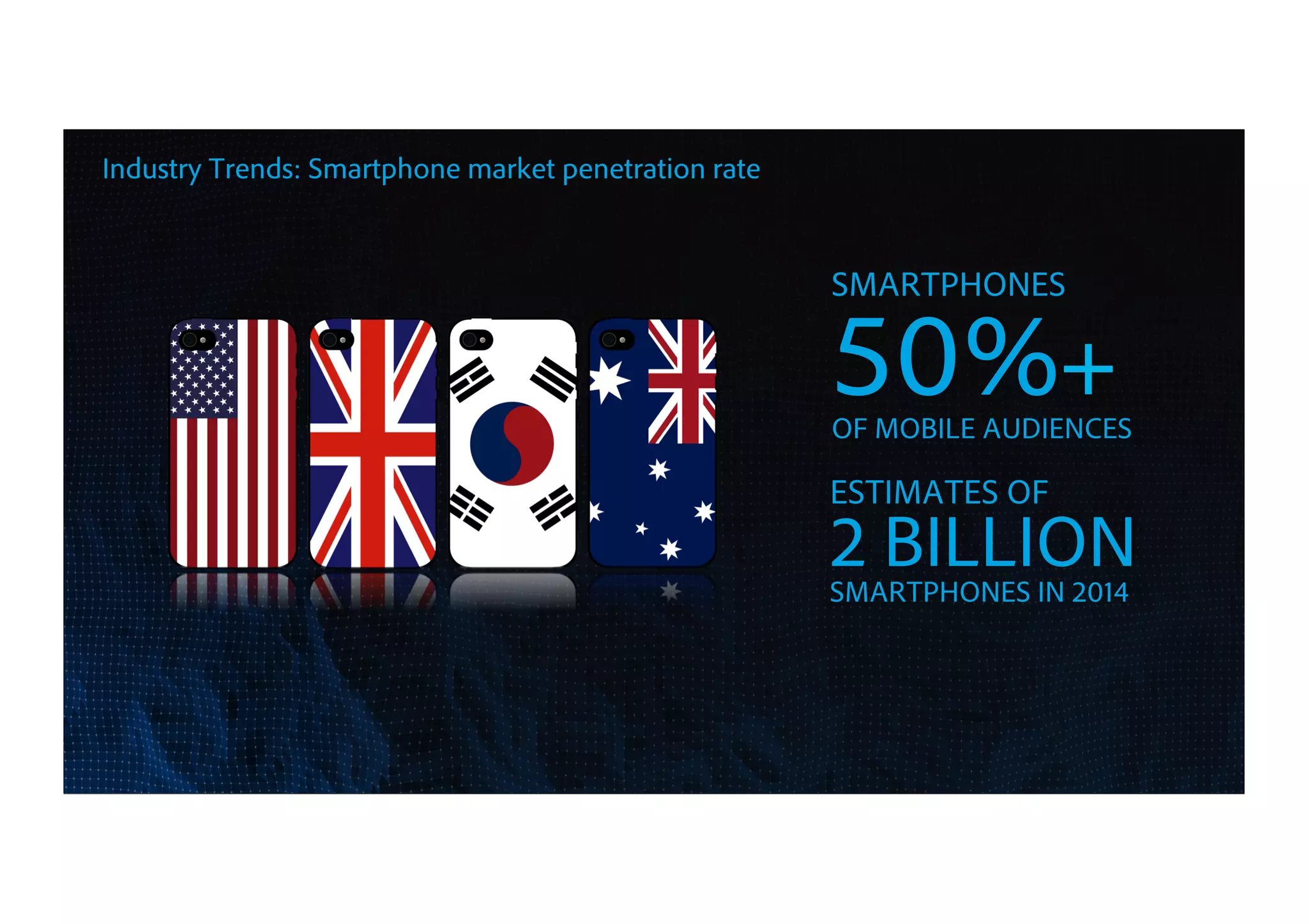

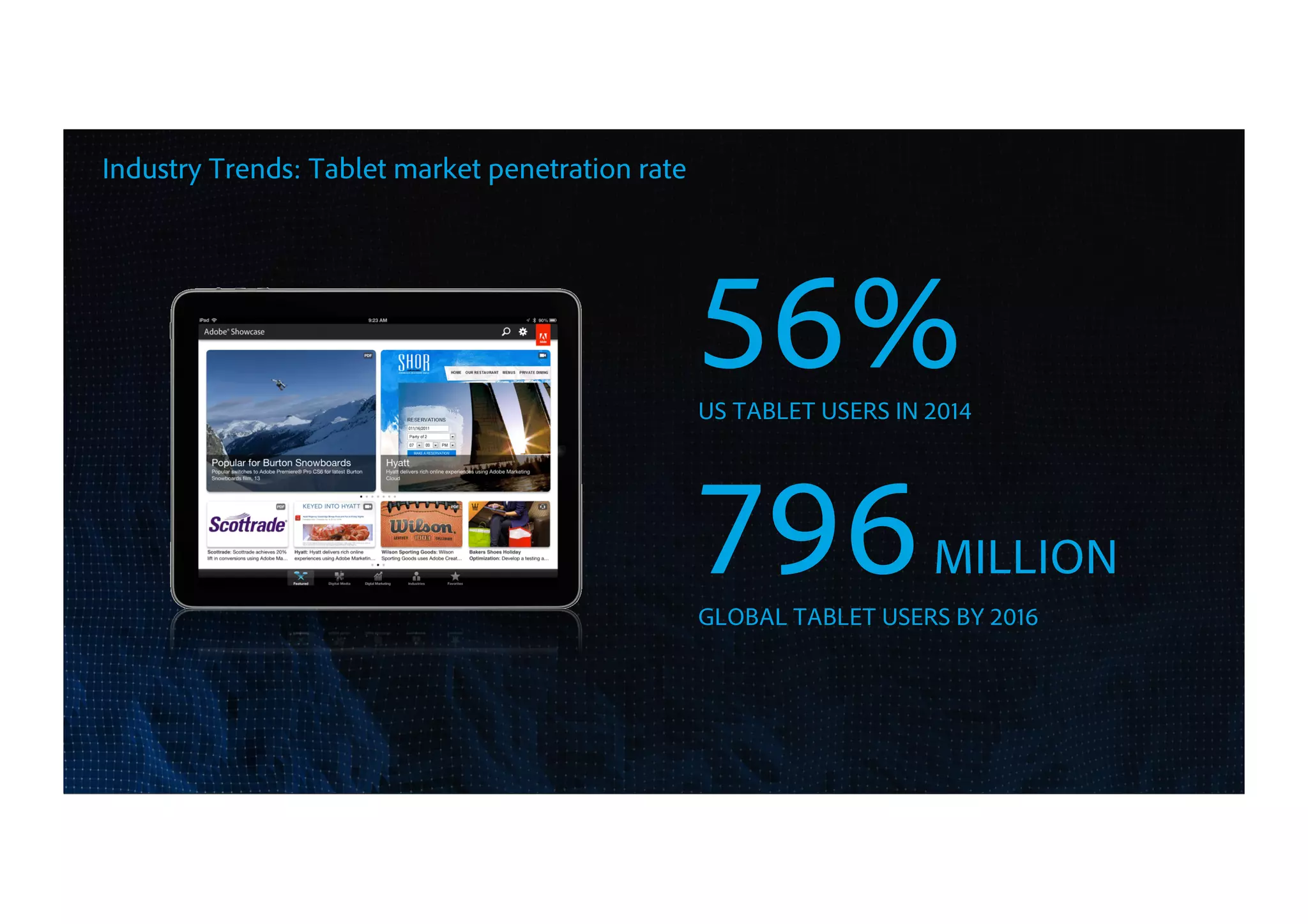

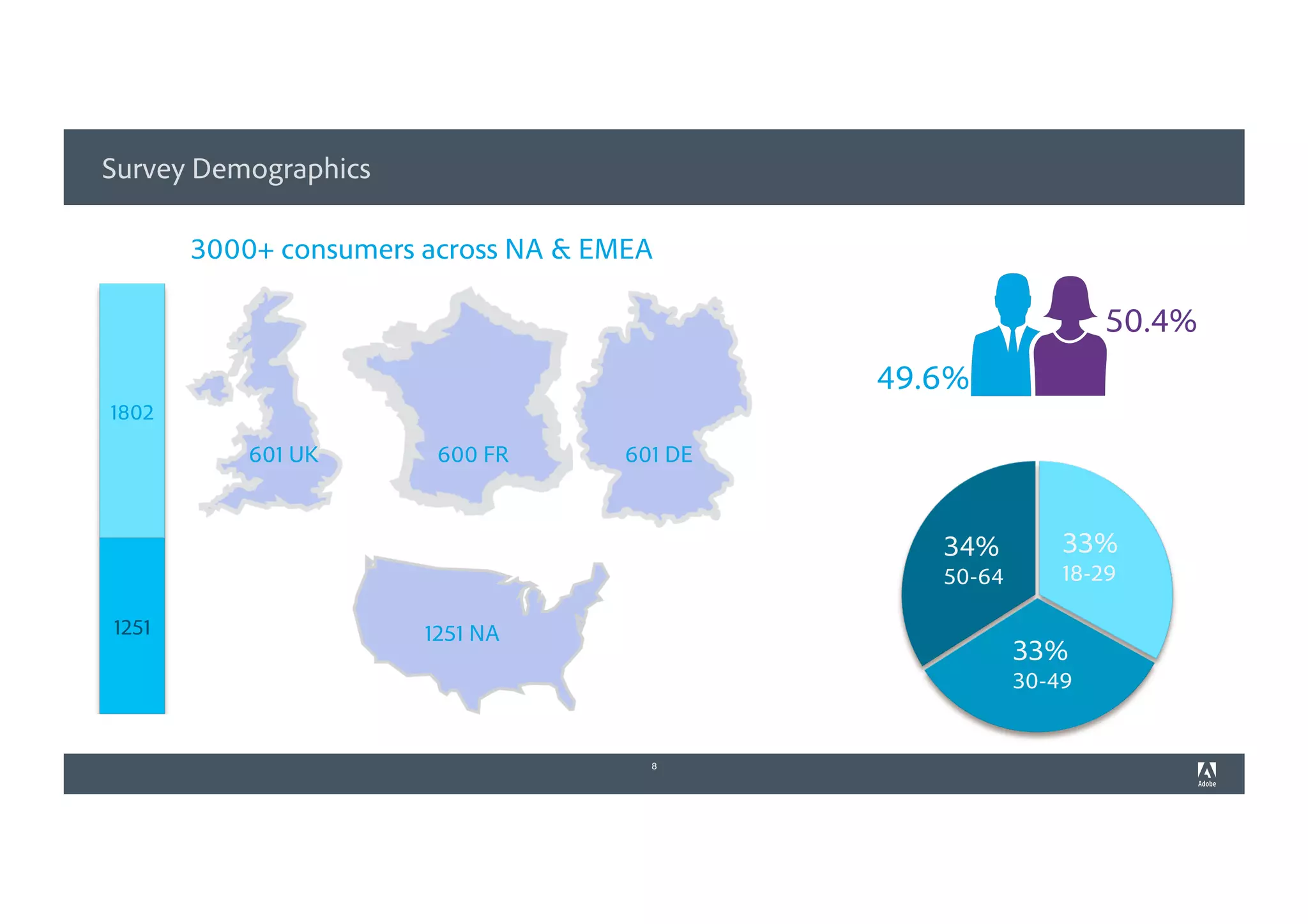

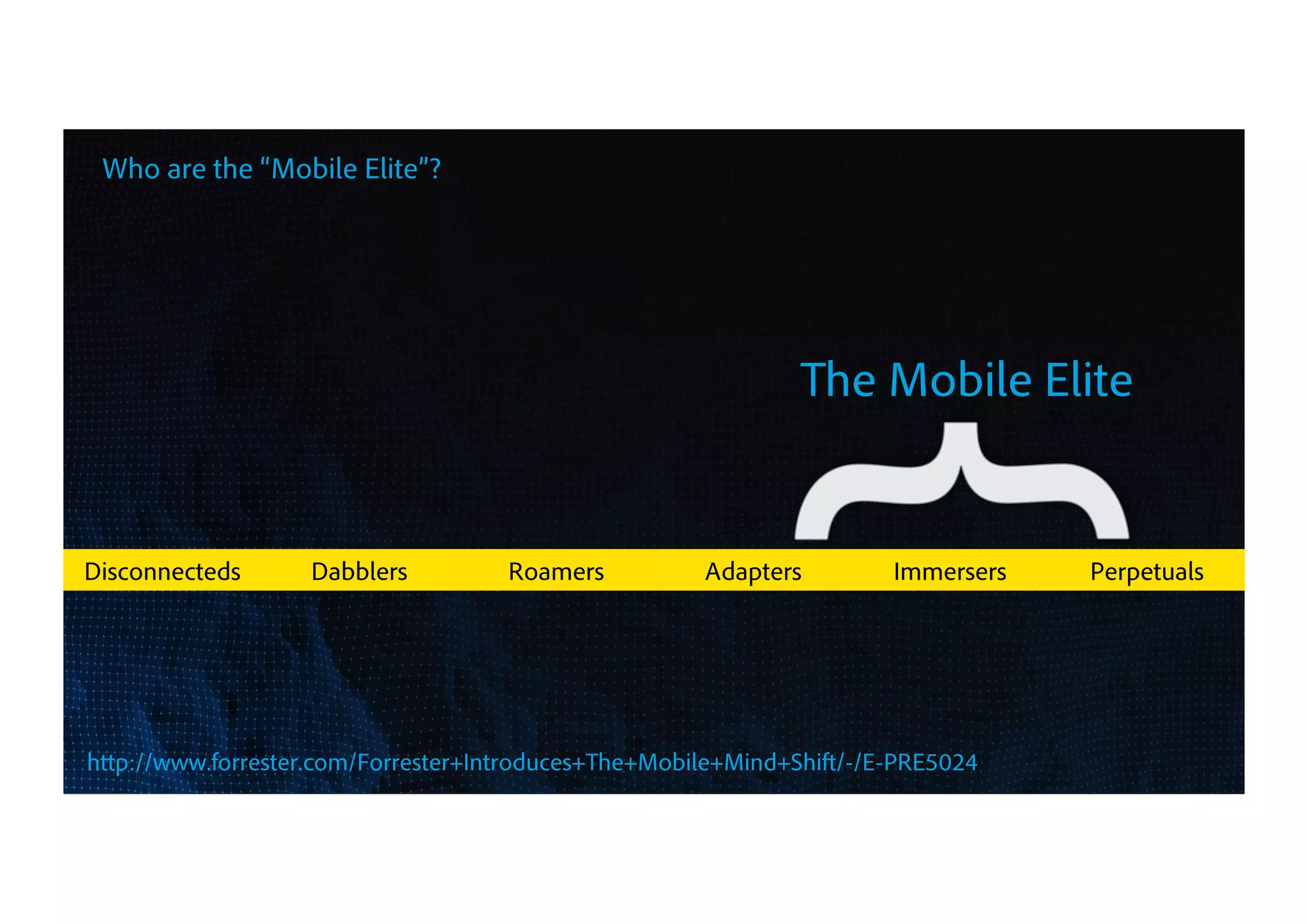

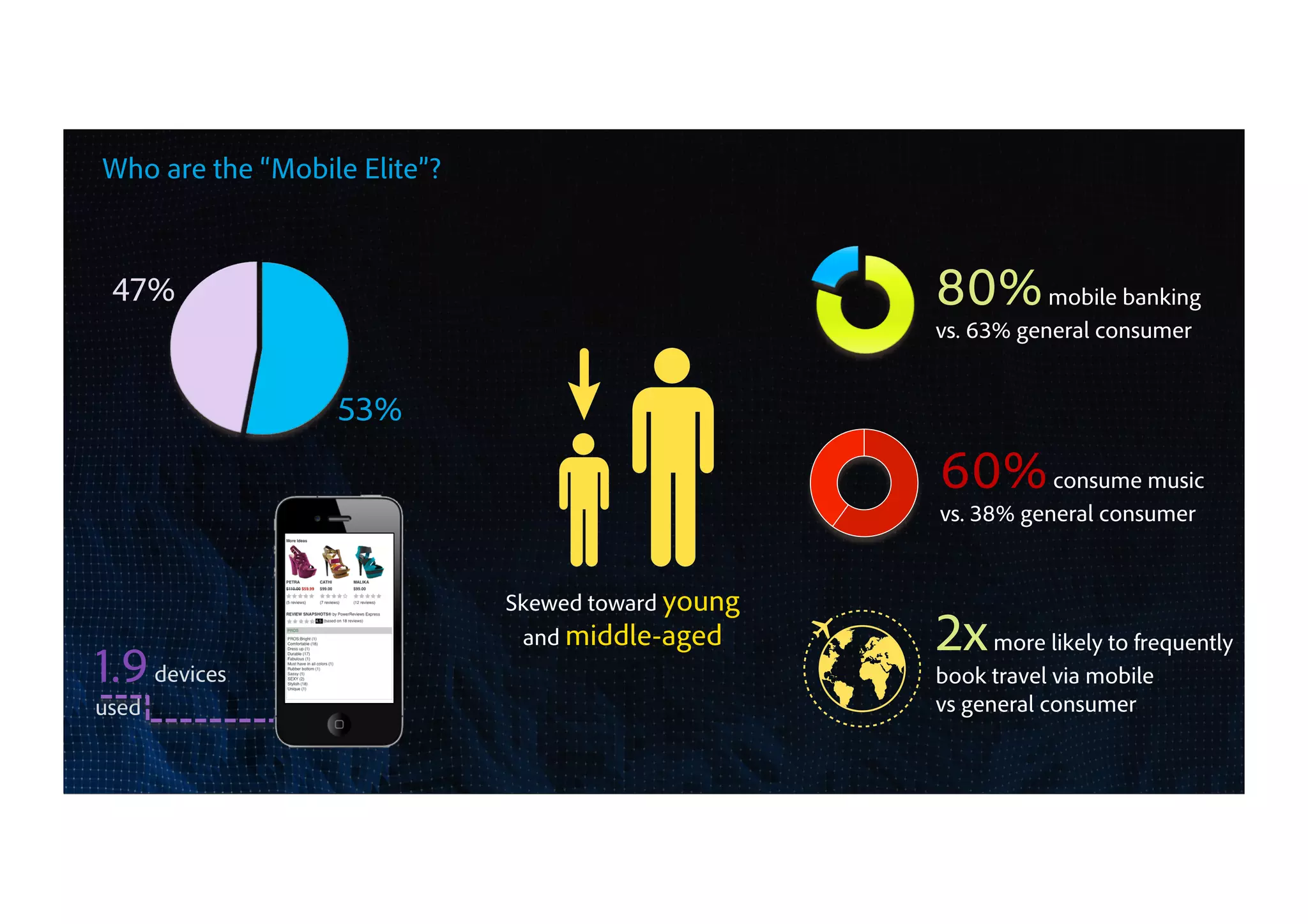

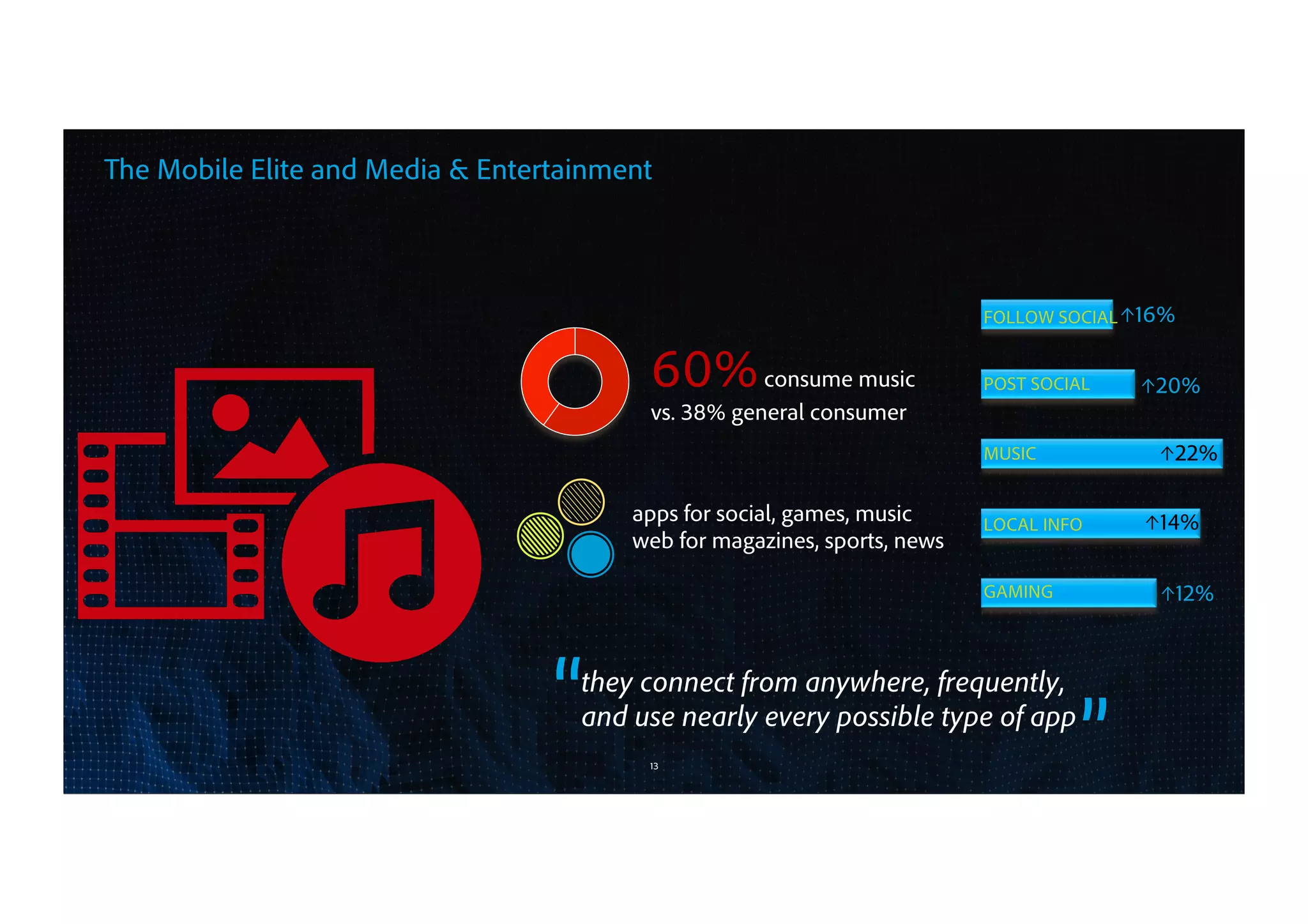

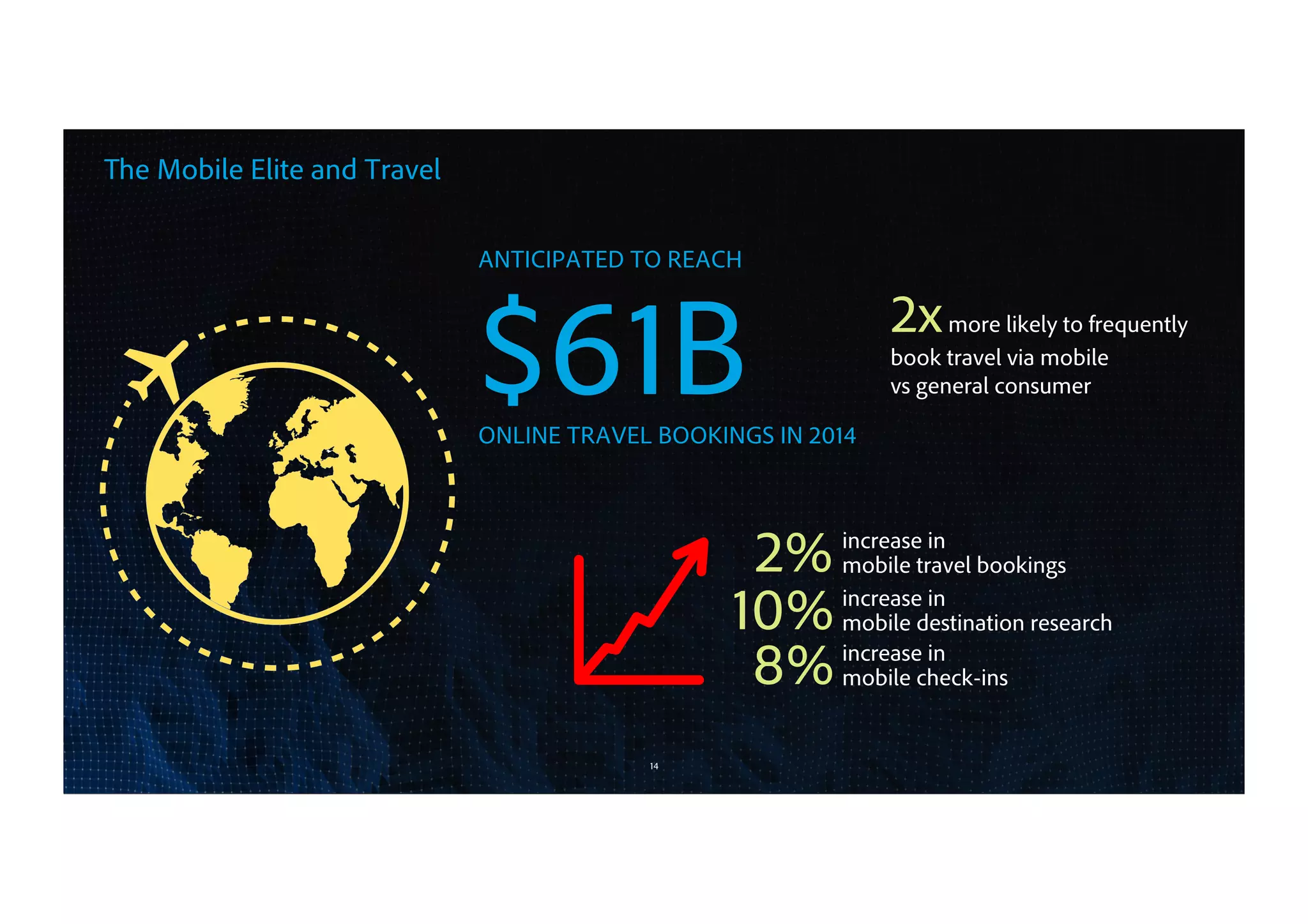

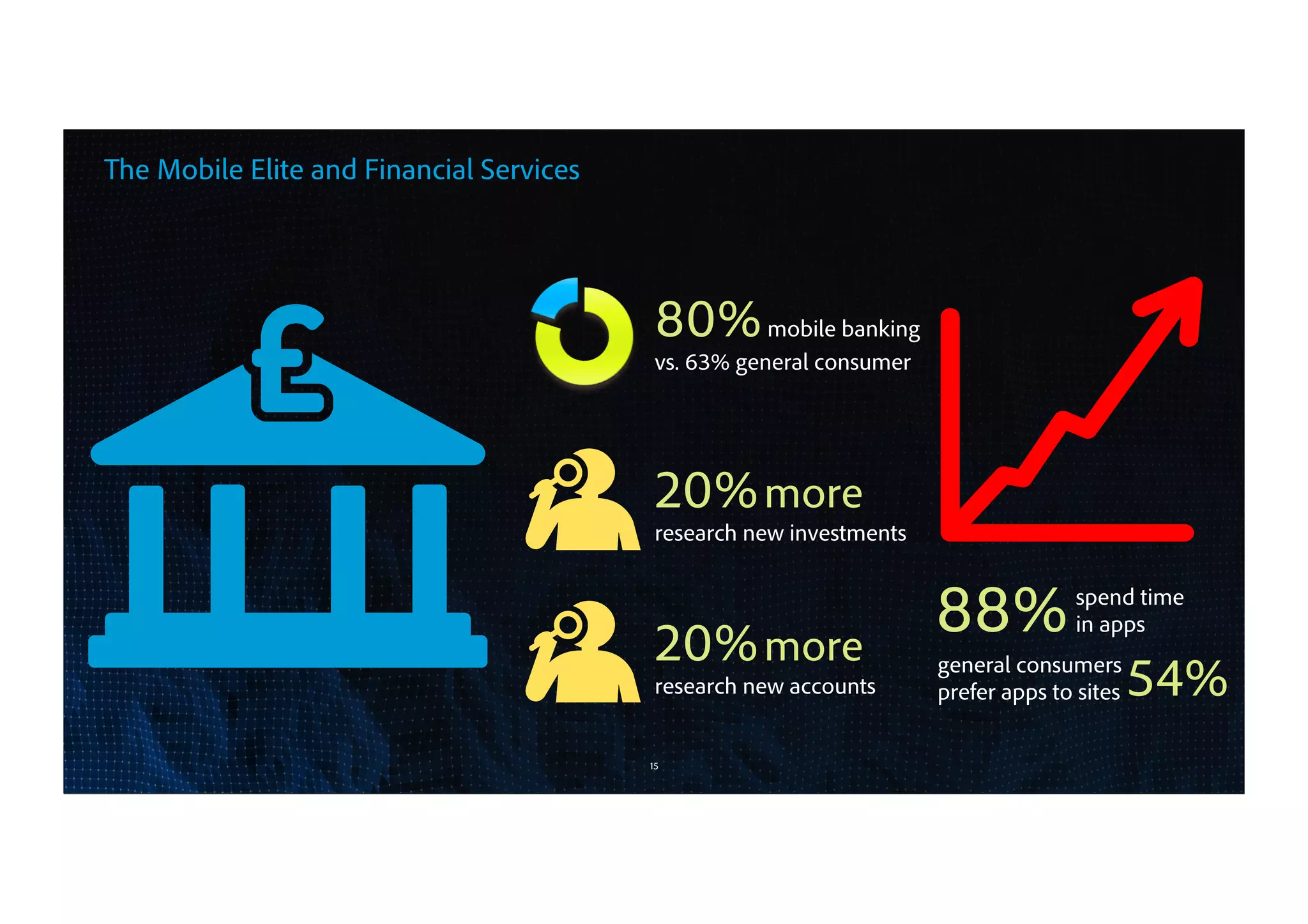

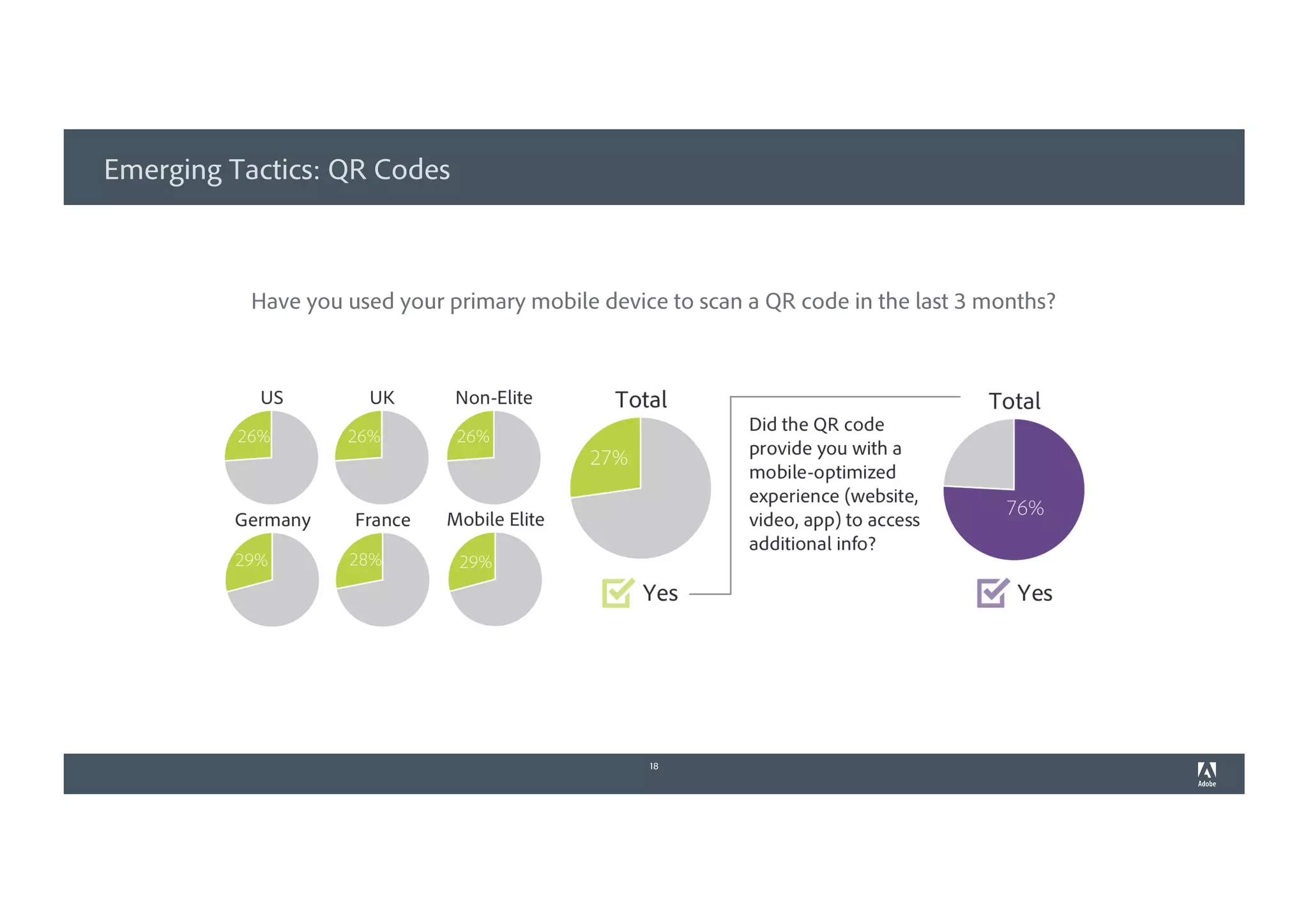

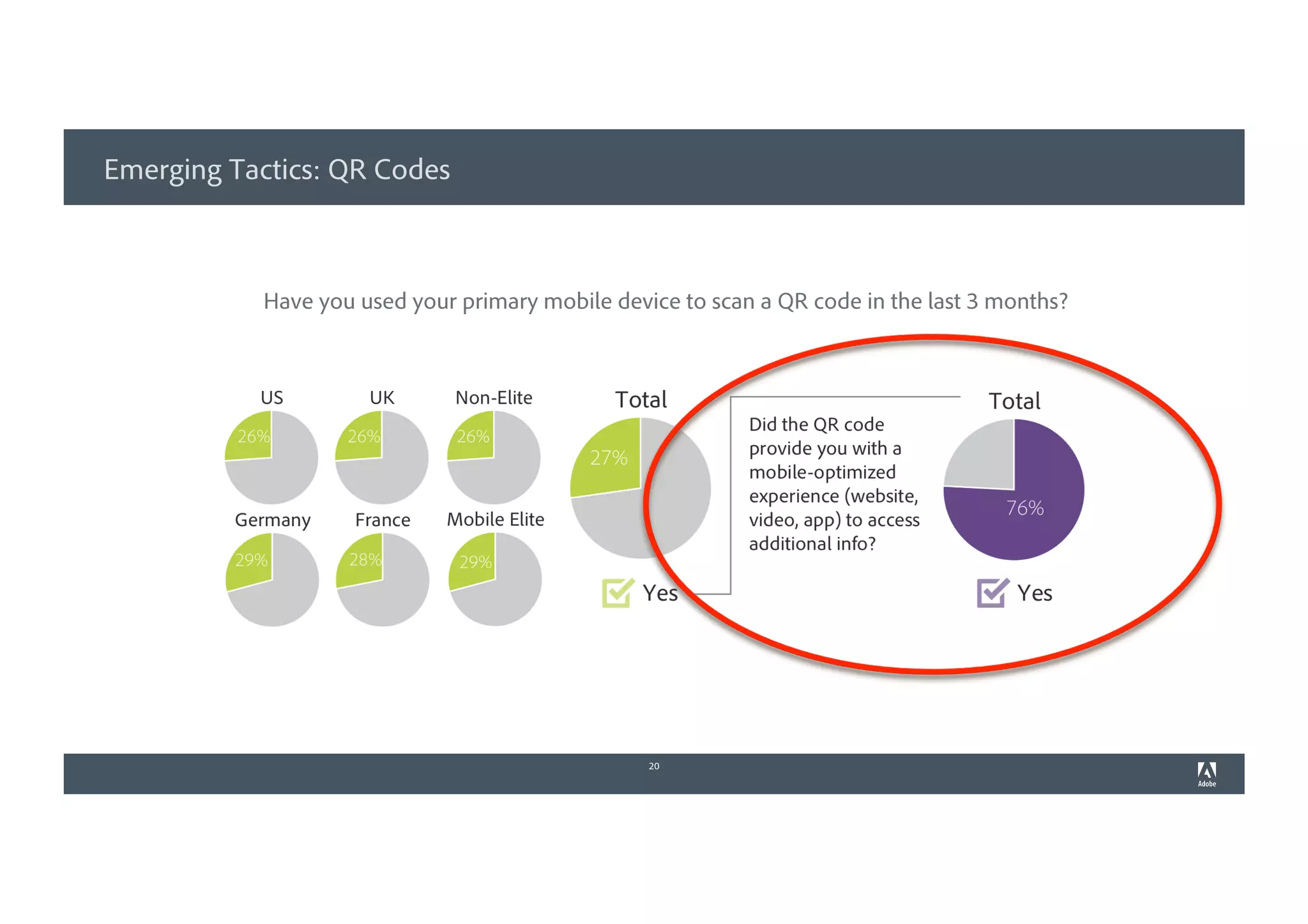

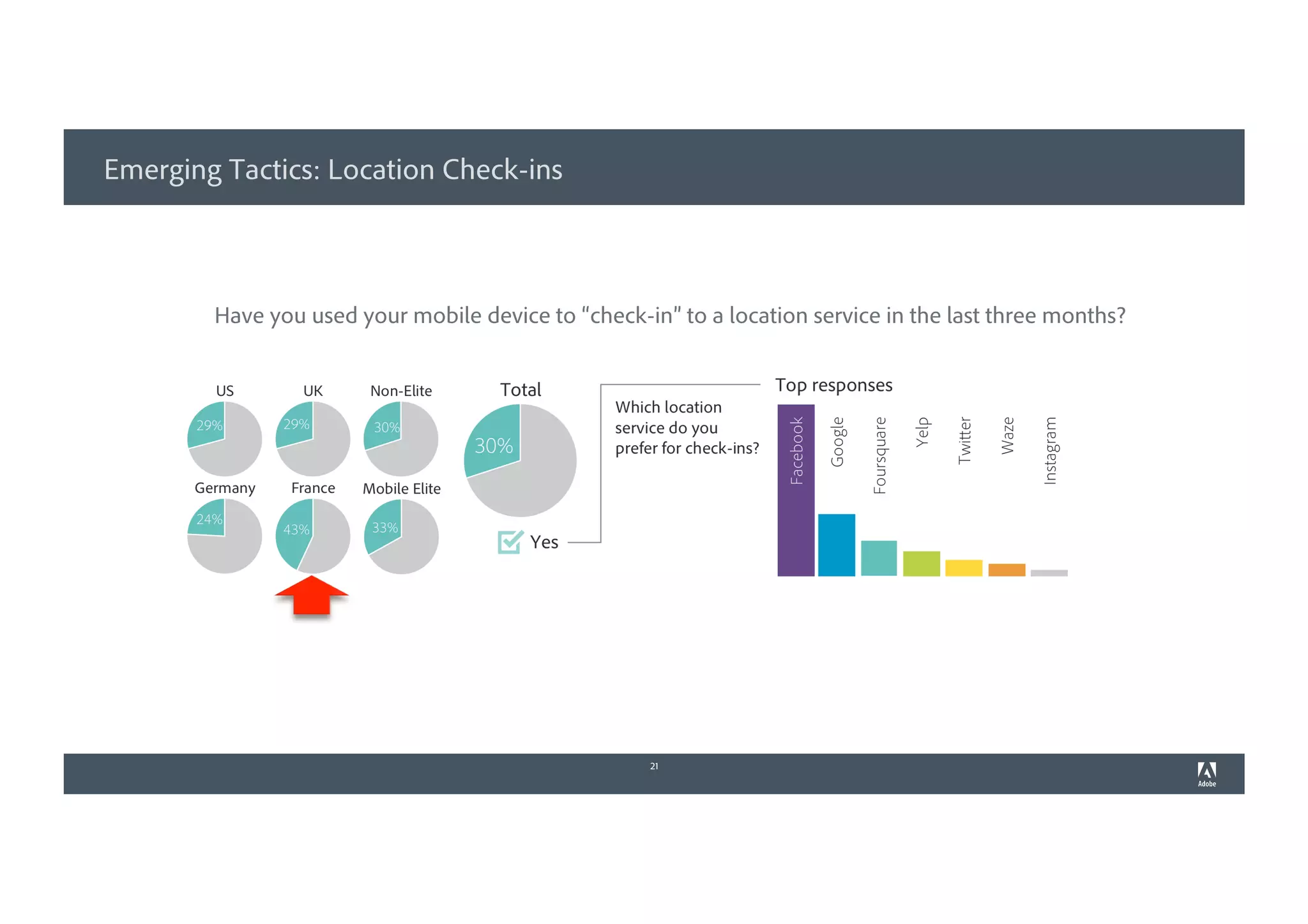

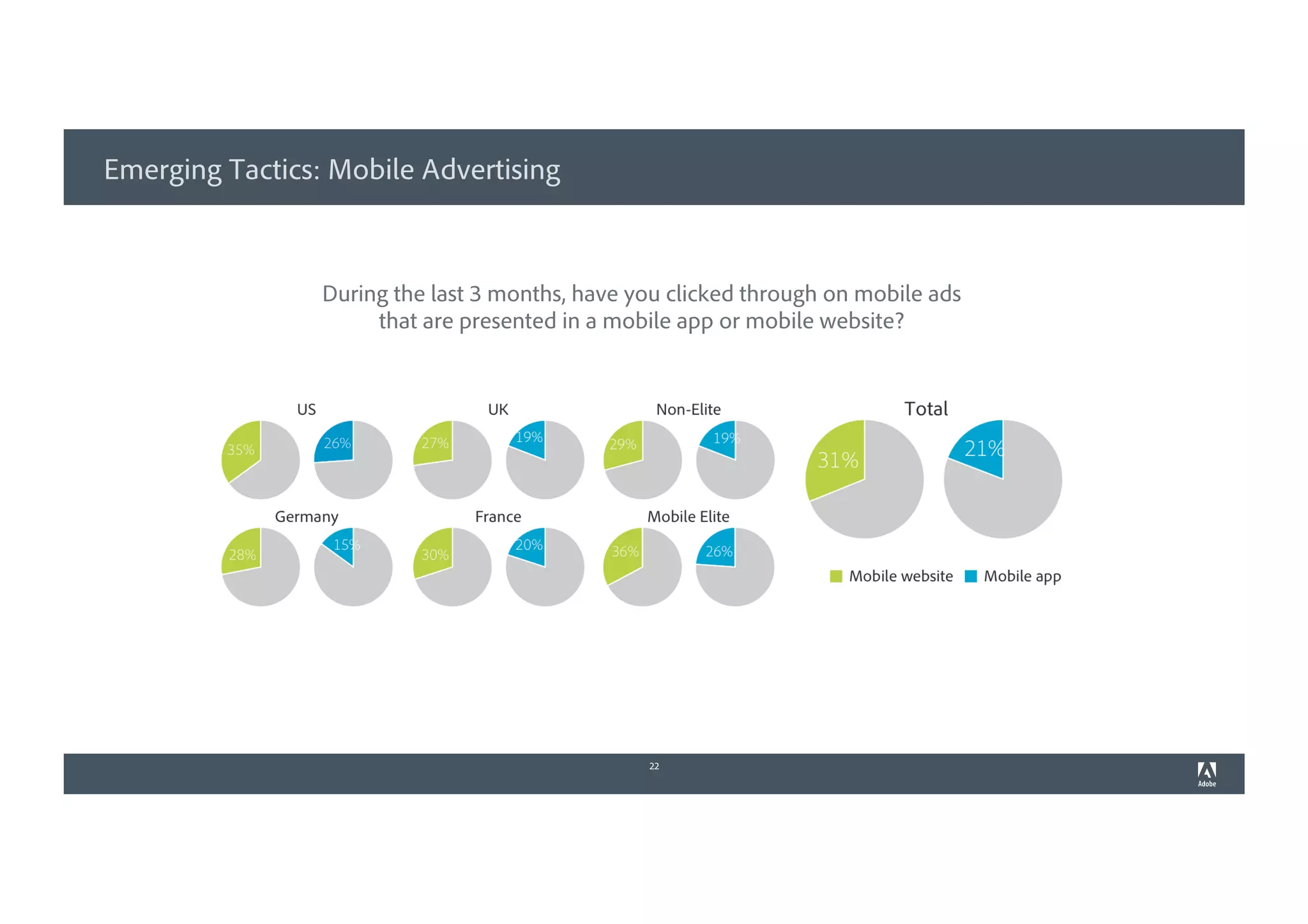

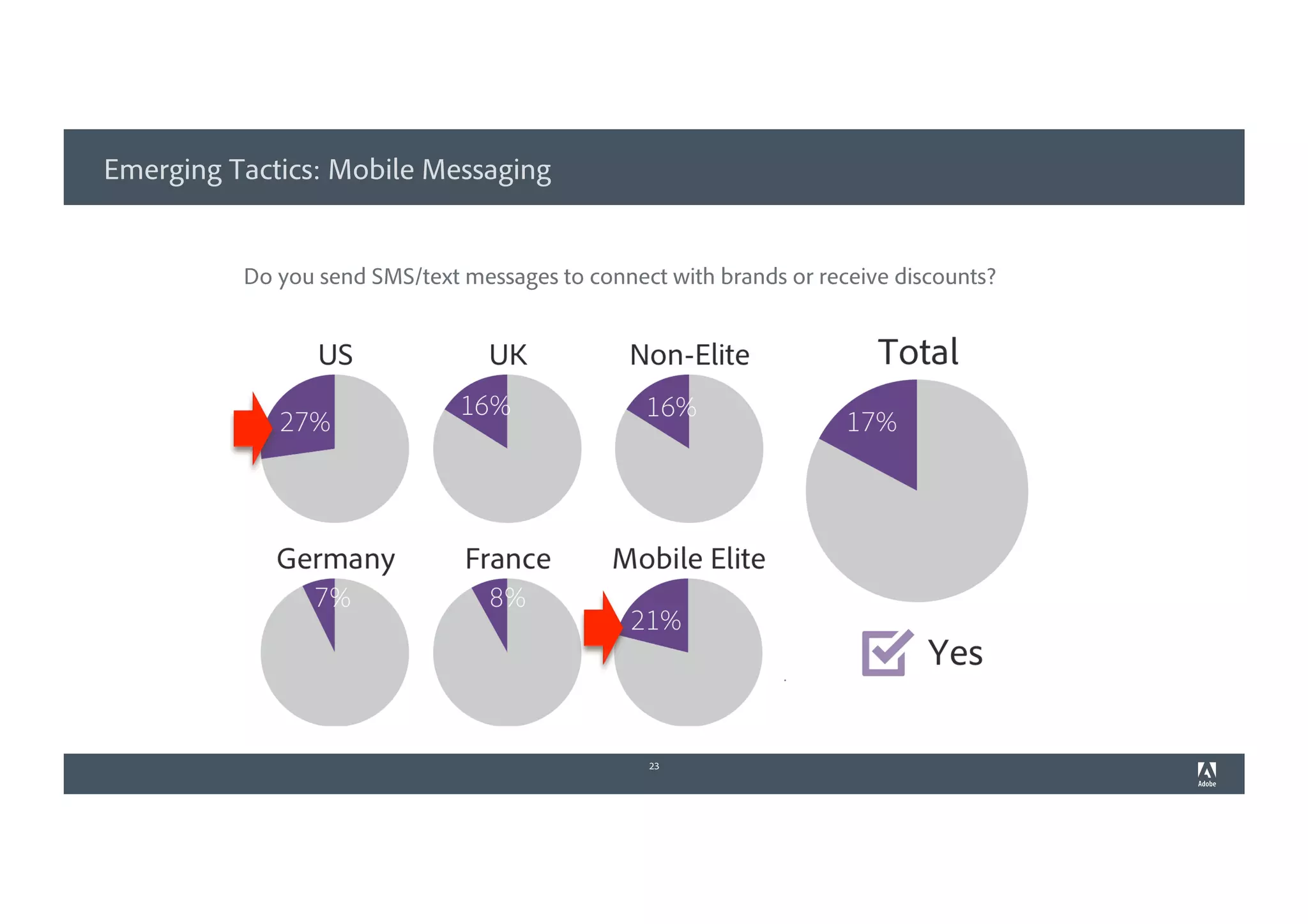

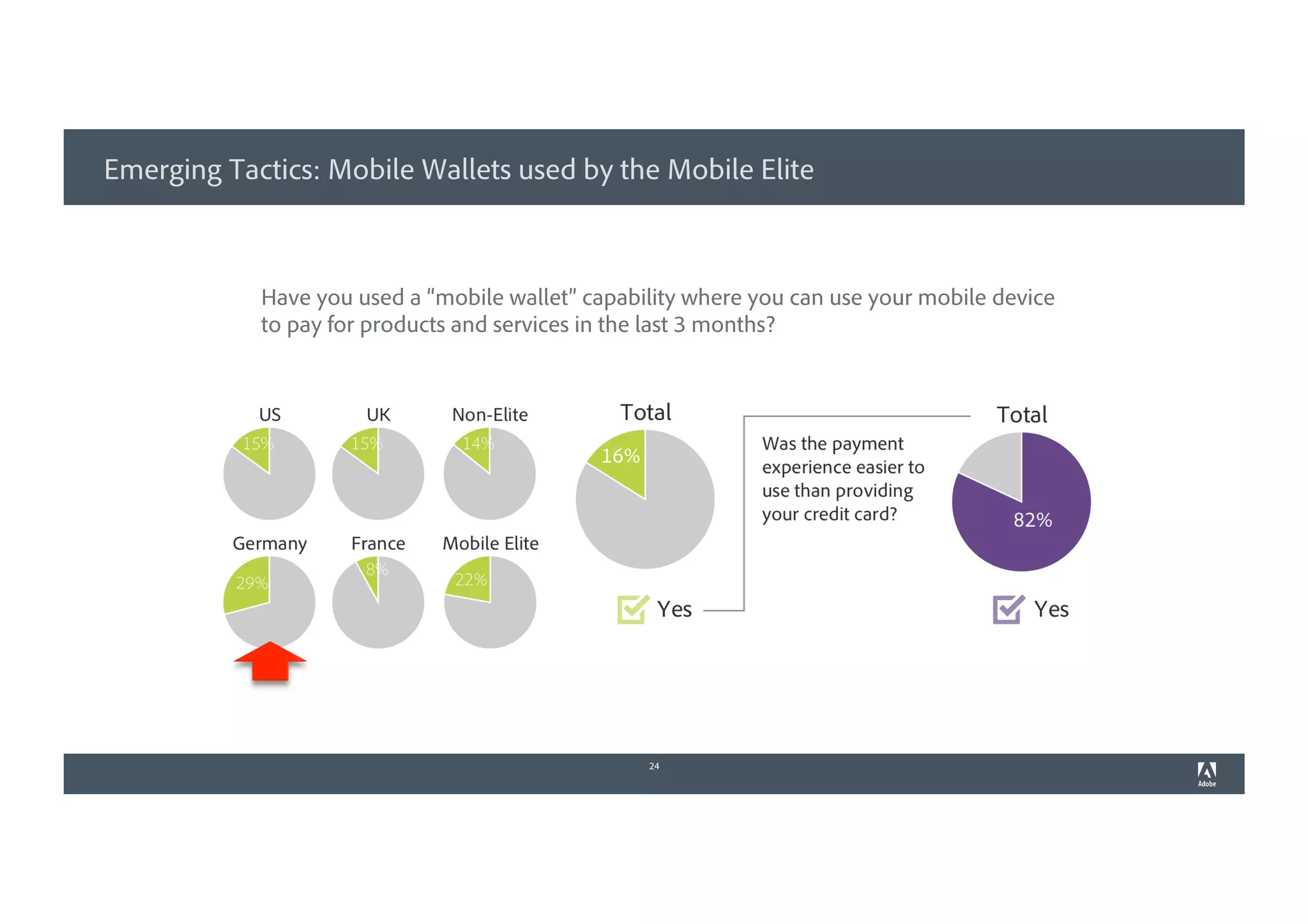

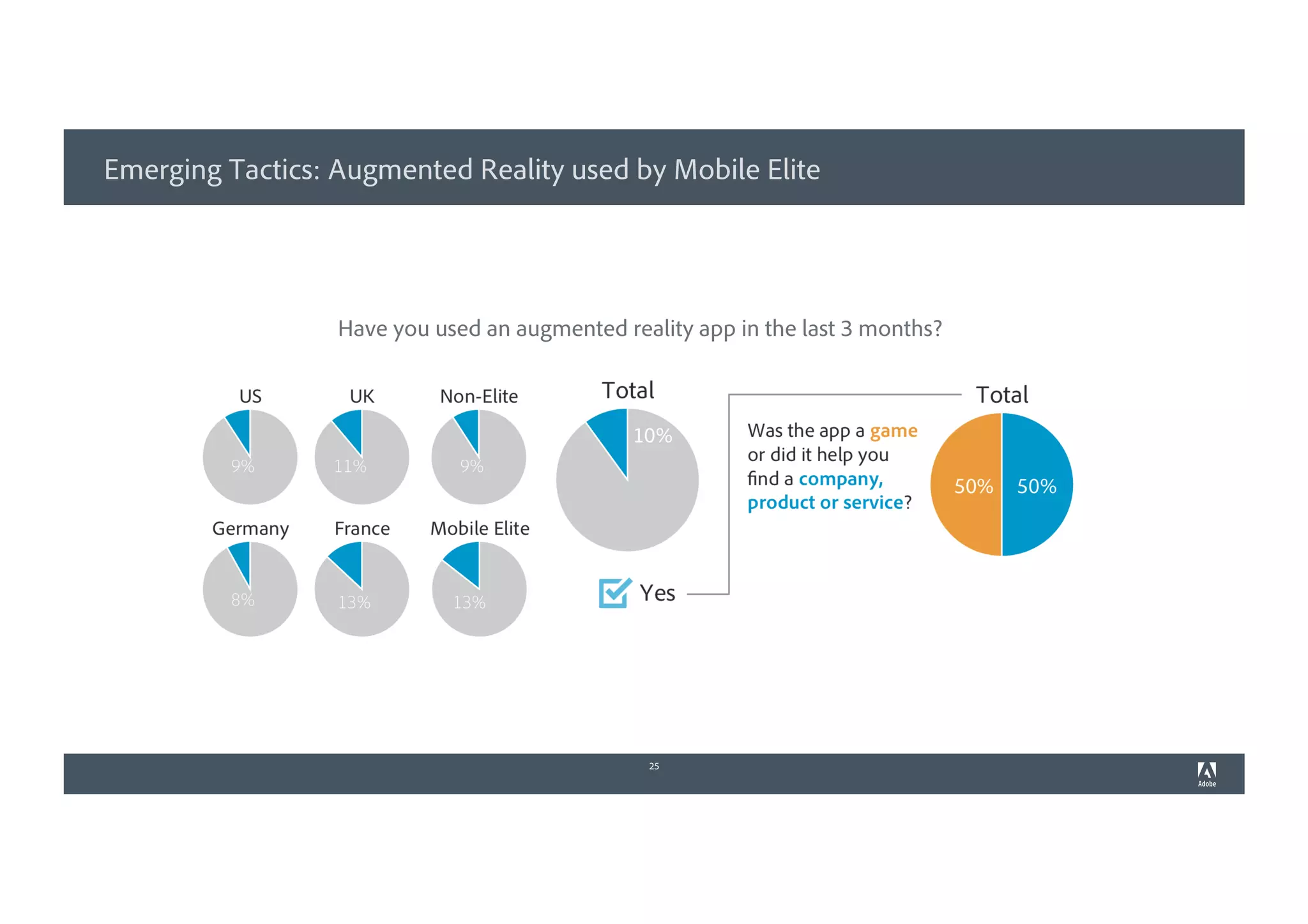

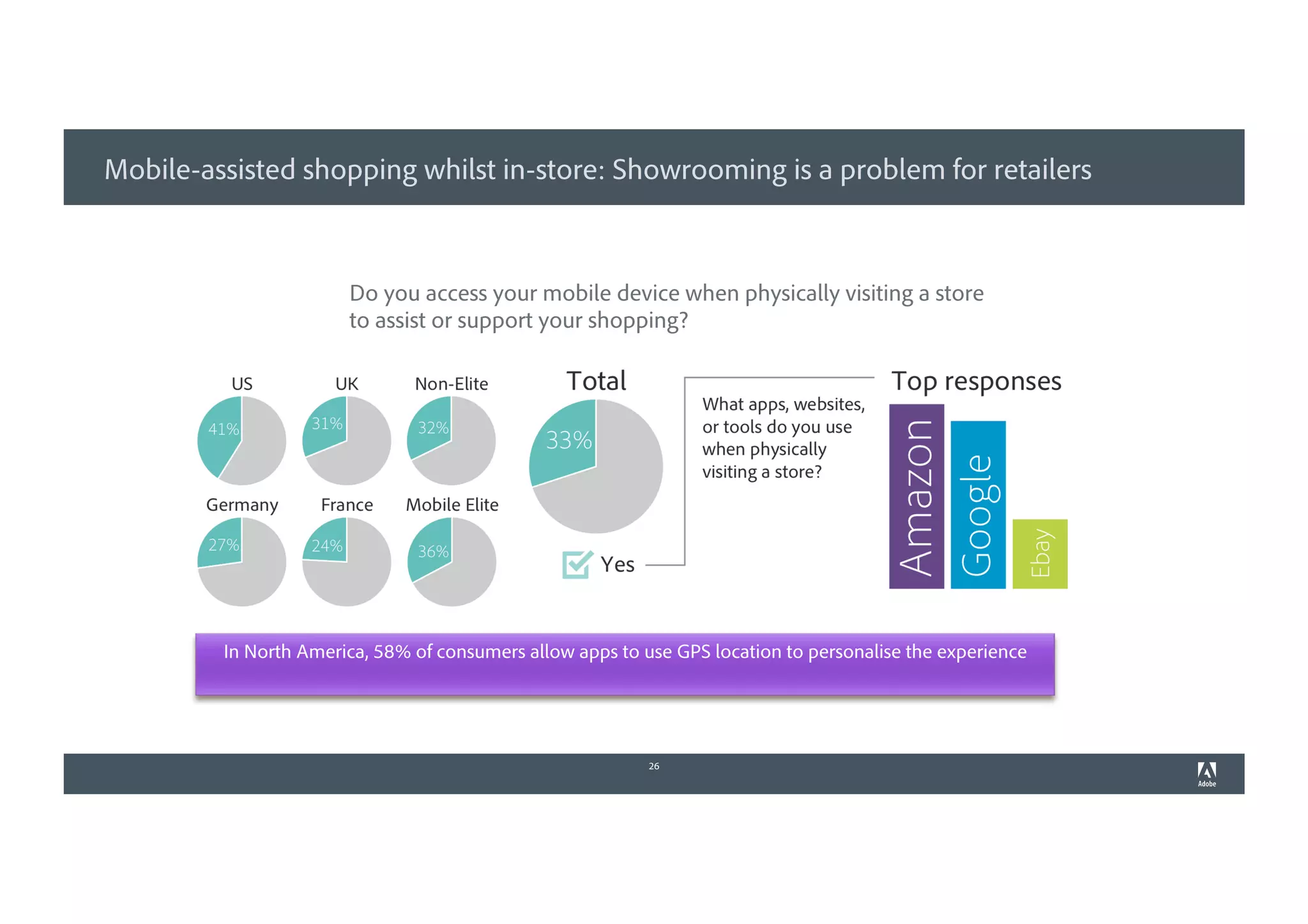

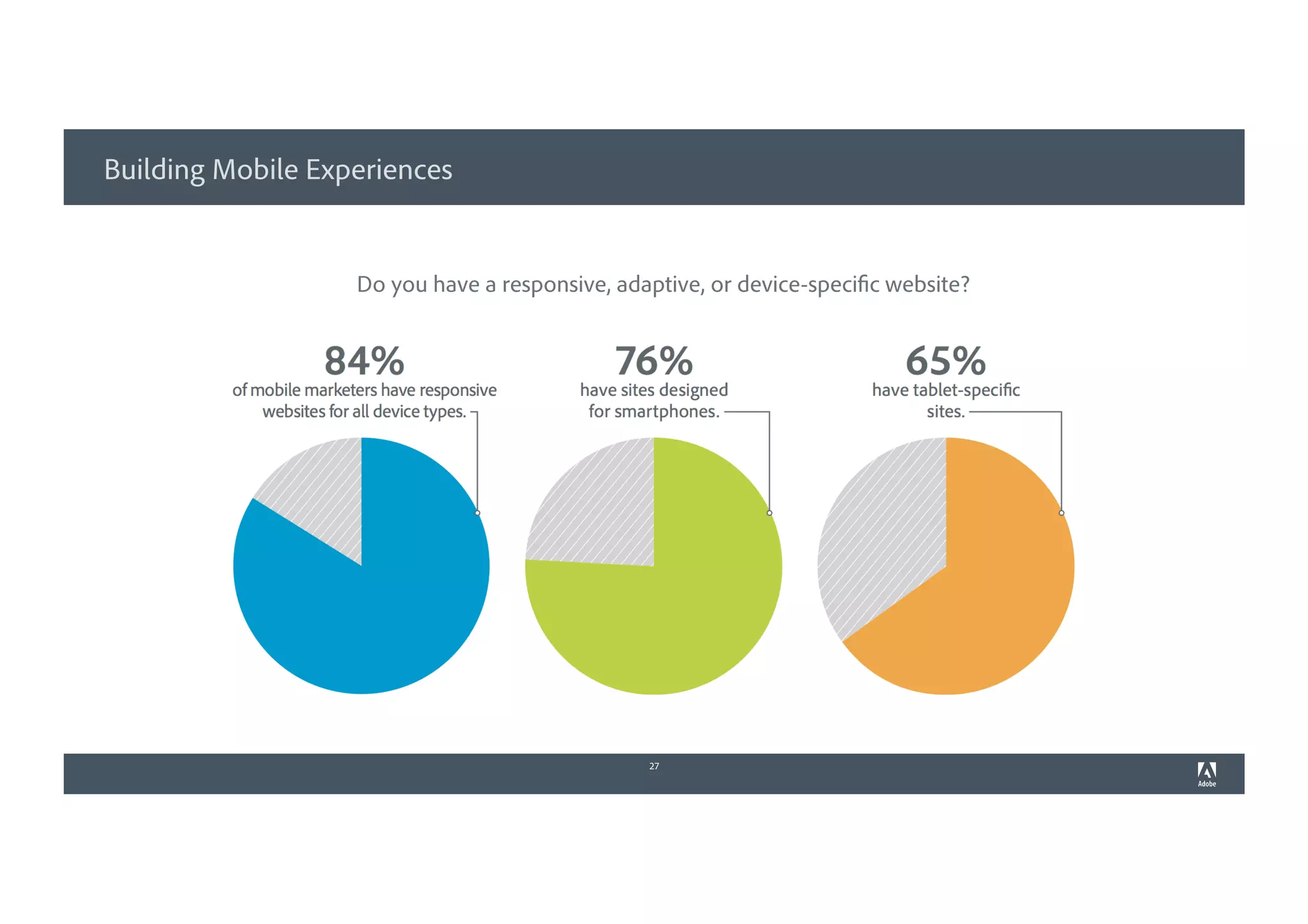

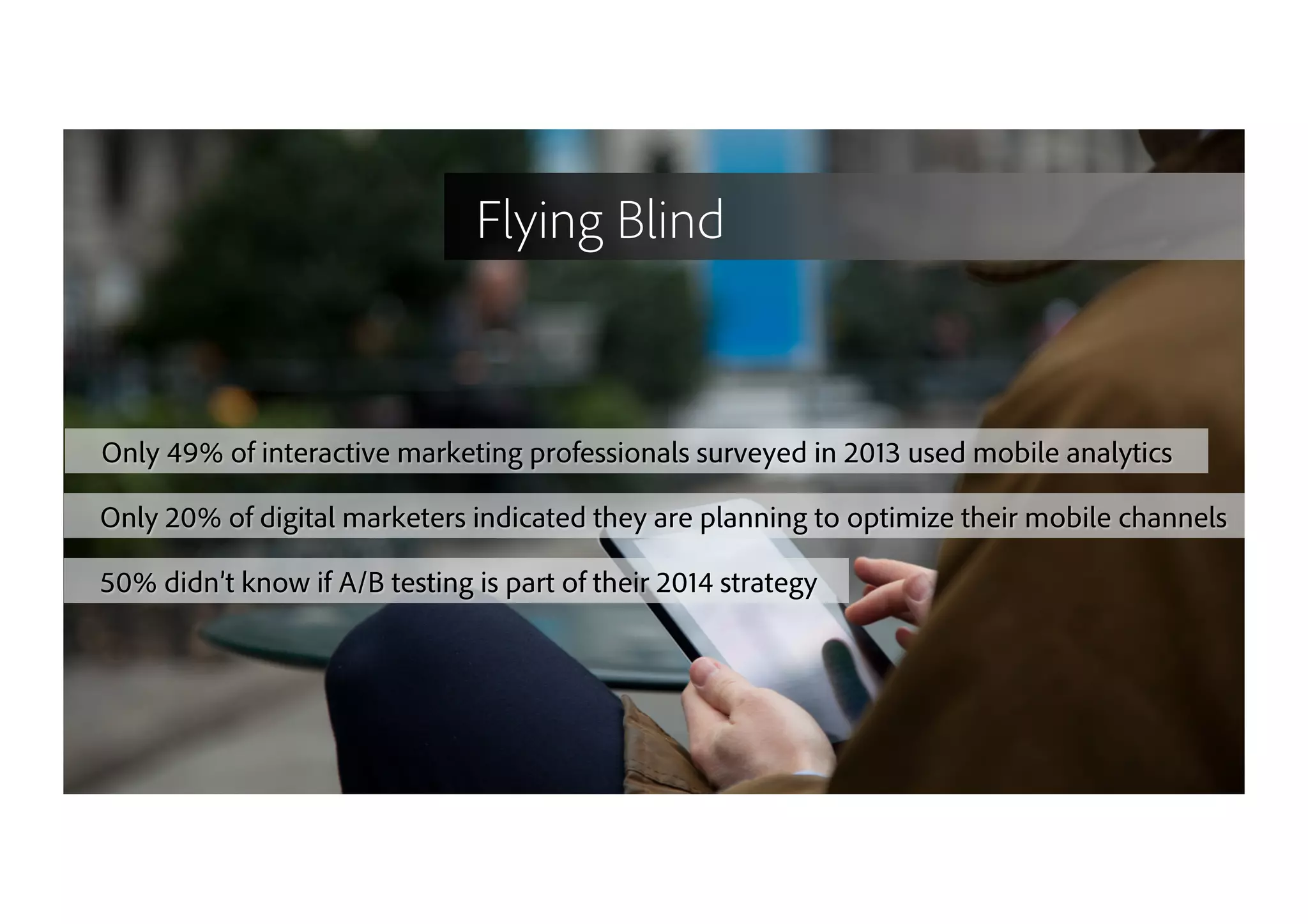

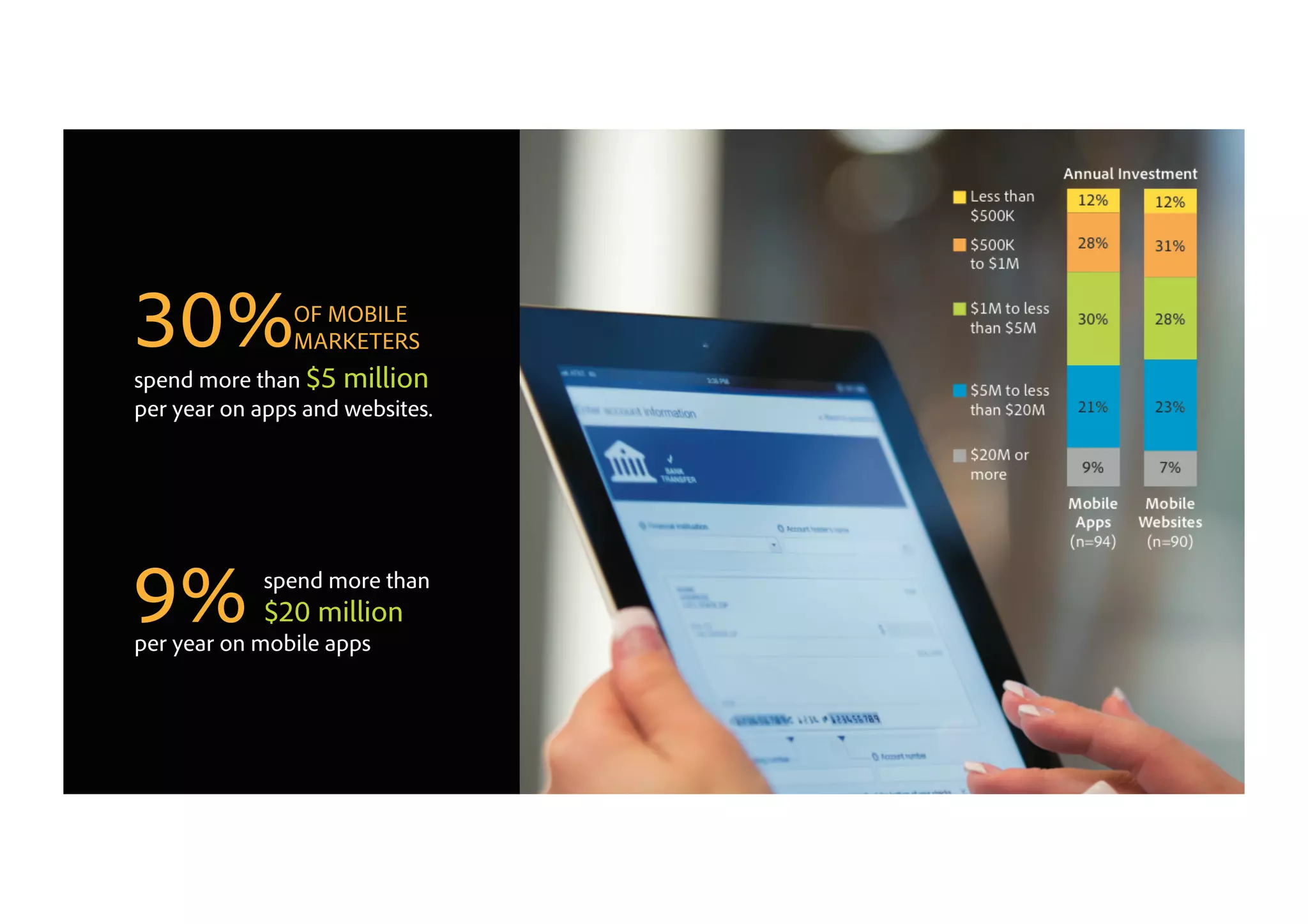

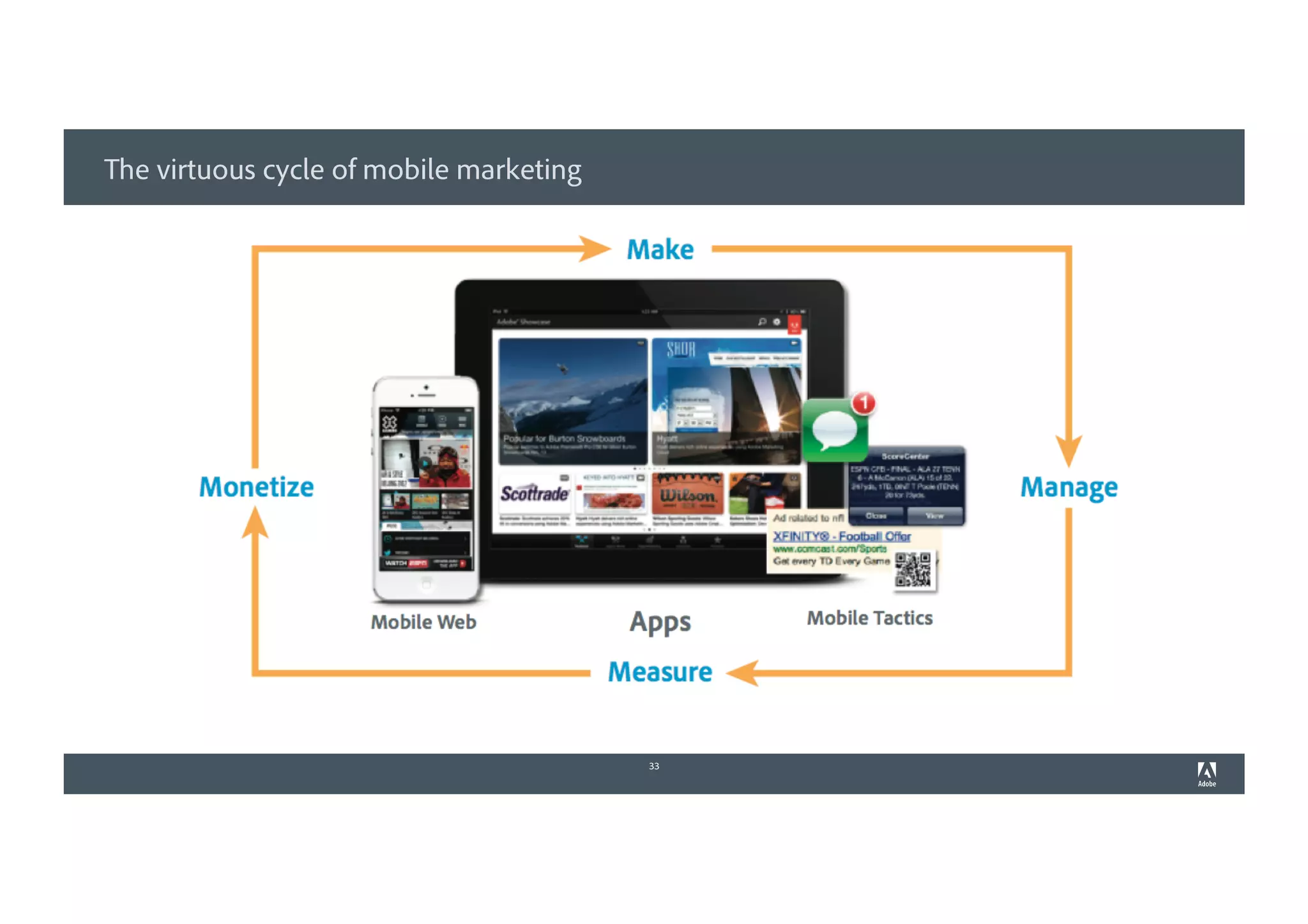

The document discusses marketing strategies aimed at the 'mobile elite,' a demographic significantly engaged in mobile banking, travel, and retail, highlighting their influence on sales and booking behaviors. It presents data from various surveys indicating that mobile experiences are critical for engagement and brand loyalty, alongside emerging tactics such as QR codes and mobile wallets. Key takeaways include the need for personalized and optimized mobile marketing strategies to meet the demands of this audience.