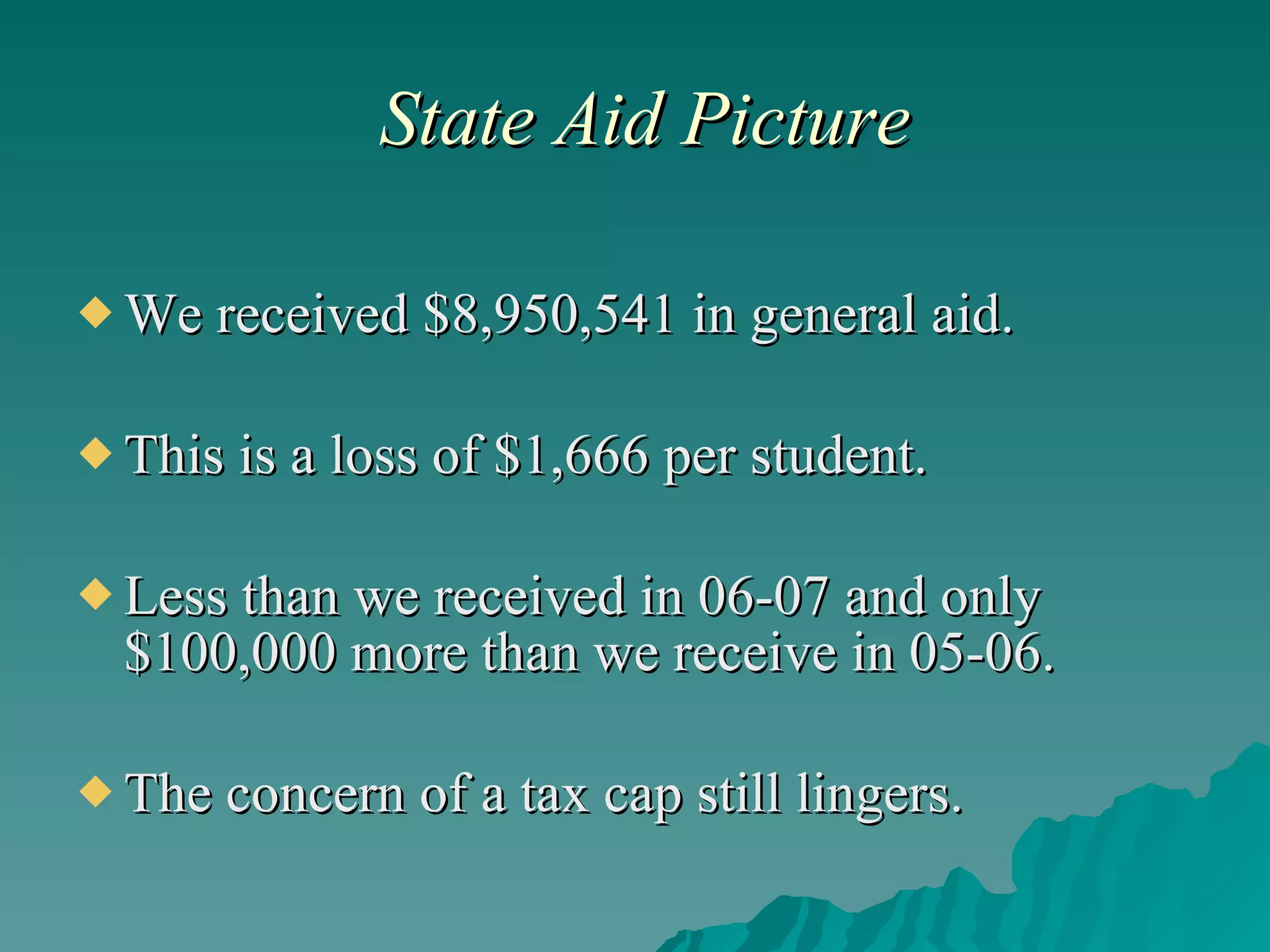

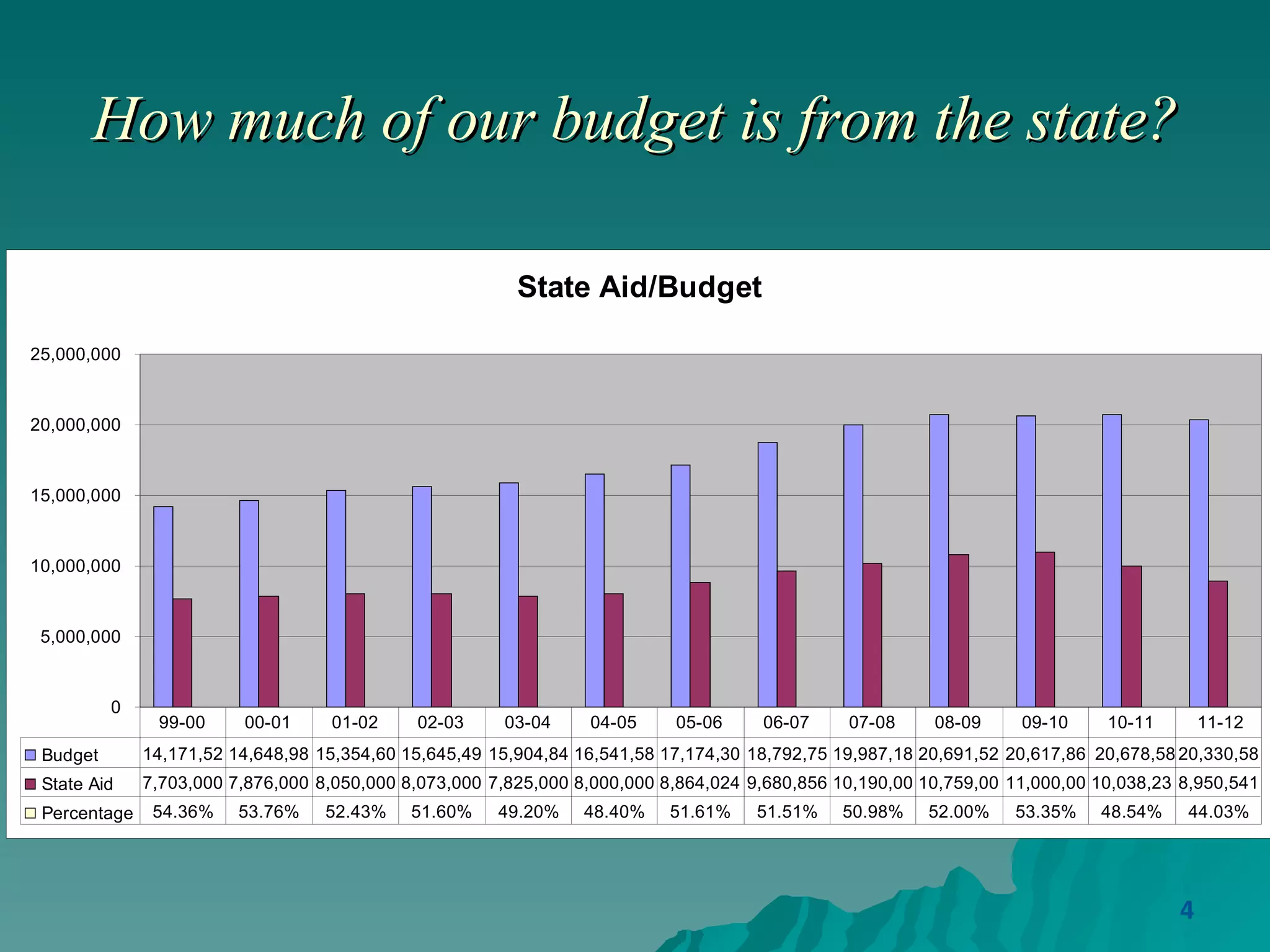

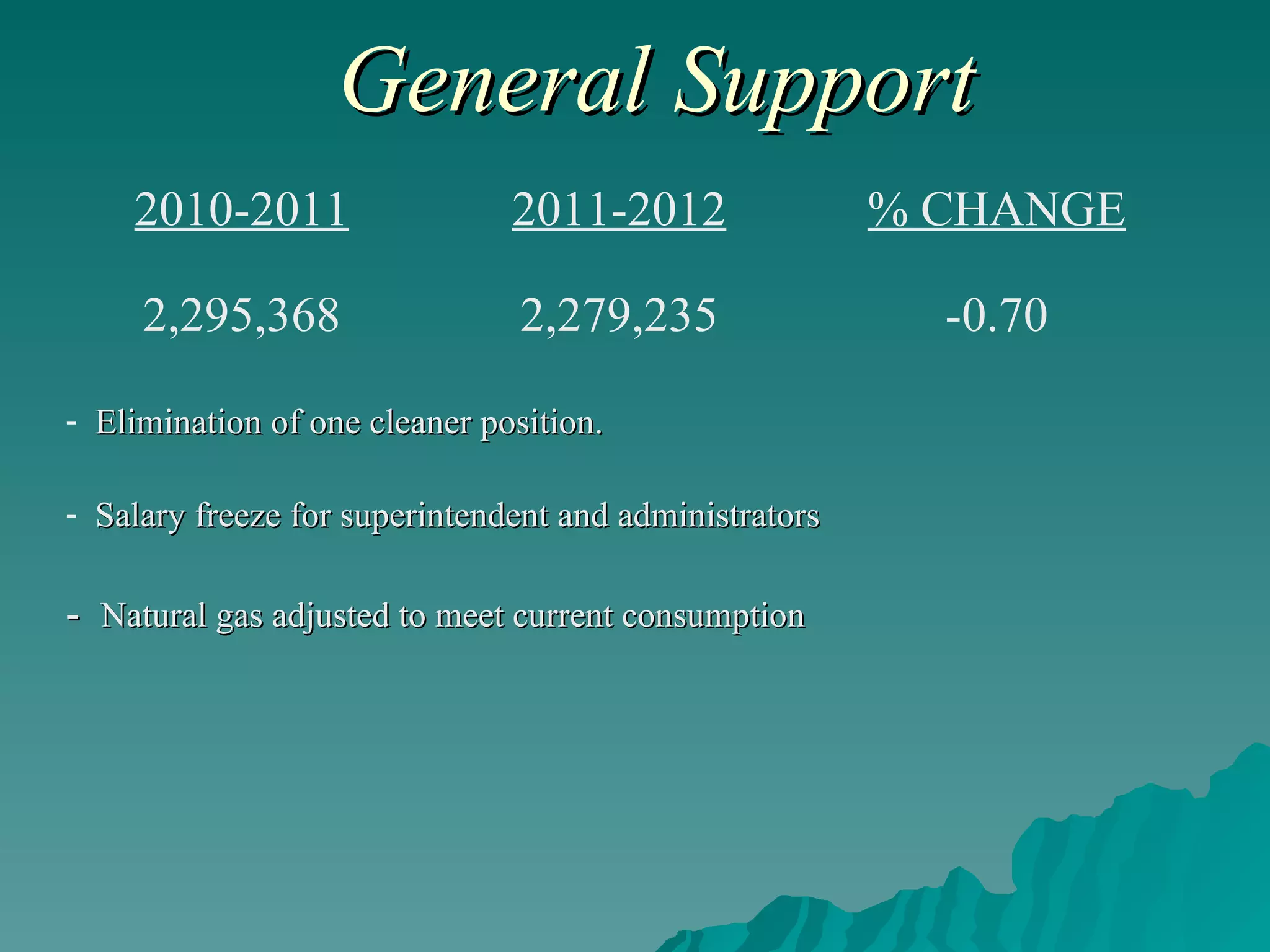

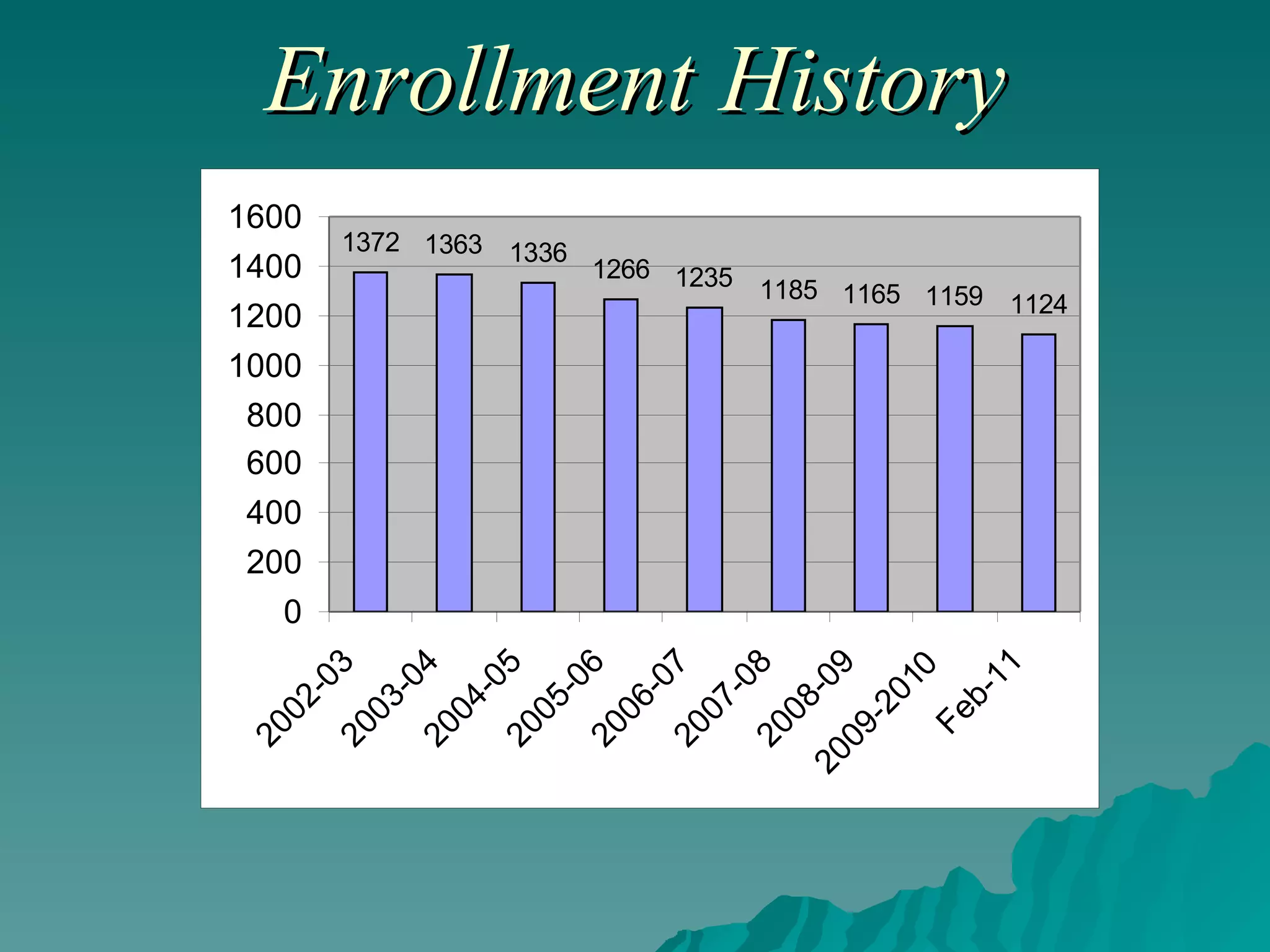

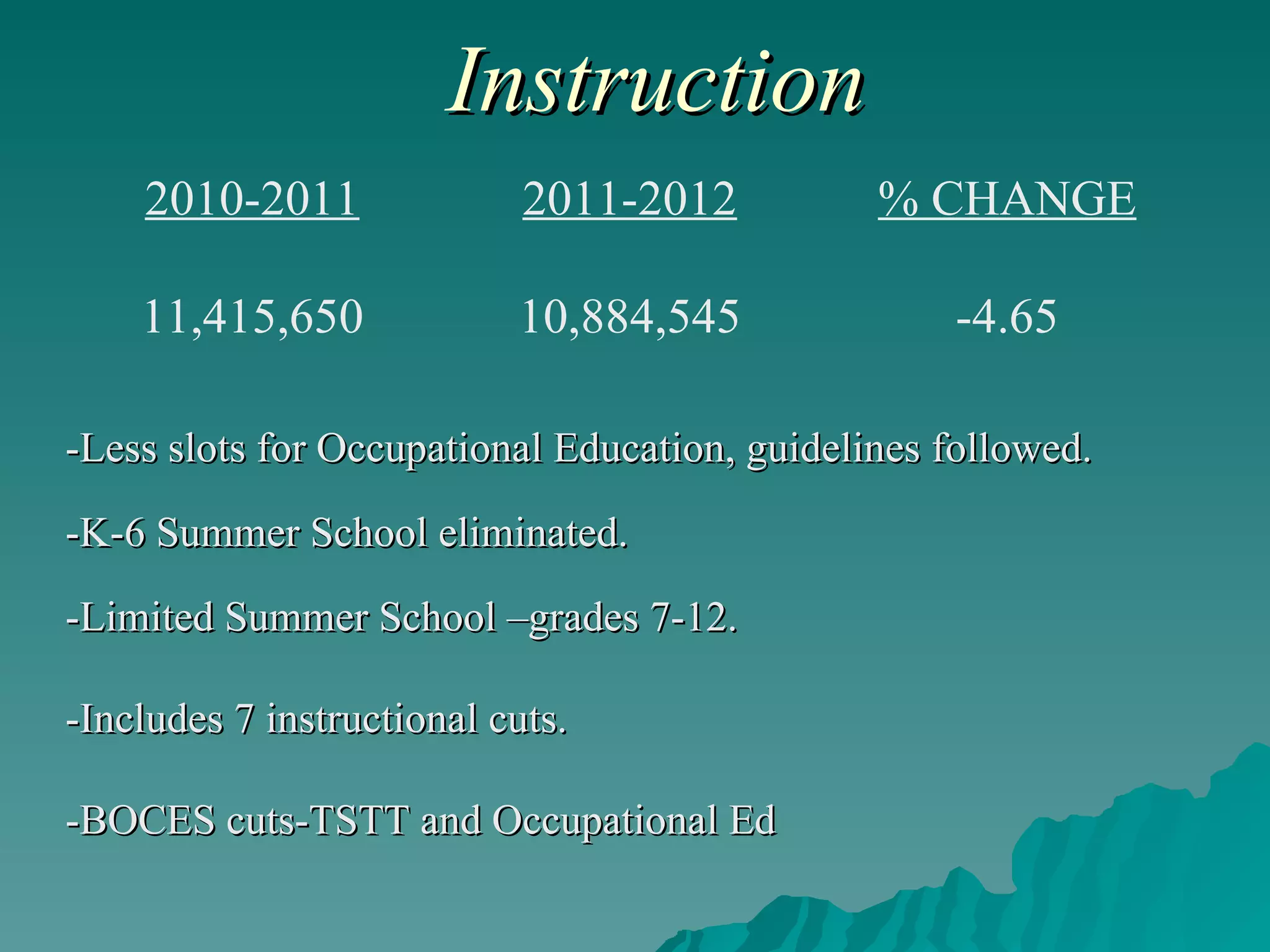

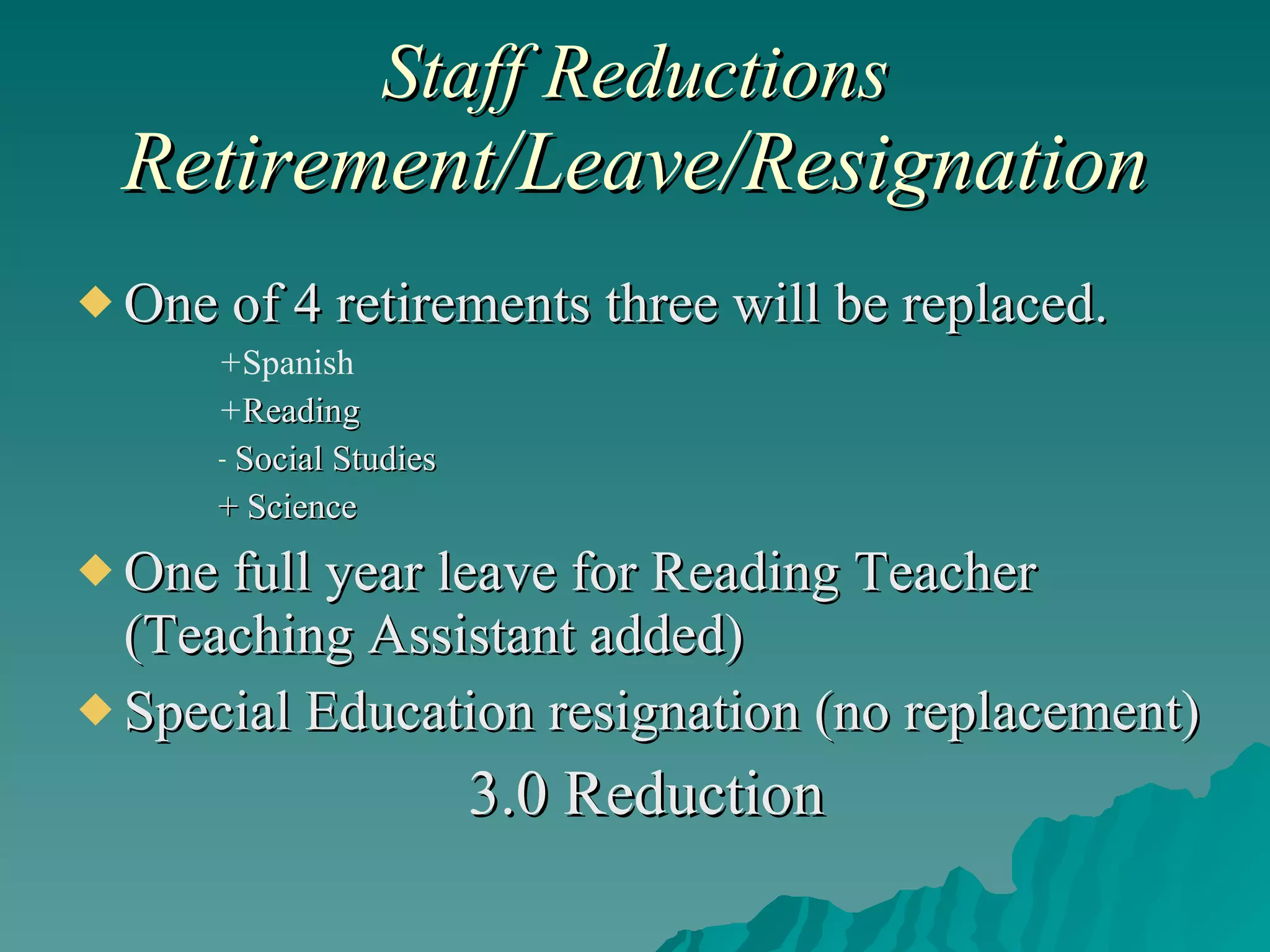

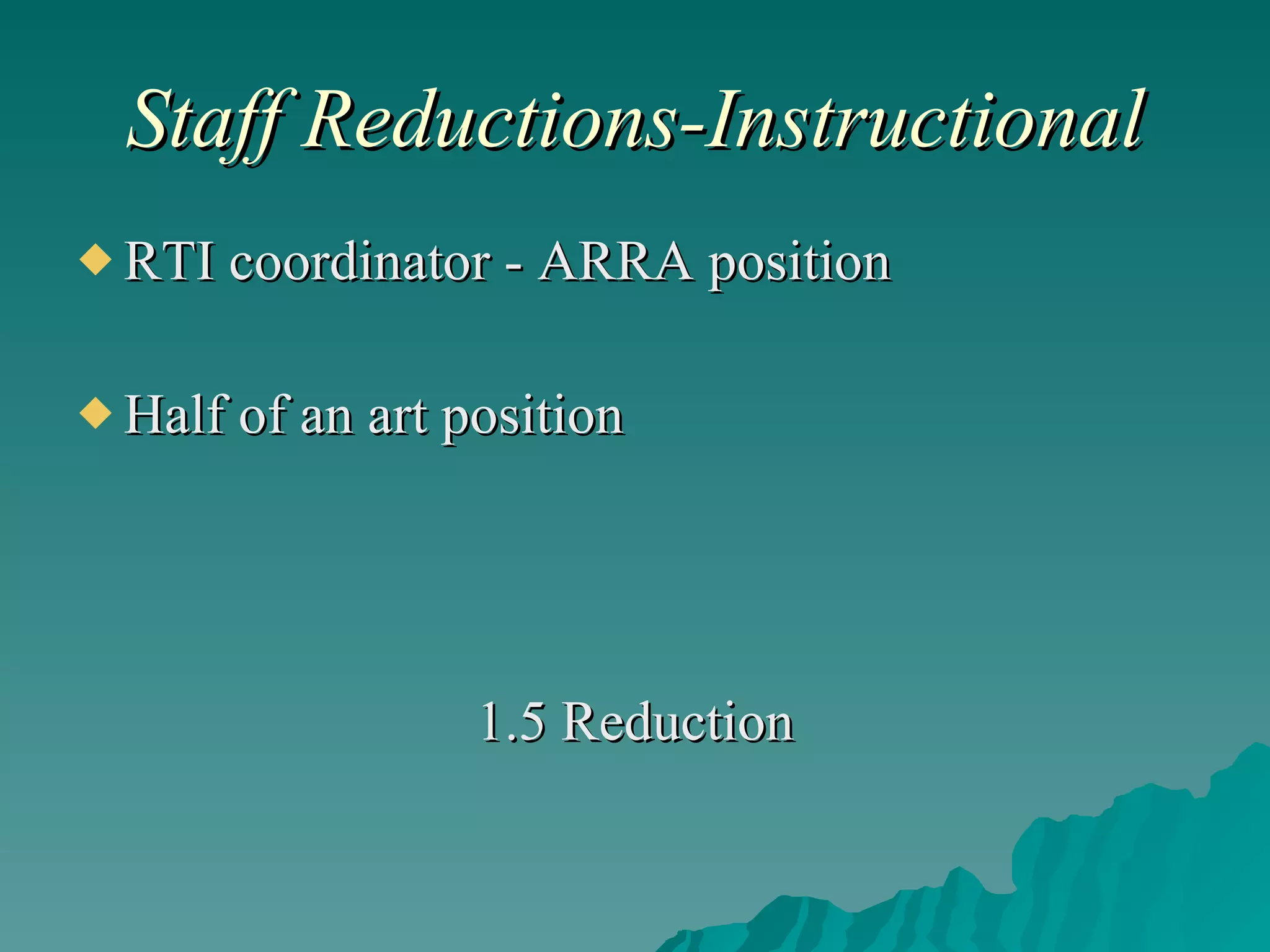

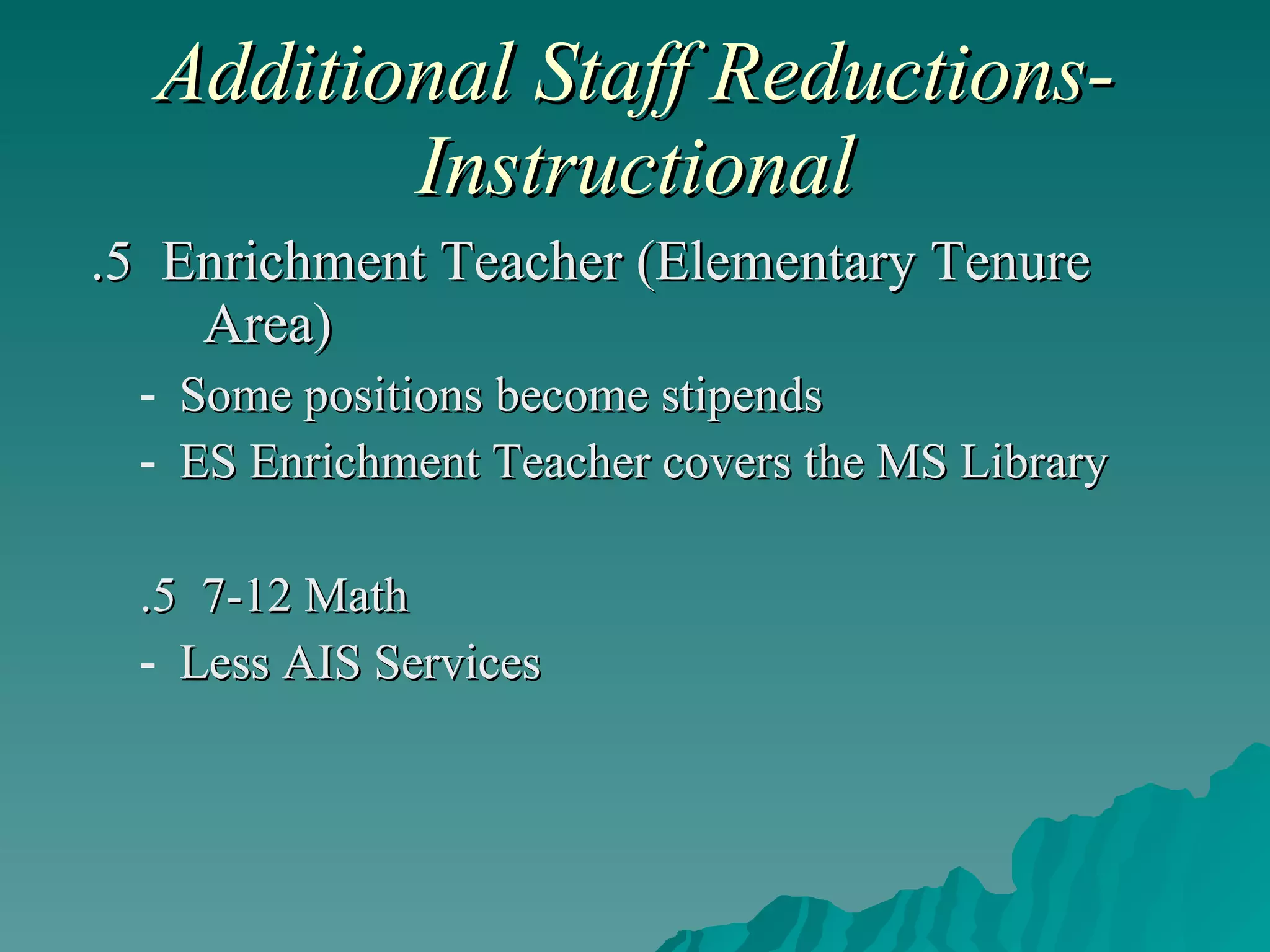

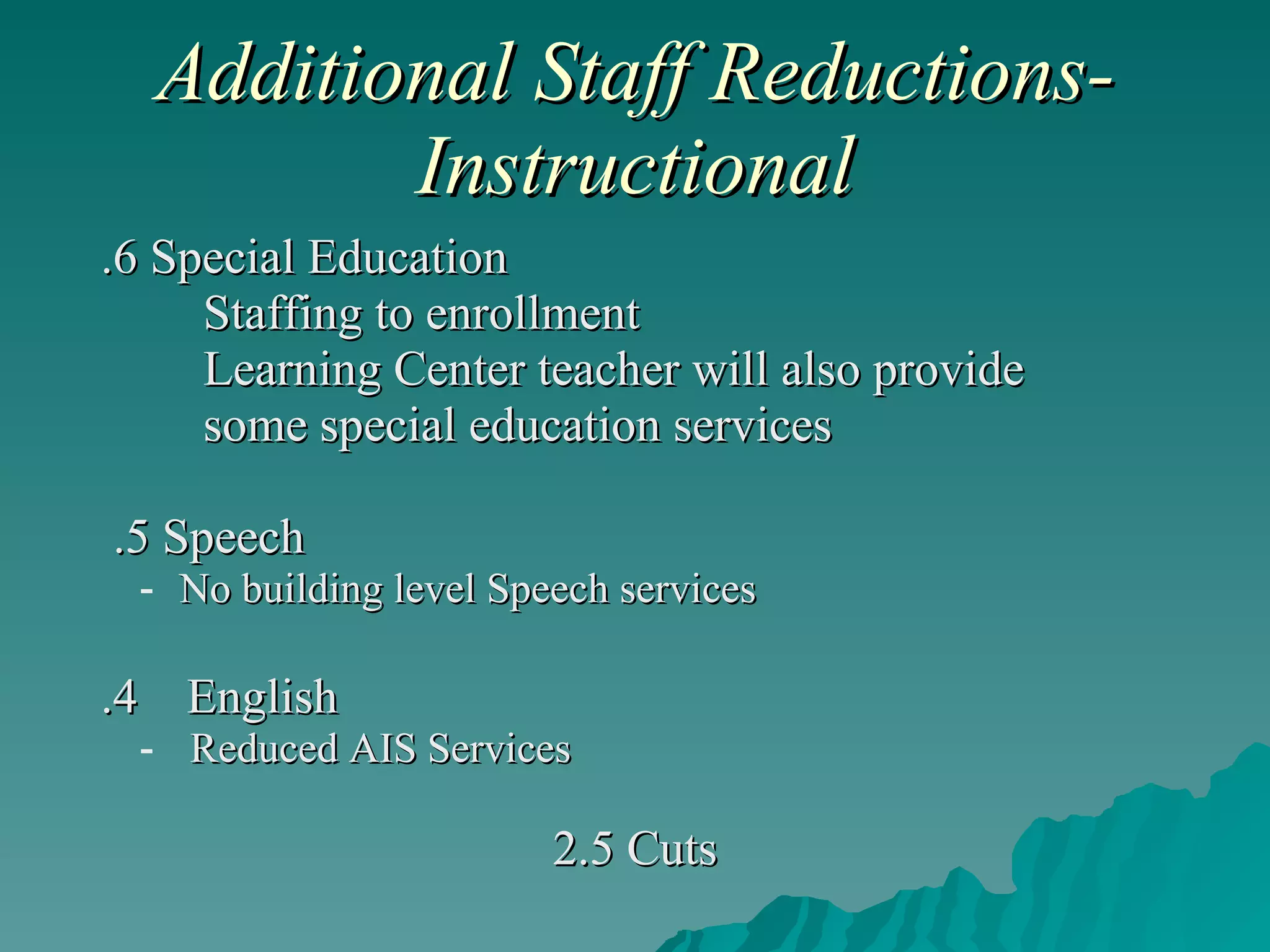

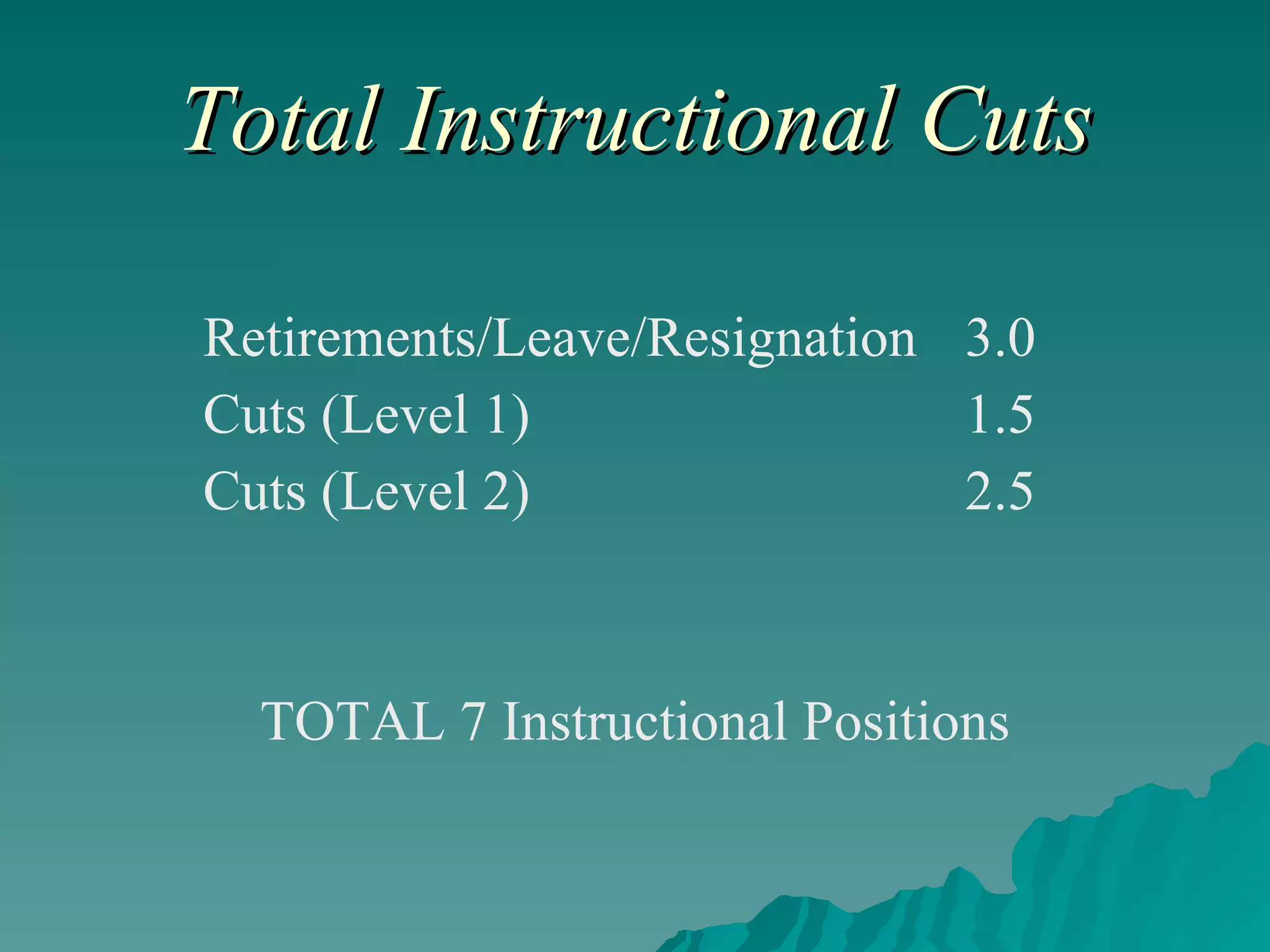

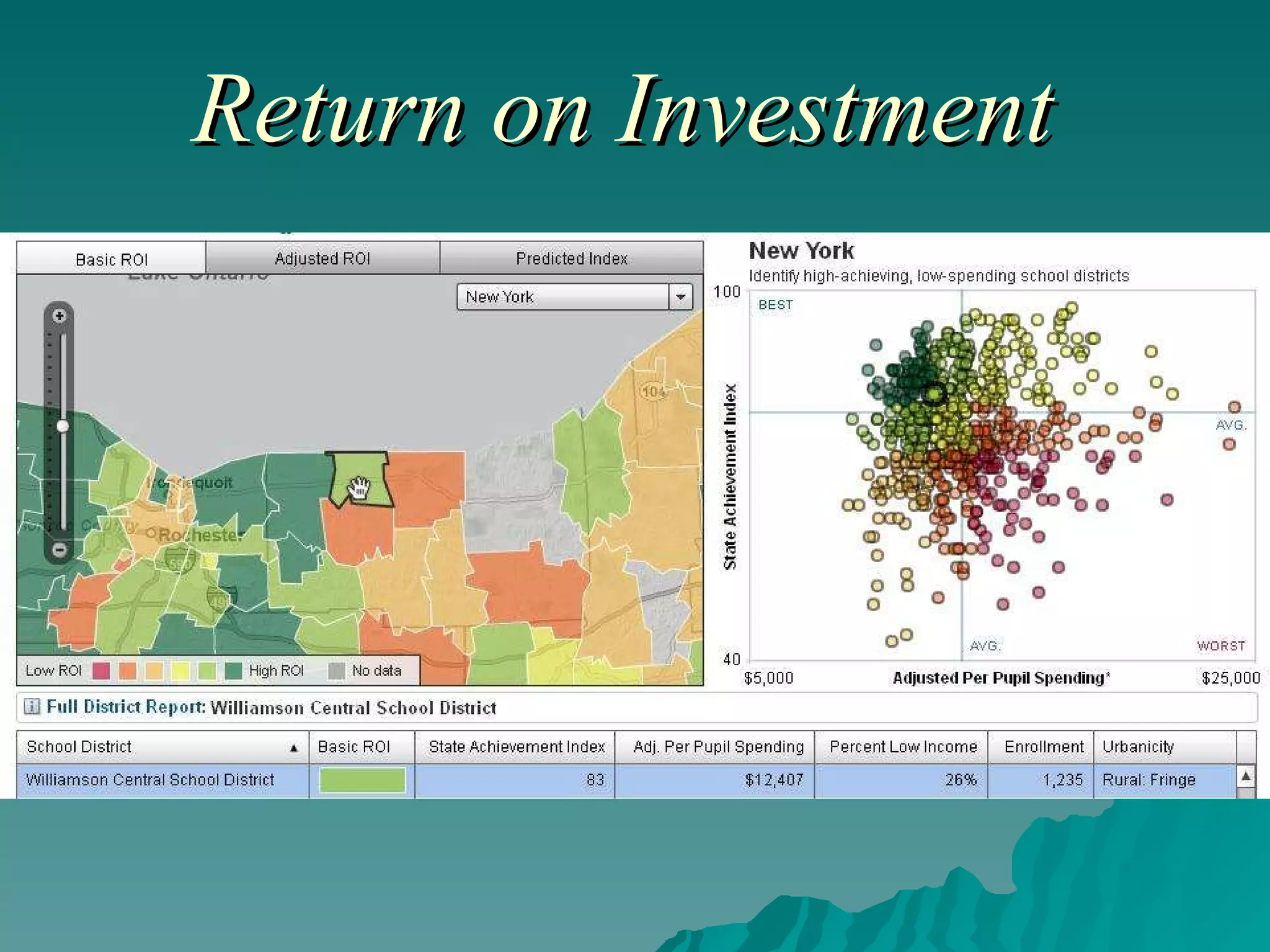

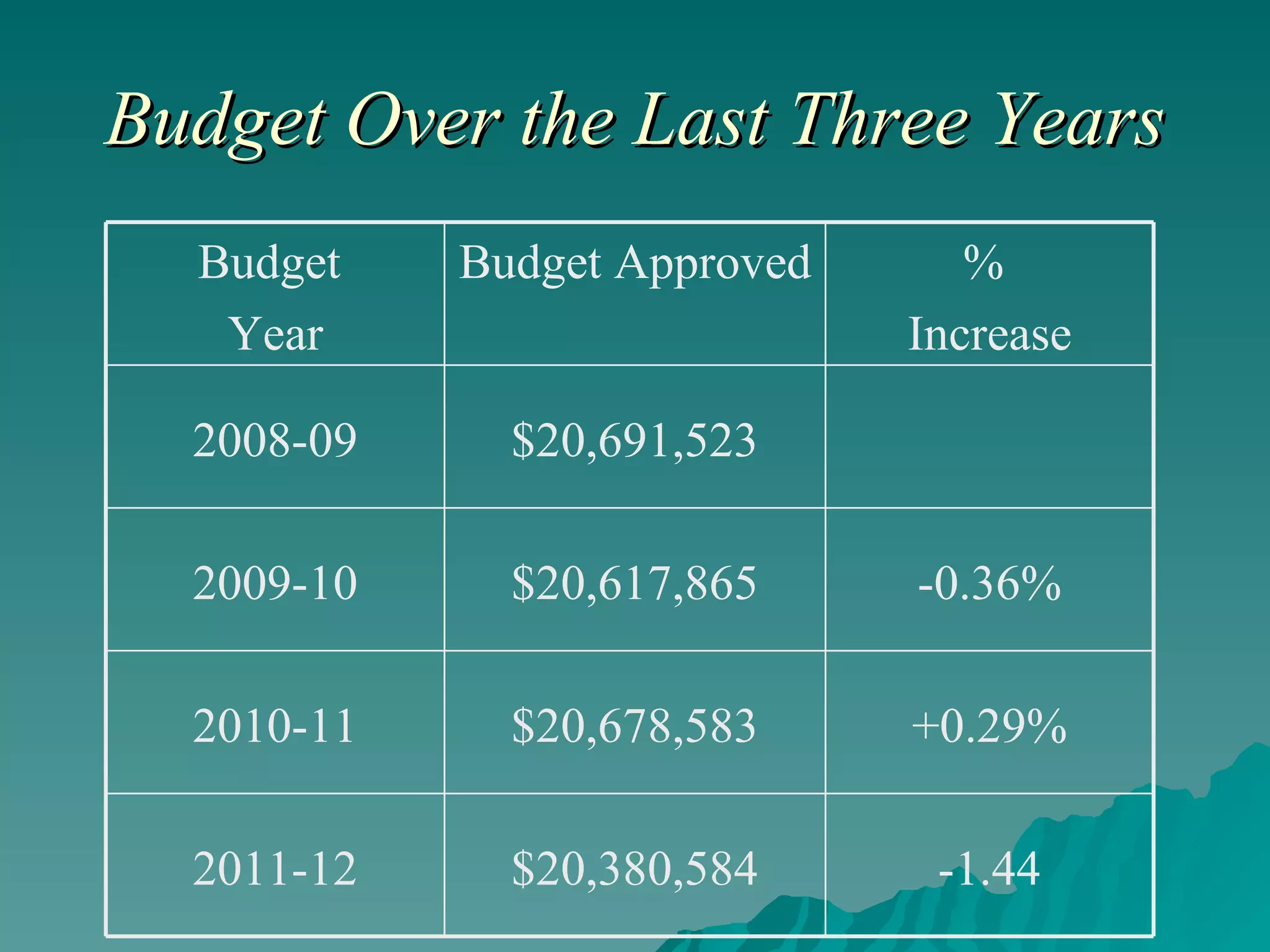

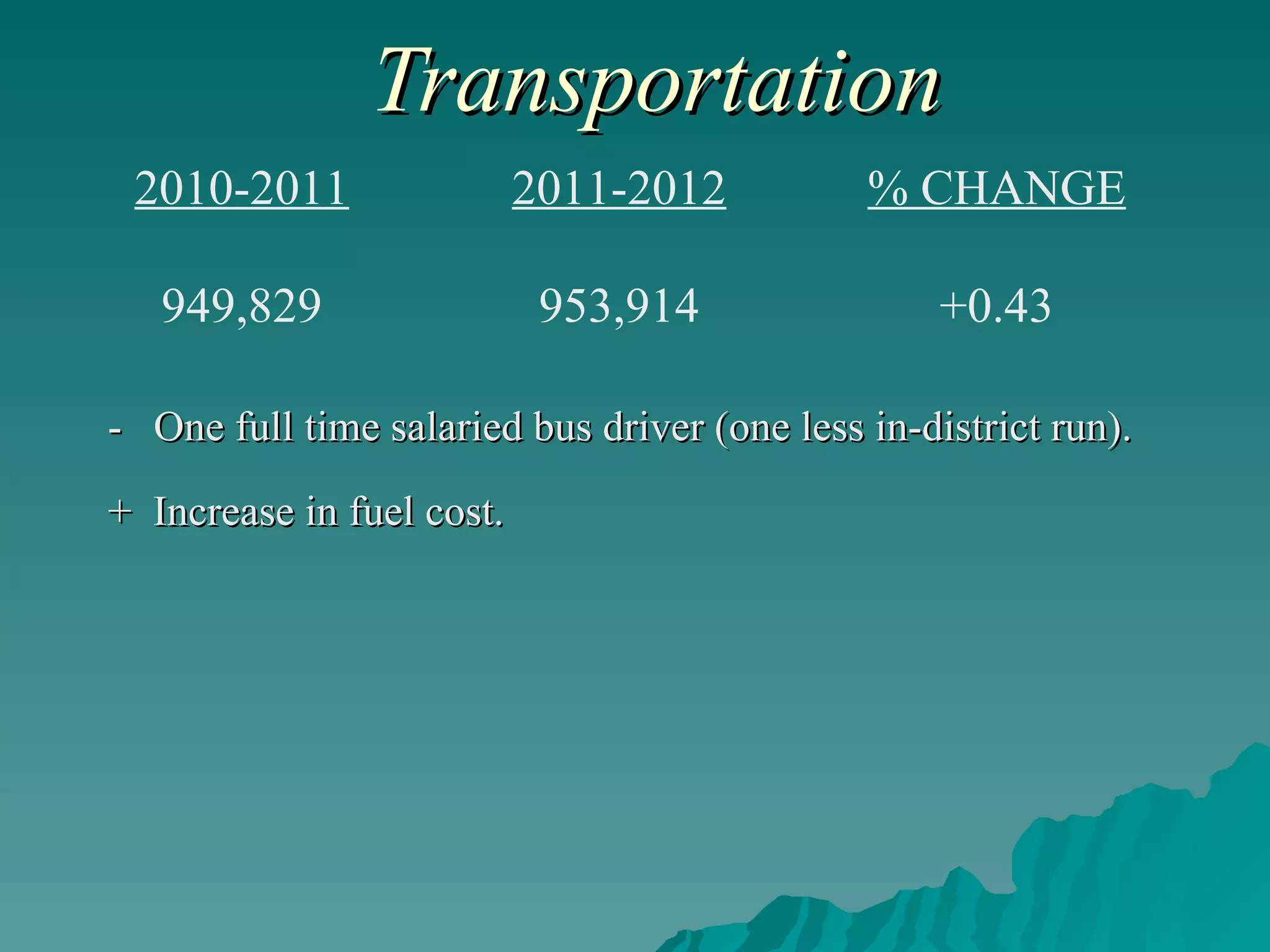

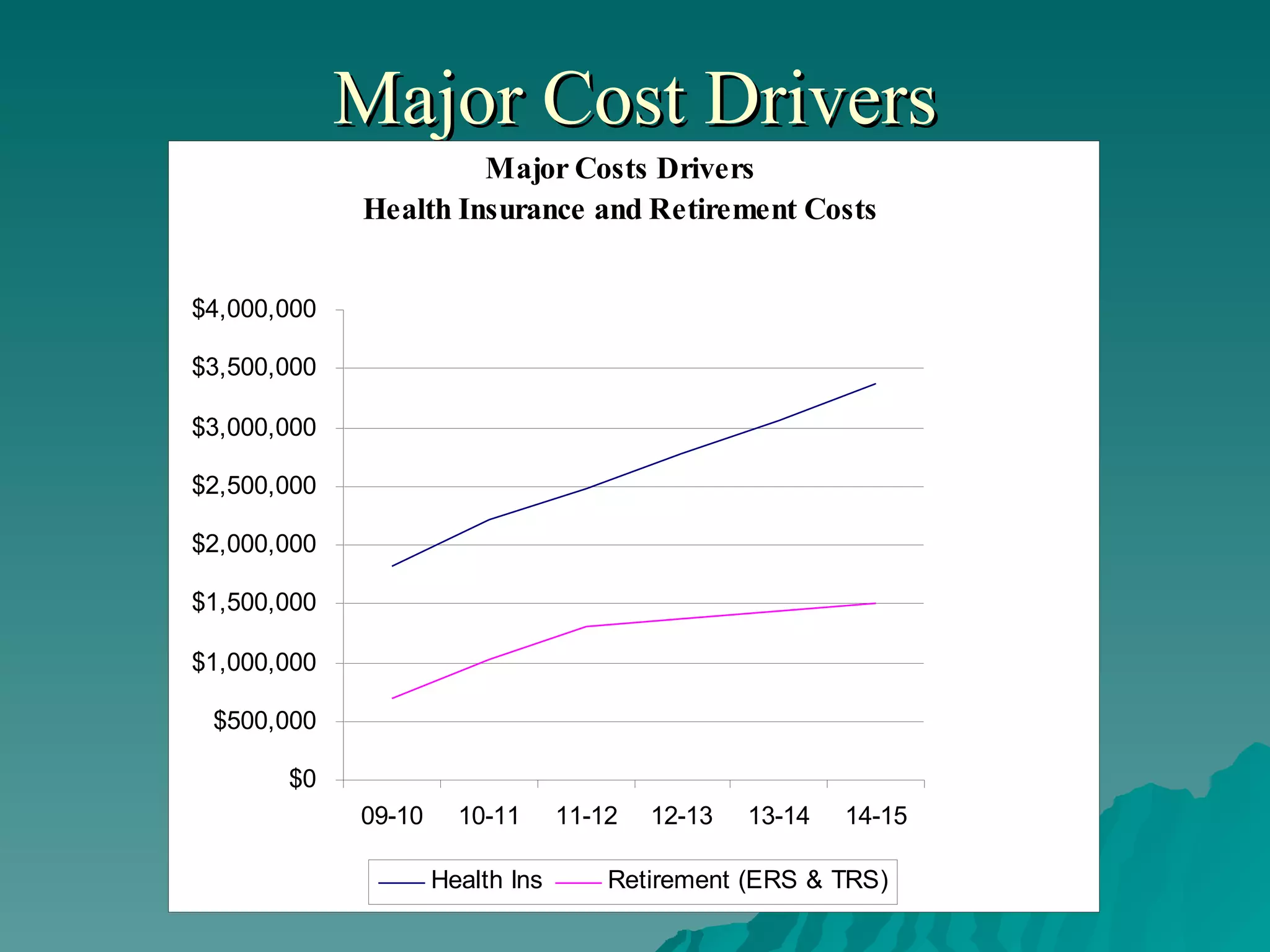

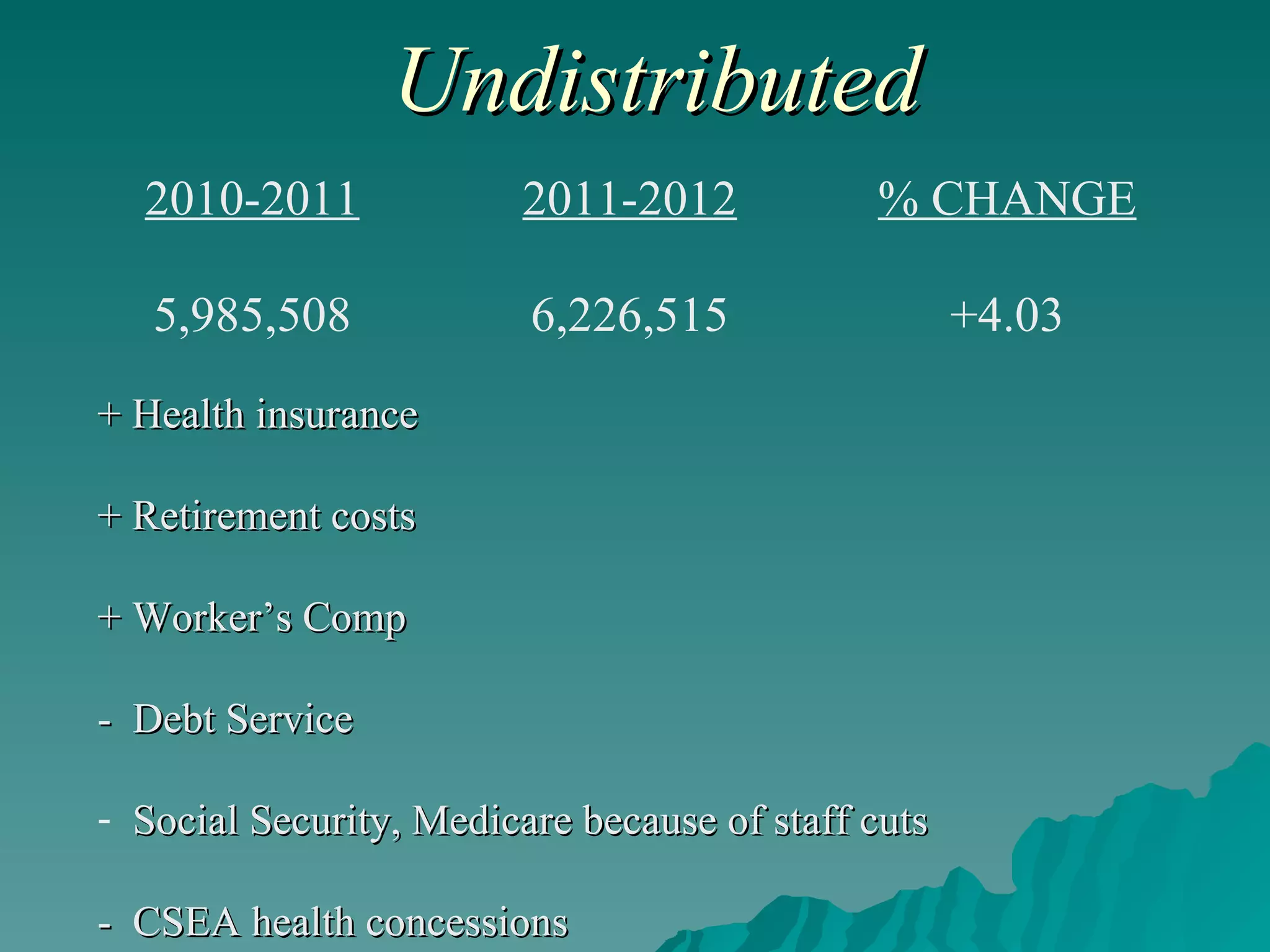

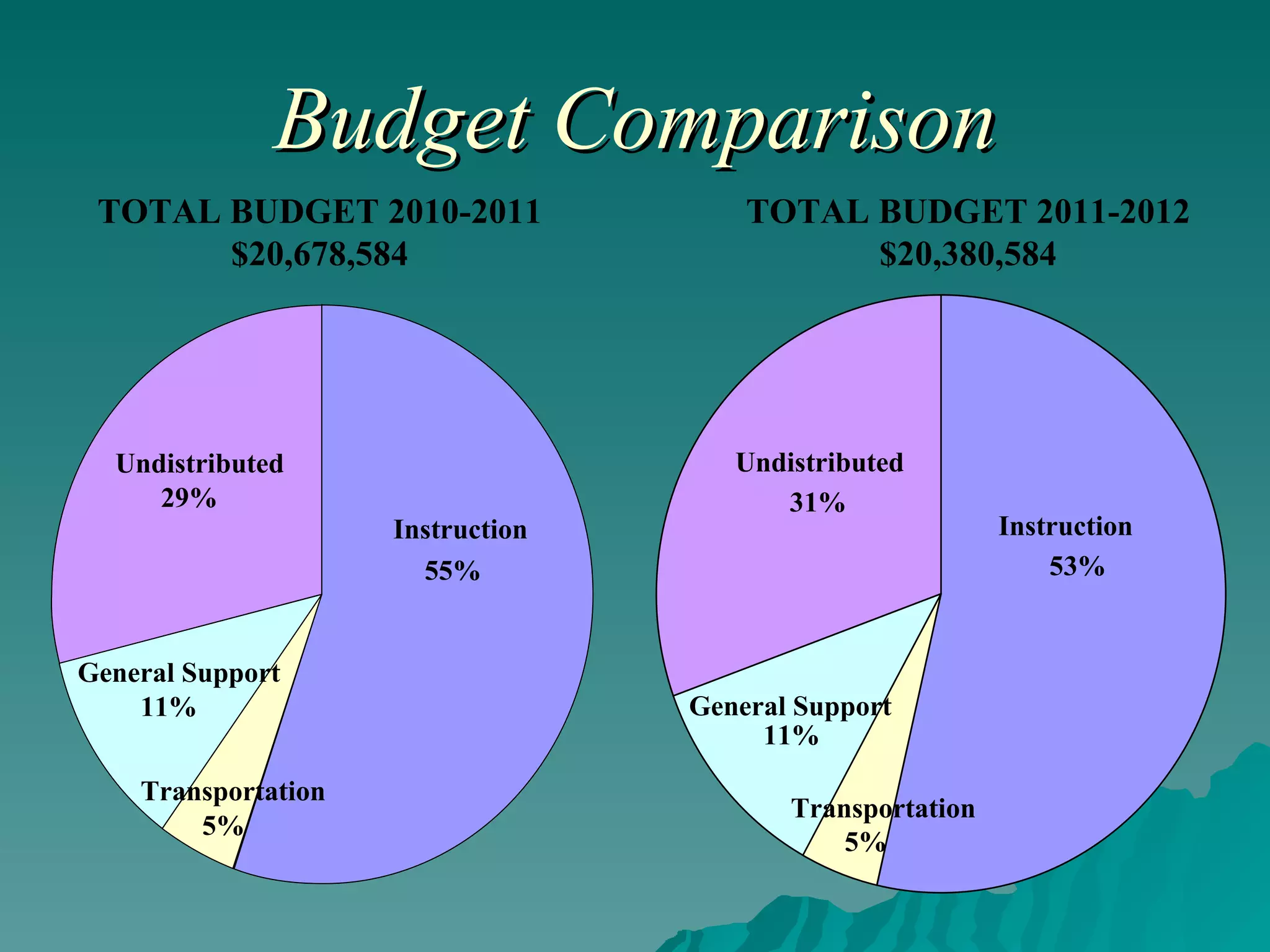

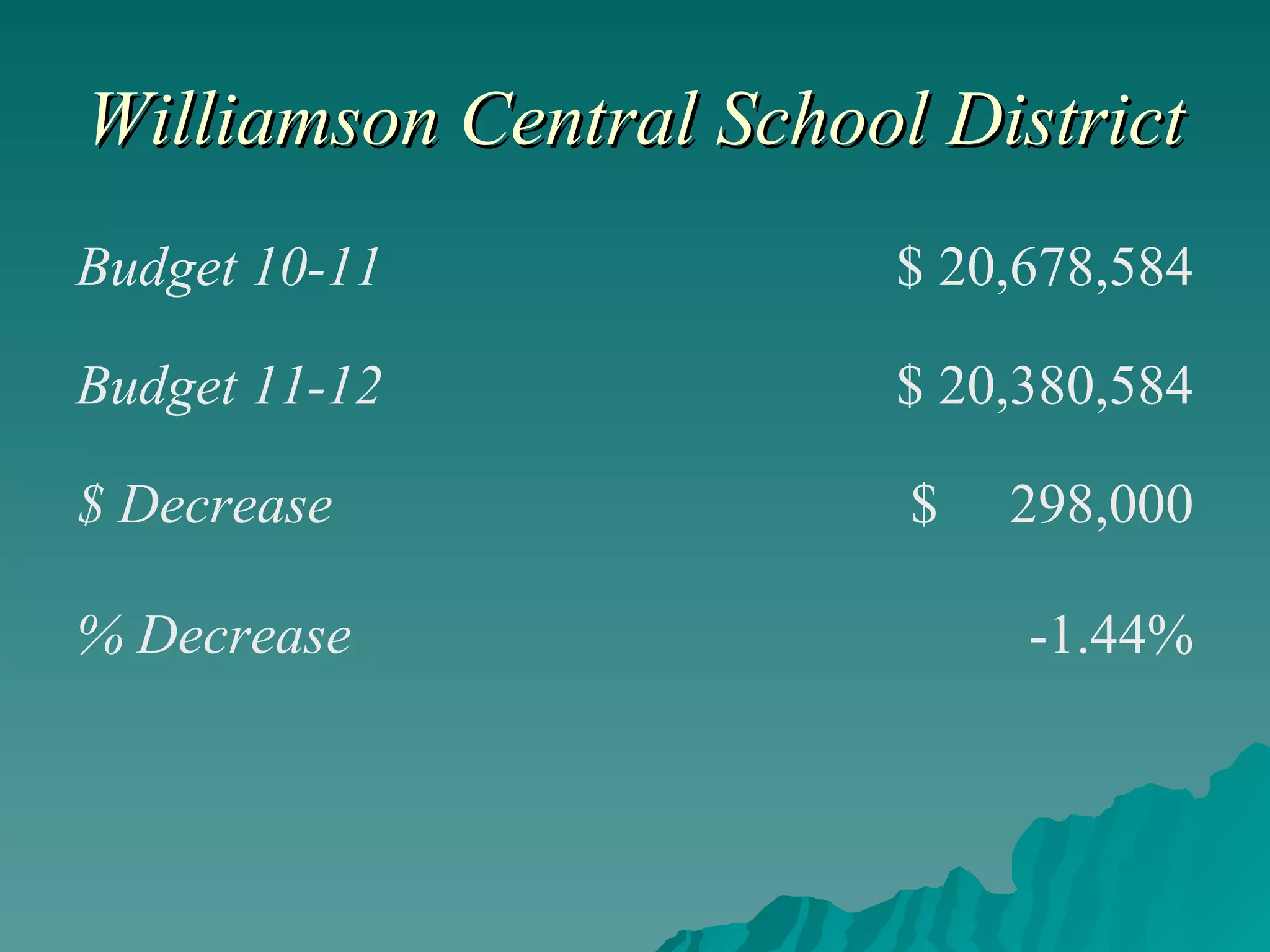

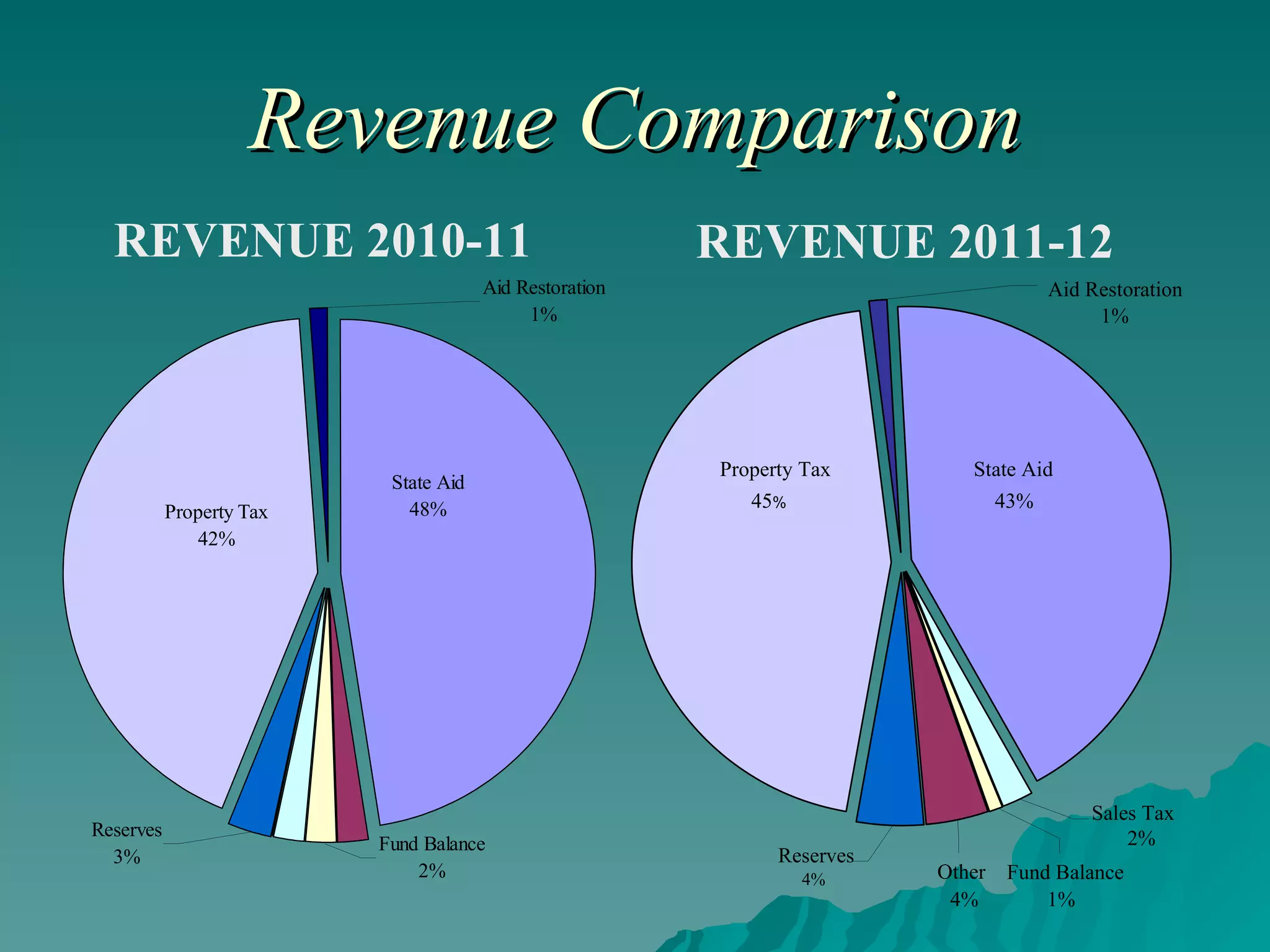

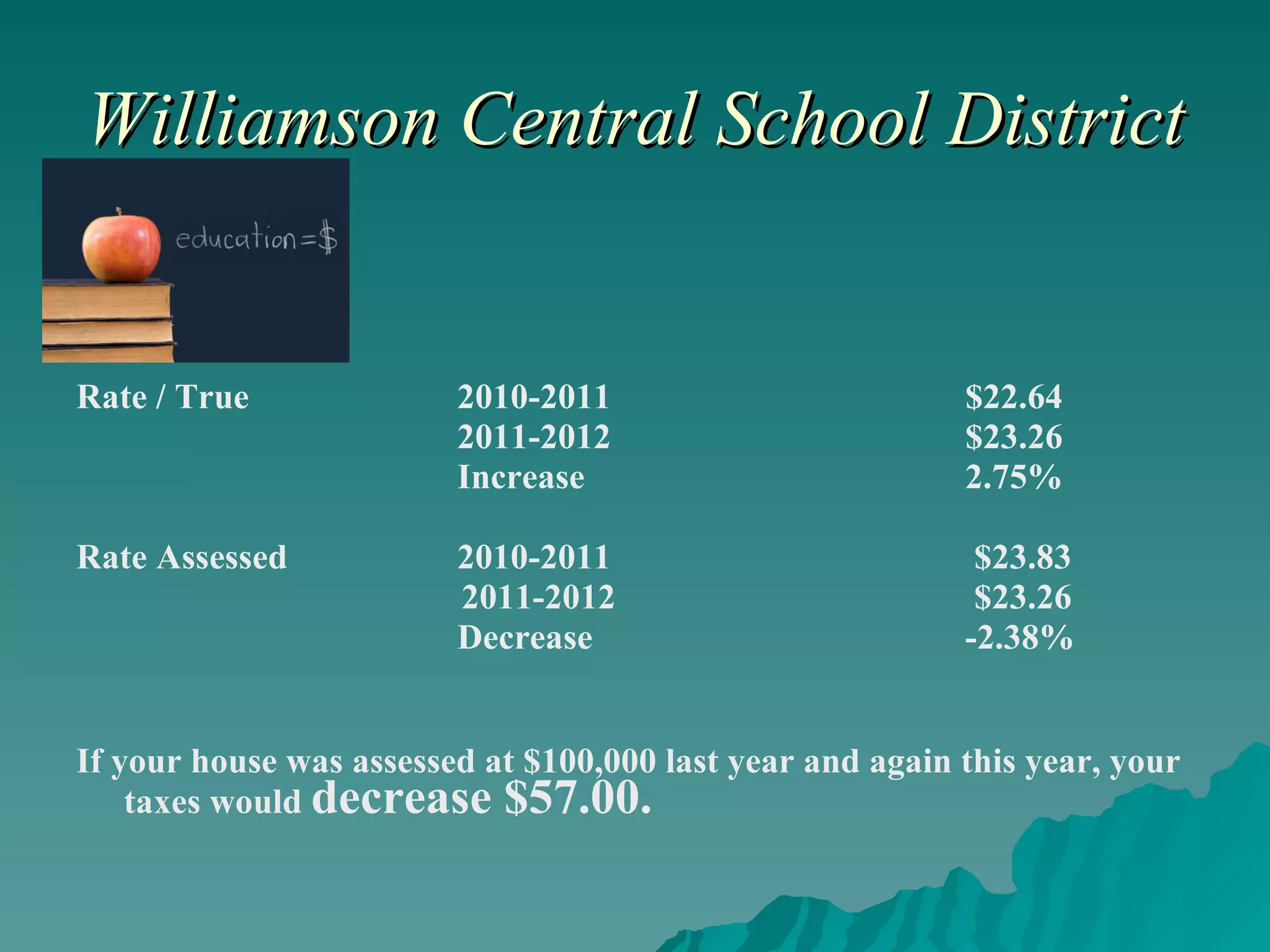

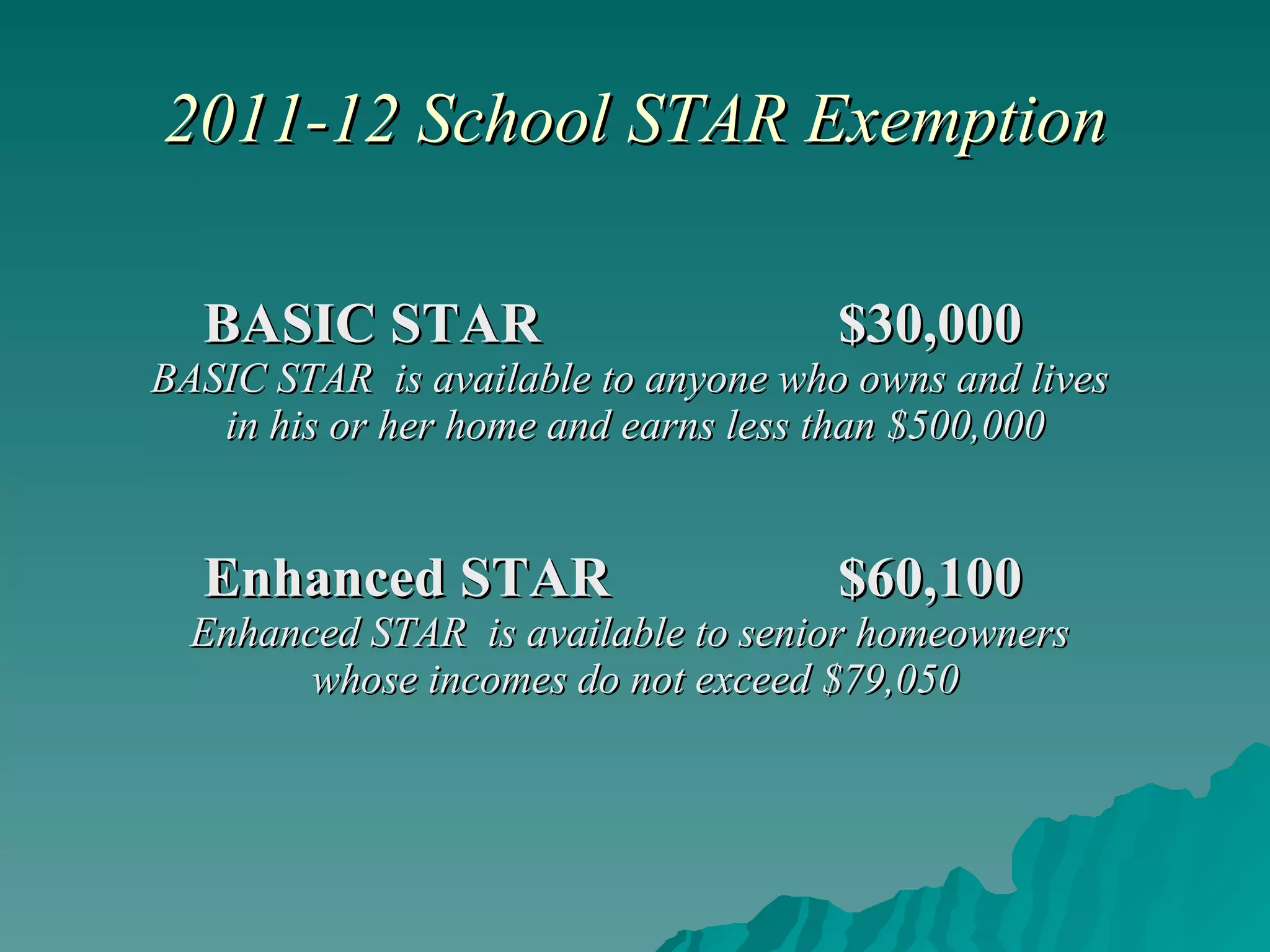

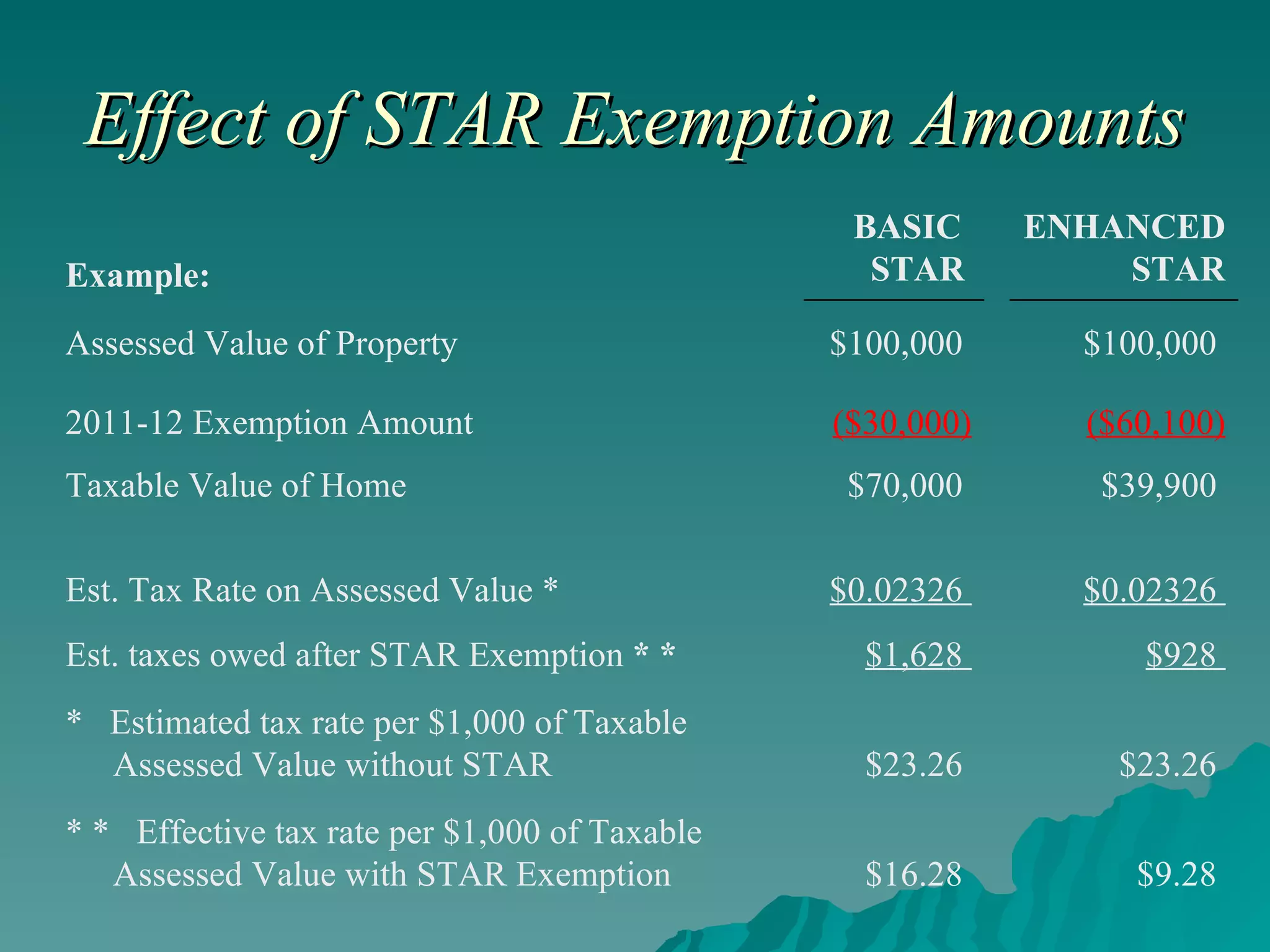

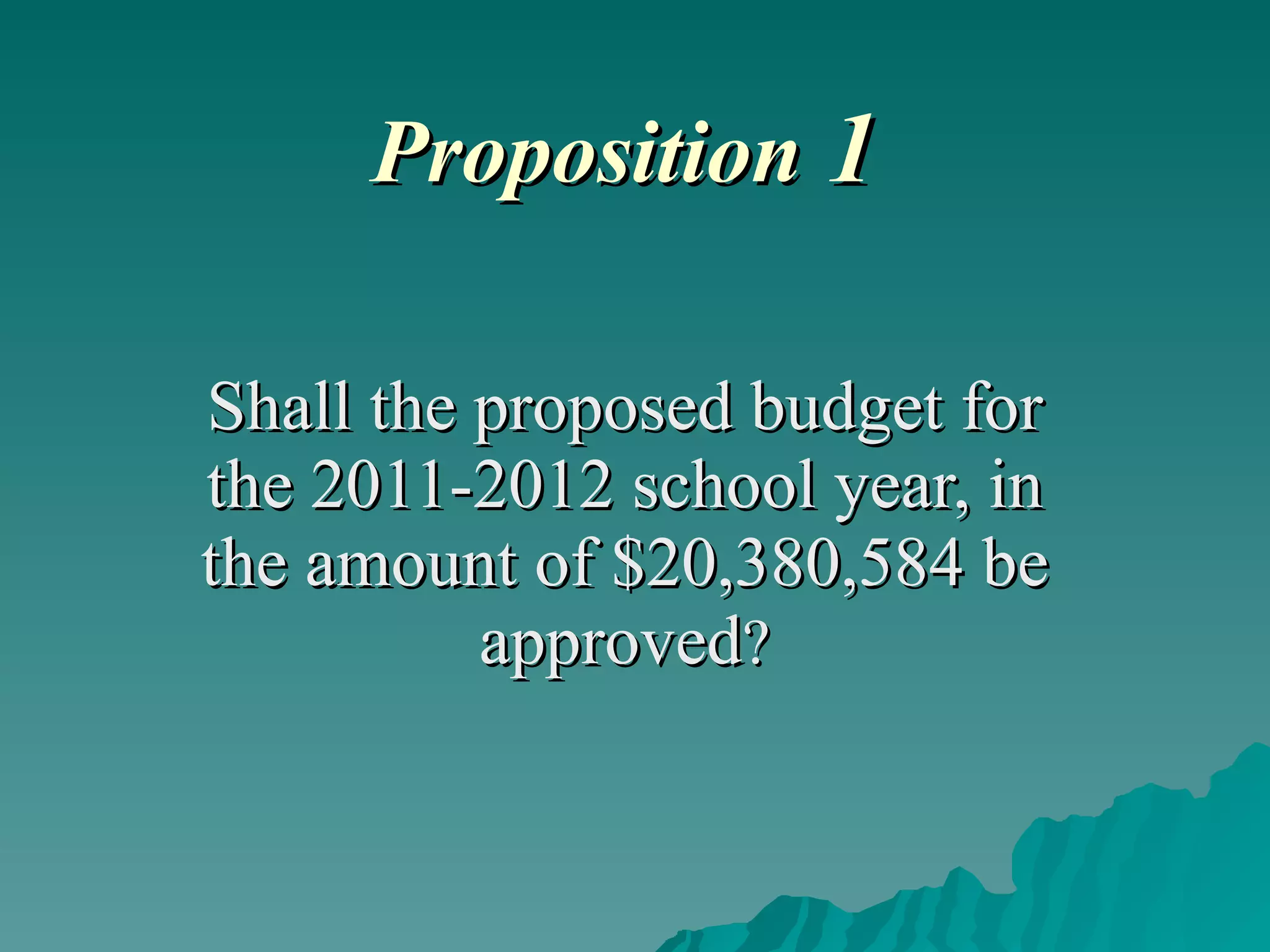

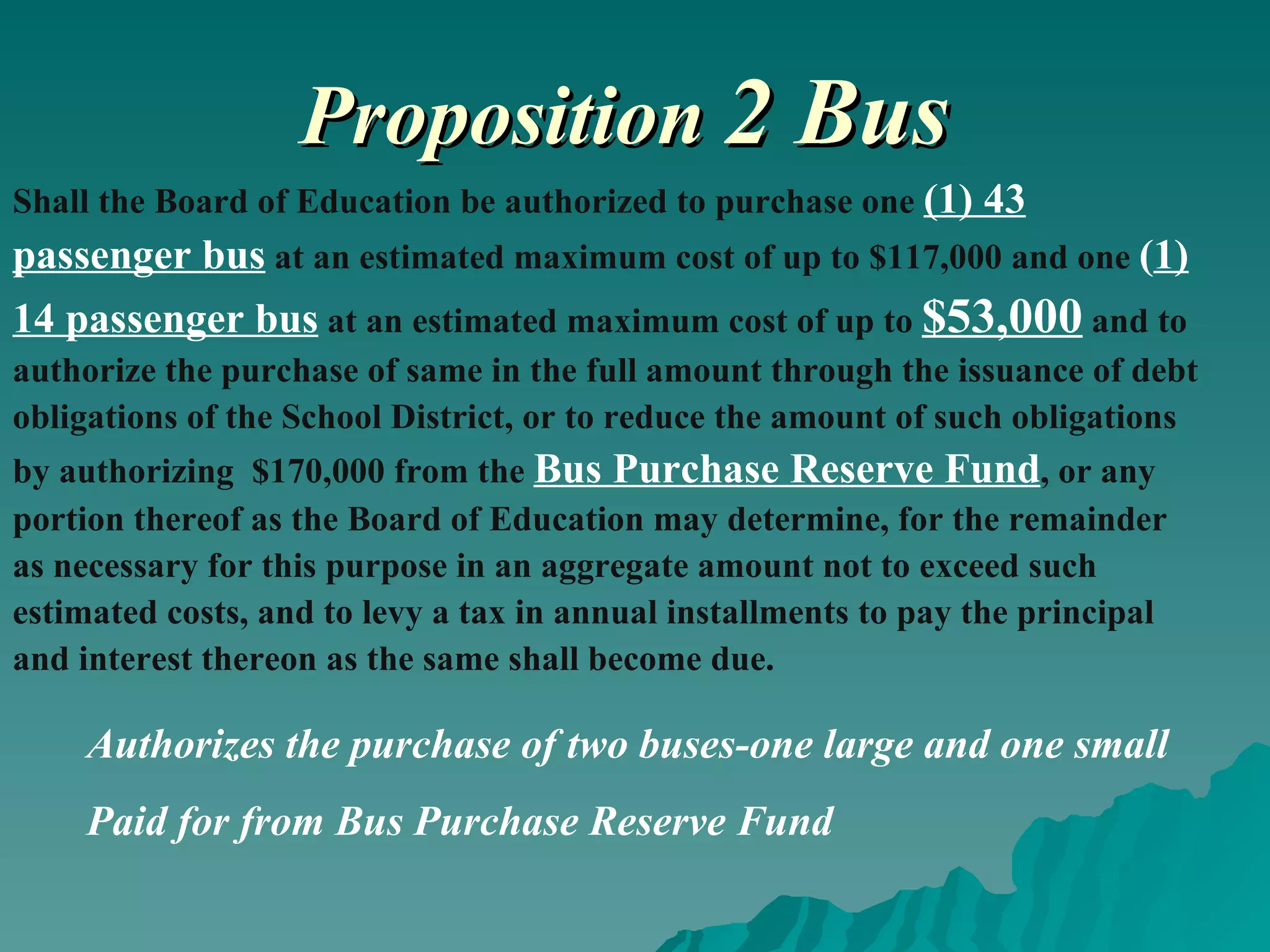

The document summarizes the budget challenges facing a public school district. It discusses factors affecting both revenue, such as declining state aid, and expenses, including staff reductions. While the district faced a budget decrease of 1.44%, it applied funds from federal grants and reserves to minimize cuts. The budget vote proposes a $20 million budget for the upcoming year along with purchasing two new buses.