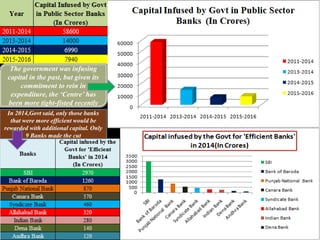

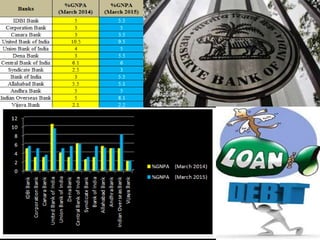

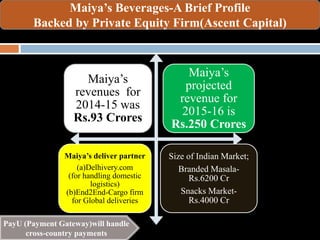

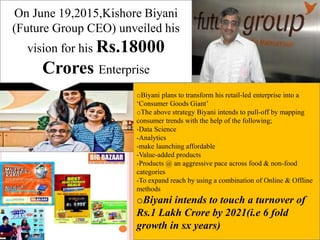

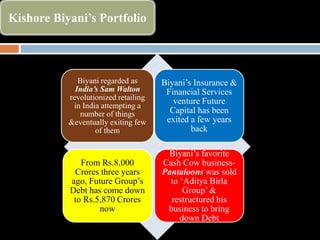

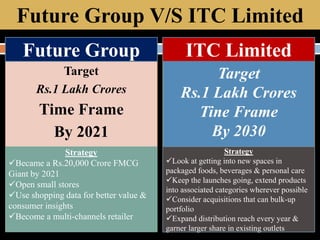

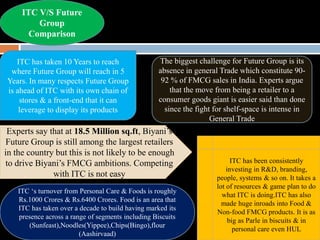

The document discusses the evolving landscape of the Indian banking and consumer goods sectors, highlighting government capital allocation to efficient public sector banks and the rise of online retail by companies like Maiya Beverages. Kishore Biyani's Future Group aims to transform into a consumer goods giant by leveraging data analytics and expanding its product offerings, despite competition from established firms like ITC. The discussion outlines strategic comparisons between Future Group and ITC, emphasizing challenges in market penetration and the significance of innovation and distribution in achieving growth.