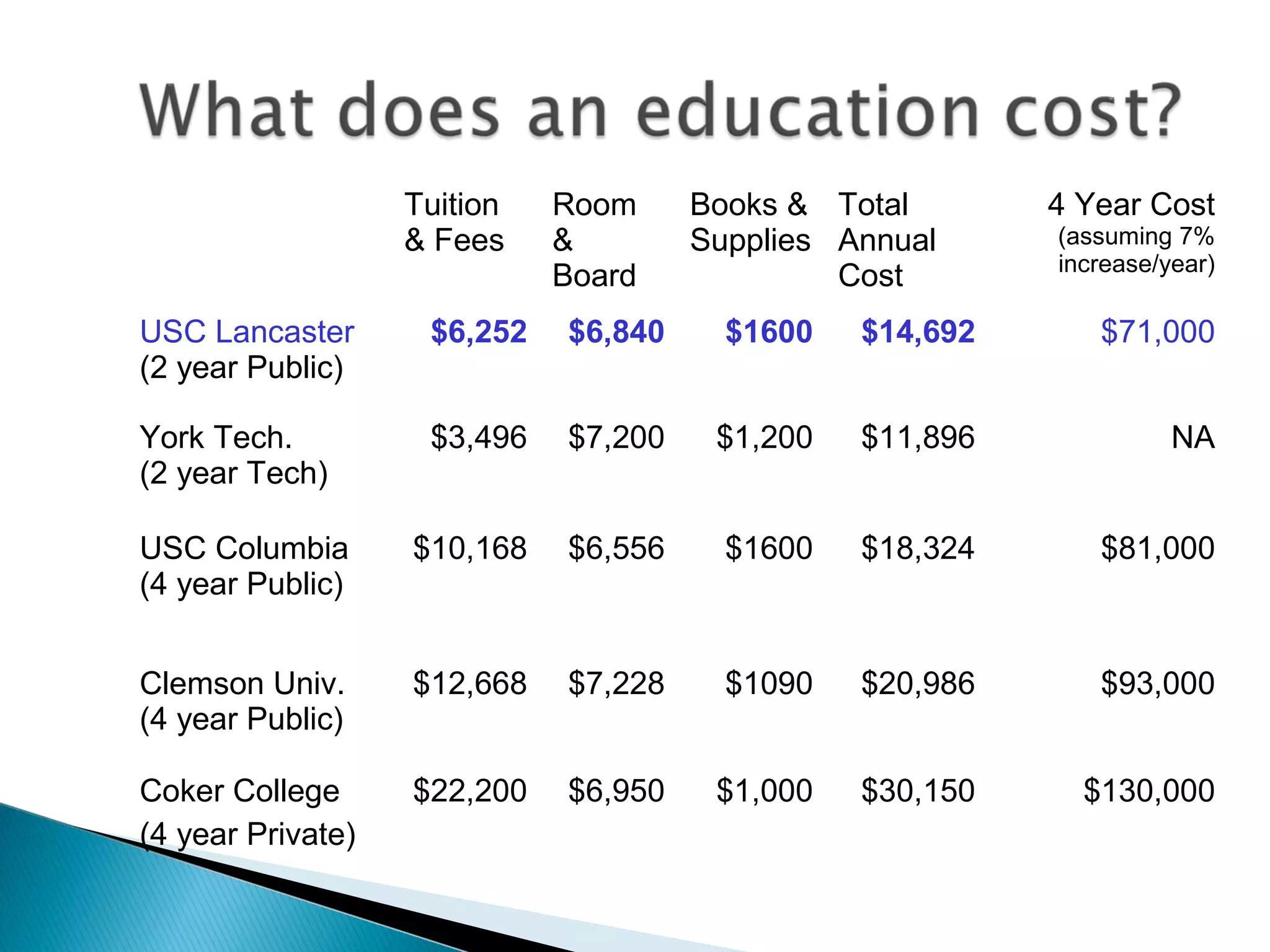

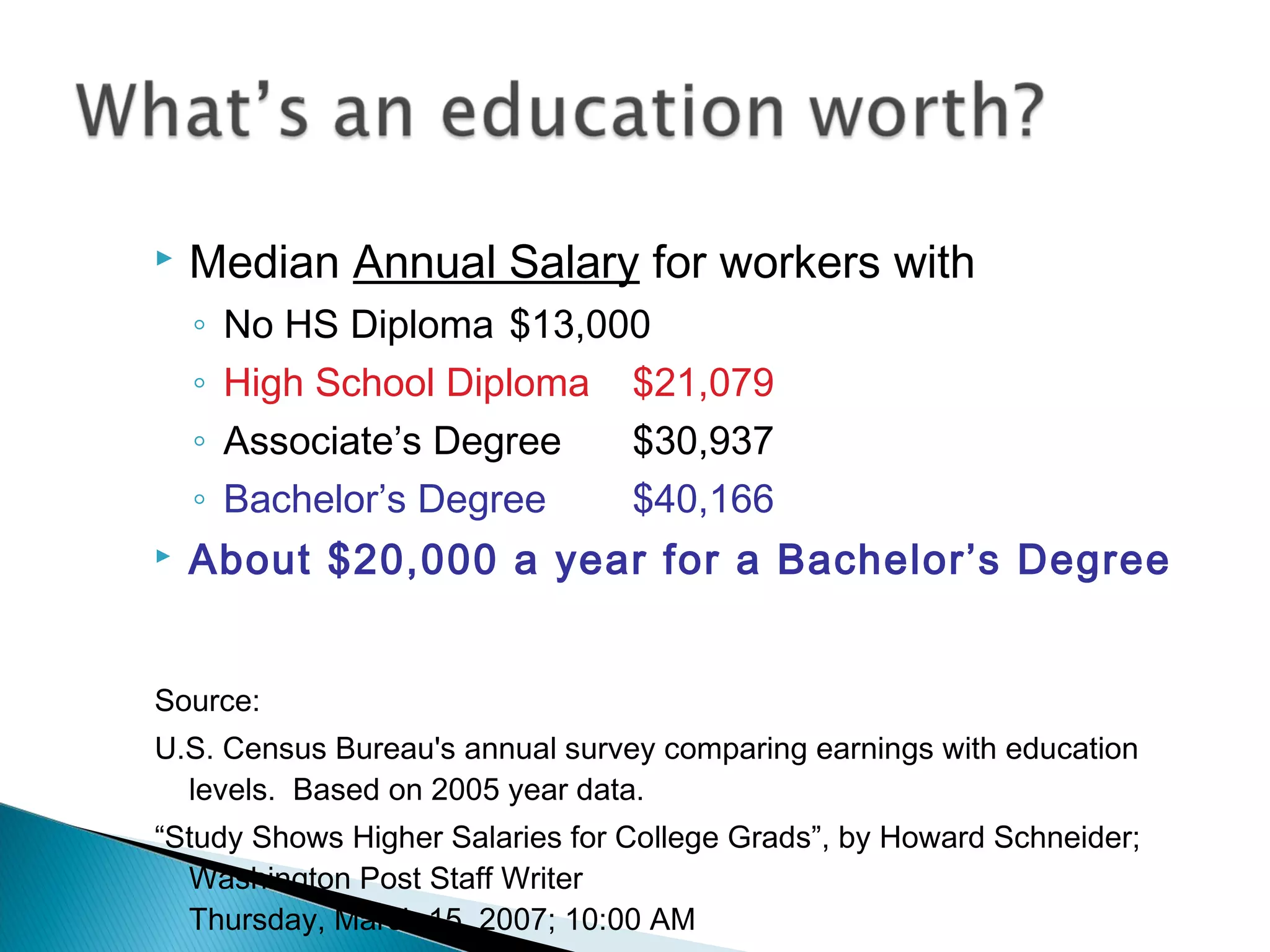

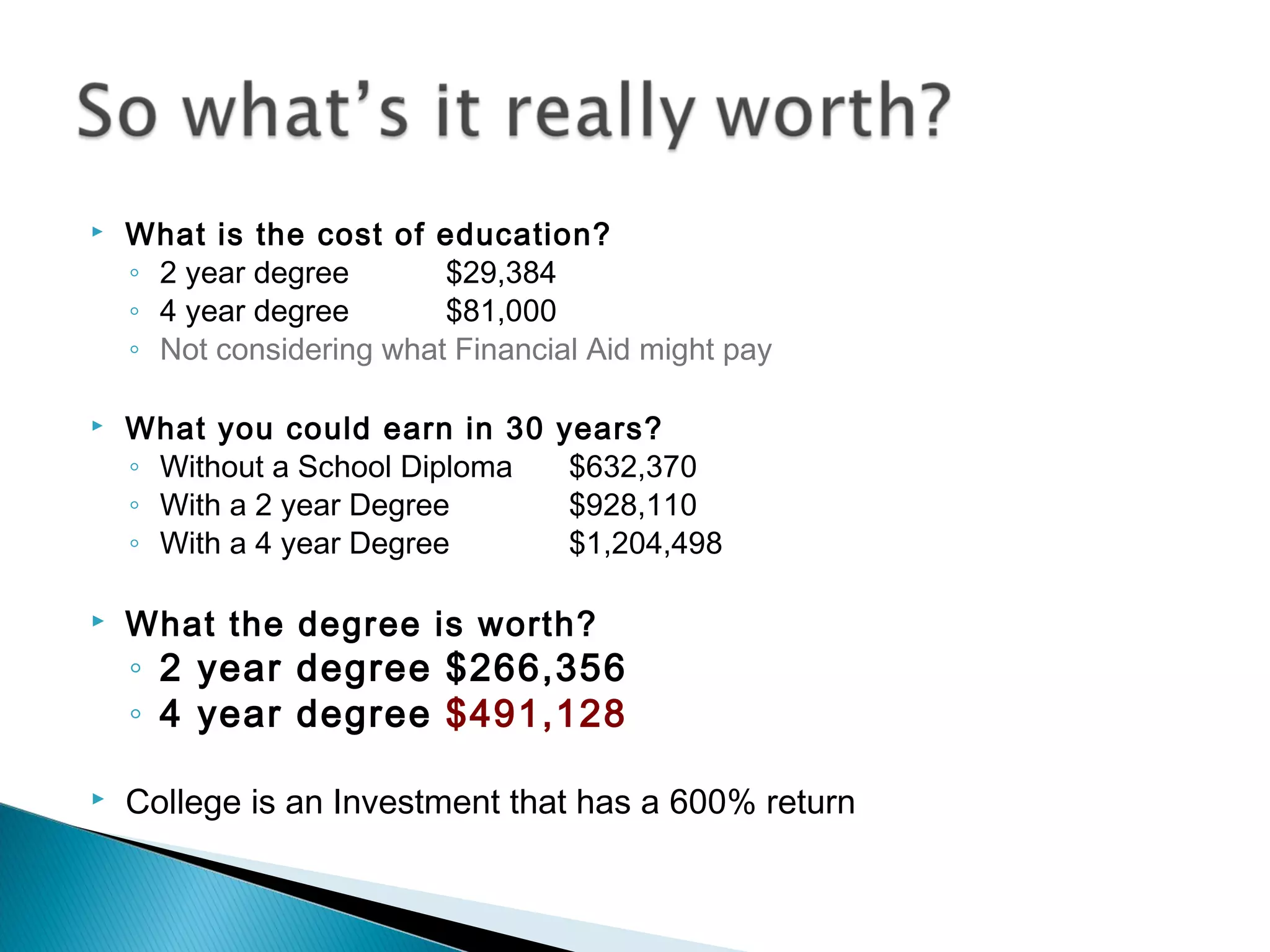

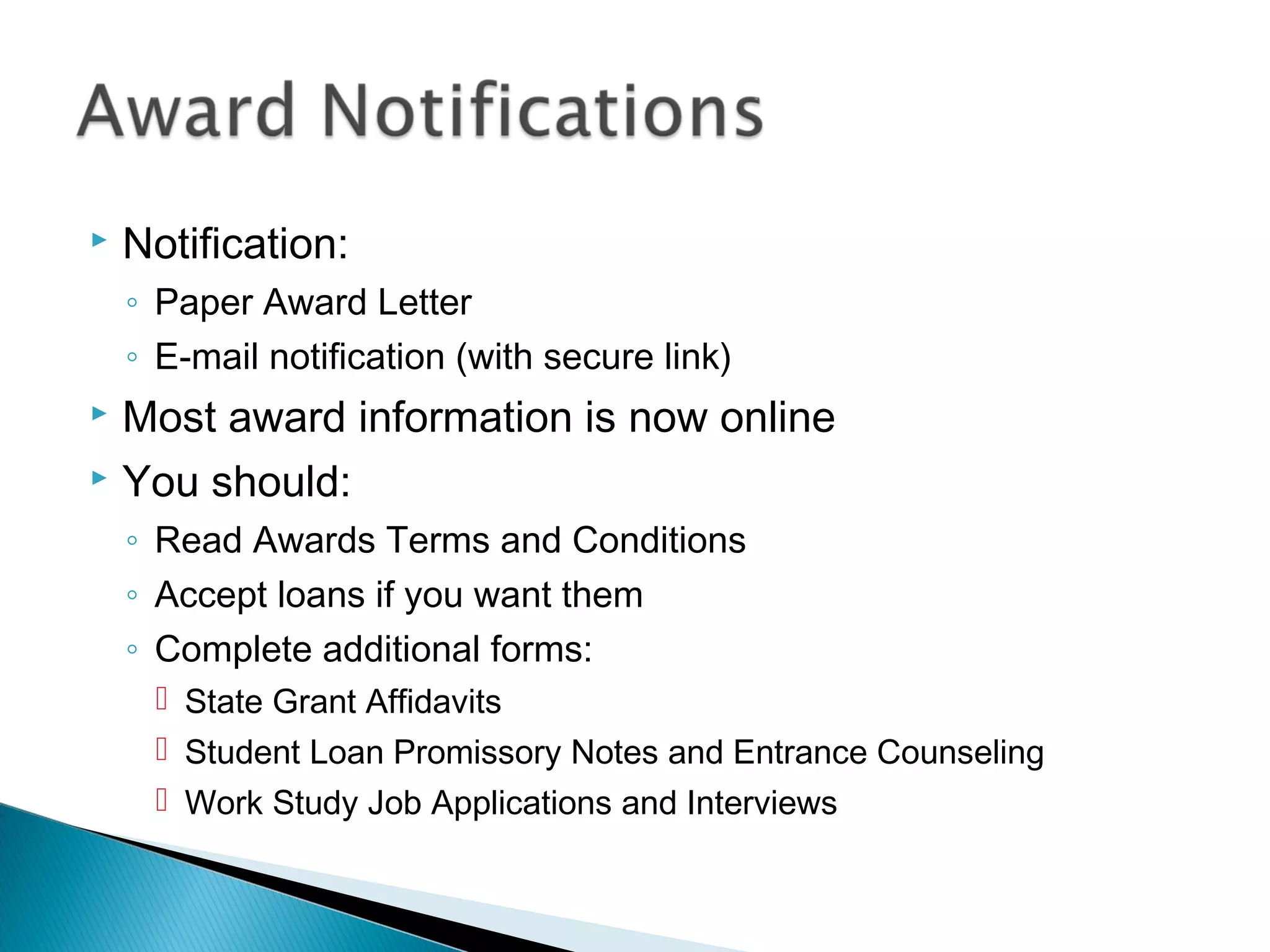

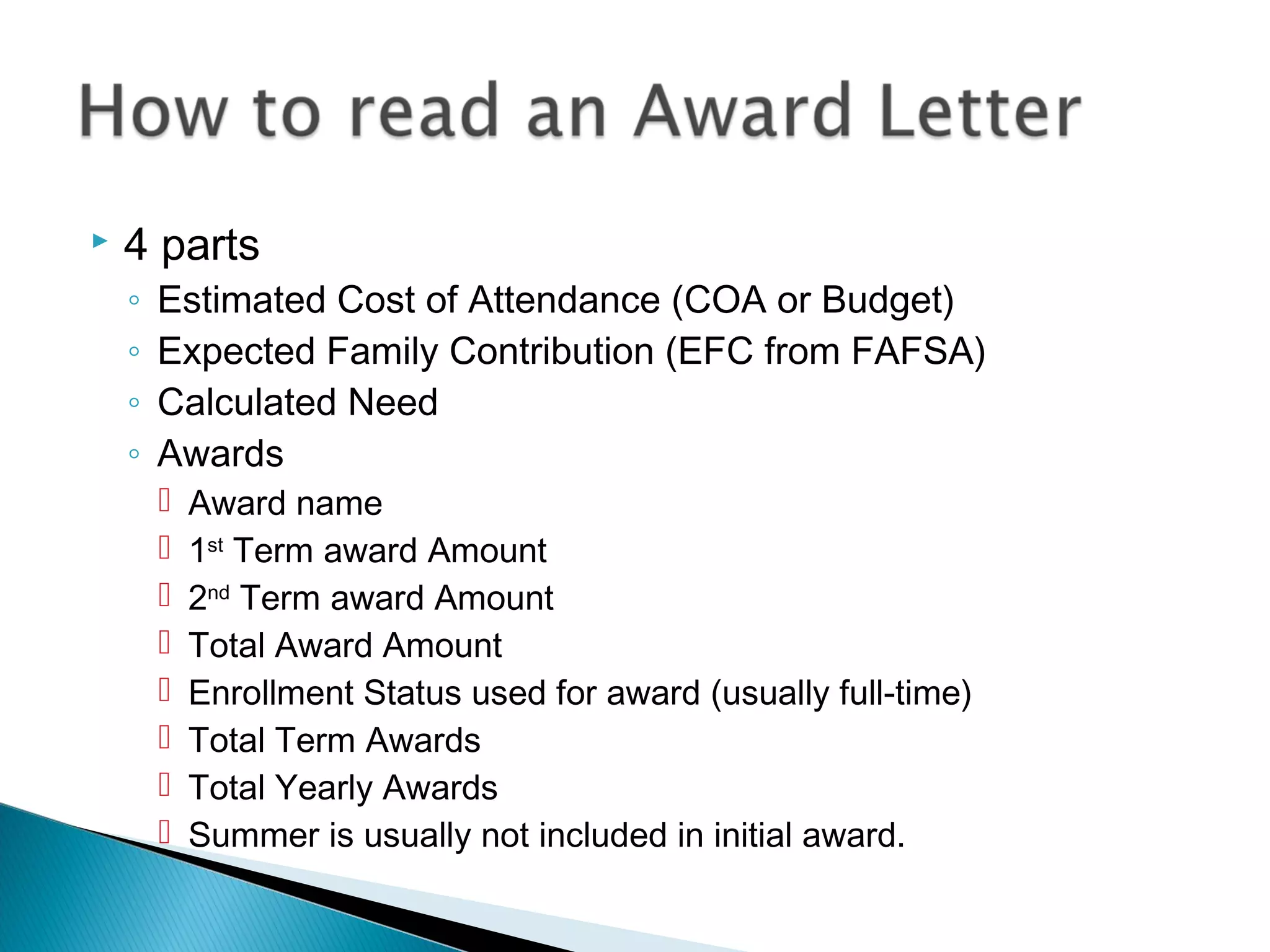

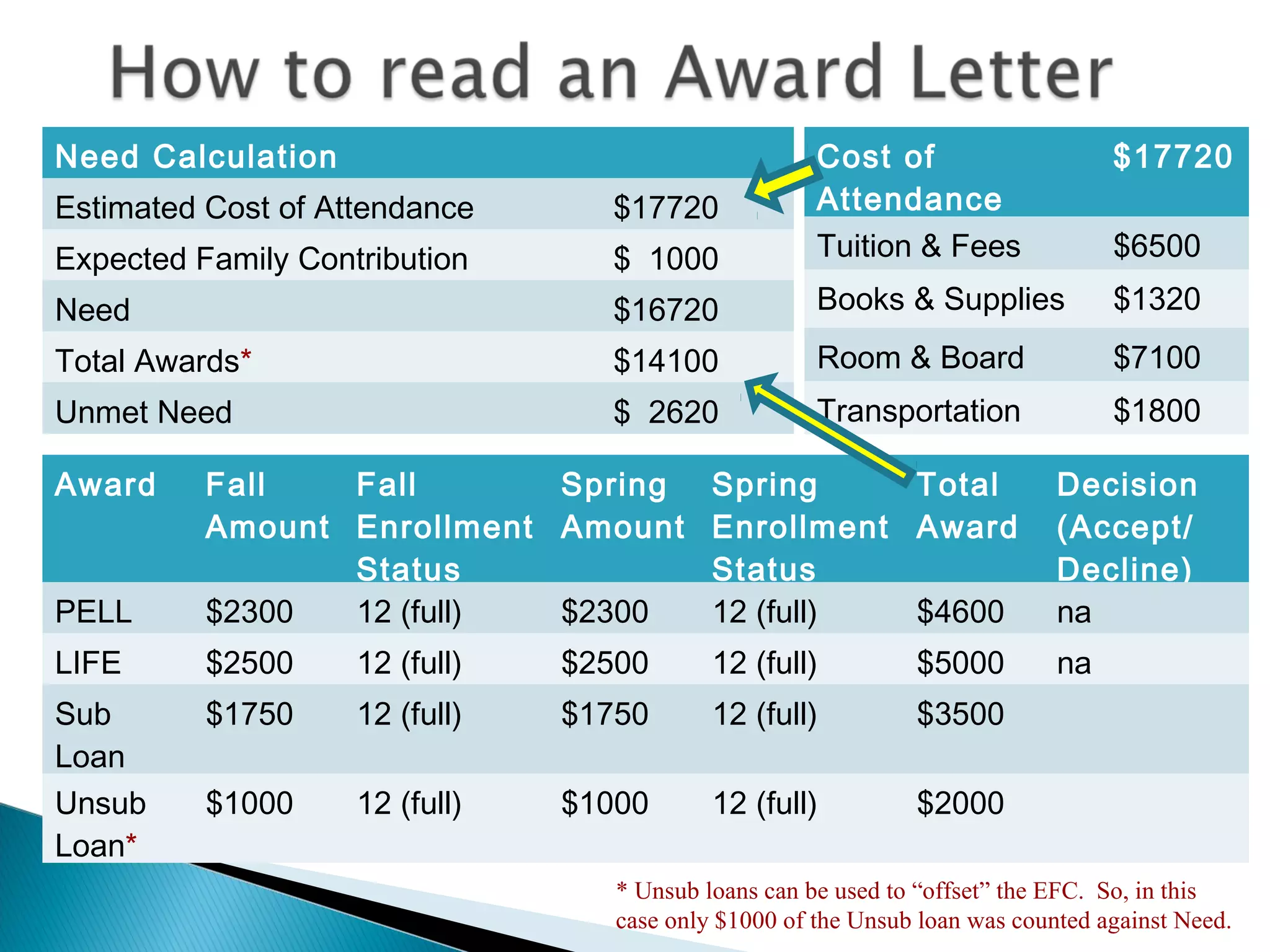

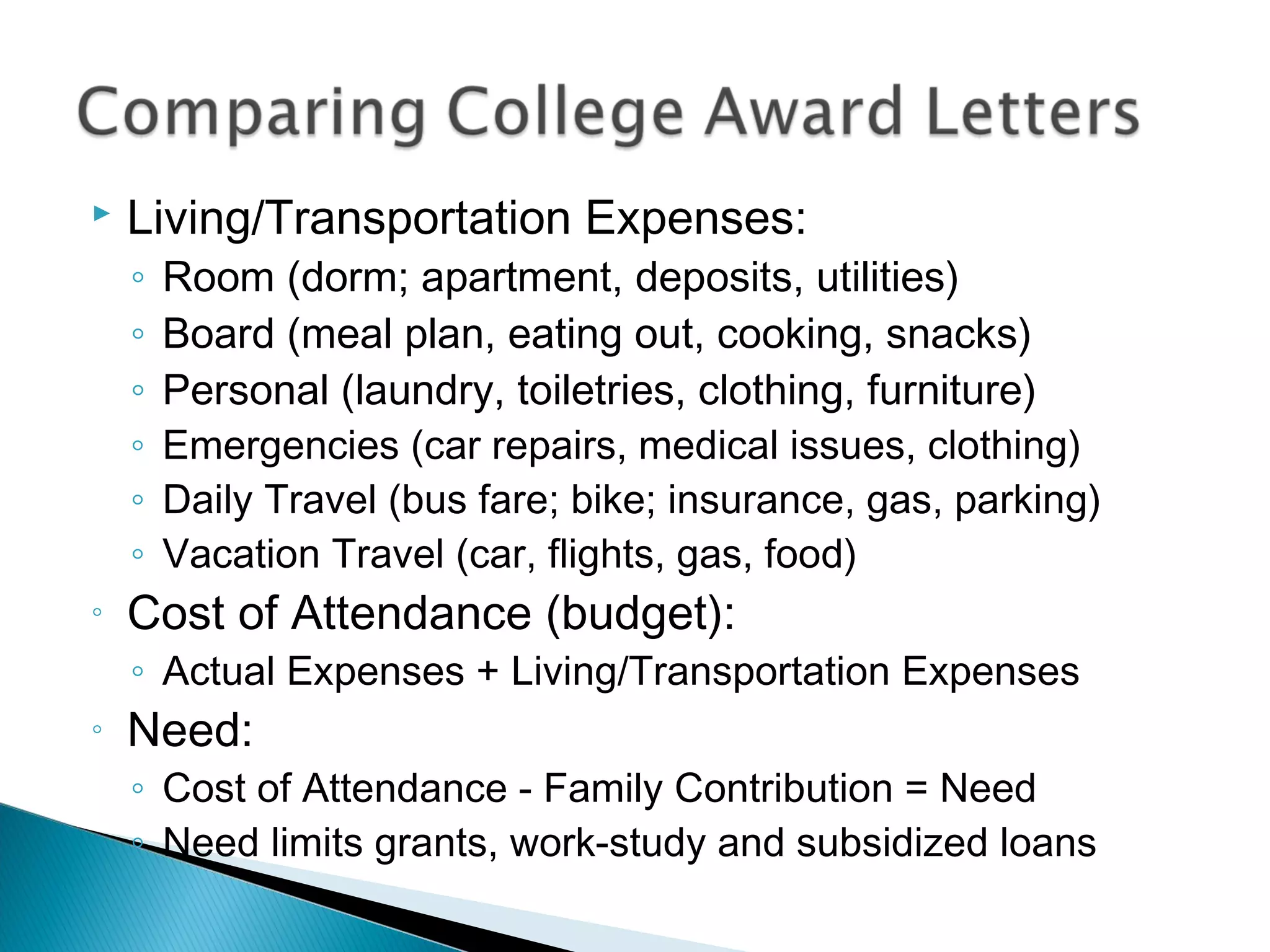

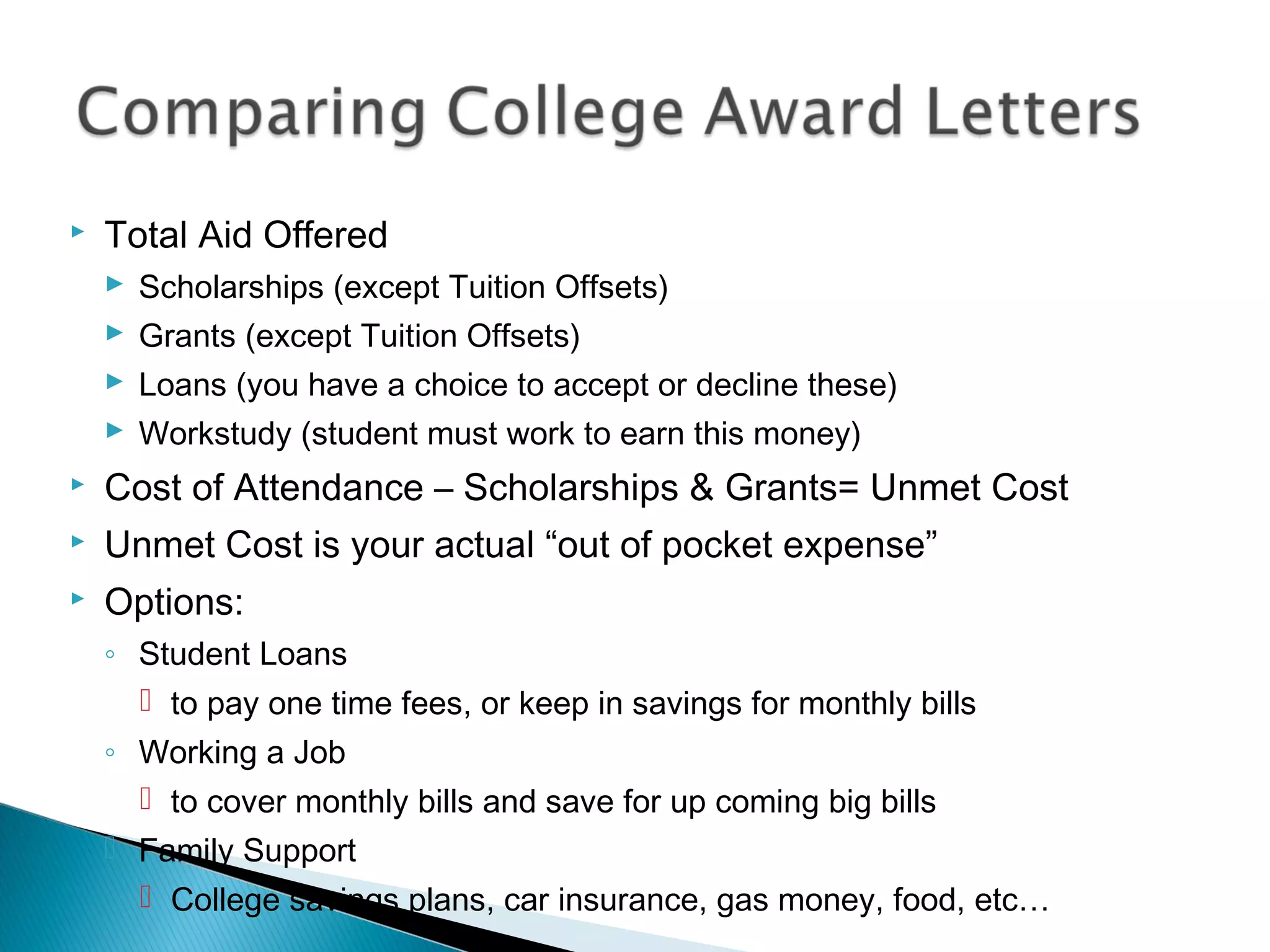

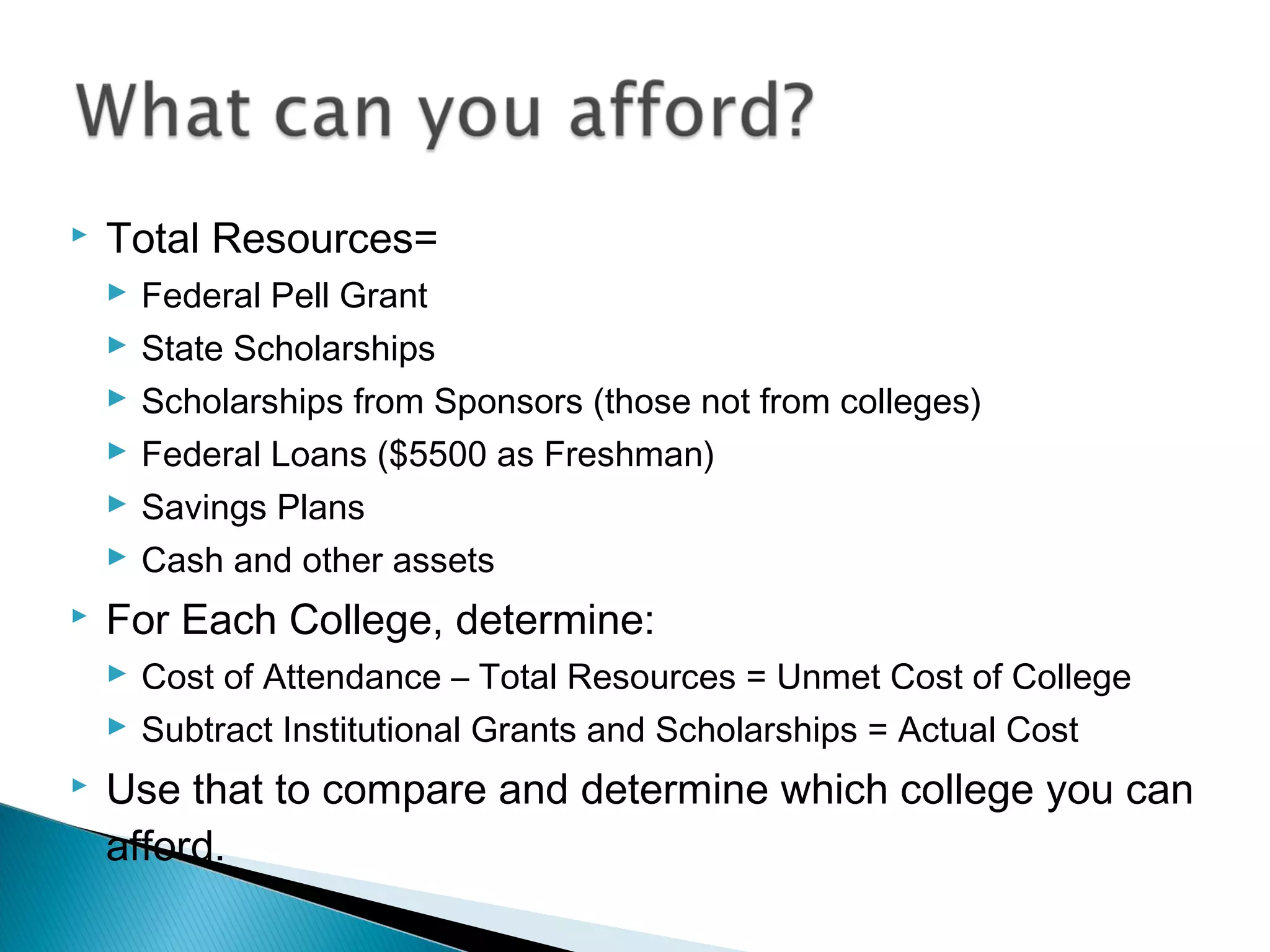

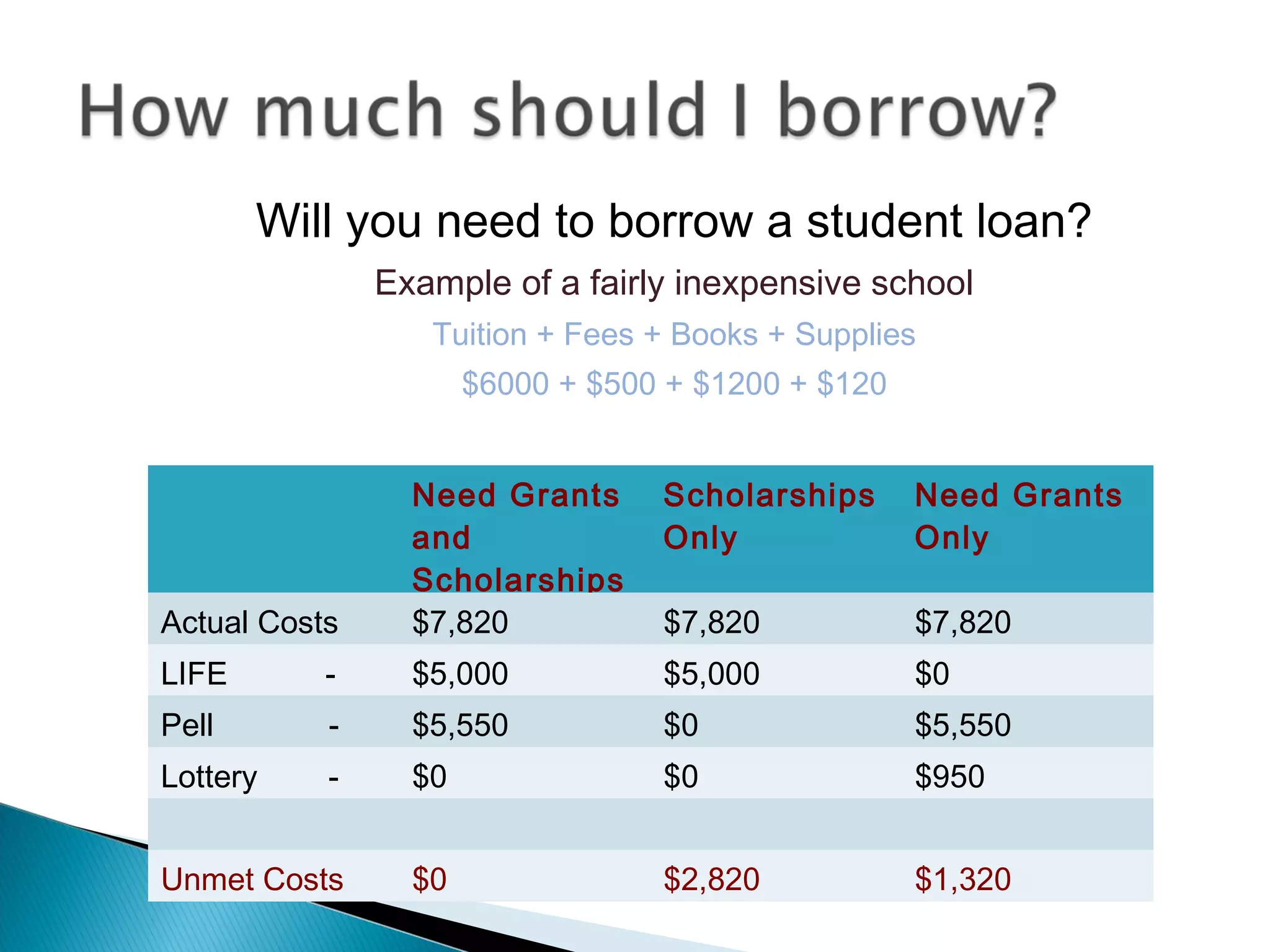

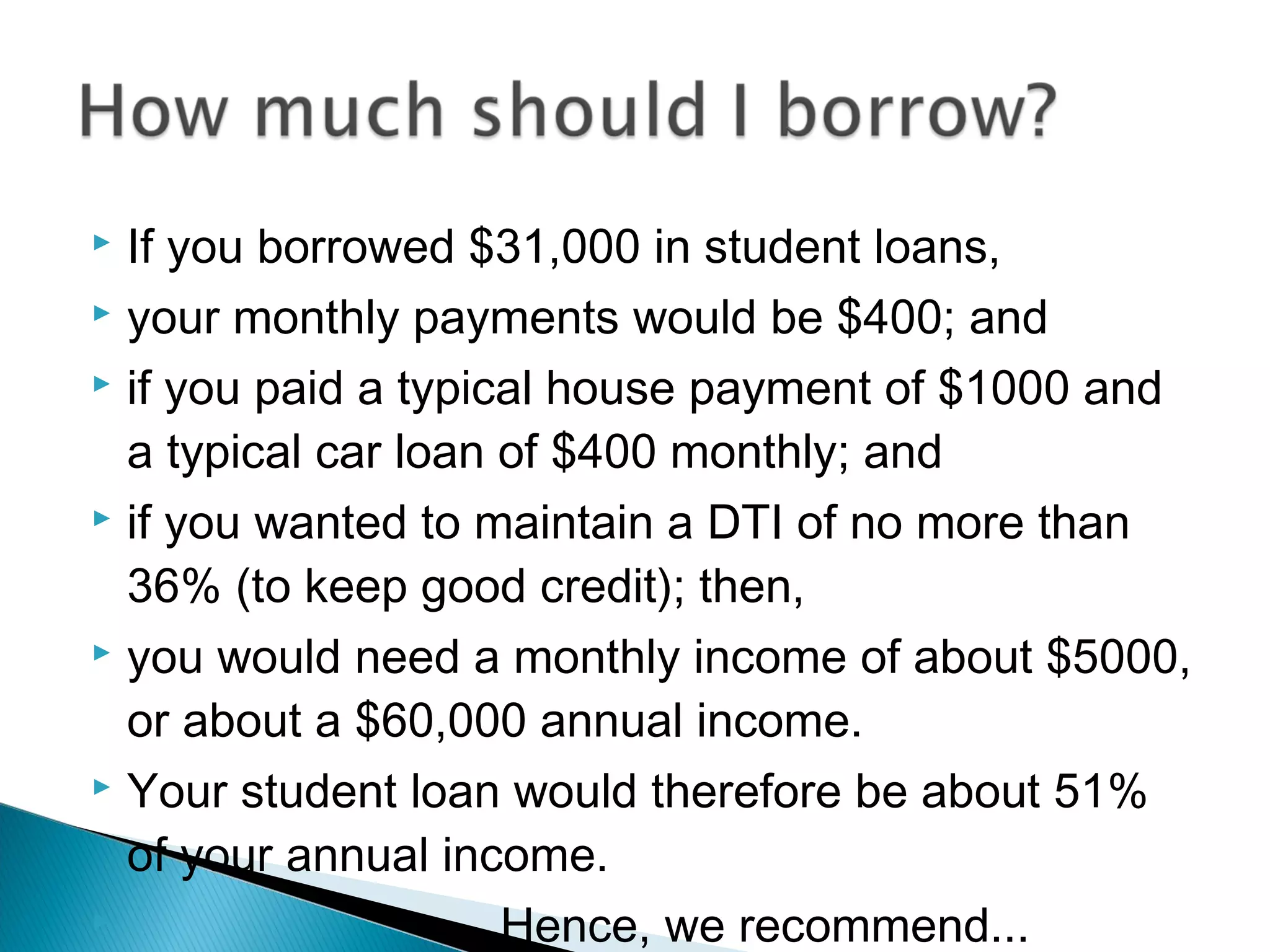

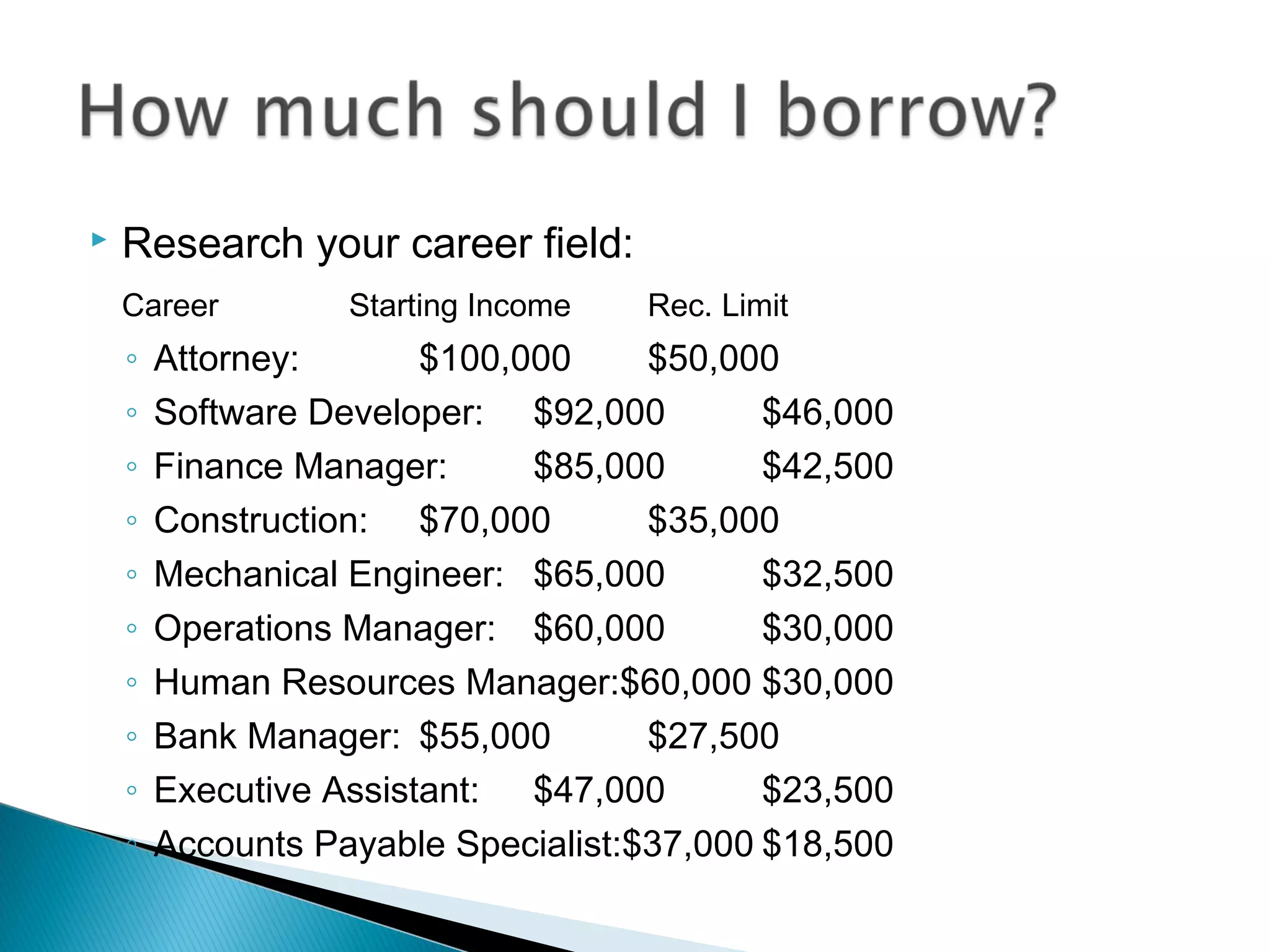

Kenneth Cole presented information on calculating the costs and financial aid for college. He discussed determining the cost of attendance, grants and scholarships, loans, and calculating the actual out-of-pocket costs for different colleges. He emphasized not borrowing more than half of the anticipated starting salary for your intended career to avoid excessive student loan debt. The presentation aimed to help students make informed decisions when comparing college costs and financial aid packages.