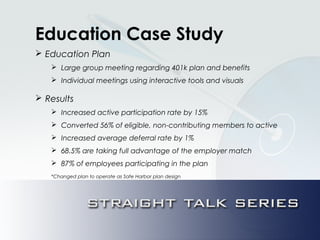

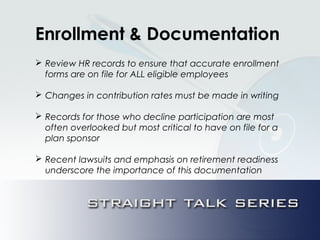

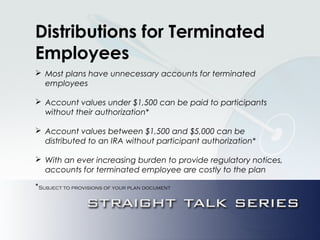

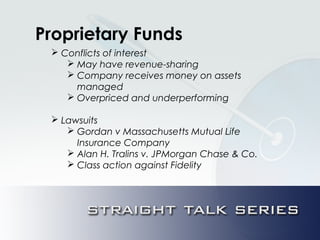

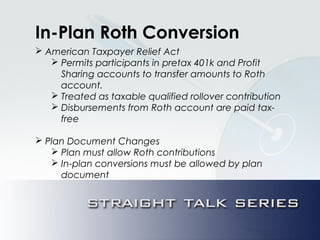

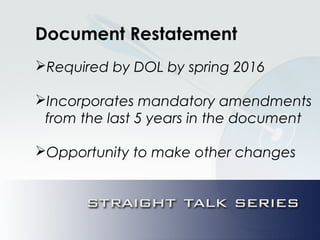

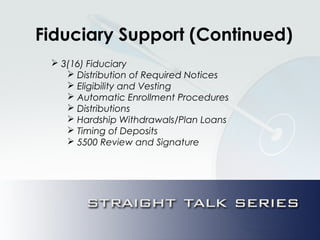

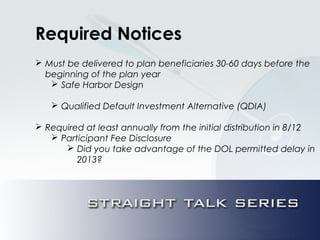

This document discusses 401k essentials for 2015, including contribution limits, employee education best practices, enrollment and documentation requirements, and distributions for terminated employees. It also provides an overview of legal and legislative updates such as conflicts of interest with proprietary funds and in-plan Roth conversions. The document concludes with a discussion of important plan features to consider like managed accounts, online tools, and fiduciary support models.