The document is a report on the practical training completed by Vaibhavi Yogesh Shah at Kotak Mahindra Bank Ltd from May 14, 2013 to June 15, 2013. It provides an overview of Kotak Mahindra Bank, including its vision, history, products and services offered such as savings accounts, current accounts, and loans. The report also describes the various branches, awards received, and milestones achieved by Kotak Mahindra Bank since its establishment in 1985.

![12

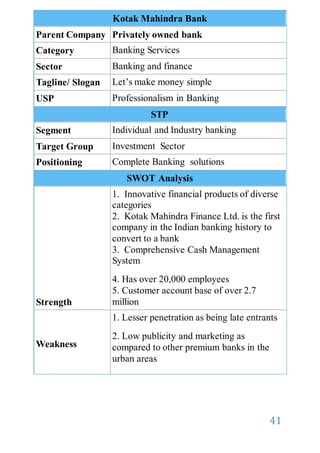

History and Development

Kotak Mahindra Bank Ltd is a charter member of financial

planning standards board India (FBSB India) and it

encourages financial planning and certified financial planner

(CEF) certification

Milestones that have shaped the Kotak Mahindra Group, since

1986

Since the inception of the erstwhile Kotak Mahindra Finance

Limited in 1985, it has been a steady and confident journey

leading to growth and success. The milestones of the group

growth story are listed below year wise

Kotak Mahindra Bank is an Indian financial service firm

established in 1985. It was previously known as Kotak

Mahindra Finance Limited, a non-banking financial company.

In February 2003, Kotak Mahindra Finance Ltd, the group's

flagship company was given the licence to carry on banking

business by the Reserve Bank of India (RBI). Kotak Mahindra

Finance Ltd. is the first company in the Indian banking history

to convert to a bank. Today it has more than 363 branches,

20,000 employees and 10,000 crore in revenue.[2]

Mr. Uday Kotak is Executive Vice Chairman & Managing

Director of Kotak Mahindra Bank Ltd. In July 2011 Mr. C.

Jayaram and Mr. Dipak Gupta, whole time directors of the

Bank, were appointe Joint Managing Directors of Kotak

Mahindra Bank. Dr. Shankar Acharya is the chairman of

board of Directors in the company.

The Bank has its registered office at Nariman Bhavan,

Nariman Point, Mumbai.](https://image.slidesharecdn.com/8fbd27c1-3ca0-4ef5-9f50-5e172fccd10f-160228235146/85/KOTAK-REPORT-12-320.jpg)

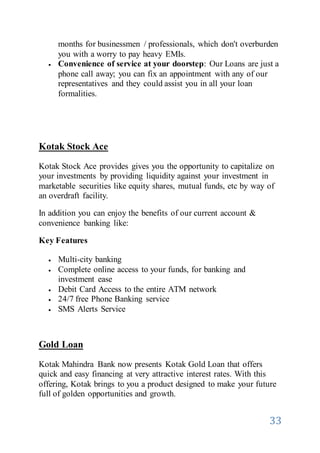

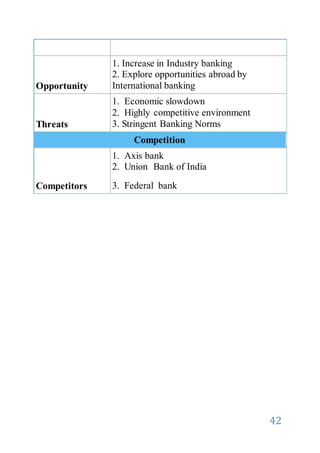

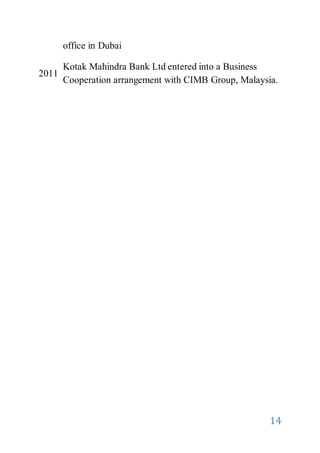

![15

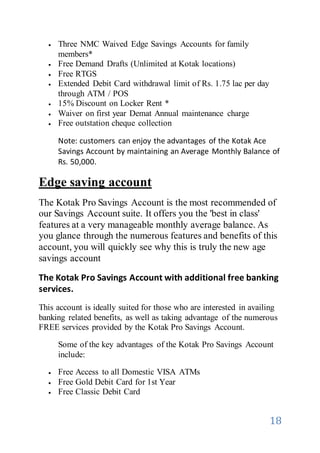

Type Public

Traded as

BSE: 500247

NSE: KOTAKBANK

Industry Financial service

Founded

1985 (as Kotak Mahindra

Finance Ltd)

Headquarters Mumbai, Republic of India

Key people

Uday Kotak (Vice Chairman)

& (MD)

Products

Deposit accounts, Loans,

Investmentservices,

Business banking solutions,

Treasury and Fixed income

products etc.

Revenue

10,963 crore

(US$1.9 billion)(2011)[1]

Net income

1,569 crore

(US$270 million)(2011)

Website www.kotak.com](https://image.slidesharecdn.com/8fbd27c1-3ca0-4ef5-9f50-5e172fccd10f-160228235146/85/KOTAK-REPORT-15-320.jpg)