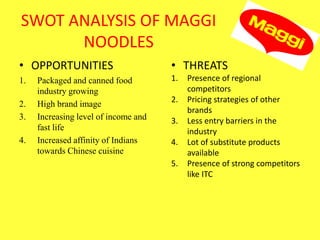

Group 9 conducted market research on Maggi noodles. They surveyed 50 respondents between ages 20-50. Most spend Rs. 100-150 monthly on noodles and choose Maggi for its taste. Respondents wanted more flavors but rated taste, availability, and price highly. Masala was most popular but some wanted Atta noodles. Mouth publicity influenced many purchasers. The group concluded Maggi would stay dominant through new variants, though competitors emerge. Respondents signaled a preference shift to healthier Atta noodles.