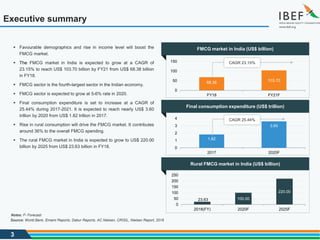

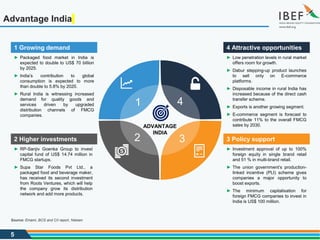

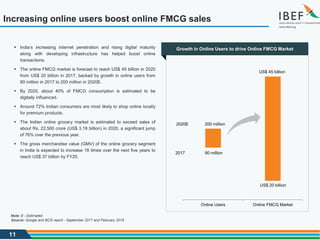

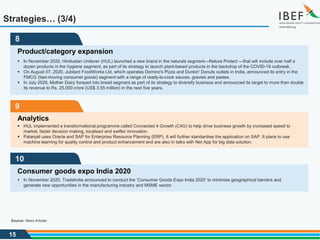

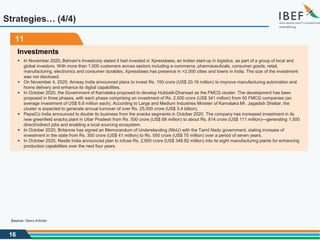

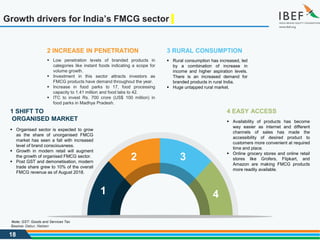

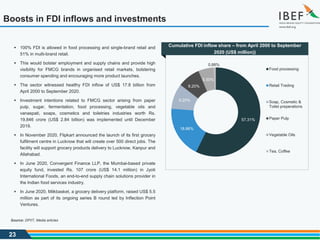

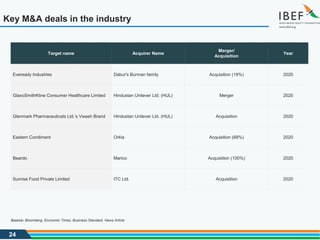

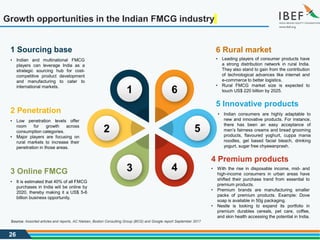

The document summarizes strategies adopted by FMCG companies in India to boost growth. Key strategies include strengthening rural networks, launching mobile apps, introducing new products, expanding into new markets and categories, focusing on e-commerce, implementing green initiatives, using analytics, and increasing investments. FMCG companies are also leveraging consumer goods expos and partnerships to generate opportunities. Overall the strategies aim to increase rural and online penetration and take advantage of rising demand.