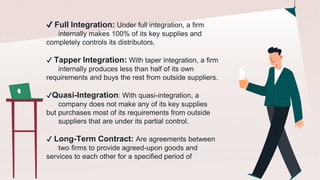

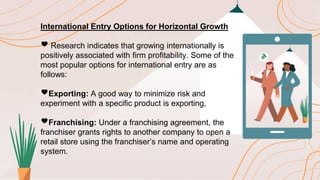

The document outlines the process of corporate strategy formulation, emphasizing the importance of establishing a long-term vision and implementing a structured approach to achieve goals. It details key growth strategies, such as concentration and diversification, and various international entry options for expanding operations. Additionally, it highlights the performance implications of related versus unrelated diversification and mentions the GE Business Screen as a tool for evaluating business opportunities.