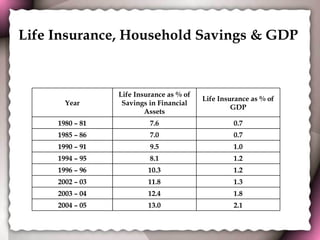

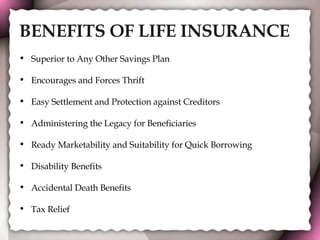

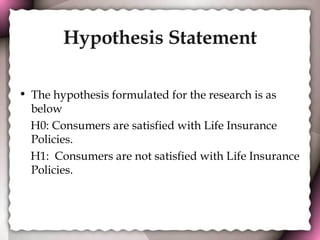

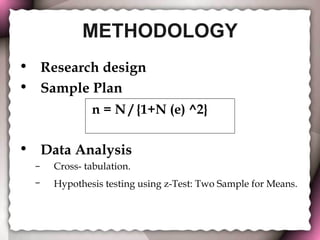

This white paper analyzes customer satisfaction with life insurance policies in India. It aims to understand customer attitudes, problems purchasing policies, and unmet expectations. A hypothesis is formed that consumers are not satisfied with life insurance policies. The paper outlines a methodology using surveys and statistical analysis to test the hypothesis. Insights from the study could help life insurance providers better meet customer needs and improve satisfaction levels.