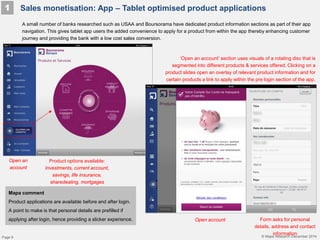

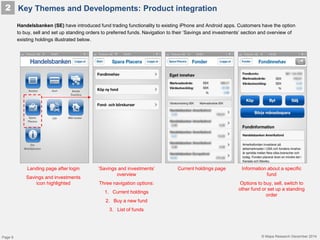

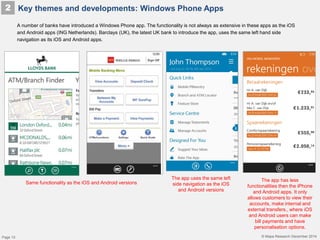

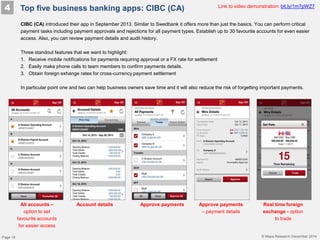

This document provides a summary of the Mapa Insight Series 2014 report. It includes summaries of reports on tablet banking, mobile banking, personal finance management, attracting start-ups, and the overall report schedule. Key topics covered in the reports include analyzing tablet experiences, mobile app functionality and innovations, personal finance tools, supporting start-ups, and the top business banking apps. The document aims to help readers better understand digital financial services trends and identify opportunities.