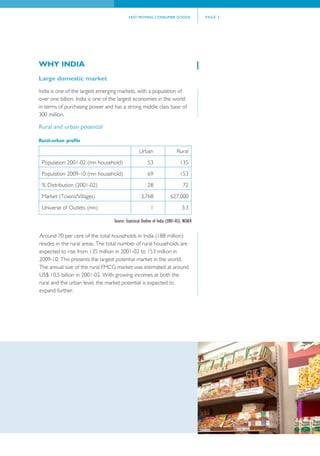

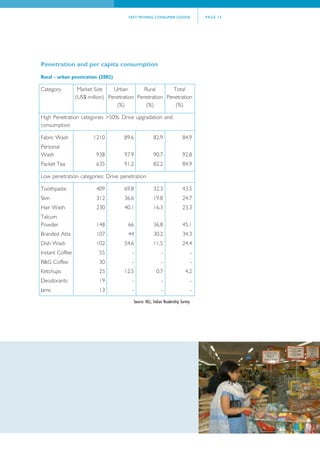

- India represents a large potential market for fast moving consumer goods (FMCG) due to its large population size and a growing middle class. Rural areas in particular present significant untapped opportunities.

- India has competitive advantages for FMCG companies including availability of key raw materials, low production costs due to cheaper labor, and presence across the entire supply chain.

- Government policies aim to increase competitiveness by reducing duties and restrictions while encouraging foreign investment in the FMCG sector.