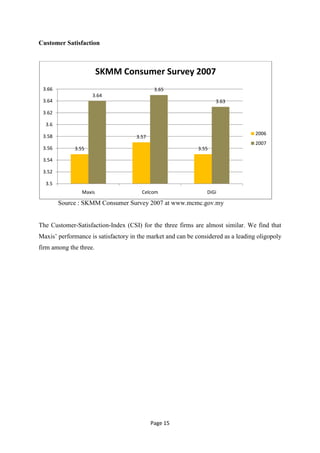

1) Maxis is the largest mobile network operator in Malaysia with over 13 million subscribers as of 2010. It operates under an oligopolistic market structure with a few major competitors like Celcom and Digi.

2) Entry into the telecommunications market is difficult due to high capital requirements and regulatory barriers. Maxis differentiates its services through customized calling plans but core mobile services are largely homogeneous.

3) Maxis engages in price competition with its rivals through starter pack price wars to gain market share, resulting in lower average revenue per user over time for all companies in the industry.