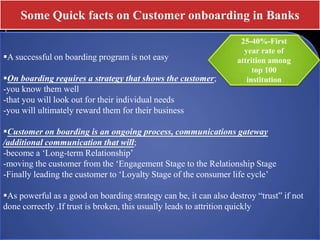

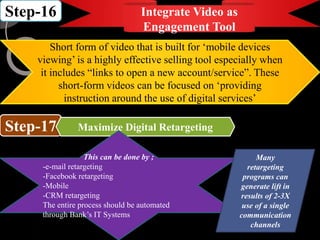

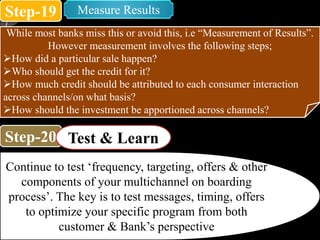

The document outlines essential strategies for effective customer onboarding in banking, emphasizing the importance of personalized communication and ongoing engagement to foster customer loyalty and trust. It details a step-by-step process that includes assigning dedicated personnel, targeting account holders, collecting data, and measuring results to enhance the onboarding experience. A focus on multichannel communication, customer insights, and a gradual approach is recommended to build a robust onboarding process.