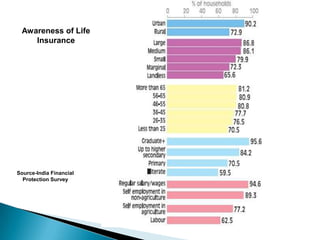

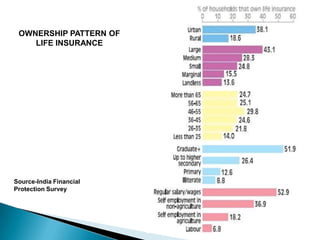

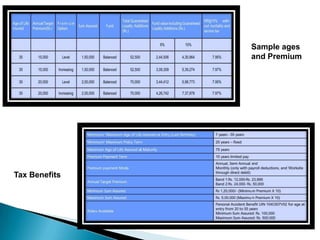

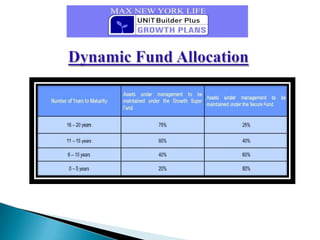

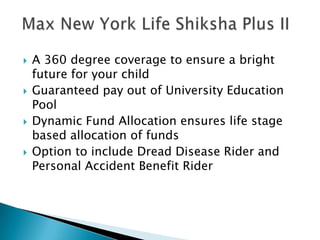

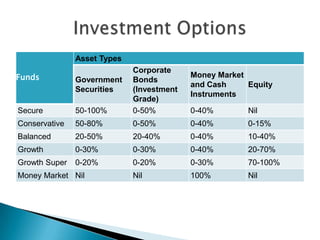

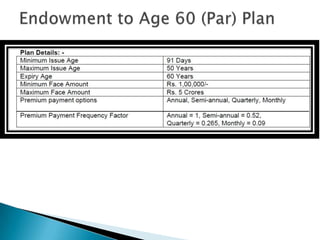

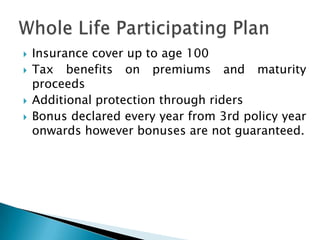

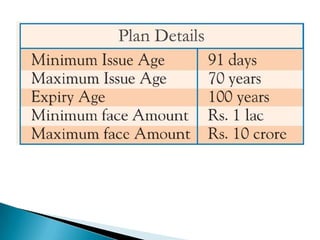

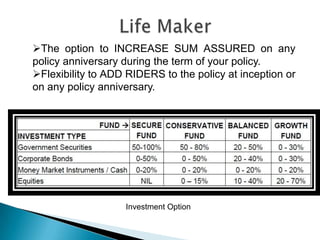

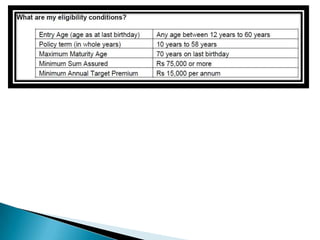

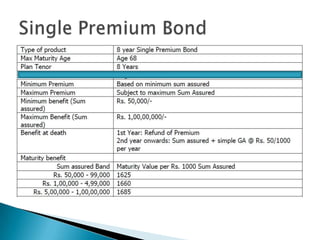

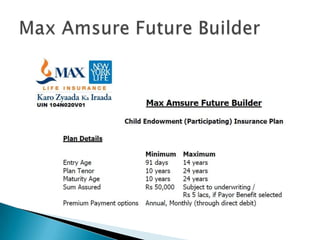

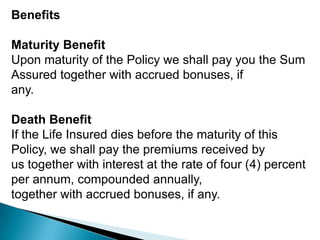

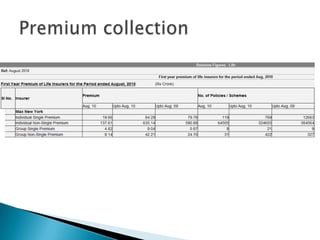

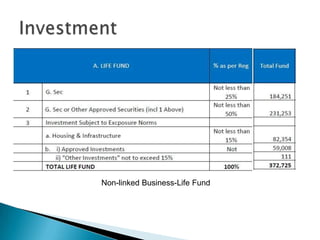

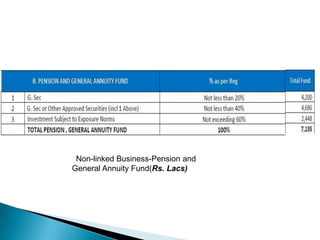

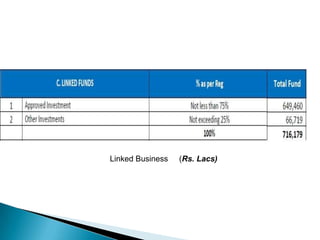

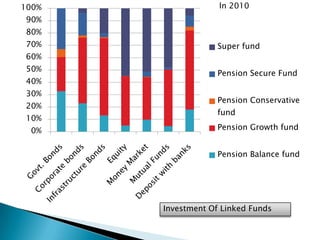

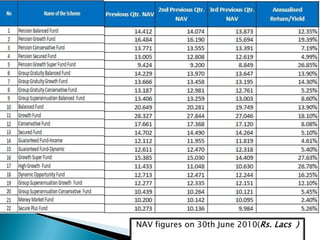

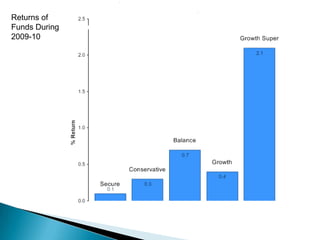

This document provides an overview of Max New York Life Insurance Company. It discusses that Max New York Life is a joint venture between Max India Limited and New York Life International established in India in 1985. It owns over 100 offices across 73 cities in India. The document also provides some statistics on the life insurance industry in India and describes several common life insurance products like term insurance, whole life insurance, and variable life insurance. It shares details on some Max New York Life insurance plans and funds.