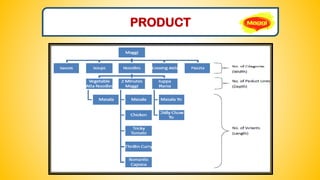

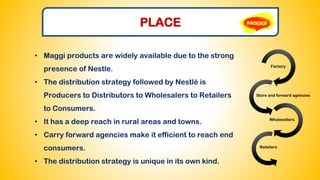

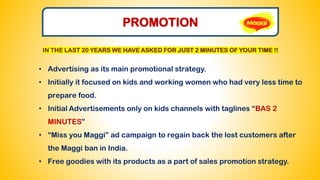

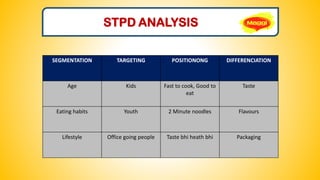

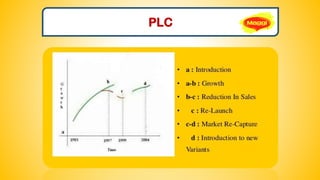

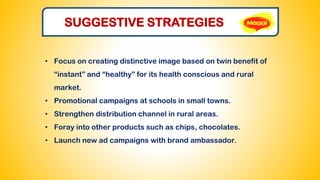

Maggi, a brand owned by Nestlé since 1947, was launched in India in 1982 and achieved a 90% market share within its first year. The company focuses on product differentiation, strong distribution strategies, and targeted promotions, leading to its dominance in the Indian noodle market despite growing competition. Recent strategies include leveraging e-commerce and targeting rural markets to capture health-conscious consumers and regain market share after previous setbacks.