The document provides an overview of insurance and the operations of insurance companies. It discusses how insurance works by pooling together funds from many individuals to pay for losses, thereby spreading out costs. It describes the key roles of underwriters in assessing risks and ratemakers in setting premium prices. It also discusses how insurance companies invest premium payments to generate revenue and have become major capital suppliers. In summary, the document outlines the basic concepts of insurance, the roles of insurance companies, and how they operate financially.

![5 | P a g e

HISTORY:

The company was founded in 1845 as the Nautilus (Capt. Nemo) Insurance Company in New

York City, with assets of just $17,000. It was renamed the New York Life Insurance Company in

1849. Its first headquarters were at 112-114 Broadway; the first president was James De Peyster

Ogden. The current New York Life headquarters was designed by noted architect Cass Gilbert

and completed in 1928. The New York Life building, at 51 Madison Avenue, was constructed

during the presidency of Darwin P. Kingsley. He expanded the company’s operations and

developed new types of insurance. As with other early insurance companies in the U.S., in its

early years the company insured the lives of slaves for their owners. In response to bills passed in

California in 2001 and in Illinois in 2003, the company reported that Nautilus sold 485

slaveholder life insurance policies during a two-year period in the 1840s; they added that their

trustees voted to end the sale of such policies 15 years before the Emancipation Proclamation.[5]

The company became known for innovative business practices. In 1860, well before state laws

required it, New York Life developed the non-forfeiture option, the predecessor to the

guaranteed cash values of modern policies, under which a policy remains in force even if a

premium payment is missed. It was also the first American life insurance company to pay a cash

dividend to policyholders, and the first U.S. company to issue policies to women at the same

rates as men. Susan B. Anthony was one of their first female policy holders, and her father

worked for NYLIC. In 1896, New York Life became the first company to insure people with

disabilities and the first to issue a policy with a disability benefit that presumes total disability to

be permanent after a predetermined period.](https://image.slidesharecdn.com/maxlifeinsurance-130514041404-phpapp02/85/Max-life-insurance-5-320.jpg)

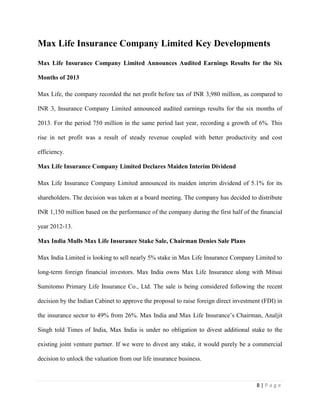

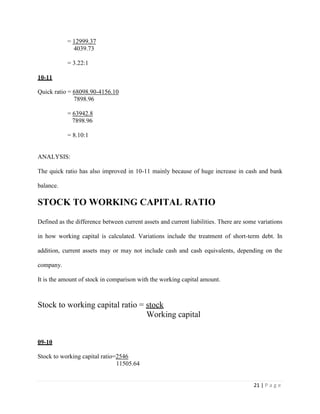

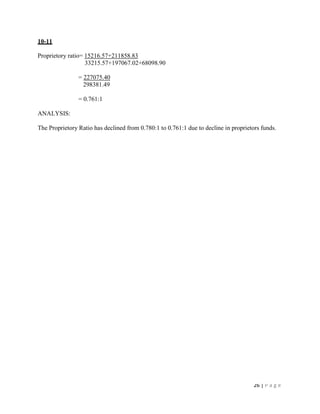

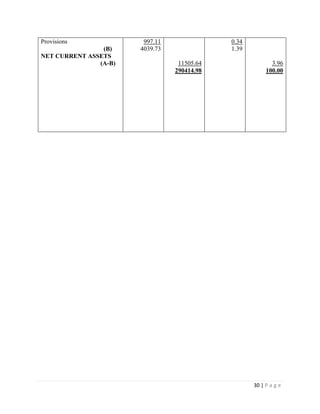

![10 | P a g e

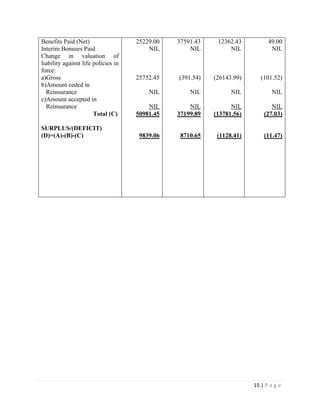

COMPARATIVE ANALYSIS

Comparative analysis of Revenue A/C

[with respect to Participating Policies (Non-Linked)]

Particulars 09-10

(Rs in lacs)

10-11

(Rs in lacs)

Absolute

Increase/

(Decrease)

(In Rs)

Percentage

Increase/

(Decrease)

(In %)

Premiums earned-(Net)

Premiums

Less: Reinsurance Ceded

Add: Reinsurance Accepted

Income from Investments

a)Interest, Dividends & Rent-

Gross

b)Profit on sale/ redemption of

investments

c)(Loss) on sale/ redemption

of investments

d)Transfer/ Gain on

revaluation/change in fair

value

e)Amortization of discount/

(premium)

f)Appropriation/Expropriation

Adjustment account

Other Income

Contribution from the

Shareholders account

Miscellaneous income

Total (A)

Commission

Operating Expenses related to

Insurance business

Provision for doubtful debts

Bad debts written off

Provision for Tax

Provision (other than taxation)

a)For diminution in the value

of investments (Net)

53649.64

219.08

NIL

53430.56

6465.18

124.86

NIL

NIL

(34.97)

NIL

NIL

27.00

60012.63

9971.02

22919.92

34.48

1

NIL

NIL

64754.61

363.73

NIL

64390.88

9155.60

492.36

(1.76)

NIL

116.76

NIL

NIL

188.00

74341.84

8911.90

21989.05

56.04

NIL

NIL

NIL

11104.97

144.65

NIL

10960.32

2690.42

367.5

(1.76)

NIL

151.73

NIL

NIL

161.00

14329.21

(1059.12)

(930.87)

21.56

(1)

NIL

NIL

20.70

66.03

NIL

20.51

41.61

294.33

NIL

NIL

433.89

NIL

NIL

596.30

23.88

(10.62)

(4.06)

62.53

(100)

NIL

NIL](https://image.slidesharecdn.com/maxlifeinsurance-130514041404-phpapp02/85/Max-life-insurance-10-320.jpg)

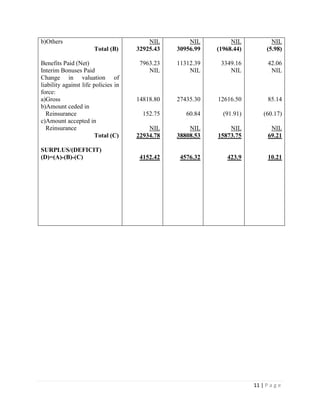

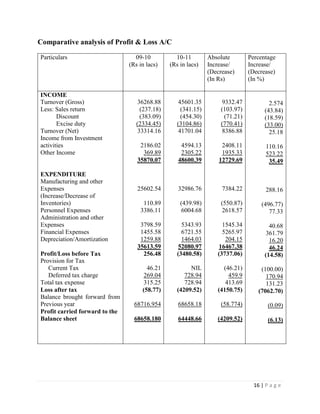

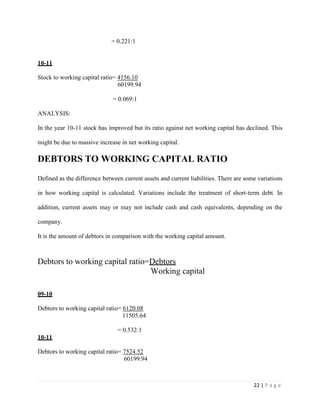

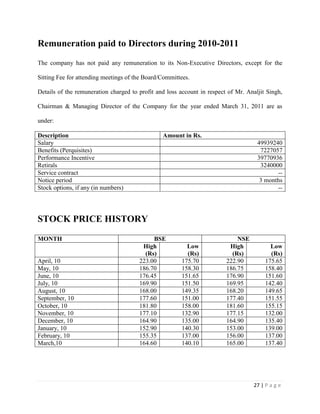

![12 | P a g e

Comparative analysis of Revenue A/C

[with respect to Non-Participating Policies (Non-Linked)]

Particulars 09-10

(Rs in lacs)

10-11

(Rs in lacs)

Absolute

Increase/

(Decrease)

(In Rs)

Percentage

Increase/

(Decrease)

(In %)

Premiums earned-(Net)

Premiums

Less: Reinsurance Ceded

Add: Reinsurance Accepted

Income from Investments

a)Interest, Dividends & Rent-

Gross

b)Profit on sale/ redemption of

investments

c)(Loss) on sale/ redemption

of investments

d)Transfer/ Gain on

revaluation/change in fair

value

e)Amortization of discount/

(premium)

f)Appropriation/Expropriation

Adjustment account

Other Income

Contribution from the

Shareholders account

Miscellaneous income

Total (A)

Commission

Operating Expenses related to

Insurance business

Provision for doubtful debts

Bad debts written off

Provision for Tax

Provision (other than taxation)

a)For diminution in the value

of investments (Net)

b)Others

Total (B)

2154.47

150.22

NIL

2004.25

406.23

16.00

NIL

NIL

(3.12)

NIL

NIL

0.02

2407.54

199.13

203.79

0.18

NIL

NIL

NIL

NIL

403.10

4020.14

126.55

NIL

3893.59

548.80

NIL

NIL

NIL

(2.08)

NIL

NIL

2.03

4442.34

630.05

1523.15

3.56

NIL

NIL

NIL

NIL

2156.76

1865.67

(23.67)

NIL

1889.34

142.57

(16)

NIL

NIL

1.04

NIL

NIL

2.01

2034.80

430.92

1319.36

3.38

NIL

NIL

NIL

NIL

1753.66

86.60

(15.76)

NIL

94.27

35.10

(100)

NIL

NIL

33.33

NIL

NIL

10050

84.52

216.40

647.41

1877.78

NIL

NIL

NIL

NIL

435.04](https://image.slidesharecdn.com/maxlifeinsurance-130514041404-phpapp02/85/Max-life-insurance-12-320.jpg)

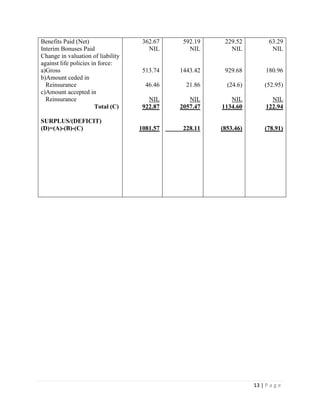

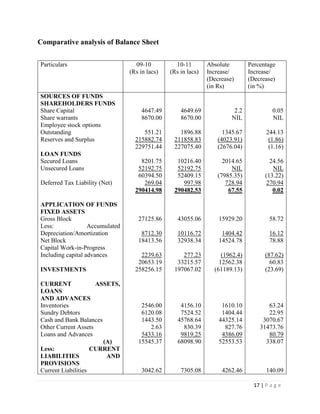

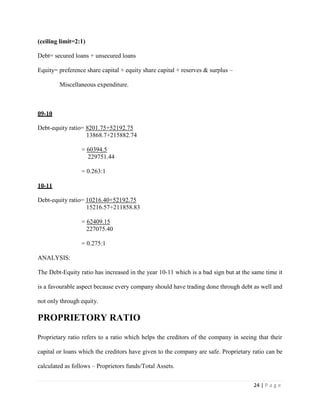

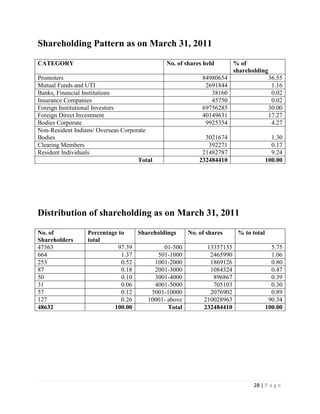

![14 | P a g e

Comparative analysis of Revenue A/C

[with respect to Linked Policies]

Particulars 09-10

(Rs in lacs)

10-11

(Rs in lacs)

Absolute

Increase/

(Decrease)

(In Rs)

Percentage

Increase/

(Decrease)

(In %)

Premiums earned-(Net)

Premiums

Less: Reinsurance Ceded

Add: Reinsurance Accepted

Income from Investments

a)Interest, Dividends & Rent-

Gross

b)Profit on sale/ redemption of

investments

c)(Loss) on sale/ redemption

of investments

d)Transfer/ Gain on

revaluation/change in fair

value

e)Amortization of discount/

(premium)

f)Appropriation/Expropriation

Adjustment account

Other Income

Contribution from the

Shareholders account

Miscellaneous income

Total (A)

Commission

Operating Expenses related to

Insurance business

Provision for doubtful debts

Bad debts written off

Provision for Tax

Provision (other than taxation)

a)For diminution in the value

of investments (Net)

b)Others

Total (B)

69030.31

548.50

NIL

68481.81

7046.46

16907.20

(2704.80)

(20417.05)

(2.93)

57.12

NIL

NIL

69367.81

2001.94

6535.95

9.41

NIL

NIL

NIL

NIL

8547.30

54693.99

390.56

NIL

54303.43

9443.52

16681.54

(19940.94)

(8901.05)

18.09

NIL

NIL

15.21

51619.80

1321.37

4342.94

44.95

NIL

NIL

NIL

NIL

5709.26

(14336.32)

(157.94)

NIL

(14178.38)

2397.06

(225.66)

(17236.14)

11516.00

21.02

(57.12)

NIL

15.21

(17748.01)

(680.57)

(2193.01)

35.54

NIL

NIL

NIL

NIL

(2838.04)

(20.77)

(28.79)

NIL

(20.70)

34.02

(1.33)

(637.24)

56.40

717.41

(100.00)

NIL

NIL

(25.59)

(34.00)

(33.56)

377.68

NIL

NIL

NIL

NIL

(33.20)](https://image.slidesharecdn.com/maxlifeinsurance-130514041404-phpapp02/85/Max-life-insurance-14-320.jpg)

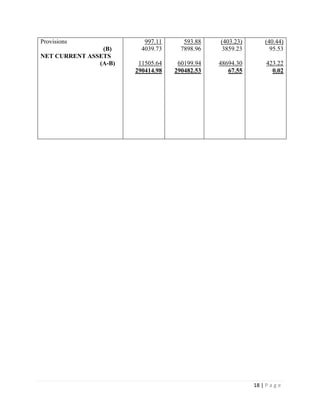

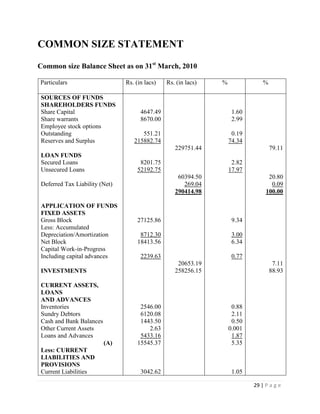

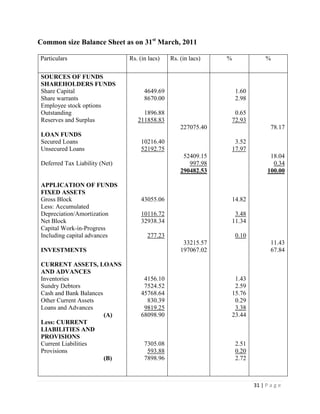

![33 | P a g e

CASH FLOW STATEMENT

Cash flow statement for the year ended 31st

March, 2010 & 2011

Particulars 10-11

Rs. (in lacs)

09-10

Rs. (in lacs)

A] CASH FLOW FROM OPERATING ACTIVITIES:

NET PROFIT/(LOSS) BEFORE TAXATION

Adjustments for:

Depreciation/Amortization

Employee Stock Option Expense

Wealth Tax

Net Loss on sale of fixed assets

Net Profit on sale of Investments

Fixed assets and Spares written off

Provision for Doubtful debts and advances

Diminution in value of Investments and doubtful advances

to subsidiary

Interest expense

Interest income

Dividend Income from current non trade investments

Liability/Provision no longer requited written back

Unrealized Foreign Exchange (Gain)/ Loss

OPERATING PROFIT BEFORE WORKING

CAPITAL CHANGES

MOVEMENT IN WORKING CAPITAL:

Decrease/ (Increase) in sundry debtors

Decrease/ (Increase) in inventories

Decrease/ (Increase) in loans and advances

Decrease/ (Increase) in trade payables

Decrease/ (Increase) in provisions

Cash generated from Operations

Income Tax Refunded/(Paid)

CASH GENERATED FROM/(USED IN) OPERATING

ACTIVITIES (A)

B] CASH FLOW FROM INVESTING ACTIVITIES

Purchase of investments in subsidiaries

Purchase of investments in mutual funds

Proceeds from sale of investments in mutual funds

Deposits with initial maturity of more than three months

Purchase of fixed assets

Proceeds from sale of fixed assets

Interest Received

Dividend income from current non trade investments

(3480.58)

1464.03

1531.28

1.94

17.44

(1969.43)

NIL

5.94

34.41

6579.99

(1878.61)

NIL

(14.68)

18.74

2310.47

(1404.44)

(1610.10)

(3814.51)

2698.12

(152.68)

(1973.14)

(687.93)

(2661.07)

(14811.17)

(176358.23)

254327.97

(36000.00)

(12504.90)

9.43

874.36

NIL

256.48

1259.88

557.63

1.70

24.14

(1760.85)

0.89

0.42

8.53

1357.13

(251.14)

(47.76)

(174.44)

(75.94)

1156.67

(830.34)

258.31

330.01

(113.25)

160.29

961.69

(18.47)

943.22

(25082.48)

(606304.44)

544722.08

NIL

(2080.61)

15.05

267.95

47.76](https://image.slidesharecdn.com/maxlifeinsurance-130514041404-phpapp02/85/Max-life-insurance-33-320.jpg)

![34 | P a g e

CASH GENERATED FROM/(USED IN) INVESTING

ACTIVITIES (B)

C] CASH FLOW FROM FINANCING ACTIVITIES

Proceeds from preferential issue of shares

Proceeds from issue of warrants

Shares issue expenses

Proceeds from exercise of employee stock options

Interest paid

Proceeds from issue of Compulsorily Convertible

Debentures

Proceeds from Long term Borrowing

Repayment of Long Term Loans

Proceeds/(Repayment) of Short Term Borrowings

CASH GENERATED FROM/(USED IN) FINANCING

ACTIVITIES (C)

NET INCREASE/(DECREASE) IN CASH AND CASH

EQUIVALENTS (A+B+C)

CASH AND CASH EQUIVALENTS AT THE

BEGINNING OF THE YEAR

CASH AND CASH EQUIVALENTS AT THE END OF

THE YEAR

15537.46

NIL

NIL

NIL

2.20

(6568.10)

NIL

10155.02

(5237.62)

(2902.75)

(4551.25)

8325.14

1443.50

9768.64

(88414.69)

15000.00

8670.00

(593.13)

0.36

(1048.60)

52192.75

53.85

(2066.03)

72.57

72281.77

(15189.70)

16633.20

1443.50](https://image.slidesharecdn.com/maxlifeinsurance-130514041404-phpapp02/85/Max-life-insurance-34-320.jpg)