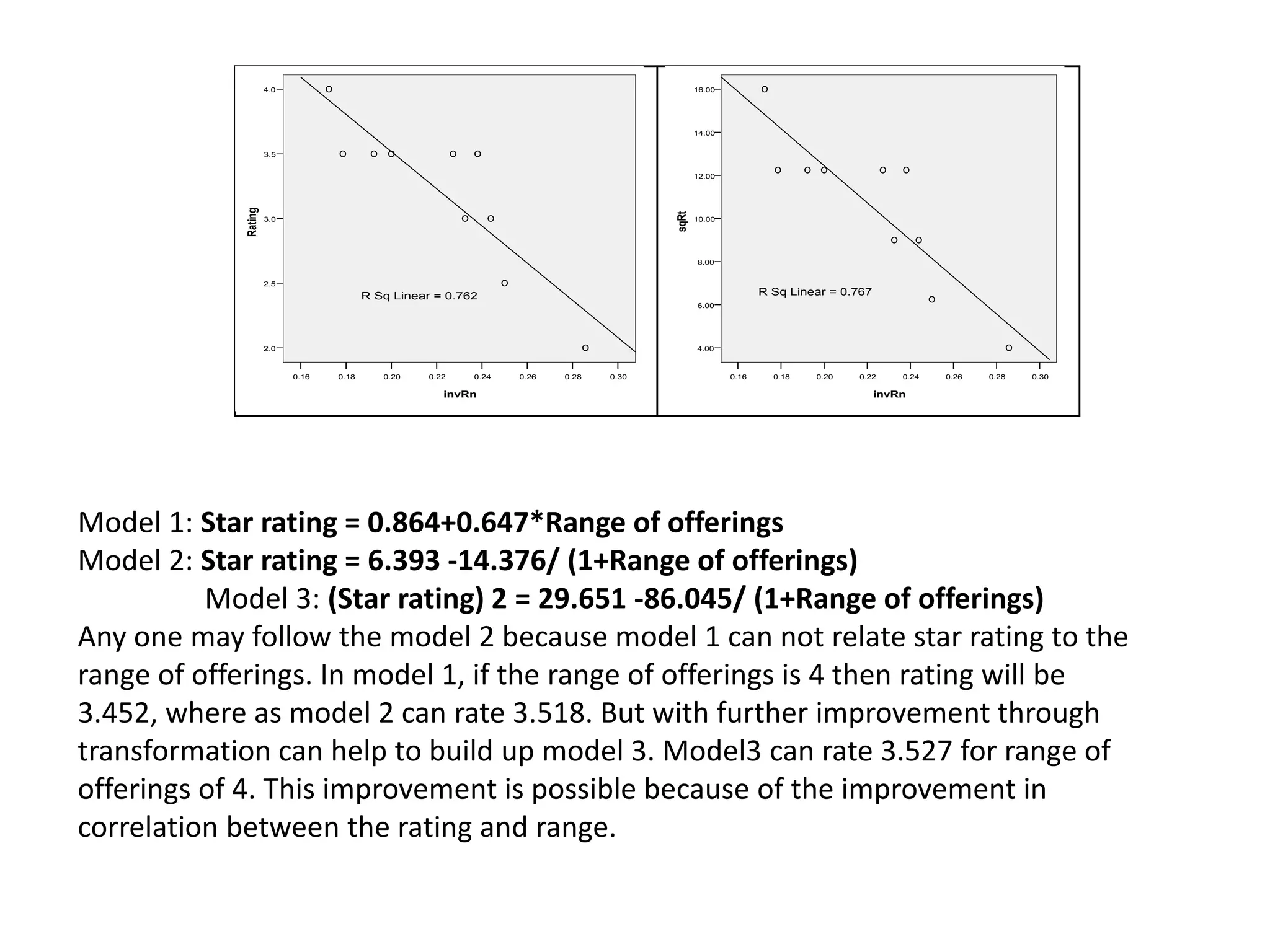

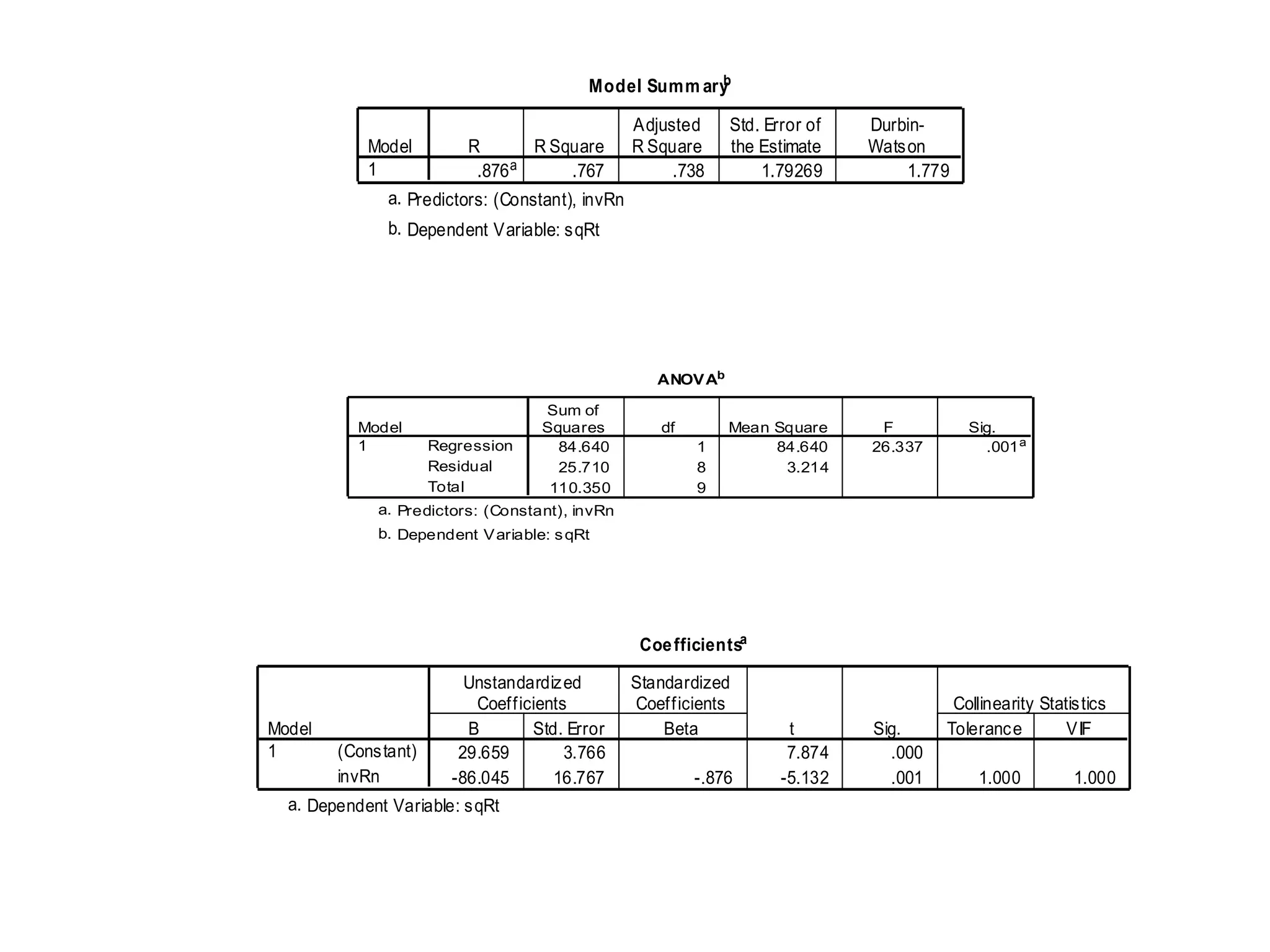

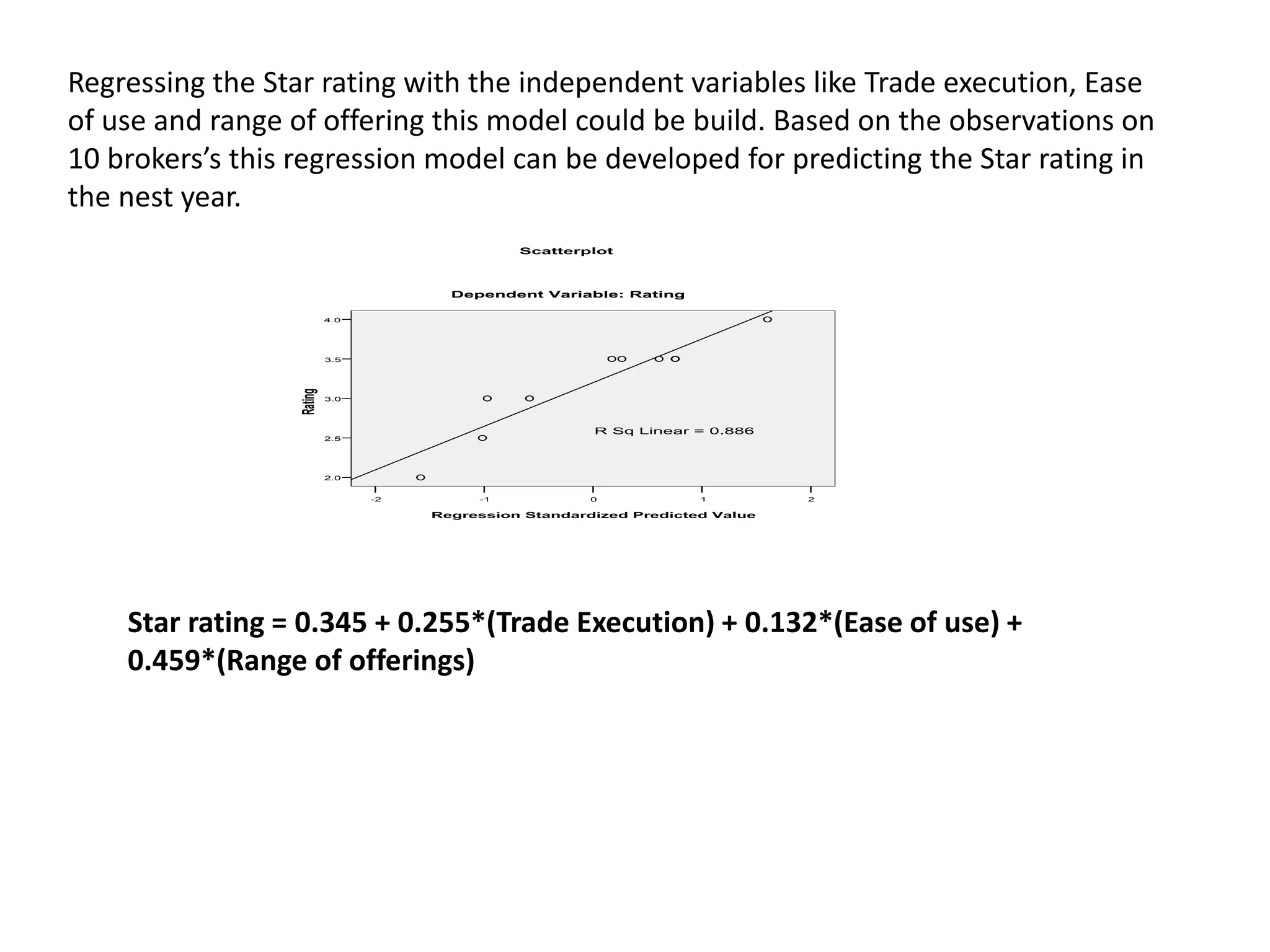

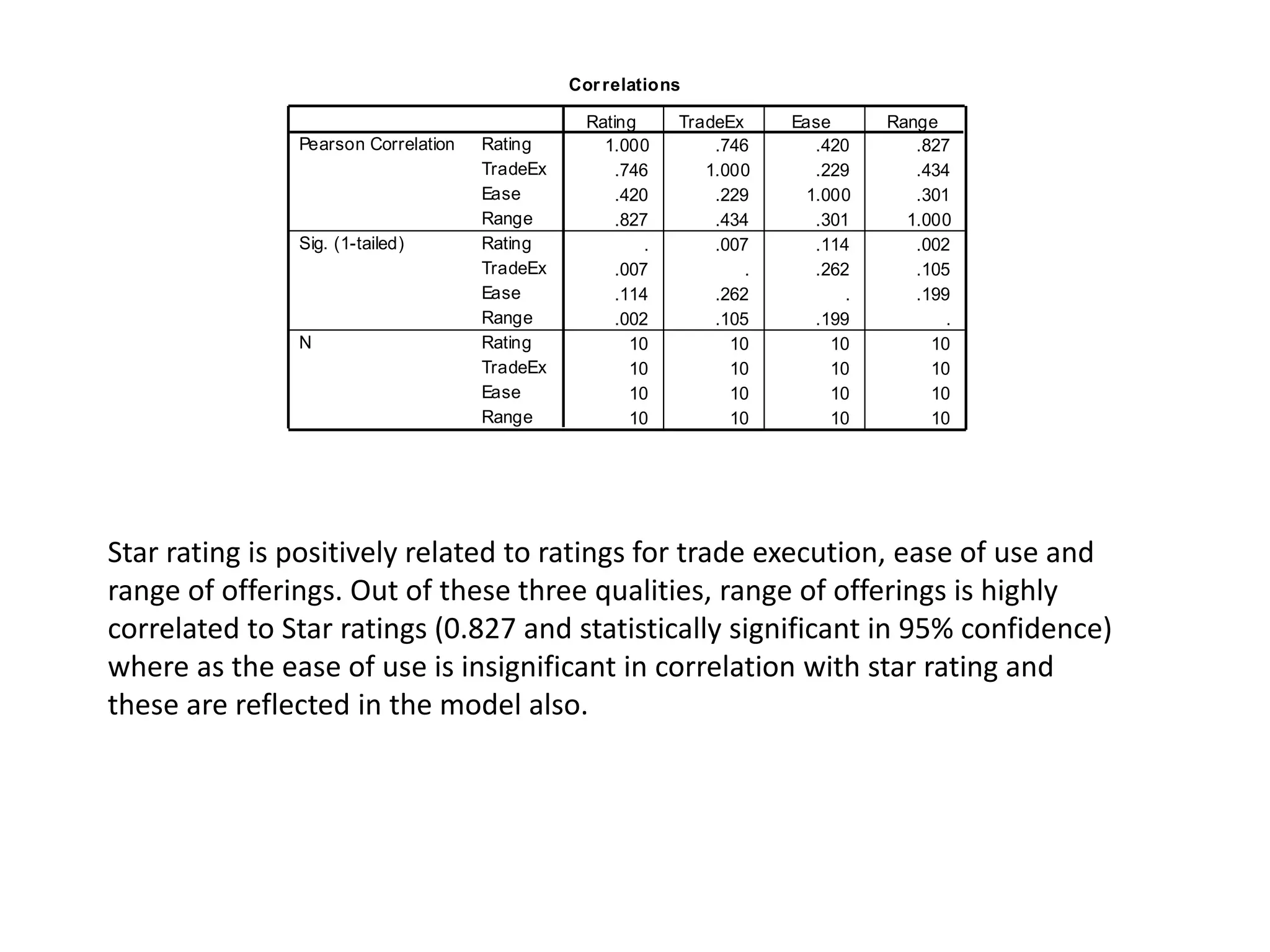

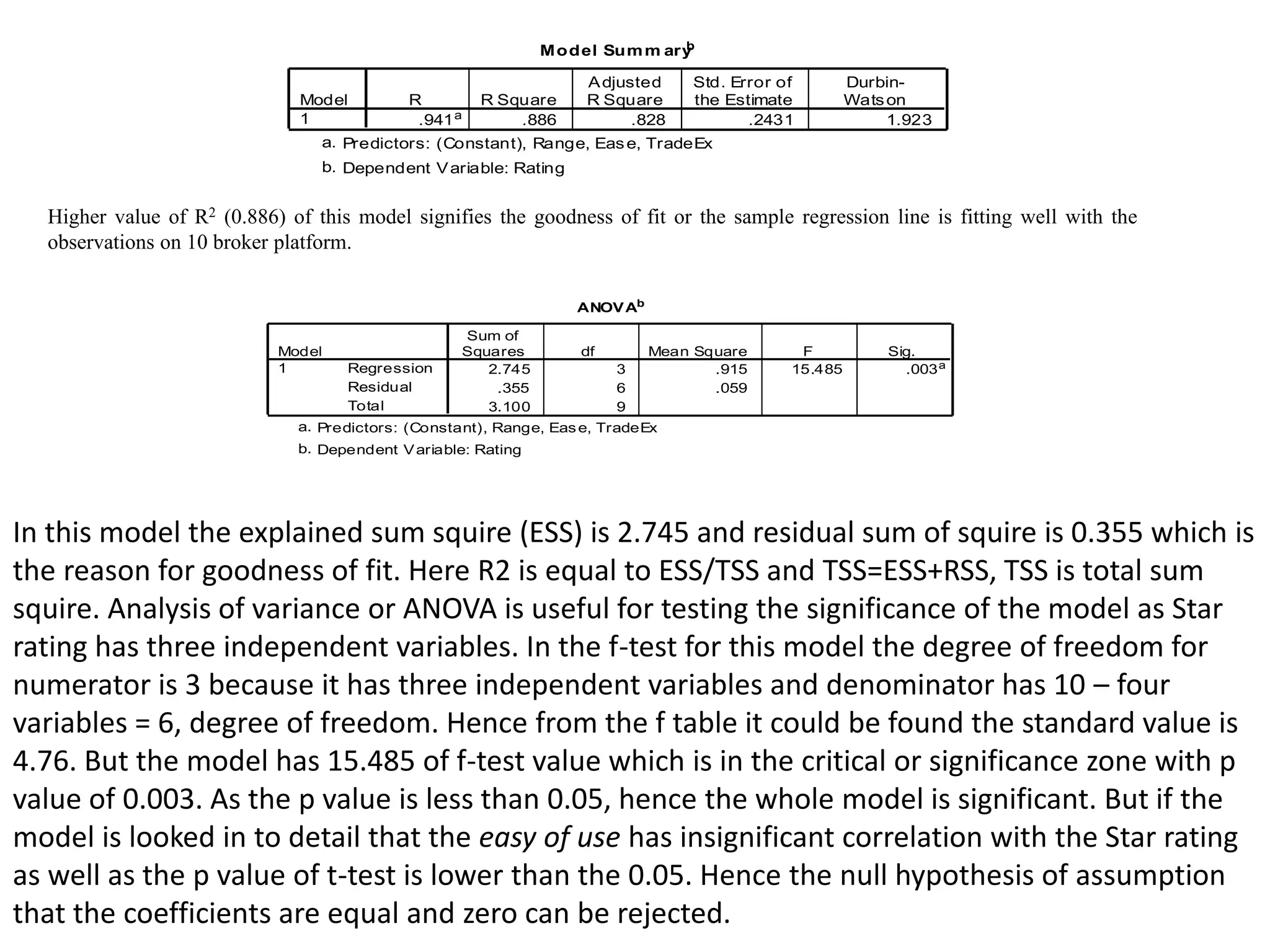

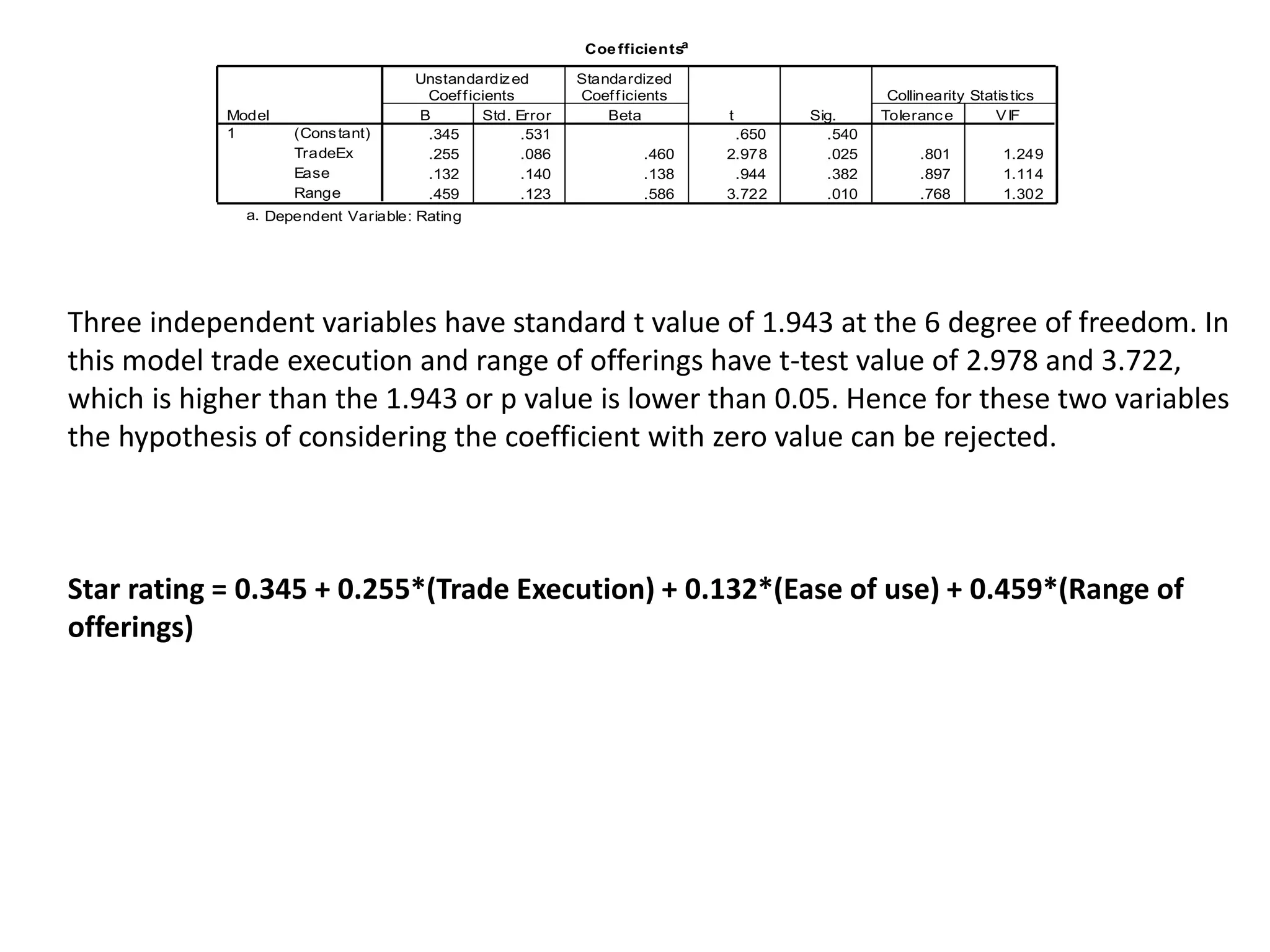

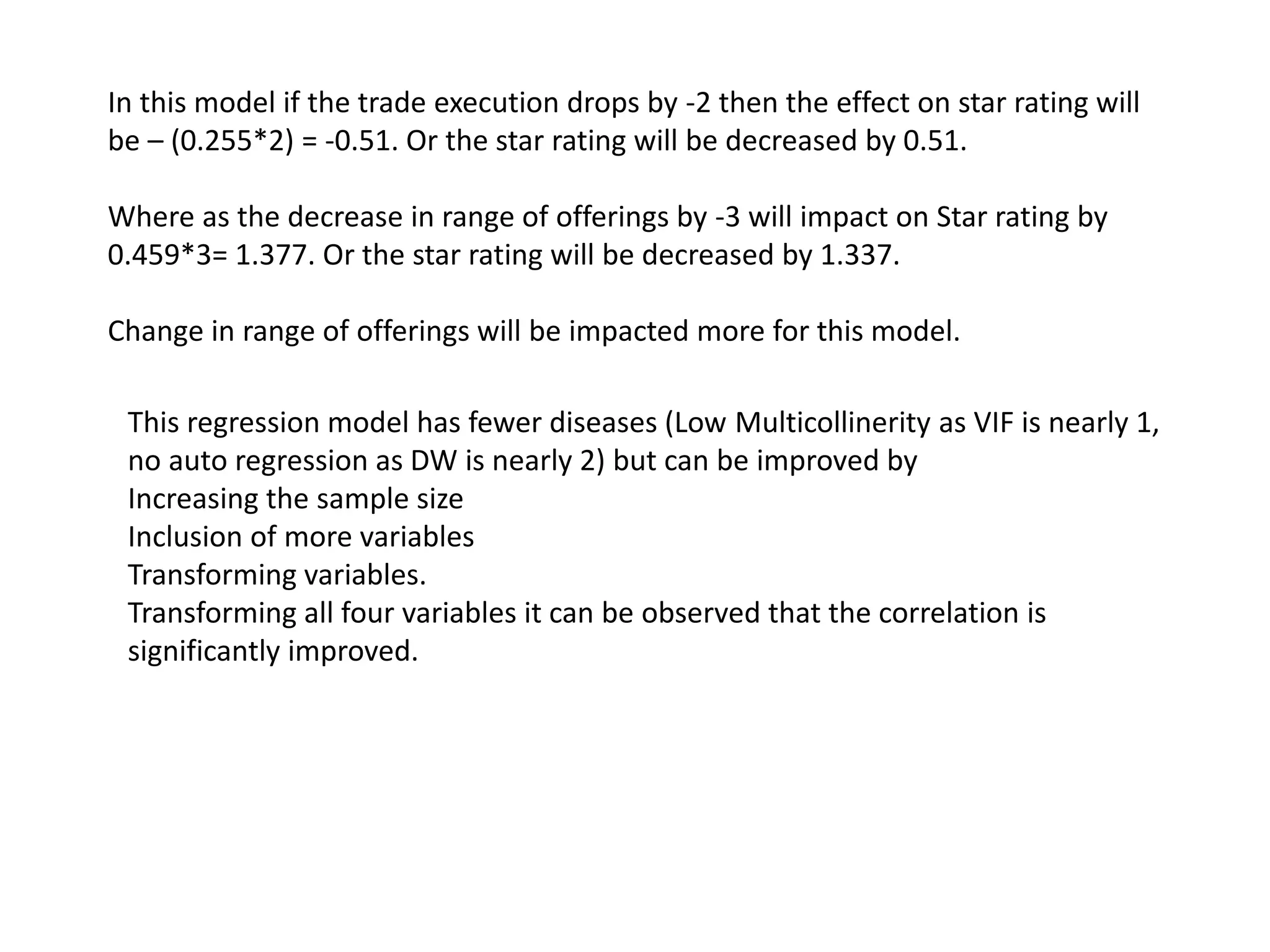

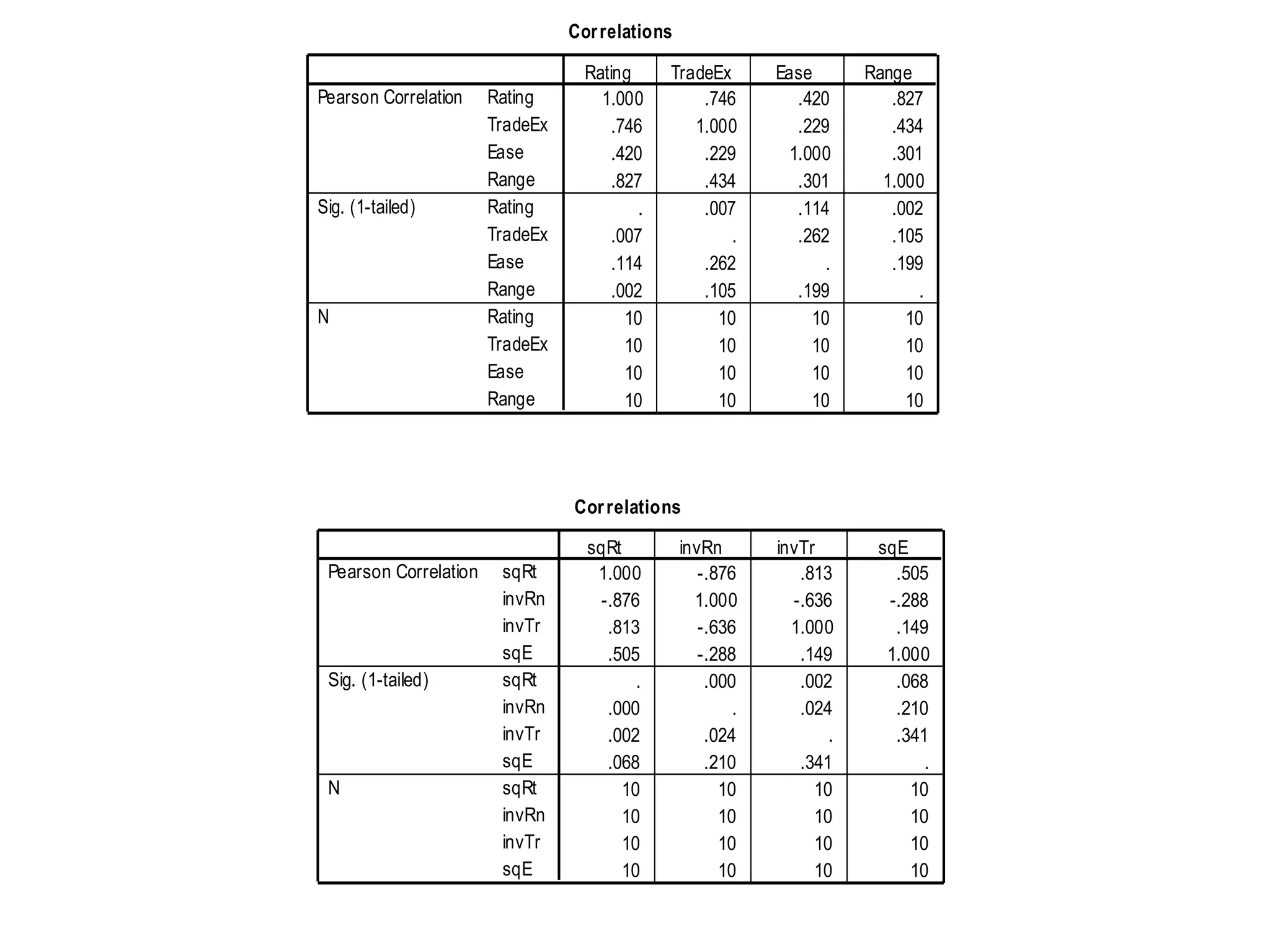

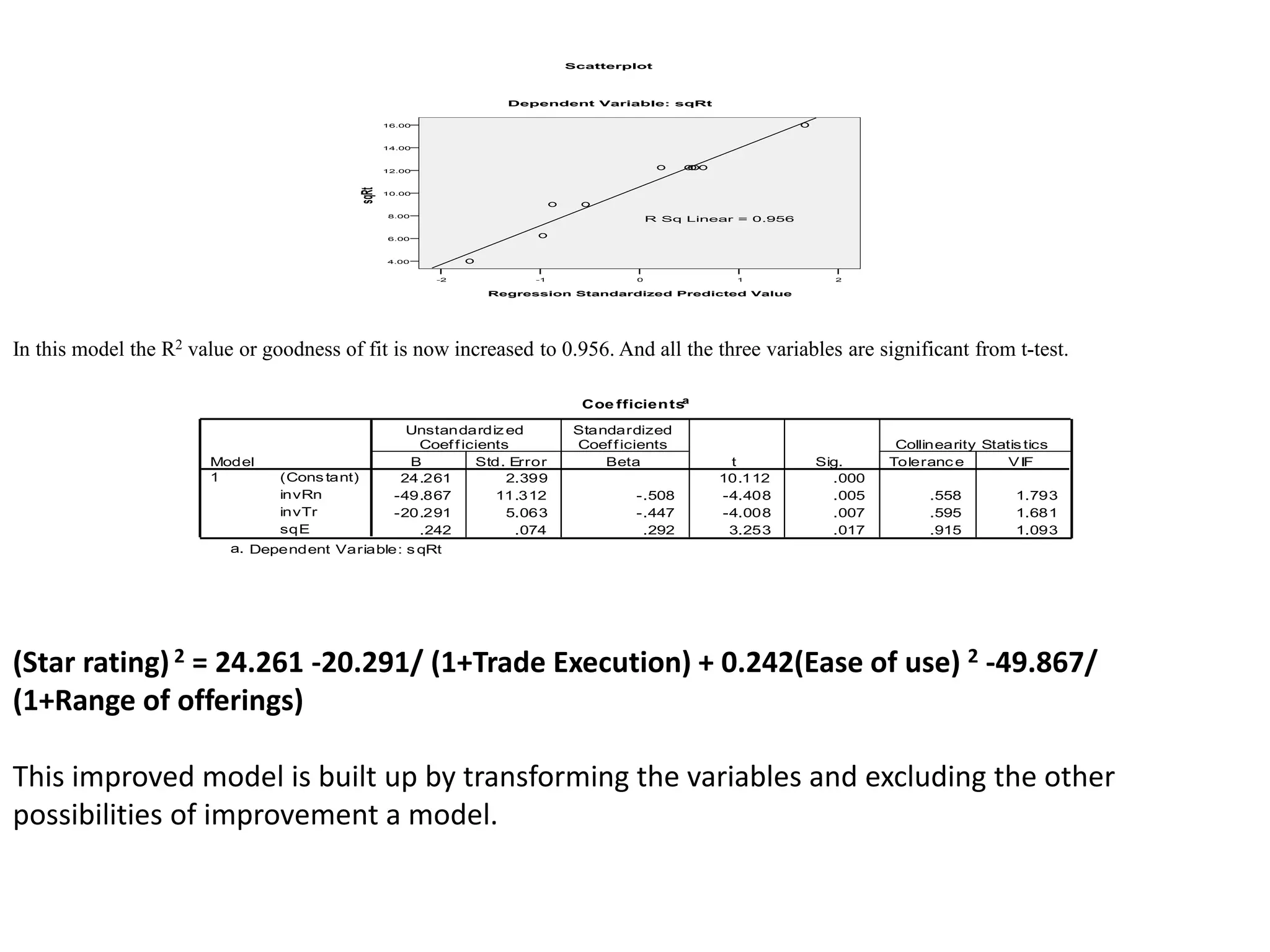

The document describes research on predicting future ratings of companies rated by broker firms. Several regression models are analyzed with the star rating as the dependent variable and variables like trade execution, ease of use, and range of offerings as independent variables. The best-fitting model has an R-squared value of 0.956, indicating it accounts for over 95% of the variation in star ratings. This model relates the square of the star rating to transformed versions of the independent variables.