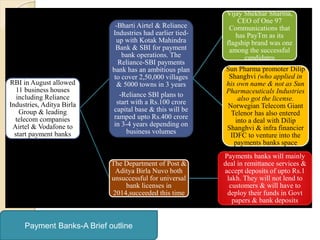

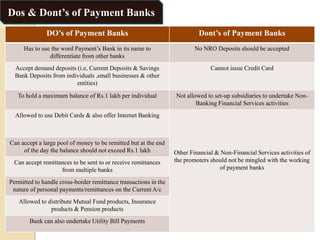

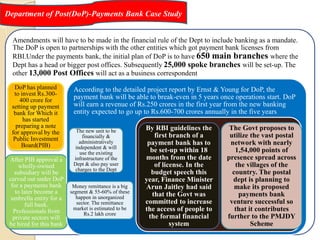

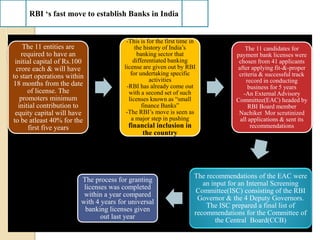

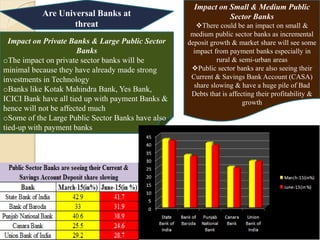

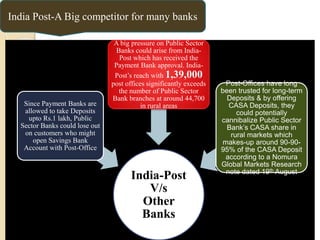

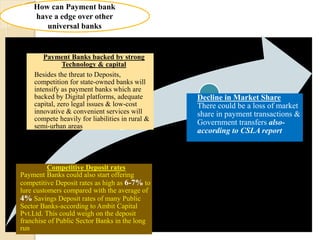

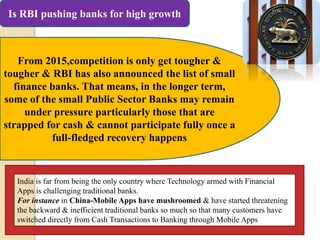

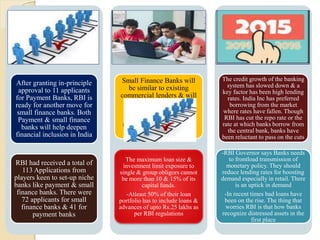

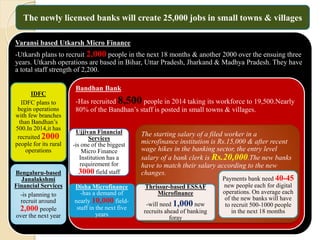

In August, the RBI granted in-principle approval to 11 entities, including major companies like Reliance Industries and Vodafone, to establish payment banks, which will primarily focus on remittance services and accept deposits up to ₹1 lakh. Payment banks are prohibited from lending but can offer services like utility bill payments and mutual funds, potentially impacting traditional banking, especially in rural and semi-urban areas. The introduction of payment banks is part of a broader effort by the RBI to enhance financial inclusion in India, alongside the forthcoming establishment of small finance banks.