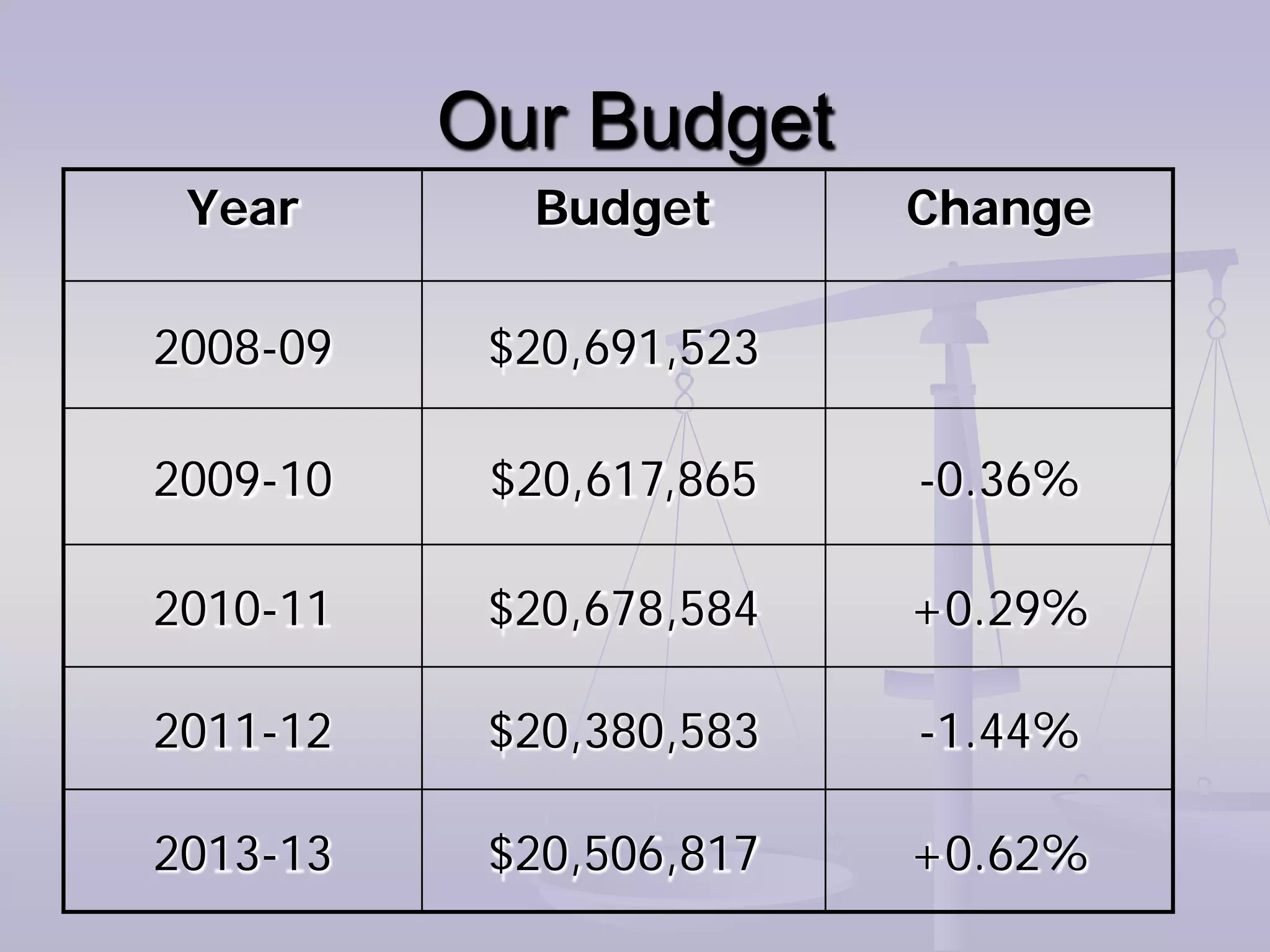

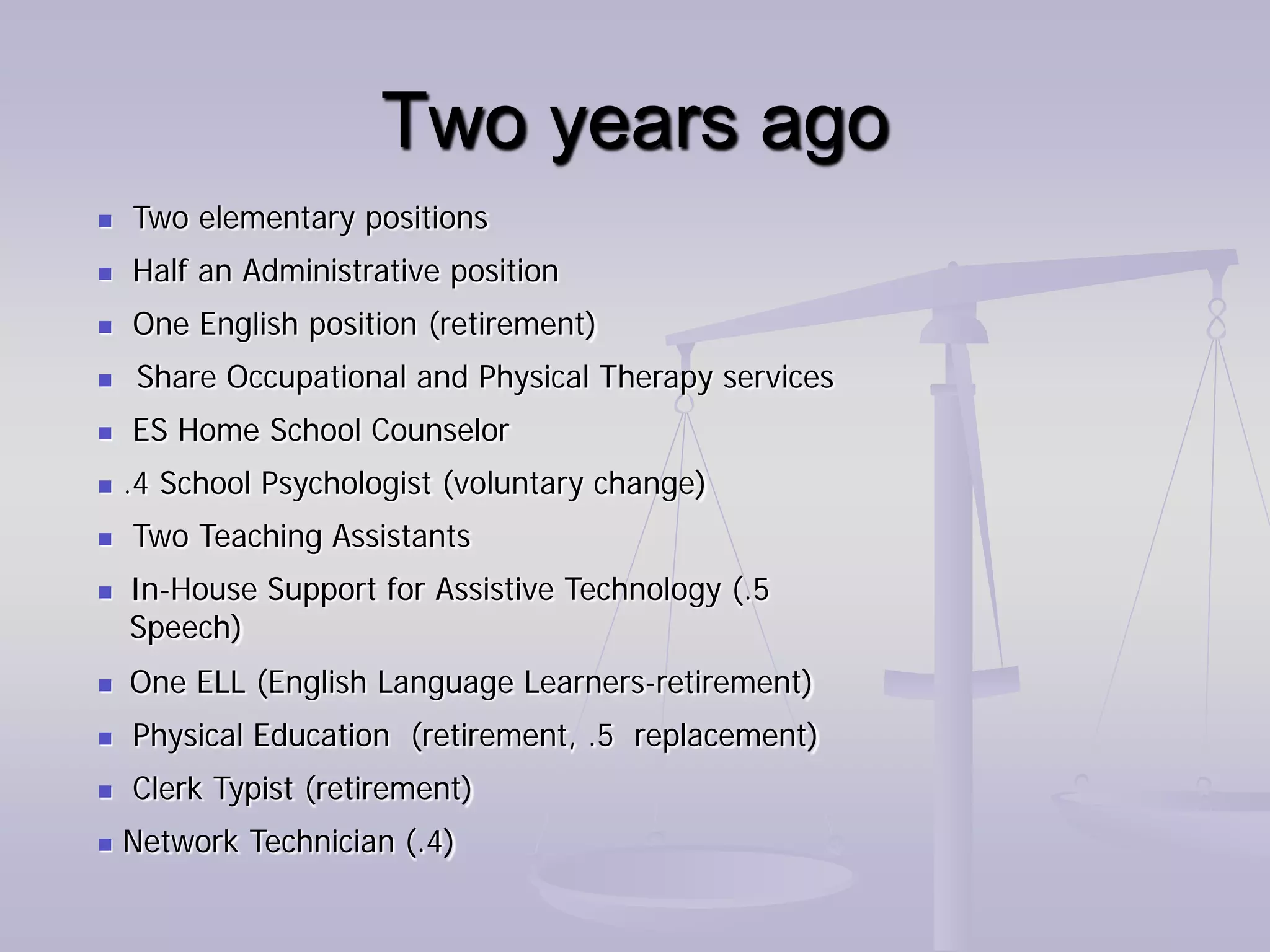

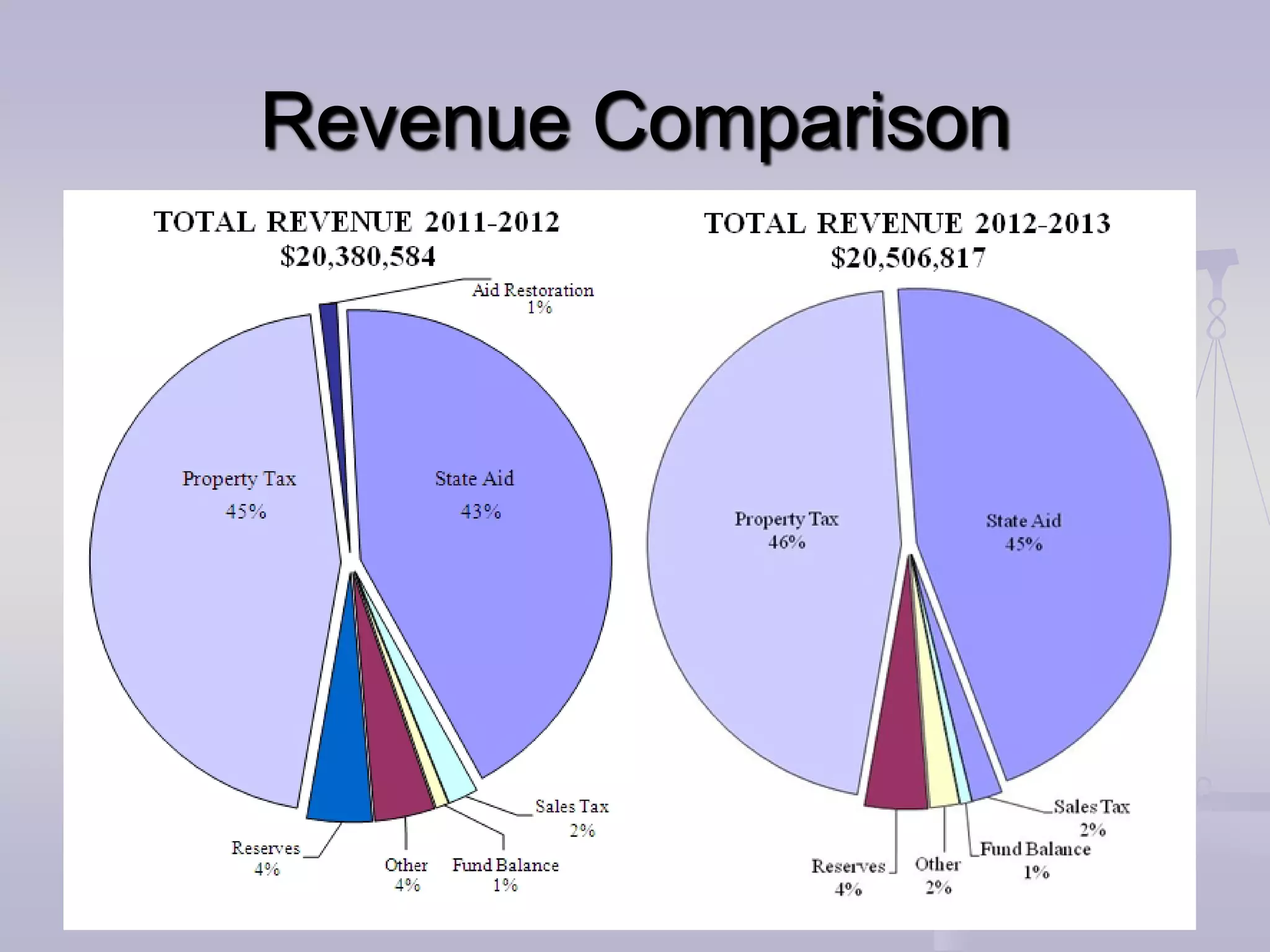

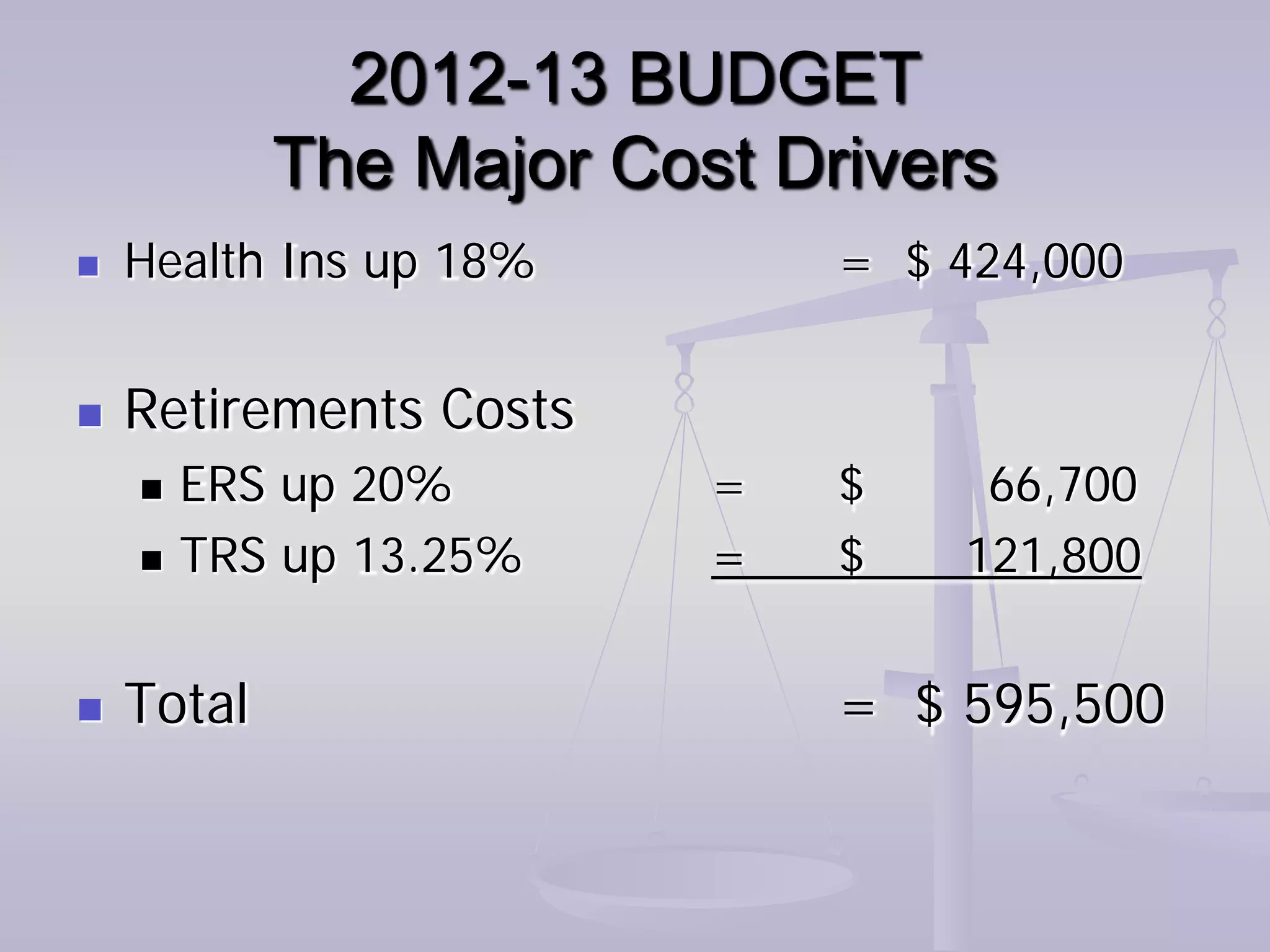

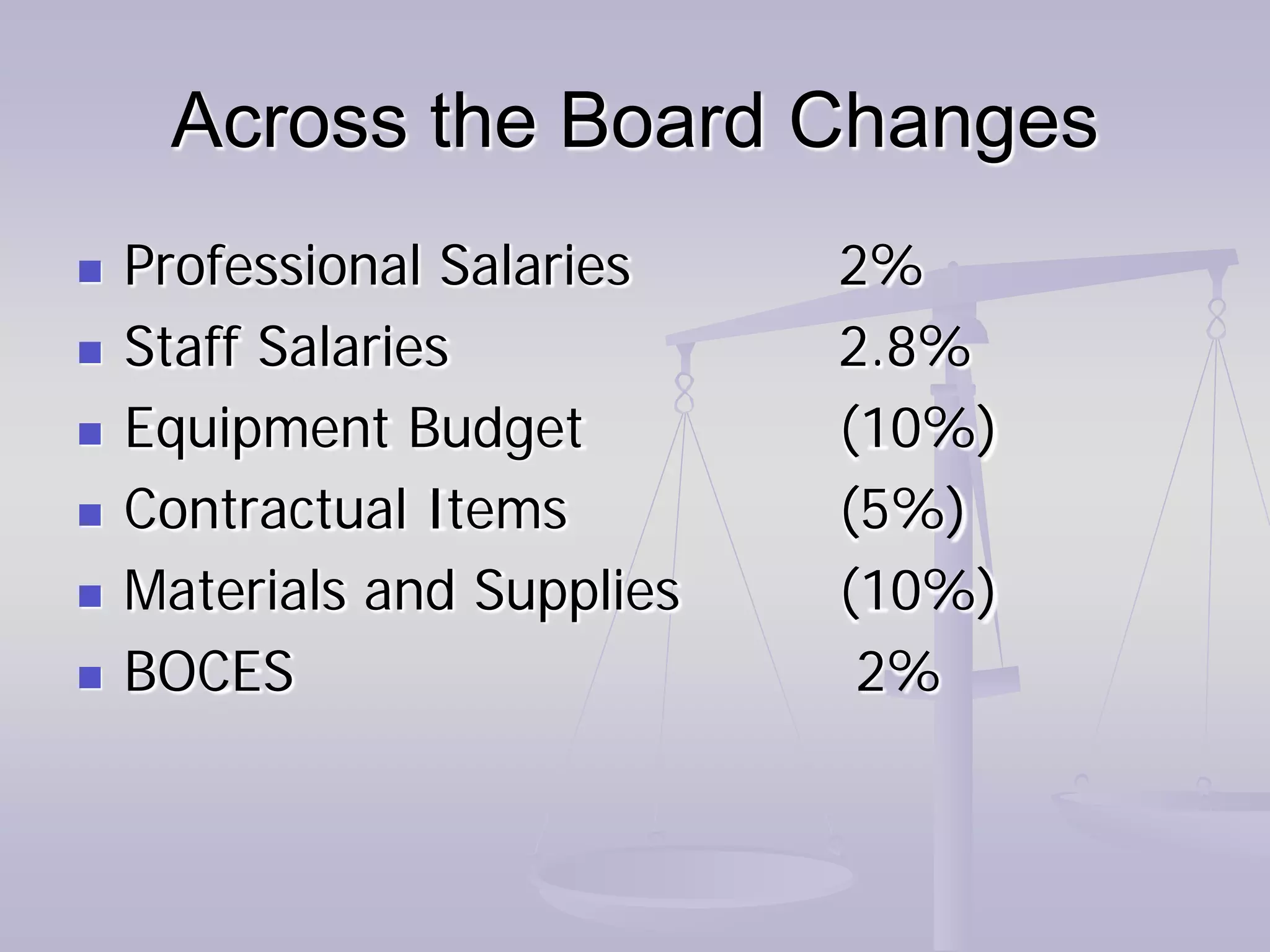

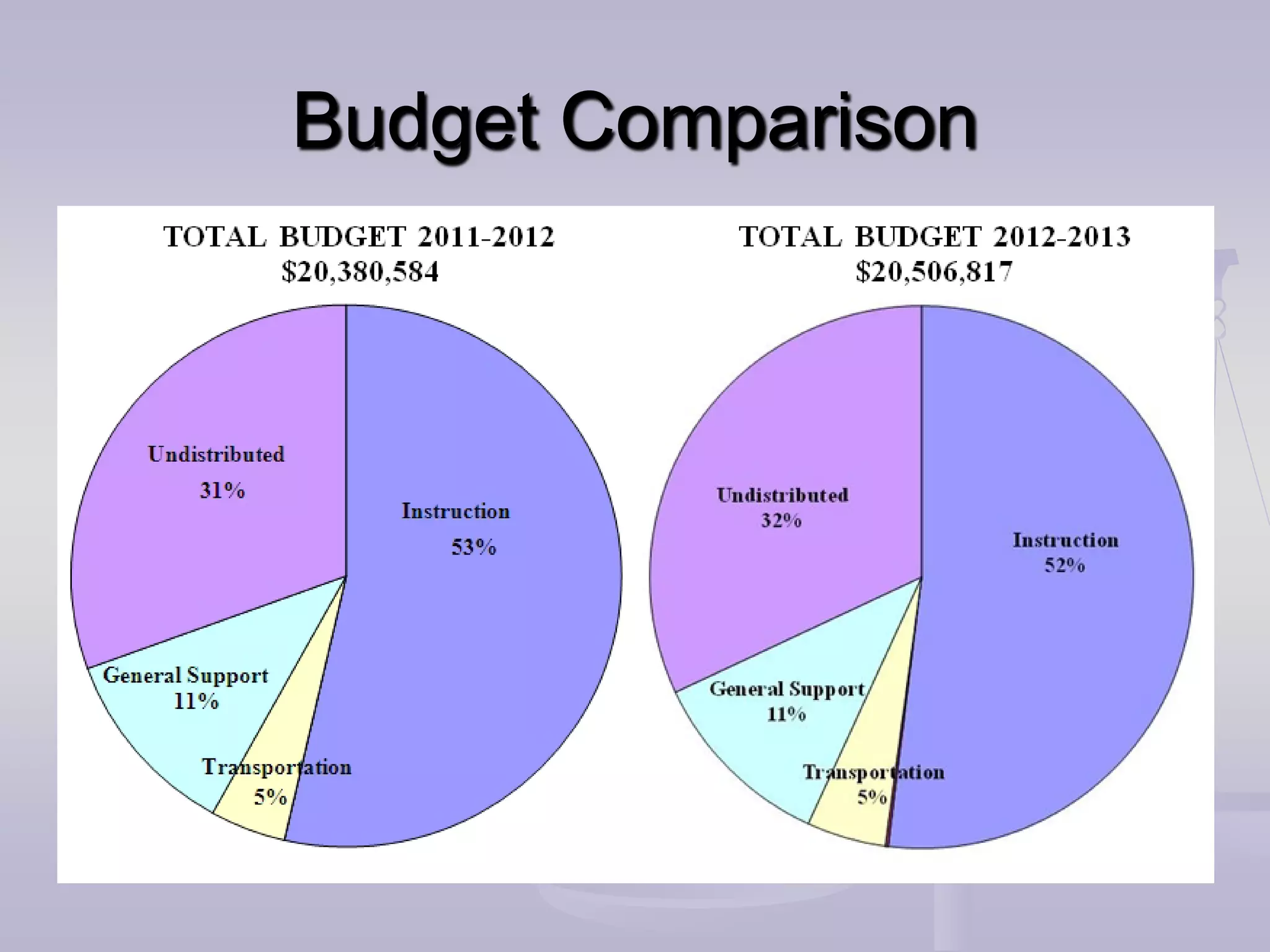

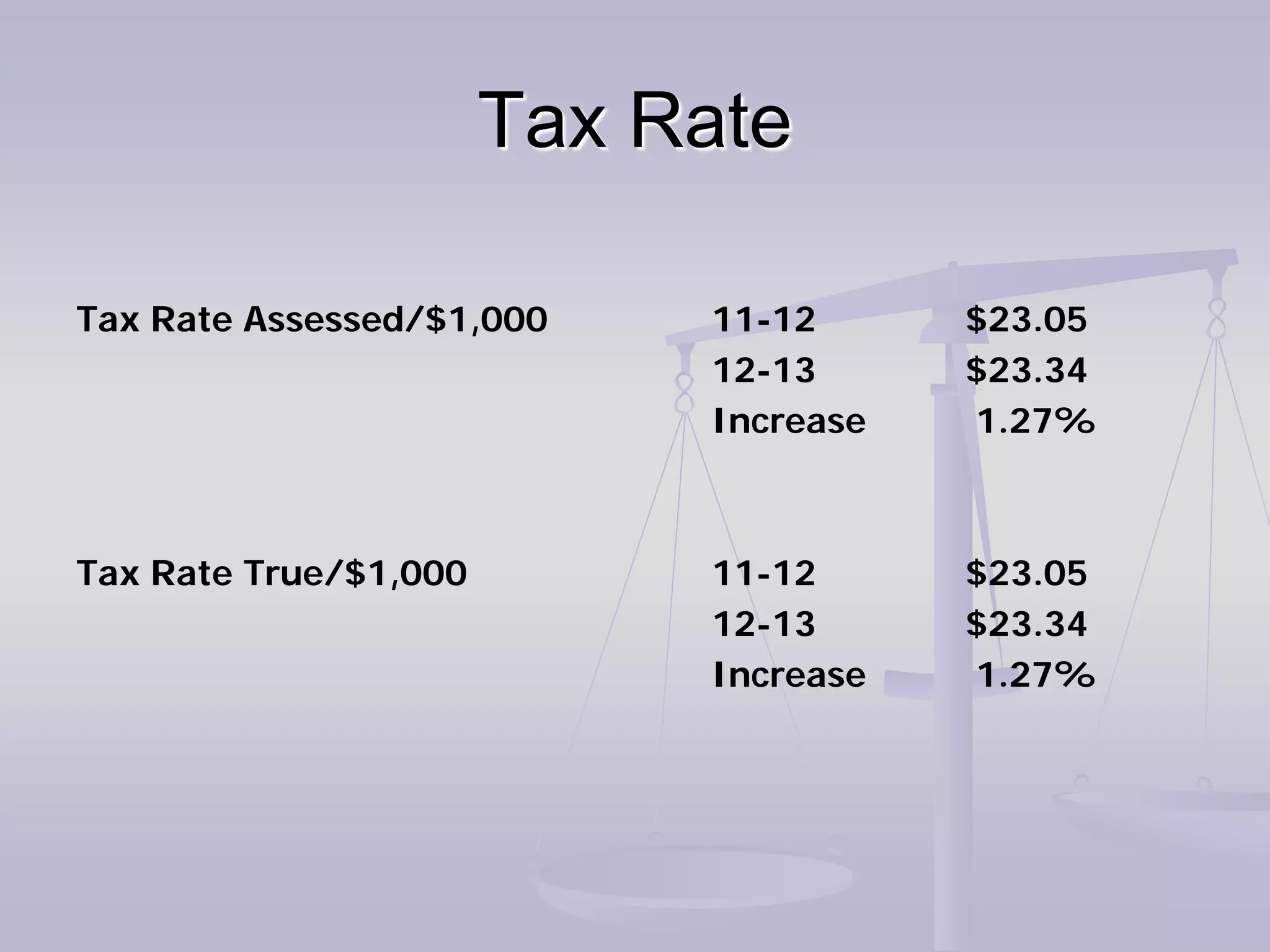

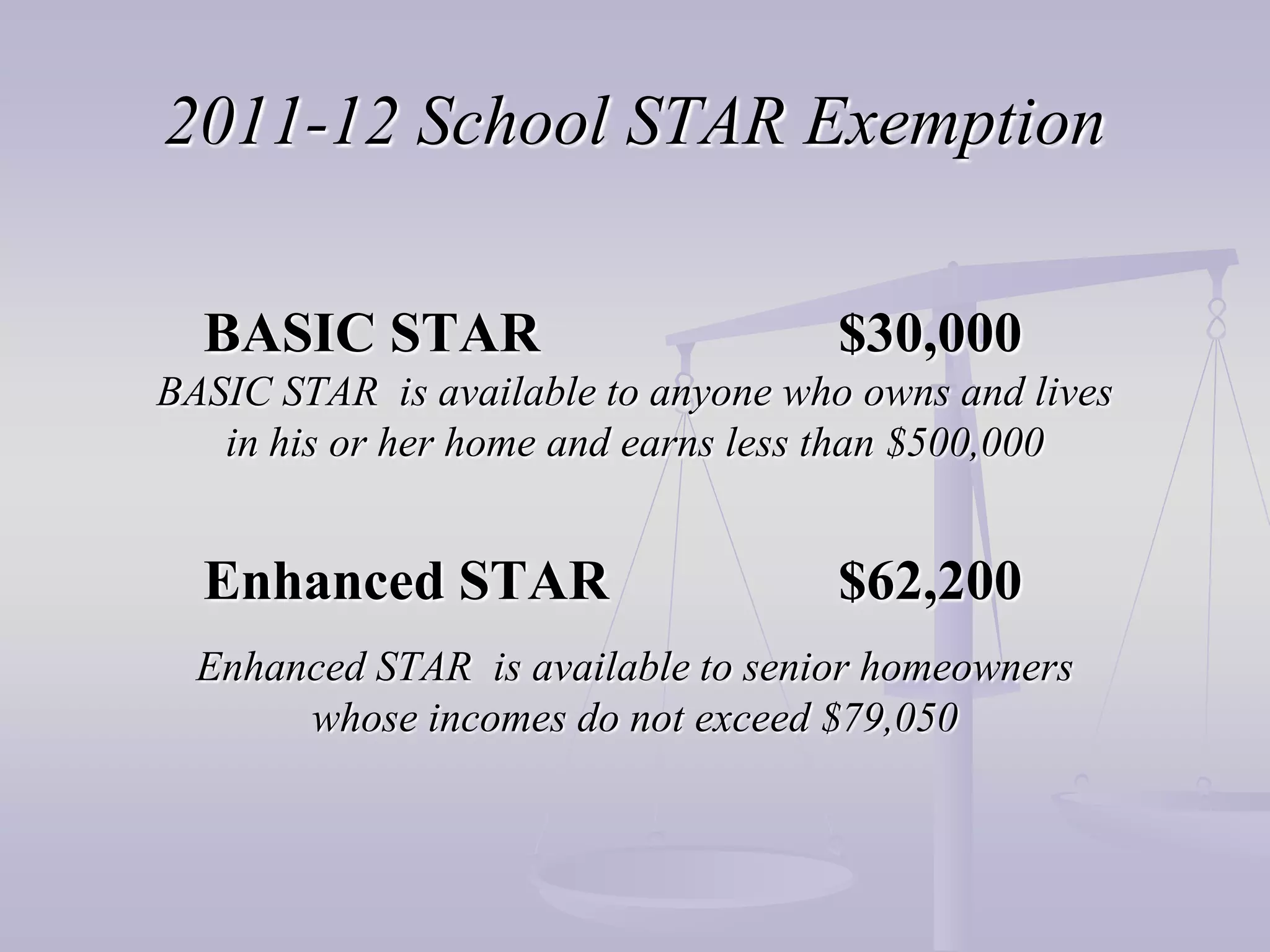

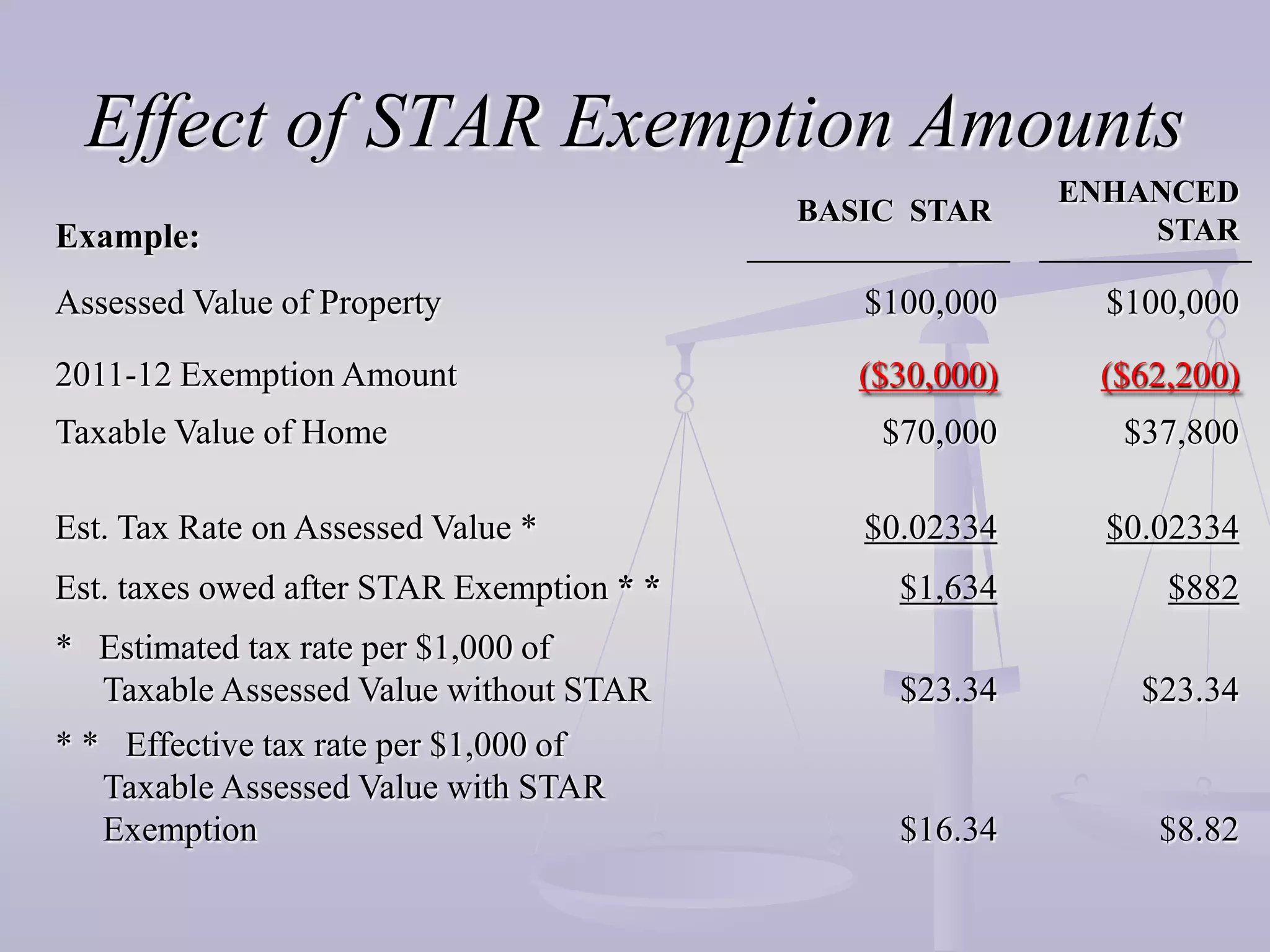

This document summarizes a school district's 2012-2013 budget. It discusses declining state aid, cuts made over the past two years including positions and programs, drivers of increased costs like health insurance and retirement costs, proposed cuts for the coming year including positions and programs, keeping the budget within the tax cap with a estimated tax rate increase of 1.27%, and asking voters to approve the $20,506,817 budget and elect a school board candidate.